Key Insights

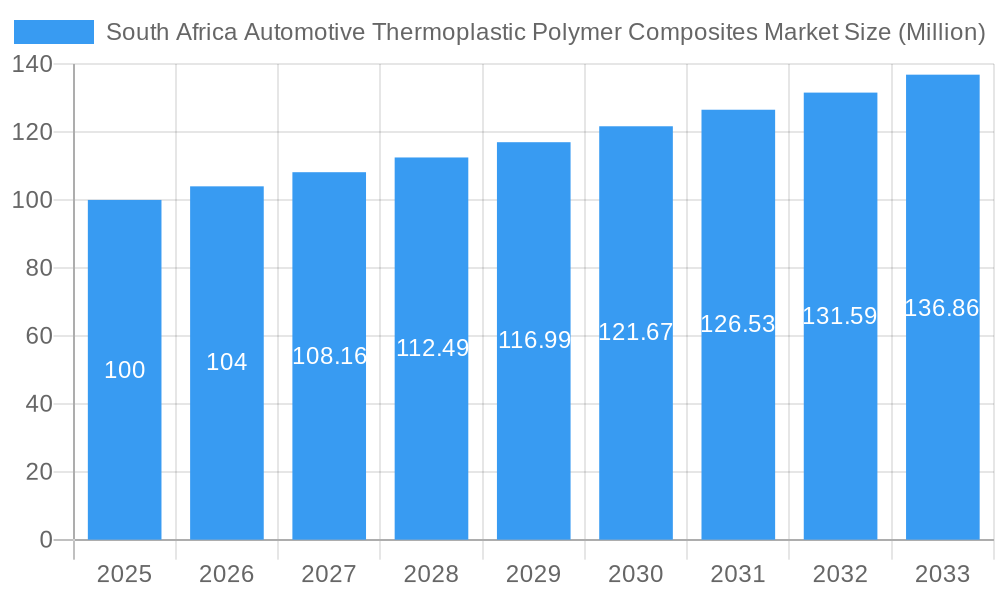

The South African automotive thermoplastic polymer composites market is poised for robust expansion, propelled by the imperative for lightweight vehicles and the integration of sophisticated manufacturing. With an estimated market size of 33.76 billion in the base year 2025 and a projected Compound Annual Growth Rate (CAGR) of 4%, the market is set to achieve significant value by 2033. This growth is underpinned by several critical drivers. The South African automotive sector is modernizing, with manufacturers prioritizing fuel efficiency and emission reduction. Thermoplastic polymer composites are instrumental, offering substantial weight savings over conventional materials, thereby enhancing fuel economy. Concurrently, the increasing adoption of advanced manufacturing processes such as injection and compression molding is optimizing production efficiency and cost-effectiveness, making these composites a compelling choice for automakers. Furthermore, government incentives supporting sustainable production and the expansion of the domestic automotive industry bolster the market's upward trend.

South Africa Automotive Thermoplastic Polymer Composites Market Market Size (In Billion)

Despite promising growth, the market encounters specific obstacles. Significant upfront investments for new manufacturing technologies and a scarcity of skilled personnel may impede progress. Additionally, price volatility of raw materials and competition from established materials like steel and aluminum present considerable limitations. Nevertheless, the long-term prospects are favorable, particularly within structural assembly and powertrain components, where the advantages of thermoplastic polymer composites are most evident. Advancements in material science, leading to superior performance and increased design versatility, will drive growth in these segments. The burgeoning electric vehicle (EV) market will also profoundly influence this sector, as the inherent lightweight properties of thermoplastic polymer composites are highly beneficial for EV design and production.

South Africa Automotive Thermoplastic Polymer Composites Market Company Market Share

South Africa Automotive Thermoplastic Polymer Composites Market Report: 2019-2033

Dive deep into the lucrative South Africa automotive thermoplastic polymer composites market with this comprehensive report, providing a detailed analysis from 2019 to 2033. This in-depth study offers invaluable insights into market dynamics, industry trends, leading players, and future growth prospects. Understand the market's current state, identify key opportunities, and make strategic decisions based on robust data and expert analysis. This report is essential for industry stakeholders, investors, and anyone seeking to navigate the complexities of this dynamic market.

South Africa Automotive Thermoplastic Polymer Composites Market Dynamics & Concentration

The South Africa automotive thermoplastic polymer composites market is characterized by moderate concentration, with key players like 3B Fiberglass, DuPont De Nemours, and Celanese Corporation holding significant market share. However, the market is also witnessing increased participation from smaller, specialized companies. Innovation is driven by the demand for lighter, stronger, and more fuel-efficient vehicles, leading to the development of advanced composite materials. Stringent emission regulations are further pushing the adoption of these materials. Product substitutes, such as traditional metal components, face increasing pressure due to the advantages offered by composites. End-user trends indicate a strong preference for vehicles incorporating these advanced materials for enhanced performance and safety. The market has witnessed xx M&A deals in the past five years, signaling consolidation and strategic expansion amongst players. The market share distribution amongst the top 5 players is estimated at approximately 60% in 2025.

- Market Concentration: Moderate, with top 5 players holding ~60% market share (2025).

- Innovation Drivers: Lightweighting, fuel efficiency, stringent emission regulations.

- Regulatory Framework: Increasingly supportive of sustainable materials.

- Product Substitutes: Traditional metals facing competitive pressure.

- End-User Trends: Growing preference for vehicles with enhanced performance and safety features.

- M&A Activity: xx deals over the past five years.

South Africa Automotive Thermoplastic Polymer Composites Market Industry Trends & Analysis

The South Africa automotive thermoplastic polymer composites market is projected to experience a CAGR of xx% during the forecast period (2025-2033), driven by several factors. The increasing demand for fuel-efficient vehicles, coupled with stringent government regulations promoting lightweighting, is a major growth catalyst. Technological advancements, such as the development of high-performance thermoplastic composites with improved durability and processing capabilities, are also driving market expansion. Consumer preferences are shifting towards vehicles offering enhanced safety and aesthetics, contributing to the increasing adoption of these materials. The market exhibits a competitive landscape with established players focusing on product innovation and strategic partnerships to maintain their market position. Market penetration for thermoplastic composites in the automotive sector is estimated to reach xx% by 2033.

Leading Markets & Segments in South Africa Automotive Thermoplastic Polymer Composites Market

The injection molding segment dominates the production process type category, accounting for approximately xx% of the market share in 2025. This is primarily driven by its cost-effectiveness and suitability for high-volume production. The structural assembly application type holds the largest market share amongst all application types, reflecting its crucial role in vehicle safety and performance.

Key Drivers for Leading Segments:

- Injection Molding: Cost-effectiveness, high-volume production capabilities.

- Structural Assembly: Crucial for vehicle safety and performance.

- Gauteng Province: Concentrated automotive manufacturing base.

Dominance Analysis:

The Gauteng province dominates the South African market due to its established automotive manufacturing base and supporting infrastructure. The injection molding process's efficiency for high-volume production makes it the leading production method. The structural assembly application's significance for vehicle safety drives its dominance.

South Africa Automotive Thermoplastic Polymer Composites Market Product Developments

Recent product developments focus on enhancing the mechanical properties, thermal stability, and processing efficiency of thermoplastic composites. Innovations include the introduction of self-reinforced composites and materials with improved impact resistance and fatigue strength. These advancements are tailored to meet the specific requirements of various automotive applications, driving their wider adoption in the market. New composites offering better recyclability are also gaining traction, aligning with sustainability initiatives.

Key Drivers of South Africa Automotive Thermoplastic Polymer Composites Market Growth

Several factors fuel the growth of the South African automotive thermoplastic polymer composites market. Stringent government regulations aimed at improving fuel efficiency and reducing emissions are compelling automakers to adopt lightweight materials. Technological advancements in composite materials, leading to enhanced performance and cost-effectiveness, are also significant drivers. Further, the growing consumer preference for fuel-efficient and safer vehicles contributes to the market's expansion.

Challenges in the South Africa Automotive Thermoplastic Polymer Composites Market Market

Despite promising growth, the market faces challenges. High initial investment costs associated with advanced composite manufacturing processes can deter smaller companies. Fluctuations in raw material prices and potential supply chain disruptions can impact production costs and profitability. Intense competition among established players creates pressure on pricing and margins. The lack of skilled labor poses a constraint on expanding manufacturing capacity. These factors collectively exert a dampening influence on market growth, resulting in a slower rate of expansion than otherwise possible.

Emerging Opportunities in South Africa Automotive Thermoplastic Polymer Composites Market

Emerging opportunities include the potential for collaborations between material suppliers and automotive manufacturers to develop tailored composite solutions. Technological breakthroughs in composite material processing techniques, like additive manufacturing, promise to improve efficiency and reduce costs. The increasing focus on sustainable and recyclable automotive components is further opening avenues for innovative composite materials with environmentally friendly features, offering a long-term competitive advantage.

Leading Players in the South Africa Automotive Thermoplastic Polymer Composites Market Sector

- 3B Fiberglass

- Dupont De Nemours

- Daicel Polymer Ltd

- Celanese Corporation

- Arkema Group

- Technocompound GmbH

- Cytex Industries Inc

- Polyone Corporation

- Hexcel Corporation

Key Milestones in South Africa Automotive Thermoplastic Polymer Composites Market Industry

- 2020: Introduction of a new high-strength thermoplastic composite by a leading supplier.

- 2022: Government initiative promoting the use of lightweight materials in vehicle manufacturing.

- 2023: Major automaker announces investment in a new composite manufacturing facility.

- 2024: Partnership between a material supplier and an automotive manufacturer for developing customized composites.

Strategic Outlook for South Africa Automotive Thermoplastic Polymer Composites Market Market

The South Africa automotive thermoplastic polymer composites market holds significant potential for growth over the next decade. Continued technological advancements, coupled with supportive government policies and increasing consumer demand for high-performance vehicles, will drive market expansion. Strategic partnerships, investments in research and development, and a focus on sustainable practices will be crucial for success in this competitive landscape. The market is poised for substantial expansion, presenting lucrative opportunities for players to capitalize on future growth prospects.

South Africa Automotive Thermoplastic Polymer Composites Market Segmentation

-

1. Production Process Type

- 1.1. Hand Layup

- 1.2. Compression Molding

- 1.3. Continous Process

- 1.4. Injection Molding

-

2. Application Type

- 2.1. Structural Assembly

- 2.2. Powertrain Component

- 2.3. Interior

- 2.4. Exterior

- 2.5. Others

South Africa Automotive Thermoplastic Polymer Composites Market Segmentation By Geography

- 1. South Africa

South Africa Automotive Thermoplastic Polymer Composites Market Regional Market Share

Geographic Coverage of South Africa Automotive Thermoplastic Polymer Composites Market

South Africa Automotive Thermoplastic Polymer Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand from automobile industry4.; Increased focus on precision products

- 3.3. Market Restrains

- 3.3.1. 4.; The cost of production and transportation4.; Regulations and quality standards

- 3.4. Market Trends

- 3.4.1. Glass Mat Thermoplastic (GMT) is Expected to Grow with a Fast Pace

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Automotive Thermoplastic Polymer Composites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Hand Layup

- 5.1.2. Compression Molding

- 5.1.3. Continous Process

- 5.1.4. Injection Molding

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Structural Assembly

- 5.2.2. Powertrain Component

- 5.2.3. Interior

- 5.2.4. Exterior

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 3B Fiberglass

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dupont De Nemours

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Daicel Polymer Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Celanese Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Arkema Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Technocompound GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cytex Industries Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Polyone Corporatio

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hexcel Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 3B Fiberglass

List of Figures

- Figure 1: South Africa Automotive Thermoplastic Polymer Composites Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Africa Automotive Thermoplastic Polymer Composites Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Automotive Thermoplastic Polymer Composites Market Revenue billion Forecast, by Production Process Type 2020 & 2033

- Table 2: South Africa Automotive Thermoplastic Polymer Composites Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: South Africa Automotive Thermoplastic Polymer Composites Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: South Africa Automotive Thermoplastic Polymer Composites Market Revenue billion Forecast, by Production Process Type 2020 & 2033

- Table 5: South Africa Automotive Thermoplastic Polymer Composites Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 6: South Africa Automotive Thermoplastic Polymer Composites Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Automotive Thermoplastic Polymer Composites Market?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the South Africa Automotive Thermoplastic Polymer Composites Market?

Key companies in the market include 3B Fiberglass, Dupont De Nemours, Daicel Polymer Ltd, Celanese Corporation, Arkema Group, Technocompound GmbH, Cytex Industries Inc, Polyone Corporatio, Hexcel Corporation.

3. What are the main segments of the South Africa Automotive Thermoplastic Polymer Composites Market?

The market segments include Production Process Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 33.76 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand from automobile industry4.; Increased focus on precision products.

6. What are the notable trends driving market growth?

Glass Mat Thermoplastic (GMT) is Expected to Grow with a Fast Pace.

7. Are there any restraints impacting market growth?

4.; The cost of production and transportation4.; Regulations and quality standards.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Automotive Thermoplastic Polymer Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Automotive Thermoplastic Polymer Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Automotive Thermoplastic Polymer Composites Market?

To stay informed about further developments, trends, and reports in the South Africa Automotive Thermoplastic Polymer Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence