Key Insights

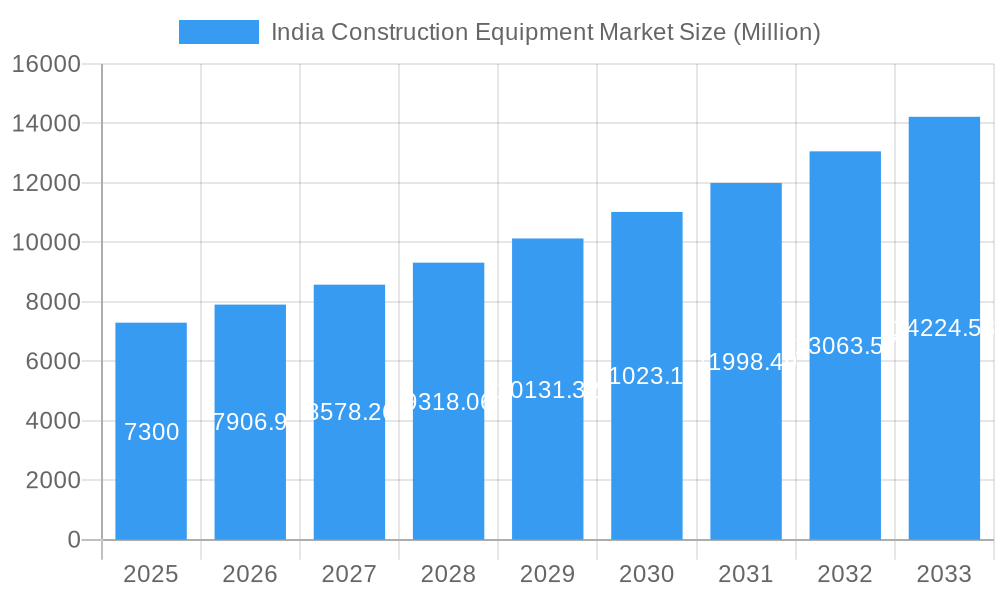

The India Construction Equipment Market is experiencing robust growth, projected to reach a market size of $7.30 billion in 2025, expanding at a compound annual growth rate (CAGR) of 8.30% from 2025 to 2033. This expansion is fueled by significant government investments in infrastructure development projects under initiatives like the Bharatmala Pariyojana and Smart Cities Mission. Increased urbanization, rapid industrialization, and rising private sector investments in real estate and construction further contribute to the market's dynamism. The demand for diverse equipment segments, including earthmoving and road construction equipment (such as excavators, bulldozers, and road rollers), material handling equipment (forklifts, cranes), concrete equipment (pumps, batching plants), and material processing equipment (crushing plants), is driving growth across various regions of India. Hydraulic drive types currently dominate the market, but the adoption of electric/hybrid models is expected to increase gradually due to environmental concerns and potential cost savings in the long run. Key players like XCMG, Liebherr, JCB, Volvo Construction Equipment, and Caterpillar are fiercely competing, leading to technological innovation and competitive pricing.

India Construction Equipment Market Market Size (In Billion)

Regional variations in market growth are anticipated, with Northern and Southern India potentially exhibiting faster growth due to higher infrastructure activity and urbanization compared to Eastern and Western India. However, all regions are projected to experience significant expansion during the forecast period. The market faces challenges like fluctuating raw material prices, supply chain disruptions, and skilled labor shortages. Nevertheless, the long-term outlook for the India Construction Equipment Market remains positive, driven by sustained government support for infrastructure projects and the nation's overall economic growth trajectory. Strategic partnerships, technological advancements focusing on automation and efficiency, and expansion into untapped rural markets will be key factors determining future success for market participants.

India Construction Equipment Market Company Market Share

India Construction Equipment Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India Construction Equipment Market, offering valuable insights for stakeholders seeking to navigate this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's current state, future trajectory, and key opportunities. The market is segmented by equipment type (earthmoving, material handling, concrete, and material processing) and drive type (hydraulic, electric/hybrid), covering key players such as XCMG, Liebherr, Kobelco, CAS, JCB, Volvo Construction Equipment, Zoomlion, Hyundai Construction Equipment, Tata Hitachi Construction Machinery, Komatsu, Action Construction Equipment, BEML, Caterpillar, SANY, and Terex. The report projects a market value of xx Million by 2033, highlighting significant growth potential.

India Construction Equipment Market Market Dynamics & Concentration

The India construction equipment market is characterized by a moderately concentrated landscape, with a few major global and domestic players holding significant market share. The market's dynamics are shaped by several crucial factors:

- Innovation: Continuous innovation in equipment technology, including the adoption of electric/hybrid drive systems and automation features, drives market growth. Companies are increasingly focusing on developing fuel-efficient and environmentally friendly equipment to meet evolving regulatory requirements.

- Regulatory Framework: Government initiatives promoting infrastructure development, such as the ambitious National Infrastructure Pipeline, significantly influence market demand. Regulatory changes regarding emission norms and safety standards also impact market dynamics.

- Product Substitutes: The market faces limited direct substitution, though alternative construction methods and technologies could indirectly impact demand.

- End-User Trends: The construction sector's growth, driven by urbanization, industrialization, and government spending on infrastructure projects, directly fuels demand for construction equipment. Increasing preference for technologically advanced and efficient equipment is evident.

- Mergers and Acquisitions (M&A): The market has witnessed a moderate level of M&A activity in recent years, as companies strategize to expand their market reach and product portfolio. The number of M&A deals is estimated at xx per year during the historical period, potentially increasing to xx by 2033. Market share distribution among major players shows a xx% concentration in the hands of top 5 companies in 2024.

India Construction Equipment Market Industry Trends & Analysis

The India construction equipment market is experiencing a dynamic surge, propelled by a confluence of significant industry trends and robust economic drivers. This sector has demonstrated remarkable resilience and growth, reflecting the nation's accelerated development trajectory.

The market has witnessed a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the historical period (2019-2024) and is projected to maintain a robust CAGR of around 8.2% during the forecast period (2025-2033). This impressive growth is primarily fueled by substantial increases in infrastructure investments, rapid urbanization, and ongoing industrialization across the country. Technological disruptions are profoundly reshaping the industry landscape, with an ever-increasing emphasis on automation, digitalization, and the pioneering adoption of electric and hybrid equipment. Consumer preferences are also evolving, shifting towards machinery that offers advanced features, superior fuel efficiency, and a reduced environmental footprint, aligning with global sustainability goals. The competitive dynamics within the market are intensely vibrant, characterized by a fierce contest for market share among both established domestic manufacturers and prominent international players. While the market penetration of electric/hybrid equipment is currently modest, estimated at around 4% in 2024, it is poised for significant expansion, with projections indicating an increase to approximately 12% by 2033, largely driven by growing environmental consciousness and supportive government incentives.

Leading Markets & Segments in India Construction Equipment Market

The Indian construction equipment market is characterized by its geographical diversity, with strong growth patterns observed across various regions. However, specific states that are currently acting as significant demand hubs and driving substantial market activity include Uttar Pradesh, Maharashtra, and Gujarat. When examining the equipment segments, Earthmoving Equipment and Road Construction Equipment collectively dominate the market, accounting for an impressive 45% of the total market value in 2024. This dominant segment is further projected to reach a market value of approximately USD 15,500 Million by 2033, underscoring its critical role in the nation's infrastructure development.

- Key Drivers:

- Government Policies & Initiatives: Proactive government initiatives such as the National Infrastructure Pipeline, the Pradhan Mantri Gati Shakti Master Plan, and the Smart Cities Mission are directly stimulating extensive infrastructure development projects, thereby creating sustained and escalating demand for construction equipment.

- Economic Growth & Investment: India's consistent and robust economic growth is a fundamental pillar supporting the construction sector. This economic vitality translates directly into increased capital expenditure and consequently higher demand for construction equipment.

- Rapid Urbanization: The relentless pace of urbanization across India necessitates substantial and ongoing investments in housing, transportation, and public utilities, leading to a perpetual and growing demand for a wide array of construction machinery.

Within the drive type segment, hydraulic equipment currently commands the largest market share due to its established reliability and widespread application. However, the electric/hybrid segment is anticipated to experience exponential growth in the coming years, driven by technological advancements and environmental imperatives. The sustained dominance of earthmoving equipment is a direct consequence of the vast scale and sheer number of infrastructure development projects underway across the country, with a particular emphasis on road construction and urban infrastructure development.

India Construction Equipment Market Product Developments

Recent product innovations highlight a focus on improved efficiency, reduced environmental impact, and enhanced safety features. Manufacturers are actively introducing electric and hybrid models, showcasing a strong commitment to sustainability. The integration of advanced technologies, such as telematics and automation, is enhancing operational efficiency and productivity. These developments are tailored to meet the evolving needs of the Indian construction sector, focusing on cost-effectiveness, reliability, and user-friendliness. The market is witnessing a clear trend toward customized solutions designed to address specific project requirements.

Key Drivers of India Construction Equipment Market Growth

Several factors contribute to the market's growth trajectory:

- Government Infrastructure Spending: Massive investments in infrastructure projects under various government initiatives fuel strong demand.

- Technological Advancements: Innovations in equipment design, efficiency, and sustainability enhance market appeal.

- Urbanization and Industrialization: Rapid growth in these sectors drives the need for construction, creating substantial market opportunities.

- Rising Disposable Incomes: Increased spending power fuels private construction projects, boosting overall market demand.

Challenges in the India Construction Equipment Market Market

Despite the positive outlook, the market faces certain challenges:

- High Import Dependence: Reliance on imported components increases vulnerability to global supply chain disruptions.

- Fluctuating Fuel Prices: Fuel costs significantly affect the operational expenses of construction equipment, impacting profitability.

- Stringent Emission Norms: Meeting evolving environmental regulations requires significant investments in technology upgrades.

- Skilled Labor Shortage: The construction industry faces a shortage of skilled labor, which can potentially hamper project timelines and efficiency.

Emerging Opportunities in India Construction Equipment Market

The long-term growth trajectory of the India construction equipment market is poised for significant expansion, propelled by a host of emerging opportunities. The increasing adoption of technologically advanced equipment, with a pronounced focus on electric and hybrid models, presents immense potential for market players. Strategic alliances and partnerships between domestic and international entities can significantly foster market growth, drive innovation, and facilitate the transfer of cutting-edge technologies. Expanding market reach into underserved or emerging regions within India, alongside tapping into the burgeoning demand from private sector-driven construction projects, offers lucrative avenues for revenue generation. Continued government support for large-scale infrastructure projects and a proactive push towards technological advancement remain pivotal catalysts for sustained market development and innovation.

Leading Players in the India Construction Equipment Market Sector

- XCMG

- Liebherr

- Kobelco

- CAS

- JCB

- Volvo Construction Equipment

- Zoomlion

- Hyundai Construction Equipment

- Tata Hitachi Construction Machinery

- Komatsu

- Action Construction Equipment

- BEML

- Caterpillar

- SANY

- Terex

Key Milestones in India Construction Equipment Market Industry

- September 2022: Schwing Stetter India launched a new range of XCMG hydraulic excavators and wheel loaders.

- January 2023: Komatsu India launched bio-diesel compatible off-highway trucks.

- February 2023: Volvo Construction Equipment launched its first electric compact excavator, the EC55, in India.

- February 2023: XCMG showcased six new customized products at ConExpo INDIA, securing pre-sale orders for nearly 100 units.

- August 2023: SANY India delivered 8 units of the SANY SCC7500A 750 Ton crawler cranes to Sanghvi Movers Limited.

Strategic Outlook for India Construction Equipment Market Market

The India construction equipment market presents a compelling and highly attractive investment opportunity, underpinned by sustained and robust infrastructure development, rapid technological advancements, and a supportive policy environment shaped by the Indian government. Strategic stakeholders in this market should prioritize the integration of sustainable technologies, the development of tailored and customized equipment solutions to meet diverse project requirements, and the strengthening of supply chain resilience to ensure consistent availability and efficient service. Collaboration and the formation of strategic partnerships will be absolutely crucial for effectively navigating market complexities, mitigating potential risks, and capitalizing on the myriad of emerging opportunities. The future growth trajectory of this market is intrinsically linked to the continuity of significant infrastructure investments, a relentless pursuit of technological innovation, and a proactive and agile adaptation to evolving regulatory frameworks. Overall, the long-term outlook for the India construction equipment market remains exceptionally positive, signaling substantial potential for continued expansion, diversification, and market leadership on a global scale.

India Construction Equipment Market Segmentation

-

1. Equipment Type

-

1.1. Earthmoving and Road Construction Equipment

- 1.1.1. Excavator

- 1.1.2. Backhoe Loader

- 1.1.3. Wheeled Loader

- 1.1.4. Motor Grader

- 1.1.5. Other Ea

-

1.2. Material Handling Equipment

- 1.2.1. Crane

- 1.2.2. Forklift & Telescopic Handler

- 1.2.3. Other Ma

-

1.3. Concrete Equipment

- 1.3.1. Asphalt Finishers

- 1.3.2. Transit Mixers

- 1.3.3. Other Co

- 1.4. Material Processing Equipment (Crushing Equipment)

-

1.1. Earthmoving and Road Construction Equipment

-

2. Drive Type

- 2.1. Hydraulic

- 2.2. Electric/Hybrid

India Construction Equipment Market Segmentation By Geography

- 1. India

India Construction Equipment Market Regional Market Share

Geographic Coverage of India Construction Equipment Market

India Construction Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Government Spending on Construction and Infrastructure Development; Others

- 3.3. Market Restrains

- 3.3.1. High Cost Associated with Maintaining and Replacing Construction Equipment

- 3.4. Market Trends

- 3.4.1. Increasing Government Spending on Construction and Infrastructure Development

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 5.1.1. Earthmoving and Road Construction Equipment

- 5.1.1.1. Excavator

- 5.1.1.2. Backhoe Loader

- 5.1.1.3. Wheeled Loader

- 5.1.1.4. Motor Grader

- 5.1.1.5. Other Ea

- 5.1.2. Material Handling Equipment

- 5.1.2.1. Crane

- 5.1.2.2. Forklift & Telescopic Handler

- 5.1.2.3. Other Ma

- 5.1.3. Concrete Equipment

- 5.1.3.1. Asphalt Finishers

- 5.1.3.2. Transit Mixers

- 5.1.3.3. Other Co

- 5.1.4. Material Processing Equipment (Crushing Equipment)

- 5.1.1. Earthmoving and Road Construction Equipment

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. Hydraulic

- 5.2.2. Electric/Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 XCMG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Liebherr

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kobelco

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CAS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 JCB

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Volvo Construction Equipment

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Zoomlion

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hyundai Construction Equipment

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tata Hitachi Construction Machinery

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Komatsu

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Action Construction Equipment

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 BEML

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Caterpillar

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 SANY

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Terex

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 XCMG

List of Figures

- Figure 1: India Construction Equipment Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Construction Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: India Construction Equipment Market Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 2: India Construction Equipment Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 3: India Construction Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Construction Equipment Market Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 5: India Construction Equipment Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 6: India Construction Equipment Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Construction Equipment Market?

The projected CAGR is approximately 8.30%.

2. Which companies are prominent players in the India Construction Equipment Market?

Key companies in the market include XCMG, Liebherr, Kobelco, CAS, JCB, Volvo Construction Equipment, Zoomlion, Hyundai Construction Equipment, Tata Hitachi Construction Machinery, Komatsu, Action Construction Equipment, BEML, Caterpillar, SANY, Terex.

3. What are the main segments of the India Construction Equipment Market?

The market segments include Equipment Type, Drive Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Government Spending on Construction and Infrastructure Development; Others.

6. What are the notable trends driving market growth?

Increasing Government Spending on Construction and Infrastructure Development.

7. Are there any restraints impacting market growth?

High Cost Associated with Maintaining and Replacing Construction Equipment.

8. Can you provide examples of recent developments in the market?

August 2023: SANY India, a leading manufacturer of construction equipment, announced the delivery of 8 units of the SANY SCC7500A 750 Ton crawler cranes in the first quarter of the financial year 2023-24, to Sanghvi Movers Limited, one of the largest crane rental company in India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Construction Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Construction Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Construction Equipment Market?

To stay informed about further developments, trends, and reports in the India Construction Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence