Key Insights

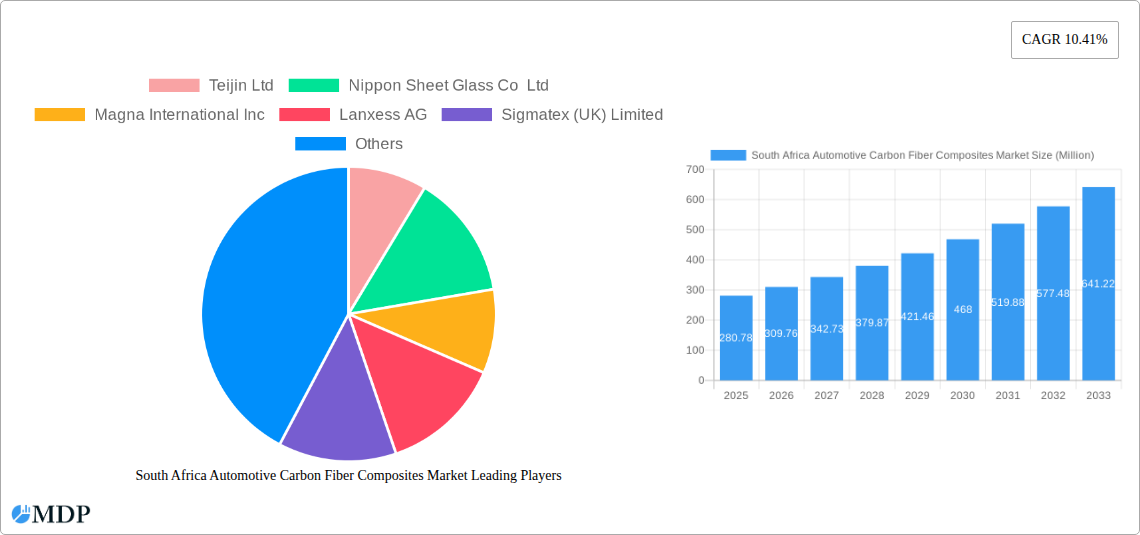

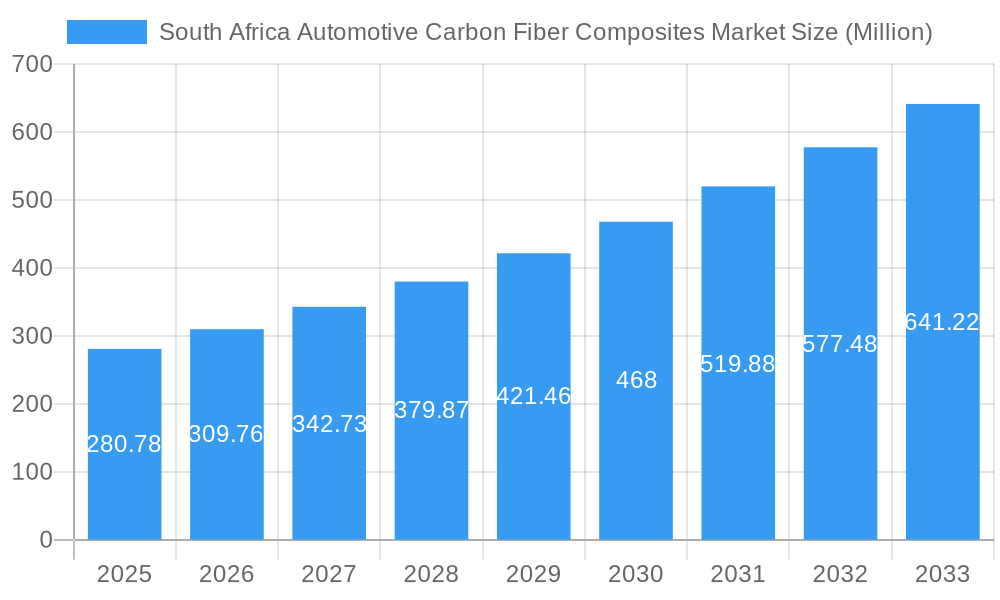

The South Africa automotive carbon fiber composites market is poised for significant growth, driven by the increasing demand for lightweight vehicles to improve fuel efficiency and reduce emissions. The market, currently valued at approximately $280.78 million (2025), is projected to experience a robust Compound Annual Growth Rate (CAGR) of 10.41% from 2025 to 2033. This expansion is fueled by several key factors. The automotive industry in South Africa is witnessing a shift towards advanced materials, with carbon fiber composites increasingly favored for their superior strength-to-weight ratio. This trend is particularly pronounced in the passenger car segment, where manufacturers are actively seeking to enhance vehicle performance and reduce fuel consumption to meet stricter emission regulations. Furthermore, the growing adoption of carbon fiber composites in various automotive applications, including structural assembly, powertrain components, and interior and exterior parts, is contributing to market growth. Investment in automotive manufacturing infrastructure and government support for technological advancements within the sector further bolster market prospects. While challenges such as the relatively high cost of carbon fiber composites compared to traditional materials exist, ongoing technological advancements and economies of scale are expected to mitigate these restraints over the forecast period.

South Africa Automotive Carbon Fiber Composites Market Market Size (In Million)

However, the market's growth trajectory is not without its limitations. The fluctuating price of raw materials, potential supply chain disruptions, and the need for skilled labor to efficiently manufacture and integrate these complex materials pose potential challenges. The market segmentation reveals a strong focus on passenger cars, reflecting the global trend toward lightweight vehicle design. Within this segment, the utilization of injection molding and compression molding manufacturing processes are expected to dominate, reflecting industry preferences for high-volume production techniques. Significant opportunities exist for companies specializing in these processes and those that provide high-quality raw materials to manufacturers. The market's geographic concentration within South Africa offers strategic entry points for both domestic and international players seeking to capitalize on this promising growth sector. Addressing the challenges through strategic partnerships and technological innovations will be crucial for sustained market expansion.

South Africa Automotive Carbon Fiber Composites Market Company Market Share

South Africa Automotive Carbon Fiber Composites Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South Africa automotive carbon fiber composites market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market dynamics, leading players, and future growth prospects. The study period is 2019-2033, with 2025 as the base and estimated year, and 2025-2033 as the forecast period. The historical period covers 2019-2024. Expect detailed segmentation analysis by vehicle type (passenger cars, commercial vehicles), application (structural assembly, powertrain component, interior, exterior, others), and manufacturing process (compression molding, injection molding, resin transfer molding, others). The report forecasts a market value of xx Million by 2033, driven by several key factors detailed within.

South Africa Automotive Carbon Fiber Composites Market Dynamics & Concentration

The South African automotive carbon fiber composites market is characterized by a moderate level of concentration, with a few major international players holding significant market share. Market share data for 2024 indicates that the top five players collectively hold approximately xx% of the market. However, the market is witnessing increased participation from smaller, specialized companies focusing on niche applications. Innovation is a key driver, with companies investing heavily in research and development to improve the performance, cost-effectiveness, and sustainability of carbon fiber composites. Stringent regulatory frameworks regarding emissions and vehicle safety standards are further shaping the market landscape, pushing automakers to adopt lighter and more efficient materials. The increasing demand for fuel-efficient vehicles presents a significant opportunity for carbon fiber composites due to their lightweight nature. While there are some product substitutes, such as aluminum and steel, carbon fiber composites offer superior strength-to-weight ratios, making them a preferred choice for high-performance applications.

- Market Concentration: Top 5 players hold approximately xx% market share (2024).

- Innovation Drivers: Focus on lighter weight, improved strength, and sustainable materials.

- Regulatory Frameworks: Stringent emission and safety standards drive adoption.

- Product Substitutes: Aluminum and steel, though carbon fiber offers superior strength-to-weight ratios.

- End-User Trends: Growing demand for fuel-efficient and high-performance vehicles.

- M&A Activities: xx M&A deals recorded in the past 5 years.

South Africa Automotive Carbon Fiber Composites Market Industry Trends & Analysis

The South African automotive carbon fiber composites market is experiencing significant growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily attributed to the increasing adoption of lightweight materials in vehicles to enhance fuel efficiency and meet stricter emission regulations. Technological advancements, such as the development of new carbon fiber materials and improved manufacturing processes, are also contributing to market expansion. Consumer preferences are shifting towards vehicles with enhanced performance and safety features, boosting the demand for high-performance composites. The competitive dynamics are marked by intense rivalry among established players and the emergence of new entrants, driving innovation and price competition. Market penetration of carbon fiber composites in the automotive sector is steadily increasing, with a projected penetration rate of xx% by 2033.

Leading Markets & Segments in South Africa Automotive Carbon Fiber Composites Market

While data on specific regional dominance within South Africa is limited, the passenger car segment dominates the South African automotive carbon fiber composites market, driven by the increasing demand for high-performance and fuel-efficient vehicles. The structural assembly application holds the largest market share, followed by the powertrain component segment.

Key Drivers by Segment:

- Passenger Cars: Growing demand for fuel-efficient and lightweight vehicles.

- Commercial Vehicles: Stringent regulations on fuel efficiency and emissions.

- Structural Assembly: Need for high strength-to-weight ratio components.

- Powertrain Component: Demand for lighter and more efficient powertrains.

- Interior/Exterior: Enhanced aesthetics and lightweight design.

- Manufacturing Processes: Compression molding is dominant due to its cost effectiveness.

South Africa Automotive Carbon Fiber Composites Market Product Developments

Recent product developments focus on enhancing the properties of carbon fiber composites, such as improved strength, stiffness, and durability, while simultaneously reducing costs. Technological advancements in manufacturing processes, including the development of faster and more efficient molding techniques, have also led to improved cost-effectiveness. The market is witnessing the introduction of new grades of carbon fiber tailored for specific automotive applications, such as high-strength fibers for structural components and high-modulus fibers for powertrain components. These advancements are improving the market fit of carbon fiber composites, making them increasingly competitive with traditional materials.

Key Drivers of South Africa Automotive Carbon Fiber Composites Market Growth

The growth of the South African automotive carbon fiber composites market is primarily driven by several factors:

- Stringent emission regulations: The need for lighter vehicles to improve fuel efficiency and reduce emissions.

- Growing demand for lightweight vehicles: Consumer preference for vehicles with improved fuel economy.

- Technological advancements: The development of new carbon fiber materials and improved manufacturing techniques.

- Government initiatives: Support for the development of the automotive industry.

Challenges in the South Africa Automotive Carbon Fiber Composites Market Market

The South African automotive carbon fiber composites market faces several challenges:

- High cost of carbon fiber materials: This limits the widespread adoption of carbon fiber composites.

- Supply chain complexities: The global nature of the carbon fiber supply chain presents logistical and sourcing challenges.

- Limited skilled workforce: Lack of expertise in manufacturing and processing carbon fiber composites. This results in xx% production delays annually.

Emerging Opportunities in South Africa Automotive Carbon Fiber Composites Market

Emerging opportunities lie in the development of new and improved carbon fiber materials, strategic partnerships between material suppliers and automakers to develop customized solutions, and expansion into new automotive segments such as electric vehicles. Technological breakthroughs in recycling and sustainable manufacturing processes will also unlock significant growth potential. Furthermore, government initiatives aimed at promoting the adoption of advanced materials in the automotive industry are expected to create favorable market conditions.

Leading Players in the South Africa Automotive Carbon Fiber Composites Market Sector

- Teijin Ltd

- Nippon Sheet Glass Co Ltd

- Magna International Inc

- Lanxess AG

- Sigmatex (UK) Limited

- Mitsubishi Chemical Group Corporation (MCG)

- Solvay SA

- BFG International

- Hexcel Corporation

- Menzolit

- SGL Carbon SE

- BASF S

Key Milestones in South Africa Automotive Carbon Fiber Composites Market Industry

- June 2023: Solvay announced the formation of Syensqo, a new company focused on composites, including supply to South African automakers. This signifies a significant commitment to the market.

- April 2023: SGL Carbon launched its new 50k carbon fiber, Sigrafil C T50-4.9/235, suitable for automotive applications and available to South African customers. This strengthens the material supply chain.

Strategic Outlook for South Africa Automotive Carbon Fiber Composites Market Market

The future of the South African automotive carbon fiber composites market appears bright, with significant growth potential driven by increasing demand for lightweight, high-performance vehicles and supportive government initiatives. Strategic partnerships between material suppliers and automakers are crucial for driving innovation and market expansion. Focus on cost reduction through technological advancements and efficient manufacturing processes will be vital for increased market penetration. The market is poised for robust growth, with significant opportunities for players who can successfully navigate the challenges and capitalize on the emerging trends.

South Africa Automotive Carbon Fiber Composites Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Application

- 2.1. Structural Assembly

- 2.2. Powertrain Component

- 2.3. Interior

- 2.4. Exterior

- 2.5. Others (Underbody, Etc.)

-

3. Manufacturing Process

- 3.1. Compression Molding

- 3.2. Injection Molding

- 3.3. Resin Transfer Molding

- 3.4. Others (Oven Molding, Etc.)

South Africa Automotive Carbon Fiber Composites Market Segmentation By Geography

- 1. South Africa

South Africa Automotive Carbon Fiber Composites Market Regional Market Share

Geographic Coverage of South Africa Automotive Carbon Fiber Composites Market

South Africa Automotive Carbon Fiber Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Lightweight and Energy-efficient Automotive Components to Foster the Growth of the Target Market

- 3.3. Market Restrains

- 3.3.1. High Manufacturing and Processing Cost of Composites

- 3.4. Market Trends

- 3.4.1. Passengers Cars to Gain Traction During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Automotive Carbon Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Structural Assembly

- 5.2.2. Powertrain Component

- 5.2.3. Interior

- 5.2.4. Exterior

- 5.2.5. Others (Underbody, Etc.)

- 5.3. Market Analysis, Insights and Forecast - by Manufacturing Process

- 5.3.1. Compression Molding

- 5.3.2. Injection Molding

- 5.3.3. Resin Transfer Molding

- 5.3.4. Others (Oven Molding, Etc.)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Teijin Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nippon Sheet Glass Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Magna International Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lanxess AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sigmatex (UK) Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mitsubishi Chemical Group Corporation (MCG)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Solvay SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BFG International

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hexcel Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Menzolit

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SGL Carbon SE

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 BASF S

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Teijin Ltd

List of Figures

- Figure 1: South Africa Automotive Carbon Fiber Composites Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Africa Automotive Carbon Fiber Composites Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: South Africa Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: South Africa Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Manufacturing Process 2020 & 2033

- Table 4: South Africa Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: South Africa Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: South Africa Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: South Africa Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Manufacturing Process 2020 & 2033

- Table 8: South Africa Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Automotive Carbon Fiber Composites Market?

The projected CAGR is approximately 10.41%.

2. Which companies are prominent players in the South Africa Automotive Carbon Fiber Composites Market?

Key companies in the market include Teijin Ltd, Nippon Sheet Glass Co Ltd, Magna International Inc, Lanxess AG, Sigmatex (UK) Limited, Mitsubishi Chemical Group Corporation (MCG), Solvay SA, BFG International, Hexcel Corporation, Menzolit, SGL Carbon SE, BASF S.

3. What are the main segments of the South Africa Automotive Carbon Fiber Composites Market?

The market segments include Vehicle Type, Application, Manufacturing Process.

4. Can you provide details about the market size?

The market size is estimated to be USD 280.78 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Lightweight and Energy-efficient Automotive Components to Foster the Growth of the Target Market.

6. What are the notable trends driving market growth?

Passengers Cars to Gain Traction During the Forecast Period.

7. Are there any restraints impacting market growth?

High Manufacturing and Processing Cost of Composites.

8. Can you provide examples of recent developments in the market?

June 2023: Solvay announced the new names of the future independent publicly traded companies that will result from its planned separation, which the company reported in March 2022. The new names are Solvay and Syensqo, effective upon completion of the planned separation of Solvay, with Syensqo operating the company's composites business and supplying carbon fiber materials to automakers worldwide, including customers from South Africa.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Automotive Carbon Fiber Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Automotive Carbon Fiber Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Automotive Carbon Fiber Composites Market?

To stay informed about further developments, trends, and reports in the South Africa Automotive Carbon Fiber Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence