Key Insights

The South American freeze-dried products market is poised for substantial growth, driven by escalating consumer demand for convenient, nutritious, and long-shelf-life food solutions. Key growth enablers include rising disposable incomes, evolving lifestyles favoring ready-to-eat options, and increasing awareness of freeze-dried food's health advantages. The freeze-dried fruits and vegetables segment is anticipated to lead market expansion due to their health benefits and culinary versatility. Growing participation in outdoor activities further fuels demand for freeze-dried prepared meals, particularly among younger consumers. Despite potential logistical and infrastructural hurdles in certain areas, the market presents a positive outlook. A competitive landscape featuring established international players and emerging regional brands fosters innovation and product diversification, positioning South America as a lucrative investment hub for the freeze-dried food industry.

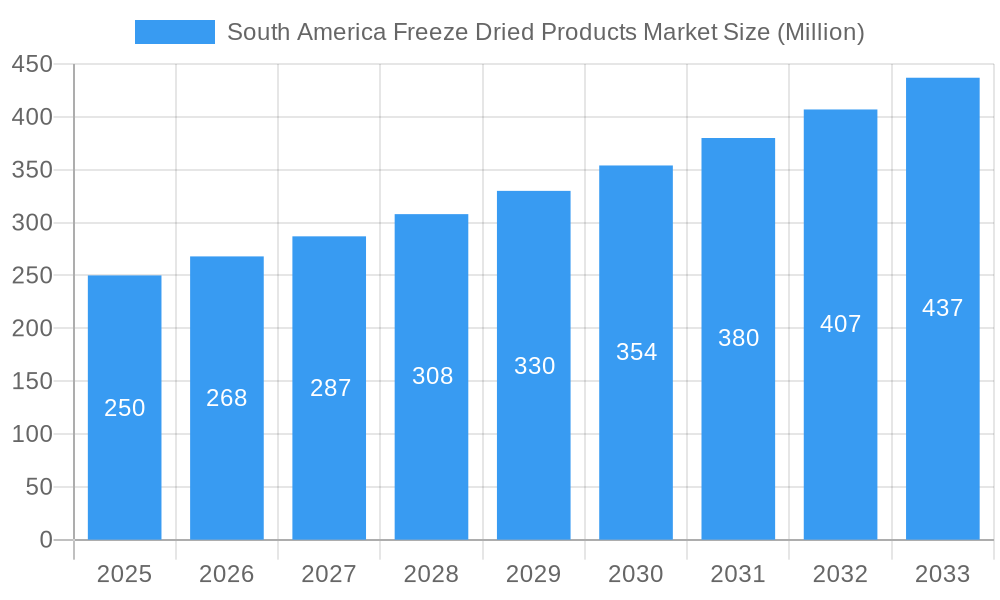

South America Freeze Dried Products Market Market Size (In Billion)

The South American freeze-dried products market is projected to reach a size of $5.5 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 6.9% from a base year of 2025. Brazil and Argentina are expected to be primary contributors to this expansion, fueled by increasing urbanization and evolving consumer preferences. Opportunities for further market propulsion exist in the expansion into less developed regions. Successful market penetration will depend on robust supply chain management, effective resolution of logistical challenges, and proactive promotion of freeze-dried product benefits.

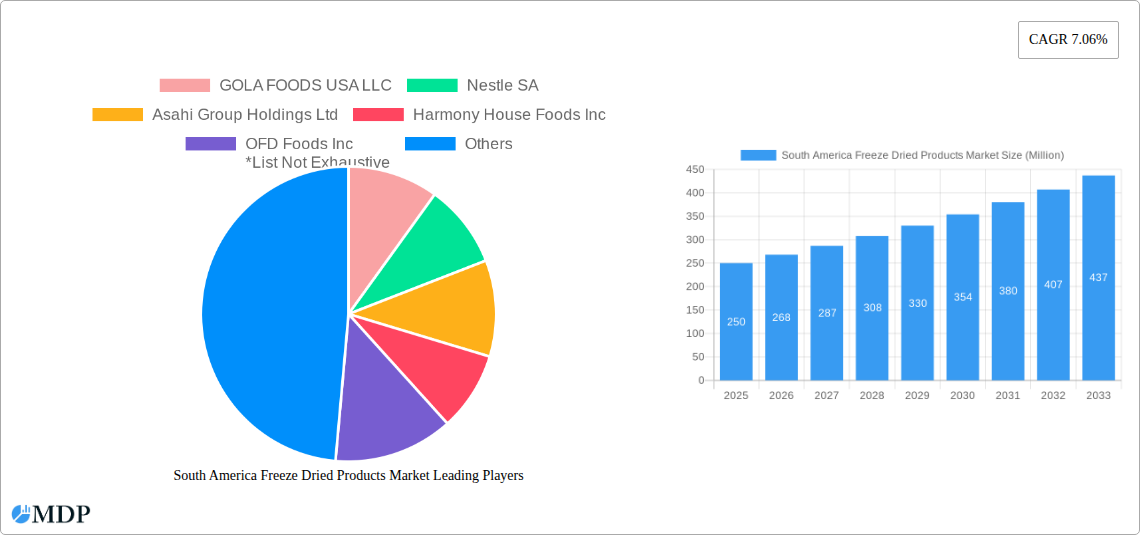

South America Freeze Dried Products Market Company Market Share

This comprehensive report offers in-depth analysis of the South American freeze-dried products market, providing critical insights for stakeholders, investors, and businesses aiming to capitalize on growth within this dynamic sector. The study covers the period from 2019 to 2033, with 2025 as the base year and 2025-2033 as the forecast period. Leveraging a robust research methodology, the report delivers accurate and actionable predictions, including detailed examinations of market size, growth drivers, challenges, and future trends across key segments and leading players.

South America Freeze-Dried Products Market Dynamics & Concentration

The South America freeze-dried products market is experiencing a period of significant transformation, driven by several key factors. Market concentration is moderate, with several major players and a growing number of niche entrants. The market share of the top 5 players (GOLA FOODS USA LLC, Nestle SA, Asahi Group Holdings Ltd, Harmony House Foods Inc, OFD Foods Inc) constitutes approximately xx% of the total market value in 2025, with Nestle SA holding the largest share. Innovation in freeze-drying technology, coupled with increasing consumer demand for convenient and nutritious food options, is a major driver of market growth. Stringent regulatory frameworks concerning food safety and labeling are shaping market practices, while the availability of substitute products (e.g., canned or frozen foods) exerts competitive pressure. End-user trends favor convenient, long-shelf-life products, especially within the growing health-conscious consumer segment. The number of M&A activities within the sector during the historical period (2019-2024) totaled xx, indicating a degree of consolidation and strategic positioning by larger players. Future M&A activity is predicted to further increase market concentration.

- Market Concentration: Moderate, with the top 5 players holding xx% market share in 2025.

- Innovation Drivers: Technological advancements in freeze-drying, consumer demand for convenience and nutrition.

- Regulatory Frameworks: Stringent food safety and labeling regulations.

- Product Substitutes: Canned and frozen foods.

- End-User Trends: Growing preference for convenient, long-shelf-life, and healthy products.

- M&A Activities: xx deals during 2019-2024, with further consolidation expected.

South America Freeze Dried Products Market Industry Trends & Analysis

The South America freeze-dried products market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This robust growth is primarily fueled by rising disposable incomes, increasing urbanization, and a shift towards convenient food options. Technological disruptions, particularly in freeze-drying techniques and packaging solutions, are enhancing product quality and extending shelf life. Consumer preferences are moving towards healthier and more natural food choices, creating opportunities for freeze-dried fruits, vegetables, and other health-focused products. Competitive dynamics are characterized by both price competition and product differentiation, with established players and new entrants vying for market share. Market penetration of freeze-dried products remains relatively low compared to traditional preservation methods, offering significant potential for future expansion. Specific examples of technological advancements include the introduction of advanced freeze-drying equipment leading to faster processing times and improved product quality.

Leading Markets & Segments in South America Freeze Dried Products Market

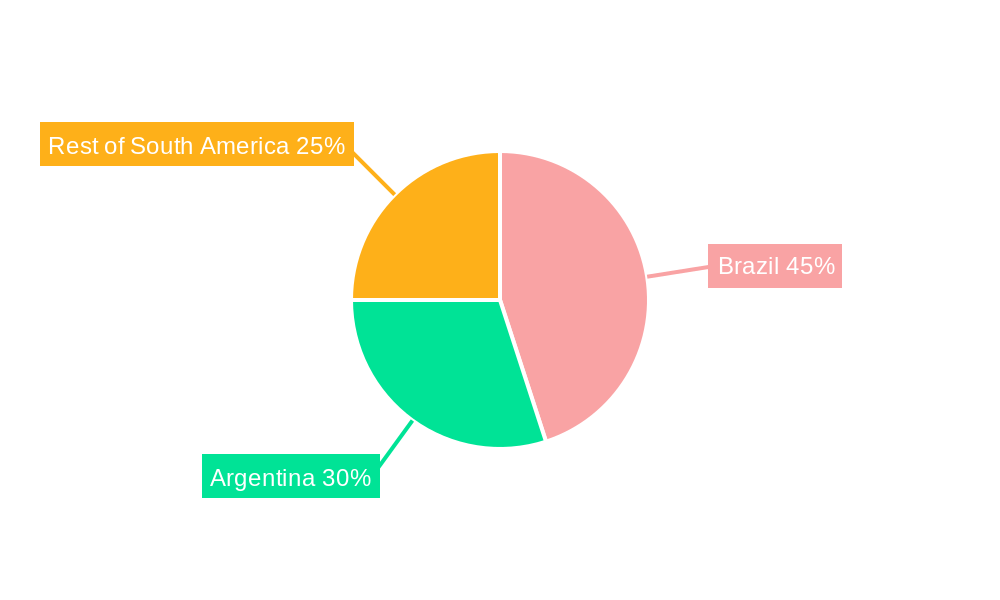

Brazil currently represents the dominant market within South America for freeze-dried products, accounting for xx% of the regional market value in 2025. This dominance is driven by several factors:

- Economic Growth: Brazil’s robust economy boosts consumer spending on convenient and premium food products.

- Infrastructure Development: Improved transportation and distribution networks facilitate wider market reach.

- Government Policies: Supportive regulations for the food processing industry.

- Population Trends: A growing middle class with increasing disposable income, and a preference for convenience.

Within product segments, Freeze-dried fruits and vegetables collectively account for the largest share of the market in 2025, driven by rising health consciousness and the perception of these products as offering natural and nutritious options. The growing demand for ready-to-eat meals is driving growth in the prepared foods segments. Freeze-dried dairy products and meat and seafood are showing strong growth potential, with increasing consumer demand.

South America Freeze Dried Products Market Product Developments

Recent innovations in freeze-drying technology have led to the development of products with improved texture, flavor, and nutritional retention. Lightweight and convenient packaging solutions are enhancing product appeal and extending shelf life. The introduction of new flavors and product formats, particularly in the prepared foods and beverage categories, is driving differentiation within the marketplace. These innovations are aimed at providing consumers with convenient, healthy, and high-quality options that align with evolving lifestyles and demands.

Key Drivers of South America Freeze Dried Products Market Growth

Several factors are fueling growth in the South America freeze-dried products market:

- Rising Disposable Incomes: Increased purchasing power allows consumers to afford premium, convenient food items.

- Growing Urbanization: Urban populations rely more on readily available and convenient food options.

- Health and Wellness Trend: Growing health consciousness drives demand for healthier, nutrient-rich foods.

- Technological Advancements: Improved freeze-drying techniques and packaging enhance product quality and shelf life.

Challenges in the South America Freeze Dried Products Market Market

Despite the growth potential, several challenges hinder market expansion:

- High Production Costs: Freeze-drying technology involves significant capital investment, impacting product pricing.

- Supply Chain Inefficiencies: Logistics and distribution challenges in certain regions can affect product availability.

- Intense Competition: Established players and new entrants create a competitive landscape. The entry of lower-cost producers poses a significant threat to profit margins.

- Consumer Awareness: Limited awareness about the benefits of freeze-dried products in some segments requires market education.

Emerging Opportunities in South America Freeze Dried Products Market

Significant opportunities exist for long-term market growth:

- Expansion into Niche Markets: Targeting specific dietary requirements (e.g., organic, vegan) and growing demand for convenient meals and snacks.

- Strategic Partnerships: Collaborations with food retailers and food service providers to enhance distribution and market reach.

- Product Diversification: Introducing new product formats and flavors to cater to evolving consumer preferences.

- Technological Innovations: Continuous improvement in freeze-drying technology can enhance product quality and reduce costs.

Leading Players in the South America Freeze Dried Products Market Sector

- GOLA FOODS USA LLC

- Nestle SA

- Asahi Group Holdings Ltd

- Harmony House Foods Inc

- OFD Foods Inc

- Expedition Foods Limited

- AJINOMOTO CO INC

- Thrive Life LLC

Key Milestones in South America Freeze Dried Products Market Industry

- 2020-Q1: Nestle SA launches a new line of freeze-dried fruit snacks in Brazil.

- 2022-Q3: A major M&A deal involving two regional freeze-dried food producers occurs in Chile.

- 2023-Q4: A new freeze-drying facility opens in Colombia.

Strategic Outlook for South America Freeze Dried Products Market Market

The South America freeze-dried products market is poised for sustained growth, driven by favorable economic conditions, evolving consumer preferences, and technological advancements. Companies adopting proactive strategies focused on innovation, efficient supply chains, strategic partnerships, and targeted market expansion will be well-positioned to capitalize on the substantial opportunities presented by this dynamic market. The focus on health and convenience, coupled with the continued development of more sophisticated and efficient freeze-drying technologies, will be crucial for future success.

South America Freeze Dried Products Market Segmentation

-

1. Product Type

- 1.1. Freeze-dried Fruits

- 1.2. Freeze-dried Vegetables

- 1.3. Freeze-dried Beverages

- 1.4. Freeze-dried Dairy Products

- 1.5. Freeze-dried Meat and Seafood

- 1.6. Prepared Foods

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience/Grocery Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Freeze Dried Products Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Freeze Dried Products Market Regional Market Share

Geographic Coverage of South America Freeze Dried Products Market

South America Freeze Dried Products Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth In Foodservice Expenditure and Tourism Sector; Premiumization with the Growth of Fortified and Flavored Water

- 3.3. Market Restrains

- 3.3.1. Concerns Regarding Plastic Waste and the Rising Inclination Toward Tap Water

- 3.4. Market Trends

- 3.4.1. Argentina witnessed as Fastest Growing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Freeze Dried Products Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Freeze-dried Fruits

- 5.1.2. Freeze-dried Vegetables

- 5.1.3. Freeze-dried Beverages

- 5.1.4. Freeze-dried Dairy Products

- 5.1.5. Freeze-dried Meat and Seafood

- 5.1.6. Prepared Foods

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience/Grocery Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Freeze Dried Products Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Freeze-dried Fruits

- 6.1.2. Freeze-dried Vegetables

- 6.1.3. Freeze-dried Beverages

- 6.1.4. Freeze-dried Dairy Products

- 6.1.5. Freeze-dried Meat and Seafood

- 6.1.6. Prepared Foods

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience/Grocery Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina South America Freeze Dried Products Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Freeze-dried Fruits

- 7.1.2. Freeze-dried Vegetables

- 7.1.3. Freeze-dried Beverages

- 7.1.4. Freeze-dried Dairy Products

- 7.1.5. Freeze-dried Meat and Seafood

- 7.1.6. Prepared Foods

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience/Grocery Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of South America South America Freeze Dried Products Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Freeze-dried Fruits

- 8.1.2. Freeze-dried Vegetables

- 8.1.3. Freeze-dried Beverages

- 8.1.4. Freeze-dried Dairy Products

- 8.1.5. Freeze-dried Meat and Seafood

- 8.1.6. Prepared Foods

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience/Grocery Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 GOLA FOODS USA LLC

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Nestle SA

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Asahi Group Holdings Ltd

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Harmony House Foods Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 OFD Foods Inc

*List Not Exhaustive

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Expedition Foods Limited

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 AJINOMOTO CO INC

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Thrive Life LLC

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 GOLA FOODS USA LLC

List of Figures

- Figure 1: South America Freeze Dried Products Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Freeze Dried Products Market Share (%) by Company 2025

List of Tables

- Table 1: South America Freeze Dried Products Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: South America Freeze Dried Products Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: South America Freeze Dried Products Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: South America Freeze Dried Products Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: South America Freeze Dried Products Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: South America Freeze Dried Products Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: South America Freeze Dried Products Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: South America Freeze Dried Products Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: South America Freeze Dried Products Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: South America Freeze Dried Products Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: South America Freeze Dried Products Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: South America Freeze Dried Products Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: South America Freeze Dried Products Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: South America Freeze Dried Products Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: South America Freeze Dried Products Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: South America Freeze Dried Products Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Freeze Dried Products Market?

The projected CAGR is approximately 6.9%.

2. Which companies are prominent players in the South America Freeze Dried Products Market?

Key companies in the market include GOLA FOODS USA LLC, Nestle SA, Asahi Group Holdings Ltd, Harmony House Foods Inc, OFD Foods Inc *List Not Exhaustive, Expedition Foods Limited, AJINOMOTO CO INC, Thrive Life LLC.

3. What are the main segments of the South America Freeze Dried Products Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth In Foodservice Expenditure and Tourism Sector; Premiumization with the Growth of Fortified and Flavored Water.

6. What are the notable trends driving market growth?

Argentina witnessed as Fastest Growing Segment.

7. Are there any restraints impacting market growth?

Concerns Regarding Plastic Waste and the Rising Inclination Toward Tap Water.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Freeze Dried Products Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Freeze Dried Products Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Freeze Dried Products Market?

To stay informed about further developments, trends, and reports in the South America Freeze Dried Products Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence