Key Insights

The Indian meat market is projected to reach $60 billion by 2025, demonstrating a Compound Annual Growth Rate (CAGR) of 8.42% from 2025 to 2033. This substantial growth is attributed to increasing disposable incomes, evolving dietary preferences favoring higher meat consumption among the expanding middle class, and rapid urbanization leading to greater product accessibility in urban centers. Advancements in food processing, retail infrastructure, and cold chain logistics further support market expansion through enhanced distribution and product longevity. Key market segments include form (canned, fresh/chilled, frozen, processed), distribution channel (off-trade, on-trade), and meat type (beef, mutton, pork, poultry, other). Poultry currently dominates due to its cost-effectiveness and widespread availability, while processed meat segments are experiencing notable growth.

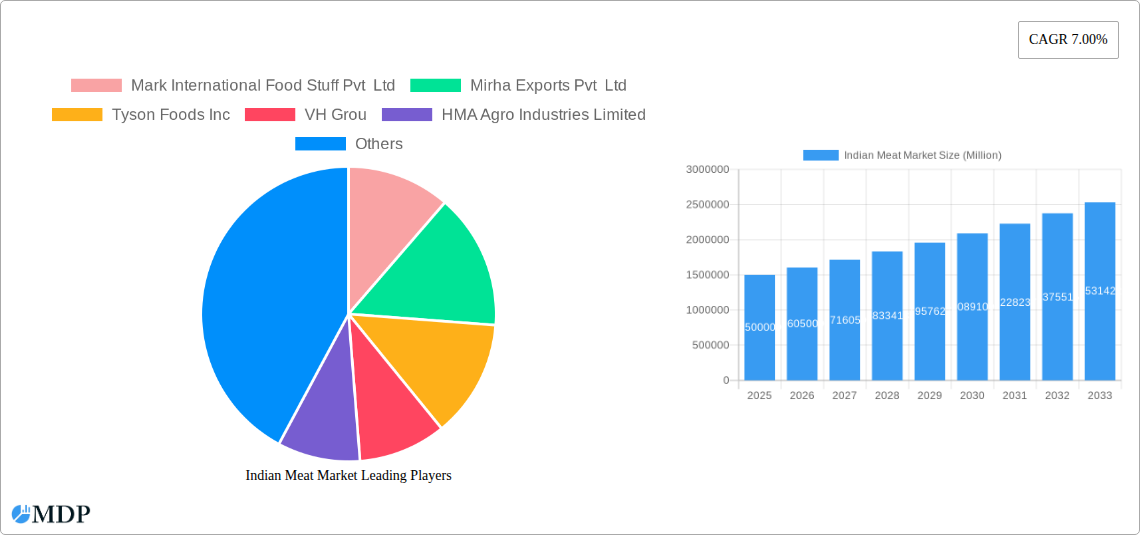

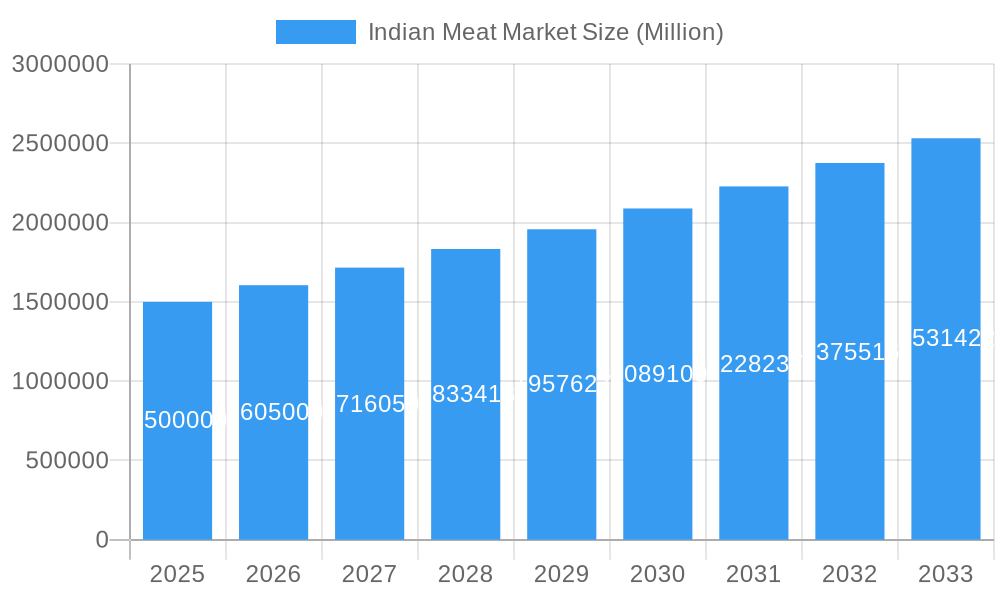

Indian Meat Market Market Size (In Billion)

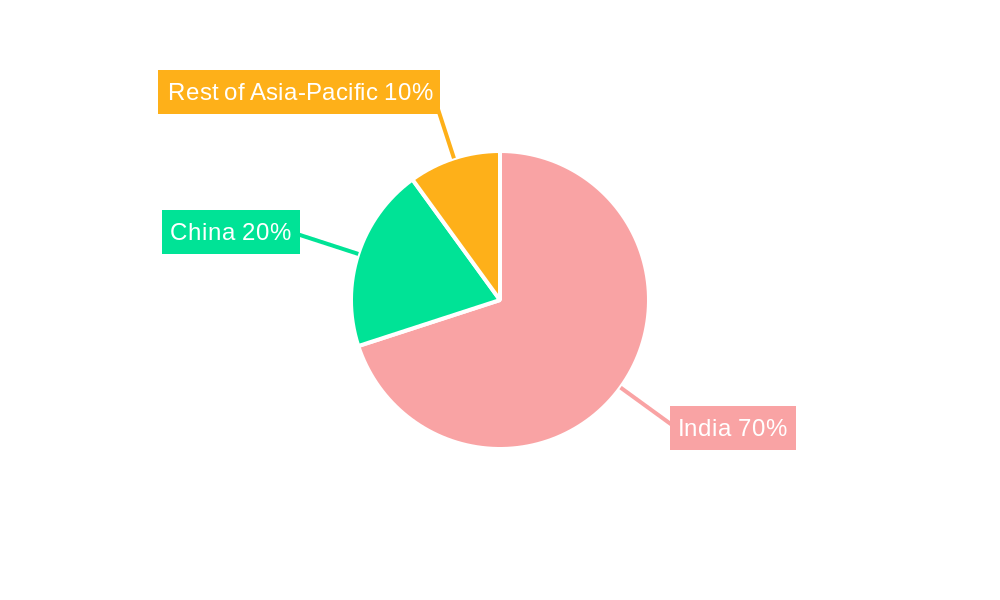

Challenges impacting the market include stringent regulations in livestock farming and meat processing, alongside ethical considerations regarding animal welfare and food safety. Regional and cultural dietary preferences also influence market dynamics. The competitive environment features both global entities like Tyson Foods and prominent domestic players such as Suguna Foods and Al-Hamd Agro Food Products. These companies are actively pursuing product innovation, diversification, and brand development to secure market share. The Asia-Pacific region, with India and China at the forefront, is a significant growth driver. The forecast period (2025-2033) indicates continued positive momentum, presenting considerable opportunities across all market segments. Success in this dynamic market necessitates addressing sustainability, traceability, and evolving consumer demands through strategic investments in technology, infrastructure, and sustainable agricultural practices.

Indian Meat Market Company Market Share

Indian Meat Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Indian meat market, covering the period from 2019 to 2033. With a base year of 2025 and a forecast period spanning 2025-2033, this study offers invaluable insights for industry stakeholders, investors, and market entrants seeking to capitalize on the burgeoning opportunities within this dynamic sector. The report examines key market segments (beef, mutton, pork, poultry, and other meats), distribution channels (on-trade and off-trade), and forms (canned, fresh/chilled, frozen, and processed). Leading players like Suguna Foods Private Limited, Tyson Foods Inc, and Mark International Food Stuff Pvt Ltd are analyzed, revealing market share dynamics and competitive landscapes. The report values are expressed in Millions.

Indian Meat Market Dynamics & Concentration

The Indian meat market is characterized by a complex interplay of factors influencing its growth and concentration. While the overall market size is substantial and growing, the level of concentration varies significantly across segments. Poultry currently dominates market share, followed by mutton, with beef and pork holding smaller, albeit growing, portions. The market exhibits both organized and unorganized players, with larger companies often focusing on processing and distribution, while smaller businesses operate primarily in the primary production and local retail segments. Innovation is a key driver, with companies investing in improved processing techniques, value-added products, and enhanced packaging to meet evolving consumer demands. Regulatory frameworks, particularly those concerning food safety and animal welfare, play a crucial role in shaping industry practices. The availability of substitutes, such as plant-based protein alternatives, represents a potential challenge, though currently limited in market penetration. Consumer preferences are shifting towards healthier and more convenient meat products, fueling demand for processed and value-added options. Finally, mergers and acquisitions (M&A) activity is relatively moderate but shows potential for consolidation, particularly among larger players seeking expansion and enhanced market reach.

- Market Concentration: xx% dominated by top 5 players (2024).

- M&A Deal Count (2019-2024): xx deals

- Innovation Drivers: Technological advancements in processing, packaging, and cold chain logistics.

- Regulatory Impact: Stringent food safety regulations driving improvements in hygiene and processing standards.

Indian Meat Market Industry Trends & Analysis

The Indian meat market is experiencing robust growth, driven by several interconnected factors. Rising disposable incomes, rapid urbanization, and changing lifestyles are contributing to increased meat consumption. A growing young population with a preference for convenience foods fuels the demand for processed and ready-to-eat meat products. Technological advancements are enhancing productivity across the value chain, from improved breeding techniques to automated processing and efficient cold chain management. However, the market also faces challenges including fluctuations in raw material prices, infrastructural bottlenecks in cold chain logistics, and varying levels of awareness regarding food safety and hygiene. The market exhibits a strong regional variation, with Southern India showing higher per capita meat consumption compared to other regions. The CAGR for the forecast period (2025-2033) is projected to be xx%, driven primarily by the growth of the processed meat segment. Market penetration of organized players is increasing steadily, but the unorganized sector still constitutes a substantial portion of the overall market. Competitive dynamics are characterized by both intense competition among established players and the emergence of new entrants, particularly in value-added segments.

Leading Markets & Segments in Indian Meat Market

Poultry dominates the Indian meat market, driven by factors like affordability, relatively lower prices compared to other meat types, and adaptability to various cuisines. The processed meat segment is experiencing the highest growth rate, fueled by increased consumer demand for convenience and ready-to-eat products. The fresh/chilled segment retains a significant share, particularly in traditional markets. Within distribution channels, the off-trade segment (retail stores, supermarkets, etc.) is growing rapidly, while the on-trade segment (restaurants, hotels, etc.) also contributes significantly. Regional variations exist, with Southern India exhibiting higher consumption, partially due to established poultry farming infrastructure and cultural preferences.

- Key Drivers for Poultry Dominance: Affordability, cultural acceptance, efficient production systems.

- Key Drivers for Processed Meat Growth: Convenience, ready-to-eat options, increasing urbanization.

- Regional Variations: South India leading in per capita consumption; significant growth potential in other regions.

Indian Meat Market Product Developments

Recent product developments focus on value-added products like ready-to-cook and ready-to-eat meals, marinated meats, and innovative processed meat snacks. Technological advancements in processing and packaging are improving product quality, extending shelf life, and enhancing convenience for consumers. These innovations cater to the rising demand for convenient and healthy food options, aligning with the changing lifestyles and preferences of Indian consumers. Companies are also emphasizing hygiene and traceability in their production processes to enhance consumer trust and meet evolving regulatory standards.

Key Drivers of Indian Meat Market Growth

Several factors are driving the growth of the Indian meat market:

- Rising Disposable Incomes: Increased purchasing power enables higher meat consumption.

- Urbanization: Urban populations generally exhibit higher per capita meat consumption.

- Changing Lifestyles: Busy lifestyles fuel the demand for convenient ready-to-eat options.

- Technological Advancements: Improved farming techniques, processing, and cold chain infrastructure.

Challenges in the Indian Meat Market Market

Despite the positive outlook, several challenges impede the market's growth:

- Fluctuating Raw Material Prices: Feed costs directly impact meat production costs.

- Cold Chain Infrastructure Gaps: Inadequate cold storage facilities lead to spoilage and losses.

- Regulatory Hurdles: Complicated regulations related to food safety and animal welfare.

- Competition: Intense competition from both organized and unorganized players.

Emerging Opportunities in Indian Meat Market

The Indian meat market presents numerous opportunities:

- Value-Added Products: Expanding the range of processed and ready-to-eat meat products.

- Strategic Partnerships: Collaborations with retailers and food service providers to enhance market reach.

- Technological Adoption: Implementing advanced technologies to improve efficiency and quality.

- Market Expansion: Targeting underpenetrated regions with higher growth potential.

Leading Players in the Indian Meat Market Sector

- Mark International Food Stuff Pvt Ltd

- Mirha Exports Pvt Ltd

- Tyson Foods Inc

- VH Group

- HMA Agro Industries Limited

- Al-Hamd Agro Food Products Pvt Ltd

- Suguna Foods Private Limited

- Farm Suzanne Pvt Ltd

- Allanasons Private Limited

- M K Overseas Private Limited

- Al Aali Exports Pvt Ltd

Key Milestones in Indian Meat Market Industry

- January 2023: Suguna Foods' Delfrez brand expands into new markets across India.

- October 2022: Delfrez opens retail outlets in Thane & Navi Mumbai.

- December 2021: VH Group acquires land for veterinary medicine production.

Strategic Outlook for Indian Meat Market Market

The Indian meat market is poised for continued growth, driven by favorable demographic trends, rising incomes, and evolving consumer preferences. Strategic opportunities exist in developing innovative products, investing in cold chain infrastructure, and leveraging technological advancements to enhance efficiency and sustainability. Companies that successfully adapt to the changing market dynamics, embrace technological innovations, and cater to evolving consumer demands are best positioned to capture significant market share in the years to come.

Indian Meat Market Segmentation

-

1. Type

- 1.1. Beef

- 1.2. Mutton

- 1.3. Pork

- 1.4. Poultry

- 1.5. Other Meat

-

2. Form

- 2.1. Canned

- 2.2. Fresh / Chilled

- 2.3. Frozen

- 2.4. Processed

-

3. Distribution Channel

-

3.1. Off-Trade

- 3.1.1. Convenience Stores

- 3.1.2. Online Channel

- 3.1.3. Supermarkets and Hypermarkets

- 3.1.4. Others

- 3.2. On-Trade

-

3.1. Off-Trade

Indian Meat Market Segmentation By Geography

- 1. India

Indian Meat Market Regional Market Share

Geographic Coverage of Indian Meat Market

Indian Meat Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use

- 3.3. Market Restrains

- 3.3.1. Increasing Shift Toward Plant-Based Protein

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indian Meat Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Beef

- 5.1.2. Mutton

- 5.1.3. Pork

- 5.1.4. Poultry

- 5.1.5. Other Meat

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Canned

- 5.2.2. Fresh / Chilled

- 5.2.3. Frozen

- 5.2.4. Processed

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Off-Trade

- 5.3.1.1. Convenience Stores

- 5.3.1.2. Online Channel

- 5.3.1.3. Supermarkets and Hypermarkets

- 5.3.1.4. Others

- 5.3.2. On-Trade

- 5.3.1. Off-Trade

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mark International Food Stuff Pvt Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mirha Exports Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tyson Foods Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 VH Grou

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HMA Agro Industries Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Al-Hamd Agro Food Products Pvt Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Suguna Foods Private Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Farm Suzanne Pvt Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Allanasons Private Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 M K Overseas Private Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Al Aali Exports Pvt Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Mark International Food Stuff Pvt Ltd

List of Figures

- Figure 1: Indian Meat Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Indian Meat Market Share (%) by Company 2025

List of Tables

- Table 1: Indian Meat Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Indian Meat Market Revenue billion Forecast, by Form 2020 & 2033

- Table 3: Indian Meat Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Indian Meat Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Indian Meat Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Indian Meat Market Revenue billion Forecast, by Form 2020 & 2033

- Table 7: Indian Meat Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Indian Meat Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indian Meat Market?

The projected CAGR is approximately 8.42%.

2. Which companies are prominent players in the Indian Meat Market?

Key companies in the market include Mark International Food Stuff Pvt Ltd, Mirha Exports Pvt Ltd, Tyson Foods Inc, VH Grou, HMA Agro Industries Limited, Al-Hamd Agro Food Products Pvt Ltd, Suguna Foods Private Limited, Farm Suzanne Pvt Ltd, Allanasons Private Limited, M K Overseas Private Limited, Al Aali Exports Pvt Ltd.

3. What are the main segments of the Indian Meat Market?

The market segments include Type, Form, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 60 billion as of 2022.

5. What are some drivers contributing to market growth?

Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Increasing Shift Toward Plant-Based Protein.

8. Can you provide examples of recent developments in the market?

January 2023: Suguna Foods' brand Delfrez which offers processed poultry and mutton products is set to foray into select cities across North, West, and the rest of South India in 2023.October 2022: Delfrez, processed food division from Suguna Foods, opened its chain of outlets in Thane & Navi Mumbai. The store offers rich and hygiene friendly processed meat option for customers.December 2021: VH Group acquired land measuring 15,030 sq. m at MIDC, Village: Kesurdi, Tal: Khandala, District: Satara, Maharashtra. It is setting up a new project to manufacture veterinary medicine products under its Animal Health Product segment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indian Meat Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indian Meat Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indian Meat Market?

To stay informed about further developments, trends, and reports in the Indian Meat Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence