Key Insights

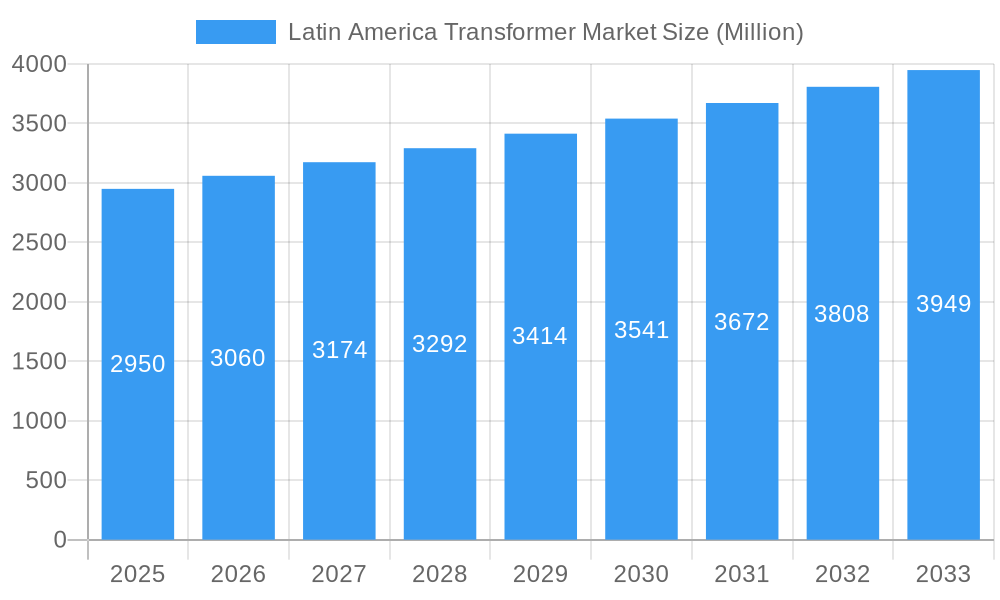

The Latin American transformer market, valued at $2.95 billion in 2025, is projected to experience steady growth, driven by robust infrastructure development, expanding electricity grids, and increasing industrialization across the region. Brazil, Mexico, and Argentina are key contributors to this market, fueled by government initiatives promoting renewable energy integration and upgrading aging power infrastructure. The market is segmented by transformer type (power, distribution), power rating (large, medium, small), cooling type (air-cooled, oil-cooled), and phase (single, three-phase). Growth is particularly notable in the power transformer segment, driven by large-scale energy projects and the increasing demand for reliable power transmission. The distribution transformer segment is also experiencing expansion, fueled by rural electrification projects and the growth of smart grids. While challenges exist, such as economic fluctuations in certain countries and potential supply chain disruptions, the long-term outlook for the Latin American transformer market remains positive, with a projected Compound Annual Growth Rate (CAGR) of 3.6% from 2025 to 2033. This growth is further supported by increasing investments in renewable energy sources, like solar and wind power, which require efficient transformer technologies for grid integration. The adoption of advanced cooling technologies and smart grid infrastructure will also contribute to the market's expansion.

Latin America Transformer Market Market Size (In Billion)

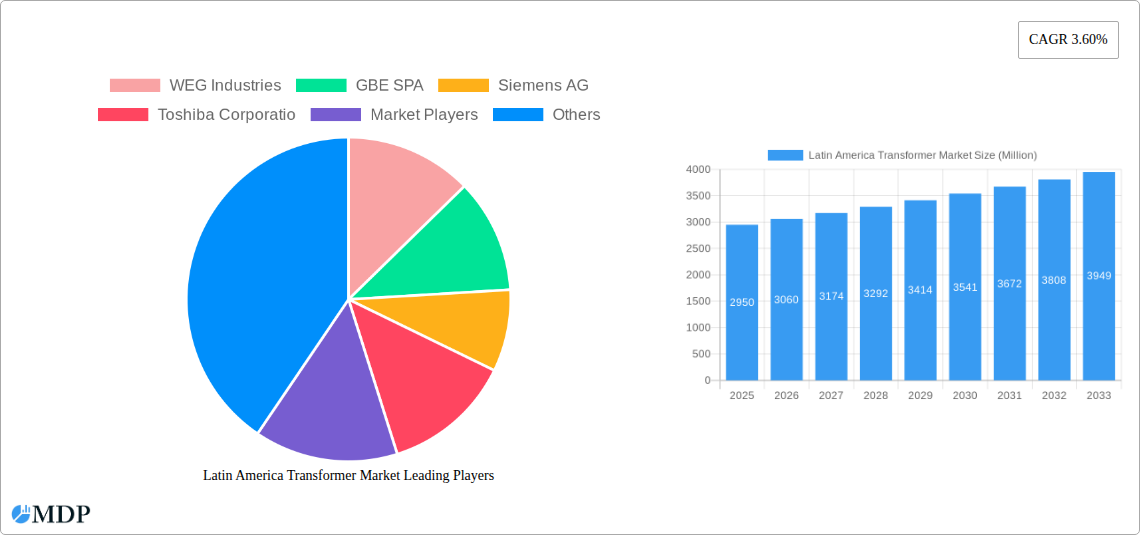

The competitive landscape is characterized by a mix of global and regional players, including WEG Industries, GBE SPA, Siemens AG, Toshiba Corporation, General Electric Company, Hyosung Corporation, Eaton Corporation PLC, Schneider Electric SE, and Hitachi Energy Ltd. These companies are focusing on product innovation, strategic partnerships, and expansion into key markets to capture a larger share of the growing market. The rising demand for energy-efficient transformers and the need for robust grid infrastructure will continue to shape the market dynamics in the coming years, creating opportunities for both established players and new entrants. Successful players will likely be those that can adapt to evolving regulatory landscapes, offer customized solutions, and effectively manage supply chain risks.

Latin America Transformer Market Company Market Share

Uncover lucrative opportunities in the booming Latin America transformer market with our comprehensive report. This in-depth analysis provides a detailed overview of market dynamics, industry trends, leading players, and future growth prospects, covering the period 2019-2033. Our report uses 2025 as the base year and offers forecasts up to 2033, providing crucial insights for strategic decision-making. Maximize your investment potential with data-driven predictions and actionable intelligence.

Latin America Transformer Market Market Dynamics & Concentration

The Latin America transformer market exhibits a moderately concentrated landscape, with key players like WEG Industries, GBE SPA, Siemens AG, Toshiba Corporation, General Electric Company, Hyosung Corporation, Eaton Corporation PLC, Schneider Electric SE, and Hitachi Energy Ltd. holding significant market share. However, the presence of numerous regional and smaller players indicates a competitive environment. Market share fluctuations are influenced by factors such as technological advancements, M&A activity, and government regulations. Innovation drivers, including the integration of smart grid technologies and the rising demand for energy-efficient transformers, are reshaping the market. Regulatory frameworks, including energy efficiency standards and grid modernization initiatives, significantly impact market growth. Product substitutes, while limited, include alternative energy solutions and energy storage systems, presenting a minor competitive threat. End-user trends, particularly the expanding industrial and renewable energy sectors, are driving demand. The number of M&A deals in the last five years has been approximately xx, indicating a moderate level of consolidation.

- Market Concentration: Moderately Concentrated

- M&A Deal Count (2019-2024): xx

- Key Innovation Drivers: Smart grid technologies, energy efficiency standards

- Regulatory Influence: Strong impact from energy efficiency standards and grid modernization initiatives.

Latin America Transformer Market Industry Trends & Analysis

The Latin America transformer market is experiencing robust growth, driven by sustained infrastructure development, increasing urbanization, and the expansion of renewable energy sources. The Compound Annual Growth Rate (CAGR) for the period 2019-2024 is estimated at xx%, while the forecast CAGR for 2025-2033 is projected at xx%. Technological disruptions, such as the adoption of digitalization and smart grid technologies, are reshaping the industry. Consumer preferences increasingly favor energy-efficient and reliable transformers. Competitive dynamics are marked by both local and international players vying for market share, leading to intense competition, particularly in the distribution transformer segment. Market penetration of smart transformers is still relatively low (xx%) but expected to increase significantly in the forecast period.

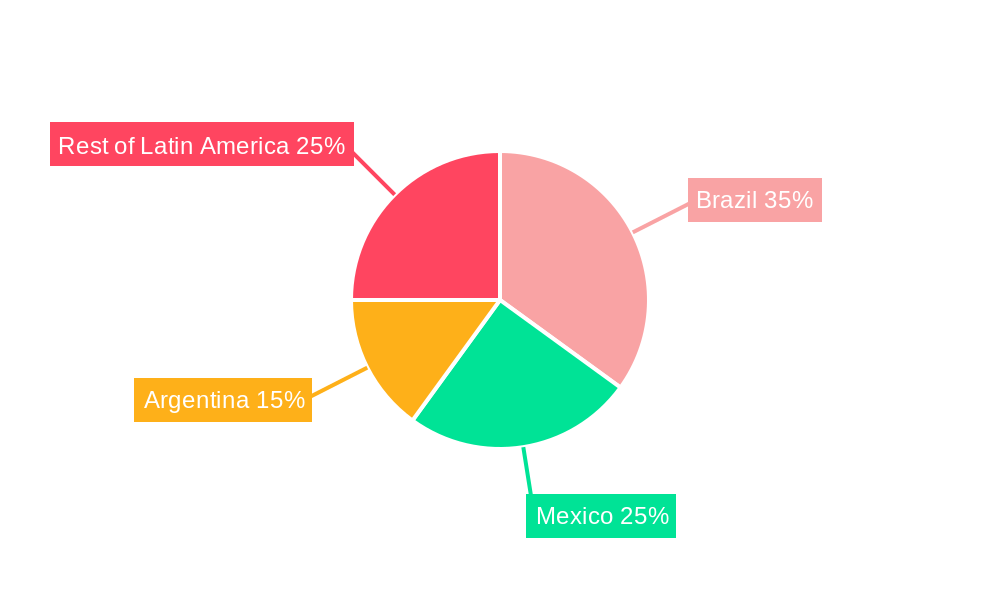

Leading Markets & Segments in Latin America Transformer Market

The Brazilian market holds the dominant position in the Latin America transformer market, owing to its robust industrial base and significant investments in infrastructure development. Mexico also represents a major market, driven by strong economic growth and increasing energy demands.

Dominant Region: Brazil

Key Segment Drivers:

- Power Transformer: Driven by large-scale power generation projects and grid expansion initiatives.

- Distribution Transformer: Fueled by rising urbanization and electrification needs.

- Large Power Rating: Dominated by industrial and utility-scale applications.

- Air-cooled Transformer: Cost-effectiveness and ease of maintenance contribute to market dominance.

- Three-Phase Transformer: Widely used in industrial and utility applications.

Brazil's dominance stems from substantial investments in renewable energy projects, coupled with government initiatives to modernize the national grid. Mexico benefits from increased industrial activity and a growing population, both driving demand for transformers. Chile's substantial investments in renewable energy, particularly solar and wind power, are contributing to its growth in the market.

Latin America Transformer Market Product Developments

Recent product innovations focus on increasing efficiency, incorporating smart grid technologies, and enhancing reliability. Manufacturers are integrating advanced sensors and communication technologies to enable real-time monitoring and predictive maintenance. These innovations improve grid management and reduce operational costs, providing significant competitive advantages. The market is witnessing a shift toward compact and modular transformer designs to optimize space and installation costs.

Key Drivers of Latin America Transformer Market Growth

Several key factors drive the growth of the Latin America transformer market. Firstly, substantial investments in infrastructure projects across the region are creating significant demand for transformers. Secondly, the expansion of renewable energy sources, including solar, wind, and hydropower, is driving the need for new grid infrastructure and related transformers. Thirdly, government initiatives promoting energy efficiency and grid modernization are further stimulating market growth. These initiatives include incentives for renewable energy adoption and standards for energy-efficient transformers.

Challenges in the Latin America Transformer Market Market

The Latin America transformer market faces challenges such as fluctuating exchange rates which affect the cost of imported components, creating price volatility and potentially impacting project timelines. Supply chain disruptions can lead to project delays and increased costs. Furthermore, intense competition from both domestic and international players can put downward pressure on prices and profit margins. Regulatory hurdles, including bureaucratic processes and permit approvals, can also hinder market development.

Emerging Opportunities in Latin America Transformer Market

Significant opportunities exist for market expansion through strategic partnerships and the adoption of innovative technologies. The increasing adoption of smart grid technologies and the growth of renewable energy sources create significant long-term growth potential. Moreover, the focus on improving grid reliability and enhancing energy efficiency across the region presents opportunities for companies offering advanced solutions.

Leading Players in the Latin America Transformer Market Sector

- WEG Industries (WEG Industries)

- GBE SPA

- Siemens AG (Siemens AG)

- Toshiba Corporation (Toshiba Corporation)

- General Electric Company (General Electric Company)

- Hyosung Corporation (Hyosung Corporation)

- Eaton Corporation PLC (Eaton Corporation PLC)

- Schneider Electric SE (Schneider Electric SE)

- Hitachi Energy Ltd (Hitachi Energy Ltd)

Key Milestones in Latin America Transformer Market Industry

- November 2023: Hitachi Energy Ltd. expands its transformer manufacturing facility in Colombia, signaling increased investment in the Latin American market. This expansion significantly boosts the region's production capacity and strengthens Hitachi Energy's position within the market.

- October 2023: Prolec's partnership with Ubicquia to develop a fully integrated smart transformer highlights the increasing focus on smart grid technologies and advanced monitoring capabilities within the Latin American transformer market. This partnership signals a shift towards more advanced and efficient transformer technologies.

Strategic Outlook for Latin America Transformer Market Market

The Latin America transformer market is poised for sustained growth, driven by a combination of factors including robust infrastructure development, increasing energy demands, and a growing emphasis on renewable energy integration. Strategic partnerships, technological advancements, and government support will continue to play a vital role in shaping the future market landscape. The focus on smart grid technologies and energy efficiency presents immense opportunities for companies to capture significant market share.

Latin America Transformer Market Segmentation

-

1. Power Rating Type

- 1.1. Large

- 1.2. Medium

- 1.3. Small

-

2. Cooling Type

- 2.1. Air-cooled

- 2.2. Oil-cooled

- 2.3. Other Cooling Types

-

3. Phase

- 3.1. Single Phase

- 3.2. Three Phase

-

4. Transformer Type

- 4.1. Power Transformer

- 4.2. Distribution Transformer

-

5. Geography

- 5.1. Argentina

- 5.2. Brazil

- 5.3. Chile

- 5.4. Mexico

- 5.5. Colombia

- 5.6. Rest of Latin America

Latin America Transformer Market Segmentation By Geography

- 1. Argentina

- 2. Brazil

- 3. Chile

- 4. Mexico

- 5. Colombia

- 6. Rest of Latin America

Latin America Transformer Market Regional Market Share

Geographic Coverage of Latin America Transformer Market

Latin America Transformer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Electricity Demand and Grid Upgradation4.; Increasing Penetration of Renewable Energy Sources in the Energy Mix

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Emphasis on Off-grid Distributed Energy Generation

- 3.4. Market Trends

- 3.4.1. Air-cooled Segment is Expected to Witness Significant Growth during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Transformer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Power Rating Type

- 5.1.1. Large

- 5.1.2. Medium

- 5.1.3. Small

- 5.2. Market Analysis, Insights and Forecast - by Cooling Type

- 5.2.1. Air-cooled

- 5.2.2. Oil-cooled

- 5.2.3. Other Cooling Types

- 5.3. Market Analysis, Insights and Forecast - by Phase

- 5.3.1. Single Phase

- 5.3.2. Three Phase

- 5.4. Market Analysis, Insights and Forecast - by Transformer Type

- 5.4.1. Power Transformer

- 5.4.2. Distribution Transformer

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. Argentina

- 5.5.2. Brazil

- 5.5.3. Chile

- 5.5.4. Mexico

- 5.5.5. Colombia

- 5.5.6. Rest of Latin America

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Argentina

- 5.6.2. Brazil

- 5.6.3. Chile

- 5.6.4. Mexico

- 5.6.5. Colombia

- 5.6.6. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Power Rating Type

- 6. Argentina Latin America Transformer Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Power Rating Type

- 6.1.1. Large

- 6.1.2. Medium

- 6.1.3. Small

- 6.2. Market Analysis, Insights and Forecast - by Cooling Type

- 6.2.1. Air-cooled

- 6.2.2. Oil-cooled

- 6.2.3. Other Cooling Types

- 6.3. Market Analysis, Insights and Forecast - by Phase

- 6.3.1. Single Phase

- 6.3.2. Three Phase

- 6.4. Market Analysis, Insights and Forecast - by Transformer Type

- 6.4.1. Power Transformer

- 6.4.2. Distribution Transformer

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. Argentina

- 6.5.2. Brazil

- 6.5.3. Chile

- 6.5.4. Mexico

- 6.5.5. Colombia

- 6.5.6. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Power Rating Type

- 7. Brazil Latin America Transformer Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Power Rating Type

- 7.1.1. Large

- 7.1.2. Medium

- 7.1.3. Small

- 7.2. Market Analysis, Insights and Forecast - by Cooling Type

- 7.2.1. Air-cooled

- 7.2.2. Oil-cooled

- 7.2.3. Other Cooling Types

- 7.3. Market Analysis, Insights and Forecast - by Phase

- 7.3.1. Single Phase

- 7.3.2. Three Phase

- 7.4. Market Analysis, Insights and Forecast - by Transformer Type

- 7.4.1. Power Transformer

- 7.4.2. Distribution Transformer

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. Argentina

- 7.5.2. Brazil

- 7.5.3. Chile

- 7.5.4. Mexico

- 7.5.5. Colombia

- 7.5.6. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Power Rating Type

- 8. Chile Latin America Transformer Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Power Rating Type

- 8.1.1. Large

- 8.1.2. Medium

- 8.1.3. Small

- 8.2. Market Analysis, Insights and Forecast - by Cooling Type

- 8.2.1. Air-cooled

- 8.2.2. Oil-cooled

- 8.2.3. Other Cooling Types

- 8.3. Market Analysis, Insights and Forecast - by Phase

- 8.3.1. Single Phase

- 8.3.2. Three Phase

- 8.4. Market Analysis, Insights and Forecast - by Transformer Type

- 8.4.1. Power Transformer

- 8.4.2. Distribution Transformer

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. Argentina

- 8.5.2. Brazil

- 8.5.3. Chile

- 8.5.4. Mexico

- 8.5.5. Colombia

- 8.5.6. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Power Rating Type

- 9. Mexico Latin America Transformer Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Power Rating Type

- 9.1.1. Large

- 9.1.2. Medium

- 9.1.3. Small

- 9.2. Market Analysis, Insights and Forecast - by Cooling Type

- 9.2.1. Air-cooled

- 9.2.2. Oil-cooled

- 9.2.3. Other Cooling Types

- 9.3. Market Analysis, Insights and Forecast - by Phase

- 9.3.1. Single Phase

- 9.3.2. Three Phase

- 9.4. Market Analysis, Insights and Forecast - by Transformer Type

- 9.4.1. Power Transformer

- 9.4.2. Distribution Transformer

- 9.5. Market Analysis, Insights and Forecast - by Geography

- 9.5.1. Argentina

- 9.5.2. Brazil

- 9.5.3. Chile

- 9.5.4. Mexico

- 9.5.5. Colombia

- 9.5.6. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Power Rating Type

- 10. Colombia Latin America Transformer Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Power Rating Type

- 10.1.1. Large

- 10.1.2. Medium

- 10.1.3. Small

- 10.2. Market Analysis, Insights and Forecast - by Cooling Type

- 10.2.1. Air-cooled

- 10.2.2. Oil-cooled

- 10.2.3. Other Cooling Types

- 10.3. Market Analysis, Insights and Forecast - by Phase

- 10.3.1. Single Phase

- 10.3.2. Three Phase

- 10.4. Market Analysis, Insights and Forecast - by Transformer Type

- 10.4.1. Power Transformer

- 10.4.2. Distribution Transformer

- 10.5. Market Analysis, Insights and Forecast - by Geography

- 10.5.1. Argentina

- 10.5.2. Brazil

- 10.5.3. Chile

- 10.5.4. Mexico

- 10.5.5. Colombia

- 10.5.6. Rest of Latin America

- 10.1. Market Analysis, Insights and Forecast - by Power Rating Type

- 11. Rest of Latin America Latin America Transformer Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Power Rating Type

- 11.1.1. Large

- 11.1.2. Medium

- 11.1.3. Small

- 11.2. Market Analysis, Insights and Forecast - by Cooling Type

- 11.2.1. Air-cooled

- 11.2.2. Oil-cooled

- 11.2.3. Other Cooling Types

- 11.3. Market Analysis, Insights and Forecast - by Phase

- 11.3.1. Single Phase

- 11.3.2. Three Phase

- 11.4. Market Analysis, Insights and Forecast - by Transformer Type

- 11.4.1. Power Transformer

- 11.4.2. Distribution Transformer

- 11.5. Market Analysis, Insights and Forecast - by Geography

- 11.5.1. Argentina

- 11.5.2. Brazil

- 11.5.3. Chile

- 11.5.4. Mexico

- 11.5.5. Colombia

- 11.5.6. Rest of Latin America

- 11.1. Market Analysis, Insights and Forecast - by Power Rating Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 WEG Industries

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 GBE SPA

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Siemens AG

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Toshiba Corporatio

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Market Players

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 General Electric Company

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Hyosung Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Eaton Corporation PLC

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Schneider Electric SE

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Hitachi Energy Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 WEG Industries

List of Figures

- Figure 1: Latin America Transformer Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Transformer Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Transformer Market Revenue Million Forecast, by Power Rating Type 2020 & 2033

- Table 2: Latin America Transformer Market Revenue Million Forecast, by Cooling Type 2020 & 2033

- Table 3: Latin America Transformer Market Revenue Million Forecast, by Phase 2020 & 2033

- Table 4: Latin America Transformer Market Revenue Million Forecast, by Transformer Type 2020 & 2033

- Table 5: Latin America Transformer Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Latin America Transformer Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Latin America Transformer Market Revenue Million Forecast, by Power Rating Type 2020 & 2033

- Table 8: Latin America Transformer Market Revenue Million Forecast, by Cooling Type 2020 & 2033

- Table 9: Latin America Transformer Market Revenue Million Forecast, by Phase 2020 & 2033

- Table 10: Latin America Transformer Market Revenue Million Forecast, by Transformer Type 2020 & 2033

- Table 11: Latin America Transformer Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Latin America Transformer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Latin America Transformer Market Revenue Million Forecast, by Power Rating Type 2020 & 2033

- Table 14: Latin America Transformer Market Revenue Million Forecast, by Cooling Type 2020 & 2033

- Table 15: Latin America Transformer Market Revenue Million Forecast, by Phase 2020 & 2033

- Table 16: Latin America Transformer Market Revenue Million Forecast, by Transformer Type 2020 & 2033

- Table 17: Latin America Transformer Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Latin America Transformer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Latin America Transformer Market Revenue Million Forecast, by Power Rating Type 2020 & 2033

- Table 20: Latin America Transformer Market Revenue Million Forecast, by Cooling Type 2020 & 2033

- Table 21: Latin America Transformer Market Revenue Million Forecast, by Phase 2020 & 2033

- Table 22: Latin America Transformer Market Revenue Million Forecast, by Transformer Type 2020 & 2033

- Table 23: Latin America Transformer Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: Latin America Transformer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Latin America Transformer Market Revenue Million Forecast, by Power Rating Type 2020 & 2033

- Table 26: Latin America Transformer Market Revenue Million Forecast, by Cooling Type 2020 & 2033

- Table 27: Latin America Transformer Market Revenue Million Forecast, by Phase 2020 & 2033

- Table 28: Latin America Transformer Market Revenue Million Forecast, by Transformer Type 2020 & 2033

- Table 29: Latin America Transformer Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Latin America Transformer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Latin America Transformer Market Revenue Million Forecast, by Power Rating Type 2020 & 2033

- Table 32: Latin America Transformer Market Revenue Million Forecast, by Cooling Type 2020 & 2033

- Table 33: Latin America Transformer Market Revenue Million Forecast, by Phase 2020 & 2033

- Table 34: Latin America Transformer Market Revenue Million Forecast, by Transformer Type 2020 & 2033

- Table 35: Latin America Transformer Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 36: Latin America Transformer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Latin America Transformer Market Revenue Million Forecast, by Power Rating Type 2020 & 2033

- Table 38: Latin America Transformer Market Revenue Million Forecast, by Cooling Type 2020 & 2033

- Table 39: Latin America Transformer Market Revenue Million Forecast, by Phase 2020 & 2033

- Table 40: Latin America Transformer Market Revenue Million Forecast, by Transformer Type 2020 & 2033

- Table 41: Latin America Transformer Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 42: Latin America Transformer Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Transformer Market?

The projected CAGR is approximately 3.60%.

2. Which companies are prominent players in the Latin America Transformer Market?

Key companies in the market include WEG Industries, GBE SPA, Siemens AG, Toshiba Corporatio, Market Players, General Electric Company, Hyosung Corporation, Eaton Corporation PLC, Schneider Electric SE, Hitachi Energy Ltd.

3. What are the main segments of the Latin America Transformer Market?

The market segments include Power Rating Type, Cooling Type, Phase, Transformer Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.95 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Electricity Demand and Grid Upgradation4.; Increasing Penetration of Renewable Energy Sources in the Energy Mix.

6. What are the notable trends driving market growth?

Air-cooled Segment is Expected to Witness Significant Growth during the Forecast Period.

7. Are there any restraints impacting market growth?

4.; Rising Emphasis on Off-grid Distributed Energy Generation.

8. Can you provide examples of recent developments in the market?

November 2023: Hitachi Energy Ltd, the Japanese electrical product manufacturer and grid automation expert, in the context of its growing business in Latin America, announced its decision to expand its distribution and other types of transformer manufacturing facility situated in Risaralda Calle La Popa Industrial Zone, Dosquebradas, Colombia, for which the company held an opening ceremony.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Transformer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Transformer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Transformer Market?

To stay informed about further developments, trends, and reports in the Latin America Transformer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence