Key Insights

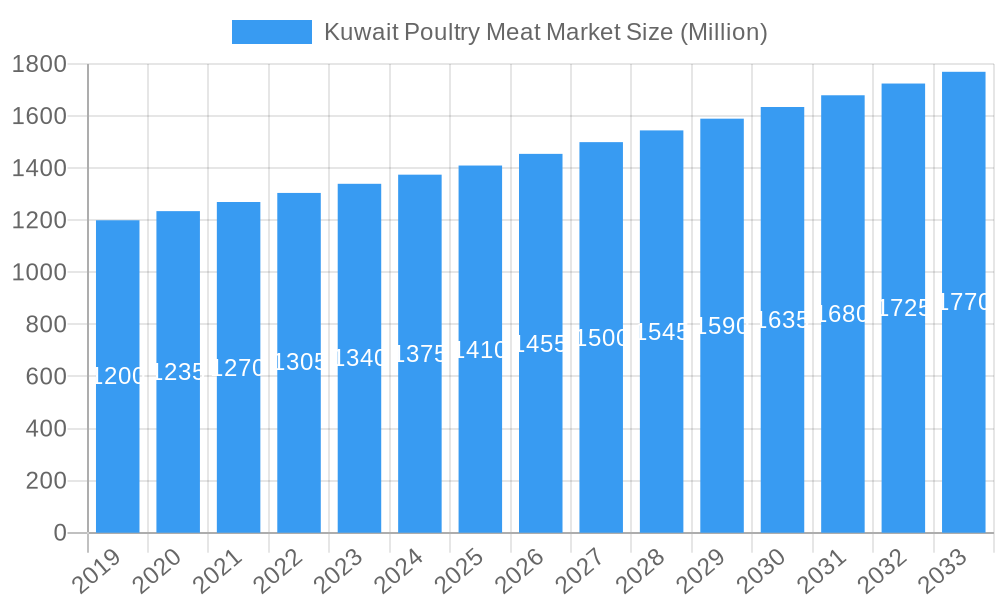

The Kuwait Poultry Meat Market is projected for robust expansion, with an estimated market size of USD 520.11 million by 2025. The market is forecast to grow at a Compound Annual Growth Rate (CAGR) of 1.01% between the base year 2025 and 2033. Key growth drivers include escalating consumer demand for protein-rich diets and a rising preference for convenient poultry products. Increased disposable incomes in Kuwait further support this trend, alongside government initiatives focused on food security and local agricultural development. Evolving consumer lifestyles, emphasizing healthy eating and lean protein consumption, also contribute to market dynamics.

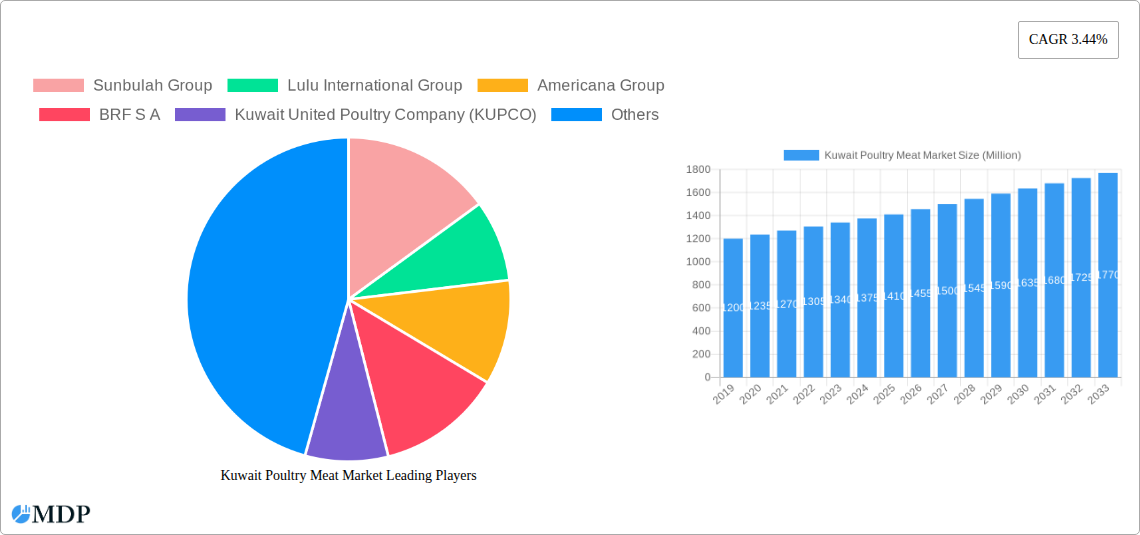

Kuwait Poultry Meat Market Market Size (In Million)

Market segmentation highlights significant growth in the "Processed" category, driven by sub-segments such as deli meats and marinated products, appealing to convenience-focused consumers. Online retail channels are emerging as a crucial distribution avenue, reflecting the region's digital retail transformation. Potential challenges include volatile raw material prices and import regulations. Intense competition among key players necessitates product innovation and strategic marketing efforts. The Kuwaiti market is expected to be a significant contributor to regional growth, fueled by a young demographic embracing new food trends and a strong preference for poultry.

Kuwait Poultry Meat Market Company Market Share

This comprehensive report, "Kuwait Poultry Meat Market: Insights, Trends, and Forecasts 2025-2033," offers detailed analysis of the Kuwaiti poultry sector. It provides market size estimations, CAGR projections, and an in-depth competitive landscape analysis featuring key players such as Sunbulah Group, Lulu International Group, Americana Group, BRF S.A., Kuwait United Poultry Company (KUPCO), The Savola Group, JBS S.A., and Almarai Food Company. The study encompasses the entire value chain, from raw material sourcing to consumer distribution, delivering actionable intelligence. It details segmentation by product form (Canned, Fresh/Chilled, Frozen, Processed - including Deli Meats, Marinated/Tenders, Meatballs, Nuggets, Sausages, and Other Processed Poultry) and distribution channel (Off-Trade: Convenience Stores, Online Channel, Supermarkets & Hypermarkets, Others; On-Trade). Historical performance (2019-2024), base year analysis (2025), and a robust forecast period (2025-2033) provide stakeholders with data-driven insights to navigate this dynamic market.

Kuwait Poultry Meat Market Market Dynamics & Concentration

The Kuwait Poultry Meat Market exhibits a moderate to high concentration, with a few key players dominating market share. Americana Group and Kuwait United Poultry Company (KUPCO) are significant contributors, alongside international giants like JBS S.A. and BRF S.A. driving competition. Innovation is a key driver, with companies increasingly focusing on value-added products and healthier alternatives. For instance, Sunbulah Group's launch of organic and gluten-free options in January 2021 directly addresses a growing consumer demand for wellness-conscious choices, contributing to market diversification and the creation of niche segments. Regulatory frameworks, while generally supportive of food security, can influence import policies and local production standards. Product substitutes, such as red meat and fish, present a constant competitive pressure, necessitating continuous product development and competitive pricing strategies. End-user trends are shifting towards convenience and health, with a rising demand for processed poultry products and ready-to-cook meals. Mergers and acquisitions (M&A) activities are anticipated to shape the market further, as larger entities seek to consolidate their market position and expand their product portfolios. While specific M&A deal counts are not readily available, the competitive intensity suggests potential for consolidation in the coming years, aimed at optimizing supply chains and increasing operational efficiencies. Market share for leading players is estimated to range from 15% to 30%, reflecting a dynamic competitive landscape.

Kuwait Poultry Meat Market Industry Trends & Analysis

The Kuwait Poultry Meat Market is experiencing robust growth, propelled by several key factors including a growing population, rising disposable incomes, and an increasing preference for protein-rich diets. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025-2033. Technological disruptions are playing a crucial role in enhancing production efficiency and product quality. Advancements in farming techniques, feed optimization, and processing technologies are leading to higher yields and improved meat quality, directly impacting consumer satisfaction and market penetration. Consumer preferences are a significant influence, with a clear trend towards convenience, health, and traceability. This is evident in the rising demand for processed poultry products, including marinated chicken, sausages, and nuggets, which offer ease of preparation for busy households. Furthermore, there's a growing awareness and demand for ethically sourced and sustainably produced poultry. Competitive dynamics within the market are intensifying, with both local and international players vying for market share. Almarai Food Company's strategic product launches, such as their marinated chicken variants in July 2020, exemplify efforts to capture new customer segments and expand their market footprint. The online channel for poultry meat sales is also experiencing a significant surge, driven by the convenience it offers and the growing adoption of e-commerce across Kuwait. This trend, coupled with the expansion of modern retail formats like hypermarkets, is redefining the distribution landscape. The market penetration of frozen and fresh/chilled poultry remains high, but processed and value-added products are gaining traction at an accelerated pace, indicating a shift in consumer consumption patterns. The increasing focus on food safety and quality standards by regulatory bodies is also a key trend, ensuring consumer trust and promoting fair competition. The overall industry analysis points towards a market poised for sustained expansion, driven by evolving consumer demands and technological advancements in production and distribution.

Leading Markets & Segments in Kuwait Poultry Meat Market

The Kuwait Poultry Meat Market is characterized by the dominance of certain segments and distribution channels, reflecting consumer preferences and infrastructural development. Within the Form segmentation, Fresh/Chilled poultry meat holds a substantial market share due to its perceived quality and versatility in traditional Kuwaiti cuisine. However, the Frozen segment is rapidly gaining prominence, driven by extended shelf life and convenience for both consumers and retailers. The Processed poultry segment, encompassing a wide array of products like Deli Meats, Marinated/Tenders, Meatballs, Nuggets, and Sausages, is experiencing the fastest growth. This surge is fueled by the increasing demand for ready-to-cook and ready-to-eat options among time-pressed consumers. Nuggets and Marinated/Tenders are particularly popular, catering to families and younger demographics. In terms of Distribution Channels, the Off-Trade segment is the primary driver of sales. Supermarkets and Hypermarkets command the largest share due to their wide reach, product variety, and organized retail environment, providing consumers with a one-stop shopping experience. The Online Channel is emerging as a significant growth area, with increasing adoption of e-commerce platforms for grocery shopping, offering unparalleled convenience and expanding market reach for poultry producers. Convenience Stores also play a vital role in providing readily accessible poultry products for immediate consumption. The On-Trade segment, including restaurants and food service establishments, contributes significantly to overall consumption, with a growing demand for high-quality poultry for culinary preparations. Key drivers for the dominance of these segments include:

- Economic Policies: Government initiatives promoting food security and local production foster growth in domestic poultry farming.

- Infrastructure Development: The expansion of modern retail outlets and efficient logistics networks supports the widespread availability of poultry products.

- Consumer Demographics: A young and growing population with increasing disposable incomes drives demand for convenient and diverse poultry options.

- Lifestyle Trends: The shift towards busy lifestyles and a preference for quick meal solutions bolster the demand for processed and ready-to-cook poultry.

- Health Consciousness: Growing awareness about the nutritional benefits of poultry protein contributes to its sustained popularity.

Kuwait Poultry Meat Market Product Developments

Product development in the Kuwait Poultry Meat Market is increasingly focused on innovation driven by consumer demand for healthier, convenient, and value-added options. Companies are introducing a wider range of marinated chicken products, catering to diverse culinary preferences. The push towards organic and gluten-free poultry products, as exemplified by Sunbulah Group's initiative, signifies a significant trend towards health and wellness. This aligns with a growing segment of consumers seeking cleaner labels and allergen-free food choices. Furthermore, advancements in processing technologies are enabling the creation of novel product formats, such as bite-sized portions, pre-marinated skewers, and gourmet sausages, enhancing consumer appeal and facilitating culinary exploration. The competitive advantage lies in offering unique flavor profiles, superior quality, and convenient packaging solutions that meet the evolving needs of the Kuwaiti market.

Key Drivers of Kuwait Poultry Meat Market Growth

Several key drivers are propelling the growth of the Kuwait Poultry Meat Market. Technologically, advancements in animal husbandry, feed formulation, and processing technologies are enhancing efficiency and product quality, leading to greater output and competitiveness. Economically, a growing population and a rising disposable income are increasing the purchasing power of consumers, driving demand for protein sources like poultry. Government support through policies aimed at boosting local production and ensuring food security further bolsters the sector. Regulatory frameworks that promote food safety and quality standards build consumer confidence. Moreover, the increasing preference for chicken as a healthier and more affordable protein alternative compared to red meat is a significant growth accelerator.

Challenges in the Kuwait Poultry Meat Market Market

Despite its growth potential, the Kuwait Poultry Meat Market faces several challenges. Regulatory hurdles, including stringent import/export regulations and evolving food safety standards, can impact supply chains and increase operational costs. Volatility in feed prices, which are largely dependent on global commodity markets, poses a significant challenge to profitability and price stability. Intense competition from both domestic producers and international suppliers can lead to price wars and pressure on profit margins. Furthermore, managing disease outbreaks in poultry farms requires robust biosecurity measures and swift response mechanisms to prevent widespread disruption. Supply chain complexities, including ensuring efficient cold chain logistics and minimizing spoilage, are also critical operational challenges that require continuous investment and optimization.

Emerging Opportunities in Kuwait Poultry Meat Market

Emerging opportunities in the Kuwait Poultry Meat Market are abundant, driven by evolving consumer trends and strategic market positioning. The growing demand for organic, free-range, and hormone-free poultry presents a lucrative niche for producers focusing on premium segments. Technological breakthroughs in sustainable farming practices and waste reduction can lead to cost efficiencies and enhanced brand reputation. Strategic partnerships with food service providers and major retailers offer avenues for market expansion and increased product visibility. The increasing adoption of e-commerce platforms also opens up new distribution channels, allowing for direct consumer engagement and broader market reach. Furthermore, developing a wider range of convenient, ready-to-cook, and ready-to-eat poultry products tailored to local tastes and preferences can capture significant market share.

Leading Players in the Kuwait Poultry Meat Market Sector

- Sunbulah Group

- Lulu International Group

- Americana Group

- BRF S.A.

- Kuwait United Poultry Company (KUPCO)

- The Savola Group

- JBS S.A.

- Almarai Food Company

Key Milestones in Kuwait Poultry Meat Market Industry

- January 2021: Sunbulah Group announced the launch of a range of products and SKUs that will be completely organic and gluten-free, due to the increasing demand.

- July 2020: Almarai Food Company introduced new products in the market, including marinated whole chicken tandoori, marinated whole chicken smoked barbecue, and marinated half chicken kabsa, thus penetrating new customer segments and increasing market share.

Strategic Outlook for Kuwait Poultry Meat Market Market

The strategic outlook for the Kuwait Poultry Meat Market is positive, with continued growth anticipated driven by sustained consumer demand and market innovation. Key growth accelerators include the expansion of value-added processed poultry products, catering to the convenience-seeking consumer base. The increasing adoption of e-commerce for grocery purchases presents a significant opportunity for enhanced market reach and direct-to-consumer sales. Investments in sustainable and ethical poultry production practices are expected to gain traction, appealing to a growing segment of health-conscious and environmentally aware consumers. Furthermore, strategic alliances and potential consolidation among key players could lead to greater operational efficiencies and a more competitive market landscape, ultimately benefiting consumers with improved product availability and quality.

Kuwait Poultry Meat Market Segmentation

-

1. Form

- 1.1. Canned

- 1.2. Fresh / Chilled

- 1.3. Frozen

-

1.4. Processed

-

1.4.1. By Processed Types

- 1.4.1.1. Deli Meats

- 1.4.1.2. Marinated/ Tenders

- 1.4.1.3. Meatballs

- 1.4.1.4. Nuggets

- 1.4.1.5. Sausages

- 1.4.1.6. Other Processed Poultry

-

1.4.1. By Processed Types

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Channel

- 2.1.3. Supermarkets and Hypermarkets

- 2.1.4. Others

- 2.2. On-Trade

-

2.1. Off-Trade

Kuwait Poultry Meat Market Segmentation By Geography

- 1. Kuwait

Kuwait Poultry Meat Market Regional Market Share

Geographic Coverage of Kuwait Poultry Meat Market

Kuwait Poultry Meat Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Clean Label Food & Beverage Products; Rising Demand for Dairy Products

- 3.3. Market Restrains

- 3.3.1. Presence of Preservatives in Ready Meals may Hamper the Market Growth

- 3.4. Market Trends

- 3.4.1 The demand for poultry meat surges as separate counters captivate consumers

- 3.4.2 thus driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kuwait Poultry Meat Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Canned

- 5.1.2. Fresh / Chilled

- 5.1.3. Frozen

- 5.1.4. Processed

- 5.1.4.1. By Processed Types

- 5.1.4.1.1. Deli Meats

- 5.1.4.1.2. Marinated/ Tenders

- 5.1.4.1.3. Meatballs

- 5.1.4.1.4. Nuggets

- 5.1.4.1.5. Sausages

- 5.1.4.1.6. Other Processed Poultry

- 5.1.4.1. By Processed Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Channel

- 5.2.1.3. Supermarkets and Hypermarkets

- 5.2.1.4. Others

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Kuwait

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sunbulah Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lulu International Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Americana Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BRF S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kuwait United Poultry Company (KUPCO)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Savola Grou

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 JBS SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Almarai Food Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Sunbulah Group

List of Figures

- Figure 1: Kuwait Poultry Meat Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Kuwait Poultry Meat Market Share (%) by Company 2025

List of Tables

- Table 1: Kuwait Poultry Meat Market Revenue million Forecast, by Form 2020 & 2033

- Table 2: Kuwait Poultry Meat Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Kuwait Poultry Meat Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Kuwait Poultry Meat Market Revenue million Forecast, by Form 2020 & 2033

- Table 5: Kuwait Poultry Meat Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Kuwait Poultry Meat Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kuwait Poultry Meat Market?

The projected CAGR is approximately 1.01%.

2. Which companies are prominent players in the Kuwait Poultry Meat Market?

Key companies in the market include Sunbulah Group, Lulu International Group, Americana Group, BRF S A, Kuwait United Poultry Company (KUPCO), The Savola Grou, JBS SA, Almarai Food Company.

3. What are the main segments of the Kuwait Poultry Meat Market?

The market segments include Form, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 520.11 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Clean Label Food & Beverage Products; Rising Demand for Dairy Products.

6. What are the notable trends driving market growth?

The demand for poultry meat surges as separate counters captivate consumers. thus driving the market.

7. Are there any restraints impacting market growth?

Presence of Preservatives in Ready Meals may Hamper the Market Growth.

8. Can you provide examples of recent developments in the market?

January 2021: Sunbulah Group announced the launch of range of products and SKUs that will be completely organic and gluten-free, due to the increasing demand.July 2020: Almarai Food Company introduced new products in the market, including marinated whole chicken tandoori, marinated whole chicken smoked barbecue, marinated whole chicken smoked barbecue, and marinated half chicken kabsa, thus penetrating new customer segments and increasing market share.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kuwait Poultry Meat Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kuwait Poultry Meat Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kuwait Poultry Meat Market?

To stay informed about further developments, trends, and reports in the Kuwait Poultry Meat Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence