Key Insights

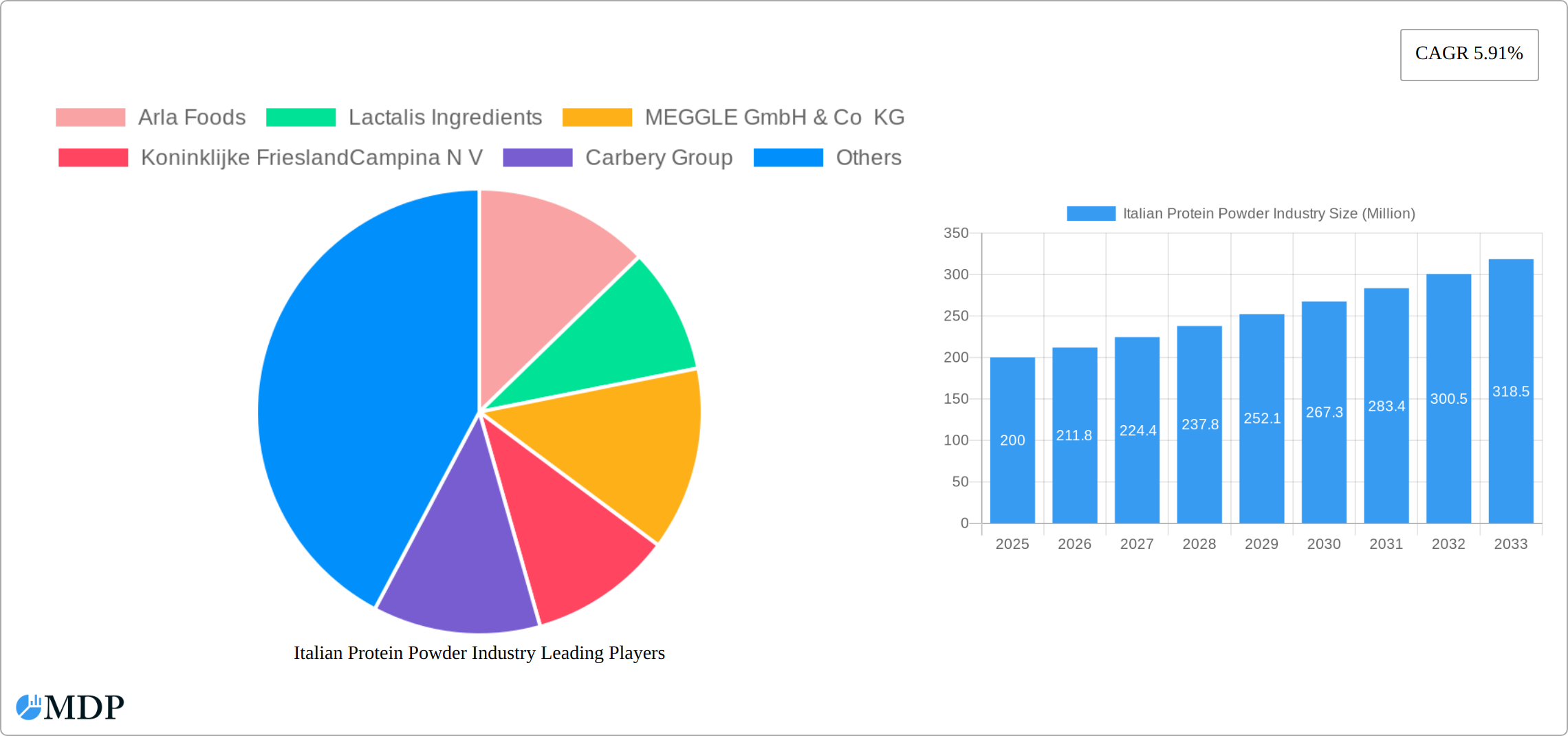

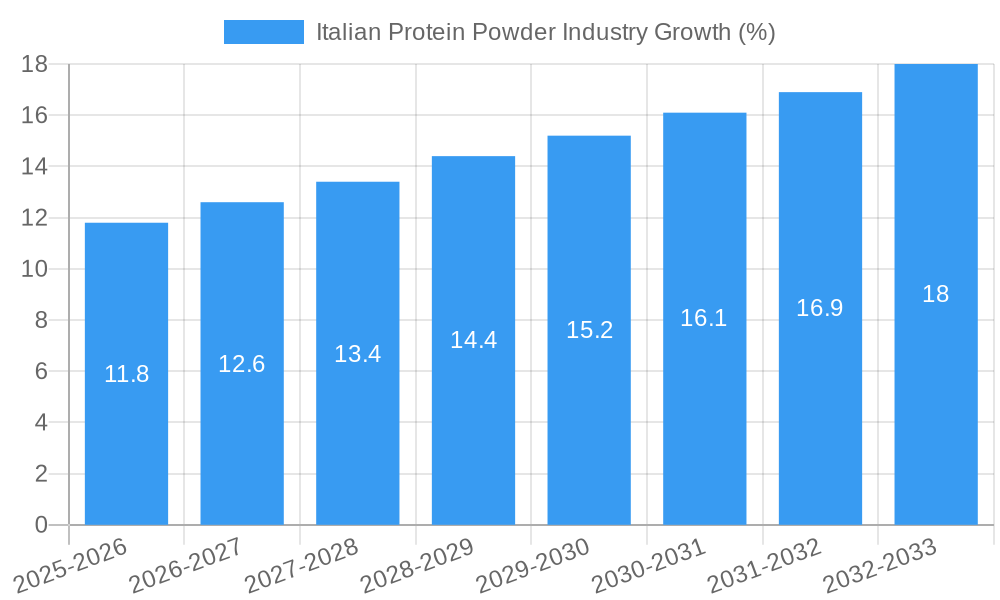

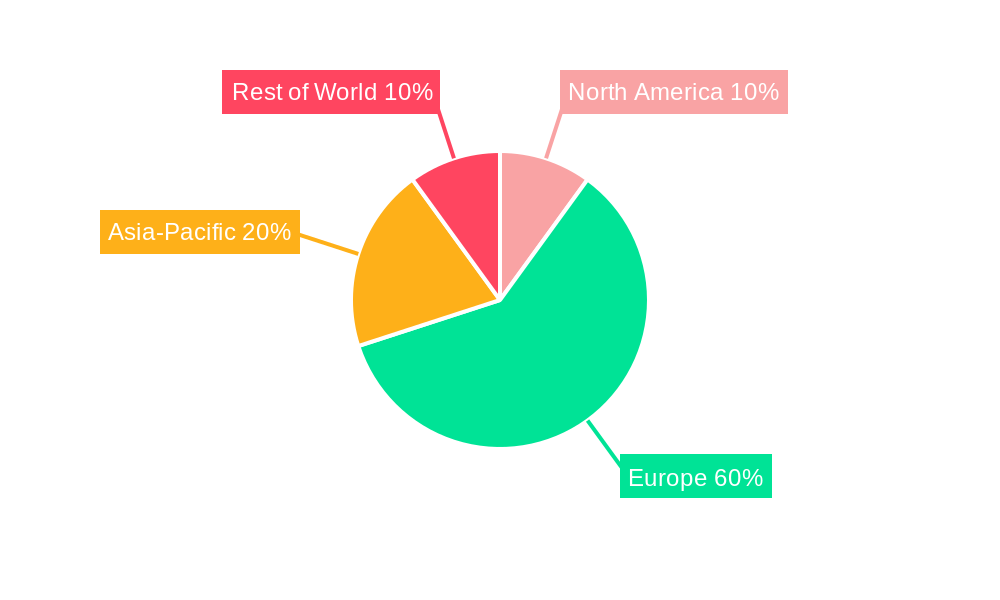

The Italian protein powder market, while lacking precise figures in the provided data, shows strong potential mirroring global trends. Considering a global CAGR of 5.91% and the rising health consciousness and fitness culture in Italy, a conservative estimate for the Italian market size in 2025 would be €200 million. This is based on the assumption that Italy, a significant European economy with a health-conscious population, holds a reasonable share of the European protein powder market. The market is segmented by protein type (whey concentrate, isolate, hydrolysate) and application (sports nutrition, infant formula, functional foods). Whey protein concentrate likely dominates due to its cost-effectiveness, while the isolate and hydrolysate segments are experiencing faster growth driven by consumer demand for higher purity and faster absorption. The sports nutrition application segment is the largest, fuelled by the increasing popularity of fitness activities and the rising awareness of protein's role in muscle building and recovery. However, the functional food segment shows promising growth potential, as protein is increasingly incorporated into various food products targeting health-conscious consumers. Major players, like some of those listed in the global data, are likely present in the Italian market, although their specific market share requires further investigation. Competitive pressures are expected, driving innovation in product formulations, flavors, and marketing strategies. The market is anticipated to experience consistent growth throughout the forecast period (2025-2033), with the CAGR potentially exceeding the global average due to increasing consumer spending on health and wellness products within Italy.

The projected growth will be driven by factors such as rising disposable incomes, increasing health awareness, and the growing popularity of fitness and sports. However, challenges remain, including potential price volatility of raw materials and stringent regulatory requirements concerning food safety and labeling. Opportunities exist in developing innovative products catering to specific dietary needs (e.g., vegan protein options) and expanding distribution channels to reach a broader consumer base. Understanding consumer preferences through market research is critical for success in this dynamic market. Strategic partnerships and collaborations with local distributors can play a vital role in penetrating the market effectively.

Italian Protein Powder Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Italian protein powder market from 2019 to 2033, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. The report covers market size, segmentation, key players, industry trends, and future growth projections, with a focus on actionable intelligence and data-driven conclusions. The Italian protein powder market, valued at €XX Million in 2024, is projected to reach €XX Million by 2033, exhibiting a CAGR of XX% during the forecast period (2025-2033).

Italian Protein Powder Industry Market Dynamics & Concentration

The Italian protein powder market is characterized by a moderately concentrated landscape, with several key players holding significant market share. Major players include Arla Foods, Lactalis Ingredients, MEGGLE GmbH & Co KG, Koninklijke FrieslandCampina N.V., Carbery Group, Lactoprot Deutschland GmbH, Glanbia Plc, Morinaga Milk Industry Co Ltd, Meggle Group, and Agrial Enterprise. However, the market also features smaller, niche players focusing on specialized protein types or applications.

Market Concentration: The top five players account for an estimated XX% of the market share in 2025. Consolidation through mergers and acquisitions (M&A) is anticipated to continue, potentially leading to increased market concentration in the coming years. Between 2019 and 2024, there were approximately XX M&A deals in the Italian protein powder industry.

Innovation Drivers: The market is driven by innovations in protein extraction techniques, the development of new protein sources (e.g., plant-based proteins), and the increasing demand for functional and fortified food products.

Regulatory Frameworks: EU regulations related to food safety and labeling significantly impact the industry. Compliance with these regulations is crucial for market entry and sustained growth.

Product Substitutes: Competitors include other protein sources, such as meat and eggs, as well as alternative protein supplements. The growth of plant-based protein alternatives poses a challenge to traditional whey-based products.

End-User Trends: Health-conscious consumers, particularly athletes and fitness enthusiasts, drive the demand for high-quality protein powder. The growing awareness of the importance of protein in maintaining a healthy lifestyle is another significant driver.

Italian Protein Powder Industry Industry Trends & Analysis

The Italian protein powder market exhibits robust growth driven by several factors. The increasing prevalence of health and wellness trends, coupled with rising disposable incomes and a growing fitness-conscious population, has fueled significant demand for protein supplements. The market is also witnessing the emergence of innovative product formulations, including plant-based protein blends, functional blends with added vitamins and minerals, and hydrolyzed whey protein for enhanced absorption.

Technological advancements in protein extraction and processing have facilitated the production of high-quality protein powders with improved taste, texture, and nutritional value. This has played a vital role in expanding the market's appeal among a wider consumer base. Consumer preference is shifting towards more convenient and easily-mixable protein powders, pushing manufacturers to improve product formulations.

The competitive dynamics are shaped by intense competition among established players and the entry of new players, particularly those focusing on specific niches or specialized product offerings. This competitiveness drives innovation and contributes to the overall market dynamism. The market has seen a CAGR of XX% during the historical period (2019-2024), reflecting the strong growth trajectory. Market penetration for whey protein products is estimated at XX% in 2025.

Leading Markets & Segments in Italian Protein Powder Industry

The Italian protein powder market is dominated by the Whey Protein Concentrate segment within the Sports and Performance Nutrition application.

Key Drivers for Dominance:

- High Protein Content: Whey protein concentrate offers a high protein content at a relatively lower price point compared to other types.

- Established Market Presence: Long-standing consumer familiarity and acceptance of whey protein.

- Extensive Distribution Channels: Wide availability across retail outlets, gyms, and online platforms.

Whey Protein Isolate: This segment is experiencing faster growth, driven by consumers seeking a purer form of protein with lower lactose and fat content. Infant formula represents a significant market for whey protein isolate, driven by stringent nutritional requirements for infant food products.

Hydrolyzed Whey Protein: This niche segment targets individuals seeking rapid protein absorption and is growing steadily due to increasing awareness amongst athletes.

Other Applications: Functional/fortified food applications, while smaller, represent a growth opportunity, as consumers seek convenient ways to enhance the nutritional profile of their daily diet.

Italian Protein Powder Industry Product Developments

Recent product innovations include the launch of Myprotein’s Whey Forward (July 2022), a collaboration with Perfect Day Inc., showcasing plant-based protein blends. Arla Foods’ Nutrilac CH-7694 (August 2021) provides a technologically advanced solution for cream cheese manufacturing. This highlights an expanding focus on innovative production techniques and the expansion into new product applications. The continued market push towards improved taste, texture, and functionality of protein powders remains a key product development area.

Key Drivers of Italian Protein Powder Industry Growth

The Italian protein powder market is experiencing robust expansion, fueled by a confluence of factors:

- Rising Health Consciousness and Wellness Focus: A burgeoning awareness of the vital role protein plays in muscle growth, weight management, overall health, and improved athletic performance is driving significant demand. Consumers are increasingly prioritizing proactive health strategies, making protein powder a key component of their wellness routines.

- Elevated Disposable Incomes and Increased Spending on Wellness: A rise in disposable income among Italian consumers is translating into increased spending on premium health and wellness products, including high-quality protein supplements. This demonstrates a willingness to invest in personal well-being.

- Expanding Fitness Culture and Participation in Sports: The surging popularity of fitness activities, both individual and team-based sports, is directly fueling the demand for protein powders to aid muscle recovery, growth, and enhanced athletic performance. This trend extends across various age demographics.

- Continuous Product Innovation and Diversification: The market is witnessing a wave of innovation, with the introduction of protein powders boasting improved taste profiles, enhanced textures, and added functionalities, catering to a wider range of consumer preferences and dietary needs. This includes the rise of plant-based and organic options.

Challenges in the Italian Protein Powder Industry Market

Despite the positive growth trajectory, the Italian protein powder market faces several challenges:

- Navigating Stringent Regulatory Environments: Adherence to EU food safety and labeling regulations presents significant operational complexities and contributes to increased production costs for businesses operating within the market.

- Mitigating Supply Chain Volatility and Raw Material Price Fluctuations: The global nature of the supply chain exposes the industry to volatility in raw material prices and potential disruptions, impacting profitability and requiring agile adaptation strategies.

- Intense Competition and Price Sensitivity: The market is characterized by intense competition among both established multinational corporations and emerging local brands, putting pressure on pricing and profit margins. Furthermore, price sensitivity amongst specific consumer segments necessitates careful pricing strategies and value propositions.

Emerging Opportunities in Italian Protein Powder Industry

The Italian protein powder market offers several emerging opportunities. The increasing demand for plant-based protein alternatives presents a significant growth avenue. Strategic partnerships, such as that between Myprotein and Perfect Day, can unlock new technologies and market access. Expansion into niche segments, like functional foods and personalized nutrition, offers further growth prospects. The use of advanced technologies such as precision fermentation for protein production is also an emerging trend.

Leading Players in the Italian Protein Powder Industry Sector

The Italian protein powder market is populated by a mix of international giants and specialized players. Key players include (but are not limited to):

- Arla Foods

- Lactalis Ingredients

- MEGGLE GmbH & Co KG

- Koninklijke FrieslandCampina N.V.

- Carbery Group

- Lactoprot Deutschland GmbH

- Glanbia Plc

- Morinaga Milk Industry Co Ltd

- Meggle Group

- Agrial Enterprise

Key Milestones in Italian Protein Powder Industry Industry

- July 2022: Myprotein partners with Perfect Day Inc. to launch Whey Forward, a plant-based protein blend.

- August 2021: Arla Foods launches Nutrilac CH-7694, an innovative whey protein ingredient solution for cream cheese production.

- July 2021: MILEI GmbH (Morinaga subsidiary) opens a new production facility in Europe, expanding its reach to the Italian market.

Strategic Outlook for Italian Protein Powder Industry Market

The Italian protein powder market presents a compelling opportunity for sustained growth. Success will hinge on a strategic approach encompassing:

- Focused Product Innovation: Prioritizing the development of innovative products, particularly plant-based alternatives, functional formulations addressing specific health needs, and sustainable sourcing practices, is critical to meeting evolving consumer preferences.

- Strategic Distribution and Digital Marketing: Expanding distribution channels, including e-commerce platforms and strategic partnerships with retailers, combined with targeted digital marketing campaigns to reach specific consumer segments, are essential for market penetration.

- Strategic Investments in R&D and Partnerships: Significant investments in research and development, alongside strategic collaborations and partnerships across the value chain, will enable businesses to maintain a competitive edge and respond effectively to market dynamics.

The market's dynamic nature creates attractive opportunities for established brands seeking expansion and ambitious newcomers aiming to establish a strong market presence. A clear understanding of consumer trends and agile adaptation to market changes are key to success in this evolving landscape.

Italian Protein Powder Industry Segmentation

-

1. Type

- 1.1. Whey Protein Concentrate

- 1.2. Whey Protein Isolate

- 1.3. Hydrolyzed Whey Protein

-

2. Application

- 2.1. Sports and Performance Nutrition

- 2.2. Infant Formula

- 2.3. Functional/Fortified Food

Italian Protein Powder Industry Segmentation By Geography

- 1. Italia

Italian Protein Powder Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.91% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for sports nutritional supplements

- 3.3. Market Restrains

- 3.3.1. Rising demand for plant-based protein

- 3.4. Market Trends

- 3.4.1. Growing consumer preference of high protein diet

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italian Protein Powder Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Whey Protein Concentrate

- 5.1.2. Whey Protein Isolate

- 5.1.3. Hydrolyzed Whey Protein

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Sports and Performance Nutrition

- 5.2.2. Infant Formula

- 5.2.3. Functional/Fortified Food

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil Italian Protein Powder Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Argentina Italian Protein Powder Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Rest of South America Italian Protein Powder Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Arla Foods

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Lactalis Ingredients

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 MEGGLE GmbH & Co KG

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Koninklijke FrieslandCampina N V

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Carbery Group

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Lactoprot Deutschland GmbH*List Not Exhaustive

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Glanbia Plc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Morinaga Milk Industry Co Ltd

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Meggle Group

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Agrial Enterprise

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Arla Foods

List of Figures

- Figure 1: Italian Protein Powder Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Italian Protein Powder Industry Share (%) by Company 2024

List of Tables

- Table 1: Italian Protein Powder Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Italian Protein Powder Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Italian Protein Powder Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Italian Protein Powder Industry Volume K Tons Forecast, by Type 2019 & 2032

- Table 5: Italian Protein Powder Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Italian Protein Powder Industry Volume K Tons Forecast, by Application 2019 & 2032

- Table 7: Italian Protein Powder Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Italian Protein Powder Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Italian Protein Powder Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Italian Protein Powder Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: Italian Protein Powder Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Italian Protein Powder Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Italian Protein Powder Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Italian Protein Powder Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 15: Italian Protein Powder Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italian Protein Powder Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Italian Protein Powder Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Italian Protein Powder Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 19: Italian Protein Powder Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Italian Protein Powder Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Italian Protein Powder Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Italian Protein Powder Industry Volume K Tons Forecast, by Type 2019 & 2032

- Table 23: Italian Protein Powder Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Italian Protein Powder Industry Volume K Tons Forecast, by Application 2019 & 2032

- Table 25: Italian Protein Powder Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Italian Protein Powder Industry Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italian Protein Powder Industry?

The projected CAGR is approximately 5.91%.

2. Which companies are prominent players in the Italian Protein Powder Industry?

Key companies in the market include Arla Foods, Lactalis Ingredients, MEGGLE GmbH & Co KG, Koninklijke FrieslandCampina N V, Carbery Group, Lactoprot Deutschland GmbH*List Not Exhaustive, Glanbia Plc, Morinaga Milk Industry Co Ltd, Meggle Group, Agrial Enterprise.

3. What are the main segments of the Italian Protein Powder Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 31 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for sports nutritional supplements.

6. What are the notable trends driving market growth?

Growing consumer preference of high protein diet.

7. Are there any restraints impacting market growth?

Rising demand for plant-based protein.

8. Can you provide examples of recent developments in the market?

July 2022: Myprotein, operating in Italy, entered into a partnership with the startup Perfect Day Inc., a producer of protein ingredients, to introduce Whey Forward. This product boasts 20 grams of protein per serving and is positioned to meet the nutritional requirements of Impact Whey.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italian Protein Powder Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italian Protein Powder Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italian Protein Powder Industry?

To stay informed about further developments, trends, and reports in the Italian Protein Powder Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence