Key Insights

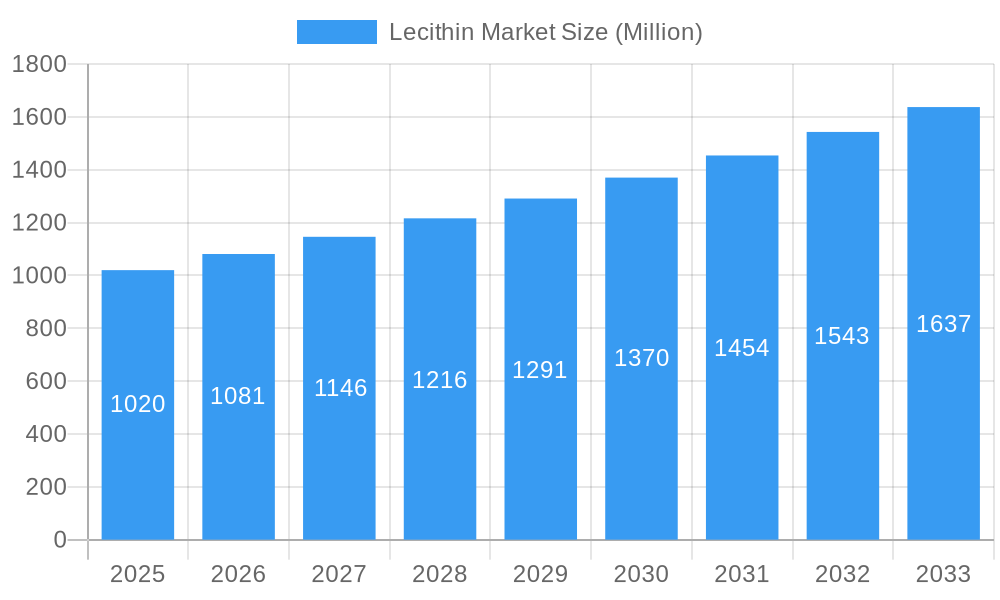

The global lecithin market is poised for substantial growth, projected to reach a market size of USD 1.02 billion in 2025 with a robust Compound Annual Growth Rate (CAGR) of 6.15% through 2033. This expansion is primarily fueled by the increasing demand for natural emulsifiers and stabilizers across a spectrum of industries. The food and beverage sector remains the dominant application, driven by consumer preferences for cleaner labels and ingredient transparency, leading to a greater incorporation of lecithin in baked goods, confectionery, dairy products, and processed foods. Furthermore, the burgeoning health and nutrition sector is a significant contributor, with lecithin gaining traction in dietary supplements and functional foods due to its perceived benefits for cognitive function and cardiovascular health. The feed industry also presents a consistent demand, leveraging lecithin's nutritional properties to enhance animal growth and feed efficiency.

Lecithin Market Market Size (In Billion)

The market dynamics are shaped by several key trends and drivers. The rising adoption of plant-based diets and the subsequent demand for lecithin derived from non-animal sources, such as soy and sunflower, are critical growth catalysts. Innovations in processing technologies are also improving the quality and functionality of lecithin, broadening its application scope. While the market is generally robust, it faces certain restraints, including the fluctuating prices of raw materials and the increasing regulatory scrutiny surrounding genetically modified organisms (GMOs) in certain regions, particularly concerning soy-based lecithin. However, the ongoing research and development into alternative and sustainable lecithin sources, alongside a growing awareness of its versatile functionalities, are expected to mitigate these challenges and sustain the market's upward trajectory.

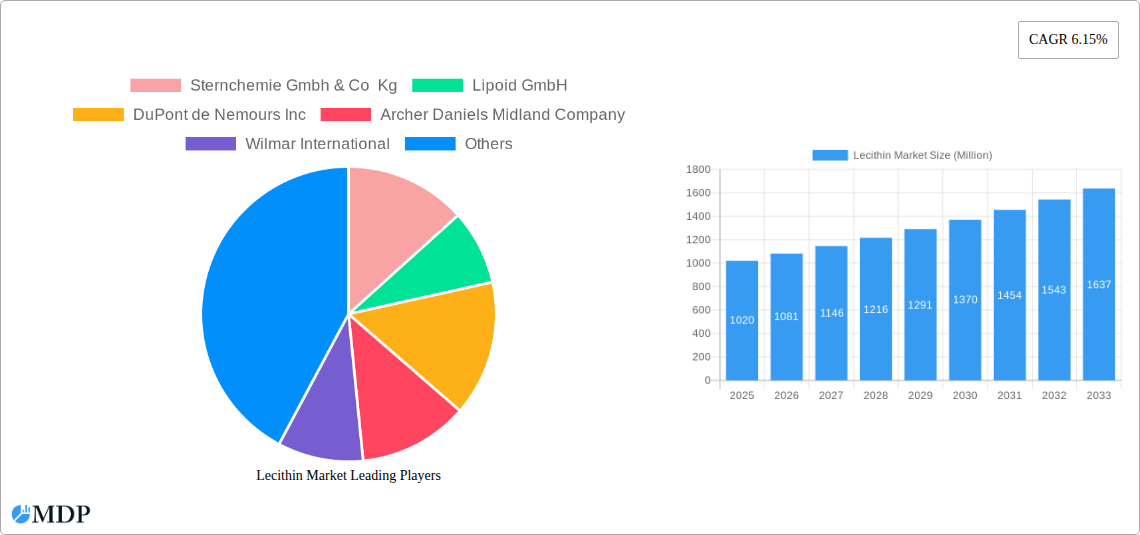

Lecithin Market Company Market Share

The Lecithin Market is experiencing robust growth driven by increasing demand across diverse applications, including food and beverage, animal feed, pharmaceuticals, and nutritional supplements. This comprehensive report offers an in-depth analysis of the global lecithin market, covering historical trends, current market dynamics, and future projections from 2019 to 2033. With a base year of 2025, the report provides crucial insights into market segmentation by source (egg, soy, sunflower, other sources) and application, alongside an exhaustive competitive landscape featuring key industry players. Discover the latest lecithin market trends, lecithin market size, and lecithin market growth drivers that are shaping this dynamic industry. Understand the impact of natural emulsifiers, non-GMO lecithin, and clean-label ingredients on consumer preferences and market expansion.

Lecithin Market Market Dynamics & Concentration

The global lecithin market exhibits a moderate to high concentration, with a few prominent players holding significant market share, estimated at around XX% for the top five companies. Innovation remains a key driver, fueled by advancements in processing technologies that enhance lecithin's functional properties and expand its application range. Regulatory frameworks, particularly concerning food safety and labeling (e.g., non-GMO claims, allergen declarations), play a crucial role in market access and product development. Product substitutes, such as other natural emulsifiers and synthetic alternatives, present a competitive challenge, but lecithin's perceived natural origin and versatility often give it an edge. End-user trends heavily favor clean-label ingredients, increased demand for plant-based products, and a growing awareness of health and wellness benefits, all of which are boosting lecithin consumption. Mergers and acquisitions (M&A) activities are a recurring feature, with an estimated XX M&A deals in the historical period (2019-2024), indicating strategic consolidation and expansion efforts among leading companies.

Lecithin Market Industry Trends & Analysis

The lecithin market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately XX% between 2025 and 2033, a testament to its expanding utility and market penetration. A significant trend is the surging demand for lecithin derived from sustainable and non-GMO sources, particularly sunflower lecithin, driven by growing consumer preference for "clean label" products and concerns about allergens associated with soy. This shift has propelled sunflower lecithin's market penetration to an estimated XX% in 2025. Technological disruptions, including advancements in extraction and purification methods, are enhancing the functional properties of lecithin, making it more efficient as an emulsifier, stabilizer, and dispersant. This allows for its wider application in sophisticated food formulations, pharmaceuticals, and specialized animal feed. Consumer preferences are increasingly leaning towards natural ingredients that offer health benefits, positioning lecithin as a favored ingredient in nutraceuticals and dietary supplements. The competitive dynamics are characterized by a blend of established global players and emerging regional manufacturers, all vying for market share through product innovation, strategic partnerships, and cost-effective production. The overall market penetration is estimated at XX% in 2025, with significant room for expansion.

Leading Markets & Segments in Lecithin Market

The Food and Beverage application segment is the dominant force in the global lecithin market, accounting for an estimated XX% of the total market share in 2025. This dominance is driven by lecithin's indispensable role as a natural emulsifier, stabilizer, and release agent in a vast array of products, including baked goods, confectionery, dairy alternatives, processed meats, and sauces. Within the Food and Beverage segment, the Soy Lecithin sub-segment continues to hold a substantial market share, estimated at XX% in 2025, due to its cost-effectiveness and established applications. However, Sunflower Lecithin is rapidly gaining traction, projected to grow at a CAGR of XX% during the forecast period, driven by its non-GMO and allergen-free profile, aligning with clean-label trends.

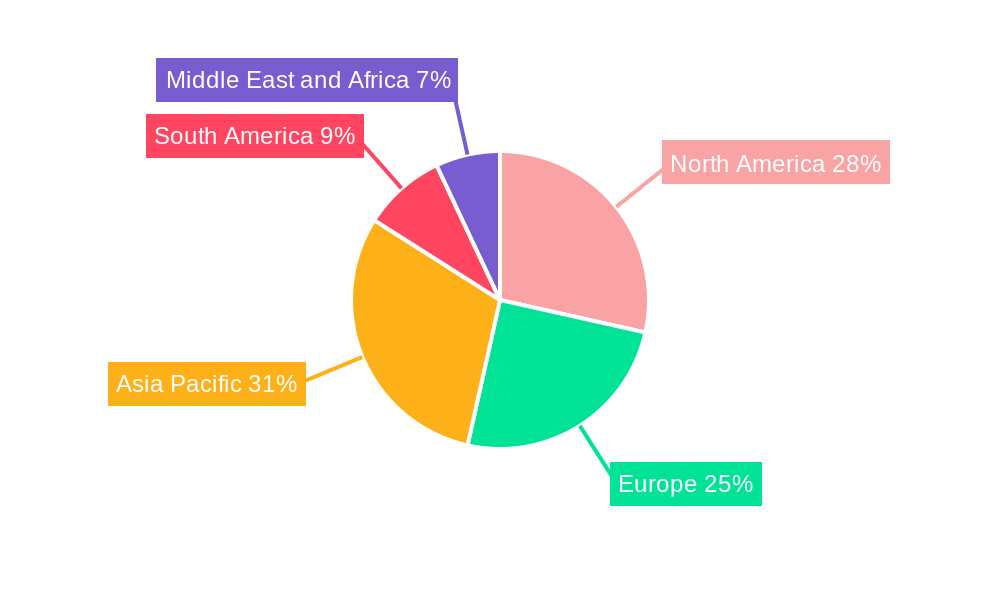

- Dominant Region: North America currently leads the lecithin market, capturing an estimated XX% of the global market share in 2025. This leadership is attributed to a strong consumer preference for processed foods, a well-established nutraceutical industry, and supportive regulatory frameworks for food additives.

- Dominant Country: The United States, within North America, is the largest single market, driven by extensive food processing industries and high consumer spending on health and wellness products.

- Key Drivers for Food & Beverage Dominance:

- Consumer demand for natural and clean-label ingredients.

- Functional benefits: emulsification, stabilization, and improved texture.

- Versatility across numerous food product categories.

- Growing demand for plant-based and dairy-free alternatives.

The Nutrition and Supplements segment is another significant growth area, with an estimated market share of XX% in 2025, driven by the increasing consumer focus on health and wellness and the recognized benefits of lecithin for cognitive function and fat metabolism. The Pharmaceutical segment, though smaller, is poised for steady growth due to lecithin's use as an excipient in drug formulations and its therapeutic applications.

Lecithin Market Product Developments

Product development in the lecithin market is intensely focused on enhancing functionality and catering to evolving consumer demands for natural and allergen-free ingredients. Innovations include specialized lecithin formulations for improved emulsification in plant-based beverages and dairy alternatives, and highly purified lecithins for pharmaceutical applications, such as liposome formulations for drug delivery. The development of novel extraction techniques is yielding lecithins with improved stability and shelf-life. Competitive advantages are being built around non-GMO certifications, allergen-free claims (especially for soy), and functional superiority in specific applications, such as improved texture in baked goods or enhanced bioavailability in supplements. The market is also seeing a rise in lecithin derivatives with tailored properties for niche applications.

Key Drivers of Lecithin Market Growth

The lecithin market's growth is propelled by several key drivers. Economically, the expanding global food processing industry and the rising demand for convenience foods are significant contributors. Technologically, advancements in lecithin extraction and purification processes are improving product quality and expanding application possibilities. Regulatory landscapes, while sometimes presenting challenges, also foster growth by providing clear guidelines for safe use and labeling, which builds consumer trust. The increasing consumer awareness of health benefits associated with lecithin, such as its role in brain health and as a source of choline, is driving demand in the nutrition and supplements sector. Furthermore, the growing trend towards plant-based diets and clean-label products directly favors lecithin, especially sunflower and soy varieties, as natural emulsifiers.

Challenges in the Lecithin Market Market

Despite robust growth prospects, the lecithin market faces several challenges. Supply chain volatility, particularly for raw materials like soybeans and sunflowers, can impact pricing and availability. Regulatory hurdles, including stringent food additive regulations and evolving allergen labeling requirements in different regions, can add complexity and cost to product development and market entry. Competitive pressures from other emulsifiers and functional ingredients, as well as the development of synthetic alternatives, require continuous innovation and cost-effectiveness from lecithin manufacturers. Furthermore, concerns regarding genetically modified organisms (GMOs) in some regions necessitate the development and clear labeling of non-GMO lecithin options. Price fluctuations of raw agricultural commodities also pose a significant challenge to maintaining stable profit margins.

Emerging Opportunities in Lecithin Market

Emerging opportunities in the lecithin market are substantial, driven by evolving consumer trends and technological advancements. The burgeoning demand for plant-based and vegan food products presents a significant avenue for growth, particularly for sunflower and soy lecithin as crucial emulsifiers and texture enhancers. Advancements in nanotechnology and drug delivery systems are creating new opportunities for highly purified lecithins in pharmaceutical applications, such as liposomes and nanoemulsions. The increasing focus on personalized nutrition and functional foods also opens doors for specialized lecithin formulations with targeted health benefits. Strategic partnerships between lecithin producers and food manufacturers, pharmaceutical companies, and nutraceutical brands are expected to accelerate market penetration and product innovation, tapping into emerging markets and niche applications.

Leading Players in the Lecithin Market Sector

- Sternchemie GmbH & Co Kg

- Lipoid GmbH

- DuPont de Nemours Inc

- Archer Daniels Midland Company

- Wilmar International

- Bunge Limited

- VAV Life Sciences Pvt Ltd

- Cargill Inc

- American Lecithin Company

- Fishmer Lecithin

Key Milestones in Lecithin Market Industry

- November 2022: Novastell introduced a variety of lecithin granules for application in food and beverage applications. In contrast to Suncithin G96, created from sunflower lecithin and is likewise non-GMO and allergen-free, Soycithin G97 IP is a classic soy lecithin that is non-GMO and fully traceable.

- April 2021: Strenchemie received a generally recognized as safe (GRAS) no-objection letter from the Food and Drug Administration (FDA) for its range of sunflower-based lecithin.

- February 2021: Strenchemie announced the release of soy lecithin dairy alternatives for the European market.

- March 2021: Lecico announced a distribution partnership with Ciranda for lecithin and phospholipids across North America, focusing on clean-label food trends and local commercial and technical support.

Strategic Outlook for Lecithin Market Market

The strategic outlook for the lecithin market is exceptionally positive, characterized by continuous innovation and expanding application frontiers. Future growth will be significantly propelled by the increasing demand for natural, plant-based, and clean-label ingredients, especially in the food and beverage sector. The pharmaceutical industry's growing reliance on lecithin for advanced drug delivery systems and the burgeoning nutraceutical market will provide substantial growth accelerators. Companies focusing on sustainable sourcing, non-GMO production, and developing specialized lecithin functionalities for niche applications will be well-positioned to capture market share. Strategic collaborations and vertical integration within the supply chain are expected to be crucial for navigating market complexities and capitalizing on emerging opportunities. The continued global shift towards health-conscious consumption patterns ensures a sustained demand for lecithin's versatile benefits.

Lecithin Market Segmentation

-

1. Source

- 1.1. Egg

- 1.2. Soy

- 1.3. Sunflower

- 1.4. Other Sources

-

2. Application

- 2.1. Food and Beverage

- 2.2. Feed

- 2.3. Nutrition and Supplements

- 2.4. Pharmaceuticals

- 2.5. Other Applications

Lecithin Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Lecithin Market Regional Market Share

Geographic Coverage of Lecithin Market

Lecithin Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation

- 3.3. Market Restrains

- 3.3.1. ; Threat of New Entrants; Bargaining Power of Buyers/Consumers; Bargaining Power of Suppliers; Threat of Substitute Products; Degree Of Competition

- 3.4. Market Trends

- 3.4.1. Surge in Demand for Dietary Supplement Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lecithin Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Egg

- 5.1.2. Soy

- 5.1.3. Sunflower

- 5.1.4. Other Sources

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverage

- 5.2.2. Feed

- 5.2.3. Nutrition and Supplements

- 5.2.4. Pharmaceuticals

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. North America Lecithin Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Source

- 6.1.1. Egg

- 6.1.2. Soy

- 6.1.3. Sunflower

- 6.1.4. Other Sources

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food and Beverage

- 6.2.2. Feed

- 6.2.3. Nutrition and Supplements

- 6.2.4. Pharmaceuticals

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Source

- 7. Europe Lecithin Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Source

- 7.1.1. Egg

- 7.1.2. Soy

- 7.1.3. Sunflower

- 7.1.4. Other Sources

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food and Beverage

- 7.2.2. Feed

- 7.2.3. Nutrition and Supplements

- 7.2.4. Pharmaceuticals

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Source

- 8. Asia Pacific Lecithin Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Source

- 8.1.1. Egg

- 8.1.2. Soy

- 8.1.3. Sunflower

- 8.1.4. Other Sources

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food and Beverage

- 8.2.2. Feed

- 8.2.3. Nutrition and Supplements

- 8.2.4. Pharmaceuticals

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Source

- 9. South America Lecithin Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Source

- 9.1.1. Egg

- 9.1.2. Soy

- 9.1.3. Sunflower

- 9.1.4. Other Sources

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food and Beverage

- 9.2.2. Feed

- 9.2.3. Nutrition and Supplements

- 9.2.4. Pharmaceuticals

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Source

- 10. Middle East and Africa Lecithin Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Source

- 10.1.1. Egg

- 10.1.2. Soy

- 10.1.3. Sunflower

- 10.1.4. Other Sources

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Food and Beverage

- 10.2.2. Feed

- 10.2.3. Nutrition and Supplements

- 10.2.4. Pharmaceuticals

- 10.2.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Source

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Sternchemie Gmbh & Co Kg

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lipoid GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DuPont de Nemours Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Archer Daniels Midland Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Wilmar International

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bunge Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 VAV Life Sciences Pvt Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cargill Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 American Lecithin Company*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fishmer Lecithin

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Sternchemie Gmbh & Co Kg

List of Figures

- Figure 1: Global Lecithin Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Lecithin Market Revenue (Million), by Source 2025 & 2033

- Figure 3: North America Lecithin Market Revenue Share (%), by Source 2025 & 2033

- Figure 4: North America Lecithin Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Lecithin Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Lecithin Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Lecithin Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Lecithin Market Revenue (Million), by Source 2025 & 2033

- Figure 9: Europe Lecithin Market Revenue Share (%), by Source 2025 & 2033

- Figure 10: Europe Lecithin Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Lecithin Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Lecithin Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Lecithin Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Lecithin Market Revenue (Million), by Source 2025 & 2033

- Figure 15: Asia Pacific Lecithin Market Revenue Share (%), by Source 2025 & 2033

- Figure 16: Asia Pacific Lecithin Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Lecithin Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Lecithin Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Lecithin Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Lecithin Market Revenue (Million), by Source 2025 & 2033

- Figure 21: South America Lecithin Market Revenue Share (%), by Source 2025 & 2033

- Figure 22: South America Lecithin Market Revenue (Million), by Application 2025 & 2033

- Figure 23: South America Lecithin Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Lecithin Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Lecithin Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Lecithin Market Revenue (Million), by Source 2025 & 2033

- Figure 27: Middle East and Africa Lecithin Market Revenue Share (%), by Source 2025 & 2033

- Figure 28: Middle East and Africa Lecithin Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Lecithin Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Lecithin Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Lecithin Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Lecithin Market Revenue Million Forecast, by Source 2020 & 2033

- Table 2: Global Lecithin Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Lecithin Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Lecithin Market Revenue Million Forecast, by Source 2020 & 2033

- Table 5: Global Lecithin Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Lecithin Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Lecithin Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Lecithin Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Lecithin Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Lecithin Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Lecithin Market Revenue Million Forecast, by Source 2020 & 2033

- Table 12: Global Lecithin Market Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Global Lecithin Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Spain Lecithin Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Lecithin Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Lecithin Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Lecithin Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Lecithin Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Russia Lecithin Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Lecithin Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Lecithin Market Revenue Million Forecast, by Source 2020 & 2033

- Table 22: Global Lecithin Market Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Lecithin Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Lecithin Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Lecithin Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Lecithin Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Lecithin Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Lecithin Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Lecithin Market Revenue Million Forecast, by Source 2020 & 2033

- Table 30: Global Lecithin Market Revenue Million Forecast, by Application 2020 & 2033

- Table 31: Global Lecithin Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Lecithin Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Lecithin Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Lecithin Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Lecithin Market Revenue Million Forecast, by Source 2020 & 2033

- Table 36: Global Lecithin Market Revenue Million Forecast, by Application 2020 & 2033

- Table 37: Global Lecithin Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: South Africa Lecithin Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Lecithin Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Lecithin Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lecithin Market?

The projected CAGR is approximately 6.15%.

2. Which companies are prominent players in the Lecithin Market?

Key companies in the market include Sternchemie Gmbh & Co Kg, Lipoid GmbH, DuPont de Nemours Inc, Archer Daniels Midland Company, Wilmar International, Bunge Limited, VAV Life Sciences Pvt Ltd, Cargill Inc, American Lecithin Company*List Not Exhaustive, Fishmer Lecithin.

3. What are the main segments of the Lecithin Market?

The market segments include Source, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation.

6. What are the notable trends driving market growth?

Surge in Demand for Dietary Supplement Driving the Market.

7. Are there any restraints impacting market growth?

; Threat of New Entrants; Bargaining Power of Buyers/Consumers; Bargaining Power of Suppliers; Threat of Substitute Products; Degree Of Competition.

8. Can you provide examples of recent developments in the market?

November 2022: Novastell introduced a variety of lecithin granules for application in food and beverage applications. In contrast to Suncithin G96, created from sunflower lecithin and is likewise non-GMO and allergen-free, Soycithin G97 IP is a classic soy lecithin that is non-GMO and fully traceable.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lecithin Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lecithin Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lecithin Market?

To stay informed about further developments, trends, and reports in the Lecithin Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence