Key Insights

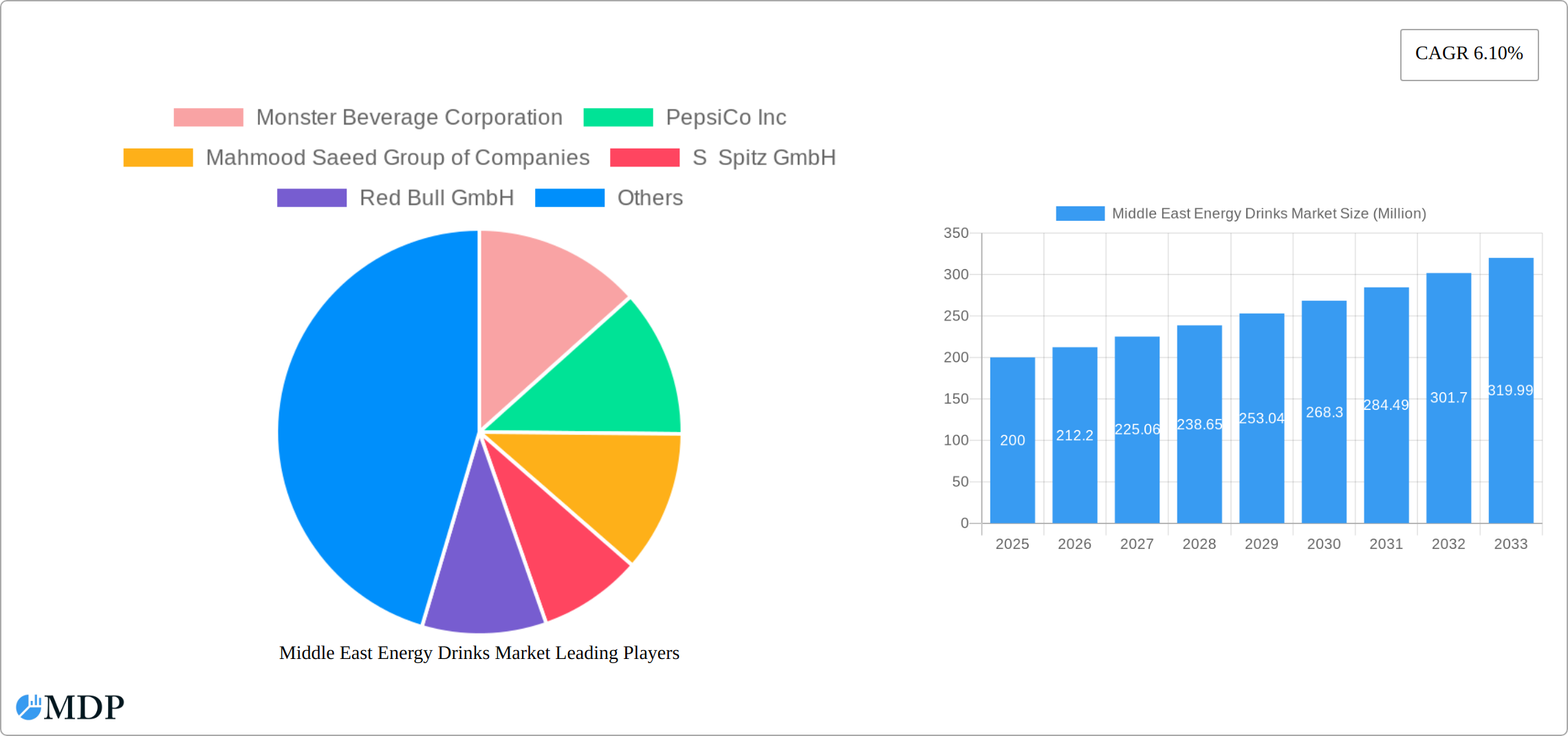

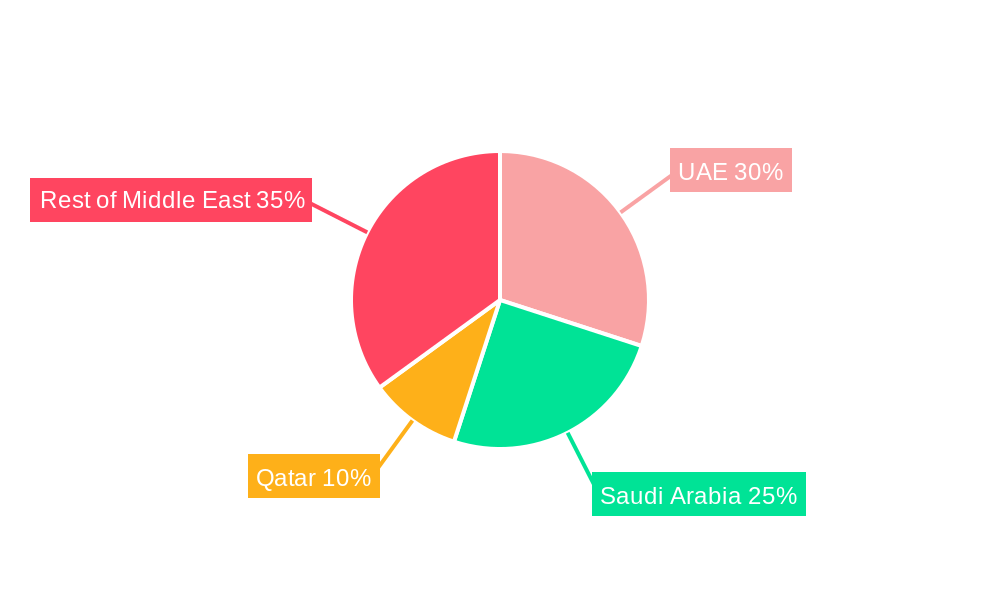

The Middle East energy drinks market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.10% from 2025 to 2033. This expansion is fueled by several key drivers. The region's burgeoning young population, with its increasing disposable incomes and preference for active lifestyles, is a significant contributor. Furthermore, the rising prevalence of health-conscious consumers is driving demand for sugar-free and low-calorie energy drink options. The market's segmentation reveals strong performance across various channels, with off-trade distribution dominating. The UAE, Saudi Arabia, and Qatar represent the most lucrative markets within the region, reflecting their higher per capita incomes and established retail infrastructure. However, the market faces challenges, including the increasing awareness of the potential health risks associated with excessive energy drink consumption and the fluctuating prices of key ingredients. The growing popularity of natural and organic energy drinks presents a significant opportunity for manufacturers to cater to health-conscious consumers seeking healthier alternatives. This segment is expected to experience above-average growth, attracting both established players and emerging brands.

The competitive landscape is characterized by a mix of international giants like Monster Beverage Corporation, Red Bull GmbH, and PepsiCo Inc., alongside regional players. These companies are actively employing strategies such as product diversification, strategic partnerships, and innovative marketing campaigns to solidify their market presence. The market's future trajectory will depend on factors including consumer preferences for healthier options, government regulations concerning sugar content, and the evolving landscape of competitive pricing. Successfully navigating these aspects will be crucial for maintaining and accelerating growth within the Middle East energy drinks sector over the forecast period. Expanding into underserved markets within the region and capitalizing on the increasing adoption of e-commerce platforms also represent vital strategic considerations for sustained success.

Middle East Energy Drinks Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Middle East energy drinks market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market trends, competitive landscapes, and future growth potential. The report leverages extensive data analysis to forecast market size reaching xx Million by 2033, revealing significant opportunities in a rapidly expanding market.

Middle East Energy Drinks Market Dynamics & Concentration

The Middle East energy drinks market exhibits a moderately concentrated landscape, dominated by global giants like Red Bull and Monster, alongside significant regional players. Market share is highly contested, with intense competition driving innovation and expansion. The market's dynamics are shaped by several key factors:

- Innovation Drivers: The demand for healthier and more diverse energy drink options fuels ongoing innovation in flavors, ingredients (e.g., natural/organic), and packaging. Sugar-free and low-calorie options are gaining significant traction.

- Regulatory Frameworks: Government regulations concerning sugar content, labeling, and marketing significantly influence product development and consumer choices. Varying regulations across the Middle Eastern countries create both challenges and opportunities.

- Product Substitutes: The market faces competition from other functional beverages, including sports drinks, coffee, and tea, presenting continuous challenges to maintain market share.

- End-User Trends: A young and increasingly health-conscious population drives demand for healthier energy drink alternatives, impacting product formulation and marketing strategies.

- M&A Activities: The report analyzes the M&A activity within the market, with an estimated xx number of deals recorded during the historical period (2019-2024), primarily focused on expanding market reach and product portfolios. Larger players are consolidating their positions through strategic acquisitions.

The market concentration ratio (CR) for the top 5 players is estimated at xx% in 2025, indicating a moderately concentrated market, although regional players hold significant influence in specific countries.

Middle East Energy Drinks Market Industry Trends & Analysis

The Middle East energy drinks market is experiencing robust growth, fueled by a confluence of factors. While precise CAGR figures require proprietary data, market projections indicate continued expansion well into the 2030s. This dynamic growth is driven by several key trends:

- Rising Disposable Incomes and Affluent Demographics: A burgeoning middle class and rising disposable incomes, particularly among younger consumers, are significantly increasing spending power and fueling demand for premium and functional beverages, including energy drinks. This trend is particularly pronounced in key markets like the UAE, Saudi Arabia, and Qatar.

- Shifting Lifestyles and Consumer Preferences: Fast-paced lifestyles, increasing urbanization, and a growing preference for convenience are driving demand for quick energy boosts. Simultaneously, a rising health consciousness is pushing demand for healthier options, including sugar-free, low-calorie, and natural or organic energy drinks. This creates a diverse market with opportunities for both traditional and innovative products.

- Evolving Distribution Channels and Marketing Strategies: E-commerce is rapidly expanding market reach, allowing brands to bypass traditional retail channels and engage directly with consumers. Sophisticated digital marketing strategies are crucial for targeting specific demographics and driving sales.

- Product Innovation and Competitive Landscape: Intense competition among established and emerging players is fostering continuous product innovation, with a focus on novel flavors, functional ingredients, and sustainable packaging. This competitive pressure benefits consumers through increased choice and value.

- Tourism and Hospitality: The significant tourism and hospitality sectors in key markets like the UAE and Qatar contribute substantially to energy drink consumption, creating a significant demand during peak seasons.

The increasing popularity of functional beverages, emphasizing health benefits beyond simple energy provision, further contributes to the market's growth trajectory.

Leading Markets & Segments in Middle East Energy Drinks Market

The UAE, Saudi Arabia, and Qatar remain the dominant markets within the Middle East energy drinks sector. Their leadership stems from a combination of factors:

Key Market Drivers (UAE, Saudi Arabia, Qatar):

- Robust economic growth and high per capita incomes, leading to higher discretionary spending.

- Well-developed and modern retail infrastructure ensuring widespread product availability.

- Significant tourism and hospitality sectors, boosting on-trade consumption.

- Generally favorable regulatory environments compared to other regions in the Middle East.

Market Share Dynamics: The UAE generally maintains the largest market share due to its sophisticated retail landscape, affluent population, and significant expat community with diverse consumption habits. Saudi Arabia holds a substantial second position due to its large population and considerable purchasing power. Qatar showcases robust growth potential, fueled by ongoing economic development and modernization.

Market segmentation reveals further insights:

- Packaging: Metal cans remain the dominant packaging type due to their convenience and cost-effectiveness. However, PET bottles are experiencing increased adoption driven by growing sustainability concerns and consumer demand for eco-friendly alternatives.

- Distribution Channels: The off-trade channel (supermarkets, convenience stores, hypermarkets) continues to dominate, but the on-trade segment (restaurants, cafes, bars) is exhibiting considerable growth, particularly in metropolitan areas.

- Product Type: Traditional energy drinks still hold the largest market share, but the segment of sugar-free and low-calorie options is experiencing exceptionally high growth rates, indicating a significant shift in consumer preferences towards healthier choices.

While the UAE, Saudi Arabia, and Qatar are leading the way, the Rest of the Middle East region demonstrates considerable, albeit slower, growth potential, primarily influenced by variations in economic development and infrastructural maturity.

Middle East Energy Drinks Market Product Developments

Recent product innovations include the introduction of sugar-free and low-calorie variants, natural/organic options, and functional beverages incorporating unique ingredients. These developments cater to the evolving preferences of health-conscious consumers while maintaining the energy-boosting properties that define the market. The successful integration of innovative ingredients and technological advancements in manufacturing processes has led to improved product quality and shelf life, enhancing the overall competitiveness of the market.

Key Drivers of Middle East Energy Drinks Market Growth

The market's growth is propelled by several key factors:

- Rising Disposable Incomes & Young Population: A significant young population with increasing disposable incomes fuels demand.

- Health & Wellness Trends: The emergence of healthier formulations, such as sugar-free and natural options, fuels market expansion.

- Favorable Regulatory Environment (in specific areas): Supportive government policies in some areas create a beneficial climate for market growth.

- Technological Advancements: Efficient production methods and improved packaging enhance product quality and shelf life.

Challenges in the Middle East Energy Drinks Market Market

The market faces several challenges:

- Health Concerns & Regulations: Growing awareness of sugar's impact and associated government regulations limit certain product formulations.

- Competition: Intense competition from established players and new entrants creates pricing pressures.

- Economic Fluctuations: Regional economic downturns can impact consumer spending.

- Supply Chain Disruptions: Geopolitical factors and global events can impact raw material availability and distribution costs.

Emerging Opportunities in Middle East Energy Drinks Market

Long-term growth opportunities arise from:

- Expanding into new market segments: Targeting niche consumer groups, such as athletes or health-conscious consumers, presents promising opportunities.

- Strategic Partnerships: Collaborations with local brands and distributors can expand market reach and distribution networks effectively.

- Product Diversification: Introducing innovative flavors, functional ingredients, and improved packaging enhances competitiveness.

Leading Players in the Middle East Energy Drinks Market Sector

- Monster Beverage Corporation

- PepsiCo Inc

- Mahmood Saeed Group of Companies

- S Spitz GmbH

- Red Bull GmbH

- Applied Nutrition Ltd

- Ghost Beverages LLC

- ZOA Energy LL

- Yeni Magazacilik Anonim Sirketi

- Anheuser-Busch InBev SA/NV

- Vital Pharmaceuticals Inc

- Congo Brands

- Sapporo Holdings Limited

- Abuljadayel Beverages Industries Llc

- Buffalo energy drinks GmbH

Key Milestones in Middle East Energy Drinks Market Industry

- 2023-2024: Continued expansion of sugar-free and low-calorie options by major international brands, reflecting the increasing health consciousness of consumers. Strategic partnerships with regional distributors and retailers expand market reach.

- Ongoing Trend: Innovation in flavors and functional ingredients, aiming to cater to evolving taste preferences and consumer demand for added benefits beyond simple energy boosts.

- Emerging Trend: Increased focus on sustainable packaging solutions to address environmental concerns and align with global sustainability initiatives.

Strategic Outlook for Middle East Energy Drinks Market Market

The Middle East energy drinks market exhibits strong growth potential, driven by increasing demand for healthier and innovative options. Strategic opportunities include focusing on product diversification, leveraging digital marketing, and forging strategic partnerships to expand market reach. Companies that successfully adapt to evolving consumer preferences and navigate regulatory landscapes will secure a competitive advantage and capitalize on the region's significant growth potential.

Middle East Energy Drinks Market Segmentation

-

1. Soft Drink Type

- 1.1. Energy Shots

- 1.2. Natural/Organic Energy Drinks

- 1.3. Sugar-free or Low-calories Energy Drinks

- 1.4. Traditional Energy Drinks

- 1.5. Other Energy Drinks

-

2. Packaging Type

- 2.1. Glass Bottles

- 2.2. Metal Can

- 2.3. PET Bottles

-

3. Distribution Channel

-

3.1. Off-trade

- 3.1.1. Convenience Stores

- 3.1.2. Online Retail

- 3.1.3. Supermarket/Hypermarket

- 3.1.4. Others

- 3.2. On-trade

-

3.1. Off-trade

Middle East Energy Drinks Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Energy Drinks Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin

- 3.3. Market Restrains

- 3.3.1. Low Stability of Riboflavin on Exposure to Light and Heat

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Energy Drinks Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 5.1.1. Energy Shots

- 5.1.2. Natural/Organic Energy Drinks

- 5.1.3. Sugar-free or Low-calories Energy Drinks

- 5.1.4. Traditional Energy Drinks

- 5.1.5. Other Energy Drinks

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Glass Bottles

- 5.2.2. Metal Can

- 5.2.3. PET Bottles

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Off-trade

- 5.3.1.1. Convenience Stores

- 5.3.1.2. Online Retail

- 5.3.1.3. Supermarket/Hypermarket

- 5.3.1.4. Others

- 5.3.2. On-trade

- 5.3.1. Off-trade

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 6. United Arab Emirates Middle East Energy Drinks Market Analysis, Insights and Forecast, 2019-2031

- 7. Saudi Arabia Middle East Energy Drinks Market Analysis, Insights and Forecast, 2019-2031

- 8. Qatar Middle East Energy Drinks Market Analysis, Insights and Forecast, 2019-2031

- 9. Israel Middle East Energy Drinks Market Analysis, Insights and Forecast, 2019-2031

- 10. Egypt Middle East Energy Drinks Market Analysis, Insights and Forecast, 2019-2031

- 11. Oman Middle East Energy Drinks Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Middle East Middle East Energy Drinks Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Monster Beverage Corporation

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 PepsiCo Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Mahmood Saeed Group of Companies

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 S Spitz GmbH

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Red Bull GmbH

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Applied Nutrition Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Ghost Beverages LLC

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 ZOA Energy LL

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Yeni Magazacilik Anonim Sirketi

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Anheuser-Busch InBev SA/NV

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Vital Pharmaceuticals Inc

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Congo Brands

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Sapporo Holdings Limited

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Abuljadayel Beverages Industries Llc

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Buffalo energy drinks GmbH

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.1 Monster Beverage Corporation

List of Figures

- Figure 1: Middle East Energy Drinks Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East Energy Drinks Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East Energy Drinks Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East Energy Drinks Market Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 3: Middle East Energy Drinks Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 4: Middle East Energy Drinks Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Middle East Energy Drinks Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Middle East Energy Drinks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United Arab Emirates Middle East Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Saudi Arabia Middle East Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Qatar Middle East Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Israel Middle East Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Egypt Middle East Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Oman Middle East Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Middle East Middle East Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Middle East Energy Drinks Market Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 15: Middle East Energy Drinks Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 16: Middle East Energy Drinks Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 17: Middle East Energy Drinks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Saudi Arabia Middle East Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: United Arab Emirates Middle East Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Israel Middle East Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Qatar Middle East Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Kuwait Middle East Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Oman Middle East Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Bahrain Middle East Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Jordan Middle East Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Lebanon Middle East Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Energy Drinks Market?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the Middle East Energy Drinks Market?

Key companies in the market include Monster Beverage Corporation, PepsiCo Inc, Mahmood Saeed Group of Companies, S Spitz GmbH, Red Bull GmbH, Applied Nutrition Ltd, Ghost Beverages LLC, ZOA Energy LL, Yeni Magazacilik Anonim Sirketi, Anheuser-Busch InBev SA/NV, Vital Pharmaceuticals Inc, Congo Brands, Sapporo Holdings Limited, Abuljadayel Beverages Industries Llc, Buffalo energy drinks GmbH.

3. What are the main segments of the Middle East Energy Drinks Market?

The market segments include Soft Drink Type, Packaging Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Low Stability of Riboflavin on Exposure to Light and Heat.

8. Can you provide examples of recent developments in the market?

January 2023: Monster Energy launched Monster Energy Zero Sugar, which is primed with 160 mg of caffeine. The launch was projected to tap a new consumer base that prefers sugar-free energy drinks. These products are available across retail channels of Saudi Arabia and United Arab Emirates.March 2022: RedBull GmBH introduced a new energy drink, i.e., Apricot-Strawberry flavor with a zero-sugar option, in order to cater to the consumers preferring sugar-free drinks in the Saudi Arabian Market.January 2022: In a move to diversify its product portfolio, PepsiCo introduced "Rockstar Energy," a line of hemp-based energy drinks in the Middle East. This new lineup, available in three flavors, claims a lower caffeine content than other Rockstar offerings. Each 12-ounce can of Rockstar Energy packs 80 mg of caffeine.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Energy Drinks Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Energy Drinks Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Energy Drinks Market?

To stay informed about further developments, trends, and reports in the Middle East Energy Drinks Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence