Key Insights

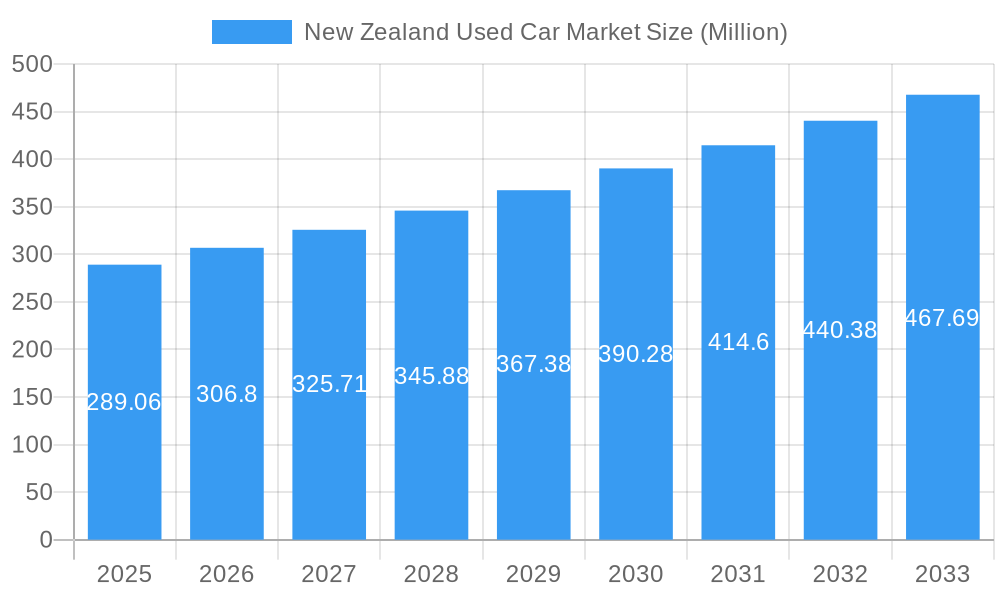

The New Zealand used car market, valued at NZD 289.06 million in 2025, is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of 6% from 2025 to 2033. This growth is driven by several factors. Increasing vehicle ownership among a growing population, coupled with rising disposable incomes, fuels demand for both new and used vehicles. Furthermore, the relatively high cost of new cars in New Zealand makes the used car market an attractive alternative for budget-conscious consumers. The market is segmented by vehicle type (hatchbacks, sedans, SUVs, MUVs), vendor type (organized and unorganized dealerships), and fuel type (gasoline, diesel, electric, and alternative fuels). The dominance of SUVs and the increasing popularity of electric vehicles are significant trends shaping the market. Challenges include fluctuations in used car imports due to global supply chain issues and the overall economic climate. The presence of both organized and unorganized dealers creates a diverse market landscape, with organized dealers offering greater transparency and warranty options while unorganized dealers often present more competitive pricing. Key players like Paul Kelly Motor Company, New Zealand Car (NZC), and Turners Automotive Group are significant contributors to the organized sector, competing based on inventory, service, and pricing strategies. The continued expansion of online platforms like AutoTrader and Autoport is also facilitating market growth by connecting buyers and sellers more efficiently.

New Zealand Used Car Market Market Size (In Million)

The forecast period (2025-2033) anticipates continued growth, albeit potentially at a slightly moderated pace toward the end of the forecast period due to potential economic factors and market saturation. The market's evolution will depend on government policies impacting vehicle imports, fuel efficiency standards, and incentives for electric vehicle adoption. The increasing popularity of electric and alternative fuel vehicles presents a considerable opportunity for market participants, and their success will be contingent on both the availability of used electric vehicles and the expansion of charging infrastructure. Competition among dealers will continue to be fierce, with a focus on providing comprehensive services and financing options to attract and retain customers. This includes factors such as extended warranties, convenient location, and transparent pricing, crucial for building trust and market share.

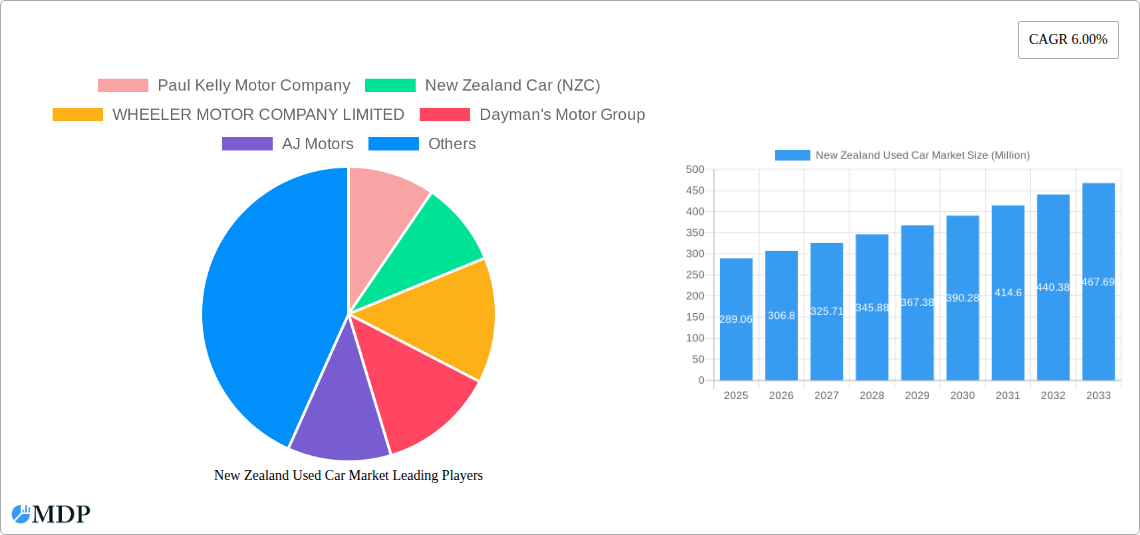

New Zealand Used Car Market Company Market Share

New Zealand Used Car Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the New Zealand used car market, covering market dynamics, industry trends, leading segments, key players, and future growth prospects. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This in-depth analysis is crucial for industry stakeholders, investors, and anyone seeking to understand this dynamic market. Expect actionable insights and data-driven forecasts, empowering informed decisions in this rapidly evolving sector. The total market value in 2024 is estimated at NZD xx Million.

New Zealand Used Car Market Market Dynamics & Concentration

The New Zealand used car market is characterized by a moderately concentrated landscape, with a few large players holding significant market share. However, a large number of smaller, independent dealers also contribute substantially. Market concentration is further influenced by the dominance of certain vehicle types and fuel types. Innovation in the sector is driven by technological advancements, particularly in online marketplaces and vehicle inspection technologies. The regulatory framework, including import regulations and emission standards (like the Clean Car Fee/Rebate scheme), significantly impacts market dynamics. Product substitutes, such as public transport and ride-sharing services, pose a moderate competitive threat, particularly in urban areas. End-user trends, influenced by factors like environmental concerns and economic conditions, are impacting demand for different vehicle types and fuel options. Mergers and acquisitions (M&A) activity has been moderate in recent years, with several smaller dealerships consolidating. Over the forecast period, xx M&A deals are predicted.

- Market Share: Top 5 players hold approximately xx% of the market share in 2024.

- M&A Activity: An estimated xx M&A deals are anticipated between 2025 and 2033.

- Regulatory Influences: The Clean Car initiative significantly impacts the demand for lower-emission vehicles.

New Zealand Used Car Market Industry Trends & Analysis

The New Zealand used car market experienced a CAGR of xx% during the historical period (2019-2024). Market growth is primarily driven by increasing vehicle ownership, particularly in suburban and rural areas. Technological disruptions, particularly the rise of online marketplaces like AutoTrader, have transformed how used cars are bought and sold. Consumer preferences are shifting towards SUVs and electric vehicles, reflecting changing lifestyles and environmental awareness. The market also faces challenges such as fluctuating used car prices influenced by global supply chain issues and economic uncertainty. Competitive dynamics are intense, with both established dealer groups and independent sellers vying for market share. Market penetration of online platforms is estimated at xx% in 2024, projected to reach xx% by 2033.

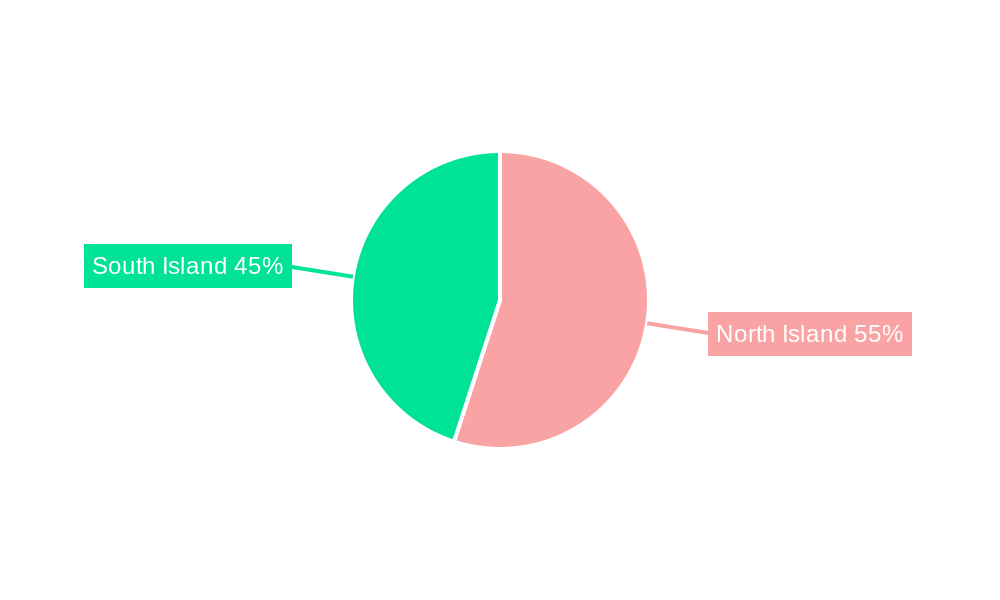

Leading Markets & Segments in New Zealand Used Car Market

The used car market shows regional variations, with the highest concentration in major urban centers like Auckland, Wellington, and Christchurch. Within vehicle types, SUVs currently dominate, driven by growing family sizes and a preference for higher ride height and space. The organized vendor segment holds a larger market share compared to the unorganized sector due to consumer trust and service offerings. Gasoline-powered vehicles currently hold the largest share of the fuel type segment, although demand for diesel and electric vehicles is steadily rising.

- Dominant Segment: SUVs (Vehicle Type) and Organized Vendors (Vendor Type).

- Key Drivers (SUVs): Growing families, preference for space and functionality.

- Key Drivers (Organized Vendors): Consumer trust, warranty options, financing facilities.

- Key Drivers (Gasoline): Established infrastructure, affordability (compared to EVs).

- Key Drivers (Auckland): Highest population density, higher disposable incomes.

New Zealand Used Car Market Product Developments

Recent product innovations focus on enhancing the online car buying experience, including virtual inspections, detailed vehicle history reports, and personalized financing options. The market is also seeing increasing adoption of telematics and connected car technologies in used vehicles. These innovations provide competitive advantages by improving transparency, convenience, and customer satisfaction.

Key Drivers of New Zealand Used Car Market Growth

Several factors drive growth, including increasing urbanization, rising disposable incomes, and government incentives for cleaner vehicles. Technological advancements in online marketplaces enhance accessibility and transparency, fostering market growth. Favorable financing options and readily available used car inventory further support market expansion.

Challenges in the New Zealand Used Car Market Market

The market faces challenges such as fluctuating used car prices due to global supply chain disruptions and economic downturns. Stricter emission regulations and the associated costs impact the supply of older, higher-emission vehicles. Intense competition among dealerships and online platforms exerts pressure on profit margins.

Emerging Opportunities in New Zealand Used Car Market

The increasing adoption of electric vehicles (EVs) presents significant opportunities for growth. Strategic partnerships between dealerships and EV manufacturers could lead to increased market share. Expansion into new technologies, such as subscription-based used car services, could unlock new revenue streams.

Leading Players in the New Zealand Used Car Market Sector

- Paul Kelly Motor Company

- New Zealand Car (NZC)

- WHEELER MOTOR COMPANY LIMITED

- Dayman's Motor Group

- AJ Motors

- Andrew Simms Group

- Turners Automotive Group

- AutoTrader

- Autoport

- Morrison Motor Group

Key Milestones in New Zealand Used Car Market Industry

- May 2023: The New Zealand Government introduced the Clean Car Fee/Rebate scheme to reduce emissions from imported used cars. This significantly altered the market by incentivizing the sale of lower-emission vehicles.

- August 2023: Andrew Simms Group collaborated with BYD Co. Ltd., strengthening its brand and market position by offering electric vehicles.

Strategic Outlook for New Zealand Used Car Market Market

The New Zealand used car market presents significant long-term growth potential, driven by evolving consumer preferences, technological innovation, and government policies promoting cleaner vehicles. Strategic investments in online platforms, electric vehicle infrastructure, and customer service will be crucial for success in this dynamic and competitive market. The market is expected to reach NZD xx Million by 2033.

New Zealand Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchback

- 1.2. Sedan

- 1.3. Sport Utility Vehicles (SUVs)

- 1.4. Multi-Purpose Vehicles (MUVs)

-

2. Vendor Type

- 2.1. Organized

- 2.2. Unorganized

-

3. Fuel Type

- 3.1. Gasoline

- 3.2. Diesel

- 3.3. Electric

- 3.4. Alternative Fuel Vehicles

New Zealand Used Car Market Segmentation By Geography

- 1. New Zealand

New Zealand Used Car Market Regional Market Share

Geographic Coverage of New Zealand Used Car Market

New Zealand Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Online Sales Channel Witnessed Significant Market Growth

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. Hatchback Cars witnessing major growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. New Zealand Used Car Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchback

- 5.1.2. Sedan

- 5.1.3. Sport Utility Vehicles (SUVs)

- 5.1.4. Multi-Purpose Vehicles (MUVs)

- 5.2. Market Analysis, Insights and Forecast - by Vendor Type

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Gasoline

- 5.3.2. Diesel

- 5.3.3. Electric

- 5.3.4. Alternative Fuel Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. New Zealand

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Paul Kelly Motor Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 New Zealand Car (NZC)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 WHEELER MOTOR COMPANY LIMITED

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dayman's Motor Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AJ Motors

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Andrew Simms Grou

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Turners Automotive Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AutoTrader

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Autoport

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Morrison Motor Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Paul Kelly Motor Company

List of Figures

- Figure 1: New Zealand Used Car Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: New Zealand Used Car Market Share (%) by Company 2025

List of Tables

- Table 1: New Zealand Used Car Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: New Zealand Used Car Market Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 3: New Zealand Used Car Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 4: New Zealand Used Car Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: New Zealand Used Car Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: New Zealand Used Car Market Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 7: New Zealand Used Car Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 8: New Zealand Used Car Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the New Zealand Used Car Market?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the New Zealand Used Car Market?

Key companies in the market include Paul Kelly Motor Company, New Zealand Car (NZC), WHEELER MOTOR COMPANY LIMITED, Dayman's Motor Group, AJ Motors, Andrew Simms Grou, Turners Automotive Group, AutoTrader, Autoport, Morrison Motor Group.

3. What are the main segments of the New Zealand Used Car Market?

The market segments include Vehicle Type, Vendor Type, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 289.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Online Sales Channel Witnessed Significant Market Growth.

6. What are the notable trends driving market growth?

Hatchback Cars witnessing major growth.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

August 2023: Andrew Simms, one of the leading dealer groups in New Zealand, collaborated with BYD Co. Ltd. Through this collaboration, the Andrew Simms Group enhanced their brand value across the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "New Zealand Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the New Zealand Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the New Zealand Used Car Market?

To stay informed about further developments, trends, and reports in the New Zealand Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence