Key Insights

The Polish e-bike market is experiencing substantial growth, propelled by heightened environmental consciousness, supportive government policies for sustainable transport, and increasing consumer purchasing power. This dynamic expansion is underscored by a projected Compound Annual Growth Rate (CAGR) of 7.21%. Key drivers include the rising adoption of e-bikes for urban commuting, the availability of diverse models to suit varied user needs, and advancements in lithium-ion battery technology. Despite initial cost and infrastructure hurdles, government incentives and ongoing improvements in cycling networks are expected to accelerate market penetration. The market is segmented by application, with city/urban e-bikes demonstrating the strongest demand, followed by trekking and cargo segments. Major international and regional manufacturers are poised to benefit from this upward trend.

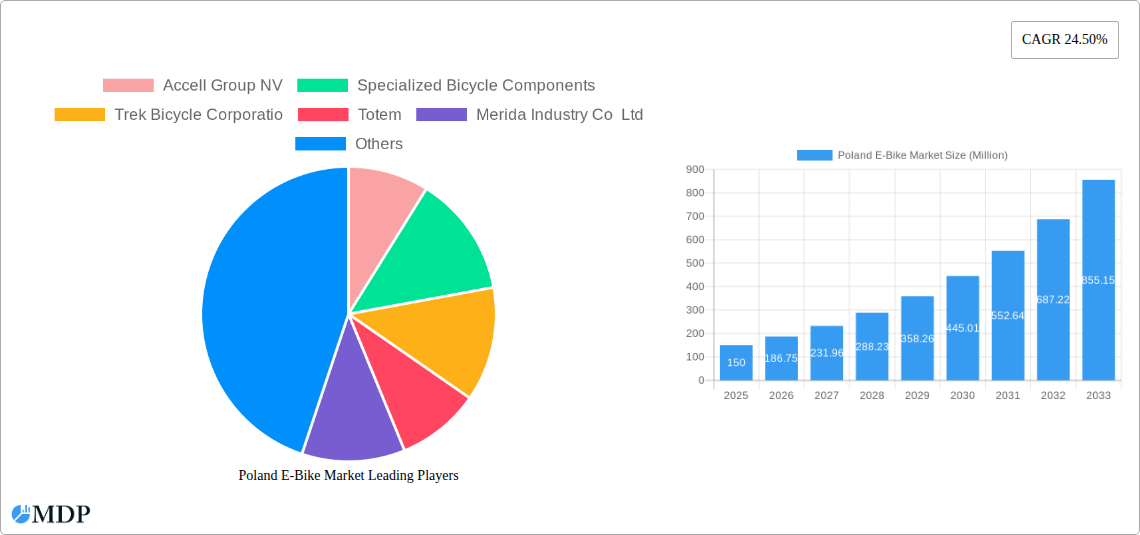

Poland E-Bike Market Market Size (In Million)

For the base year 2025, the Polish e-bike market is valued at 370.63 million. Projections indicate sustained growth through 2033, supported by Poland's economic development, ongoing urbanization, and a continued emphasis on environmental sustainability. Technological advancements, particularly in battery performance and charging solutions, will be critical. The expansion of dedicated e-bike infrastructure, including charging facilities and dedicated lanes, will further stimulate market momentum. Increased competition is anticipated, prompting manufacturers to focus on product innovation, diversification, and strategic alliances to enhance affordability and accessibility, thereby ensuring continued market expansion.

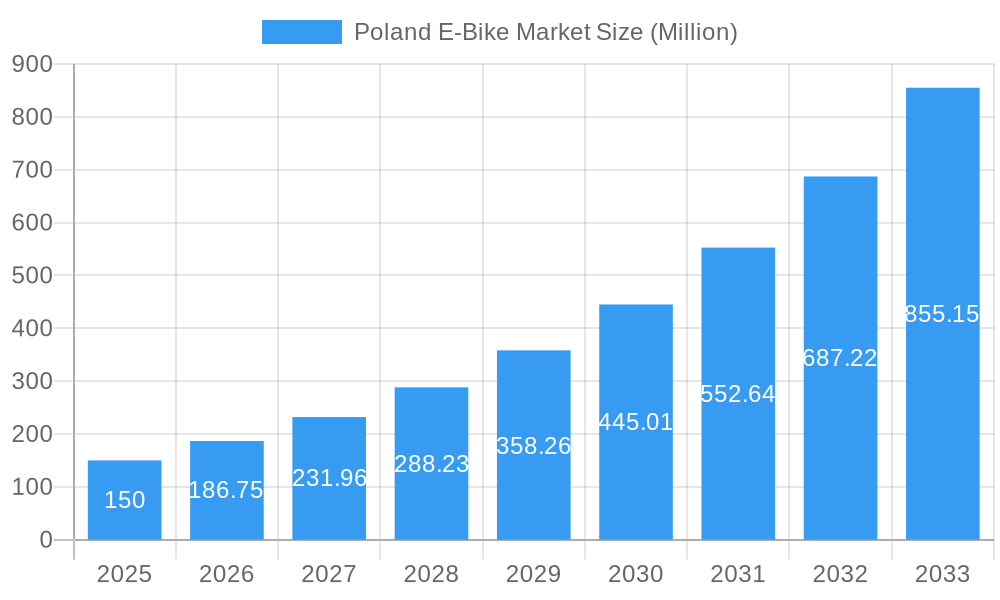

Poland E-Bike Market Company Market Share

Poland E-Bike Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Poland e-bike market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market dynamics, key trends, leading players, and future growth potential. Expect detailed segmentation across propulsion types (Pedal Assisted, Speed Pedelec, Throttle Assisted), application types (Cargo/Utility, City/Urban, Trekking), and battery types (Lead Acid Battery, Lithium-ion Battery, Others). The report projects a market value reaching xx Million by 2033.

Poland E-Bike Market Market Dynamics & Concentration

The Poland e-bike market exhibits a dynamic landscape shaped by several factors. Market concentration is currently moderate, with a few dominant players and several smaller niche players vying for market share. Innovation is a key driver, with continuous improvements in battery technology, motor efficiency, and overall bike design. The regulatory framework, while evolving, is supportive of e-bike adoption, fostering growth. Product substitutes, primarily traditional bicycles and other forms of personal transport, present competition, influencing pricing and market penetration.

End-user trends show a shift towards eco-friendly and convenient modes of transportation, particularly among younger demographics and urban dwellers. Increased awareness of environmental concerns is further fueling this trend. The number of M&A activities in the sector remains relatively low, currently at an estimated xx deals annually, but has the potential for growth, especially with the increasing interest of larger conglomerates in this market.

- Market Share: Dominant players hold approximately 50% of the market share in 2025, with the remaining share distributed among smaller companies.

- M&A Activities: xx M&A deals annually (2019-2024), predicted to increase slightly in the forecast period.

- Innovation: Ongoing development in battery technology and motor systems drives growth.

Poland E-Bike Market Industry Trends & Analysis

The Poland e-bike market is experiencing robust growth, driven by several factors. The increasing awareness of environmental sustainability and the need for eco-friendly transportation options are key drivers. Urbanization and the growing popularity of cycling as a mode of commuting and recreation are boosting demand. Technological advancements, particularly in battery technology and motor efficiency, are making e-bikes more affordable, accessible, and appealing.

Government initiatives promoting cycling infrastructure and e-bike adoption are further contributing to market expansion. Consumer preferences shift towards lighter, more aesthetically pleasing designs with longer battery life and improved connectivity features. The competitive landscape is intensifying, leading to price wars and product innovation. The CAGR for the Poland e-bike market is estimated to be xx% during the forecast period (2025-2033), with market penetration predicted to reach xx% by 2033.

Leading Markets & Segments in Poland E-Bike Market

The City/Urban segment currently dominates the Poland e-bike market, accounting for approximately 60% of total sales in 2025. This is fueled by increasing urbanization, traffic congestion, and government support for cycling infrastructure in urban areas. Lithium-ion batteries dominate the battery type segment due to their superior energy density and longer lifespan. The Pedal Assisted propulsion type leads in market share, catering to the preference for a balance between human effort and electric assistance.

Key Drivers for City/Urban Segment:

- Growing urban population.

- Increased traffic congestion.

- Government initiatives promoting cycling infrastructure.

- Growing awareness of health and environmental benefits.

Key Drivers for Lithium-ion Batteries:

- Superior energy density and lifespan.

- Improved performance and reliability.

- Decreasing costs.

Poland E-Bike Market Product Developments

Recent product developments highlight a trend towards lighter, more integrated designs, enhanced connectivity features (e.g., smartphone integration), and improved battery performance. Companies are focusing on creating e-bikes that cater to specific user needs and preferences, leading to a more diverse product portfolio. Technological advancements like the integration of advanced motor systems (like TQ’s HPR550 motor system featured in Scott's Solace) and improved battery technologies are key differentiators. The market shows a significant move toward improved safety features and integrated lighting systems, driving greater consumer adoption.

Key Drivers of Poland E-Bike Market Growth

Several key factors propel the growth of the Poland e-bike market. Technological advancements in battery technology and motor efficiency are critical, enabling longer ranges, faster charging times, and lighter weight e-bikes. Government policies promoting cycling and e-bike adoption, including infrastructure development and financial incentives, are boosting market demand. The growing awareness of environmental sustainability among consumers is driving a shift towards eco-friendly transportation options. Economic factors, such as increasing disposable incomes and affordability of e-bikes, also contribute to market growth.

Challenges in the Poland E-Bike Market Market

Despite positive growth, the Poland e-bike market faces several challenges. Regulatory hurdles related to e-bike safety standards and regulations can hinder market expansion. Supply chain disruptions, particularly related to battery components and electronic parts, can affect production and pricing. Intense competition among established and emerging players creates price pressure and necessitates continuous innovation. The relatively high initial cost of e-bikes compared to traditional bicycles remains a barrier for some potential consumers. The lack of widespread charging infrastructure in some areas can hinder the adoption of e-bikes, reducing their practical convenience.

Emerging Opportunities in Poland E-Bike Market

Significant opportunities exist for long-term growth in the Poland e-bike market. Technological breakthroughs in battery technology, motor systems, and connectivity will continue to drive innovation and improve the overall e-bike experience. Strategic partnerships between e-bike manufacturers, component suppliers, and infrastructure providers can facilitate market expansion. Expansion into new market segments, such as cargo e-bikes for businesses, will broaden the market appeal. Government policies promoting e-bike adoption and the development of related infrastructure will create further growth opportunities.

Leading Players in the Poland E-Bike Market Sector

- Accell Group NV

- Specialized Bicycle Components (Specialized Bicycle Components)

- Trek Bicycle Corporation (Trek Bicycle Corporation)

- Totem

- Merida Industry Co Ltd (Merida Industry Co Ltd)

- Giant Manufacturing Co Ltd (Giant Manufacturing Co Ltd)

- SCOTT Sports SA (SCOTT Sports SA)

- Kross SA

- GEOBIKE MFC

- Cervélo Cycles Inc (Cervélo Cycles)

Key Milestones in Poland E-Bike Market Industry

- October 2022: Cervélo introduces the ZHT-5 electric road bike, offered in two specifications (ZHT-5 XX1 AXS, and ZHT-5 GX Eagle AXS). This launch signifies a move towards higher-end e-road bikes.

- November 2022: Giant unveils the Stormguard E+, a full-suspension e-bike, demonstrating advancements in e-MTB technology and market expansion into higher-priced segments.

- December 2022: Scott Sports launches the Solace, a new electric road bike featuring TQ’s HPR550 motor system, signifying adoption of advanced motor technology.

Strategic Outlook for Poland E-Bike Market Market

The Poland e-bike market holds immense potential for future growth, driven by technological advancements, supportive government policies, and increasing consumer awareness. Strategic opportunities include focusing on innovative product development, expanding into new market segments (e.g., cargo e-bikes), and establishing strong distribution networks. Companies that invest in research and development, build strong brand reputations, and cultivate effective marketing strategies will be well-positioned to capitalize on the market's growth potential. The market’s expansion is predicted to be fueled by rising disposable incomes, improved infrastructure, and an increasingly environmentally conscious population.

Poland E-Bike Market Segmentation

-

1. Propulsion Type

- 1.1. Pedal Assisted

- 1.2. Speed Pedelec

- 1.3. Throttle Assisted

-

2. Application Type

- 2.1. Cargo/Utility

- 2.2. City/Urban

- 2.3. Trekking

-

3. Battery Type

- 3.1. Lead Acid Battery

- 3.2. Lithium-ion Battery

- 3.3. Others

Poland E-Bike Market Segmentation By Geography

- 1. Poland

Poland E-Bike Market Regional Market Share

Geographic Coverage of Poland E-Bike Market

Poland E-Bike Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Increase in Automotive Sector

- 3.3. Market Restrains

- 3.3.1. Digitization of R&D Operations in Automotive Sector

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland E-Bike Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Pedal Assisted

- 5.1.2. Speed Pedelec

- 5.1.3. Throttle Assisted

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Cargo/Utility

- 5.2.2. City/Urban

- 5.2.3. Trekking

- 5.3. Market Analysis, Insights and Forecast - by Battery Type

- 5.3.1. Lead Acid Battery

- 5.3.2. Lithium-ion Battery

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Accell Group NV

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Specialized Bicycle Components

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Trek Bicycle Corporatio

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Totem

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Merida Industry Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Giant Manufacturing Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SCOTT Sports SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kross SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GEOBIKE MFC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cervélo Cycles Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Cervélo Cycles

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Accell Group NV

List of Figures

- Figure 1: Poland E-Bike Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Poland E-Bike Market Share (%) by Company 2025

List of Tables

- Table 1: Poland E-Bike Market Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 2: Poland E-Bike Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 3: Poland E-Bike Market Revenue million Forecast, by Battery Type 2020 & 2033

- Table 4: Poland E-Bike Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Poland E-Bike Market Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 6: Poland E-Bike Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 7: Poland E-Bike Market Revenue million Forecast, by Battery Type 2020 & 2033

- Table 8: Poland E-Bike Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland E-Bike Market?

The projected CAGR is approximately 7.21%.

2. Which companies are prominent players in the Poland E-Bike Market?

Key companies in the market include Accell Group NV, Specialized Bicycle Components, Trek Bicycle Corporatio, Totem, Merida Industry Co Ltd, Giant Manufacturing Co Ltd, SCOTT Sports SA, Kross SA, GEOBIKE MFC, Cervélo Cycles Inc, Cervélo Cycles.

3. What are the main segments of the Poland E-Bike Market?

The market segments include Propulsion Type, Application Type, Battery Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 370.63 million as of 2022.

5. What are some drivers contributing to market growth?

Exponential Increase in Automotive Sector.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Digitization of R&D Operations in Automotive Sector.

8. Can you provide examples of recent developments in the market?

December 2022: Scott sports has launched the Solace, a new electric road bike aimed new drop-bar electric bike range that is based on TQ’s HPR550 motor system.November 2022: The Stormguard E+, a full-suspension e-bike, is unveiled by Giant. The bicycles will be available for purchase in Europe in 2023 and will cost 7,999 Euros for the E+1 and 6,499 Euros for the E+2.October 2022: Cervelo introduces the ZHT-5 The bike is offered in 2 specs, with the ZHT-5 XX1 AXS, and the ZHT-5 GX Eagle AXS.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland E-Bike Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland E-Bike Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland E-Bike Market?

To stay informed about further developments, trends, and reports in the Poland E-Bike Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence