Key Insights

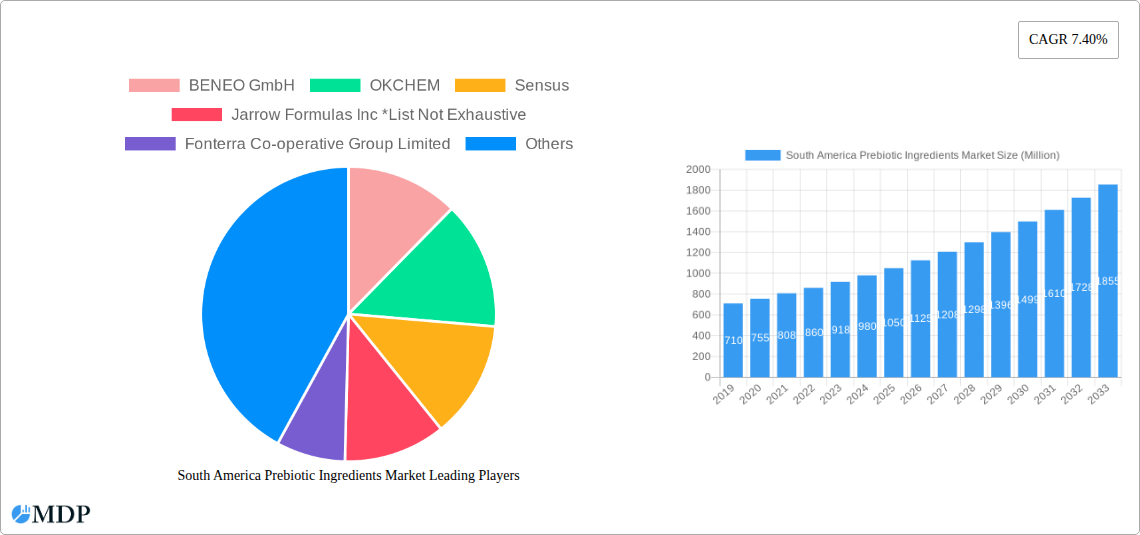

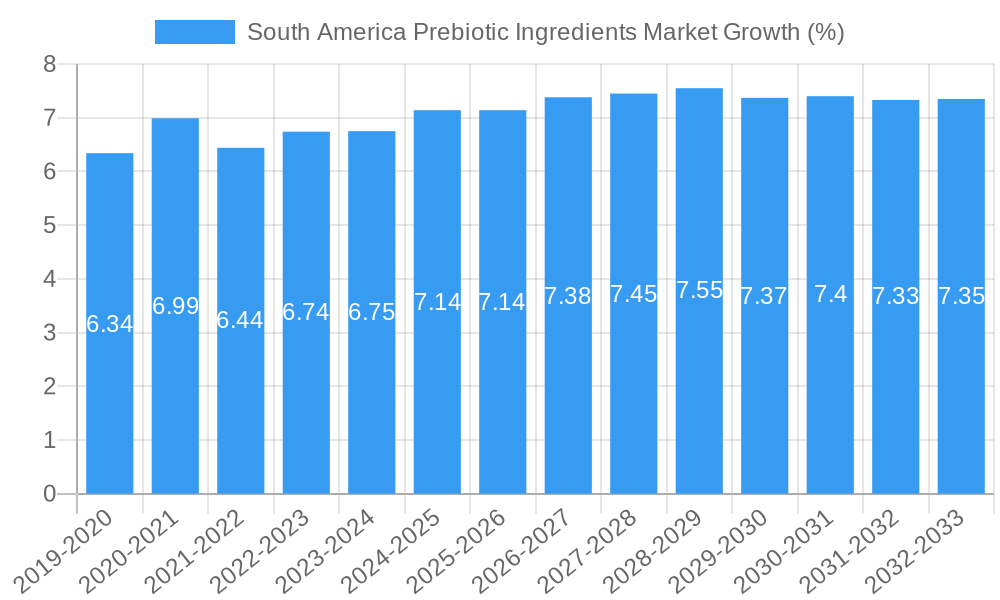

The South America Prebiotic Ingredients Market is poised for substantial growth, projected to reach a market size of approximately $1.2 billion by 2033, expanding at a Compound Annual Growth Rate (CAGR) of 7.40% from its estimated 2025 valuation. This expansion is primarily fueled by increasing consumer awareness regarding gut health and the associated benefits of prebiotic consumption, leading to a higher demand for products enriched with prebiotics like Fructo-oligosaccharides (FOS) and Galacto-oligosaccharides (GOS). The burgeoning infant formula segment, driven by concerns for early childhood nutrition and development, represents a significant application area. Furthermore, the expanding fortified food and beverage sector, along with the growing dietary supplements market, are key accelerators for market penetration across South America.

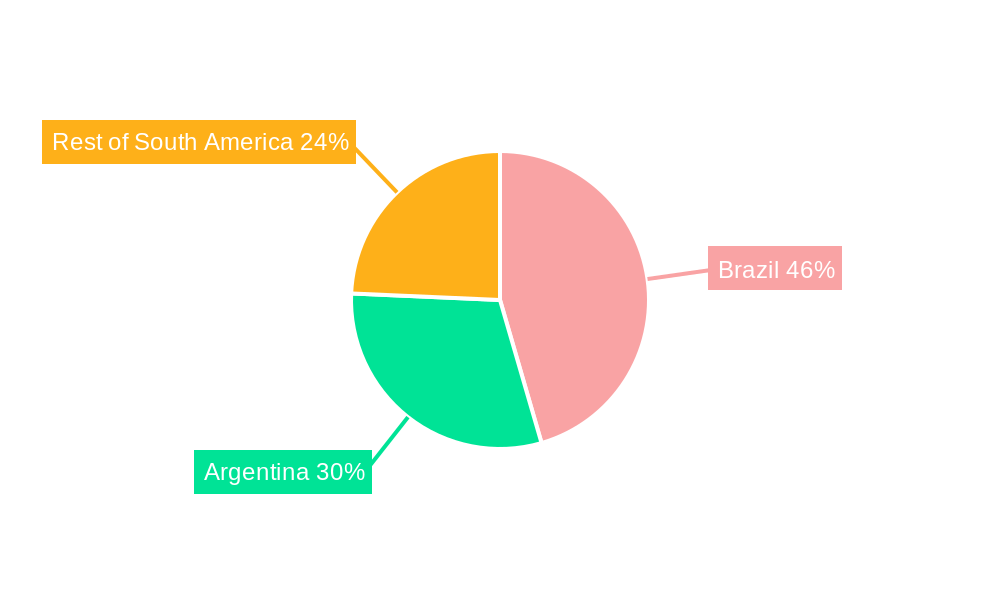

The market's trajectory is also shaped by evolving consumer preferences towards natural and functional food ingredients. The demand for improved digestive health, immune system support, and enhanced nutrient absorption is driving innovation and product development. While the market exhibits strong growth potential, challenges such as price sensitivity among certain consumer demographics and the need for greater consumer education on the distinct benefits of various prebiotic types can pose restraints. However, the increasing presence of key players like BENEO GmbH, Fonterra Co-operative Group Limited, and Nexira, alongside growing investments in research and development, are expected to mitigate these challenges and propel the market forward. Geographically, Brazil is anticipated to be a dominant market, followed by Argentina and the broader Rest of South America, reflecting regional demographic trends and evolving dietary habits.

Unlock the immense potential of the South American prebiotic ingredients market with our comprehensive report. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this in-depth analysis delves into market dynamics, industry trends, leading segments, product innovations, growth drivers, challenges, opportunities, and key players. Discover actionable insights into the burgeoning demand for prebiotics across infant formula, fortified foods, beverages, dietary supplements, and animal feed. With a projected CAGR of XX%, this market presents a significant opportunity for stakeholders seeking to capitalize on the growing health and wellness consciousness in the region.

South America Prebiotic Ingredients Market Market Dynamics & Concentration

The South America prebiotic ingredients market is characterized by a moderate concentration, with key players like BENEO GmbH, Sensus, and Fonterra Co-operative Group Limited holding significant market share. Innovation is primarily driven by an increasing consumer demand for scientifically backed gut health solutions and a growing awareness of the link between the microbiome and overall well-being. Regulatory frameworks are evolving, with a focus on ensuring product safety and efficacy, which, while sometimes presenting hurdles, ultimately fosters a more robust and trustworthy market. Product substitutes, such as probiotics, exist, but prebiotics offer unique benefits in nourishing beneficial gut bacteria, driving their adoption. End-user trends strongly favor natural, plant-derived ingredients and transparent labeling. Merger and acquisition (M&A) activities, though not extensively documented in public records for this specific regional market, are anticipated to increase as larger global players seek to expand their footprint and smaller, innovative companies become acquisition targets. We estimate XX M&A deals within the study period.

- Market Share Drivers: Consumer education, R&D investment, strategic partnerships.

- Innovation Focus: Novel sources of prebiotic fibers, enhanced bioavailability, synbiotic formulations.

- Regulatory Landscape: Food safety standards, labeling requirements, health claim approvals.

- Competitive Landscape: Differentiated product offerings, supply chain reliability, pricing strategies.

- M&A Activity Indicators: Venture capital funding in emerging companies, consolidation by established manufacturers.

South America Prebiotic Ingredients Market Industry Trends & Analysis

The South America prebiotic ingredients market is poised for substantial growth, projected at a XX% CAGR from 2025 to 2033. This expansion is underpinned by a confluence of robust market growth drivers, significant technological disruptions, evolving consumer preferences, and dynamic competitive forces. A primary growth driver is the escalating consumer awareness regarding the health benefits associated with a balanced gut microbiome. This heightened consciousness is translating into a tangible demand for prebiotic-fortified products across various food and beverage categories, as well as a surge in the dietary supplements sector. Furthermore, advancements in food science and biotechnology are enabling the development of novel and more effective prebiotic ingredients, expanding their applicability and appeal.

Technological disruptions are playing a pivotal role, with ongoing research uncovering new sources of prebiotic fibers and optimizing extraction and production processes. This leads to improved cost-effectiveness and a wider range of functional benefits. The penetration of these ingredients into mainstream consumer products is steadily increasing, moving beyond niche health foods to become integral components in everyday items.

Consumer preferences are shifting towards natural, clean-label, and plant-based ingredients, aligning perfectly with the origins of many prebiotic fibers like FOS and GOS. This trend is particularly strong in South America, where consumers are increasingly seeking healthier alternatives to processed foods. The demand for personalized nutrition solutions is also a significant factor, with prebiotics being recognized for their role in addressing individual gut health needs.

The competitive dynamics within the market are intensifying. Established global players are vying for market share alongside emerging regional manufacturers. Strategic partnerships and collaborations are becoming crucial for market access, R&D acceleration, and product innovation. The market penetration of prebiotics is still in its nascent stages in certain segments, offering considerable headroom for growth and market expansion. For instance, the animal feed segment, while currently smaller, shows immense potential as the focus on animal gut health and productivity intensifies.

- Market Penetration: Expected to reach XX% by 2033 in the fortified food and beverage segment.

- Technological Advancements: Enzymatic synthesis of GOS, novel fiber extraction techniques.

- Consumer Demand: Growing preference for natural, organic, and non-GMO prebiotic ingredients.

- Competitive Landscape: Increasing focus on supply chain optimization and R&D collaborations.

- Emerging Applications: Functional beverages, ready-to-eat meals, and pet food.

Leading Markets & Segments in South America Prebiotic Ingredients Market

Brazil is emerging as the dominant market within the South America prebiotic ingredients landscape, driven by its large population, growing middle class, and increasing health consciousness. The strong economic policies supporting food and beverage innovation, coupled with a well-developed agricultural sector, provide a fertile ground for the expansion of prebiotic ingredients. Argentina also holds significant potential, with a growing demand for health-focused food products and dietary supplements. The "Rest of South America" encompasses a diverse range of countries, each with unique growth trajectories, but collectively contributing to the overall market expansion.

Type Segment Dominance:

- FOS (Fructo-oligosaccharide) is anticipated to dominate the market due to its widespread availability, cost-effectiveness, and proven efficacy in promoting gut health. Its versatility allows for easy incorporation into various food and beverage applications.

- GOS (Galacto-oligosaccharide) is experiencing rapid growth, driven by its excellent prebiotic properties and its strong association with infant nutrition. The increasing demand for specialized infant formulas is a key factor here.

- Insulin represents a significant segment, particularly in dietary supplements, owing to its well-researched health benefits and its role in managing blood sugar levels, a growing concern in the region.

- Other In encompasses emerging prebiotic fibers and compounds, which are gaining traction as research uncovers their unique benefits and applications.

Application Segment Dominance:

- Infant Formula is a leading application, driven by parental focus on infant health and development, and the proven benefits of prebiotics for a developing gut microbiome.

- Fortified Food and Beverage is expected to witness the most substantial growth, as manufacturers increasingly integrate prebiotics into everyday products to enhance their nutritional profile and appeal to health-conscious consumers.

- Dietary Supplements represent a mature yet consistently growing segment, catering to individuals seeking targeted gut health solutions and overall wellness.

- Animal Feed is an emerging application with immense untapped potential, as the focus on animal welfare, productivity, and disease prevention through gut health gains momentum in the agricultural sector.

Geographical Dominance Analysis:

Brazil's dominance is fueled by its large consumer base and proactive approach to adopting health and wellness trends. Government initiatives promoting healthy eating habits and increased disposable income contribute to a higher market penetration for prebiotic-fortified products. Argentina's market is characterized by a growing awareness of the importance of digestive health, leading to a steady demand for both functional foods and supplements. The "Rest of South America," while fragmented, offers opportunities for niche market development and expansion, particularly in countries with a rising middle class and an increasing access to information about health and nutrition.

South America Prebiotic Ingredients Market Product Developments

Product developments in the South America prebiotic ingredients market are increasingly focused on innovative extraction methods and the creation of novel prebiotic compounds with enhanced functionalities. Companies are investing in R&D to develop prebiotic fibers from underutilized agricultural by-products, contributing to sustainability and cost-effectiveness. The trend towards synbiotics, combining prebiotics with probiotics, is also gaining momentum, offering synergistic benefits for gut health. These innovations aim to improve taste, texture, and solubility, making prebiotics more appealing for a wider range of applications, including functional beverages, baked goods, and confectionery. Competitive advantages are being built through superior product quality, robust scientific validation of health claims, and the ability to provide tailored solutions to food manufacturers.

Key Drivers of South America Prebiotic Ingredients Market Growth

The South America prebiotic ingredients market is propelled by a combination of powerful drivers. Increasing consumer awareness regarding the critical role of gut health in overall well-being is a primary catalyst. This awareness fuels demand across all application segments. Technological advancements in ingredient processing and the discovery of novel prebiotic sources are enhancing product efficacy and reducing costs. Favorable regulatory environments that support health claims and product innovation further encourage market expansion. Economic growth in several South American nations is leading to higher disposable incomes, allowing consumers to invest more in health-conscious food choices and dietary supplements. Furthermore, the growing prevalence of lifestyle diseases such as obesity and digestive disorders is driving consumers to seek preventative health solutions, with prebiotics playing a significant role.

Challenges in the South America Prebiotic Ingredients Market Market

Despite its promising growth, the South America prebiotic ingredients market faces several challenges. High production costs for certain specialized prebiotic ingredients can limit their widespread adoption, particularly in price-sensitive markets. Limited consumer awareness in some sub-segments and rural areas regarding the specific benefits of prebiotics, compared to general health foods, can hinder market penetration. Complex and evolving regulatory landscapes across different countries can create hurdles for market entry and product standardization. Competition from alternative health solutions, such as probiotics and other functional ingredients, requires continuous innovation and strong marketing efforts. Furthermore, supply chain disruptions and the need for consistent quality control can pose logistical challenges for manufacturers.

Emerging Opportunities in South America Prebiotic Ingredients Market

Emerging opportunities in the South America prebiotic ingredients market are abundant, driven by a shift towards preventative healthcare and the demand for natural, functional foods. Expansion into emerging economies within South America presents a significant avenue for growth, as these markets develop and consumer awareness increases. Strategic partnerships between ingredient manufacturers, food and beverage companies, and research institutions can accelerate product development and market reach. Technological breakthroughs in areas like encapsulation and targeted delivery systems offer potential for more effective and personalized prebiotic solutions. The growing demand for plant-based and sustainable food products aligns perfectly with many naturally sourced prebiotic ingredients, opening new market segments. Furthermore, the increasing focus on animal nutrition and welfare presents a substantial, yet relatively untapped, opportunity for prebiotic ingredient applications in the feed industry.

Leading Players in the South America Prebiotic Ingredients Market Sector

- BENEO GmbH

- OKCHEM

- Sensus

- Jarrow Formulas Inc

- Fonterra Co-operative Group Limited

- Nexira

Key Milestones in South America Prebiotic Ingredients Market Industry

- 2019: Increased investment in gut health research and development by leading ingredient suppliers.

- 2020: Growing consumer interest in immune-boosting ingredients amidst global health concerns.

- 2021: Launch of new prebiotic-fortified infant formula products in key South American markets.

- 2022: Expansion of dietary supplement lines featuring diverse prebiotic fiber sources.

- 2023: Growing collaborations between ingredient manufacturers and local food producers for product innovation.

- 2024: Enhanced focus on sustainable sourcing and production of prebiotic ingredients.

Strategic Outlook for South America Prebiotic Ingredients Market Market

The strategic outlook for the South America prebiotic ingredients market is exceptionally bright, driven by increasing consumer demand for scientifically validated gut health solutions. Growth accelerators will include the expansion of product applications into mainstream food and beverage categories, the development of novel prebiotic ingredients with enhanced functionalities, and strategic collaborations to penetrate underserved markets. Manufacturers who focus on transparent labeling, sustainable sourcing, and robust scientific backing for their products will gain a competitive edge. The market is expected to witness continued innovation in synbiotic formulations and personalized nutrition solutions, catering to the evolving needs of health-conscious consumers. Investment in R&D and strategic market entry will be crucial for capturing the substantial growth potential in this dynamic region.

South America Prebiotic Ingredients Market Segmentation

-

1. Type

- 1.1. Insulin

- 1.2. FOS (Fructo-oligosaccharide)

- 1.3. GOS (Galacto-oligosaccharide)

- 1.4. Other In

-

2. Application

- 2.1. Infant Formula

- 2.2. Fortified Food and Beverage

- 2.3. Dietary Supplements

- 2.4. Animal Feed

- 2.5. Other Applications

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Prebiotic Ingredients Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Prebiotic Ingredients Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Beauty Supplements Products

- 3.4. Market Trends

- 3.4.1. Growing Inclination Toward Prebiotics & Synbiotics Products Across The Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Prebiotic Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Insulin

- 5.1.2. FOS (Fructo-oligosaccharide)

- 5.1.3. GOS (Galacto-oligosaccharide)

- 5.1.4. Other In

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Infant Formula

- 5.2.2. Fortified Food and Beverage

- 5.2.3. Dietary Supplements

- 5.2.4. Animal Feed

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Prebiotic Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Insulin

- 6.1.2. FOS (Fructo-oligosaccharide)

- 6.1.3. GOS (Galacto-oligosaccharide)

- 6.1.4. Other In

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Infant Formula

- 6.2.2. Fortified Food and Beverage

- 6.2.3. Dietary Supplements

- 6.2.4. Animal Feed

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Prebiotic Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Insulin

- 7.1.2. FOS (Fructo-oligosaccharide)

- 7.1.3. GOS (Galacto-oligosaccharide)

- 7.1.4. Other In

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Infant Formula

- 7.2.2. Fortified Food and Beverage

- 7.2.3. Dietary Supplements

- 7.2.4. Animal Feed

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of South America South America Prebiotic Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Insulin

- 8.1.2. FOS (Fructo-oligosaccharide)

- 8.1.3. GOS (Galacto-oligosaccharide)

- 8.1.4. Other In

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Infant Formula

- 8.2.2. Fortified Food and Beverage

- 8.2.3. Dietary Supplements

- 8.2.4. Animal Feed

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Brazil South America Prebiotic Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 10. Argentina South America Prebiotic Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of South America South America Prebiotic Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 BENEO GmbH

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 OKCHEM

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Sensus

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Jarrow Formulas Inc *List Not Exhaustive

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Fonterra Co-operative Group Limited

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Nexira

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.1 BENEO GmbH

List of Figures

- Figure 1: South America Prebiotic Ingredients Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Prebiotic Ingredients Market Share (%) by Company 2024

List of Tables

- Table 1: South America Prebiotic Ingredients Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Prebiotic Ingredients Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: South America Prebiotic Ingredients Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: South America Prebiotic Ingredients Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: South America Prebiotic Ingredients Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South America Prebiotic Ingredients Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil South America Prebiotic Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina South America Prebiotic Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of South America South America Prebiotic Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South America Prebiotic Ingredients Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: South America Prebiotic Ingredients Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: South America Prebiotic Ingredients Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: South America Prebiotic Ingredients Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: South America Prebiotic Ingredients Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: South America Prebiotic Ingredients Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: South America Prebiotic Ingredients Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: South America Prebiotic Ingredients Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: South America Prebiotic Ingredients Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: South America Prebiotic Ingredients Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: South America Prebiotic Ingredients Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: South America Prebiotic Ingredients Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Prebiotic Ingredients Market?

The projected CAGR is approximately 7.40%.

2. Which companies are prominent players in the South America Prebiotic Ingredients Market?

Key companies in the market include BENEO GmbH, OKCHEM, Sensus, Jarrow Formulas Inc *List Not Exhaustive, Fonterra Co-operative Group Limited, Nexira.

3. What are the main segments of the South America Prebiotic Ingredients Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products.

6. What are the notable trends driving market growth?

Growing Inclination Toward Prebiotics & Synbiotics Products Across The Region.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Beauty Supplements Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Prebiotic Ingredients Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Prebiotic Ingredients Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Prebiotic Ingredients Market?

To stay informed about further developments, trends, and reports in the South America Prebiotic Ingredients Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence