Key Insights

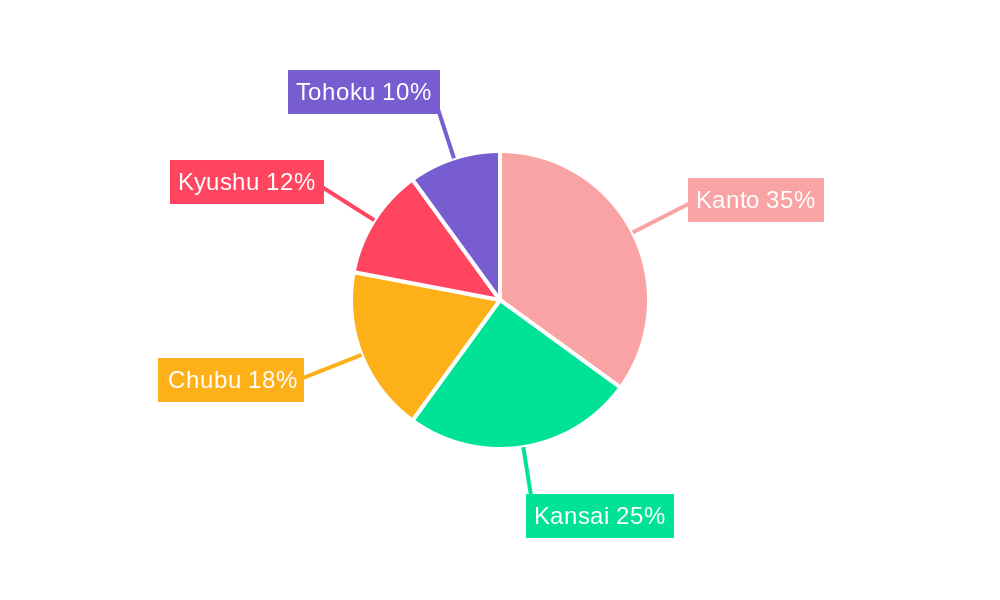

Japan's e-bike market is poised for significant expansion, driven by heightened environmental consciousness, government support for sustainable transport, and the growing need for accessible mobility solutions among the elderly. The market, valued at 3116.2 million in the base year 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.85% from 2025 to 2033. Key growth drivers include the increasing popularity of pedal-assist e-bikes for commuting and recreation, the rising demand for cargo and utility e-bikes for last-mile delivery, and the shift towards advanced lithium-ion batteries for enhanced performance. While initial costs present a challenge, government incentives and financing options are mitigating this factor. The market is segmented by propulsion type (pedal-assist, speed pedelec, throttle-assist), application (cargo/utility, city/urban, trekking), and battery technology (lead-acid, lithium-ion). Major players such as Panasonic Cycle Technology, Yamaha Bicycle, and Bridgestone Cycle are focusing on innovation and strategic alliances. Demand is concentrated in Kanto, Kansai, and Chubu regions due to population density and urban infrastructure.

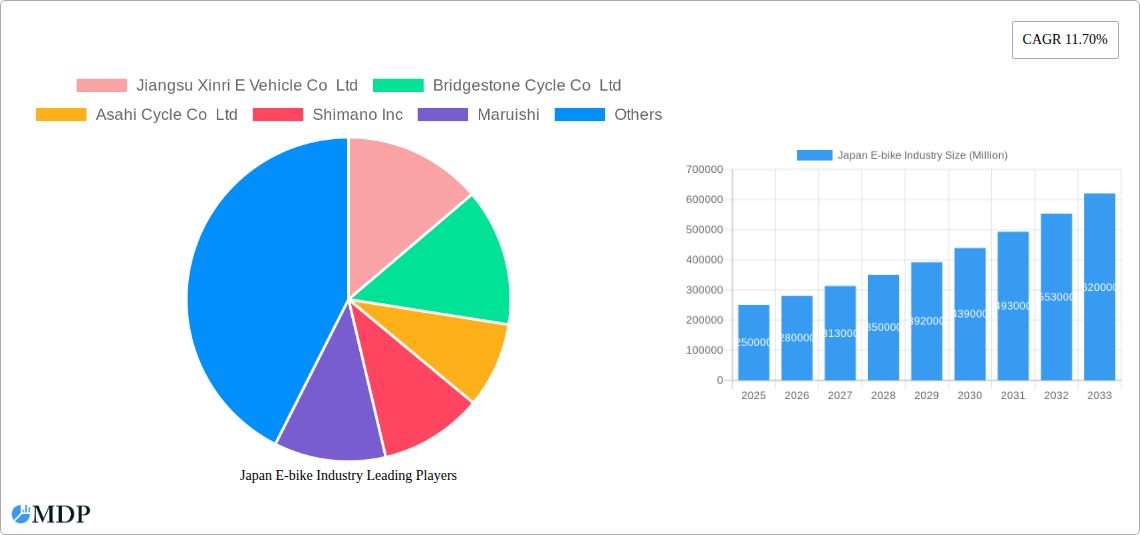

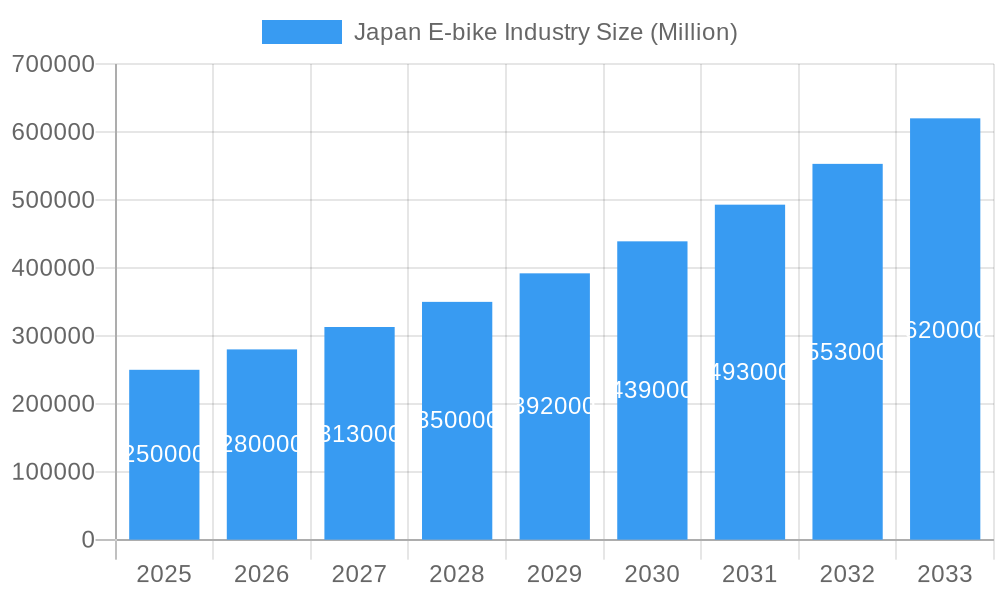

Japan E-bike Industry Market Size (In Billion)

The forecast period (2025-2033) indicates sustained growth, with the lithium-ion battery segment expected to lead due to superior performance. The expansion of e-bikes in last-mile logistics and the growth of shared e-bike services will further propel market expansion. Continuous technological advancements, including lighter frames, extended battery life, and improved safety features, are anticipated to boost market penetration. Manufacturers will increasingly compete on innovation, pricing, and after-sales support. Sustained government backing, development of charging infrastructure, and consumer education on the environmental and health benefits of e-bikes will be crucial for market success.

Japan E-bike Industry Company Market Share

Japan E-bike Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Japan e-bike industry, covering market dynamics, trends, leading players, and future growth prospects. The study period spans 2019-2033, with a focus on 2025 as the base and estimated year. This report is essential for industry stakeholders, investors, and anyone seeking a detailed understanding of this rapidly evolving market. The report projects a market value of xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx%.

Japan E-bike Industry Market Dynamics & Concentration

This section analyzes the competitive landscape of the Japanese e-bike market, examining market concentration, innovation drivers, regulatory influences, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities. The market is characterized by a mix of established global players and domestic manufacturers. Market share is currently dominated by a few key players, with the top three holding approximately xx% of the market.

- Market Concentration: High concentration with a few dominant players, resulting in intense competition.

- Innovation Drivers: Technological advancements in battery technology, motor efficiency, and smart connectivity features are driving innovation.

- Regulatory Framework: Government initiatives promoting sustainable transportation and stricter emission norms are shaping market growth.

- Product Substitutes: Competition from other forms of personal transport, such as traditional bicycles and scooters, exists, albeit with e-bikes demonstrating advantages in many use cases.

- End-User Trends: Growing preference for eco-friendly and convenient transportation options among urban commuters is significantly boosting demand.

- M&A Activity: The number of M&A deals in the sector has been relatively low in the past five years (approximately xx deals), indicating a degree of stability among the major players but with the potential for future consolidation.

Japan E-bike Industry Trends & Analysis

The Japanese e-bike market demonstrates robust growth, driven by several key factors. Increased consumer awareness of environmental concerns and the rising popularity of cycling as a form of exercise and leisure contribute significantly. Technological advancements in battery technology, leading to increased range and reduced charging times, also fuel market expansion. The rising adoption of e-bikes for commuting and delivery services, owing to their efficiency and cost-effectiveness, further propels the market's growth trajectory. The market penetration rate for e-bikes in Japan is estimated at xx% in 2025, projected to reach xx% by 2033. This translates to a significant increase in market size and an overall CAGR of xx% throughout the forecast period. Competitive dynamics are intense with established players facing challenges from newer entrants specializing in niche segments.

Leading Markets & Segments in Japan E-bike Industry

The Japanese e-bike market is segmented by propulsion type (Pedal Assisted, Speed Pedelec, Throttle Assisted), application type (Cargo/Utility, City/Urban, Trekking), and battery type (Lead Acid Battery, Lithium-ion Battery, Others). The City/Urban segment currently dominates due to high urban density and increasing preference for eco-friendly commuting. Lithium-ion batteries are the preferred choice, owing to their superior performance and longer lifespan.

- Dominant Segment: City/Urban application type and Lithium-ion battery type.

- Key Drivers:

- Government Initiatives: Subsidies and tax breaks for e-bike purchases.

- Infrastructure Development: Expanding dedicated cycling lanes and charging stations.

- Economic Factors: Rising disposable incomes and increasing urbanization.

The strong preference for Pedal Assisted e-bikes is largely driven by their balance of convenience, ease of use, and fitness benefits.

Japan E-bike Industry Product Developments

Recent product innovations focus on enhanced battery technology (longer range, faster charging), lighter and more compact motor designs, and improved integration of smart features (GPS, connectivity, anti-theft systems). Companies are differentiating their offerings through advanced features, design aesthetics, and targeted marketing campaigns to specific demographics. The market is experiencing a shift towards increasingly sophisticated e-bikes, driven by consumer demand for improved functionality and technology integration.

Key Drivers of Japan E-bike Industry Growth

Several factors contribute to the growth of the Japanese e-bike industry. Government incentives such as subsidies and tax breaks are key in stimulating demand. Technological advancements resulting in improved battery life and reduced weight are equally important. The growing awareness of environmental issues and the shift towards sustainable transportation are significant drivers of market growth. Finally, the increasing urbanization and associated traffic congestion are pushing consumers towards more efficient modes of commuting, thus fuelling the e-bike market's expansion.

Challenges in the Japan E-bike Industry Market

The industry faces challenges, including the high initial cost of e-bikes, range anxiety (concerns about battery life), and a lack of widespread charging infrastructure in certain areas. Competition from other modes of transportation, such as public transit and automobiles, also poses a challenge. Supply chain disruptions and fluctuations in raw material prices add to the complexity of the industry. These factors contribute to the current relatively low market penetration rate compared to other developed countries.

Emerging Opportunities in Japan E-bike Industry

The Japanese e-bike market presents several growth opportunities. The development of next-generation battery technologies and increased range will address range anxiety. Strategic partnerships between e-bike manufacturers and public transportation authorities can improve charging infrastructure and integration with existing transport systems. Expanding into new market segments (e.g., cargo e-bikes for delivery services) and penetrating the less densely populated areas offer significant growth potentials.

Leading Players in the Japan E-bike Industry Sector

Key Milestones in Japan E-bike Industry Industry

- June 2022: Yamaha introduced a new mid-drive electric bike motor with increased power in a smaller package, enhancing performance and efficiency.

- July 2022: Kawasaki debuted the Elektrode bicycle, featuring three adjustable speed modes, a disc brake, an integrated battery, and a wheel-mounted motor.

- November 2022: Jiangsu Lvneng Electrical Bicycle Technology Co., Ltd. introduced the 20F02 folding electric bicycle, catering to the growing demand for compact and portable e-bikes.

Strategic Outlook for Japan E-bike Industry Market

The future of the Japanese e-bike industry looks promising, driven by technological advancements, supportive government policies, and a growing environmentally conscious population. Strategic partnerships and investments in research and development will be crucial for companies to maintain a competitive edge. Expanding into new market segments and focusing on niche applications will drive further growth. The market is poised for significant expansion, presenting attractive opportunities for both established players and new entrants.

Japan E-bike Industry Segmentation

-

1. Propulsion Type

- 1.1. Pedal Assisted

- 1.2. Speed Pedelec

- 1.3. Throttle Assisted

-

2. Application Type

- 2.1. Cargo/Utility

- 2.2. City/Urban

- 2.3. Trekking

-

3. Battery Type

- 3.1. Lead Acid Battery

- 3.2. Lithium-ion Battery

- 3.3. Others

Japan E-bike Industry Segmentation By Geography

- 1. Japan

Japan E-bike Industry Regional Market Share

Geographic Coverage of Japan E-bike Industry

Japan E-bike Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Travel and Tourism to Fuel Market Demand

- 3.3. Market Restrains

- 3.3.1. High Maintenance cost of RV Rental Fleets

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan E-bike Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Pedal Assisted

- 5.1.2. Speed Pedelec

- 5.1.3. Throttle Assisted

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Cargo/Utility

- 5.2.2. City/Urban

- 5.2.3. Trekking

- 5.3. Market Analysis, Insights and Forecast - by Battery Type

- 5.3.1. Lead Acid Battery

- 5.3.2. Lithium-ion Battery

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Jiangsu Xinri E Vehicle Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bridgestone Cycle Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Asahi Cycle Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Shimano Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Maruishi

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fujikom Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Panasonic Cycle Technology Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Trek Bicycle Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Yamaha Bicycle

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kawasaki Motors Corporation Japan

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Jiangsu Xinri E Vehicle Co Ltd

List of Figures

- Figure 1: Japan E-bike Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Japan E-bike Industry Share (%) by Company 2025

List of Tables

- Table 1: Japan E-bike Industry Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 2: Japan E-bike Industry Revenue million Forecast, by Application Type 2020 & 2033

- Table 3: Japan E-bike Industry Revenue million Forecast, by Battery Type 2020 & 2033

- Table 4: Japan E-bike Industry Revenue million Forecast, by Region 2020 & 2033

- Table 5: Japan E-bike Industry Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 6: Japan E-bike Industry Revenue million Forecast, by Application Type 2020 & 2033

- Table 7: Japan E-bike Industry Revenue million Forecast, by Battery Type 2020 & 2033

- Table 8: Japan E-bike Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan E-bike Industry?

The projected CAGR is approximately 4.85%.

2. Which companies are prominent players in the Japan E-bike Industry?

Key companies in the market include Jiangsu Xinri E Vehicle Co Ltd, Bridgestone Cycle Co Ltd, Asahi Cycle Co Ltd, Shimano Inc, Maruishi, Fujikom Co Ltd, Panasonic Cycle Technology Co Ltd, Trek Bicycle Corporation, Yamaha Bicycle, Kawasaki Motors Corporation Japan.

3. What are the main segments of the Japan E-bike Industry?

The market segments include Propulsion Type, Application Type, Battery Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3116.2 million as of 2022.

5. What are some drivers contributing to market growth?

Increased Travel and Tourism to Fuel Market Demand.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Maintenance cost of RV Rental Fleets.

8. Can you provide examples of recent developments in the market?

November 2022: Jiangsu Lvneng Electrical Bicycle Technology Co., Ltd. has introduced the 20F02 folding electric bicycle.July 2022: Kawasaki debuted the Elektrode bicycle in the market. It has three adjustable speed modes, a disc brake, an integrated battery, and a motor located on the wheel. The list cost is $1,099.June 2022: Yamaha has introduced a new mid-drive electric bike motor with increased power in a smaller package.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan E-bike Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan E-bike Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan E-bike Industry?

To stay informed about further developments, trends, and reports in the Japan E-bike Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence