Key Insights

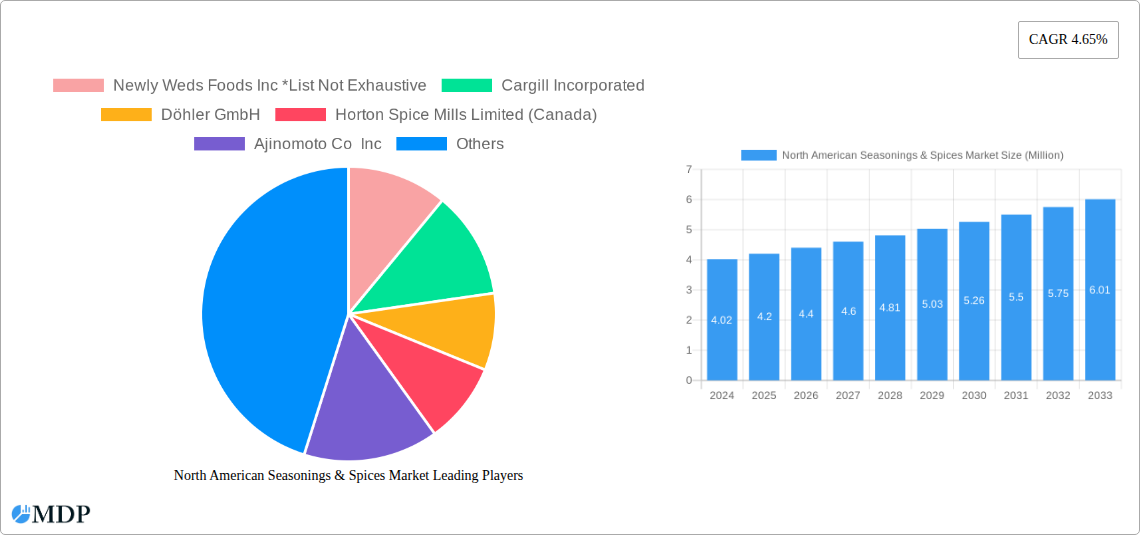

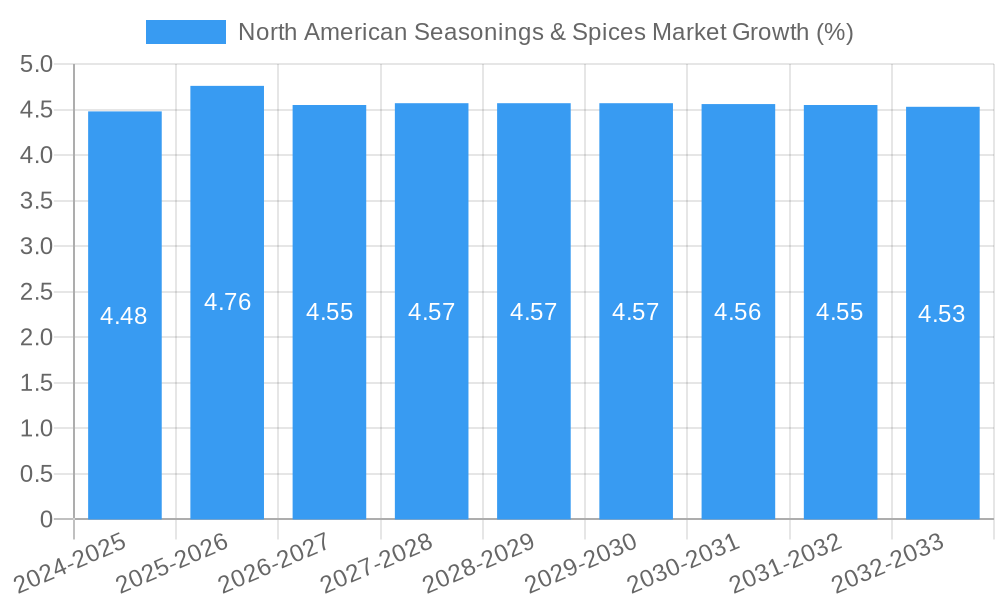

The North American Seasonings & Spices Market is poised for robust growth, with a current market size of approximately $4.20 billion. This expansion is driven by a confluence of factors, including evolving consumer preferences towards healthier and more flavorful food options, a growing demand for convenience in meal preparation, and the increasing popularity of ethnic and global cuisines across the United States, Canada, and Mexico. The market is projected to witness a Compound Annual Growth Rate (CAGR) of 4.65% from the base year of 2025, reaching an estimated value of over $6 billion by 2033. Key product segments such as herbs and seasonings, particularly those offering distinct flavor profiles like thyme, basil, and oregano, are experiencing significant traction. Similarly, spices, including pepper, cardamom, and turmeric, are vital components fueling this market expansion, catering to a diverse range of culinary applications.

The market's trajectory is further shaped by dynamic trends and strategic initiatives from leading companies. A significant driver is the rising consumer consciousness regarding health and wellness, leading to a greater demand for natural, organic, and low-sodium seasonings and spices. Innovation in product development, including the introduction of ready-to-use spice blends, functional seasonings with added health benefits, and sustainable sourcing practices, will continue to be pivotal. While growth is strong, potential restraints include fluctuating raw material prices and the complexities of supply chain management. Nonetheless, the overarching outlook for the North American Seasonings & Spices Market remains highly positive, supported by a strong CAGR and widespread consumer adoption across various food applications, from bakery and confectionery to meat, seafood, and savory snacks.

North American Seasonings & Spices Market: Comprehensive Analysis 2019-2033

This report provides an in-depth analysis of the North American Seasonings & Spices Market, covering the historical period from 2019 to 2024, the base and estimated year of 2025, and a detailed forecast from 2025 to 2033. Explore market dynamics, key trends, leading segments, product innovations, growth drivers, challenges, emerging opportunities, and strategic outlook for this robust and evolving industry.

North American Seasonings & Spices Market Market Dynamics & Concentration

The North American seasonings and spices market exhibits a moderate to high concentration, with a few dominant players holding significant market share, while a substantial number of smaller and niche manufacturers contribute to market diversity. Innovation drivers are primarily focused on clean label ingredients, natural flavors, functional benefits, and convenience. Regulatory frameworks, such as those set by the FDA in the United States and Health Canada, play a crucial role in ensuring product safety and authenticity, influencing ingredient sourcing and processing. Product substitutes, while present in certain categories (e.g., artificial flavorings for natural spices), are increasingly being challenged by the growing consumer demand for natural and perceived healthier alternatives. End-user trends are strongly skewed towards health-conscious consumers seeking reduced sodium, natural sweeteners, and plant-based flavor profiles. This is driving demand for salt substitutes and a wider variety of herbs and spices. Mergers and acquisitions (M&A) activities are a significant trend, with companies acquiring smaller players to expand their product portfolios, geographical reach, and technological capabilities. M&A deal counts are projected to remain steady, driven by the pursuit of market share consolidation and the integration of innovative technologies. Key players like McCormick & Company Incorporated, Cargill Incorporated, and Kerry Group PLC are actively involved in strategic acquisitions to strengthen their competitive positions. The market share of key players is estimated to be over 60% for the top 5 companies, indicating a consolidated landscape in specific product categories.

North American Seasonings & Spices Market Industry Trends & Analysis

The North American seasonings and spices market is poised for sustained growth, driven by a confluence of powerful trends. A primary growth driver is the increasing consumer preference for flavorful and convenient food options, fueled by busy lifestyles and a desire for global culinary experiences. This translates into higher demand for ready-to-use spice blends, marinades, and seasoning mixes across various applications. The growing health and wellness movement is another significant catalyst, pushing consumers towards natural, organic, and non-GMO ingredients. This trend benefits segments like herbs and seasonings and spices that are perceived as healthier alternatives to artificial flavorings and excessive salt. Consequently, market penetration of functional ingredients, such as antioxidants derived from spices and seasonings, is on the rise. Technological disruptions, including advancements in extraction, encapsulation, and processing technologies, are enabling manufacturers to deliver enhanced flavor profiles, longer shelf-life, and improved nutritional value. These innovations are crucial for meeting evolving consumer demands. Furthermore, the e-commerce boom has expanded market reach for both established and emerging brands, allowing for direct-to-consumer sales and greater accessibility to niche products. Competitive dynamics are characterized by intense innovation, strategic partnerships, and a focus on sustainability and traceability. Companies are investing heavily in R&D to develop unique flavor profiles and cater to specific dietary needs. The Compound Annual Growth Rate (CAGR) for the North American Seasonings & Spices Market is estimated to be in the range of 4.5% to 6.0% during the forecast period.

Leading Markets & Segments in North American Seasonings & Spices Market

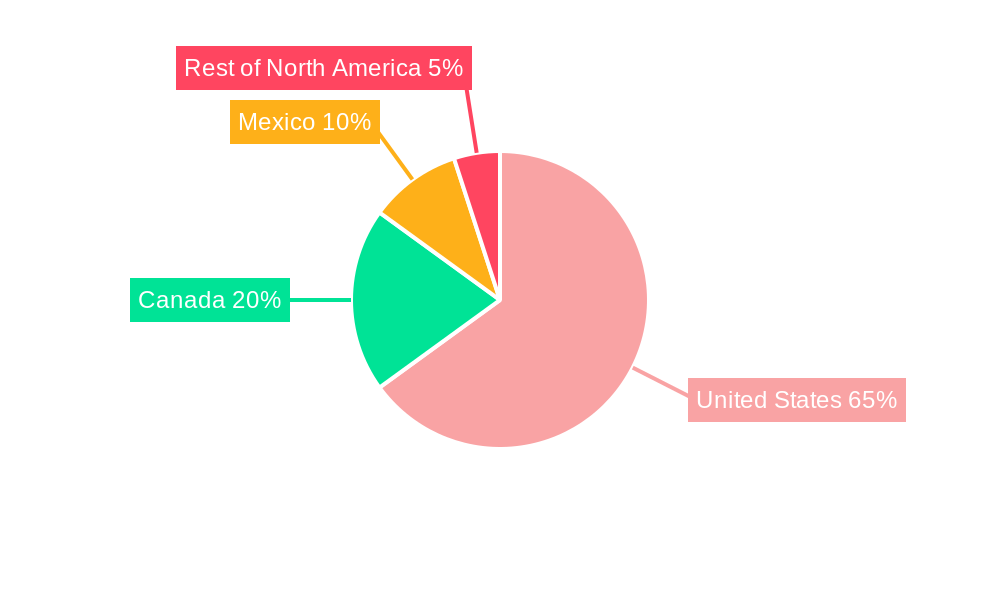

The United States dominates the North American seasonings and spices market, accounting for a substantial majority of sales and consumption. This dominance is driven by its large population, high disposable incomes, and a sophisticated food processing industry.

Product Type Dominance:

- Herbs and Seasonings represent the largest segment, driven by their widespread use in everyday cooking and their association with health benefits. Within this, Other Herbs and Seasonings is expected to witness significant growth due to the introduction of novel blends and exotic herbs catering to evolving consumer palates. Basil and Oregano remain evergreen favorites.

- Spices also hold a strong position, with Pepper being a staple. Turmeric, owing to its perceived health benefits, is experiencing rapid growth. Cinnamon and Clove are consistent performers, particularly in bakery applications.

- Salt and Salt Substitutes represent a growing segment, with a strong emphasis on reduced sodium options and potassium chloride-based substitutes driven by health concerns.

Application Dominance:

- Soup, Noodles, and Pasta is a leading application, benefiting from the convenience and widespread consumption of these food categories. Seasonings and spices are integral to their flavor profiles.

- Meat and Seafood applications are significant, with consumers seeking to enhance the taste of protein-rich foods.

- Savory Snacks represent a rapidly growing application, with manufacturers increasingly incorporating innovative and bold spice blends to create exciting new product offerings.

- Bakery and Confectionery continues to be a strong segment, with spices like cinnamon and nutmeg being essential.

- Sauces, Salads, and Dressing also contribute substantially to market demand.

Geographical Dominance:

- United States: As mentioned, the US leads due to its market size, advanced food industry, and strong consumer demand for diverse flavors.

- Canada: A significant market with growing demand for convenience foods and natural ingredients.

- Mexico: Represents a market with immense growth potential, driven by a rich culinary heritage and increasing adoption of processed food products.

Key drivers for dominance include strong consumer demand for convenience and flavor, advances in food processing technologies, favorable economic conditions, and increasing disposable incomes.

North American Seasonings & Spices Market Product Developments

Product development in the North American seasonings and spices market is largely driven by consumer demand for natural, clean-label, and functional ingredients. Manufacturers are innovating with exotic spice blends, single-origin spices, and botanical extracts to offer unique flavor experiences. There's a significant focus on developing reduced-sodium and low-sugar seasoning options to cater to health-conscious consumers. Innovations also include shelf-stable, ready-to-use spice pastes and marinades, enhancing convenience for home cooks. Product differentiation is achieved through superior taste profiles, extended shelf-life, and demonstrable health benefits. Technological advancements in aroma capture and flavor encapsulation are playing a crucial role in preserving the freshness and potency of spices and herbs.

Key Drivers of North American Seasonings & Spices Market Growth

The North American seasonings and spices market growth is propelled by several key drivers. Evolving consumer preferences towards healthier and natural food options are paramount, increasing demand for plant-based ingredients and clean labels. The ever-increasing demand for convenience foods and ready-to-eat meals necessitates flavorful and easy-to-use seasoning solutions. Global culinary trends and a growing interest in ethnic cuisines are expanding the palate for novel and exotic spices. Technological advancements in flavor extraction, preservation, and blending technologies enable the creation of superior and diverse product offerings. Furthermore, the expansion of the food service sector and the growth of private-label brands contribute significantly to market expansion by providing wider distribution channels and catering to budget-conscious consumers.

Challenges in the North American Seasonings & Spices Market Market

Despite robust growth, the North American seasonings and spices market faces several challenges. Fluctuations in the prices of raw materials, such as agricultural commodities, can impact profitability and price stability. Stringent regulatory requirements regarding food safety, labeling, and sourcing necessitate continuous compliance efforts and can increase operational costs. Supply chain disruptions, exacerbated by global events, can affect the availability and timely delivery of key ingredients. Intense competition from established players and new entrants, often with aggressive pricing strategies, poses a constant challenge. Additionally, consumer skepticism towards processed foods and a desire for complete transparency in ingredient sourcing and processing require manufacturers to invest in sustainable and ethical practices, which can be costly.

Emerging Opportunities in North American Seasonings & Spices Market

Emerging opportunities in the North American seasonings and spices market are multifaceted. The growing demand for plant-based and vegan food products presents a significant opportunity for developing innovative seasoning blends that enhance the flavor of meat alternatives. The "functional foods" trend, where ingredients offer added health benefits beyond nutrition, opens avenues for spices and herbs with antioxidant, anti-inflammatory, or digestive properties. Personalized nutrition and customized flavor solutions are gaining traction, allowing for niche market development. Strategic partnerships between spice manufacturers and food product developers can lead to the creation of novel and appealing products. Furthermore, investments in sustainable sourcing and traceability initiatives can build consumer trust and brand loyalty, unlocking new market segments. The expansion of e-commerce platforms offers direct access to consumers and facilitates the growth of smaller, specialized brands.

Leading Players in the North American Seasonings & Spices Market Sector

- Newly Weds Foods Inc

- Cargill Incorporated

- Döhler GmbH

- Horton Spice Mills Limited (Canada)

- Ajinomoto Co Inc

- Olam International

- Kerry Group PLC

- Associated British Foods PLC

- McCormick & Company Incorporated

- All Seasonings Ingredients Inc

Key Milestones in North American Seasonings & Spices Market Industry

- June 2021: Kerry opened a new taste facility in Mexico. Located in Irapuato, Mexico, the new state-of-the-art facility will significantly increase Kerry's capacity in the region and further support customers in delivering local and sustainable taste solutions, which also include the production of innovative seasonings.

- April 2021: Olam Food Ingredients (OFI) acquired US-based private-label spices and seasonings manufacturer Olde Thompson at an enterprise value of USD 950 million through its wholly-owned subsidiary Olam Holdings Inc. The acquisition helped expand OFI's private label capabilities and enabled the business to provide consumers with a comprehensive range of bold, authentic, and natural tastes and flavors with end-to-end traceability and sustainability.

- January 2021: Cargill launched a purified sea salt flour. The ingredient is ultra-fine cut, powder-like sodium chloride. It is suitable for applications that require extremely fine sizing for blending, including dry soup, cereal, flour, and spice mixes, as well as for topping snack foods.

Strategic Outlook for North American Seasonings & Spices Market Market

The strategic outlook for the North American seasonings and spices market remains highly optimistic, driven by an expanding consumer base and continuous innovation. Focusing on health and wellness trends, particularly clean labels and reduced sodium alternatives, will be crucial for sustained growth. Investments in advanced processing technologies to enhance flavor, shelf-life, and nutritional profiles will create competitive advantages. Strategic M&A activities will continue to be a key strategy for market consolidation and portfolio expansion. Exploring emerging markets within North America and leveraging e-commerce channels for direct-to-consumer engagement will unlock new revenue streams. Emphasis on sustainability and ethical sourcing practices will build brand loyalty and appeal to an increasingly conscious consumer base. The future potential lies in developing unique, culturally inspired spice blends and functional ingredients that cater to specialized dietary needs and evolving culinary preferences.

North American Seasonings & Spices Market Segmentation

-

1. Product Type

- 1.1. Salt and Salt Substitutes

-

1.2. Herbs and Seasonings

- 1.2.1. Thyme

- 1.2.2. Basil

- 1.2.3. Oregano

- 1.2.4. Parsley

- 1.2.5. Other Herbs and Seasonings

-

1.3. Spices

- 1.3.1. Pepper

- 1.3.2. Cardamom

- 1.3.3. Cinnamon

- 1.3.4. Clove

- 1.3.5. Nutmeg

- 1.3.6. Turmeric

- 1.3.7. Other Spices

-

2. Application

- 2.1. Bakery and Confectionery

- 2.2. Soup, Noodles, and Pasta

- 2.3. Meat and Seafood

- 2.4. Sauces, Salads, and Dressing

- 2.5. Savory Snacks

- 2.6. Other Applications

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North American Seasonings & Spices Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North American Seasonings & Spices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.65% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus On Health and Wellness; Surge in Product Innovation

- 3.3. Market Restrains

- 3.3.1. Presence of Substitutes

- 3.4. Market Trends

- 3.4.1. Increased Demand for Spice Blends in the Food Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North American Seasonings & Spices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Salt and Salt Substitutes

- 5.1.2. Herbs and Seasonings

- 5.1.2.1. Thyme

- 5.1.2.2. Basil

- 5.1.2.3. Oregano

- 5.1.2.4. Parsley

- 5.1.2.5. Other Herbs and Seasonings

- 5.1.3. Spices

- 5.1.3.1. Pepper

- 5.1.3.2. Cardamom

- 5.1.3.3. Cinnamon

- 5.1.3.4. Clove

- 5.1.3.5. Nutmeg

- 5.1.3.6. Turmeric

- 5.1.3.7. Other Spices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery and Confectionery

- 5.2.2. Soup, Noodles, and Pasta

- 5.2.3. Meat and Seafood

- 5.2.4. Sauces, Salads, and Dressing

- 5.2.5. Savory Snacks

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North American Seasonings & Spices Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Salt and Salt Substitutes

- 6.1.2. Herbs and Seasonings

- 6.1.2.1. Thyme

- 6.1.2.2. Basil

- 6.1.2.3. Oregano

- 6.1.2.4. Parsley

- 6.1.2.5. Other Herbs and Seasonings

- 6.1.3. Spices

- 6.1.3.1. Pepper

- 6.1.3.2. Cardamom

- 6.1.3.3. Cinnamon

- 6.1.3.4. Clove

- 6.1.3.5. Nutmeg

- 6.1.3.6. Turmeric

- 6.1.3.7. Other Spices

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Bakery and Confectionery

- 6.2.2. Soup, Noodles, and Pasta

- 6.2.3. Meat and Seafood

- 6.2.4. Sauces, Salads, and Dressing

- 6.2.5. Savory Snacks

- 6.2.6. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North American Seasonings & Spices Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Salt and Salt Substitutes

- 7.1.2. Herbs and Seasonings

- 7.1.2.1. Thyme

- 7.1.2.2. Basil

- 7.1.2.3. Oregano

- 7.1.2.4. Parsley

- 7.1.2.5. Other Herbs and Seasonings

- 7.1.3. Spices

- 7.1.3.1. Pepper

- 7.1.3.2. Cardamom

- 7.1.3.3. Cinnamon

- 7.1.3.4. Clove

- 7.1.3.5. Nutmeg

- 7.1.3.6. Turmeric

- 7.1.3.7. Other Spices

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Bakery and Confectionery

- 7.2.2. Soup, Noodles, and Pasta

- 7.2.3. Meat and Seafood

- 7.2.4. Sauces, Salads, and Dressing

- 7.2.5. Savory Snacks

- 7.2.6. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North American Seasonings & Spices Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Salt and Salt Substitutes

- 8.1.2. Herbs and Seasonings

- 8.1.2.1. Thyme

- 8.1.2.2. Basil

- 8.1.2.3. Oregano

- 8.1.2.4. Parsley

- 8.1.2.5. Other Herbs and Seasonings

- 8.1.3. Spices

- 8.1.3.1. Pepper

- 8.1.3.2. Cardamom

- 8.1.3.3. Cinnamon

- 8.1.3.4. Clove

- 8.1.3.5. Nutmeg

- 8.1.3.6. Turmeric

- 8.1.3.7. Other Spices

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Bakery and Confectionery

- 8.2.2. Soup, Noodles, and Pasta

- 8.2.3. Meat and Seafood

- 8.2.4. Sauces, Salads, and Dressing

- 8.2.5. Savory Snacks

- 8.2.6. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North American Seasonings & Spices Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Salt and Salt Substitutes

- 9.1.2. Herbs and Seasonings

- 9.1.2.1. Thyme

- 9.1.2.2. Basil

- 9.1.2.3. Oregano

- 9.1.2.4. Parsley

- 9.1.2.5. Other Herbs and Seasonings

- 9.1.3. Spices

- 9.1.3.1. Pepper

- 9.1.3.2. Cardamom

- 9.1.3.3. Cinnamon

- 9.1.3.4. Clove

- 9.1.3.5. Nutmeg

- 9.1.3.6. Turmeric

- 9.1.3.7. Other Spices

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Bakery and Confectionery

- 9.2.2. Soup, Noodles, and Pasta

- 9.2.3. Meat and Seafood

- 9.2.4. Sauces, Salads, and Dressing

- 9.2.5. Savory Snacks

- 9.2.6. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. United States North American Seasonings & Spices Market Analysis, Insights and Forecast, 2019-2031

- 11. Canada North American Seasonings & Spices Market Analysis, Insights and Forecast, 2019-2031

- 12. Mexico North American Seasonings & Spices Market Analysis, Insights and Forecast, 2019-2031

- 13. Rest of North America North American Seasonings & Spices Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Newly Weds Foods Inc *List Not Exhaustive

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Cargill Incorporated

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Döhler GmbH

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Horton Spice Mills Limited (Canada)

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Ajinomoto Co Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Olam International

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Kerry Group PLC

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Associated British Foods PLC

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 McCormick & Company Incorporated

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 All Seasonings Ingredients Inc

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Newly Weds Foods Inc *List Not Exhaustive

List of Figures

- Figure 1: North American Seasonings & Spices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North American Seasonings & Spices Market Share (%) by Company 2024

List of Tables

- Table 1: North American Seasonings & Spices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North American Seasonings & Spices Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: North American Seasonings & Spices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: North American Seasonings & Spices Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North American Seasonings & Spices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North American Seasonings & Spices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North American Seasonings & Spices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North American Seasonings & Spices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North American Seasonings & Spices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North American Seasonings & Spices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North American Seasonings & Spices Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: North American Seasonings & Spices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: North American Seasonings & Spices Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North American Seasonings & Spices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: North American Seasonings & Spices Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: North American Seasonings & Spices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: North American Seasonings & Spices Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North American Seasonings & Spices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North American Seasonings & Spices Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: North American Seasonings & Spices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 21: North American Seasonings & Spices Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North American Seasonings & Spices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: North American Seasonings & Spices Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 24: North American Seasonings & Spices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 25: North American Seasonings & Spices Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North American Seasonings & Spices Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North American Seasonings & Spices Market?

The projected CAGR is approximately 4.65%.

2. Which companies are prominent players in the North American Seasonings & Spices Market?

Key companies in the market include Newly Weds Foods Inc *List Not Exhaustive, Cargill Incorporated, Döhler GmbH, Horton Spice Mills Limited (Canada), Ajinomoto Co Inc, Olam International, Kerry Group PLC, Associated British Foods PLC, McCormick & Company Incorporated, All Seasonings Ingredients Inc.

3. What are the main segments of the North American Seasonings & Spices Market?

The market segments include Product Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus On Health and Wellness; Surge in Product Innovation.

6. What are the notable trends driving market growth?

Increased Demand for Spice Blends in the Food Industry.

7. Are there any restraints impacting market growth?

Presence of Substitutes.

8. Can you provide examples of recent developments in the market?

June 2021: Kerry opened a new taste facility in Mexico. Located in Irapuato, Mexico, the new state-of-the-art facility will significantly increase Kerry's capacity in the region and further support customers in delivering local and sustainable taste solutions, which also include the production of innovative seasonings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North American Seasonings & Spices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North American Seasonings & Spices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North American Seasonings & Spices Market?

To stay informed about further developments, trends, and reports in the North American Seasonings & Spices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence