Key Insights

The Saudi Arabian poultry market, estimated at $19 billion in 2024, is projected for substantial growth with a Compound Annual Growth Rate (CAGR) of 3.4% from 2024 to 2033. This expansion is driven by a growing population, increased urbanization, and a dietary shift towards protein-rich foods, significantly elevating demand for poultry products. Government initiatives focused on food security and agricultural diversification further bolster the sector. The burgeoning tourism industry and the expansion of the food service sector also contribute to heightened consumption. The market is segmented by product type, including eggs, broiler meat, and processed poultry, with robust demand across all categories. Distribution channels span both on-trade (restaurants, hotels) and off-trade (retail stores, supermarkets), each presenting growth opportunities. Leading companies such as Almarai Company Limited, Americana Group Inc., and Almunajem Foods Co. are spearheading innovation in modern poultry farming to meet escalating demand and enhance operational efficiency. Key challenges include managing feed costs, mitigating disease outbreaks, and advancing sustainable farming practices.

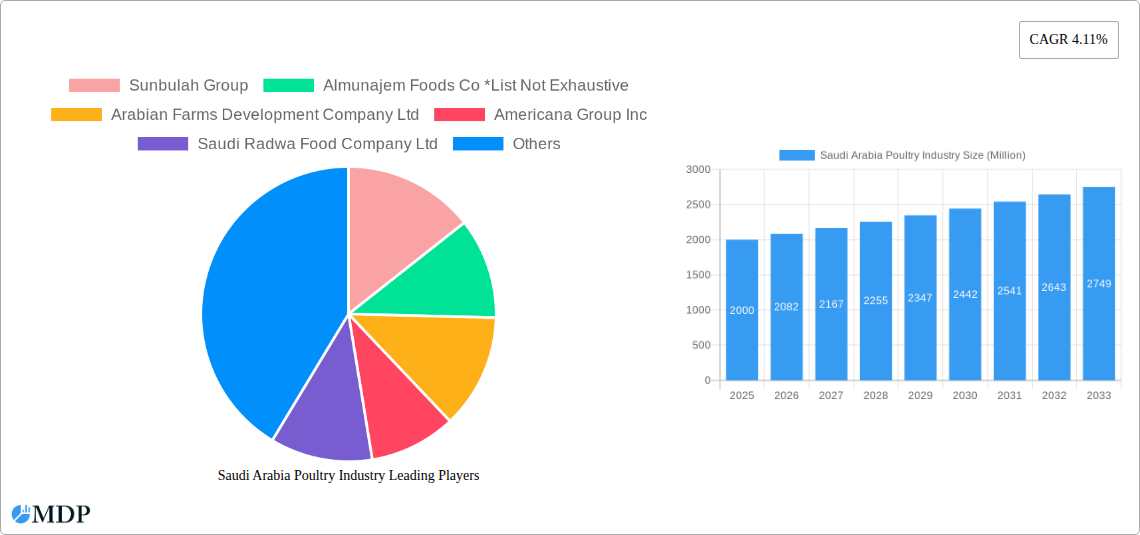

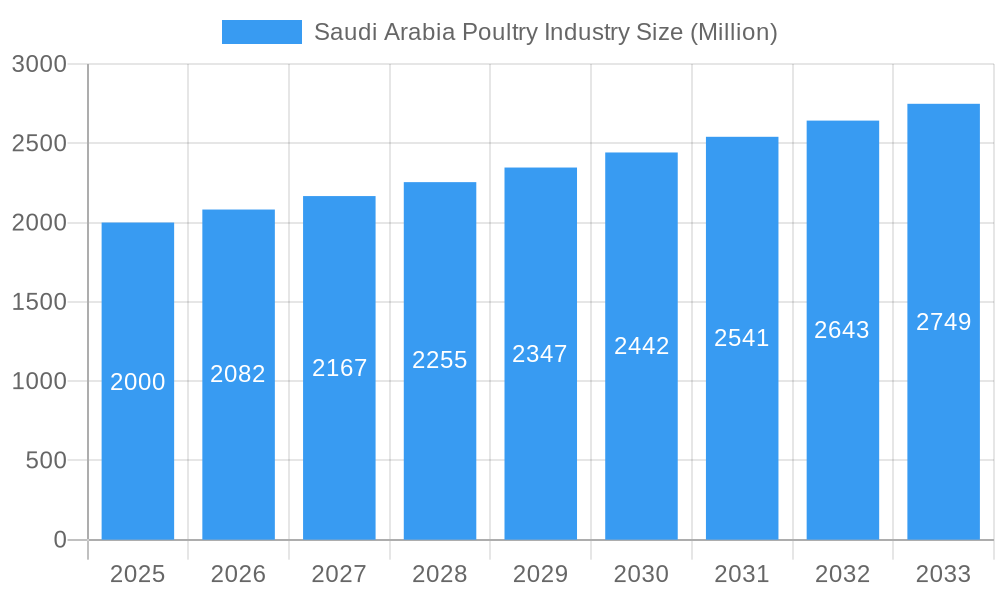

Saudi Arabia Poultry Industry Market Size (In Billion)

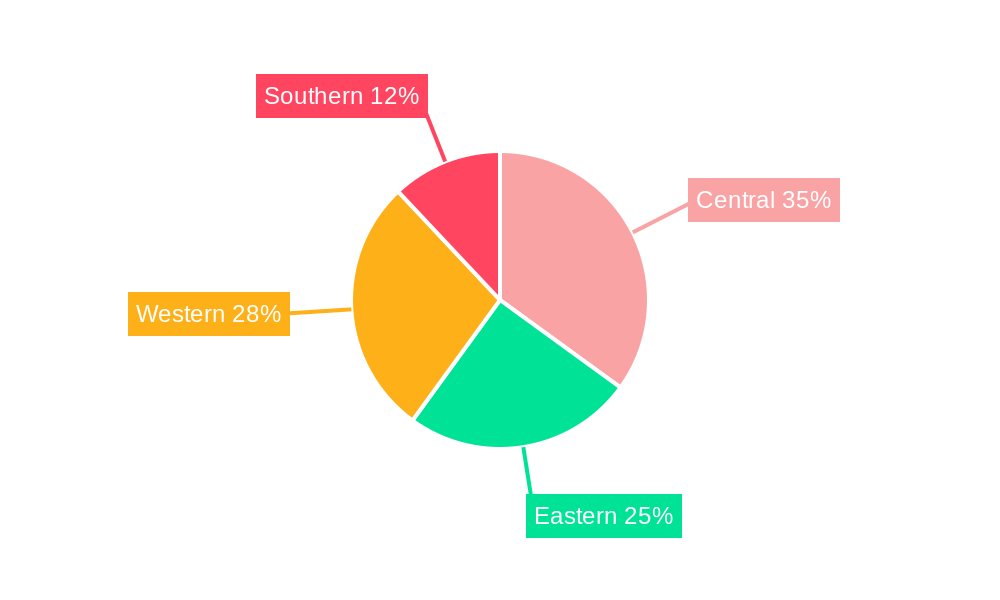

Geographically, the market is concentrated across Saudi Arabia's Central, Eastern, Western, and Southern regions. While precise regional market shares are not detailed, factors like population density and economic activity are presumed to influence consumption patterns, with higher demand expected in densely populated and economically prosperous areas. The industry's future prosperity depends on effectively navigating these challenges and leveraging opportunities arising from increasing demand, technological advancements, and government support. Embracing sustainable and ethical poultry farming practices will be crucial for long-term growth and maintaining consumer confidence. The forecast period indicates significant prospects for both established and emerging players to invest and expand their presence within Saudi Arabia's dynamic poultry industry. In-depth analysis of specific regional consumption trends and competitive dynamics is recommended for a more precise market understanding.

Saudi Arabia Poultry Industry Company Market Share

Saudi Arabia Poultry Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Saudi Arabia poultry industry, covering market dynamics, leading players, industry trends, and future growth opportunities. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is an essential resource for investors, industry stakeholders, and anyone seeking to understand this dynamic market.

Saudi Arabia Poultry Industry Market Dynamics & Concentration

The Saudi Arabian poultry industry exhibits a moderately concentrated market structure, with several major players commanding significant market share. While precise market share figures for each company remain confidential, key players like Sunbulah Group, Almunajem Foods Co., Arabian Farms Development Company Ltd, Americana Group Inc, Saudi Radwa Food Company Ltd, Al Kabeer Group, Al Watania Poultry, Tanmiah Food Company, Almarai Company Limited, and Balady Poultry Trading Company contribute significantly to the overall production and distribution of poultry products.

Market concentration is influenced by factors such as economies of scale, access to capital, and brand recognition. Innovation, driven by technological advancements in feed formulations, breeding techniques, and processing technologies, is a key driver of growth. The regulatory framework, including food safety standards and halal certification requirements, plays a crucial role in shaping market operations. The availability of substitutes, primarily red meat and plant-based proteins, influences consumer choices. Furthermore, evolving consumer preferences toward healthier and more convenient poultry products impact demand dynamics. The industry has witnessed a moderate number of mergers and acquisitions (M&A) in recent years (xx deals between 2019-2024), reflecting consolidation trends and strategic expansion efforts. Further, the increasing adoption of automation and technology has led to improved efficiency and reduced operational costs.

Saudi Arabia Poultry Industry Industry Trends & Analysis

The Saudi Arabian poultry industry is experiencing robust growth, fueled by a rising population, increasing urbanization, and shifting dietary habits. The market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was xx%, driven by factors such as rising disposable incomes, increasing demand for affordable protein sources, and government support for the agricultural sector. The market penetration of processed poultry products has also been on an upward trajectory, reaching xx% in 2024. Technological disruptions, like the adoption of automation in hatcheries and processing plants, have improved efficiency and reduced production costs. Consumer preferences are shifting towards convenient, ready-to-eat products and value-added offerings. Competitive dynamics are characterized by price competition, product differentiation, and branding strategies. The forecast period (2025-2033) projects a CAGR of xx%, with continued growth driven by factors such as population growth and increased per capita consumption. The market is expected to reach a value of xx Million by 2033.

Leading Markets & Segments in Saudi Arabia Poultry Industry

The Saudi Arabian poultry market is dominated by the Broiler Meat segment, accounting for approximately xx% of the total market value in 2025. This is driven by factors such as high consumer preference for chicken meat. The Off-Trade distribution channel is the most prevalent, reflecting the widespread availability of poultry products in supermarkets, hypermarkets, and other retail outlets.

Key Drivers for Broiler Meat Dominance:

- High consumer demand for affordable protein.

- Favorable government policies supporting poultry production.

- Efficient production and distribution networks.

Key Drivers for Off-Trade Dominance:

- Widespread retail infrastructure.

- Convenient access for consumers.

- Strong cold chain infrastructure ensuring freshness.

The Eggs segment holds a significant share as well (approximately xx%), driven by its affordability and nutritional value. Processed meat is gaining traction, driven by increasing consumer demand for convenient and value-added products. Regional differences exist, with urban areas exhibiting higher consumption of processed products and rural areas showing stronger demand for fresh meat.

Saudi Arabia Poultry Industry Product Developments

Recent product innovations include the introduction of value-added products like marinated chicken, ready-to-cook meals, and organic chicken options. These offerings cater to changing consumer preferences and offer a competitive advantage for producers. Technological trends, such as automated processing and packaging lines, are enhancing product quality, efficiency, and hygiene. This continuous improvement in product offerings is vital for enhancing market penetration and addressing the rising demand for convenient and high-quality products.

Key Drivers of Saudi Arabia Poultry Industry Growth

Several factors contribute to the growth of the Saudi Arabian poultry industry. These include:

- Government support: Initiatives to promote local poultry production and investment in infrastructure.

- Technological advancements: Automation in hatcheries and processing plants improving efficiency and reducing costs.

- Rising disposable incomes: Increased purchasing power enabling greater consumption of protein-rich foods.

- Population growth: Expanding population fuels higher demand for poultry products.

Challenges in the Saudi Arabia Poultry Industry Market

The Saudi Arabian poultry industry faces several challenges:

- Feed costs: Fluctuations in global grain prices impact production costs. This resulted in a xx% increase in production costs in 2024 compared to 2019.

- Competition: Increased competition from imports and regional producers puts downward pressure on prices.

- Disease outbreaks: Avian influenza and other diseases pose a risk to production and profitability.

Emerging Opportunities in Saudi Arabia Poultry Industry

The Saudi Arabian poultry industry is poised for significant growth fueled by several emerging opportunities:

- Value-added products: Growing demand for convenient, ready-to-eat, and processed poultry products offers significant market potential.

- Technological advancements: Continued innovation in breeding, feed technology, and processing creates opportunities for enhanced efficiency and reduced costs.

- Strategic partnerships: Collaboration between local producers and international companies will allow for technology transfer and knowledge sharing.

Leading Players in the Saudi Arabia Poultry Industry Sector

- Sunbulah Group

- Almunajem Foods Co.

- Arabian Farms Development Company Ltd

- Americana Group Inc

- Saudi Radwa Food Company Ltd

- Al Kabeer Group

- Al Watania Poultry

- Tanmiah Food Company

- Almarai Company Limited

- Balady Poultry Trading Company

Key Milestones in Saudi Arabia Poultry Industry Industry

- February 2023: Golden Chicken Farms partnered with Petersime to expand its broiler hatchery capacity to 50 million birds per year. This significantly boosts domestic production capacity.

- October 2022: BRF (Brazil) and HPDC launched a USD 500 Million joint venture to establish a comprehensive poultry production chain in Saudi Arabia. This signifies increased foreign direct investment and competition.

- August 2022: Seara (JBS SA) launched a range of high-quality frozen poultry and meat products in the Middle East, expanding product choices for consumers. This increase competition in the frozen poultry segment.

Strategic Outlook for Saudi Arabia Poultry Industry Market

The Saudi Arabian poultry industry is projected to witness continued growth in the coming years, driven by factors such as population increase, rising disposable incomes, and shifting consumer preferences. Strategic opportunities lie in expanding the production of value-added products, leveraging technological advancements to improve efficiency and sustainability, and forging strategic partnerships to access new markets and technologies. The focus on enhancing product quality, exploring new distribution channels and strengthening the cold chain will be crucial for capturing the potential market growth.

Saudi Arabia Poultry Industry Segmentation

-

1. Product Type

- 1.1. Eggs

- 1.2. Broiler Meat

-

1.3. Processed Meat

- 1.3.1. Nuggets and Popcorn

- 1.3.2. Burgers

- 1.3.3. Mortadella

- 1.3.4. Franks, Sausages, and Hot Dogs

- 1.3.5. Marinated Poultry Products

- 1.3.6. Other Processed Poultry Meats

-

2. Distribution Channel

- 2.1. On-Trade

-

2.2. Off-Trade

- 2.2.1. Hypermarkets/Supermarkets

- 2.2.2. Conveience Stores

- 2.2.3. Online Retail

- 2.2.4. Other Distribution Channel

Saudi Arabia Poultry Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Poultry Industry Regional Market Share

Geographic Coverage of Saudi Arabia Poultry Industry

Saudi Arabia Poultry Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Escalating Demand for Processed Poultry Products; Favorable Government Initiatives to Boost Production

- 3.3. Market Restrains

- 3.3.1. Rising Vegan Trend among Young Consumers; Deeper Penetration of Red Meat Across Saudi Arabia

- 3.4. Market Trends

- 3.4.1. Demand for Processed Poultry Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Poultry Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Eggs

- 5.1.2. Broiler Meat

- 5.1.3. Processed Meat

- 5.1.3.1. Nuggets and Popcorn

- 5.1.3.2. Burgers

- 5.1.3.3. Mortadella

- 5.1.3.4. Franks, Sausages, and Hot Dogs

- 5.1.3.5. Marinated Poultry Products

- 5.1.3.6. Other Processed Poultry Meats

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-Trade

- 5.2.2. Off-Trade

- 5.2.2.1. Hypermarkets/Supermarkets

- 5.2.2.2. Conveience Stores

- 5.2.2.3. Online Retail

- 5.2.2.4. Other Distribution Channel

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sunbulah Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Almunajem Foods Co *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Arabian Farms Development Company Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Americana Group Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Saudi Radwa Food Company Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Al Kabeer Group Me

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Al Watania Poultry

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tanmiah Food Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Almarai Company Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Balady Poultry Trading Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sunbulah Group

List of Figures

- Figure 1: Saudi Arabia Poultry Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Poultry Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Poultry Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Saudi Arabia Poultry Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: Saudi Arabia Poultry Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Saudi Arabia Poultry Industry Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 5: Saudi Arabia Poultry Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Saudi Arabia Poultry Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Saudi Arabia Poultry Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Saudi Arabia Poultry Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 9: Saudi Arabia Poultry Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 10: Saudi Arabia Poultry Industry Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 11: Saudi Arabia Poultry Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Saudi Arabia Poultry Industry Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Poultry Industry?

The projected CAGR is approximately 3.4%.

2. Which companies are prominent players in the Saudi Arabia Poultry Industry?

Key companies in the market include Sunbulah Group, Almunajem Foods Co *List Not Exhaustive, Arabian Farms Development Company Ltd, Americana Group Inc, Saudi Radwa Food Company Ltd, Al Kabeer Group Me, Al Watania Poultry, Tanmiah Food Company, Almarai Company Limited, Balady Poultry Trading Company.

3. What are the main segments of the Saudi Arabia Poultry Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 19 billion as of 2022.

5. What are some drivers contributing to market growth?

Escalating Demand for Processed Poultry Products; Favorable Government Initiatives to Boost Production.

6. What are the notable trends driving market growth?

Demand for Processed Poultry Drives the Market.

7. Are there any restraints impacting market growth?

Rising Vegan Trend among Young Consumers; Deeper Penetration of Red Meat Across Saudi Arabia.

8. Can you provide examples of recent developments in the market?

February 2023: Golden Chicken Farms partnered with an advanced technology company named Petersime's, which offers an X-Streamer incubator solution, to expand the broiler hatchery and increase the company's capacity to 50 million/year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Poultry Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Poultry Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Poultry Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Poultry Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence