Key Insights

The Italy Construction Equipment Market is poised for significant expansion, with projections indicating a market size of $5.8 billion by 2033. This growth trajectory is underpinned by a robust Compound Annual Growth Rate (CAGR) of 2.9% from a 2024 base year. Key drivers include escalating government investments in infrastructure development, particularly in urban renewal and transportation networks, which are directly stimulating demand for construction machinery. A thriving construction sector, encompassing both residential and commercial developments, further bolsters this market expansion. The market is segmented by equipment type, including cranes, telescopic handlers, excavators, loaders and backhoes, motor graders, and other machinery, and by propulsion systems: internal combustion engine, electric, and hybrid. The increasing adoption of sustainable construction practices is fueling demand for electric and hybrid machinery, presenting substantial growth prospects. While supply chain volatility and fluctuating raw material costs may pose challenges, the ongoing infrastructure development and consistent construction sector growth ensure a positive market outlook. Prominent market participants, such as Caterpillar Inc., CNH Industrial N.V., and Komatsu Ltd., are actively engaged through technological innovation and strategic alliances to maintain a competitive advantage. The Italian market's sustained growth makes it an attractive prospect for both established entities and new entrants, with diverse applications promising continued potential throughout the forecast period.

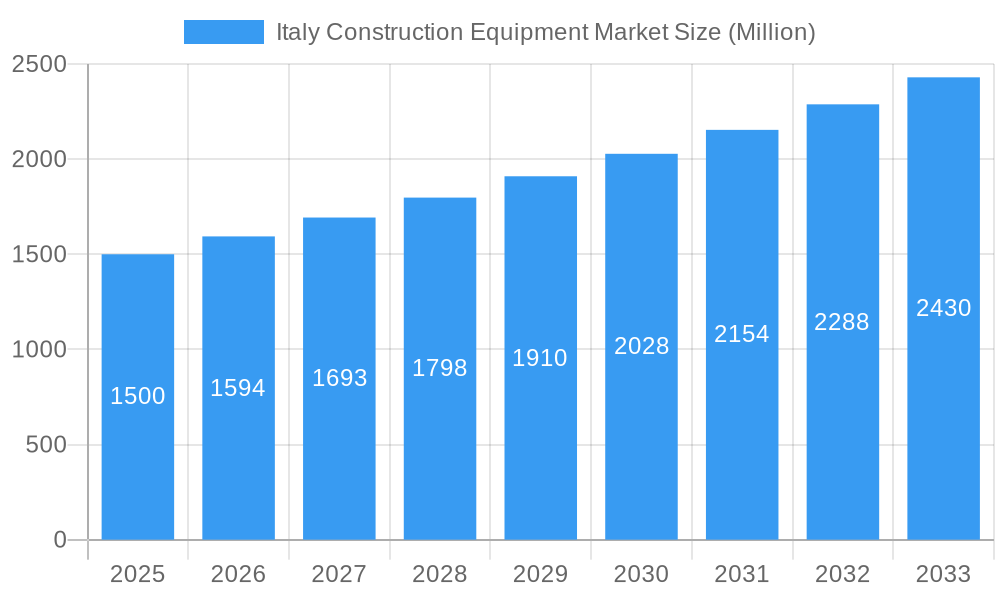

Italy Construction Equipment Market Market Size (In Billion)

Detailed segmentation of the Italian Construction Equipment Market offers critical insights. The Excavators segment is anticipated to lead market share due to its widespread application across diverse construction activities. Concurrently, significant growth is expected within the Electric and Hybrid propulsion segment, driven by heightened environmental consciousness and regulatory mandates promoting eco-friendly solutions. Regional disparities in Italy may influence market dynamics, reflecting varying levels of infrastructure advancement and economic vitality. Intense competition among leading manufacturers is characterized by continuous product innovation, technological breakthroughs, and strategic collaborations aimed at expanding market presence. Success in this market will hinge on providing efficient, environmentally responsible, and technologically advanced equipment tailored to the specific needs of the Italian construction industry. Analysis of historical data from 2019-2024, projected growth rates, and current market dynamics provide a strong foundation for these positive growth forecasts.

Italy Construction Equipment Market Company Market Share

Italy Construction Equipment Market: Comprehensive Analysis (2019-2033)

This comprehensive report delivers in-depth analysis of the Italy Construction Equipment Market, providing essential intelligence for industry stakeholders, investors, and businesses navigating this evolving sector. The report encompasses the period from 2019 to 2033, with specific focus on the estimated year 2025 and a detailed forecast for 2025-2033. Key segments examined include machinery types (cranes, telescopic handlers, excavators, loaders and backhoes, motor graders, and other machinery) and propulsion systems (internal combustion engine, electric, and hybrid). Leading companies such as Caterpillar Inc., CNH Industrial N.V., and Komatsu Ltd. are profiled, detailing their market strategies and contributions. Uncover critical trends, emerging opportunities, and significant challenges shaping the future of Italy's construction equipment landscape.

Italy Construction Equipment Market Market Dynamics & Concentration

The Italian construction equipment market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the market is characterized by increasing competition from both established international players and regional businesses. Innovation is a key driver, particularly in the development of electric and hybrid machinery, driven by stricter environmental regulations and a growing emphasis on sustainability. The regulatory framework, encompassing safety standards and emission norms, significantly impacts market dynamics. Product substitutes, such as alternative construction methods, pose a moderate challenge. End-user trends reveal a rising demand for technologically advanced, fuel-efficient, and environmentally friendly equipment. The number of mergers and acquisitions (M&A) within the sector has seen a moderate increase over the past five years, indicating a drive for consolidation and expansion.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025.

- M&A Activity: An estimated xx M&A deals were concluded in the Italian construction equipment market between 2019 and 2024.

- Innovation Drivers: Stringent emission regulations and growing demand for sustainable construction practices are pushing innovation in electric and hybrid machinery.

- Regulatory Framework: Compliance with EU and national safety and environmental standards is crucial for market participation.

- End-User Trends: Increased demand for efficient, technologically advanced, and sustainable construction equipment is observed.

Italy Construction Equipment Market Industry Trends & Analysis

The Italy Construction Equipment Market is experiencing a dynamic period of growth, propelled by a confluence of strategic initiatives and technological evolution. A primary catalyst is the robust pipeline of public and private infrastructure development projects. These initiatives, often backed by substantial government investment and economic recovery programs, are creating significant demand for a wide array of construction machinery. Furthermore, the industry is undergoing a profound transformation driven by technological advancements. The increasing integration of automation, sophisticated telematics for real-time data and remote monitoring, and the burgeoning adoption of electric propulsion systems are fundamentally reshaping how construction operations are conducted. Consumer preferences are also a key influencer, with a discernible shift towards fuel-efficient, environmentally conscious, and technologically advanced equipment that offers enhanced productivity and reduced operational impact. The competitive landscape remains intense, characterized by the presence of both established global players and agile new entrants. This vigorous competition not only keeps pricing competitive but also serves as a powerful engine for continuous innovation. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.8% during the forecast period (2025-2033). The penetration of electric and hybrid machines is anticipated to see a substantial rise, increasing from an estimated 8% in 2025 to around 25% by 2033, reflecting a strong commitment to sustainability and operational efficiency.

Leading Markets & Segments in Italy Construction Equipment Market

The Northern region of Italy represents the dominant market segment, driven by strong infrastructure development and industrial activity. Within machinery types, excavators and loaders/backhoes comprise the largest segments, reflecting the high demand for earthmoving and construction activities. The internal combustion engine (ICE) segment currently dominates the propulsion market; however, the electric and hybrid segment is witnessing rapid growth due to environmental concerns and government incentives.

- Key Drivers (Northern Region): High concentration of construction projects, robust industrial activity, supportive government policies.

- Key Drivers (Excavators and Loaders/Backhoes): High demand in infrastructure development, construction, and earthmoving activities.

- Key Drivers (Internal Combustion Engine): Established technology, lower initial cost compared to electric/hybrid models.

- Key Drivers (Electric/Hybrid): Growing environmental awareness, government incentives, reduction in operating costs.

Italy Construction Equipment Market Product Developments

Product innovation in the Italian construction equipment sector is sharply focused on elevating operational efficiency, enhancing environmental sustainability, and bolstering safety standards. Key developments include the introduction of a diverse range of electric and hybrid models, designed to meet stringent emissions regulations and reduce operating costs. Advanced telematics systems are becoming increasingly standard, enabling sophisticated remote monitoring, predictive maintenance, and optimized fleet management. Furthermore, manufacturers are integrating cutting-edge safety features, such as enhanced visibility aids and intelligent operator assistance systems, to create a safer working environment. These advancements directly address the escalating demand within the Italian construction sector for solutions that are not only environmentally responsible but also technologically sophisticated and safe. Consequently, the market is witnessing a significant shift in competitive advantage towards manufacturers that can consistently deliver equipment that excels in technological superiority, energy efficiency, and safety performance.

Key Drivers of Italy Construction Equipment Market Growth

The robust growth trajectory of the Italian construction equipment market is underpinned by several pivotal drivers. Foremost among these are government-led initiatives aimed at bolstering infrastructure development across the nation, including significant investments in transportation networks, urban renewal projects, and the modernization of existing facilities. These large-scale projects inherently create a sustained demand for a broad spectrum of construction machinery. Complementing these infrastructure efforts are rapid technological advancements. Innovations in automation, including autonomous and semi-autonomous machinery, and the ongoing electrification of equipment are significantly enhancing operational efficiency, reducing labor dependency, and lowering long-term operational expenses. Moreover, increasingly stringent environmental regulations and a heightened societal focus on sustainability are compelling the adoption of greener construction practices and, by extension, more environmentally friendly and energy-efficient equipment. This regulatory push is acting as a significant accelerator for market growth.

Challenges in the Italy Construction Equipment Market Market

The market faces challenges such as fluctuating raw material prices impacting manufacturing costs, supply chain disruptions leading to equipment shortages, and intense competition amongst numerous players. Strict regulatory compliance requirements and economic uncertainties can also impact market growth, potentially affecting investment and demand.

Emerging Opportunities in Italy Construction Equipment Market

The Italian construction equipment market is ripe with emerging opportunities, particularly driven by the accelerated adoption of digital technologies. The integration of the Internet of Things (IoT) and Artificial Intelligence (AI) is revolutionizing operational efficiency through real-time data analytics, predictive maintenance capabilities, and smarter resource allocation. These digital tools are empowering construction companies to make more informed, data-driven decisions, leading to optimized project timelines and reduced costs. Furthermore, the landscape is increasingly shaped by strategic collaborations and partnerships. Synergies between equipment manufacturers, cutting-edge technology providers, and forward-thinking construction companies are fostering a fertile ground for innovation and market expansion, leading to the development of integrated solutions. The pervasive global emphasis on sustainability also presents a substantial opportunity for manufacturers specializing in eco-friendly construction equipment, including those utilizing alternative fuels, renewable energy sources, and sustainable materials.

Leading Players in the Italy Construction Equipment Market Sector

Key Milestones in Italy Construction Equipment Market Industry

- June 2023: CNH Industrial N.V. opened a new manufacturing facility in Cesena, focusing on mini-excavators and mini-track loaders, including electric models. This expansion significantly boosts production capacity and reinforces their commitment to the Italian market and sustainable technologies.

- May 2023: Bobcat launched the E19e electric mini-excavator in Italy, featuring a larger 17.3 kWh battery, demonstrating a commitment to offering more powerful and sustainable solutions within the Italian construction sector.

Strategic Outlook for Italy Construction Equipment Market Market

The future outlook for the Italy Construction Equipment Market is exceptionally promising, fueled by a sustained commitment to infrastructure investment, the relentless pace of technological advancement, and a deeply ingrained emphasis on environmental sustainability. Companies that prioritize strategic partnerships and foster collaborative ecosystems are poised for significant success. Focused research and development (R&D) initiatives, particularly in areas like electrification, digitalization, and advanced materials, will be critical for staying ahead of the curve. Proactive adaptation to evolving market dynamics, including shifts in regulatory frameworks and end-user preferences, will be paramount. The market offers lucrative avenues for businesses that can adeptly respond to the growing demand for construction equipment that is not only highly efficient and technologically advanced but also demonstrably environmentally friendly and cost-effective to operate. Success in this evolving market will hinge on a company's ability to innovate, collaborate, and align its product offerings with the core values of sustainability and operational excellence.

Italy Construction Equipment Market Segmentation

-

1. Machinery Type

- 1.1. Cranes

- 1.2. Telescopic Handlers

- 1.3. Excavators

- 1.4. Loaders and Backhoes

- 1.5. Motor Graders

- 1.6. Other Machinery Types

-

2. Propulsion

- 2.1. Internal Combustion Engine

- 2.2. Electric and Hybrid

Italy Construction Equipment Market Segmentation By Geography

- 1. Italy

Italy Construction Equipment Market Regional Market Share

Geographic Coverage of Italy Construction Equipment Market

Italy Construction Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Infrastructure Activities Across the Country

- 3.3. Market Restrains

- 3.3.1. Rapid Expansion of Construction Equipment Rental Industry

- 3.4. Market Trends

- 3.4.1. Electrification Of Construction Equipment May Propel The Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 5.1.1. Cranes

- 5.1.2. Telescopic Handlers

- 5.1.3. Excavators

- 5.1.4. Loaders and Backhoes

- 5.1.5. Motor Graders

- 5.1.6. Other Machinery Types

- 5.2. Market Analysis, Insights and Forecast - by Propulsion

- 5.2.1. Internal Combustion Engine

- 5.2.2. Electric and Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Caterpillar Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CNH Industrial N V

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Komatsu Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wirtgen Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Deere & Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Liebherr Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hitachi Construction Equipment Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Doosan Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AB Volvo

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 JC Bamford Excavators Ltd (JCB

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Manitowoc Company Inc ?

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Caterpillar Inc

List of Figures

- Figure 1: Italy Construction Equipment Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italy Construction Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: Italy Construction Equipment Market Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 2: Italy Construction Equipment Market Revenue billion Forecast, by Propulsion 2020 & 2033

- Table 3: Italy Construction Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Italy Construction Equipment Market Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 5: Italy Construction Equipment Market Revenue billion Forecast, by Propulsion 2020 & 2033

- Table 6: Italy Construction Equipment Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Construction Equipment Market?

The projected CAGR is approximately 2.9%.

2. Which companies are prominent players in the Italy Construction Equipment Market?

Key companies in the market include Caterpillar Inc, CNH Industrial N V, Komatsu Ltd, Wirtgen Group, Deere & Company, Liebherr Group, Hitachi Construction Equipment Ltd, Doosan Corporation, AB Volvo, JC Bamford Excavators Ltd (JCB, Manitowoc Company Inc ?.

3. What are the main segments of the Italy Construction Equipment Market?

The market segments include Machinery Type, Propulsion.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Infrastructure Activities Across the Country.

6. What are the notable trends driving market growth?

Electrification Of Construction Equipment May Propel The Market Growth.

7. Are there any restraints impacting market growth?

Rapid Expansion of Construction Equipment Rental Industry.

8. Can you provide examples of recent developments in the market?

June 2023: CNH Industrial N.V. inaugurated a state-of-the-art manufacturing facility in Cesena, Italy, marking a significant development in the company's expansion efforts. This new plant is dedicated to the production of mini-excavators and mini-track loaders, with a special focus on electric models.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Construction Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Construction Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Construction Equipment Market?

To stay informed about further developments, trends, and reports in the Italy Construction Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence