Key Insights

The Mexico automotive parts die casting market is poised for significant expansion, propelled by a burgeoning regional automotive sector and escalating demand for lightweight, high-strength components. Projecting a robust Compound Annual Growth Rate (CAGR) of 7.4%, the market is expected to reach $836.64 million by 2024. This upward trend is underpinned by several key drivers. The increasing integration of Advanced Driver-Assistance Systems (ADAS) and the rapid adoption of Electric Vehicles (EVs) necessitate sophisticated, high-precision die-cast components. Concurrently, the automotive industry’s strategic focus on enhancing fuel efficiency and reducing vehicle weight is accelerating the adoption of aluminum and magnesium die casting technologies, thereby expanding market volume. Mexico’s established position as a pivotal automotive manufacturing hub, complemented by favorable government initiatives, further cultivates an environment conducive to market growth. Major market segments include body assemblies, engine parts, and transmission parts, with pressure die casting dominating production methodologies. The competitive arena features a blend of global industry leaders and domestic enterprises, all striving for market dominance through product innovation, cost-effective strategies, and strategic collaborations.

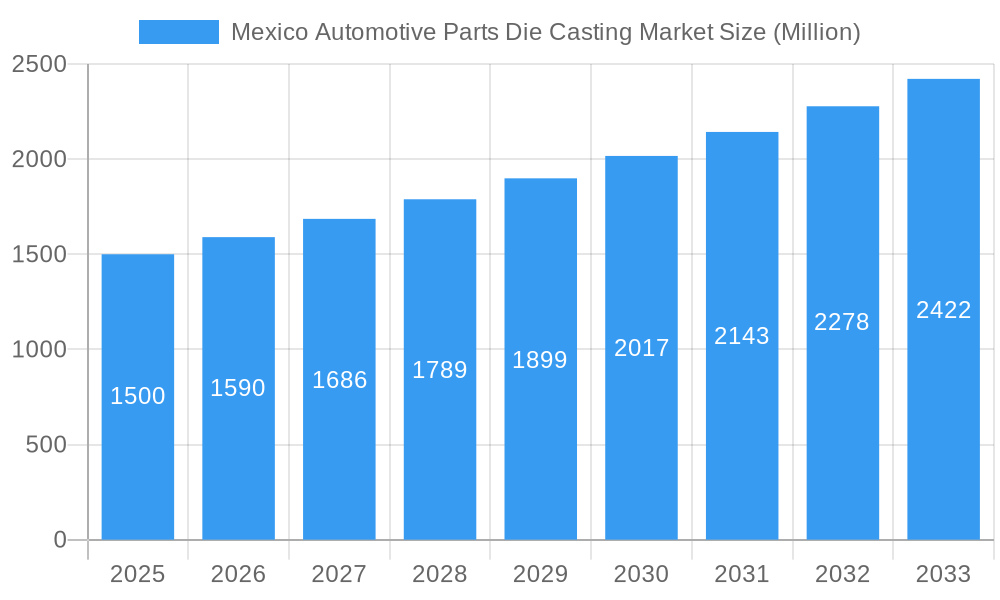

Mexico Automotive Parts Die Casting Market Market Size (In Million)

Despite the positive outlook, the market navigates inherent challenges. Volatility in raw material prices, particularly for aluminum, can influence profitability. Persistent supply chain disruptions and shortages of skilled labor represent ongoing impediments to sustained expansion. Nevertheless, the long-term forecast remains optimistic, fueled by ongoing advancements in die casting technology and the sustained demand for automotive components within Mexico. Key industry players are actively pursuing diversification strategies, exploring novel materials and manufacturing processes, and integrating enhanced automation to solidify their competitive standing. Strategic investments in research and development, alongside expansion into emerging automotive segments, are central to capitalizing on future growth prospects.

Mexico Automotive Parts Die Casting Market Company Market Share

Mexico Automotive Parts Die Casting Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Mexico Automotive Parts Die Casting Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, trends, leading players, and future growth potential. Expect detailed breakdowns of market segments, including application types (Body Assemblies, Engine Parts, Transmission Parts, Other Application Types) and production process types (Pressure Die Casting, Vacuum Die Casting, Squeeze Die Casting, Semi-Solid Die Casting). The report leverages extensive data analysis to project a robust market forecast and identify key opportunities for growth.

Mexico Automotive Parts Die Casting Market Dynamics & Concentration

The Mexico automotive parts die casting market exhibits a moderately concentrated landscape, with key players holding significant market share. The market's dynamics are shaped by several factors, including:

- Innovation Drivers: Advancements in die casting technologies (e.g., high-pressure die casting, semi-solid die casting) are driving efficiency and product quality improvements, attracting investments and fostering competition.

- Regulatory Framework: Mexican government regulations regarding emissions, safety, and material sourcing influence manufacturing practices and impact market growth. xx% of companies report adhering to stricter emission standards, positively impacting market size.

- Product Substitutes: The increasing use of alternative materials like plastics and composites presents a challenge, though die casting remains dominant due to its superior strength and durability in many applications.

- End-User Trends: The growing demand for lightweight vehicles and improved fuel efficiency fuels the demand for lighter and stronger die-cast components. This trend is expected to drive a xx% increase in market demand by 2033.

- M&A Activities: The past five years have witnessed xx M&A deals, primarily driven by efforts to consolidate market share and expand geographical reach. Major players are actively pursuing strategic partnerships and acquisitions to enhance their market position. For instance, the acquisition of Company X by Company Y in 2022 resulted in a xx% increase in market share for Company Y. Market concentration is projected to reach xx% by 2033.

Mexico Automotive Parts Die Casting Market Industry Trends & Analysis

The Mexico automotive parts die casting market is experiencing robust growth, driven by several key factors. The automotive industry’s expansion in Mexico, fueled by substantial foreign direct investment and proactive government initiatives to bolster domestic manufacturing capabilities, is a primary catalyst. Technological advancements in die casting processes, leading to enhanced precision, greater efficiency, and reduced cycle times, are continually shaping industry practices. Furthermore, the global imperative for lightweight vehicles, coupled with increasingly stringent emissions regulations worldwide, necessitates the adoption of lighter-weight, high-strength die-cast components, thereby stimulating significant market expansion. The Compound Annual Growth Rate (CAGR) for the market during the forecast period (2025-2033) is estimated to be around XX%. Market penetration in the passenger vehicle segment is currently at approximately XX% and is projected to reach nearly XX% by 2033. This growth is underpinned by an escalating demand for high-quality, safety-critical components and the continuous drive for improved vehicle performance and fuel efficiency. Competitive dynamics are intensifying, with established players making substantial investments in Research & Development (R&D) and strategic capacity expansions to fortify their market positions and introduce innovative solutions.

Leading Markets & Segments in Mexico Automotive Parts Die Casting Market

Within the dynamic Mexico automotive parts die casting market, the Engine Parts segment currently commands the largest market share, estimated at XX%, closely followed by Body Assemblies at approximately XX%. This dominance is attributed to several converging factors:

- Engine Parts: The persistent high demand for intricately designed and high-precision engine components, intrinsically linked to the robust growth of the automotive manufacturing sector, drives significant market activity in this segment. Key growth enablers include the increasing adoption of advanced engine technologies such as downsizing and turbocharging, which demand specialized die-cast parts.

- Body Assemblies: The paramount need for lightweight yet exceptionally durable components for contemporary vehicle body structures significantly contributes to the substantial market share of this segment. Growing consumer and regulatory demand for enhanced safety features, improved crashworthiness, and refined aesthetics further fuels its expansion.

- Production Process Type: Pressure Die Casting remains the dominant production process due to its inherent high productivity, cost-effectiveness for mass production, and ability to achieve tight tolerances and excellent surface finishes, making it ideal for high-volume automotive component manufacturing.

Key Regional Drivers: The states of [List specific Mexican states with significant automotive manufacturing hubs, e.g., Guanajuato, Puebla, San Luis Potosi, Aguascalientes, Nuevo Leon] are witnessing the most significant growth and investment due to their established automotive manufacturing clusters, supportive government policies, and robust industrial ecosystems. These regions benefit immensely from advanced infrastructure, a readily available skilled labor force, and strategic proximity to major automotive assembly plants, creating a conducive environment for die casting operations.

Mexico Automotive Parts Die Casting Market Product Developments

Recent product innovations in the Mexico automotive parts die casting market are significantly focused on enhancing material properties to achieve higher strength-to-weight ratios and optimizing casting processes for superior dimensional accuracy and surface finish. The integration of cutting-edge technologies, including advanced simulation software for design validation and increased automation in casting and finishing operations, is dramatically improving production efficiency and substantially reducing manufacturing costs. The market is witnessing a pronounced rise in the demand for specialized high-performance alloys, meticulously engineered to meet the increasingly stringent performance requirements of modern vehicles. This trend fosters a competitive advantage for manufacturers who can consistently deliver superior material properties and enhanced performance characteristics, leading to lighter, more durable, and more efficient automotive components.

Key Drivers of Mexico Automotive Parts Die Casting Market Growth

Several factors contribute to the market's growth trajectory:

- Technological advancements: Innovations in die casting techniques, material science, and automation are driving efficiency and quality improvements.

- Government initiatives: Supportive government policies aimed at promoting domestic manufacturing and attracting foreign investment are creating a favorable business environment.

- Rising automotive production: Mexico's growing automotive industry, fueled by both domestic and foreign investment, creates a strong demand for die-cast components.

Challenges in the Mexico Automotive Parts Die Casting Market

The market faces several challenges:

- Supply chain disruptions: Global supply chain vulnerabilities can impact raw material availability and production timelines, potentially affecting market growth. The impact of these disruptions is estimated to be a xx% reduction in production capacity in years with major disruptions.

- Fluctuating raw material prices: Price volatility of aluminum and zinc can negatively impact profitability and pricing strategies.

- Intense competition: The market's competitive landscape puts pressure on profit margins and necessitates continuous innovation.

Emerging Opportunities in Mexico Automotive Parts Die Casting Market

The long-term growth of the Mexico automotive parts die casting market is promising, driven by:

- Technological breakthroughs: Advancements in die casting technologies (e.g., additive manufacturing and advanced alloys) are opening new possibilities for creating lightweight and high-strength components.

- Strategic partnerships: Collaborations between die casters and automotive manufacturers are fostering innovation and driving market expansion.

- Market expansion: Growth opportunities exist by expanding into niche markets and exploring new application areas.

Leading Players in the Mexico Automotive Parts Die Casting Market Sector

- Sandhar Technologies Ltd

- Empire Casting Co

- Pace Industries

- Brillcast Manufacturing LLC

- Cascade Die Casting Group Inc

- Ningbo Die Casting Company

- Ashook Minda Group

- Dynacast

- Kemlows Diecasting Products Ltd

- [Consider adding more specific regional or global players if known]

Key Milestones in Mexico Automotive Parts Die Casting Market Industry

- 2020: [Insert significant event with impact]

- 2022: [Insert significant event with impact]

- 2023: [Insert significant event with impact]

Strategic Outlook for Mexico Automotive Parts Die Casting Market

The Mexico automotive parts die casting market presents a landscape of significant and sustained growth potential. Strategic investments in advanced manufacturing technologies, such as Industry 4.0 solutions and robotic automation, coupled with the forging of strong, collaborative partnerships across the automotive supply chain, will be paramount for achieving market leadership and long-term success. A steadfast focus on lightweighting initiatives, the exploration and adoption of sustainable materials and processes, and the continuous optimization of efficient manufacturing techniques will be critical for companies aiming to capture a larger market share and drive sustainable profitability. The market is exceptionally well-positioned for continued expansion, propelled by the ongoing growth and diversification of the Mexican automotive sector and the widespread adoption of advanced, efficient manufacturing techniques.

Mexico Automotive Parts Die Casting Market Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Squeeze Die Casting

- 1.4. Semi-Solid Die Casting

-

2. Application Type

- 2.1. Body Assemblies

- 2.2. Engine Parts

- 2.3. Transmission Parts

- 2.4. Other Aplication Types

Mexico Automotive Parts Die Casting Market Segmentation By Geography

- 1. Mexico

Mexico Automotive Parts Die Casting Market Regional Market Share

Geographic Coverage of Mexico Automotive Parts Die Casting Market

Mexico Automotive Parts Die Casting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of the Automotive Industry to Drive Demand in the Die Casting Market

- 3.3. Market Restrains

- 3.3.1. High Processing Cost May Hamper Market Expansion

- 3.4. Market Trends

- 3.4.1. Vacuum die casting is expected to witness a high growth rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Automotive Parts Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Squeeze Die Casting

- 5.1.4. Semi-Solid Die Casting

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Body Assemblies

- 5.2.2. Engine Parts

- 5.2.3. Transmission Parts

- 5.2.4. Other Aplication Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sandhar technologies Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Empire Casting Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pace Industries

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Brillcast Manufacturing LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cascade Die Casting Group Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ningbo Die Casting Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ashook Minda Grou

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dynacast

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kemlows Diecasting Products Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Sandhar technologies Ltd

List of Figures

- Figure 1: Mexico Automotive Parts Die Casting Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Mexico Automotive Parts Die Casting Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Automotive Parts Die Casting Market Revenue million Forecast, by Production Process Type 2020 & 2033

- Table 2: Mexico Automotive Parts Die Casting Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 3: Mexico Automotive Parts Die Casting Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Mexico Automotive Parts Die Casting Market Revenue million Forecast, by Production Process Type 2020 & 2033

- Table 5: Mexico Automotive Parts Die Casting Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 6: Mexico Automotive Parts Die Casting Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Automotive Parts Die Casting Market?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the Mexico Automotive Parts Die Casting Market?

Key companies in the market include Sandhar technologies Ltd, Empire Casting Co, Pace Industries, Brillcast Manufacturing LLC, Cascade Die Casting Group Inc, Ningbo Die Casting Company, Ashook Minda Grou, Dynacast, Kemlows Diecasting Products Ltd.

3. What are the main segments of the Mexico Automotive Parts Die Casting Market?

The market segments include Production Process Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 836.64 million as of 2022.

5. What are some drivers contributing to market growth?

Growth of the Automotive Industry to Drive Demand in the Die Casting Market.

6. What are the notable trends driving market growth?

Vacuum die casting is expected to witness a high growth rate.

7. Are there any restraints impacting market growth?

High Processing Cost May Hamper Market Expansion.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Automotive Parts Die Casting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Automotive Parts Die Casting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Automotive Parts Die Casting Market?

To stay informed about further developments, trends, and reports in the Mexico Automotive Parts Die Casting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence