Key Insights

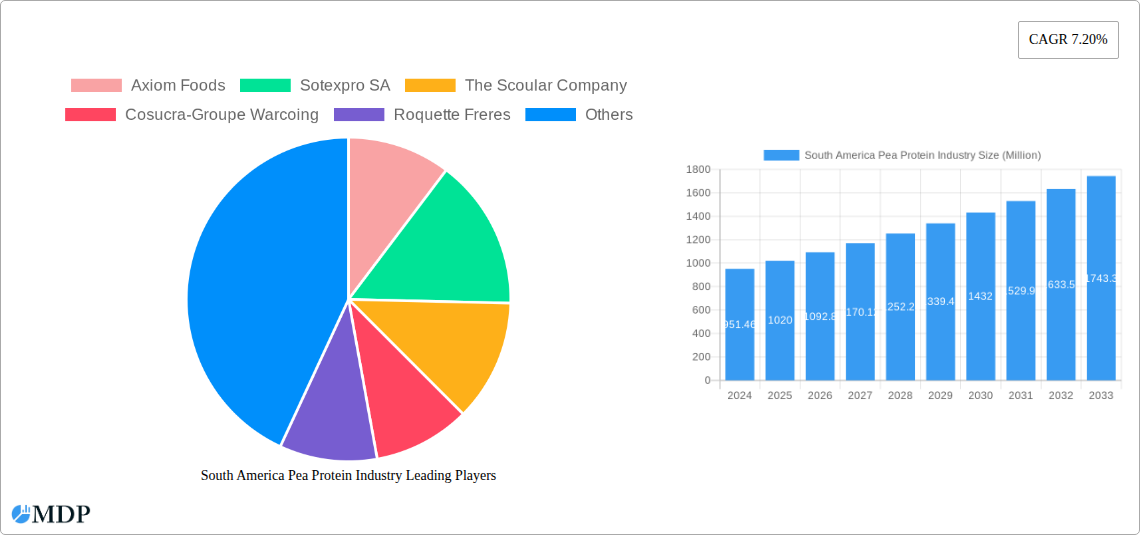

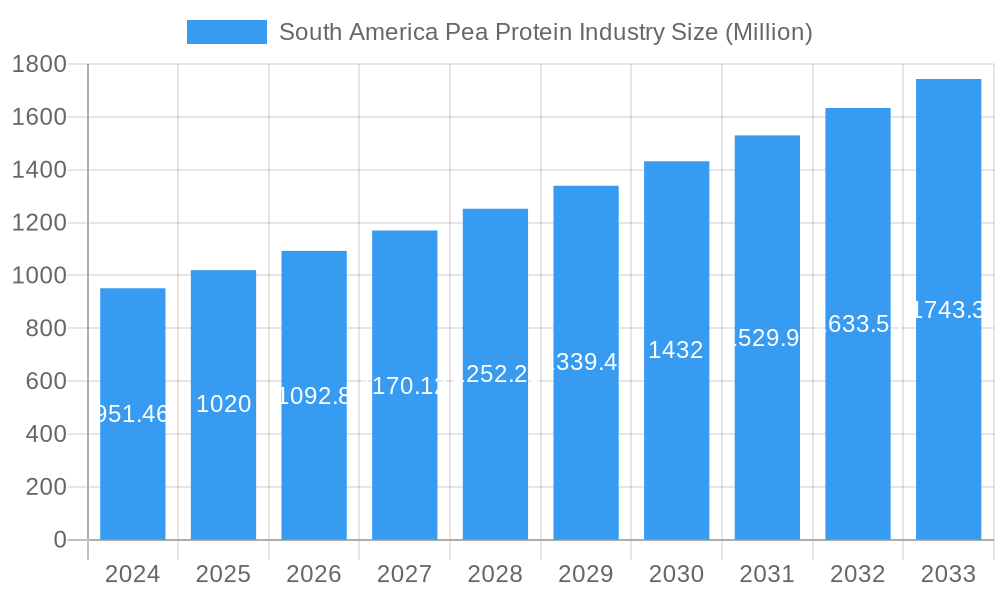

The South American pea protein market is poised for substantial expansion, projected to reach a valuation of $1020 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 7.20% through 2033. This upward trajectory is primarily fueled by a confluence of evolving consumer preferences and a burgeoning demand for plant-based protein alternatives across the region. Consumers are increasingly seeking healthier and more sustainable dietary options, driving significant adoption of pea protein in nutritional supplements, beverages, and food applications such as bakery and snacks. Furthermore, the growing awareness of the environmental impact of traditional animal agriculture is accelerating the shift towards plant-based protein sources, with pea protein emerging as a versatile and cost-effective solution. The market's growth is also supported by advancements in processing technologies that enhance the taste, texture, and solubility of pea protein ingredients, making them more appealing to a wider consumer base and food manufacturers.

South America Pea Protein Industry Market Size (In Million)

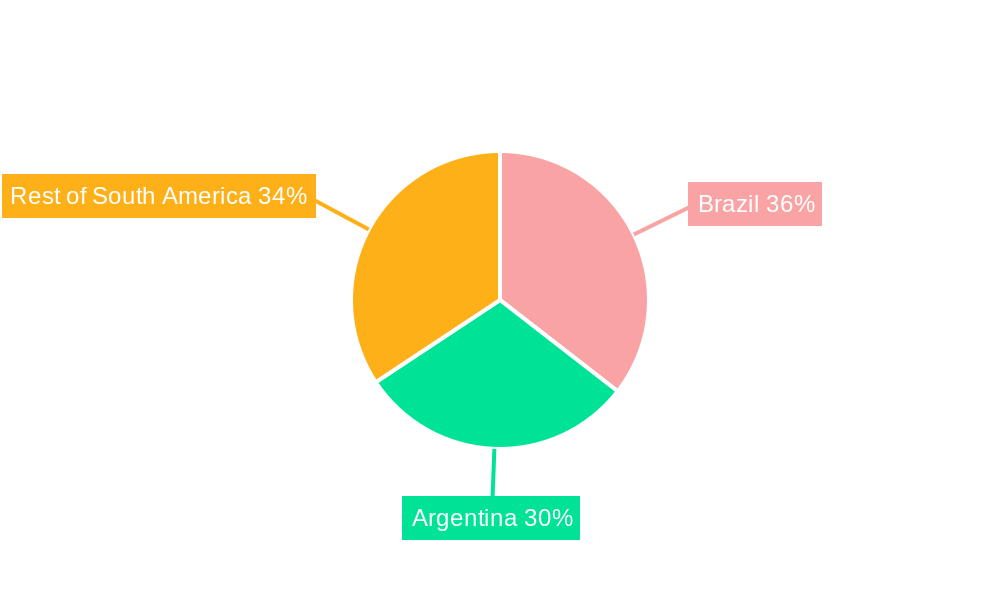

The market segmentation reveals a dynamic landscape with Pea Protein Isolates commanding a significant share due to their high protein content and purity, catering to specialized nutritional needs. Pea Protein Concentrates also play a crucial role, offering a more cost-effective alternative. Textured Pea Protein is gaining traction, particularly in meat extenders and substitutes, addressing the growing demand for plant-based meat alternatives that mimic the texture of animal protein. Geographically, Brazil and Argentina are expected to be key growth engines within South America, driven by their established agricultural infrastructure and a growing vegan and flexitarian population. While South America offers immense growth potential, challenges such as fluctuating raw material prices and the need for further consumer education regarding the benefits of pea protein could present restraints. However, the overarching trend towards health, wellness, and sustainability, coupled with the innovation displayed by key players like Roquette Freres and Puris Foods, is expected to propel the South American pea protein market to new heights in the coming years.

South America Pea Protein Industry Company Market Share

South America Pea Protein Industry Market Report: Unlocking Growth and Innovation

Gain unparalleled insights into the burgeoning South America Pea Protein Industry with this comprehensive market research report. Covering the study period from 2019 to 2033, with a base and estimated year of 2025, this report delves deep into the dynamics shaping this rapidly evolving sector. Discover critical market intelligence, actionable strategies, and future projections essential for industry stakeholders, including manufacturers, suppliers, investors, and end-users. Our analysis leverages high-traffic keywords to maximize visibility and ensure you access the most relevant information.

This report provides an in-depth analysis of Pea Protein Isolates, Pea Protein Concentrates, and Textured Pea Protein segments, alongside their applications in Bakery, Meat Extenders and Substitutes, Nutritional Supplements, Beverages, Snacks, and Others across key geographies like Brazil, Argentina, and the Rest of South America. With historical data from 2019-2024 and a robust forecast period from 2025-2033, this report is your definitive guide to navigating the opportunities and challenges within the South American pea protein market.

South America Pea Protein Industry Market Dynamics & Concentration

The South America Pea Protein Industry is characterized by a moderate to high market concentration, with key players such as Roquette Freres, Axiom Foods, and The Scoular Company holding significant market share. Innovation is a primary driver, fueled by increasing consumer demand for plant-based alternatives and advancements in protein extraction and processing technologies. Regulatory frameworks, particularly concerning food safety and labeling standards, are evolving and influencing market entry and product development. Product substitutes, including soy protein and other plant-based proteins, present a competitive challenge, necessitating continuous product differentiation and quality enhancement. End-user trends are heavily influenced by health and wellness consciousness, with a growing preference for non-GMO, allergen-free, and sustainable protein sources. Merger and Acquisition (M&A) activities are expected to increase as larger players seek to consolidate their market position and expand their product portfolios. The M&A deal count is projected to rise by approximately 15% over the forecast period, driven by strategic acquisitions aimed at enhancing production capacity and geographical reach.

South America Pea Protein Industry Industry Trends & Analysis

The South America Pea Protein Industry is poised for substantial growth, driven by a confluence of factors including a rising global demand for plant-based diets, increasing health consciousness among consumers, and a growing awareness of the environmental sustainability of pea protein production. The market penetration of pea protein is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 12% over the forecast period of 2025-2033. Technological disruptions are playing a pivotal role, with advancements in processing techniques leading to improved taste, texture, and functionality of pea protein ingredients, making them more appealing for a wider range of food and beverage applications. Consumer preferences are shifting towards clean-label products, natural ingredients, and transparent sourcing, which favors pea protein due to its generally recognized as safe (GRAS) status and its favorable environmental footprint compared to animal-based proteins. Competitive dynamics are intensifying, with both established players and new entrants vying for market share. Strategic investments in research and development are crucial for companies to stay ahead, focusing on creating novel applications and enhancing the nutritional profile of their pea protein offerings. The "protein enrichment" trend across various food categories, from snacks to beverages, is a significant growth driver, as consumers actively seek to increase their protein intake. Furthermore, the increasing prevalence of lactose intolerance and dairy allergies is indirectly fueling the demand for plant-based protein alternatives like pea protein. The economic viability of pea cultivation in South America, coupled with supportive government policies aimed at promoting agricultural exports and value-added processing, further bolsters the industry's growth trajectory.

Leading Markets & Segments in South America Pea Protein Industry

The South America Pea Protein Industry is dominated by Brazil, which holds an estimated market share of 40% due to its extensive agricultural infrastructure and strong demand for food ingredients. This dominance is further propelled by favorable government policies supporting the agricultural sector and increasing investments in food processing technologies.

Key Dominant Segments:

Type:

- Pea Protein Isolates: This segment is leading the market, accounting for approximately 50% of the total market share, driven by their high protein content (over 80%) and versatility in applications requiring superior functional properties. The increasing demand for high-protein nutritional supplements and clean-label food products is a primary driver.

- Pea Protein Concentrates: Holding a significant share of around 35%, concentrates are valued for their cost-effectiveness and are widely used in animal feed and some food applications.

- Textured Pea Protein: Though a smaller segment currently at around 15%, it is experiencing the fastest growth due to its potential as a meat alternative.

Application:

- Nutritional Supplements: This segment commands the largest market share, estimated at 30%, driven by the global wellness trend and the demand for plant-based protein powders and bars.

- Meat Extenders and Substitutes: This is a rapidly growing segment, projected to reach 25% market share, fueled by the increasing popularity of vegetarian and vegan diets.

- Bakery: Accounting for approximately 15% of the market, pea protein is increasingly incorporated into baked goods for added protein and nutritional value.

- Beverages: With a market share of around 10%, pea protein is finding its way into plant-based milks, smoothies, and protein drinks.

- Snacks: This segment holds about 10%, with pea protein used in bars, crisps, and other savory snacks.

- Others: The remaining 10% includes applications in pet food and specialized nutritional products.

Geography:

- Brazil: As mentioned, Brazil is the leading market, with an estimated market share of 40%. Key drivers include a robust agricultural base, significant domestic consumption, and growing export potential.

- Argentina: Holds an estimated 30% market share, driven by its strong agricultural output and increasing adoption of plant-based products.

- Rest of South America: This segment, encompassing countries like Chile, Colombia, and Peru, accounts for the remaining 30% and is expected to witness considerable growth due to rising disposable incomes and increasing awareness of health and sustainability.

South America Pea Protein Industry Product Developments

Product innovation in the South America Pea Protein Industry is centered on enhancing functionality, taste, and sustainability. Companies are developing new grades of pea protein isolates and concentrates with improved solubility, emulsification, and gelling properties, catering to a broader range of food and beverage applications. The introduction of textured pea protein with a meat-like texture and bite is a significant development, directly addressing the burgeoning demand for plant-based meat alternatives. Furthermore, advancements in processing technologies are leading to cleaner labels and allergen-free formulations, appealing to health-conscious consumers. These developments are crucial for establishing competitive advantages by meeting specific end-user needs and differentiating products in a crowded market.

Key Drivers of South America Pea Protein Industry Growth

The South America Pea Protein Industry's growth is propelled by several key factors. A significant driver is the escalating global consumer shift towards plant-based diets, spurred by health and environmental concerns, which directly translates to increased demand for pea protein. Technological advancements in extraction and processing are enhancing the functionality and palatability of pea protein, broadening its applications across food and beverage sectors. Favorable regulatory landscapes in several South American countries, promoting the production and consumption of plant-based foods, also contribute to growth. Furthermore, the cost-effectiveness and sustainability advantages of pea protein compared to other protein sources make it an attractive option for manufacturers.

Challenges in the South America Pea Protein Industry Market

Despite its promising growth, the South America Pea Protein Industry faces several challenges. A primary restraint is the inherent variability in the quality and availability of raw peas due to agricultural factors like climate and pest infestations, which can impact supply chain stability and pricing. Competitive pressures from established protein sources, including soy and whey protein, require continuous innovation and marketing efforts. Furthermore, consumer perception regarding the taste and texture of some pea protein products, although improving, remains a barrier to wider adoption in certain applications. Regulatory hurdles related to novel food ingredient approvals and labeling standards in some emerging markets can also slow down market penetration.

Emerging Opportunities in South America Pea Protein Industry

Emerging opportunities in the South America Pea Protein Industry are vast and varied. The increasing global focus on sustainable food systems presents a significant advantage, as pea cultivation is known for its lower environmental impact compared to animal agriculture. Technological breakthroughs in flavor masking and texturization are opening doors for pea protein to replace animal proteins in a wider array of processed foods, including convenience meals and snacks. Strategic partnerships between ingredient suppliers and food manufacturers are creating new product development pipelines. Moreover, the expansion of export markets, particularly to regions with high demand for plant-based proteins, offers substantial growth potential.

Leading Players in the South America Pea Protein Industry Sector

- Axiom Foods

- Sotexpro SA

- The Scoular Company

- Cosucra-Groupe Warcoing

- Roquette Freres

- Puris Foods

- Glanbia Plc

- Fenchem

Key Milestones in South America Pea Protein Industry Industry

- 2019: Increased investment in research for novel pea protein applications and improved processing technologies.

- 2020: Growing consumer awareness regarding the health benefits of plant-based diets, leading to a surge in demand for pea protein supplements.

- 2021: Major food manufacturers begin incorporating pea protein into mainstream product lines, including beverages and snacks.

- 2022: Advancements in texturization technology result in improved textured pea protein products mimicking meat more closely.

- 2023: Several South American countries introduce supportive policies for the growth of the plant-based food sector.

- 2024: Expansion of production capacities by key players to meet the growing regional and global demand.

Strategic Outlook for South America Pea Protein Industry Market

The strategic outlook for the South America Pea Protein Industry remains highly optimistic, fueled by sustained consumer demand for plant-based and sustainable food options. Key growth accelerators include continued innovation in product development, focusing on enhanced taste, texture, and nutritional profiles. Strategic partnerships and potential mergers and acquisitions will play a crucial role in market consolidation and expansion. The industry will likely witness further investment in advanced processing technologies to improve efficiency and product quality. Furthermore, leveraging the inherent sustainability of pea cultivation will be a critical marketing and brand-building strategy, appealing to environmentally conscious consumers and businesses.

South America Pea Protein Industry Segmentation

-

1. Type

- 1.1. Pea Protein Isolates

- 1.2. Pea Protein Concentrates

- 1.3. Textured Pea Protein

-

2. Application

- 2.1. Bakery

- 2.2. Meat Extenders and Substitutes

- 2.3. Nutritional Supplements

- 2.4. Beverages

- 2.5. Snacks

- 2.6. Others

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Pea Protein Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Pea Protein Industry Regional Market Share

Geographic Coverage of South America Pea Protein Industry

South America Pea Protein Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Prevalence of Lactose Intolerance Driving the Market; Growing Influence of Healthy Lifestyle Trends and Rising Non-Traditional Users

- 3.3. Market Restrains

- 3.3.1. Wide Availability of Alternative Protein Sources

- 3.4. Market Trends

- 3.4.1. Brazil Dominates the Plant Protein Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Pea Protein Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Pea Protein Isolates

- 5.1.2. Pea Protein Concentrates

- 5.1.3. Textured Pea Protein

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Meat Extenders and Substitutes

- 5.2.3. Nutritional Supplements

- 5.2.4. Beverages

- 5.2.5. Snacks

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Pea Protein Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Pea Protein Isolates

- 6.1.2. Pea Protein Concentrates

- 6.1.3. Textured Pea Protein

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Bakery

- 6.2.2. Meat Extenders and Substitutes

- 6.2.3. Nutritional Supplements

- 6.2.4. Beverages

- 6.2.5. Snacks

- 6.2.6. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Pea Protein Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Pea Protein Isolates

- 7.1.2. Pea Protein Concentrates

- 7.1.3. Textured Pea Protein

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Bakery

- 7.2.2. Meat Extenders and Substitutes

- 7.2.3. Nutritional Supplements

- 7.2.4. Beverages

- 7.2.5. Snacks

- 7.2.6. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of South America South America Pea Protein Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Pea Protein Isolates

- 8.1.2. Pea Protein Concentrates

- 8.1.3. Textured Pea Protein

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Bakery

- 8.2.2. Meat Extenders and Substitutes

- 8.2.3. Nutritional Supplements

- 8.2.4. Beverages

- 8.2.5. Snacks

- 8.2.6. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Axiom Foods

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Sotexpro SA

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 The Scoular Company

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Cosucra-Groupe Warcoing

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Roquette Freres

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Puris Foods*List Not Exhaustive

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Glanbia Plc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Fenchem

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Axiom Foods

List of Figures

- Figure 1: South America Pea Protein Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Pea Protein Industry Share (%) by Company 2025

List of Tables

- Table 1: South America Pea Protein Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: South America Pea Protein Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: South America Pea Protein Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: South America Pea Protein Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: South America Pea Protein Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: South America Pea Protein Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 7: South America Pea Protein Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: South America Pea Protein Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: South America Pea Protein Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: South America Pea Protein Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 11: South America Pea Protein Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: South America Pea Protein Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: South America Pea Protein Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: South America Pea Protein Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 15: South America Pea Protein Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: South America Pea Protein Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Pea Protein Industry?

The projected CAGR is approximately 7.20%.

2. Which companies are prominent players in the South America Pea Protein Industry?

Key companies in the market include Axiom Foods, Sotexpro SA, The Scoular Company, Cosucra-Groupe Warcoing, Roquette Freres, Puris Foods*List Not Exhaustive, Glanbia Plc, Fenchem.

3. What are the main segments of the South America Pea Protein Industry?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1020 Million as of 2022.

5. What are some drivers contributing to market growth?

Prevalence of Lactose Intolerance Driving the Market; Growing Influence of Healthy Lifestyle Trends and Rising Non-Traditional Users.

6. What are the notable trends driving market growth?

Brazil Dominates the Plant Protein Market.

7. Are there any restraints impacting market growth?

Wide Availability of Alternative Protein Sources.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Pea Protein Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Pea Protein Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Pea Protein Industry?

To stay informed about further developments, trends, and reports in the South America Pea Protein Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence