Key Insights

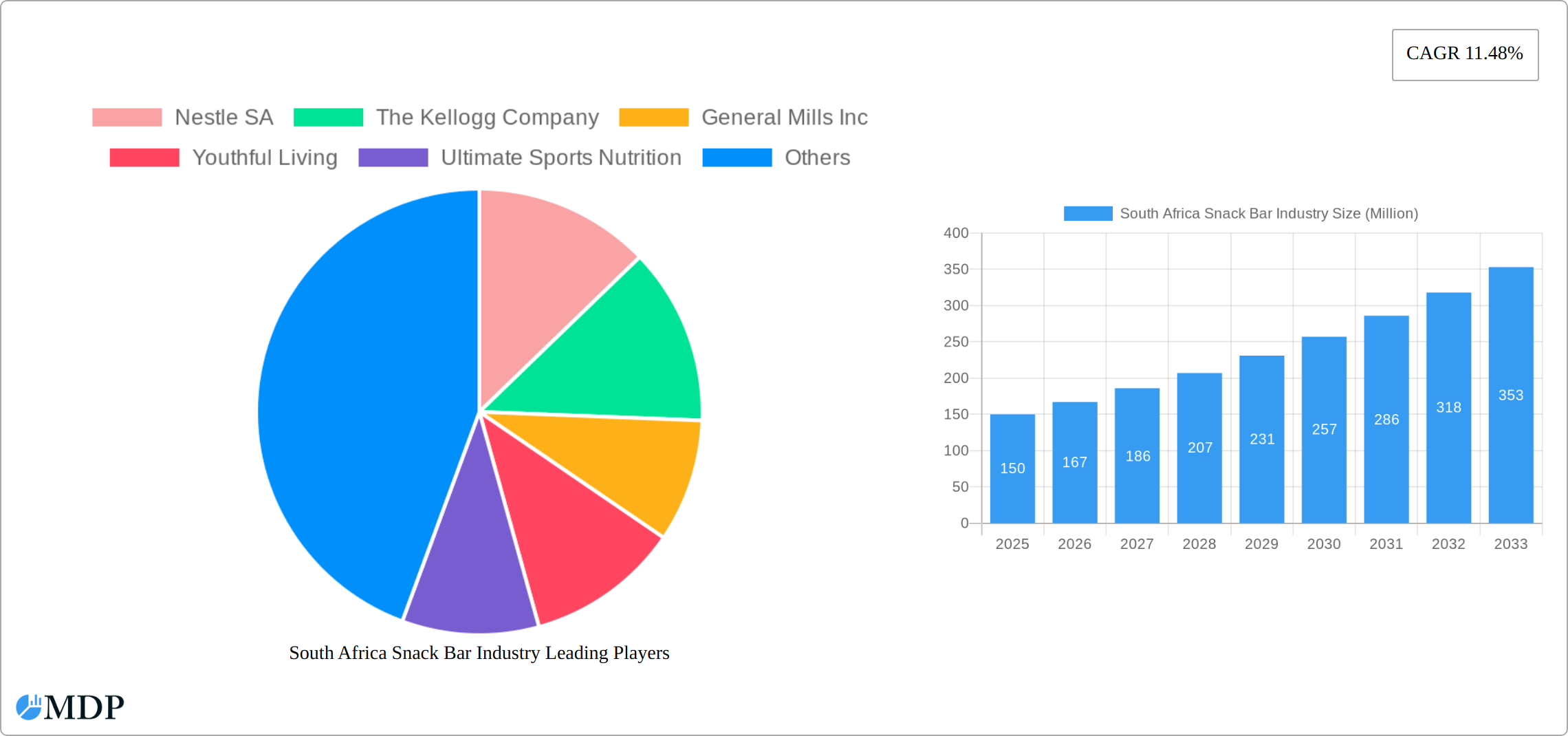

The South African snack bar market, a dynamic segment within the broader confectionery industry, presents a compelling investment opportunity. Driven by increasing health consciousness, the demand for nutritious and convenient snack options is fueling significant growth. The market's CAGR of 11.48% from 2019-2024 suggests a robust trajectory, likely to continue in the forecast period (2025-2033). While precise market sizing for South Africa is unavailable in the provided data, considering the Middle East & Africa region's inclusion, and extrapolating from the overall MEA growth, a reasonable estimate for the South African snack bar market size in 2025 could be around $150 million USD. This is based on the assumption that South Africa, given its developed economy and significant consumer base, accounts for a substantial portion of the MEA market. Key growth drivers include rising disposable incomes, increased urbanization leading to busier lifestyles demanding quick and easy meal replacements, and the proliferation of fitness and wellness trends emphasizing protein-rich and functional snacks. The segment is diversified across product types including cereal bars, energy bars, and other snack bars, catering to diverse consumer preferences. Distribution channels are equally diverse, encompassing supermarkets, convenience stores, and a growing online retail presence. Key players such as Nestle, Kellogg's, and General Mills, alongside local and international specialty brands, are competing fiercely in this space, focusing on product innovation and strategic distribution partnerships to secure market share.

However, challenges remain. Fluctuations in raw material prices and economic instability can impact pricing and profitability. The intensely competitive landscape demands constant innovation to meet evolving consumer demands. Furthermore, concerns about added sugars and artificial ingredients present an ongoing challenge that necessitates the development of healthier, more natural alternatives. The South African snack bar market’s future hinges on the ability of players to address these challenges effectively, capitalizing on the strong growth potential while catering to the evolving preferences of increasingly health-conscious consumers. The focus on sustainable sourcing and ethical manufacturing practices will also play an increasingly important role in shaping consumer choices and brand loyalty.

South Africa Snack Bar Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the South Africa snack bar industry, covering market dynamics, trends, leading players, and future opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry stakeholders, investors, and businesses seeking to navigate this dynamic market. The South African snack bar market, valued at xx Million in 2024, is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. This report utilizes robust data and analysis to offer actionable insights into this rapidly evolving sector.

South Africa Snack Bar Industry Market Dynamics & Concentration

The South African snack bar market is characterized by a moderate level of concentration, with several large multinational corporations and a number of smaller, niche players competing for market share. Key market dynamics include increasing consumer demand for healthier and more convenient snack options, growing adoption of online retail channels, and ongoing product innovation. The regulatory landscape is relatively stable, although evolving health and labeling regulations impact product formulations and marketing strategies. Significant product substitutes exist, such as fresh fruit, yogurt, and other convenient food items, creating competitive pressure. The market is witnessing a rise in mergers and acquisitions (M&A) activity, reflecting consolidation trends and the pursuit of growth through strategic acquisitions. For example, Mondelez International's acquisition of Clif Bar & Company in June 2022 demonstrates this trend.

- Market Share: Nestle SA holds an estimated xx% market share, followed by Mondelez International Inc. at xx%, and Kellogg Company at xx%. The remaining market share is divided among numerous smaller players.

- M&A Activity: A total of xx M&A deals were recorded between 2019 and 2024, indicating a moderate level of consolidation in the industry. This is expected to rise slightly to xx deals over the forecast period.

- Innovation Drivers: Healthier ingredients, functional benefits (e.g., protein bars), and convenient packaging formats are key innovation drivers.

- End-User Trends: Growing health consciousness, increasing demand for on-the-go snacks, and a preference for natural and organic ingredients are shaping consumer preferences.

South Africa Snack Bar Industry Industry Trends & Analysis

The South African snack bar market is experiencing robust growth, driven by a confluence of factors. Rising disposable incomes, rapid urbanization, and evolving lifestyles are significantly increasing snack consumption. The burgeoning health and wellness trend fuels demand for nutritious and functional snack bars, creating a dynamic market segment. Technological advancements, encompassing improved manufacturing processes and innovative packaging solutions, enhance both efficiency and product quality. However, the industry also faces challenges such as intense competition, volatile raw material prices, and the ever-changing landscape of consumer preferences. The rise of e-commerce is reshaping distribution channels, creating both opportunities and complexities for market players. This growth is reflected in several key metrics:

- Market Growth Drivers: Increased disposable incomes, shifting lifestyle patterns emphasizing convenience, a heightened focus on health and wellness, and the expansion of modern retail formats across the country.

- Technological Disruptions: The rapid growth of e-commerce, coupled with streamlined manufacturing processes and innovative packaging designed for extended shelf life and enhanced appeal.

- Consumer Preferences: A clear and growing demand for healthier, more natural, and convenient snacking options, with a focus on functional benefits.

- Competitive Dynamics: Intense competition exists among established brands and a wave of new entrants vying for market share.

- CAGR (2025-2033): [Insert Projected CAGR]% (Source: [Cite your source])

- Market Penetration: [Insert Market Penetration Data]% in supermarkets/hypermarkets, [Insert Market Penetration Data]% in convenience stores, [Insert Market Penetration Data]% in online retail stores. (Source: [Cite your source])

Leading Markets & Segments in South Africa Snack Bar Industry

The South African snack bar market exhibits robust growth across diverse segments and distribution channels. Supermarkets and hypermarkets remain the dominant distribution channel, leveraging their extensive reach and well-established infrastructure. The energy bar segment showcases particularly strong growth, fueled by increasing consumer interest in functional foods that support active lifestyles. Market penetration is notably higher in urban areas compared to rural regions, reflecting differences in income levels and access to retail outlets.

Key Distribution Channels & Influencers:

- Supermarkets/Hypermarkets: Benefit from established distribution networks, extensive product assortments, and strong consumer reach, making them key players in the market.

- Convenience Stores: Capitalize on convenient locations and extended operating hours, catering to the on-the-go consumer segment.

- Online Retail Stores: Experience growth driven by increasing e-commerce penetration and expanding consumer access to a broader range of snack bar options.

- Economic Policies & Government Initiatives: Supportive government policies aimed at boosting the food industry contribute positively to market expansion and stability.

- Infrastructure Development: Well-developed infrastructure, particularly in urban areas, facilitates efficient and cost-effective distribution networks.

Market Share Analysis:

Supermarkets/hypermarkets maintain a leading market share, commanding the highest sales volume and revenue generation due to their superior consumer reach and established distribution networks. The energy bar segment holds a significant portion of the market share due to the rising demand for functional foods that cater to health-conscious and active consumers.

South Africa Snack Bar Industry Product Developments

The South African snack bar market is characterized by continuous product innovation, with manufacturers focusing on healthier ingredients, appealing flavor profiles, and enhanced functional benefits. Recent trends include the introduction of fruit and vegetable-based bars, organic and naturally sourced ingredient options, and an expanding range of protein and energy bars designed to meet diverse dietary needs and preferences. These innovations directly respond to the evolving consumer demand for healthier and more functional snacking options. Furthermore, advancements in manufacturing and packaging technologies are enhancing product quality, extending shelf life, and improving the overall market appeal of these products.

Key Drivers of South Africa Snack Bar Industry Growth

Several factors drive the growth of the South African snack bar industry. Increasing disposable incomes among consumers empower them to purchase more premium snack products. The growing health-conscious population fuels demand for nutrient-rich bars. Technological improvements in manufacturing and packaging optimize production and enhance product quality. Favorable government policies also promote market expansion.

Challenges in the South Africa Snack Bar Industry Market

Despite significant growth, the South African snack bar industry faces several key challenges, including fierce competition, fluctuating raw material costs, and the ever-shifting landscape of consumer preferences. Supply chain disruptions can significantly impact production and distribution, necessitating robust and resilient supply chain management strategies. Maintaining consistent product quality under pressure requires rigorous quality control measures. Furthermore, navigating the regulatory landscape, including food labeling and ingredient requirements, presents ongoing challenges impacting production and marketing strategies.

Emerging Opportunities in South Africa Snack Bar Industry

The South African snack bar industry presents exciting long-term opportunities. The rising popularity of health and wellness trends fuels demand for functional and nutritious bars. Strategic partnerships with local suppliers and distributors expand market access. Innovative product development and marketing strategies cater to evolving consumer demands and maintain a competitive edge. Expansion into new geographic areas and the adoption of e-commerce channels create additional growth avenues.

Leading Players in the South Africa Snack Bar Industry Sector

- Nestle SA

- The Kellogg Company

- General Mills Inc

- Youthful Living

- Ultimate Sports Nutrition

- Post Holdings

- Lotus Bakeries Corporate

- Mondelez International Inc

- Rush Nutrition SA

- Quest Nutrition LLC

Key Milestones in South Africa Snack Bar Industry Industry

- March 2022: CLIF Bar launched its CLIF Thin snack bars, expanding its product portfolio.

- June 2022: Mondelez International acquired Clif Bar & Company, boosting its presence in the South African market.

- October 2022: Kellogg Co. introduced three new Nutri-Grain flavor mashups, including fruit and vegetable breakfast bars and 'Bites'.

Strategic Outlook for South Africa Snack Bar Industry Market

The South African snack bar market holds significant future potential. Continued growth is expected, driven by rising disposable incomes, evolving consumer preferences, and the increasing demand for healthier and more convenient snack options. Strategic partnerships, product diversification, and a focus on innovation will be critical for companies seeking to thrive in this competitive market. Companies with strong distribution networks, a focus on consumer health and wellness, and the ability to adapt to changing market dynamics are best positioned for success.

South Africa Snack Bar Industry Segmentation

-

1. Product Type

- 1.1. Cereal Bars

- 1.2. Energy Bars

- 1.3. Other Snack Bars

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

South Africa Snack Bar Industry Segmentation By Geography

- 1. South Africa

South Africa Snack Bar Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.48% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for specialty and organic coffee pods and capsules; Innovations in packaging formats

- 3.3. Market Restrains

- 3.3.1. Availability of counterfeit products

- 3.4. Market Trends

- 3.4.1. Demand for Convenient and Healthy On-The-Go Snacking

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Snack Bar Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cereal Bars

- 5.1.2. Energy Bars

- 5.1.3. Other Snack Bars

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. UAE South Africa Snack Bar Industry Analysis, Insights and Forecast, 2019-2031

- 7. South Africa South Africa Snack Bar Industry Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia South Africa Snack Bar Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA South Africa Snack Bar Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Nestle SA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 The Kellogg Company

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 General Mills Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Youthful Living

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Ultimate Sports Nutrition

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Post Holdings

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Lotus Bakeries Corporate

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Mondelez International Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Rush Nutrition SA*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Quest Nutrition LLC

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Nestle SA

List of Figures

- Figure 1: South Africa Snack Bar Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Snack Bar Industry Share (%) by Company 2024

List of Tables

- Table 1: South Africa Snack Bar Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Snack Bar Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: South Africa Snack Bar Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: South Africa Snack Bar Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South Africa Snack Bar Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: UAE South Africa Snack Bar Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South Africa South Africa Snack Bar Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Saudi Arabia South Africa Snack Bar Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of MEA South Africa Snack Bar Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Africa Snack Bar Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 11: South Africa Snack Bar Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: South Africa Snack Bar Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Snack Bar Industry?

The projected CAGR is approximately 11.48%.

2. Which companies are prominent players in the South Africa Snack Bar Industry?

Key companies in the market include Nestle SA, The Kellogg Company, General Mills Inc, Youthful Living, Ultimate Sports Nutrition, Post Holdings, Lotus Bakeries Corporate, Mondelez International Inc, Rush Nutrition SA*List Not Exhaustive, Quest Nutrition LLC.

3. What are the main segments of the South Africa Snack Bar Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for specialty and organic coffee pods and capsules; Innovations in packaging formats.

6. What are the notable trends driving market growth?

Demand for Convenient and Healthy On-The-Go Snacking.

7. Are there any restraints impacting market growth?

Availability of counterfeit products.

8. Can you provide examples of recent developments in the market?

October 2022: Kellogg Co. introduced three new flavor mashups within its Nutri-Grain brand, including two new fruit and vegetable breakfast bars and new 'Bites.' The new soft-baked breakfast bars are made with fruit and vegetable flavors and are available in strawberry, squash, apple, and carrot varieties.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Snack Bar Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Snack Bar Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Snack Bar Industry?

To stay informed about further developments, trends, and reports in the South Africa Snack Bar Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence