Key Insights

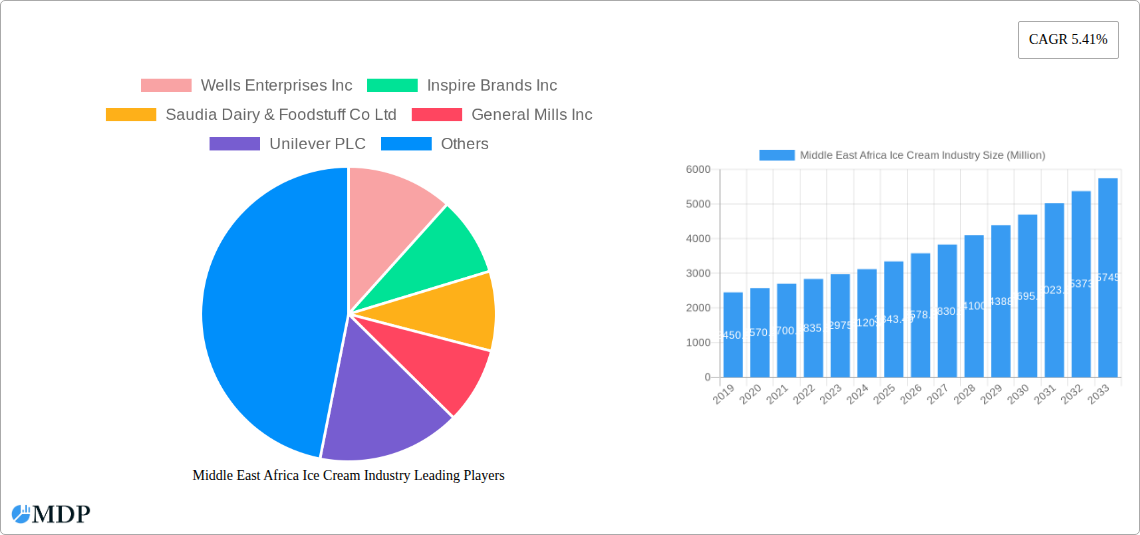

The Middle East and Africa (MEA) ice cream market is poised for robust expansion, projected to reach a substantial USD 3,343.49 million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 5.41% through 2033. This growth is primarily propelled by an increasing demand for impulse ice cream, driven by rising disposable incomes and a burgeoning young population across the region. The convenience of readily available, single-serving treats in supermarkets and hypermarkets, alongside the growing footprint of convenience stores, caters effectively to impulse purchases. Furthermore, the escalating popularity of artisanal ice cream, offering premium ingredients and unique flavor profiles, is capturing a significant share, appealing to consumers seeking indulgent and differentiated experiences. The expansion of online retail channels is also a key facilitator, providing consumers with greater access and convenience, further stimulating market penetration.

Middle East Africa Ice Cream Industry Market Size (In Billion)

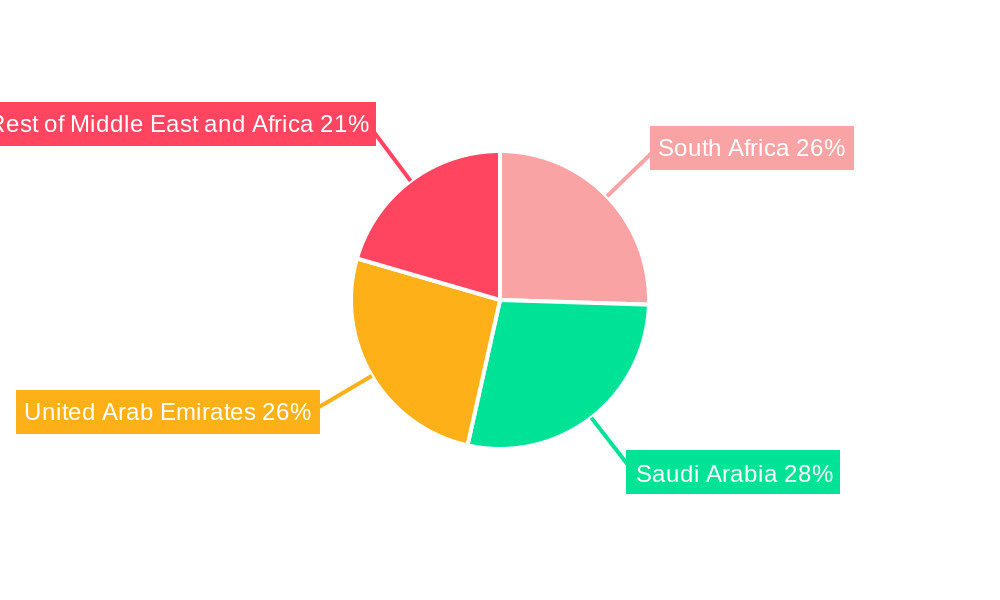

While the market enjoys strong growth drivers, certain restraints need to be navigated. Fluctuations in raw material prices, particularly dairy and sugar, can impact profitability and necessitate strategic sourcing and pricing adjustments. Additionally, the competitive landscape, featuring established global players and emerging local brands, intensifies price pressures and demands continuous innovation in product development and marketing strategies. Geographically, the MEA region presents a diverse market. While South Africa, Saudi Arabia, and the United Arab Emirates are significant contributors, the "Rest of Middle East and Africa" segment holds immense untapped potential, offering substantial opportunities for market penetration and growth for both domestic and international companies willing to invest in understanding and catering to local preferences and economic conditions. The ongoing urbanization and increasing adoption of Western consumption patterns are expected to further fuel demand across all segments and geographies.

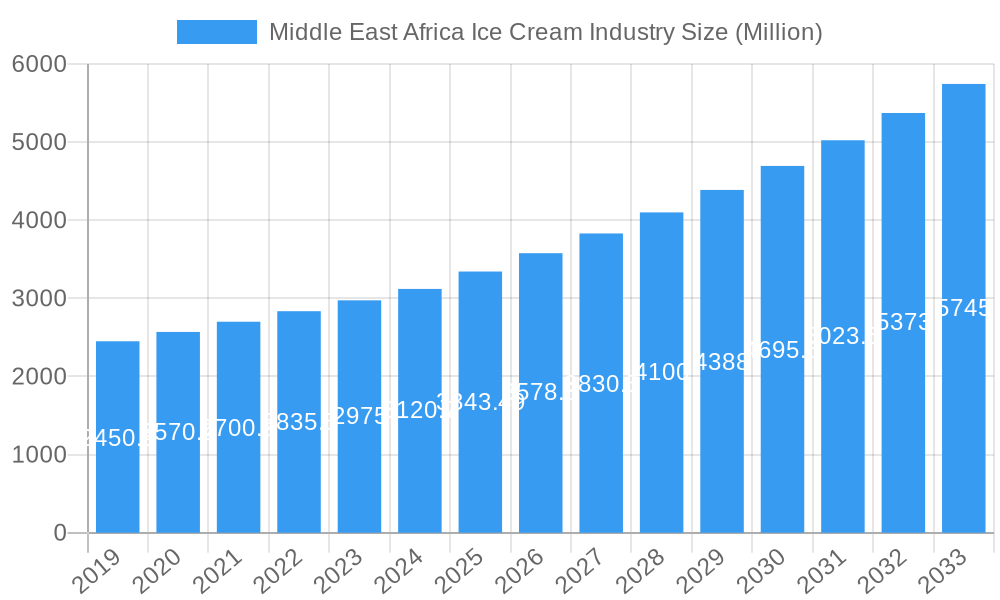

Middle East Africa Ice Cream Industry Company Market Share

Uncover the Sweet Success: Middle East Africa Ice Cream Industry Market Report 2025-2033

Dive into the booming Middle East Africa ice cream market with this comprehensive report, meticulously crafted for industry stakeholders seeking actionable insights and strategic advantages. This analysis spans from 2019 to 2033, with a deep dive into the base year 2025 and an extended forecast period, covering historical trends and future projections for this dynamic sector. Explore high-traffic keywords like "Middle East ice cream market," "Africa ice cream industry," "Saudi Arabia ice cream sales," "UAE ice cream trends," and "artisanal ice cream growth" to maximize your search visibility.

This report provides an in-depth understanding of the Middle East Africa ice cream industry, offering granular data on market size, segmentation, competitive landscape, and future opportunities. Identify untapped potential and capitalize on evolving consumer preferences for premium, innovative, and convenient ice cream solutions across diverse geographies and distribution channels.

Middle East Africa Ice Cream Industry Market Dynamics & Concentration

The Middle East Africa ice cream industry exhibits a dynamic market concentration, driven by a blend of global giants and emerging regional players. Innovation remains a key differentiator, with companies continuously introducing novel flavors, healthier options, and indulgent experiences to capture consumer attention. Regulatory frameworks, while generally supportive, can vary across countries, impacting product formulations and market entry strategies. Product substitutes, such as frozen yogurt and gelato, present a moderate competitive threat, but the inherent appeal of traditional ice cream continues to dominate. End-user trends lean towards premiumization, with consumers increasingly seeking high-quality ingredients and unique taste profiles. Mergers and acquisitions (M&A) activities are on the rise as larger entities seek to consolidate market share and expand their regional footprint. Key M&A deals in recent years have focused on acquiring smaller, innovative brands and bolstering distribution networks.

- Market Share: While specific current market share figures are proprietary, the top 5 players collectively command over 60% of the regional market.

- M&A Deal Counts: An average of 5-7 significant M&A deals have been recorded annually over the past three years, indicating a consolidating market.

Middle East Africa Ice Cream Industry Industry Trends & Analysis

The Middle East Africa ice cream industry is poised for substantial growth, fueled by a confluence of favorable market trends and evolving consumer behaviors. Market growth drivers are prominently linked to rising disposable incomes, particularly in affluent urban centers, and a growing young population with a taste for indulgent treats. Technological disruptions are transforming the landscape, with advancements in freezing technology leading to improved product texture and shelf-life, while e-commerce platforms are revolutionizing distribution channels, making ice cream more accessible than ever. Consumer preferences are shifting towards healthier indulgence, with increasing demand for low-sugar, plant-based, and natural ingredient options. This is prompting manufacturers to innovate with a wider variety of fruit-based, dairy-free, and functional ice creams. The competitive dynamics are intensifying, characterized by aggressive product launches, strategic pricing, and enhanced marketing campaigns. Brands are increasingly focusing on storytelling and unique brand experiences to connect with consumers. The penetration of modern retail formats, such as supermarkets and hypermarkets, is also a significant growth accelerator, offering wider product assortments and promotional opportunities. The "out-of-home" consumption segment, driven by the burgeoning tourism and hospitality sectors, further bolsters market expansion.

Leading Markets & Segments in Middle East Africa Ice Cream Industry

The Middle East Africa ice cream industry is dominated by a few key regions and product segments, offering lucrative opportunities for expansion and strategic focus.

Dominant Geography

- Saudi Arabia and United Arab Emirates (UAE) emerge as the leading markets, driven by their robust economies, high disposable incomes, and a large expatriate population with diverse consumption habits. These nations have well-established retail infrastructures and a strong appetite for premium and imported ice cream brands. The governments' focus on economic diversification and tourism promotion further boosts the demand for convenience and indulgence products.

- South Africa represents a significant market with a well-developed modern retail sector and a growing middle class. While facing some economic headwinds, its large population base and established brand loyalty provide a stable foundation for the ice cream industry.

- Rest of Middle-East and Africa presents a mixed but promising landscape, with countries like Egypt and Nigeria showing considerable growth potential due to their large populations and increasing urbanization.

Dominant Product Type

- Take Home Ice Cream holds the largest market share, reflecting the trend of at-home consumption, especially in family-oriented cultures. The availability of larger pack sizes and value-for-money offerings makes this segment a consistent performer.

- Impulse Ice Cream is crucial for impulse purchases, particularly in convenience stores and high-footfall areas. Its performance is closely tied to the availability of single-serving formats and appealing promotions.

- Artisanal Ice Cream is experiencing rapid growth, driven by consumers seeking unique flavors, premium ingredients, and handcrafted quality. This segment caters to a niche but expanding consumer base willing to pay a premium for superior taste and experience.

Dominant Distribution Channel

- Supermarkets/Hypermarkets are the primary distribution channel, offering wide product variety and convenient shopping experiences. Their extensive reach and promotional activities significantly influence consumer purchasing decisions.

- Convenience Stores are vital for impulse purchases and cater to immediate consumption needs, especially in urban and high-traffic areas.

- Online Retail Stores are rapidly gaining traction, offering convenience and a wider selection, especially for specialized or premium ice cream products. This channel is projected to see significant growth in the coming years.

Middle East Africa Ice Cream Industry Product Developments

Product innovation in the Middle East Africa ice cream market is increasingly focused on catering to evolving consumer demands for healthier and more exotic options. Manufacturers are developing a range of sugar-free, low-calorie, and plant-based ice creams to address health-conscious consumers. The introduction of novel flavor combinations, often inspired by local ingredients and global culinary trends, provides a competitive edge. Innovations in packaging, such as resealable tubs and single-serving cups, enhance convenience and appeal. The integration of premium ingredients like dark chocolate, exotic fruits, and gourmet nuts further elevates the perceived value and taste experience, driving premiumization within the market.

Key Drivers of Middle East Africa Ice Cream Industry Growth

The Middle East Africa ice cream industry is propelled by several interconnected drivers. Economic growth and rising disposable incomes in key countries directly translate into increased consumer spending on discretionary items like ice cream. A significant young demographic with a penchant for indulgent treats further fuels demand. Urbanization and the expansion of modern retail infrastructure enhance accessibility and availability. Furthermore, growing tourism in regions like the UAE and Egypt boosts demand for impulse and premium ice cream products. The increasing adoption of digital platforms and e-commerce is also expanding reach and convenience for consumers.

Challenges in the Middle East Africa Ice Cream Industry Market

Despite its promising growth, the Middle East Africa ice cream market faces several challenges. High import duties and complex regulatory landscapes in some countries can hinder market entry and increase operational costs. Supply chain complexities and the need for cold chain logistics across vast and sometimes challenging terrains present significant logistical hurdles. Intense competition from both local and international players necessitates continuous innovation and aggressive marketing strategies. Fluctuations in raw material prices, such as milk, sugar, and cocoa, can impact profitability. Economic downturns and currency volatility in certain regions can also dampen consumer spending power.

Emerging Opportunities in Middle East Africa Ice Cream Industry

Emerging opportunities in the Middle East Africa ice cream industry are abundant, driven by innovation and strategic market penetration. The growing demand for healthier alternatives, such as plant-based and low-sugar ice creams, presents a significant growth avenue. Strategic partnerships with local businesses can help navigate market complexities and enhance distribution networks. The expanding middle class in developing African nations offers untapped potential for market expansion. Furthermore, leveraging e-commerce and direct-to-consumer (DTC) models can provide direct access to consumers and facilitate the introduction of niche or premium products. Investing in sustainable sourcing and production can also resonate with an increasingly environmentally conscious consumer base.

Leading Players in the Middle East Africa Ice Cream Industry Sector

- Wells Enterprises Inc

- Inspire Brands Inc

- Saudia Dairy & Foodstuff Co Ltd

- General Mills Inc

- Unilever PLC

- Mars Incorporated

- Graviss Group

- IFFCO Group

- Gatti Ice Cream

- Nestlé S A

Key Milestones in Middle East Africa Ice Cream Industry Industry

- May 2023: Siwar Foods signed a private label and distributor agreement with French company Sarl So Mochi to market and distribute a range of Mochi ice cream in the Middle East, starting with the launch in the Kingdom of Saudi Arabia.

- May 2022: Baskin-Robbins partnered with the premium chocolate brand Galaxy to launch a fusion product, Milk Chocolate Twist. The product is developed with a fusion concept of flagship chocolate from Galaxy and ice cream from Baskin Robins. The new flavor will be served in a sundae topped with hot fudge, milk chocolate balls, and two Galaxy flutes at a few Baskin-Robbins locations in Saudi Arabia and the United Arab Emirates.

- March 2022: Baskin-Robbins company which operates under Inspire Brands, expanded its presence in the United Arab Emirates by opening its 1000th store in the Middle East, North Africa, and Australia combined. The outlet opened at Dubai Hills Mall, and Baskin-Robbins hosted a public ice cream party at Ain Dubai to mark the event.

Strategic Outlook for Middle East Africa Ice Cream Industry Market

The strategic outlook for the Middle East Africa ice cream industry is exceptionally positive, with strong growth anticipated throughout the forecast period. Key growth accelerators include continued product innovation focusing on health and indulgence, alongside aggressive market penetration strategies in under-served regions. The digitalization of retail and the expansion of e-commerce will further unlock new avenues for consumer engagement and sales. Strategic collaborations and potential acquisitions of smaller, innovative brands will be crucial for major players to maintain competitive advantage. Anticipated favorable demographic trends and rising consumer affluence across the region will ensure sustained demand for ice cream products, making this a prime market for investment and expansion.

Middle East Africa Ice Cream Industry Segmentation

-

1. Product Type

- 1.1. Impulse Ice Cream

- 1.2. Take Home Ice Cream

- 1.3. Artisanal Ice Cream

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialist Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

-

3. Geography

- 3.1. South Africa

- 3.2. Saudi Arabia

- 3.3. United Arab Emirates

- 3.4. Rest of Middle-East and Africa

Middle East Africa Ice Cream Industry Segmentation By Geography

- 1. South Africa

- 2. Saudi Arabia

- 3. United Arab Emirates

- 4. Rest of Middle East and Africa

Middle East Africa Ice Cream Industry Regional Market Share

Geographic Coverage of Middle East Africa Ice Cream Industry

Middle East Africa Ice Cream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Low-fat and Non-Dairy Ice Cream Products; Growing Acceptance of Experimental Flavors

- 3.3. Market Restrains

- 3.3.1. Rising Concern over Health Issues Associated with Ice Cream

- 3.4. Market Trends

- 3.4.1. Demand for Low-fat and Non-dairy Ice Cream Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Africa Ice Cream Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Impulse Ice Cream

- 5.1.2. Take Home Ice Cream

- 5.1.3. Artisanal Ice Cream

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialist Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. Saudi Arabia

- 5.3.3. United Arab Emirates

- 5.3.4. Rest of Middle-East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Saudi Arabia

- 5.4.3. United Arab Emirates

- 5.4.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. South Africa Middle East Africa Ice Cream Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Impulse Ice Cream

- 6.1.2. Take Home Ice Cream

- 6.1.3. Artisanal Ice Cream

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Specialist Stores

- 6.2.4. Online Retail Stores

- 6.2.5. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. Saudi Arabia

- 6.3.3. United Arab Emirates

- 6.3.4. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Saudi Arabia Middle East Africa Ice Cream Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Impulse Ice Cream

- 7.1.2. Take Home Ice Cream

- 7.1.3. Artisanal Ice Cream

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Specialist Stores

- 7.2.4. Online Retail Stores

- 7.2.5. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. Saudi Arabia

- 7.3.3. United Arab Emirates

- 7.3.4. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. United Arab Emirates Middle East Africa Ice Cream Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Impulse Ice Cream

- 8.1.2. Take Home Ice Cream

- 8.1.3. Artisanal Ice Cream

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Specialist Stores

- 8.2.4. Online Retail Stores

- 8.2.5. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. Saudi Arabia

- 8.3.3. United Arab Emirates

- 8.3.4. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of Middle East and Africa Middle East Africa Ice Cream Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Impulse Ice Cream

- 9.1.2. Take Home Ice Cream

- 9.1.3. Artisanal Ice Cream

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Specialist Stores

- 9.2.4. Online Retail Stores

- 9.2.5. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. South Africa

- 9.3.2. Saudi Arabia

- 9.3.3. United Arab Emirates

- 9.3.4. Rest of Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Wells Enterprises Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Inspire Brands Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Saudia Dairy & Foodstuff Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 General Mills Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Unilever PLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Mars Incorporated

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Graviss Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 IFFCO Group

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Gatti Ice Cream*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Nestlé S A

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Wells Enterprises Inc

List of Figures

- Figure 1: Middle East Africa Ice Cream Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East Africa Ice Cream Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 5: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Geography 2020 & 2033

- Table 7: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 11: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 13: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Geography 2020 & 2033

- Table 15: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 18: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 19: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 20: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 21: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 26: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 27: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 28: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 29: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Geography 2020 & 2033

- Table 31: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 33: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 34: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 35: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 36: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 37: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Geography 2020 & 2033

- Table 39: Middle East Africa Ice Cream Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Middle East Africa Ice Cream Industry Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Africa Ice Cream Industry?

The projected CAGR is approximately 5.41%.

2. Which companies are prominent players in the Middle East Africa Ice Cream Industry?

Key companies in the market include Wells Enterprises Inc, Inspire Brands Inc, Saudia Dairy & Foodstuff Co Ltd, General Mills Inc, Unilever PLC, Mars Incorporated, Graviss Group, IFFCO Group, Gatti Ice Cream*List Not Exhaustive, Nestlé S A.

3. What are the main segments of the Middle East Africa Ice Cream Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 3,343.49 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Low-fat and Non-Dairy Ice Cream Products; Growing Acceptance of Experimental Flavors.

6. What are the notable trends driving market growth?

Demand for Low-fat and Non-dairy Ice Cream Products.

7. Are there any restraints impacting market growth?

Rising Concern over Health Issues Associated with Ice Cream.

8. Can you provide examples of recent developments in the market?

May 2023: Siwar Foods signed a private label and distributor agreement with French company Sarl So Mochi to market and distribute a range of Mochi ice cream in the Middle East, starting with the launch in the Kingdom of Saudi Arabia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Africa Ice Cream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Africa Ice Cream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Africa Ice Cream Industry?

To stay informed about further developments, trends, and reports in the Middle East Africa Ice Cream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence