Key Insights

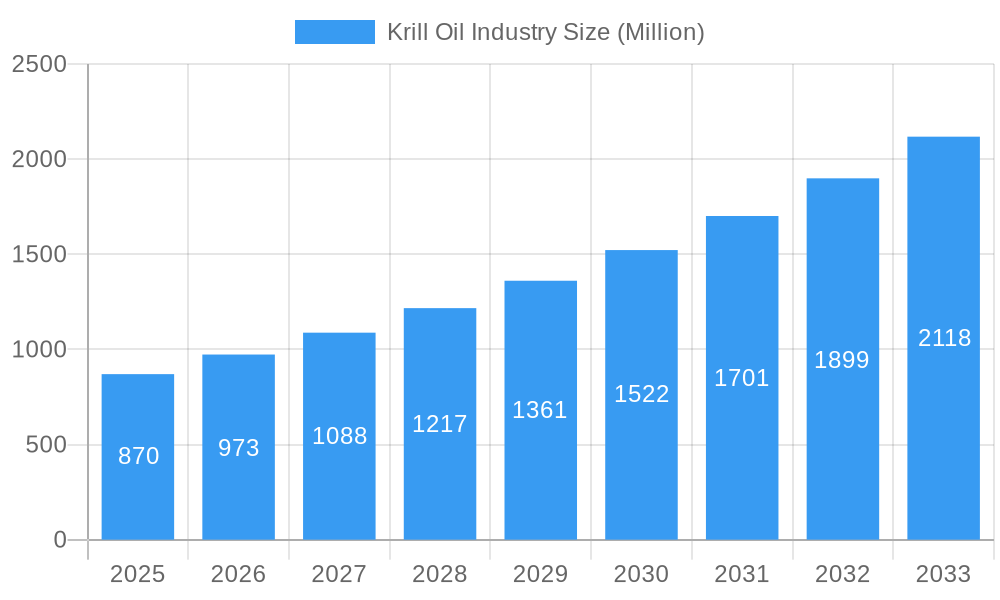

The global Krill Oil market is projected for significant growth, anticipated to reach $2.8 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 6.8%. This expansion is fueled by escalating consumer interest in natural, health-enhancing supplements. Key drivers include increased awareness of krill oil's superior bioavailability and its rich Omega-3 fatty acid content (EPA and DHA), vital for cardiovascular health, cognitive function, and inflammation reduction. The pharmaceutical and dietary supplement industries are primary adopters, utilizing krill oil for its therapeutic benefits. Its incorporation into functional foods and beverages is also growing as consumers seek convenient wellness solutions. The pet and animal food sectors present emerging opportunities as pet owners increasingly prioritize high-quality ingredients for their animals' health and nutrition. This sustained growth confirms krill oil's premium status in the health and wellness sector.

Krill Oil Industry Market Size (In Billion)

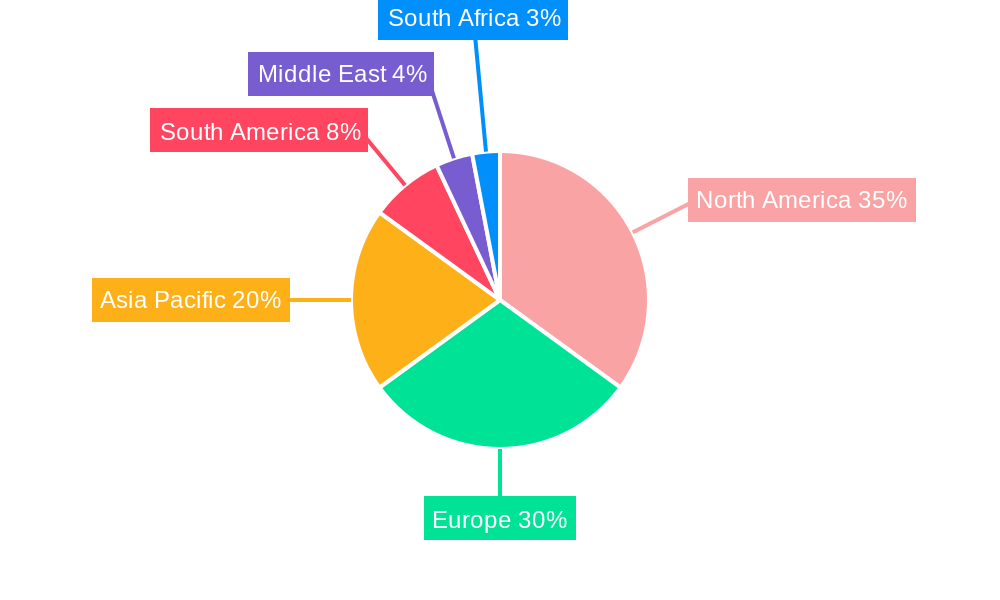

Market momentum is further bolstered by the rising demand for sustainable and ethically sourced marine ingredients. Krill, harvested from Antarctic waters, aligns with these consumer values, offering an environmentally responsible alternative to fish oil. Advancements in extraction and processing technologies are improving krill oil's purity and efficacy, stimulating market demand. However, challenges such as high raw material costs and the competitive landscape from established omega-3 sources like fish oil and algal oil present restraints. Intense competition among key players, including NutriGold Inc., RIMFROST AS, and Aker BioMarine, necessitates product differentiation and competitive pricing. Geographically, North America and Europe are expected to lead market share, driven by high health consciousness and disposable incomes. The Asia Pacific region is poised for the fastest growth, fueled by increasing health awareness and a growing middle class.

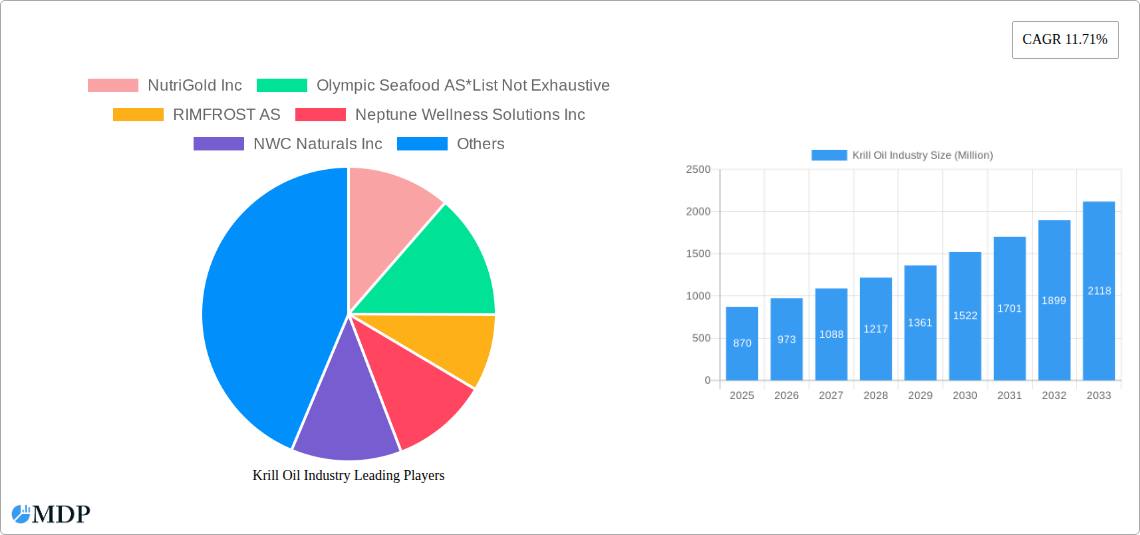

Krill Oil Industry Company Market Share

Krill Oil Industry: Navigating the Future of Sustainable Marine Nutraceuticals

Dive deep into the burgeoning Krill Oil industry with this comprehensive market analysis. Spanning from 2019 to 2033, this report provides an in-depth understanding of market dynamics, key trends, and growth opportunities. Our detailed study, using 2025 as the base and estimated year, forecasts market expansion through 2033, offering actionable insights for stakeholders. Discover the competitive landscape, innovation drivers, and leading market segments to inform your strategic decisions in this high-growth nutraceutical sector.

Krill Oil Industry Market Dynamics & Concentration

The global Krill Oil market is characterized by a moderate to high concentration, with a few key players dominating a significant portion of the market share. Companies such as Aker BioMarine, Neptune Wellness Solutions Inc., and RIMFROST AS are at the forefront, leveraging their extensive research and development capabilities and robust supply chains. Innovation is a critical driver, fueled by increasing consumer awareness of krill oil's superior bioavailability and omega-3 fatty acid profile compared to fish oil. Regulatory frameworks, particularly those pertaining to sustainable fishing practices and product quality, are becoming increasingly stringent, shaping market entry and operational strategies. The threat of product substitutes, primarily fish oil and algal oil, remains a consideration, though krill oil's unique phospholipid-bound omega-3s and astaxanthin content offer distinct advantages. End-user trends indicate a growing preference for natural, sustainable, and health-promoting ingredients, directly benefiting the krill oil sector. Mergers and acquisition (M&A) activities, while not overwhelmingly frequent, play a crucial role in market consolidation and expansion, enabling leading companies to acquire innovative technologies or secure greater market access. For instance, strategic partnerships and smaller acquisitions are observed to enhance product portfolios and expand geographical reach. The overall market concentration is influenced by proprietary extraction technologies and exclusive access to Antarctic krill resources.

Krill Oil Industry Industry Trends & Analysis

The Krill Oil industry is experiencing robust growth, driven by a confluence of factors that underscore its rising prominence in the global nutraceuticals and pharmaceuticals markets. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. This upward trajectory is primarily fueled by escalating consumer demand for health and wellness products, particularly those rich in omega-3 fatty acids. Krill oil stands out due to its superior absorption rates and the presence of astaxanthin, a potent antioxidant. This unique composition positions krill oil as a preferred choice for cardiovascular health, cognitive function, and anti-inflammatory benefits. Technological disruptions have played a significant role in enhancing extraction efficiency and purity, leading to the development of higher-quality krill oil products. Innovations in sustainable harvesting practices and processing techniques are also critical, aligning with the growing global consciousness towards environmental responsibility. Consumer preferences are shifting towards natural and sustainable sources of nutrients, making krill oil an attractive alternative to traditional fish oil. The clean label movement further amplifies this trend, with consumers seeking products with minimal processing and recognizable ingredients. Competitive dynamics are intensifying, with established players investing in product differentiation and market expansion, while new entrants focus on niche applications and innovative formulations. The increasing market penetration of krill oil in dietary supplements and functional foods, alongside its growing application in pharmaceuticals and pet food, indicates a broadening market base. This sustained demand, coupled with ongoing research highlighting diverse health benefits, points towards a consistently expanding market for krill oil. The market penetration is estimated to reach xx% by 2033.

Leading Markets & Segments in Krill Oil Industry

North America currently leads the Krill Oil industry, driven by a highly health-conscious consumer base and a strong presence of dietary supplement manufacturers. The United States, in particular, represents a dominant market due to significant per capita expenditure on health and wellness products and established regulatory pathways for dietary supplements. Economic policies that encourage investment in the health sector and robust infrastructure supporting the distribution of nutraceuticals further bolster North America's leading position.

Within the Form segment, Tablet form commands the largest market share, accounting for approximately 60% of the total market. This dominance is attributed to consumer convenience, ease of dosage, and established manufacturing processes for tablet production. However, the Liquid form is witnessing rapid growth, driven by innovation in formulations and increasing demand for specialized delivery systems and products catering to specific health needs.

In terms of Application, Dietary Supplements represent the largest and most lucrative segment, capturing an estimated 55% of the market. This is directly linked to the widespread recognition of krill oil's benefits for heart health, joint support, and cognitive function. The Pharmaceuticals segment, while smaller, is experiencing substantial growth as research into the therapeutic applications of krill oil for conditions like arthritis and hyperlipidemia intensifies. The Pet Food and Animal Food segment is also a significant contributor, with pet owners increasingly seeking high-quality nutritional supplements for their animals, recognizing the omega-3 benefits for pet health and wellness. The Functional Food and Beverages segment, though nascent, holds considerable potential, with manufacturers exploring the incorporation of krill oil into innovative food and beverage products to enhance their nutritional profiles and appeal to health-conscious consumers. Key drivers for dominance in these segments include:

- Consumer Awareness: High awareness of omega-3 benefits and krill oil's superior absorption.

- Product Innovation: Development of diverse product forms and applications catering to varied needs.

- Regulatory Support: Favorable regulatory environments for dietary supplements and functional foods in leading regions.

- Supply Chain Stability: Established supply chains for sustainably sourced krill oil.

Krill Oil Industry Product Developments

Product development in the Krill Oil industry is increasingly focused on enhancing bioavailability, purity, and targeted delivery of omega-3 fatty acids and astaxanthin. Innovations include advanced extraction techniques that preserve the natural phospholipid structure of krill oil, leading to superior absorption compared to triglyceride-based oils. Companies are also developing specialized formulations for specific health benefits, such as enhanced cognitive function, joint health, and cardiovascular support. The integration of krill oil into various delivery systems, including softgels, capsules, and even chewables, caters to diverse consumer preferences. Furthermore, the growing demand for sustainable and ethically sourced ingredients is driving the development of krill oil products certified for marine stewardship. These developments aim to differentiate products, capture niche markets, and address the evolving needs of health-conscious consumers.

Key Drivers of Krill Oil Industry Growth

The growth of the Krill Oil industry is propelled by several key drivers. Firstly, increasing consumer awareness regarding the health benefits of omega-3 fatty acids, particularly EPA and DHA, for cardiovascular health, brain function, and anti-inflammatory properties, is a primary catalyst. Krill oil's superior bioavailability due to its phospholipid structure and the presence of astaxanthin, a potent antioxidant, further enhances its appeal. Secondly, the growing trend towards natural and sustainable health products aligns perfectly with krill oil's origin from sustainably managed Antarctic fisheries. Regulatory bodies increasingly emphasizing sustainable fishing practices also indirectly favor krill oil. Technological advancements in extraction and processing have led to higher purity and more efficient production, making krill oil more competitive. The expanding applications in pharmaceuticals and pet food segments also contribute significantly to overall market expansion.

Challenges in the Krill Oil Industry Market

Despite its growth, the Krill Oil industry faces several challenges. The primary restraint is the high cost of production compared to fish oil, largely due to the specialized harvesting and processing techniques required. Supply chain volatility, influenced by seasonal availability of krill and strict international fishing quotas, can also impact pricing and availability. Regulatory hurdles in certain regions regarding novel food ingredients and health claims can slow down market penetration. Furthermore, intense competition from established fish oil and emerging algal oil markets, which often offer lower price points, poses a significant competitive pressure. The environmental impact of krill harvesting, though generally well-managed, can sometimes draw scrutiny, necessitating continuous efforts to ensure sustainability.

Emerging Opportunities in Krill Oil Industry

The Krill Oil industry is ripe with emerging opportunities, driven by ongoing scientific research and evolving consumer demands. Technological breakthroughs in sustainable aquaculture and advanced extraction methods promise to improve efficiency and reduce costs, potentially making krill oil more accessible. Strategic partnerships between krill oil producers and pharmaceutical companies are accelerating the development and commercialization of krill oil-based therapeutics for various chronic diseases. Market expansion into developing economies, where awareness of health supplements is rapidly growing, presents a significant untapped potential. The increasing consumer demand for clean-label products and the growing acceptance of krill oil in functional foods and beverages offer further avenues for innovation and market penetration.

Leading Players in the Krill Oil Industry Sector

- Aker BioMarine

- Neptune Wellness Solutions Inc.

- RIMFROST AS

- Olympic Seafood AS

- Enzymotec Ltd

- Qingdao Kangjing Marine Biotechnology Co Ltd

- NutriGold Inc.

- NWC Naturals Inc.

- Coastside Bio Resources

- RB LLC

Key Milestones in Krill Oil Industry Industry

- 2019: Increased research publications highlighting the unique benefits of krill oil's phospholipid structure and astaxanthin content, boosting consumer interest.

- 2020: Several companies achieve MSC (Marine Stewardship Council) certification for sustainable krill harvesting, enhancing market trust and appeal.

- 2021: Introduction of new krill oil formulations targeting specific health benefits like cognitive support and joint health, expanding product portfolios.

- 2022: Growing adoption of krill oil in the pet food industry as a premium omega-3 supplement for animal health.

- 2023: Advancements in extraction technology leading to higher purity krill oil products with improved shelf-life.

- 2024: Strategic collaborations between krill oil manufacturers and functional food/beverage companies to develop innovative consumer products.

Strategic Outlook for Krill Oil Industry Market

The strategic outlook for the Krill Oil industry is highly optimistic, projecting sustained growth driven by an increasing demand for high-quality, bioavailable omega-3s and potent antioxidants. Key growth accelerators include continued scientific validation of krill oil's health benefits, particularly in areas of cardiovascular, cognitive, and joint health. Strategic focus on enhancing sustainable harvesting practices and transparent supply chains will be crucial for maintaining market leadership and consumer trust. Expansion into new geographical markets and the development of novel delivery systems and applications, such as fortified functional foods and advanced pharmaceutical preparations, will unlock significant future potential. Investments in R&D for improved extraction efficiency and cost reduction will further solidify krill oil's competitive position against other omega-3 sources.

Krill Oil Industry Segmentation

-

1. Form

- 1.1. Liquid

- 1.2. Tablet

-

2. Application

- 2.1. Dietary Supplements

- 2.2. Pharmaceuticals

- 2.3. Pet Food and Animal Food

- 2.4. Functional Food and Beverages

Krill Oil Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. South Africa

- 6.1. Saudi Arabia

- 6.2. Rest of Middle East

Krill Oil Industry Regional Market Share

Geographic Coverage of Krill Oil Industry

Krill Oil Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use

- 3.3. Market Restrains

- 3.3.1. Increasing Shift Toward Plant-Based Protein

- 3.4. Market Trends

- 3.4.1. Rising Demand for Omega-3 Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Krill Oil Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Liquid

- 5.1.2. Tablet

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dietary Supplements

- 5.2.2. Pharmaceuticals

- 5.2.3. Pet Food and Animal Food

- 5.2.4. Functional Food and Beverages

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. North America Krill Oil Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Form

- 6.1.1. Liquid

- 6.1.2. Tablet

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Dietary Supplements

- 6.2.2. Pharmaceuticals

- 6.2.3. Pet Food and Animal Food

- 6.2.4. Functional Food and Beverages

- 6.1. Market Analysis, Insights and Forecast - by Form

- 7. Europe Krill Oil Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Form

- 7.1.1. Liquid

- 7.1.2. Tablet

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Dietary Supplements

- 7.2.2. Pharmaceuticals

- 7.2.3. Pet Food and Animal Food

- 7.2.4. Functional Food and Beverages

- 7.1. Market Analysis, Insights and Forecast - by Form

- 8. Asia Pacific Krill Oil Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Form

- 8.1.1. Liquid

- 8.1.2. Tablet

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Dietary Supplements

- 8.2.2. Pharmaceuticals

- 8.2.3. Pet Food and Animal Food

- 8.2.4. Functional Food and Beverages

- 8.1. Market Analysis, Insights and Forecast - by Form

- 9. South America Krill Oil Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Form

- 9.1.1. Liquid

- 9.1.2. Tablet

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Dietary Supplements

- 9.2.2. Pharmaceuticals

- 9.2.3. Pet Food and Animal Food

- 9.2.4. Functional Food and Beverages

- 9.1. Market Analysis, Insights and Forecast - by Form

- 10. Middle East Krill Oil Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Form

- 10.1.1. Liquid

- 10.1.2. Tablet

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Dietary Supplements

- 10.2.2. Pharmaceuticals

- 10.2.3. Pet Food and Animal Food

- 10.2.4. Functional Food and Beverages

- 10.1. Market Analysis, Insights and Forecast - by Form

- 11. South Africa Krill Oil Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Form

- 11.1.1. Liquid

- 11.1.2. Tablet

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Dietary Supplements

- 11.2.2. Pharmaceuticals

- 11.2.3. Pet Food and Animal Food

- 11.2.4. Functional Food and Beverages

- 11.1. Market Analysis, Insights and Forecast - by Form

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 NutriGold Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Olympic Seafood AS*List Not Exhaustive

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 RIMFROST AS

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Neptune Wellness Solutions Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 NWC Naturals Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Coastside Bio Resources

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Enzymotec Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 RB LLC

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Aker BioMarine

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Qingdao Kangjing Marine Biotechnology Co Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 NutriGold Inc

List of Figures

- Figure 1: Global Krill Oil Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Krill Oil Industry Revenue (billion), by Form 2025 & 2033

- Figure 3: North America Krill Oil Industry Revenue Share (%), by Form 2025 & 2033

- Figure 4: North America Krill Oil Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Krill Oil Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Krill Oil Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Krill Oil Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Krill Oil Industry Revenue (billion), by Form 2025 & 2033

- Figure 9: Europe Krill Oil Industry Revenue Share (%), by Form 2025 & 2033

- Figure 10: Europe Krill Oil Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Krill Oil Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Krill Oil Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Krill Oil Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Krill Oil Industry Revenue (billion), by Form 2025 & 2033

- Figure 15: Asia Pacific Krill Oil Industry Revenue Share (%), by Form 2025 & 2033

- Figure 16: Asia Pacific Krill Oil Industry Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Krill Oil Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Krill Oil Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Krill Oil Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Krill Oil Industry Revenue (billion), by Form 2025 & 2033

- Figure 21: South America Krill Oil Industry Revenue Share (%), by Form 2025 & 2033

- Figure 22: South America Krill Oil Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: South America Krill Oil Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Krill Oil Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Krill Oil Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Krill Oil Industry Revenue (billion), by Form 2025 & 2033

- Figure 27: Middle East Krill Oil Industry Revenue Share (%), by Form 2025 & 2033

- Figure 28: Middle East Krill Oil Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East Krill Oil Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East Krill Oil Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East Krill Oil Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: South Africa Krill Oil Industry Revenue (billion), by Form 2025 & 2033

- Figure 33: South Africa Krill Oil Industry Revenue Share (%), by Form 2025 & 2033

- Figure 34: South Africa Krill Oil Industry Revenue (billion), by Application 2025 & 2033

- Figure 35: South Africa Krill Oil Industry Revenue Share (%), by Application 2025 & 2033

- Figure 36: South Africa Krill Oil Industry Revenue (billion), by Country 2025 & 2033

- Figure 37: South Africa Krill Oil Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Krill Oil Industry Revenue billion Forecast, by Form 2020 & 2033

- Table 2: Global Krill Oil Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Krill Oil Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Krill Oil Industry Revenue billion Forecast, by Form 2020 & 2033

- Table 5: Global Krill Oil Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Krill Oil Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Krill Oil Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Krill Oil Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Krill Oil Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Krill Oil Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Krill Oil Industry Revenue billion Forecast, by Form 2020 & 2033

- Table 12: Global Krill Oil Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 13: Global Krill Oil Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Krill Oil Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Krill Oil Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: France Krill Oil Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Russia Krill Oil Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Krill Oil Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Krill Oil Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Krill Oil Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Krill Oil Industry Revenue billion Forecast, by Form 2020 & 2033

- Table 22: Global Krill Oil Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Global Krill Oil Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: India Krill Oil Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: China Krill Oil Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Japan Krill Oil Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Australia Krill Oil Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Krill Oil Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Krill Oil Industry Revenue billion Forecast, by Form 2020 & 2033

- Table 30: Global Krill Oil Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 31: Global Krill Oil Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Brazil Krill Oil Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina Krill Oil Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Krill Oil Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Global Krill Oil Industry Revenue billion Forecast, by Form 2020 & 2033

- Table 36: Global Krill Oil Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 37: Global Krill Oil Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 38: Global Krill Oil Industry Revenue billion Forecast, by Form 2020 & 2033

- Table 39: Global Krill Oil Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 40: Global Krill Oil Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Saudi Arabia Krill Oil Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East Krill Oil Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Krill Oil Industry?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Krill Oil Industry?

Key companies in the market include NutriGold Inc, Olympic Seafood AS*List Not Exhaustive, RIMFROST AS, Neptune Wellness Solutions Inc, NWC Naturals Inc, Coastside Bio Resources, Enzymotec Ltd, RB LLC, Aker BioMarine, Qingdao Kangjing Marine Biotechnology Co Ltd.

3. What are the main segments of the Krill Oil Industry?

The market segments include Form, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use.

6. What are the notable trends driving market growth?

Rising Demand for Omega-3 Products.

7. Are there any restraints impacting market growth?

Increasing Shift Toward Plant-Based Protein.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Krill Oil Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Krill Oil Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Krill Oil Industry?

To stay informed about further developments, trends, and reports in the Krill Oil Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence