Key Insights

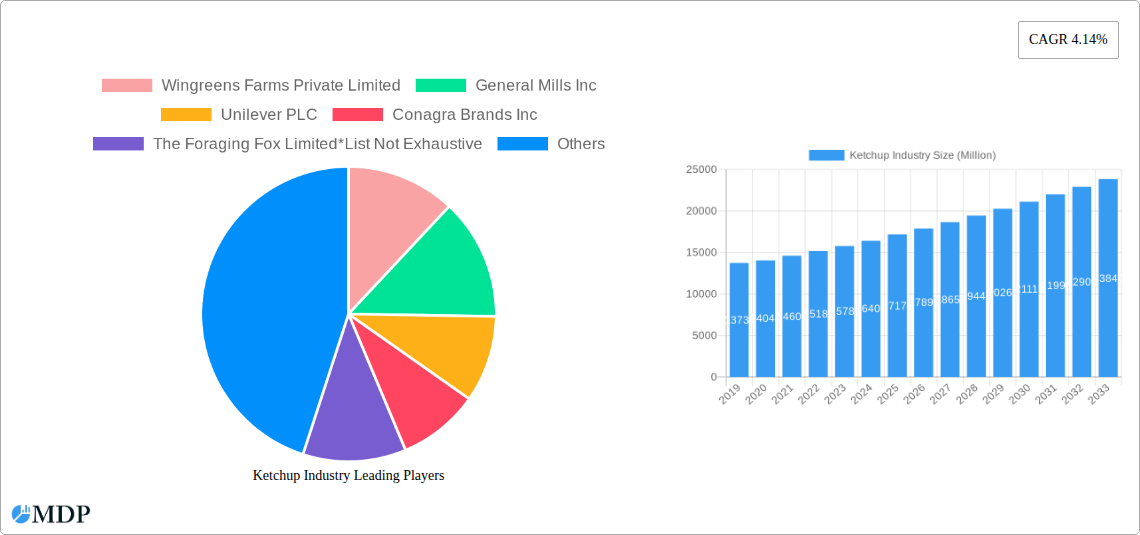

The global ketchup market is poised for steady growth, projected to reach $17.17 billion with a Compound Annual Growth Rate (CAGR) of 4.14% between 2025 and 2033. This expansion is driven by evolving consumer preferences for convenient and flavor-enhanced food options, coupled with a growing demand for diverse culinary experiences. The increasing popularity of quick-service restaurants (QSRs) and the rise of the foodservice industry globally are significant drivers, as ketchup remains a staple condiment in these settings. Furthermore, advancements in packaging technology, including the widespread adoption of pouches for their convenience and reduced waste, are contributing to market penetration. The 'Flavored Ketchup' segment is expected to witness particularly robust growth, catering to consumers seeking novel taste profiles and international culinary inspirations. This trend is further amplified by the burgeoning online retail sector, which offers consumers unparalleled access to a wide array of ketchup varieties, including niche and premium offerings.

Ketchup Industry Market Size (In Billion)

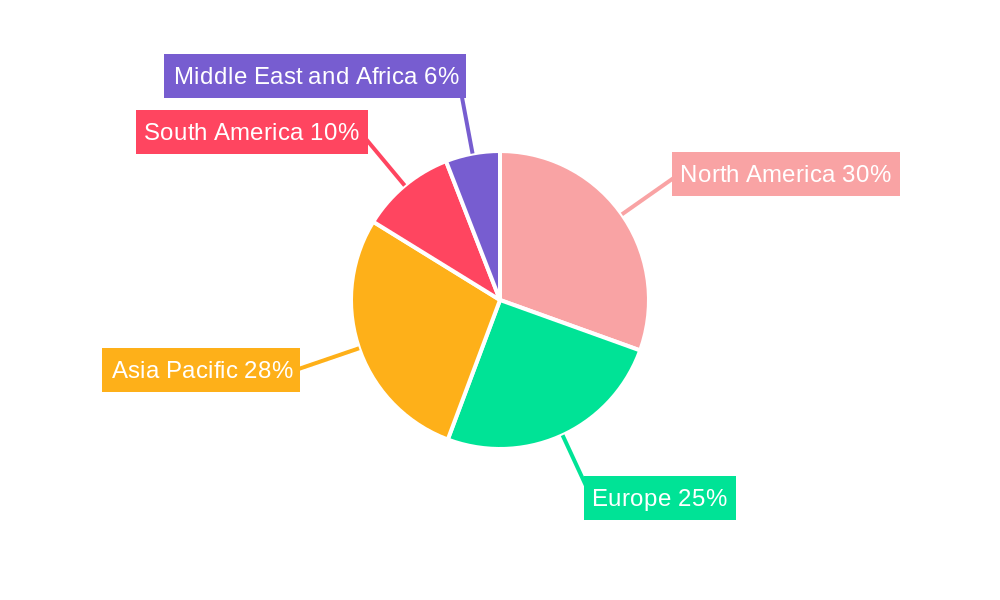

The market's trajectory is supported by strong performances in key regions like Asia Pacific, driven by its large population and increasing disposable incomes, and North America, where established consumption patterns and a focus on product innovation continue to fuel demand. While the 'On-trade' segment, encompassing restaurants and food services, is a dominant force, the 'Off-trade' channel, particularly supermarkets and hypermarkets, is also seeing consistent expansion. However, potential restraints include the growing health consciousness among consumers, leading to a demand for lower-sugar and natural ingredient alternatives, and price sensitivity in certain developing economies. Major industry players like The Kraft Heinz Company, Unilever PLC, and Nestlé S.A. are actively investing in product development and strategic expansions to capitalize on these market dynamics and maintain a competitive edge.

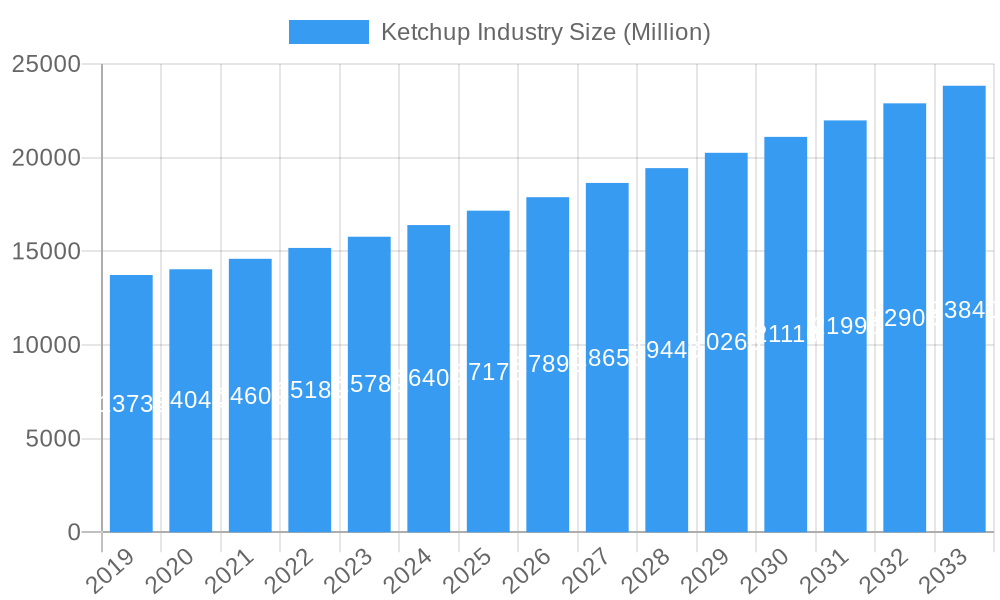

Ketchup Industry Company Market Share

Unlock critical insights into the global ketchup market with this comprehensive, SEO-optimized report. Delve into the evolving dynamics, emerging trends, and future outlook of the ketchup industry, a staple condiment with a significant global presence. This report provides in-depth analysis for stakeholders seeking to capitalize on growth opportunities, understand competitive landscapes, and navigate market challenges. Covering the study period of 2019–2033, with a base year of 2025, this research offers actionable intelligence for manufacturers, distributors, retailers, and investors in the dynamic sauce and condiment market.

Ketchup Industry Market Dynamics & Concentration

The ketchup industry exhibits moderate to high market concentration, with a few dominant players controlling a significant share of the global market. Innovation remains a key driver, fueled by evolving consumer preferences for healthier options, novel flavors, and sustainable packaging. Regulatory frameworks, particularly concerning food safety and labeling, play a crucial role in shaping market operations. Product substitutes, such as other tomato-based sauces and diverse condiment options, present a continuous competitive challenge. End-user trends are shifting towards premiumization, organic ingredients, and reduced sugar content, influencing product development and marketing strategies. Mergers and acquisitions (M&A) activities, while not as frequent as in some other food sectors, have been instrumental in consolidating market share and expanding product portfolios. For instance, strategic acquisitions can lead to an increase in market share by a substantial percentage, and specific M&A deal counts are meticulously analyzed within this report to identify key consolidation patterns.

Ketchup Industry Industry Trends & Analysis

The ketchup market is experiencing robust growth, projected to reach substantial valuations in the coming years. This expansion is primarily driven by increasing global demand for processed foods, the growing popularity of fast-food chains, and a rising awareness of the versatility of ketchup as a culinary ingredient beyond its traditional applications. Technological disruptions, including advancements in food processing and packaging solutions, are enabling manufacturers to develop innovative product offerings and improve supply chain efficiencies. Consumer preferences are undergoing a significant evolution, with a discernible shift towards healthier alternatives, such as low-sugar, organic, and plant-based ketchup options. This has spurred a wave of product innovation, with companies introducing a wider array of flavors and formulations to cater to diverse palates. The competitive dynamics within the industry are characterized by intense rivalry among established global brands and the emergence of niche players focusing on specific market segments, such as artisanal or gourmet ketchup. The market penetration of organic and specialized ketchup variants is steadily increasing, indicating a growing consumer appetite for premium and health-conscious products. The compound annual growth rate (CAGR) for the global ketchup market is meticulously detailed in this report, offering a clear projection of its future trajectory.

Leading Markets & Segments in Ketchup Industry

The ketchup industry is segmented by Product Type into Regular Ketchup and Flavored Ketchup. The Packaging segment includes Bottled and Pouch options, while Distribution Channels are broadly categorized into On-trade (Foodservice) and Off-trade (encompassing Supermarkets/Hypermarkets, Convenience Stores, Online Retail Stores, and Other Off-trade Channels). The Regular Ketchup segment continues to dominate the market due to its universal appeal and widespread adoption. However, Flavored Ketchup is demonstrating significant growth, driven by consumer demand for innovative taste experiences.

- Dominant Region/Country: North America currently represents the largest market for ketchup, driven by established consumption habits and the strong presence of major fast-food chains. However, the Asia-Pacific region is emerging as a key growth driver, fueled by rapid urbanization, increasing disposable incomes, and the expanding fast-food culture.

- Product Type Dominance: While Regular Ketchup holds the largest market share, the Flavored Ketchup segment is poised for substantial expansion. Innovations in flavors such as sriracha, garlic, and chipotle are resonating with consumers seeking novel culinary experiences.

- Packaging Trends: Bottled ketchup remains the preferred packaging format for household consumption, offering convenience and value. The Pouch segment, however, is gaining traction, particularly in foodservice and for single-serving portions, due to its cost-effectiveness and reduced environmental impact.

- Distribution Channel Dynamics: Off-trade channels, particularly Supermarkets/Hypermarkets and Online Retail Stores, are the primary drivers of ketchup sales. The burgeoning e-commerce landscape is further accelerating growth in online retail, providing consumers with enhanced accessibility and a wider product selection. The On-trade (Foodservice) segment also contributes significantly, with ketchup being an indispensable accompaniment to various fast-food and casual dining dishes.

Ketchup Industry Product Developments

Product innovation in the ketchup industry is a pivotal strategy for maintaining market relevance and capturing evolving consumer demands. Recent developments highlight a focus on health-conscious formulations, including reduced-sugar and organic variants, catering to the growing wellness trend. Novel flavor profiles, such as spicy, smoky, and artisanal blends, are expanding the appeal of ketchup beyond its traditional role. Furthermore, advancements in sustainable packaging, exemplified by the exploration of paper-based and recyclable materials, underscore the industry's commitment to environmental responsibility. These innovations not only enhance product appeal but also provide a competitive edge in a dynamic marketplace.

Key Drivers of Ketchup Industry Growth

The ketchup industry is propelled by several key growth drivers. The increasing global demand for processed and convenience foods, coupled with the ubiquitous presence of fast-food culture, forms a foundational driver. Technological advancements in food processing and preservation techniques ensure consistent quality and extend shelf life. The rising disposable incomes in emerging economies are leading to increased consumption of a wider range of food products, including condiments like ketchup. Furthermore, innovative marketing strategies and the introduction of new product variants, including healthier options and novel flavors, are stimulating consumer interest and driving demand. The foodservice sector's consistent need for ketchup as a staple condiment also contributes significantly to market expansion.

Challenges in the Ketchup Industry Market

Despite its strong growth trajectory, the ketchup industry faces several challenges. Regulatory hurdles related to food safety standards and ingredient labeling can impact production costs and market entry. The presence of numerous product substitutes, ranging from other tomato-based sauces to diverse condiment options, creates intense competition and can limit market share for individual products. Fluctuations in the prices of key raw materials, such as tomatoes, can affect profit margins and influence pricing strategies. Furthermore, evolving consumer perceptions regarding the health implications of high sugar and sodium content in traditional ketchup formulations pose a persistent challenge, necessitating continuous product reformulation and marketing of healthier alternatives.

Emerging Opportunities in Ketchup Industry

The ketchup industry is ripe with emerging opportunities for growth and innovation. The burgeoning demand for clean-label and organic products presents a significant avenue for market expansion, allowing companies to cater to health-conscious consumers. The development and adoption of sustainable packaging solutions, such as biodegradable and recyclable materials, align with global environmental consciousness and can enhance brand image. Furthermore, the increasing penetration of e-commerce platforms offers a direct-to-consumer channel, enabling wider market reach and personalized marketing strategies. Exploring niche markets and developing specialized ketchup variants for specific culinary applications or dietary needs also represent promising opportunities for diversification and revenue generation.

Leading Players in the Ketchup Industry Sector

- Wingreens Farms Private Limited

- General Mills Inc

- Unilever PLC

- Conagra Brands Inc

- The Foraging Fox Limited

- The Kraft Heinz Company

- Windmill Organics Ltd

- Del Monte Foods Holdings Limited

- McCormick & Company Incorporated

- Nestlé S A

Key Milestones in Ketchup Industry Industry

- June 2022: Heinz launched a range of new cold ketchup in Canada. It's the same iconic, slow-pouring ketchup, now cold, with a label that turns icy blue when it's perfectly chilled. The new product by Heinz was available at participating Wendy's locations in Canada for a limited duration and at selected grocery stores in specially-marked display fridges. This innovative launch capitalized on seasonal demand and introduced a novel consumer experience.

- May 2022: HEINZ, the maker of the world's favorite ketchup and beloved condiments, is teaming up with Pulpex to develop a paper-based, renewable and recyclable bottle made from 100 percent sustainably sourced wood pulp. Innovating its iconic ketchup bottle, HEINZ is the first sauce brand to test the potential of Pulpex's sustainable paper bottle packaging for its range of world-famous condiments. This move signals a significant shift towards sustainable packaging solutions within the industry.

- November 2021: The Kraft Heinz company launched a new ketchup, the Marz Edition ketchup, made with tomatoes grown under the Martian soil condition. The company claimed that the tomatoes used for the Marz Edition ketchup were grown in extreme temperatures and soil conditions similar to that of the Red Planet. This bold marketing campaign generated considerable buzz and highlighted the innovative spirit within the company.

Strategic Outlook for Ketchup Industry Market

The strategic outlook for the ketchup industry is optimistic, driven by continuous innovation and expanding global markets. Key growth accelerators include the increasing adoption of plant-based and organic ketchup variants, catering to evolving health consciousness. Strategic partnerships with technology providers for supply chain optimization and e-commerce integration will be crucial for enhancing market reach and efficiency. Market expansion into developing economies, coupled with product diversification to meet regional taste preferences, presents significant opportunities. The industry's ability to embrace sustainable practices in both production and packaging will further solidify its long-term viability and appeal to a conscious consumer base.

Ketchup Industry Segmentation

-

1. Product Type

- 1.1. Regular Ketchup

- 1.2. Flavored Ketchup

-

2. Packaging

- 2.1. Bottled

- 2.2. Pouch

-

3. Distribution Channel

- 3.1. On-trade (Foodservice)

-

3.2. Off-trade

- 3.2.1. Supermarkets/Hypermarkets

- 3.2.2. Convenience Stores

- 3.2.3. Online Retail Stores

- 3.2.4. Other Off-trade Channels

Ketchup Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Ketchup Industry Regional Market Share

Geographic Coverage of Ketchup Industry

Ketchup Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Health Consciousness among consumer

- 3.3. Market Restrains

- 3.3.1. High Cost of natural Ingredients

- 3.4. Market Trends

- 3.4.1. Increasing Inclination Toward Organic Ketchup

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ketchup Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Regular Ketchup

- 5.1.2. Flavored Ketchup

- 5.2. Market Analysis, Insights and Forecast - by Packaging

- 5.2.1. Bottled

- 5.2.2. Pouch

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. On-trade (Foodservice)

- 5.3.2. Off-trade

- 5.3.2.1. Supermarkets/Hypermarkets

- 5.3.2.2. Convenience Stores

- 5.3.2.3. Online Retail Stores

- 5.3.2.4. Other Off-trade Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Ketchup Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Regular Ketchup

- 6.1.2. Flavored Ketchup

- 6.2. Market Analysis, Insights and Forecast - by Packaging

- 6.2.1. Bottled

- 6.2.2. Pouch

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. On-trade (Foodservice)

- 6.3.2. Off-trade

- 6.3.2.1. Supermarkets/Hypermarkets

- 6.3.2.2. Convenience Stores

- 6.3.2.3. Online Retail Stores

- 6.3.2.4. Other Off-trade Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Ketchup Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Regular Ketchup

- 7.1.2. Flavored Ketchup

- 7.2. Market Analysis, Insights and Forecast - by Packaging

- 7.2.1. Bottled

- 7.2.2. Pouch

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. On-trade (Foodservice)

- 7.3.2. Off-trade

- 7.3.2.1. Supermarkets/Hypermarkets

- 7.3.2.2. Convenience Stores

- 7.3.2.3. Online Retail Stores

- 7.3.2.4. Other Off-trade Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Ketchup Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Regular Ketchup

- 8.1.2. Flavored Ketchup

- 8.2. Market Analysis, Insights and Forecast - by Packaging

- 8.2.1. Bottled

- 8.2.2. Pouch

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. On-trade (Foodservice)

- 8.3.2. Off-trade

- 8.3.2.1. Supermarkets/Hypermarkets

- 8.3.2.2. Convenience Stores

- 8.3.2.3. Online Retail Stores

- 8.3.2.4. Other Off-trade Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Ketchup Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Regular Ketchup

- 9.1.2. Flavored Ketchup

- 9.2. Market Analysis, Insights and Forecast - by Packaging

- 9.2.1. Bottled

- 9.2.2. Pouch

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. On-trade (Foodservice)

- 9.3.2. Off-trade

- 9.3.2.1. Supermarkets/Hypermarkets

- 9.3.2.2. Convenience Stores

- 9.3.2.3. Online Retail Stores

- 9.3.2.4. Other Off-trade Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Ketchup Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Regular Ketchup

- 10.1.2. Flavored Ketchup

- 10.2. Market Analysis, Insights and Forecast - by Packaging

- 10.2.1. Bottled

- 10.2.2. Pouch

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. On-trade (Foodservice)

- 10.3.2. Off-trade

- 10.3.2.1. Supermarkets/Hypermarkets

- 10.3.2.2. Convenience Stores

- 10.3.2.3. Online Retail Stores

- 10.3.2.4. Other Off-trade Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Wingreens Farms Private Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 General Mills Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Unilever PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Conagra Brands Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Foraging Fox Limited*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 The Kraft Heinz Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Windmill Organics Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Del Monte Foods Holdings Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 McCormick & Company Incorporated

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nestlé S A

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Wingreens Farms Private Limited

List of Figures

- Figure 1: Global Ketchup Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Ketchup Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Ketchup Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Ketchup Industry Revenue (Million), by Packaging 2025 & 2033

- Figure 5: North America Ketchup Industry Revenue Share (%), by Packaging 2025 & 2033

- Figure 6: North America Ketchup Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America Ketchup Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Ketchup Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Ketchup Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Ketchup Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 11: Europe Ketchup Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Ketchup Industry Revenue (Million), by Packaging 2025 & 2033

- Figure 13: Europe Ketchup Industry Revenue Share (%), by Packaging 2025 & 2033

- Figure 14: Europe Ketchup Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: Europe Ketchup Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Europe Ketchup Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Ketchup Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Ketchup Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Ketchup Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Ketchup Industry Revenue (Million), by Packaging 2025 & 2033

- Figure 21: Asia Pacific Ketchup Industry Revenue Share (%), by Packaging 2025 & 2033

- Figure 22: Asia Pacific Ketchup Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Asia Pacific Ketchup Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Asia Pacific Ketchup Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Ketchup Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Ketchup Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 27: South America Ketchup Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: South America Ketchup Industry Revenue (Million), by Packaging 2025 & 2033

- Figure 29: South America Ketchup Industry Revenue Share (%), by Packaging 2025 & 2033

- Figure 30: South America Ketchup Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: South America Ketchup Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: South America Ketchup Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Ketchup Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Ketchup Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 35: Middle East and Africa Ketchup Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Middle East and Africa Ketchup Industry Revenue (Million), by Packaging 2025 & 2033

- Figure 37: Middle East and Africa Ketchup Industry Revenue Share (%), by Packaging 2025 & 2033

- Figure 38: Middle East and Africa Ketchup Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Middle East and Africa Ketchup Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Middle East and Africa Ketchup Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Ketchup Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Ketchup Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Ketchup Industry Revenue Million Forecast, by Packaging 2020 & 2033

- Table 3: Global Ketchup Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Ketchup Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Ketchup Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Ketchup Industry Revenue Million Forecast, by Packaging 2020 & 2033

- Table 7: Global Ketchup Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Ketchup Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Ketchup Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Ketchup Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Ketchup Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Ketchup Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Ketchup Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Ketchup Industry Revenue Million Forecast, by Packaging 2020 & 2033

- Table 15: Global Ketchup Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: Global Ketchup Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Spain Ketchup Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Ketchup Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Germany Ketchup Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: France Ketchup Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Italy Ketchup Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Europe Ketchup Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Ketchup Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 24: Global Ketchup Industry Revenue Million Forecast, by Packaging 2020 & 2033

- Table 25: Global Ketchup Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 26: Global Ketchup Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: China Ketchup Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Japan Ketchup Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: India Ketchup Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Australia Ketchup Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Ketchup Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Ketchup Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 33: Global Ketchup Industry Revenue Million Forecast, by Packaging 2020 & 2033

- Table 34: Global Ketchup Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Ketchup Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Brazil Ketchup Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Argentina Ketchup Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of South America Ketchup Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Global Ketchup Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 40: Global Ketchup Industry Revenue Million Forecast, by Packaging 2020 & 2033

- Table 41: Global Ketchup Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 42: Global Ketchup Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 43: South Africa Ketchup Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: United Arab Emirates Ketchup Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Rest of Middle East and Africa Ketchup Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ketchup Industry?

The projected CAGR is approximately 4.14%.

2. Which companies are prominent players in the Ketchup Industry?

Key companies in the market include Wingreens Farms Private Limited, General Mills Inc, Unilever PLC, Conagra Brands Inc, The Foraging Fox Limited*List Not Exhaustive, The Kraft Heinz Company, Windmill Organics Ltd, Del Monte Foods Holdings Limited, McCormick & Company Incorporated, Nestlé S A.

3. What are the main segments of the Ketchup Industry?

The market segments include Product Type, Packaging, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Health Consciousness among consumer.

6. What are the notable trends driving market growth?

Increasing Inclination Toward Organic Ketchup.

7. Are there any restraints impacting market growth?

High Cost of natural Ingredients.

8. Can you provide examples of recent developments in the market?

June 2022: Heinz launched a range of new cold ketchup in Canada. It's the same iconic, slow-pouring ketchup, now cold, with a label that turns icy blue when it's perfectly chilled. The new product by Heinz was available at participating Wendy's locations in Canada for a limited duration and at selected grocery stores in specially-marked display fridges.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ketchup Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ketchup Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ketchup Industry?

To stay informed about further developments, trends, and reports in the Ketchup Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence