Key Insights

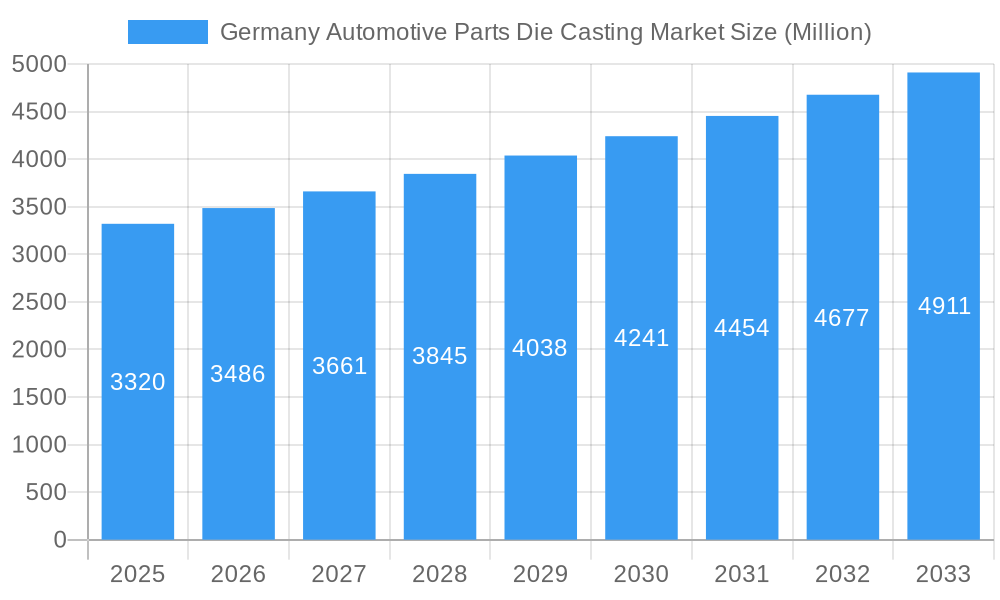

The Germany automotive parts die casting market, valued at €3.32 billion in 2025, is projected to experience robust growth, driven by the increasing demand for lightweight vehicles and the rising adoption of electric vehicles (EVs). The market's Compound Annual Growth Rate (CAGR) of 5% from 2025 to 2033 signifies a consistent expansion. This growth is fueled by several key factors. Firstly, the automotive industry's continuous pursuit of fuel efficiency necessitates the use of lightweight materials like aluminum and magnesium in die casting, leading to increased demand for these components. Secondly, the increasing complexity of automotive designs and the integration of advanced technologies necessitate more sophisticated die casting processes, such as vacuum and semi-solid die casting, driving innovation and market expansion within the sector. Finally, Germany's strong automotive manufacturing base, particularly in regions like North Rhine-Westphalia, Bavaria, and Baden-Württemberg, provides a fertile ground for the growth of this market. While supply chain disruptions and fluctuating raw material prices pose potential restraints, the overall market outlook remains positive due to the long-term trends in automotive manufacturing.

Germany Automotive Parts Die Casting Market Market Size (In Billion)

The segment analysis reveals a significant contribution from engine and transmission components to the overall market value. Pressure die casting remains the dominant production process, though the adoption of more advanced techniques like vacuum and semi-solid die casting is gaining traction, driven by the need for higher precision and improved material properties. Key players in the market, including Sandhar Technologies Ltd, Raltor Metal Technik India Pvt Ltd, and Endurance Group, are strategically investing in research and development to enhance their product offerings and cater to the evolving needs of the automotive industry. The competitive landscape is marked by both domestic and international players, reflecting the global nature of the automotive supply chain. The consistent growth forecast underscores the Germany automotive parts die casting market's potential for continued expansion and innovation in the coming years.

Germany Automotive Parts Die Casting Market Company Market Share

Germany Automotive Parts Die Casting Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Germany automotive parts die casting market, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, industry trends, leading players, and future growth prospects. Maximize your strategic decision-making with data-driven analysis and actionable recommendations.

Keywords: Germany Automotive Parts Die Casting Market, Die Casting, Automotive Parts, Germany, Market Analysis, Market Forecast, Industry Trends, Market Size, Market Share, Aluminum Die Casting, Zinc Die Casting, Magnesium Die Casting, Engine Parts, Transmission Components, Body Parts, Pressure Die Casting, Vacuum Die Casting, Sandhar Technologies Ltd, Raltor Metal Technik India Pvt Ltd, Endurance Group, Castwel Auto Parts Pvt Ltd, Rockman Industries Ltd, Mino Industry USA INC, Gibbs Die Casting Group, Dynacast, Kinetic Die Casting Company, Ningbo Parison Die Casting Co Ltd

Germany Automotive Parts Die Casting Market Market Dynamics & Concentration

This section analyzes the competitive landscape of the German automotive parts die casting market, exploring factors influencing market concentration, innovation, and growth. We delve into regulatory changes, the impact of substitute products, evolving end-user demands, and the frequency of mergers and acquisitions (M&A) activities. The analysis includes detailed examination of market share distribution among key players and the number of M&A deals concluded during the study period.

- Market Concentration: The market exhibits a (xx)% concentration ratio, with the top 5 players holding approximately (xx)% market share in 2024. This indicates a (moderately/highly) consolidated market.

- Innovation Drivers: Technological advancements in die casting processes (e.g., semi-solid die casting) and the development of lightweight materials are driving market innovation.

- Regulatory Framework: Stringent emission norms and safety regulations in Germany significantly influence the demand for lightweight and high-performance die-cast components.

- Product Substitutes: The market faces competition from alternative manufacturing processes such as forging and plastic injection molding.

- End-User Trends: The increasing demand for electric vehicles (EVs) and lightweight vehicles is boosting demand for die-cast components made from aluminum and magnesium.

- M&A Activities: The number of M&A transactions in the German automotive parts die casting market between 2019 and 2024 was (xx). These activities are primarily driven by the need to enhance production capabilities, expand geographical reach, and gain access to new technologies.

Germany Automotive Parts Die Casting Market Industry Trends & Analysis

The German automotive parts die casting market is experiencing a transformative period, propelled by several influential factors. A significant driver is the escalating demand for lightweight vehicles, a critical component in enhancing fuel efficiency and reducing emissions. This trend is further amplified by the rapid adoption of electric vehicles (EVs), which require specialized, lightweight components for battery casings, motor housings, and structural elements. Technological advancements are also reshaping the landscape, with a focus on automation, digitalization, and the integration of Industry 4.0 principles within die casting facilities. This leads to improved precision, reduced cycle times, and enhanced overall operational efficiency. Changing consumer preferences for more sustainable and technologically advanced vehicles are indirectly influencing the demand for innovative and high-performance die-cast parts. The competitive dynamics are characterized by a mix of established global players and agile local manufacturers vying for market share, often focusing on specialization and niche applications.

The market is projected to witness a robust Compound Annual Growth Rate (CAGR) of approximately **6.8%** during the forecast period (2025-2033). This growth is underpinned by the aforementioned drivers, particularly the sustained push towards electrification and the ongoing pursuit of optimized vehicle performance and safety. Market penetration of aluminum die castings, a favored material due to its lightweight properties and recyclability, is anticipated to reach an impressive **75%** by 2033, indicating its dominance in the sector.

Leading Markets & Segments in Germany Automotive Parts Die Casting Market

This section identifies the dominant segments within the German automotive parts die casting market based on raw material, application type, and production process. The analysis explores the key drivers of dominance for each segment, including economic policies and infrastructure development.

- Raw Material: Aluminum remains the dominant raw material, driven by its lightweight properties and cost-effectiveness. Zinc and magnesium are expected to see increased adoption due to their specific performance advantages in certain applications.

- Application Type: Engine parts and transmission components constitute the largest application segments, reflecting the high demand for these components in the automotive industry. Growth in electric vehicles is driving demand for body parts and other applications.

- Production Process Type: Pressure die casting continues to be the most prevalent production process, due to its high productivity and efficiency. However, vacuum die casting and semi-solid die casting are gaining traction due to their ability to produce high-quality components with improved surface finish and mechanical properties. The increasing demand for high-precision and complex components is driving the adoption of these advanced processes.

Germany Automotive Parts Die Casting Market Product Developments

Recent product developments in the Germany automotive parts die casting market are keenly focused on pushing the boundaries of material science and manufacturing processes. A primary objective is to enhance the performance, durability, and efficiency of die-cast components through the strategic incorporation of advanced, lightweight materials. This includes the extensive use of high-strength aluminum alloys, magnesium alloys, and increasingly, composite materials where applicable, to achieve significant weight reduction without compromising structural integrity. Innovations in surface finishing technologies are also a key area of focus, aiming for improved aesthetics, corrosion resistance, and enhanced tribological properties.

Furthermore, there's a pronounced trend towards the integration of complex geometries and multi-functional components within a single die-casting operation. This not only reduces the number of individual parts required but also streamlines assembly processes and further contributes to vehicle lightweighting. Advanced manufacturing techniques such as vacuum-assisted die casting and hot chamber die casting are being refined and implemented to achieve higher precision, tighter tolerances, and superior dimensional accuracy, especially for critical automotive applications like powertrain components, chassis parts, and EV battery enclosures. These advancements are directly aligned with the industry's overarching goals of improving fuel efficiency, increasing vehicle range, and meeting stringent automotive safety standards.

Key Drivers of Germany Automotive Parts Die Casting Market Growth

The German automotive parts die casting market’s growth is driven by several key factors. The increasing demand for lightweight vehicles, fueled by stricter fuel efficiency regulations and growing environmental concerns, is a major driver. Technological advancements in die casting processes, such as the development of high-pressure die casting and semi-solid die casting, are also contributing to market growth. Furthermore, government incentives promoting the adoption of electric vehicles (EVs) are boosting demand for die-cast components.

Challenges in the Germany Automotive Parts Die Casting Market Market

The Germany automotive parts die casting market, while promising, is not without its inherent challenges. A significant concern remains the volatility of raw material prices, with fluctuations in the cost of key inputs like aluminum and magnesium directly impacting production costs and profitability for manufacturers. The market also experiences intense competition, both from established global leaders with extensive resources and from agile new entrants often offering specialized solutions or competitive pricing, which can exert downward pressure on profit margins.

Meeting the ever-increasing and stringent quality, safety, and environmental standards set by automotive OEMs and regulatory bodies presents another hurdle. This often necessitates substantial investments in advanced manufacturing technologies, rigorous quality control systems, and specialized training for the workforce, thereby increasing operational expenses. Additionally, the globalized nature of the automotive supply chain makes it susceptible to disruptions caused by geopolitical events, trade policy changes, natural disasters, or unforeseen public health crises. Such supply chain vulnerabilities can lead to production delays, increased lead times, and challenges in meeting just-in-time delivery schedules, potentially impacting the overall growth trajectory of the market.

Emerging Opportunities in Germany Automotive Parts Die Casting Market

The German automotive parts die casting market presents several emerging opportunities. The increasing adoption of electric vehicles and hybrid electric vehicles (HEVs) is creating significant demand for lightweight components, particularly those made from aluminum and magnesium. Advancements in die casting technology, such as the development of high-pressure die casting and semi-solid die casting, are providing opportunities to improve component quality and reduce manufacturing costs. Strategic partnerships and collaborations between die casters and automotive manufacturers are creating avenues for innovation and technological advancements.

Leading Players in the Germany Automotive Parts Die Casting Market Sector

- Georg Fischer AG

- ZF Friedrichshafen AG

- Nemak, S.A.B. de C.V.

- Martinrea International Inc.

- DGS Castings

- TRUMPF SE + Co. KG

- Lacks Enterprises

- VALLOUREC

- MetalFlow

- Casting Technology Ltd.

Key Milestones in Germany Automotive Parts Die Casting Market Industry

- 2020: Introduction of a new high-pressure die casting machine by a leading player, enhancing production capacity and quality.

- 2022: Acquisition of a smaller die casting company by a major player, leading to increased market share.

- 2023: Launch of a new lightweight aluminum alloy specifically designed for automotive applications.

Strategic Outlook for Germany Automotive Parts Die Casting Market Market

The strategic outlook for the Germany automotive parts die casting market is one of significant opportunity and dynamic evolution. The unwavering demand for lightweight vehicles, fueled by stringent emissions regulations and the accelerating transition to electric mobility, will continue to be a primary growth engine. Companies that can master the production of complex, high-performance components for EV powertrains, battery systems, and lightweight structural applications will be at a distinct advantage.

Strategic partnerships and collaborations will be crucial for navigating the complexities of the market. This includes forging closer ties with automotive OEMs to co-develop innovative solutions and secure long-term supply contracts. Significant investments in research and development (R&D) are imperative to stay ahead of technological curves, particularly in areas like advanced material alloys, novel die-casting techniques (e.g., additive manufacturing integration with casting), and automation. A strong emphasis on sustainable manufacturing practices, including energy-efficient processes, waste reduction, and the use of recycled materials, will not only meet regulatory requirements but also resonate with increasingly environmentally conscious consumers and OEMs. Players who demonstrate agility in adapting to evolving industry trends, embrace digital transformation for enhanced operational efficiency, and consistently meet the highest standards of quality and sustainability will be exceptionally well-positioned to capitalize on the substantial growth prospects within this vital market sector.

Germany Automotive Parts Die Casting Market Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Squeeze Die Casting

- 1.4. Semi-Solid Die Casting

-

2. Raw Material

- 2.1. Aluminum

- 2.2. Zinc

- 2.3. Magnesium

-

3. Application Type

- 3.1. Engine Parts

- 3.2. Transmission Components

- 3.3. Body Parts

- 3.4. Other Applications

Germany Automotive Parts Die Casting Market Segmentation By Geography

- 1. Germany

Germany Automotive Parts Die Casting Market Regional Market Share

Geographic Coverage of Germany Automotive Parts Die Casting Market

Germany Automotive Parts Die Casting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Aluminium Use in Die Casting Equipment is Likely to Drive Demand for the Die-Casting Market

- 3.3. Market Restrains

- 3.3.1. High Raw Material Prices May One of The Factors That Hindering Target Market Growth.

- 3.4. Market Trends

- 3.4.1. Increasing Aluminium Use in Die Casting Equipment is Likely to Drive Demand for the Die-Casting Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Automotive Parts Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Squeeze Die Casting

- 5.1.4. Semi-Solid Die Casting

- 5.2. Market Analysis, Insights and Forecast - by Raw Material

- 5.2.1. Aluminum

- 5.2.2. Zinc

- 5.2.3. Magnesium

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Engine Parts

- 5.3.2. Transmission Components

- 5.3.3. Body Parts

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sandhar Technologies Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Raltor Metal Technik India Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Endurance Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Castwel Auto Parts Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rockman Industries Ltd *List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mino Industry USA INC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gibbs Die Casting Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dynacast

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kinetic Die Casting Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ningbo Parison Die Casting Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sandhar Technologies Ltd

List of Figures

- Figure 1: Germany Automotive Parts Die Casting Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany Automotive Parts Die Casting Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Automotive Parts Die Casting Market Revenue Million Forecast, by Production Process Type 2020 & 2033

- Table 2: Germany Automotive Parts Die Casting Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 3: Germany Automotive Parts Die Casting Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 4: Germany Automotive Parts Die Casting Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Germany Automotive Parts Die Casting Market Revenue Million Forecast, by Production Process Type 2020 & 2033

- Table 6: Germany Automotive Parts Die Casting Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 7: Germany Automotive Parts Die Casting Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 8: Germany Automotive Parts Die Casting Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Automotive Parts Die Casting Market?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Germany Automotive Parts Die Casting Market?

Key companies in the market include Sandhar Technologies Ltd, Raltor Metal Technik India Pvt Ltd, Endurance Group, Castwel Auto Parts Pvt Ltd, Rockman Industries Ltd *List Not Exhaustive, Mino Industry USA INC, Gibbs Die Casting Group, Dynacast, Kinetic Die Casting Company, Ningbo Parison Die Casting Co Ltd.

3. What are the main segments of the Germany Automotive Parts Die Casting Market?

The market segments include Production Process Type, Raw Material, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.32 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Aluminium Use in Die Casting Equipment is Likely to Drive Demand for the Die-Casting Market.

6. What are the notable trends driving market growth?

Increasing Aluminium Use in Die Casting Equipment is Likely to Drive Demand for the Die-Casting Market.

7. Are there any restraints impacting market growth?

High Raw Material Prices May One of The Factors That Hindering Target Market Growth..

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Automotive Parts Die Casting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Automotive Parts Die Casting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Automotive Parts Die Casting Market?

To stay informed about further developments, trends, and reports in the Germany Automotive Parts Die Casting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence