Key Insights

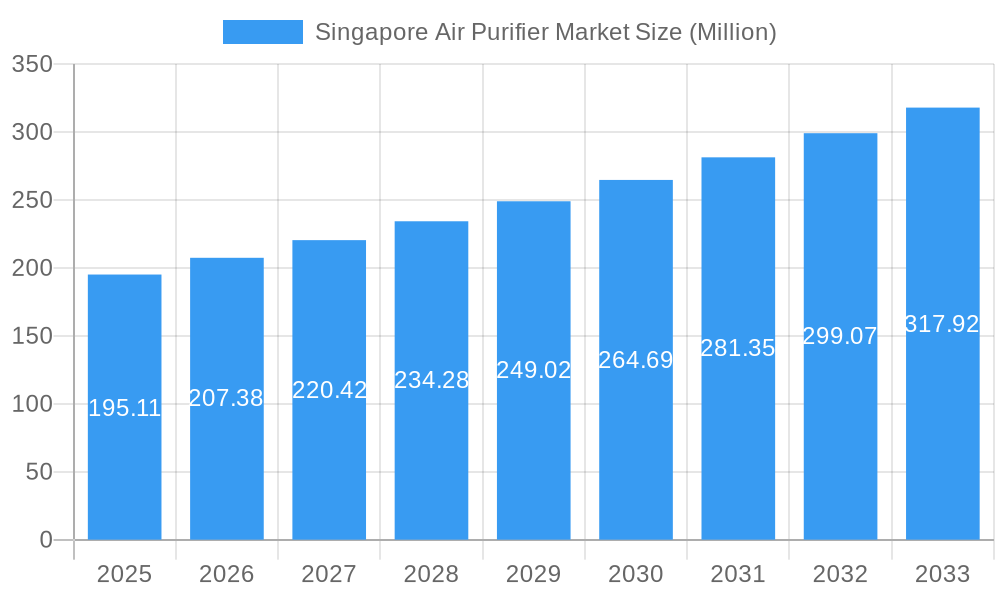

The Singapore air purifier market, valued at $195.11 million in 2025, is projected to experience robust growth, driven by increasing air pollution concerns, rising disposable incomes, and a growing awareness of respiratory health issues. The market's Compound Annual Growth Rate (CAGR) of 6.26% from 2025 to 2033 indicates a significant expansion opportunity. Key drivers include government initiatives promoting cleaner air, increased urbanization leading to higher pollution levels, and a preference for technologically advanced air purifiers with features like HEPA filtration and smart connectivity. The residential segment currently dominates the market, fueled by rising household incomes and a focus on improving indoor air quality. However, the commercial and industrial segments are anticipated to witness significant growth, driven by the increasing adoption of air purifiers in offices, schools, and industrial facilities to enhance worker productivity and overall environmental health. The high-efficiency particulate air (HEPA) filtration technology segment holds a substantial market share due to its effectiveness in removing airborne pollutants. However, other filtration technologies, such as electrostatic precipitators (ESPs) and ionizers, are gaining traction owing to their cost-effectiveness and specific applications. Leading brands like Dyson, Winix, Daikin, LG, Samsung, and Philips are competing intensely, offering a diverse range of products catering to different consumer needs and budgets. The stand-alone air purifier type currently dominates the market, but in-duct systems are expected to show growth, driven by their seamless integration into existing HVAC systems in commercial buildings.

Singapore Air Purifier Market Market Size (In Million)

The competitive landscape is characterized by both established international players and local brands. Strategic collaborations, product innovation, and aggressive marketing campaigns are crucial for market success. The continued growth of the market is contingent upon maintaining public awareness of air quality issues, further technological advancements in air purification technologies, and supportive government policies encouraging cleaner air initiatives. The forecast period (2025-2033) suggests a considerable expansion of the market, driven by the factors mentioned above. Understanding consumer preferences for specific features, price points, and brand loyalty will be critical for companies seeking to capitalize on this growing market. Growth in the industrial sector will depend largely on regulations and environmental consciousness in various industries.

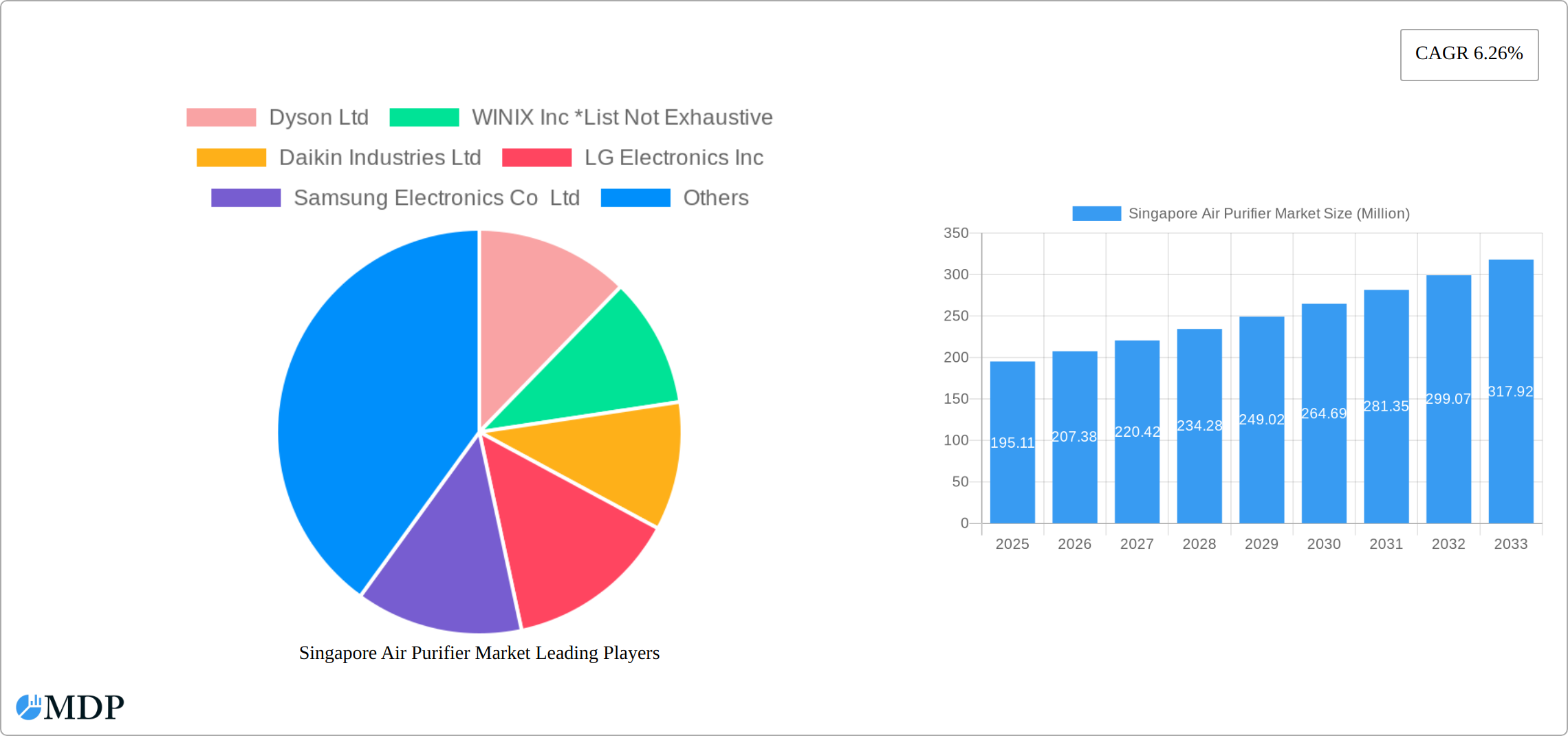

Singapore Air Purifier Market Company Market Share

Singapore Air Purifier Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Singapore air purifier market, offering valuable insights for industry stakeholders. The study period covers 2019-2033, with a focus on 2025 as the base and estimated year. We project significant growth, driven by factors such as rising air pollution concerns, increasing disposable incomes, and technological advancements. The report analyzes market dynamics, leading players, emerging trends, and future growth potential, providing actionable intelligence to navigate this dynamic market. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Singapore Air Purifier Market Dynamics & Concentration

The Singapore air purifier market exhibits a moderately concentrated landscape, with key players like Dyson Ltd, WINIX Inc, Daikin Industries Ltd, LG Electronics Inc, Samsung Electronics Co Ltd, Amway (Malaysia) Holdings Berhad, Koninklijke Philips NV, Sharp Corporation, Panasonic Corporation, and IQAir holding significant market share. However, the presence of numerous smaller players indicates opportunities for market entry and expansion. Innovation is a crucial driver, with companies focusing on smart features, improved filtration technologies, and aesthetically pleasing designs. Stringent government regulations regarding air quality standards further fuel market growth, while the availability of alternative solutions, such as improved ventilation systems, presents some competitive pressure. End-user trends show a growing preference for high-efficiency, energy-efficient, and aesthetically appealing air purifiers. M&A activity in the sector remains relatively low, with only xx deals recorded in the past five years, suggesting a focus on organic growth and product development.

- Market Concentration: Moderately concentrated, with top players holding xx% market share in 2025.

- Innovation Drivers: Smart features, improved filtration, aesthetically pleasing designs.

- Regulatory Framework: Stringent air quality standards drive demand.

- Product Substitutes: Improved ventilation systems pose some competitive threat.

- End-user Trends: Growing preference for energy-efficient and aesthetically appealing products.

- M&A Activities: xx deals recorded (2019-2024).

Singapore Air Purifier Market Industry Trends & Analysis

The Singapore air purifier market is experiencing robust growth, propelled by several key factors. Rising awareness of air pollution and its health impacts has driven consumer demand, particularly in urban areas. Technological advancements, such as the incorporation of smart sensors and improved filtration technologies (HEPA, electrostatic precipitators), have enhanced product appeal. Changing consumer preferences towards healthier lifestyles and premium home appliances further contribute to the market’s expansion. The competitive landscape is characterized by intense rivalry amongst established players and emerging brands, leading to product innovation and price competition. Market penetration remains relatively high in residential settings, with significant growth potential observed in the commercial and industrial sectors.

Leading Markets & Segments in Singapore Air Purifier Market

The Singapore air purifier market is significantly driven by the residential sector, fueled by rising disposable incomes and a growing awareness of health and well-being among Singaporean households. This segment's expansion is further bolstered by increasing concerns about air pollution and its impact on respiratory health. However, substantial growth potential exists within the commercial and industrial sectors. Businesses are increasingly recognizing the importance of clean indoor air quality for employee productivity, health, and regulatory compliance. This demand is particularly strong in sectors like healthcare, education, and manufacturing, where stringent air quality standards are paramount. High-efficiency particulate air (HEPA) filtration technology remains the dominant force, appreciated for its proven efficacy in removing a wide spectrum of airborne pollutants, including particulate matter, allergens, and other harmful substances. The preference for stand-alone air purifiers persists due to their ease of installation, flexibility, and cost-effectiveness compared to integrated in-duct systems.

- Dominant Segment: Residential (driven by health consciousness and rising disposable incomes)

- Key Drivers for Residential Segment: Increased awareness of air pollution's health effects, rising disposable incomes, and a preference for improved home environments.

- Key Drivers for Commercial Segment: Improved employee well-being, enhanced productivity, regulatory compliance, and creating a positive brand image.

- Key Drivers for Industrial Segment: Occupational safety and health regulations, improved worker productivity, and maintaining a clean manufacturing environment.

- Dominant Filtration Technology: HEPA (High-Efficiency Particulate Air) filters, offering superior pollutant removal capabilities.

- Dominant Type: Stand-alone air purifiers, valued for their ease of installation, mobility, and cost-effectiveness.

Singapore Air Purifier Market Product Developments

Recent innovations in the Singapore air purifier market underscore a clear trend toward smarter, more efficient, and aesthetically pleasing devices. Manufacturers are integrating advanced features such as smart sensors for real-time air quality monitoring, Wi-Fi connectivity for remote control and scheduling via mobile apps, and sophisticated filtration systems capable of targeting specific pollutants. Beyond functionality, design is also a key focus, with manufacturers producing sleek and stylish air purifiers that seamlessly integrate into modern homes and offices. This convergence of functionality and aesthetics is broadening the appeal of air purifiers to a wider consumer base and accelerating market adoption across all segments.

Key Drivers of Singapore Air Purifier Market Growth

Several factors contribute to the growth of the Singapore air purifier market. The increasing prevalence of air pollution, both indoors and outdoors, remains a primary driver. Government regulations promoting better air quality standards further incentivize the adoption of air purifiers. Technological advancements in filtration technology and smart features have improved product efficacy and convenience, boosting demand. Rising disposable incomes also allow more consumers to invest in these products.

Challenges in the Singapore Air Purifier Market

The Singapore air purifier market faces challenges like the relatively high cost of premium air purifiers, potentially limiting market penetration in lower-income segments. Competition from established and emerging brands leads to price pressures, affecting profit margins. Supply chain disruptions and fluctuations in raw material prices pose potential risks.

Emerging Opportunities in Singapore Air Purifier Market

Significant opportunities exist in expanding the market penetration within the commercial and industrial sectors. This requires strategic partnerships with building management companies, contractors, and businesses to highlight the value proposition of improved indoor air quality. The integration of air purifiers into smart home ecosystems presents further avenues for growth, enhancing user experience and offering seamless control. Furthermore, a growing focus on sustainability and energy efficiency presents an opportunity for manufacturers to develop and market eco-friendly air purifiers, appealing to environmentally conscious consumers. This includes exploring more sustainable manufacturing processes and utilizing energy-efficient components.

Leading Players in the Singapore Air Purifier Market Sector

- Dyson Ltd

- WINIX Inc

- Daikin Industries Ltd

- LG Electronics Inc

- Samsung Electronics Co Ltd

- Amway (Malaysia) Holdings Berhad

- Koninklijke Philips NV

- Sharp Corporation

- Panasonic Corporation

- IQAir

Key Milestones in Singapore Air Purifier Market Industry

- May 2023: LG Electronics Singapore launched the LG PuriCare AeroFurniture, a stylish air purifier designed for modern living.

- May 2023: Dyson Limited revamped its air purifier range, incorporating advanced HEPA H13 filtration and intelligent sensing.

Strategic Outlook for Singapore Air Purifier Market Market

The Singapore air purifier market exhibits strong growth potential, driven by several key factors: continuous advancements in filtration technologies providing improved performance and efficiency; a rising emphasis on health and wellness, leading to increased consumer demand; and the expanding commercial and industrial sectors seeking enhanced indoor air quality. To fully leverage this potential, strategic partnerships, innovative product development, and a commitment to sustainable practices are crucial. The long-term prospects remain exceptionally positive, fueled by evolving consumer preferences, heightened awareness of air quality, and the persistent need for clean and healthy indoor environments.

Singapore Air Purifier Market Segmentation

-

1. Filtration Technology

- 1.1. High-efficiency Particulate Air (HEPA)

- 1.2. Other Fi

-

2. Type

- 2.1. Stand-alone

- 2.2. In-duct

-

3. End User

- 3.1. Residential

- 3.2. Commercial

- 3.3. Industrial

Singapore Air Purifier Market Segmentation By Geography

- 1. Singapore

Singapore Air Purifier Market Regional Market Share

Geographic Coverage of Singapore Air Purifier Market

Singapore Air Purifier Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Airborne Diseases and Growing Health Consciousness4.; Increasing awareness among consumers about the importance of indoor air quality

- 3.3. Market Restrains

- 3.3.1. 4.; High Installation and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Increasing Airborne Diseases and Growing Health Consciousness Among Consumers are Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Air Purifier Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 5.1.1. High-efficiency Particulate Air (HEPA)

- 5.1.2. Other Fi

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Stand-alone

- 5.2.2. In-duct

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dyson Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 WINIX Inc *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Daikin Industries Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LG Electronics Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Samsung Electronics Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amway (Malaysia) Holdings Berhad

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Koninklijke Philips NV

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sharp Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Panasonic Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 IQAir

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Dyson Ltd

List of Figures

- Figure 1: Singapore Air Purifier Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Singapore Air Purifier Market Share (%) by Company 2025

List of Tables

- Table 1: Singapore Air Purifier Market Revenue Million Forecast, by Filtration Technology 2020 & 2033

- Table 2: Singapore Air Purifier Market Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 3: Singapore Air Purifier Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Singapore Air Purifier Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 5: Singapore Air Purifier Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Singapore Air Purifier Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Singapore Air Purifier Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Singapore Air Purifier Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Singapore Air Purifier Market Revenue Million Forecast, by Filtration Technology 2020 & 2033

- Table 10: Singapore Air Purifier Market Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 11: Singapore Air Purifier Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Singapore Air Purifier Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 13: Singapore Air Purifier Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Singapore Air Purifier Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: Singapore Air Purifier Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Singapore Air Purifier Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Air Purifier Market?

The projected CAGR is approximately 6.26%.

2. Which companies are prominent players in the Singapore Air Purifier Market?

Key companies in the market include Dyson Ltd, WINIX Inc *List Not Exhaustive, Daikin Industries Ltd, LG Electronics Inc, Samsung Electronics Co Ltd, Amway (Malaysia) Holdings Berhad, Koninklijke Philips NV, Sharp Corporation, Panasonic Corporation, IQAir.

3. What are the main segments of the Singapore Air Purifier Market?

The market segments include Filtration Technology, Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 195.11 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Airborne Diseases and Growing Health Consciousness4.; Increasing awareness among consumers about the importance of indoor air quality.

6. What are the notable trends driving market growth?

Increasing Airborne Diseases and Growing Health Consciousness Among Consumers are Expected to Drive the Market.

7. Are there any restraints impacting market growth?

4.; High Installation and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

May 2023: LG Electronics Singapore announced the launch of the LG PuriCare AeroFurniture. The LG PuriCare AeroFurniture sets to revolutionize how people view home appliances, especially air purifiers, and provide a sophisticated and effective solution for modern living. Featuring a chic design, it combines both style and functionality to bring fresh, clean air to users with its advanced air purification technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Air Purifier Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Air Purifier Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Air Purifier Market?

To stay informed about further developments, trends, and reports in the Singapore Air Purifier Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence