Key Insights

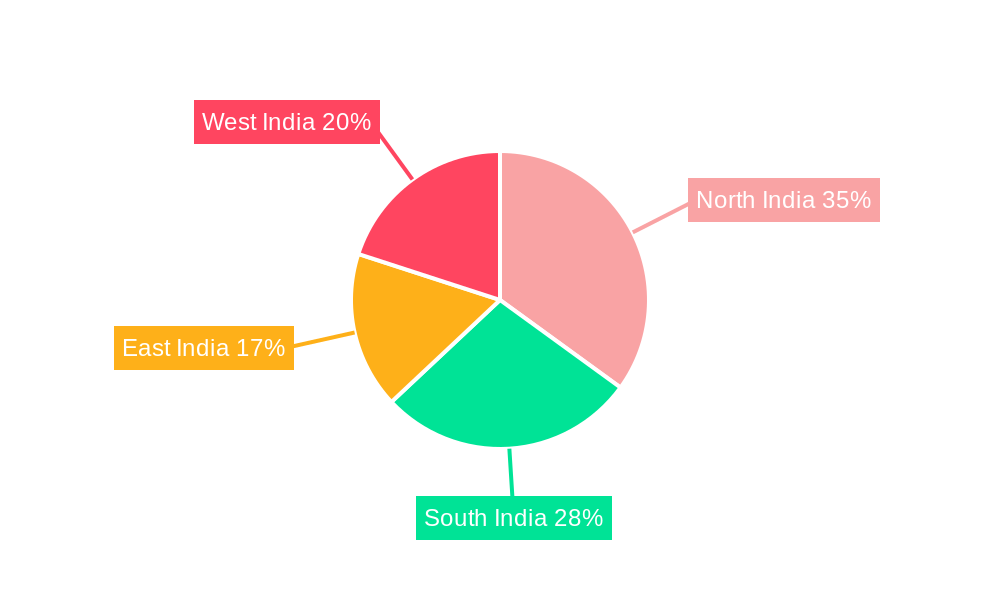

The Indian connected vehicles market is experiencing robust expansion, driven by increasing smartphone adoption, enhanced digital infrastructure, and supportive government digitalization initiatives. Projections indicate a Compound Annual Growth Rate (CAGR) of 15.4%, with the market size expected to reach 6.49 billion by 2024. Key growth drivers include the escalating demand for Advanced Driver-Assistance Systems (ADAS), widespread adoption of telematics for fleet management and insurance, and the growing popularity of connected infotainment systems. Analysis of segment performance highlights significant growth across diverse applications, connectivity types, and vehicle categories. While passenger cars currently dominate, commercial vehicles are poised for substantial growth, attributed to improvements in operational efficiency and safety features. The advancement of Vehicle-to-Vehicle (V2V) and Vehicle-to-Infrastructure (V2I) communication technologies is anticipated to accelerate, particularly in urban centers, leading to optimized traffic management and heightened safety. Regional growth patterns suggest a stronger initial uptake in metropolitan areas of North and West India, owing to higher vehicle density and technological readiness, with other regions expected to rapidly converge and contribute to overall market expansion.

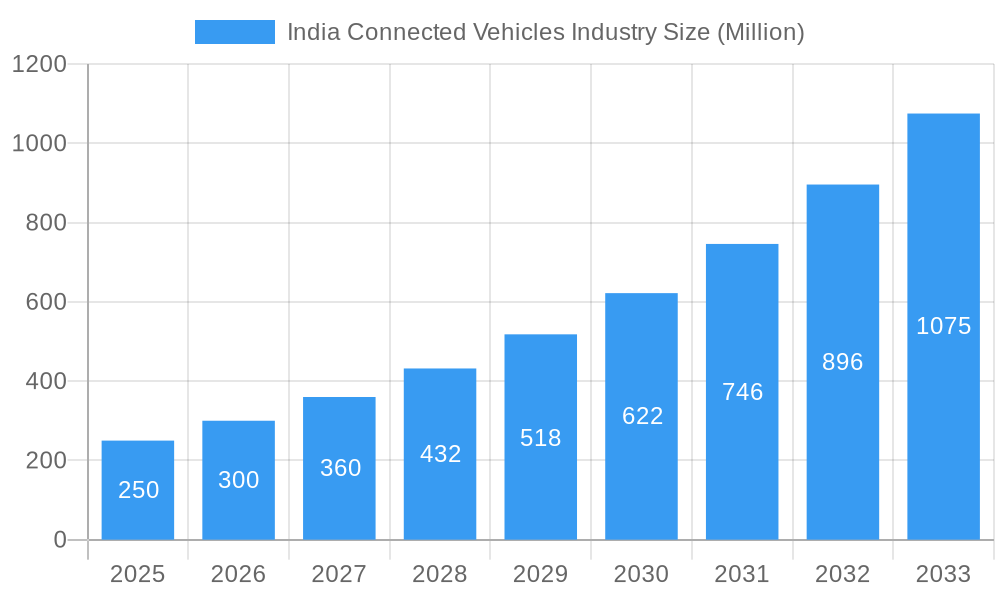

India Connected Vehicles Industry Market Size (In Billion)

Challenges, including high initial investment for infrastructure and consumer adoption barriers, especially in rural regions, are expected to be addressed through declining hardware costs, increased government support, and rising consumer awareness of connected vehicle advantages. The competitive landscape is characterized by a blend of global and domestic automotive manufacturers and technology providers, fostering intense competition and continuous innovation. This dynamic environment is set to further propel market growth, expanding the addressable market for hardware manufacturers, software developers, and telecommunication service providers. Strategic collaborations between automotive companies and technology leaders will be instrumental in integrating advanced functionalities and delivering a superior user experience.

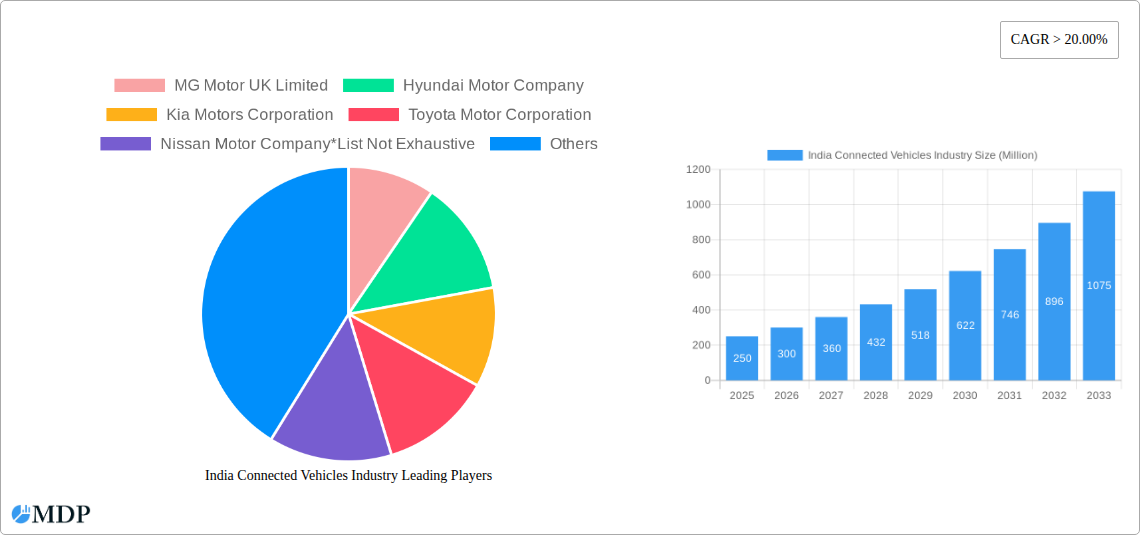

India Connected Vehicles Industry Company Market Share

India Connected Vehicles Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning India Connected Vehicles market, offering invaluable insights for stakeholders, investors, and industry professionals. Forecasting robust growth from 2025 to 2033, this report leverages extensive data analysis from the historical period (2019-2024) and utilizes 2025 as the base year and estimated year for a precise market outlook. The study covers key market segments, leading players, and emerging trends, providing a clear roadmap for navigating this dynamic landscape. The market is expected to reach xx Million by 2033.

India Connected Vehicles Industry Market Dynamics & Concentration

This section delves into the competitive landscape of the Indian connected vehicles market, analyzing market concentration, innovation drivers, regulatory frameworks, and influential factors shaping industry growth. The market is characterized by a mix of established global players and emerging domestic companies. The market share is currently dominated by a few key players, with Maruti Suzuki India Limited, Hyundai Motor Company, Kia Motors Corporation, Toyota Motor Corporation, and Nissan Motor Company holding significant positions. However, the market is experiencing increased competition with the entry of new players and technological advancements.

- Market Concentration: The market exhibits a moderately concentrated structure with the top 5 players holding approximately xx% of the market share in 2025.

- Innovation Drivers: Government initiatives promoting digitalization, advancements in 5G technology, and rising demand for enhanced safety and convenience features are major drivers of innovation.

- Regulatory Frameworks: Government regulations regarding data privacy, cybersecurity, and vehicle emission standards significantly influence market dynamics.

- Product Substitutes: The absence of direct substitutes strengthens the market's growth trajectory.

- End-User Trends: Increasing smartphone penetration and digital literacy among consumers fuel the adoption of connected vehicle technologies.

- M&A Activities: The past five years have witnessed xx M&A deals, indicating strategic consolidation within the industry.

India Connected Vehicles Industry Industry Trends & Analysis

This section provides a detailed analysis of the market’s growth trajectory, technological disruptions, consumer behavior, and competitive dynamics. The Indian connected vehicles market is experiencing exponential growth, driven by a confluence of factors. The market is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration of connected vehicles is expected to reach xx% by 2033. Key growth drivers include increasing affordability of vehicles, rising consumer disposable incomes, expanding 4G and 5G network coverage, and the government's push for smart cities and digital infrastructure. Technological advancements, such as Artificial Intelligence (AI) and Machine Learning (ML) integration, are transforming the landscape, leading to the development of sophisticated features. Consumer preference is shifting towards advanced safety features, entertainment options, and connected services, creating a high demand for these technologies.

Leading Markets & Segments in India Connected Vehicles Industry

This section identifies the dominant regions, countries, and segments within the Indian connected vehicles market.

By Application Type:

- Driver Assistance: This segment is experiencing the highest growth due to increasing safety concerns and the availability of advanced driver-assistance systems (ADAS).

- Telematics: The telematics segment is rapidly expanding, fueled by the demand for fleet management solutions and usage-based insurance programs.

- Infotainment: This segment displays strong growth, driven by the integration of advanced infotainment systems and smartphone connectivity.

- Other Application Types: This segment encompasses various applications, including remote diagnostics and over-the-air updates, exhibiting moderate growth.

By Connectivity Type:

- V2Vehicle (V2V): This segment is expected to witness significant growth as V2V communication technologies improve road safety and efficiency.

- V2Infrastructure (V2I): The V2I segment is growing as smart city initiatives promote infrastructure-to-vehicle communication.

- V2Pedestrian (V2P): The V2P segment is emerging as a promising area, enhancing safety for pedestrians and improving urban mobility.

By Vehicle Type:

- Passenger Cars: This segment dominates the market due to high vehicle ownership and increasing demand for advanced features.

- Commercial Vehicles: The commercial vehicle segment is experiencing robust growth, driven by fleet management and logistics optimization needs.

Key Drivers: Favorable government policies, investment in infrastructure development, and a growing middle class are key drivers for the market's dominance in these segments.

India Connected Vehicles Industry Product Developments

The Indian connected vehicles market showcases continuous product innovation, with a focus on enhancing safety, convenience, and entertainment features. Technological trends include the integration of AI and ML for advanced driver assistance systems, the development of secure in-vehicle communication systems, and the introduction of user-friendly infotainment platforms. These innovations are tailored to meet the specific needs and preferences of the Indian market, ensuring high market fit.

Key Drivers of India Connected Vehicles Industry Growth

Several factors are propelling the growth of the Indian connected vehicles market. Technological advancements, such as 5G deployment and improved AI capabilities, enable more sophisticated connected features. Favorable government policies promoting digitalization and infrastructure development create a conducive environment. Economic factors, including rising disposable incomes and increased vehicle ownership, further stimulate market growth.

Challenges in the India Connected Vehicles Industry Market

Despite the promising growth trajectory, several challenges hinder the market's expansion. Regulatory uncertainties surrounding data privacy and cybersecurity pose significant hurdles. Supply chain disruptions and component shortages can impact production and timely delivery. Intense competition among established players and new entrants necessitates innovative strategies for sustained success.

Emerging Opportunities in India Connected Vehicles Industry

The Indian connected vehicles market presents several opportunities for long-term growth. Technological breakthroughs in areas such as autonomous driving and V2X communication open up exciting avenues. Strategic partnerships between automotive manufacturers, technology providers, and telecom operators can create synergistic value. Expanding into rural markets and tapping into the growing demand for commercial vehicle connectivity offers significant potential.

Leading Players in the India Connected Vehicles Industry Sector

- MG Motor UK Limited

- Hyundai Motor Company

- Kia Motors Corporation

- Toyota Motor Corporation

- Nissan Motor Company

- Maruti Suzuki India Limited

Key Milestones in India Connected Vehicles Industry Industry

- 2020: Launch of 5G trials in India, paving the way for enhanced connectivity.

- 2021: Introduction of several new connected car models by leading manufacturers.

- 2022: Government initiatives promoting the adoption of connected vehicle technologies.

- 2023: Increased investments in infrastructure development supporting connected car applications.

Strategic Outlook for India Connected Vehicles Industry Market

The Indian connected vehicles market holds immense potential for growth. Continued advancements in technology, supportive government policies, and rising consumer demand will drive market expansion. Strategic partnerships and innovative business models will be critical for players seeking to capitalize on this burgeoning market. The focus on delivering safe, reliable, and user-friendly connected vehicle solutions will determine success in this competitive landscape.

India Connected Vehicles Industry Segmentation

-

1. Application Type

- 1.1. Driver Assistance

- 1.2. Telematics

- 1.3. Infotainment

- 1.4. Other Application Types

-

2. Connectivity Type

- 2.1. Integrated

- 2.2. Embedded

- 2.3. Tethered

-

3. Vehicle Connectivity

- 3.1. Vehicle-to-Vehicle (V2V)

- 3.2. Vehicle-to-Infrastructure (V2I)

- 3.3. Vehicle-to-Pedestrain (V2P)

-

4. Vehicle Type

- 4.1. Passenger Cars

- 4.2. Commercial Vehicle

India Connected Vehicles Industry Segmentation By Geography

- 1. India

India Connected Vehicles Industry Regional Market Share

Geographic Coverage of India Connected Vehicles Industry

India Connected Vehicles Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing disposable income and Low-interest rates from lenders increase the market demand

- 3.3. Market Restrains

- 3.3.1. High initial costs may obstruct the growth

- 3.4. Market Trends

- 3.4.1. EVs will Boost the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Connected Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Driver Assistance

- 5.1.2. Telematics

- 5.1.3. Infotainment

- 5.1.4. Other Application Types

- 5.2. Market Analysis, Insights and Forecast - by Connectivity Type

- 5.2.1. Integrated

- 5.2.2. Embedded

- 5.2.3. Tethered

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Connectivity

- 5.3.1. Vehicle-to-Vehicle (V2V)

- 5.3.2. Vehicle-to-Infrastructure (V2I)

- 5.3.3. Vehicle-to-Pedestrain (V2P)

- 5.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.4.1. Passenger Cars

- 5.4.2. Commercial Vehicle

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 MG Motor UK Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hyundai Motor Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kia Motors Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Toyota Motor Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nissan Motor Company*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Maruti Suzuki India Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 MG Motor UK Limited

List of Figures

- Figure 1: India Connected Vehicles Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Connected Vehicles Industry Share (%) by Company 2025

List of Tables

- Table 1: India Connected Vehicles Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 2: India Connected Vehicles Industry Revenue billion Forecast, by Connectivity Type 2020 & 2033

- Table 3: India Connected Vehicles Industry Revenue billion Forecast, by Vehicle Connectivity 2020 & 2033

- Table 4: India Connected Vehicles Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 5: India Connected Vehicles Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: India Connected Vehicles Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 7: India Connected Vehicles Industry Revenue billion Forecast, by Connectivity Type 2020 & 2033

- Table 8: India Connected Vehicles Industry Revenue billion Forecast, by Vehicle Connectivity 2020 & 2033

- Table 9: India Connected Vehicles Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 10: India Connected Vehicles Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Connected Vehicles Industry?

The projected CAGR is approximately 15.4%.

2. Which companies are prominent players in the India Connected Vehicles Industry?

Key companies in the market include MG Motor UK Limited, Hyundai Motor Company, Kia Motors Corporation, Toyota Motor Corporation, Nissan Motor Company*List Not Exhaustive, Maruti Suzuki India Limited.

3. What are the main segments of the India Connected Vehicles Industry?

The market segments include Application Type, Connectivity Type, Vehicle Connectivity, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.49 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing disposable income and Low-interest rates from lenders increase the market demand.

6. What are the notable trends driving market growth?

EVs will Boost the Market's Growth.

7. Are there any restraints impacting market growth?

High initial costs may obstruct the growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Connected Vehicles Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Connected Vehicles Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Connected Vehicles Industry?

To stay informed about further developments, trends, and reports in the India Connected Vehicles Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence