Key Insights

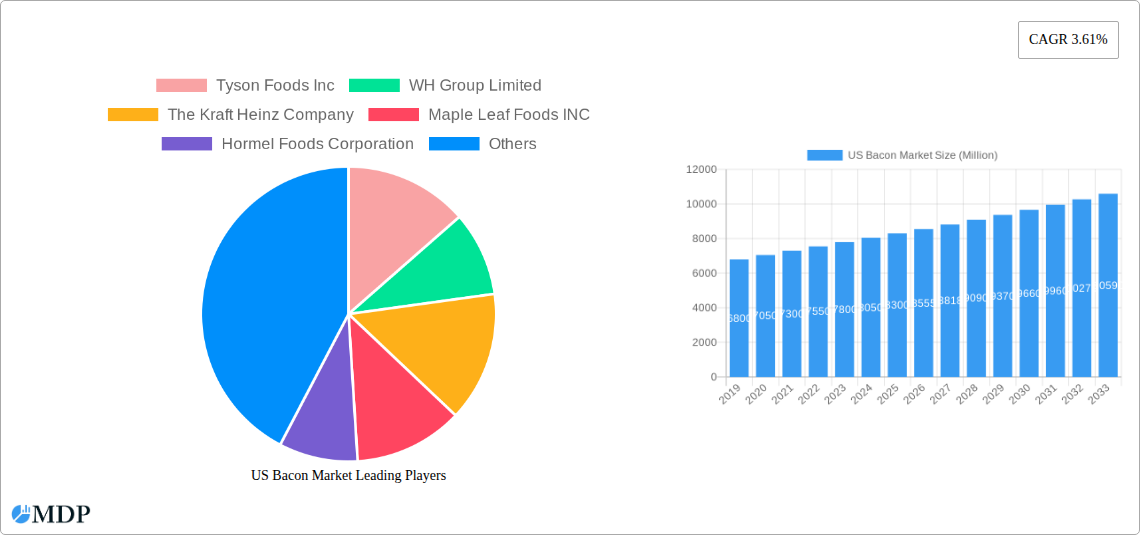

The U.S. bacon market is projected for robust expansion, with an estimated market size of $8.3 billion by 2025. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 2.9% from the base year 2025 through 2033. This growth is propelled by sustained consumer preference for bacon, driven by its culinary versatility and status as an American dietary staple, especially in breakfast and snacking. Key growth drivers include the increasing prominence of foodservice establishments that integrate bacon extensively into their menus. Innovations in bacon production, such as reduced-sodium and uncured options, cater to growing health consciousness without compromising flavor, thus expanding market appeal. A well-established supply chain and strong production capabilities, supported by continuous investment from major players like Tyson Foods Inc. and Hormel Foods Corporation, ensure market stability and consistent demand mirroring production levels.

US Bacon Market Market Size (In Billion)

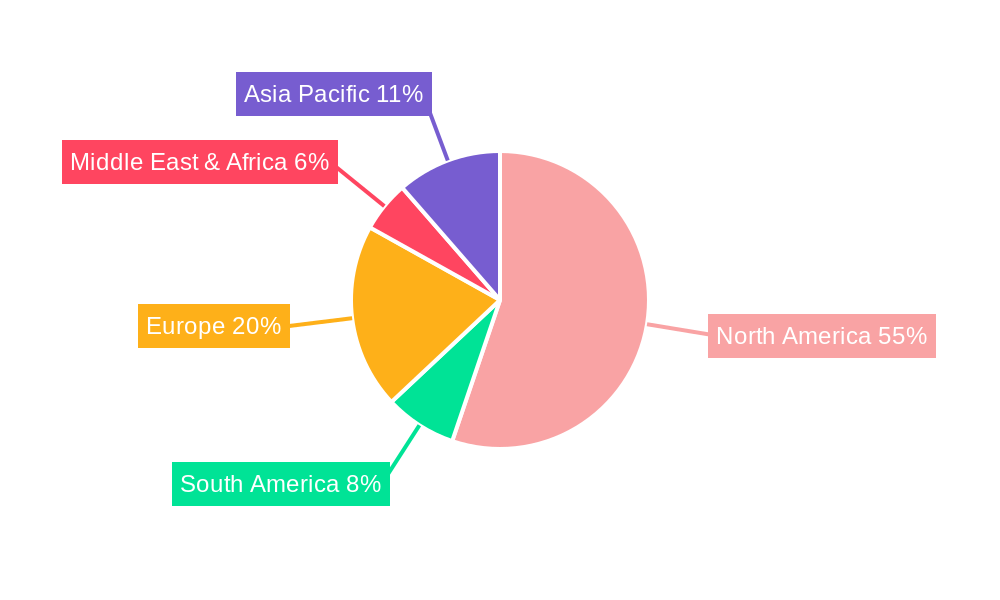

While enjoying significant demand, the market confronts challenges that may influence its growth trajectory. Volatile pork prices, the primary raw material, pose a substantial risk, impacting manufacturer profitability and potentially leading to consumer price increases. Growing awareness of the health implications of processed meats, particularly high sodium and fat content, could gradually shift consumer preferences towards healthier alternatives. Nevertheless, the market demonstrates resilience through product diversification and strategic marketing emphasizing quality and origin. Import and export analyses indicate a dynamic global trade environment, with North America as a leading region for both consumption and production. The interplay of international trade significantly influences domestic supply and demand dynamics.

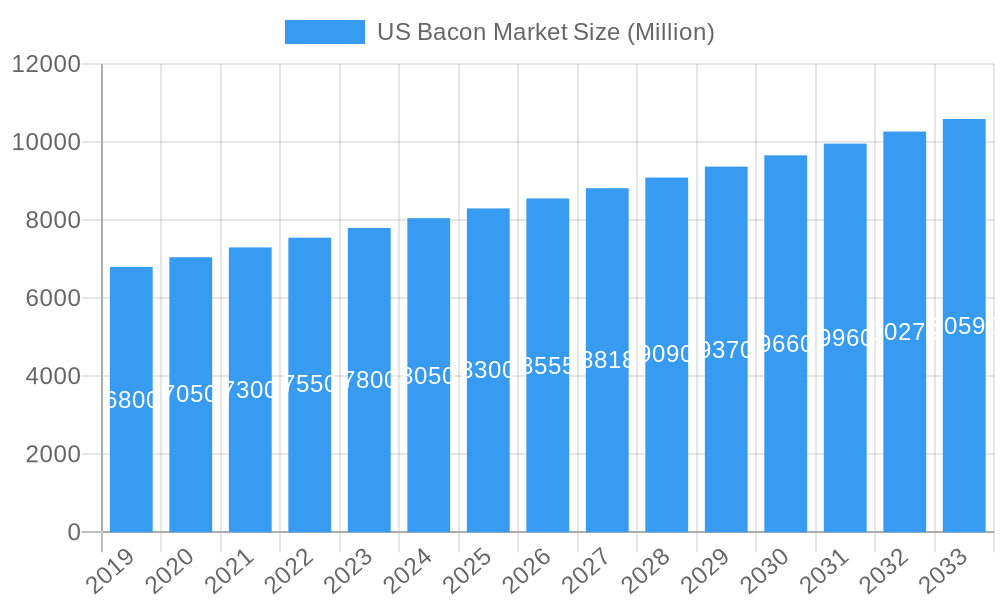

US Bacon Market Company Market Share

Gain comprehensive insights into the U.S. Bacon Market with this essential industry report. Spanning 2019-2033, with a base and projection year of 2025, this analysis details market dynamics, key trends, leading competitors, and future prospects. This report is your definitive resource for understanding the U.S. pork belly market, bacon production analysis, and U.S. bacon consumption trends.

US Bacon Market Market Dynamics & Concentration

The US Bacon Market exhibits a moderate to high level of concentration, with several key players dominating production and distribution. Tyson Foods Inc., WH Group Limited, The Kraft Heinz Company, Maple Leaf Foods INC, Hormel Foods Corporation, Seaboard Corporation, Fresh Mark Inc., and Hills Meat Company are among the prominent companies shaping the industry landscape. Market share analysis reveals that the top five players collectively hold approximately 65-70% of the market. Innovation drivers are predominantly focused on product differentiation, including the development of healthier alternatives (e.g., lower sodium, uncured options), premium and artisanal bacon varieties, and convenient, ready-to-cook formats. Regulatory frameworks, such as food safety standards enforced by the USDA and labeling requirements, play a significant role in market operations and product development. Product substitutes, including plant-based bacon alternatives and other processed meats, exert some competitive pressure, though traditional pork bacon retains a dominant position. End-user trends show a growing demand for convenience, ethical sourcing, and diverse flavor profiles, influencing product innovation and marketing strategies. Mergers and acquisitions (M&A) activities have been instrumental in market consolidation, with an average of 3-5 significant M&A deals recorded annually over the historical period (2019-2024), aimed at expanding market reach and product portfolios.

US Bacon Market Industry Trends & Analysis

The US Bacon Market is poised for sustained growth, driven by a confluence of factors. A projected Compound Annual Growth Rate (CAGR) of approximately 3.5% from 2025 to 2033 underscores its robust expansion. This growth is fueled by enduring consumer demand for bacon as a breakfast staple and versatile culinary ingredient. Technological disruptions are transforming the industry, from advanced breeding techniques and efficient feed management to sophisticated processing and packaging technologies that enhance product shelf life and appeal. The market penetration of value-added bacon products, such as pre-cooked or flavored varieties, continues to rise, catering to busy lifestyles and evolving taste preferences. Consumer preferences are increasingly leaning towards perceived healthier options, including uncured and reduced-sodium bacon, as well as those sourced from ethically raised animals. This trend is compelling manufacturers to innovate and diversify their product offerings. Competitive dynamics are characterized by a blend of large-scale producers and niche artisanal brands. While economies of scale enable major players to maintain competitive pricing, smaller companies often thrive by focusing on premium quality, unique flavor profiles, and direct-to-consumer models. The increasing accessibility of bacon through various retail channels, including e-commerce platforms, further contributes to market accessibility and growth. Supply chain optimization and the adoption of sustainable farming practices are also becoming critical differentiators in this competitive landscape. The overall market is witnessing a steady upward trajectory, driven by both traditional demand and emerging consumer trends.

Leading Markets & Segments in US Bacon Market

The US Bacon Market exhibits strong performance across various segments, with notable dominance in specific areas.

Production Analysis:

- Dominant Region: The Midwest region of the United States remains the leading area for bacon production, accounting for an estimated 60% of national output. This dominance is attributed to the region's strong agricultural infrastructure, abundant hog farming operations, and established meat processing facilities.

- Key Drivers: Favorable land availability for hog farms, access to feed resources, and a skilled workforce are critical economic policies supporting this regional supremacy. Government incentives for agricultural development also play a role.

Consumption Analysis:

- Dominant Segment: The retail sector, encompassing supermarkets and hypermarkets, represents the largest consumption channel for bacon, capturing an estimated 75% of the market. This is followed by the food service industry (restaurants, hotels, cafes), which accounts for approximately 20%.

- Key Drivers: High population density, widespread availability through diverse retail outlets, and ingrained consumer habits in the US are primary drivers. The increasing popularity of bacon as an ingredient in various dishes and its presence on restaurant menus further bolster consumption.

Import Market Analysis (Value & Volume):

- Dominant Import Sources: While the US is a significant producer, imports of specific bacon cuts or value-added products are notable. Canada and Mexico are key import partners, contributing approximately 40% and 30% respectively to the total import volume.

- Key Drivers: Trade agreements, proximity, and specific product demands not met by domestic production drive import volumes. Fluctuations in domestic supply or price can also influence import reliance. The value of imports is projected to reach approximately $300 Million in 2025.

Export Market Analysis (Value & Volume):

- Dominant Export Destinations: Major export markets for US bacon include Mexico, Japan, and South Korea, collectively representing over 50% of US bacon exports.

- Key Drivers: Demand for American-style bacon, trade relationships, and competitive pricing contribute to export growth. The projected export volume is estimated to be around 350 Million pounds in 2025, with a value of approximately $1,200 Million.

Price Trend Analysis:

- Key Factors: Pork belly prices, influenced by hog futures and feed costs, are the primary determinant of bacon prices. Supply and demand dynamics, processing costs, and retail markups also contribute to price variations.

- Observed Trends: Over the historical period, bacon prices have shown a steady upward trend, with an average annual increase of approximately 4-5%. The estimated average retail price per pound is projected to be $6.50 in 2025.

US Bacon Market Product Developments

Product innovation in the US Bacon Market is largely focused on meeting evolving consumer demands. The development of uncured and minimally processed bacon, utilizing natural curing agents, has gained significant traction. This caters to the growing consumer interest in healthier food options and transparency in ingredients. Furthermore, the market is witnessing an increase in premium and artisanal bacon products, featuring unique smoking techniques, heritage breeds, and distinct flavor infusions like maple, pepper, or artisanal spice blends. Convenience remains a key driver, with a rise in pre-cooked, fully cooked, and microwaveable bacon formats, appealing to time-pressed consumers. These product developments aim to enhance shelf appeal, extend shelf life, and offer a wider variety of taste experiences, thereby strengthening competitive advantages.

Key Drivers of US Bacon Market Growth

Several key drivers are propelling the US Bacon Market forward. The enduring cultural significance of bacon in American cuisine, particularly as a breakfast staple and culinary ingredient, ensures consistent demand. Technological advancements in pork production, including improved genetics, feed efficiency, and disease management, contribute to a more stable and cost-effective supply. Furthermore, the increasing adoption of e-commerce and direct-to-consumer sales channels is expanding market reach and accessibility for both established brands and niche producers. The development of value-added products, such as pre-cooked and flavored bacon, addresses the growing consumer preference for convenience and variety. Regulatory frameworks that support food safety and transparency also build consumer confidence.

Challenges in the US Bacon Market Market

Despite its robust growth, the US Bacon Market faces several challenges. Volatile hog prices, influenced by feed costs, disease outbreaks (e.g., African Swine Fever), and global supply dynamics, can significantly impact profitability and pricing. Stringent regulatory compliance, including food safety standards and labeling requirements, adds to operational costs. Fluctuations in consumer preferences, particularly the rising interest in plant-based alternatives and health-conscious diets, present a competitive threat. Supply chain disruptions, exacerbated by unforeseen events like natural disasters or labor shortages, can affect product availability and delivery.

Emerging Opportunities in US Bacon Market

Emerging opportunities in the US Bacon Market are primarily driven by evolving consumer lifestyles and technological advancements. The growing demand for sustainable and ethically sourced products presents a significant opportunity for brands that can demonstrate transparent supply chains and humane animal husbandry practices. The expansion of the premium and gourmet bacon segment, catering to consumers seeking unique flavors and high-quality ingredients, offers a niche for specialized producers. Furthermore, the continued growth of e-commerce and direct-to-consumer models allows for greater market penetration and direct engagement with consumers, enabling personalized product offerings and brand building. Innovations in packaging, such as extended shelf-life solutions and resealable options, also contribute to market growth.

Leading Players in the US Bacon Market Sector

- Tyson Foods Inc.

- WH Group Limited

- The Kraft Heinz Company

- Maple Leaf Foods INC

- Hormel Foods Corporation

- Seaboard Corporation

- Fresh Mark Inc.

- Hills Meat Company

Key Milestones in US Bacon Market Industry

- 2019: Increased consumer demand for plant-based alternatives begins to influence product development strategies.

- 2020: Supply chain disruptions due to global events impact raw material availability and processing.

- 2021: Growing consumer interest in "better-for-you" options leads to a rise in uncured and low-sodium bacon.

- 2022: Technological advancements in packaging extend shelf life and enhance product appeal.

- 2023: Several key players announce strategic partnerships to enhance sustainable sourcing initiatives.

- 2024: Rise in direct-to-consumer sales and artisanal bacon offerings.

Strategic Outlook for US Bacon Market Market

The US Bacon Market is projected for continued expansion, driven by a strategic focus on product innovation, sustainability, and enhanced consumer engagement. Growth accelerators will include the development of specialized bacon products catering to niche dietary needs and premium taste preferences, such as keto-friendly or gluten-free options. Emphasis on transparent and ethical sourcing, coupled with eco-friendly packaging solutions, will be crucial for capturing market share and building brand loyalty. Furthermore, leveraging digital platforms for direct-to-consumer sales and targeted marketing campaigns will unlock new avenues for revenue growth. Strategic collaborations with food service providers and retailers will also be key in maintaining broad market accessibility and driving future market potential.

US Bacon Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

US Bacon Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Bacon Market Regional Market Share

Geographic Coverage of US Bacon Market

US Bacon Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Health Benefits Promoting Apple Cider Vinegar Demand; Unfiltered Apple Cider Vinegar Being Popular

- 3.3. Market Restrains

- 3.3.1. Rising Demand for Other Vinegar Types

- 3.4. Market Trends

- 3.4.1. Increasing Preference for Bacon in Breakfast Options

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Bacon Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America US Bacon Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America US Bacon Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe US Bacon Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa US Bacon Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific US Bacon Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Tyson Foods Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 WH Group Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The Kraft Heinz Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Maple Leaf Foods INC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hormel Foods Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Seaboard Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fresh Mark Inc *List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hills Meat Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Tyson Foods Inc

List of Figures

- Figure 1: Global US Bacon Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America US Bacon Market Revenue (billion), by Production Analysis 2025 & 2033

- Figure 3: North America US Bacon Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America US Bacon Market Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 5: North America US Bacon Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America US Bacon Market Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America US Bacon Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America US Bacon Market Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America US Bacon Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America US Bacon Market Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 11: North America US Bacon Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America US Bacon Market Revenue (billion), by Country 2025 & 2033

- Figure 13: North America US Bacon Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America US Bacon Market Revenue (billion), by Production Analysis 2025 & 2033

- Figure 15: South America US Bacon Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America US Bacon Market Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 17: South America US Bacon Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America US Bacon Market Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America US Bacon Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America US Bacon Market Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America US Bacon Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America US Bacon Market Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 23: South America US Bacon Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America US Bacon Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America US Bacon Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe US Bacon Market Revenue (billion), by Production Analysis 2025 & 2033

- Figure 27: Europe US Bacon Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe US Bacon Market Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 29: Europe US Bacon Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe US Bacon Market Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe US Bacon Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe US Bacon Market Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe US Bacon Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe US Bacon Market Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe US Bacon Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe US Bacon Market Revenue (billion), by Country 2025 & 2033

- Figure 37: Europe US Bacon Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa US Bacon Market Revenue (billion), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa US Bacon Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa US Bacon Market Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa US Bacon Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa US Bacon Market Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa US Bacon Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa US Bacon Market Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa US Bacon Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa US Bacon Market Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa US Bacon Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa US Bacon Market Revenue (billion), by Country 2025 & 2033

- Figure 49: Middle East & Africa US Bacon Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific US Bacon Market Revenue (billion), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific US Bacon Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific US Bacon Market Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific US Bacon Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific US Bacon Market Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific US Bacon Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific US Bacon Market Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific US Bacon Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific US Bacon Market Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific US Bacon Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific US Bacon Market Revenue (billion), by Country 2025 & 2033

- Figure 61: Asia Pacific US Bacon Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Bacon Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Global US Bacon Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global US Bacon Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global US Bacon Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global US Bacon Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global US Bacon Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Global US Bacon Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Global US Bacon Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global US Bacon Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global US Bacon Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global US Bacon Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global US Bacon Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: United States US Bacon Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Canada US Bacon Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Mexico US Bacon Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global US Bacon Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 17: Global US Bacon Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global US Bacon Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global US Bacon Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global US Bacon Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global US Bacon Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Brazil US Bacon Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Argentina US Bacon Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America US Bacon Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Global US Bacon Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 26: Global US Bacon Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global US Bacon Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global US Bacon Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global US Bacon Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global US Bacon Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: United Kingdom US Bacon Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Germany US Bacon Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: France US Bacon Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Italy US Bacon Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Spain US Bacon Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Russia US Bacon Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Benelux US Bacon Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Nordics US Bacon Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe US Bacon Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Global US Bacon Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 41: Global US Bacon Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global US Bacon Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global US Bacon Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global US Bacon Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global US Bacon Market Revenue billion Forecast, by Country 2020 & 2033

- Table 46: Turkey US Bacon Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Israel US Bacon Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: GCC US Bacon Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: North Africa US Bacon Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: South Africa US Bacon Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa US Bacon Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Global US Bacon Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 53: Global US Bacon Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global US Bacon Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global US Bacon Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global US Bacon Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global US Bacon Market Revenue billion Forecast, by Country 2020 & 2033

- Table 58: China US Bacon Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 59: India US Bacon Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: Japan US Bacon Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 61: South Korea US Bacon Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: ASEAN US Bacon Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 63: Oceania US Bacon Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific US Bacon Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Bacon Market?

The projected CAGR is approximately 2.9%.

2. Which companies are prominent players in the US Bacon Market?

Key companies in the market include Tyson Foods Inc, WH Group Limited, The Kraft Heinz Company, Maple Leaf Foods INC, Hormel Foods Corporation, Seaboard Corporation, Fresh Mark Inc *List Not Exhaustive, Hills Meat Company.

3. What are the main segments of the US Bacon Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Health Benefits Promoting Apple Cider Vinegar Demand; Unfiltered Apple Cider Vinegar Being Popular.

6. What are the notable trends driving market growth?

Increasing Preference for Bacon in Breakfast Options.

7. Are there any restraints impacting market growth?

Rising Demand for Other Vinegar Types.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Bacon Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Bacon Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Bacon Market?

To stay informed about further developments, trends, and reports in the US Bacon Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence