Key Insights

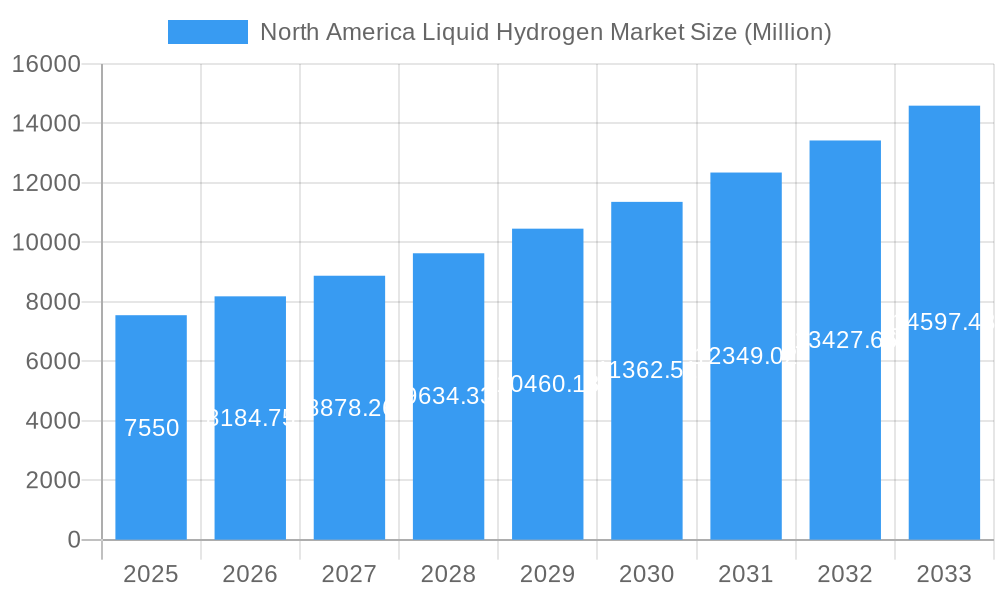

The North American liquid hydrogen market, valued at $7.55 billion in 2025, is projected to experience robust growth, driven by increasing demand from the automotive, chemicals and petrochemicals, and aerospace sectors. The market's Compound Annual Growth Rate (CAGR) of 8.50% from 2025 to 2033 reflects a significant upward trajectory, fueled by the rising adoption of hydrogen fuel cell vehicles (FCEVs) and the expanding use of hydrogen in industrial processes. Government initiatives promoting clean energy and reducing carbon emissions are further bolstering market expansion. Significant investments in hydrogen production infrastructure, including advancements in liquefaction and storage technologies, are also contributing to market growth. While challenges remain, such as high production costs and the need for extensive infrastructure development, the long-term outlook for the North American liquid hydrogen market remains positive. The United States, as the largest economy in North America, is expected to dominate the market share, followed by Canada and Mexico. The distribution segment, encompassing containers and tanks, is crucial for efficient transportation and storage, and its growth parallels the overall market expansion.

North America Liquid Hydrogen Market Market Size (In Billion)

The segment breakdown reveals a significant contribution from the automotive sector, driven by the increasing adoption of hydrogen fuel cell vehicles. The chemicals and petrochemicals industry's utilization of hydrogen as a feedstock and in refining processes also plays a vital role in market growth. Aerospace applications, albeit a smaller segment currently, are anticipated to witness substantial growth fueled by increasing demand for cleaner aviation fuels. Key market players, including Air Products and Chemicals Inc., Air Liquide S.A., and Linde plc, are actively investing in research and development, capacity expansion, and strategic partnerships to capitalize on the burgeoning market opportunities. Competition among these players is intense, driving innovation and efficiency improvements. Future growth will hinge on continued technological advancements, supportive government policies, and the successful deployment of hydrogen infrastructure to effectively support the expanding market demand.

North America Liquid Hydrogen Market Company Market Share

North America Liquid Hydrogen Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America liquid hydrogen market, offering invaluable insights for stakeholders across the value chain. From market dynamics and leading players to future growth projections, this report is your essential guide to navigating this rapidly evolving sector. The study period covers 2019-2033, with 2025 as the base and estimated year.

North America Liquid Hydrogen Market Market Dynamics & Concentration

This section analyzes the competitive landscape, market concentration, and key influencing factors shaping the North American liquid hydrogen market. We examine innovation drivers, regulatory landscapes, the impact of substitute products, evolving end-user trends, and the frequency of mergers and acquisitions (M&A). The market concentration is assessed through market share analysis of key players such as Air Products and Chemicals Inc, AIR WATER INC, Air Liquide S A, Iwatani Corporation, Linde plc, Messer Group GmbH, Engie SA, and Universal Industrial Gases Inc. The report reveals that xx of the market is controlled by the top 6 players in 2025. The number of M&A deals within the sector from 2019 to 2024 stood at xx, indicating a dynamic and consolidating market.

- Market Concentration: xx% market share held by the top 6 players in 2025.

- Innovation Drivers: Focus on improving storage and transportation efficiency, cost reductions through process optimization, and exploration of new applications.

- Regulatory Framework: Analysis of government policies and incentives promoting hydrogen adoption, including tax credits and emission reduction targets.

- Product Substitutes: Evaluation of competing energy sources and technologies, and their impact on liquid hydrogen market growth.

- End-User Trends: Examination of shifts in demand across key sectors such as automotive, chemicals, aerospace, and others.

- M&A Activity: Analysis of mergers and acquisitions, highlighting strategic implications for market consolidation and technological advancement. The number of M&A deals from 2019-2024 was xx.

North America Liquid Hydrogen Market Industry Trends & Analysis

This section delves into the key industry trends impacting the North American liquid hydrogen market. We examine market growth drivers, including increasing demand for clean energy, technological advancements in production and storage, and supportive government policies. We also analyze the disruptive potential of emerging technologies and their impact on market dynamics. The competitive landscape is thoroughly examined, focusing on strategies employed by major players. The report projects a Compound Annual Growth Rate (CAGR) of xx% for the forecast period (2025-2033) and identifies key segments showing the highest market penetration. Analysis of consumer preferences and their impact on market segmentation will also be presented.

Leading Markets & Segments in North America Liquid Hydrogen Market

This section identifies the dominant regions, countries, and segments within the North American liquid hydrogen market. Analysis focuses on factors driving the dominance of these areas, such as favorable economic policies, well-established infrastructure, and strong industry presence. Both distribution channels (containers, tanks) and end-user segments (automotive, chemicals and petrochemicals, aerospace, other) are analyzed in detail.

- Dominant Regions/Countries: Detailed analysis of regional market share and growth drivers, highlighting the factors behind the dominance of specific regions or countries within North America.

- Distribution Segments: In-depth analysis of market share and growth drivers for each distribution method (containers, tanks), considering factors like transportation costs, storage capacity, and safety regulations.

- End-User Segments: A comprehensive analysis of each end-user segment (automotive, chemicals and petrochemicals, aerospace, other) including market size, growth rate, and drivers such as regulatory pressures, technological advances, and economic conditions.

North America Liquid Hydrogen Market Product Developments

This section summarizes recent product innovations, highlighting key technological advancements, novel applications, and the competitive advantages offered by these developments. The focus is on assessing how these innovations are shaping market dynamics and improving the market fit of liquid hydrogen technologies.

Key Drivers of North America Liquid Hydrogen Market Growth

This section outlines the key factors driving the growth of the North American liquid hydrogen market. This includes technological advancements (e.g., improved storage and transportation efficiency), favorable economic conditions (e.g., government subsidies and incentives), and supportive regulatory policies (e.g., carbon reduction targets).

Challenges in the North America Liquid Hydrogen Market Market

This section identifies the key challenges and restraints hindering market growth. This includes regulatory hurdles, supply chain complexities, and intense competition, along with a quantified assessment of their impact.

Emerging Opportunities in North America Liquid Hydrogen Market

This section highlights emerging opportunities and catalysts driving long-term market growth, including technological breakthroughs, strategic partnerships, and market expansion strategies in promising sectors.

Leading Players in the North America Liquid Hydrogen Market Sector

- Air Products and Chemicals Inc

- AIR WATER INC

- Air Liquide S A

- Iwatani Corporation

- Linde plc

- Messer Group GmbH

- Engie SA

- Universal Industrial Gases Inc

Key Milestones in North America Liquid Hydrogen Market Industry

August 2023: Hyzon Motors Inc., Performance Food Group, Inc., and Chart Industries, Inc. successfully completed Hyzon's first commercial run of a liquid hydrogen fuel cell electric vehicle, covering over 540 miles. This milestone demonstrates the viability of liquid hydrogen for long-haul transportation.

May 2022: Air Liquide opened a major liquid hydrogen production and logistics facility in North Las Vegas, Nevada, with a capacity to deliver over 30 tonnes per day, supporting the growing demand for hydrogen in clean mobility.

Strategic Outlook for North America Liquid Hydrogen Market Market

This section summarizes the growth accelerators and future market potential, highlighting strategic opportunities for businesses operating in or considering entering the North American liquid hydrogen market. The long-term outlook is positive, driven by increasing investment, technological advancements, and a growing focus on decarbonization. The market is expected to witness significant expansion over the forecast period.

North America Liquid Hydrogen Market Segmentation

-

1. Distribution

- 1.1. Containers

- 1.2. Tanks

-

2. End-User

- 2.1. Automotive

- 2.2. Chemicals and Petrochemicals

- 2.3. Aerospace

- 2.4. Other End-Users

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Rest of North America

North America Liquid Hydrogen Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Liquid Hydrogen Market Regional Market Share

Geographic Coverage of North America Liquid Hydrogen Market

North America Liquid Hydrogen Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Focus on the Decarbonization of Global Energy4.; Expansion of Automobile Industry

- 3.3. Market Restrains

- 3.3.1. 4.; High Costs Associated with Transportation of Liquid Hydrogen

- 3.4. Market Trends

- 3.4.1. Automotive Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Liquid Hydrogen Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution

- 5.1.1. Containers

- 5.1.2. Tanks

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Automotive

- 5.2.2. Chemicals and Petrochemicals

- 5.2.3. Aerospace

- 5.2.4. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Distribution

- 6. United States North America Liquid Hydrogen Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Distribution

- 6.1.1. Containers

- 6.1.2. Tanks

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Automotive

- 6.2.2. Chemicals and Petrochemicals

- 6.2.3. Aerospace

- 6.2.4. Other End-Users

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Distribution

- 7. Canada North America Liquid Hydrogen Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Distribution

- 7.1.1. Containers

- 7.1.2. Tanks

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Automotive

- 7.2.2. Chemicals and Petrochemicals

- 7.2.3. Aerospace

- 7.2.4. Other End-Users

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Distribution

- 8. Rest of North America North America Liquid Hydrogen Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Distribution

- 8.1.1. Containers

- 8.1.2. Tanks

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Automotive

- 8.2.2. Chemicals and Petrochemicals

- 8.2.3. Aerospace

- 8.2.4. Other End-Users

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Distribution

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Air Products and Chemicals Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 AIR WATER INC

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Air Liquide S A

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Iwatani Corporation

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Linde plc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Messer Group GmbH

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Engie SA*List Not Exhaustive 6 4 Market Player Rankin

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Universal Industrial Gases Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Air Products and Chemicals Inc

List of Figures

- Figure 1: North America Liquid Hydrogen Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Liquid Hydrogen Market Share (%) by Company 2025

List of Tables

- Table 1: North America Liquid Hydrogen Market Revenue Million Forecast, by Distribution 2020 & 2033

- Table 2: North America Liquid Hydrogen Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: North America Liquid Hydrogen Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: North America Liquid Hydrogen Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Liquid Hydrogen Market Revenue Million Forecast, by Distribution 2020 & 2033

- Table 6: North America Liquid Hydrogen Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 7: North America Liquid Hydrogen Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: North America Liquid Hydrogen Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: North America Liquid Hydrogen Market Revenue Million Forecast, by Distribution 2020 & 2033

- Table 10: North America Liquid Hydrogen Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 11: North America Liquid Hydrogen Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America Liquid Hydrogen Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: North America Liquid Hydrogen Market Revenue Million Forecast, by Distribution 2020 & 2033

- Table 14: North America Liquid Hydrogen Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 15: North America Liquid Hydrogen Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: North America Liquid Hydrogen Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Liquid Hydrogen Market?

The projected CAGR is approximately 8.50%.

2. Which companies are prominent players in the North America Liquid Hydrogen Market?

Key companies in the market include Air Products and Chemicals Inc, AIR WATER INC, Air Liquide S A, Iwatani Corporation, Linde plc, Messer Group GmbH, Engie SA*List Not Exhaustive 6 4 Market Player Rankin, Universal Industrial Gases Inc.

3. What are the main segments of the North America Liquid Hydrogen Market?

The market segments include Distribution, End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.55 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Focus on the Decarbonization of Global Energy4.; Expansion of Automobile Industry.

6. What are the notable trends driving market growth?

Automotive Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Costs Associated with Transportation of Liquid Hydrogen.

8. Can you provide examples of recent developments in the market?

In August 2023, Hyzon Motors Inc., Performance Food Group, Inc., and Chart Industries, Inc. revealed the triumphant completion of Hyzon's first commercial run with a liquid hydrogen fuel cell electric vehicle. Commencing in Temple City, Texas, the truck completed deliveries to eight PFG customers near Dallas, Texas, traveling over 540 miles on a 16-hour constant run, including temperatures of over 100 degrees Fahrenheit.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Liquid Hydrogen Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Liquid Hydrogen Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Liquid Hydrogen Market?

To stay informed about further developments, trends, and reports in the North America Liquid Hydrogen Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence