Key Insights

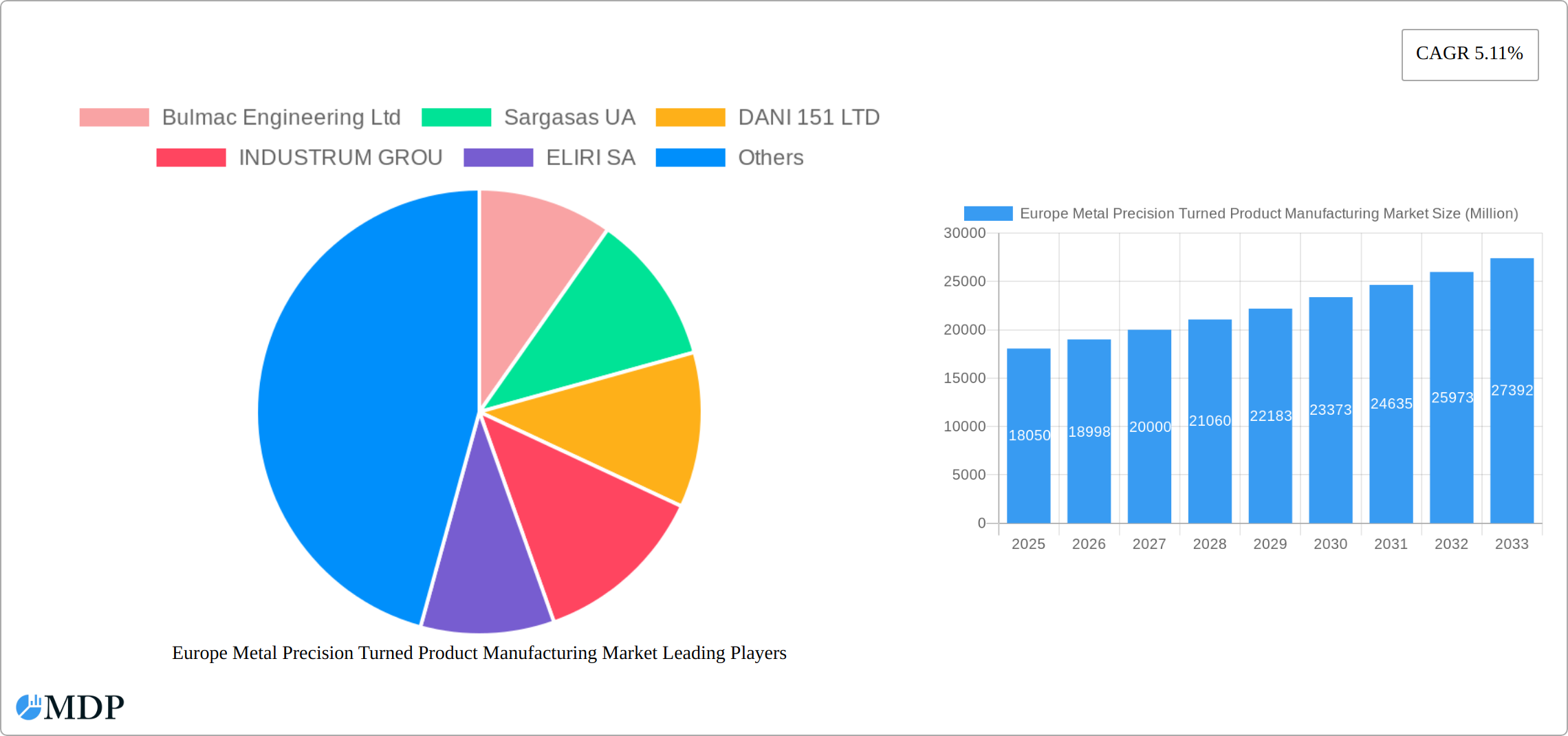

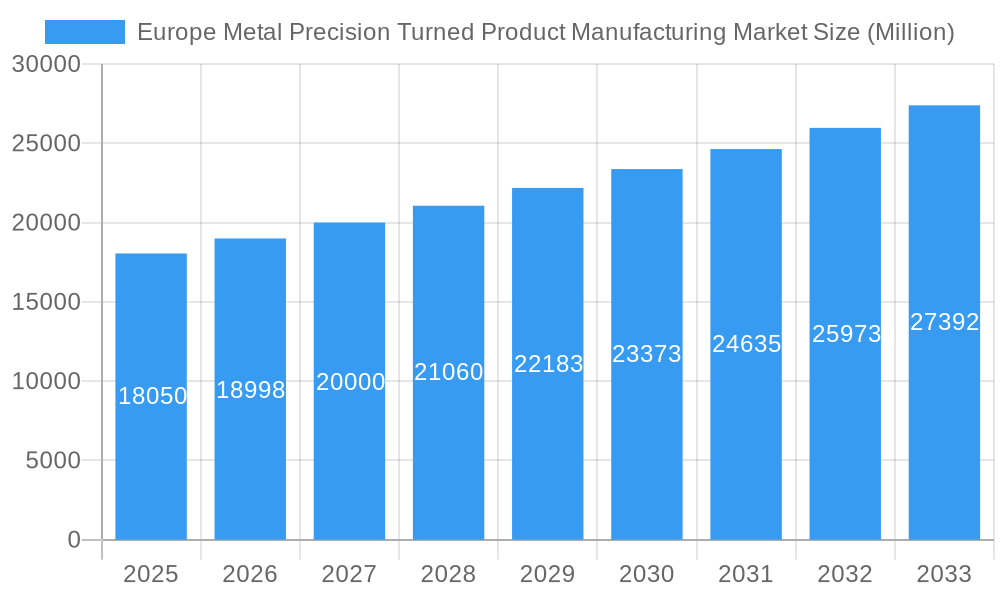

The European metal precision turned product manufacturing market, valued at €18.05 billion in 2025, is projected to experience robust growth, driven by increasing demand from automotive, electronics, and healthcare sectors. A Compound Annual Growth Rate (CAGR) of 5.11% is anticipated from 2025 to 2033, indicating a significant market expansion. This growth is fueled by the rising adoption of advanced manufacturing technologies like CNC machining, which enhance precision, efficiency, and automation. The automotive industry, a major consumer of precision-turned parts, is expected to be a key driver, spurred by the growth in electric vehicle production and the need for intricate components. The burgeoning electronics sector, demanding miniaturized and high-precision components for smartphones, computers, and other devices, further contributes to market expansion. Furthermore, the healthcare industry's increasing reliance on precision-engineered medical instruments fuels demand. While challenges such as fluctuating raw material prices and skilled labor shortages exist, the overall outlook remains positive, with continued innovation and technological advancements shaping the future of the European metal precision turned product manufacturing landscape. Specific segments like CNC operation and automatic screw machines are expected to witness accelerated growth due to their efficiency and precision capabilities. Germany, France, and the United Kingdom are expected to be leading markets within Europe, driven by robust manufacturing sectors and technological advancements.

Europe Metal Precision Turned Product Manufacturing Market Market Size (In Billion)

The market segmentation reveals significant opportunities. The CNC operation segment benefits from superior precision and efficiency, attracting high-value applications in diverse industries. Automatic screw machines offer high-volume production capabilities, while rotary transfer machines excel in complex part manufacturing. The strong presence of established players like Bulmac Engineering Ltd and Sargasas UA, alongside emerging companies like Aspired LLC, signifies a competitive and dynamic market environment. The consistent investment in research and development, along with the integration of Industry 4.0 technologies, will further drive growth and innovation within the market. Regional variations in growth will be influenced by economic conditions, technological adoption rates, and government policies supporting the manufacturing sector within each European nation.

Europe Metal Precision Turned Product Manufacturing Market Company Market Share

Europe Metal Precision Turned Product Manufacturing Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Metal Precision Turned Product Manufacturing Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, trends, leading players, and future growth prospects. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Europe Metal Precision Turned Product Manufacturing Market Dynamics & Concentration

The Europe Metal Precision Turned Product Manufacturing Market is characterized by a moderately consolidated landscape, with several key players holding significant market share. Market concentration is influenced by factors such as technological capabilities, geographical reach, and vertical integration. The market exhibits a dynamic interplay of innovation drivers, including advancements in CNC machining, additive manufacturing, and automation. Regulatory frameworks, including environmental regulations and safety standards, significantly impact manufacturing processes and costs. Product substitutes, such as 3D-printed components and other precision manufacturing techniques, exert competitive pressure. End-user trends, particularly in the automotive and electronics sectors, drive demand for specific precision turned products with high tolerances and surface finishes. The market has witnessed notable M&A activity, with xx deals recorded between 2019 and 2024, further shaping the competitive landscape. Key players such as Bulmac Engineering Ltd, Sargasas UA, and DANI 151 LTD hold significant market shares, estimated at xx%, xx%, and xx% respectively in 2025.

- Market Concentration: Moderately consolidated, with top 5 players holding approximately xx% of the market share in 2025.

- Innovation Drivers: Advancements in CNC machining, additive manufacturing, and automation.

- Regulatory Framework: Stringent environmental and safety regulations influencing manufacturing practices.

- Product Substitutes: 3D printing and other precision manufacturing technologies posing competitive pressure.

- End-user Trends: Growing demand from automotive, electronics, and healthcare sectors.

- M&A Activity: xx M&A deals between 2019 and 2024, resulting in market consolidation.

Europe Metal Precision Turned Product Manufacturing Market Industry Trends & Analysis

The Europe Metal Precision Turned Product Manufacturing Market is experiencing robust growth driven by increasing demand across various end-user industries. Technological advancements, particularly in CNC machining and automation, are enhancing efficiency and precision, leading to higher production volumes and reduced costs. Consumer preferences for high-quality, customized products are driving demand for precision-engineered components. The market is characterized by intense competition, with companies investing heavily in R&D to develop innovative products and manufacturing processes. The market is segmented by operation (manual and CNC), machine type (automatic screw machines, rotary transfer machines, CNC lathes, etc.), and end-user (automotive, electronics, defense, healthcare, etc.). The CNC operation segment dominates the market due to its high precision and efficiency. The automotive sector represents a significant portion of the end-user market, driving demand for high-precision components. The market is expected to grow at a CAGR of xx% during the forecast period (2025-2033), with a market penetration rate of xx% by 2033.

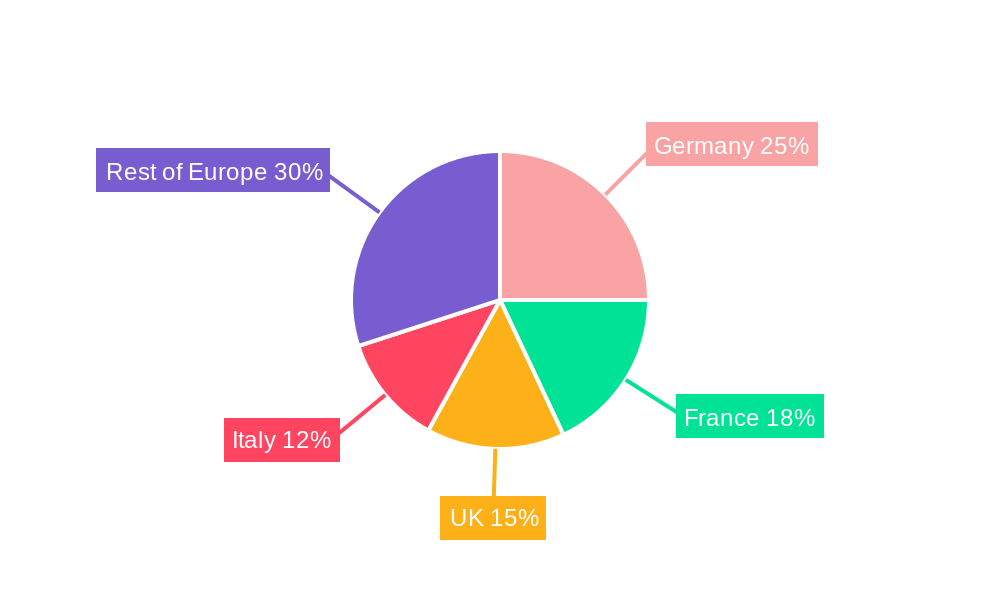

Leading Markets & Segments in Europe Metal Precision Turned Product Manufacturing Market

Germany, the UK, and France are the leading markets in Europe for metal precision turned product manufacturing. These countries benefit from well-established industrial bases, skilled labor, and a strong presence of automotive and electronics manufacturers. The CNC operation segment dominates the market, driven by the high precision and efficiency of CNC machines. Within machine types, CNC lathes and turning centers hold the largest share, followed by automatic screw machines. The automotive industry remains the leading end-user segment, owing to the high demand for precision components in automobiles.

- Key Drivers in Leading Markets:

- Germany: Strong automotive industry, advanced manufacturing infrastructure, skilled workforce.

- UK: Established manufacturing base, focus on high-precision engineering, access to skilled labor.

- France: Growing automotive and aerospace sectors, government support for manufacturing innovation.

- Dominant Segments:

- By Operation: CNC Operation (due to higher precision and efficiency).

- By Machine Type: CNC Lathes and Turning Centers (high demand and versatility).

- By End-User: Automotive (high volume demand for precision components).

Europe Metal Precision Turned Product Manufacturing Market Product Developments

The landscape of metal precision turned product manufacturing in Europe is being dynamically reshaped by a series of forward-thinking product developments. A paramount focus remains on **elevating precision to unprecedented levels**, achieved through the integration of sophisticated real-time monitoring systems and advanced metrology tools directly into CNC machinery. This ensures tighter tolerances and superior part quality, crucial for high-stakes industries. Concurrently, there's a significant drive towards **enhancing operational efficiency and automation**. This is being realized through the development of smarter CNC machines equipped with predictive maintenance capabilities, adaptive machining software that optimizes cutting parameters on the fly, and robotic integration for streamlined material handling and automated quality inspection. The synergy between **additive manufacturing techniques and traditional turning** is also a key innovation area, enabling the creation of complex prototypes and highly specialized, intricate components that were previously impossible to produce. Furthermore, the relentless pursuit of **new material frontiers** is yielding advanced alloys and composites with superior strength-to-weight ratios, enhanced corrosion resistance, and improved thermal properties, opening doors to novel applications. These innovations are not only responding to the escalating demands for tighter tolerances and faster production cycles but are also critically addressing the growing imperative for **sustainable manufacturing practices**. This includes the exploration and adoption of recyclable materials, energy-efficient machining processes, and waste reduction strategies, aligning the industry with environmental stewardship goals and circular economy principles.

Key Drivers of Europe Metal Precision Turned Product Manufacturing Market Growth

The growth of the Europe Metal Precision Turned Product Manufacturing Market is fueled by several factors:

- Technological Advancements: Automation, CNC technology, and advanced materials are driving efficiency and precision.

- Economic Growth: Expansion of end-user industries (automotive, electronics) boosts demand for precision components.

- Government Regulations: Environmental and safety regulations drive innovation in sustainable manufacturing processes.

Challenges in the Europe Metal Precision Turned Product Manufacturing Market

The Europe Metal Precision Turned Product Manufacturing Market navigates a complex terrain marked by several persistent and evolving challenges:

- Escalating Operational Costs: Beyond rising labor expenditures in many Western European nations, manufacturers are grappling with the increased cost of energy, raw materials, and specialized tooling, impacting overall production competitiveness and profit margins.

- Global Supply Chain Volatility: The recent history of supply chain disruptions remains a significant hurdle. Geopolitical instability, trade policy shifts, and unforeseen events continue to create bottlenecks for the procurement of critical raw materials, specialized components, and even the timely delivery of finished goods, leading to production delays and increased lead times.

- Intensified Competitive Landscape: The market is characterized by fierce competition from both established European players and emerging manufacturers from regions with lower cost structures. This necessitates a continuous and substantial investment in research and development, advanced technologies, and process optimization to maintain a competitive edge and differentiate offerings.

- Skilled Workforce Shortages: A growing concern is the scarcity of highly skilled machinists, CNC programmers, and manufacturing engineers. The aging workforce and a lack of new talent entering the field pose a significant challenge to adopting and effectively utilizing the latest advanced manufacturing technologies.

- Stringent Regulatory Environment: European manufacturers must adhere to a complex web of environmental, safety, and quality regulations. While these standards ensure high-quality and responsible production, compliance can add significant overhead and operational complexity.

Emerging Opportunities in Europe Metal Precision Turned Product Manufacturing Market

Despite the challenges, the Europe Metal Precision Turned Product Manufacturing Market is ripe with significant and evolving opportunities:

- Digital Transformation and Industry 4.0 Integration: The widespread adoption of Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT) sensors, and big data analytics presents a transformative opportunity. These technologies enable enhanced predictive maintenance, real-time process optimization, improved quality control through automated inspection, and the development of "smart factories" that are more agile and efficient.

- Strategic Collaborations and Ecosystem Development: Fostering closer partnerships between precision turning manufacturers, technology providers (e.g., software developers, tool manufacturers), research institutions, and end-user industries is crucial. These collaborations can accelerate the co-development of cutting-edge solutions, facilitate knowledge transfer, and create robust industrial ecosystems that drive innovation and market penetration.

- Growth in High-Demand Niche Sectors: The increasing complexity and precision requirements in sectors such as medical devices (implants, surgical instruments), aerospace and defense (complex aerospace components, defense systems), and renewable energy (components for wind turbines, energy storage) offer substantial growth avenues. Specializing in these high-value, demanding markets can lead to premium pricing and sustained demand.

- Additive Manufacturing and Hybrid Processes: The growing integration of additive manufacturing (3D printing) with traditional subtractive turning processes allows for the creation of highly complex geometries and customized parts. This "hybrid manufacturing" approach opens up new design possibilities and caters to the increasing demand for bespoke, high-performance components.

- Sustainability as a Competitive Advantage: As global demand for environmentally conscious products and processes increases, manufacturers who invest in sustainable materials, energy-efficient operations, and circular economy principles can gain a significant competitive advantage and attract environmentally aware clientele.

Leading Players in the Europe Metal Precision Turned Product Manufacturing Market Sector

- Bulmac Engineering Ltd

- Sargasas UA

- DANI 151 LTD

- INDUSTRUM GROU

- ELIRI SA

- R K ENTERPRISES

- VASCHUK LTD

- Arçimed Mold & Injection

- Hardy's Precision Engineering

- Aspired LLC

- Qingdao Guanglai Jiayue International Trade Co Ltd

- UAB Kiruna

Key Milestones in Europe Metal Precision Turned Product Manufacturing Market Industry

- July 2023: Indri-MIM's acquisition of CMG Technologies in the UK marked a significant consolidation in the sector, significantly expanding Indri-MIM's metal injection molding (MIM) and additive manufacturing capabilities. This strategic move bolsters their capacity for producing high-precision metal components and strengthens their competitive standing within the broader European precision manufacturing landscape.

- January 2023: Xometry's strategic expansion into Europe with the launch of Xometry.UK provided UK customers with enhanced access to on-demand manufacturing services. This initiative is expected to not only stimulate competition by offering a wider range of manufacturing options but also to foster innovation by providing a more accessible platform for businesses to bring their designs to life through precision manufacturing.

- Q4 2022: Several European precision turning companies reported significant investments in advanced CNC machining centers equipped with state-of-the-art automation and Industry 4.0 integration capabilities. These investments underscore the industry's commitment to enhancing efficiency, precision, and responsiveness to meet evolving market demands.

- Ongoing: A consistent trend throughout the past year has been the increased adoption of advanced materials, including high-performance alloys and novel composites, by leading European precision turning manufacturers. This reflects the growing demand for components with superior mechanical properties, lighter weight, and enhanced durability across critical sectors like automotive, aerospace, and medical technology.

Strategic Outlook for Europe Metal Precision Turned Product Manufacturing Market Market

The Europe Metal Precision Turned Product Manufacturing Market is poised for continued growth, driven by technological innovation, expanding end-user industries, and strategic partnerships. Companies focusing on automation, advanced materials, and sustainable manufacturing practices are well-positioned to capitalize on future market opportunities. The market's continued evolution hinges on adaptability, innovation, and strategic alliances to address the challenges and leverage the opportunities presented by a dynamic and competitive landscape.

Europe Metal Precision Turned Product Manufacturing Market Segmentation

-

1. Operation

- 1.1. Manual Operation

- 1.2. CNC Operation

-

2. Machine Types

- 2.1. Automatic Screw Machines

- 2.2. Rotary Transfer Machines

- 2.3. Computer Numerically Controlled(CNC)

- 2.4. Lathes or Turning Center

- 2.5. Other Machine Types

-

3. End-User

- 3.1. Industries

- 3.2. Automobile

- 3.3. Electronics

- 3.4. Defense and Healthcare

- 3.5. Other End-Users

Europe Metal Precision Turned Product Manufacturing Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East and Africa

Europe Metal Precision Turned Product Manufacturing Market Regional Market Share

Geographic Coverage of Europe Metal Precision Turned Product Manufacturing Market

Europe Metal Precision Turned Product Manufacturing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand from automobile industry4.; Increased focus on precision products

- 3.3. Market Restrains

- 3.3.1. 4.; The cost of production and transportation4.; Regulations and quality standards

- 3.4. Market Trends

- 3.4.1. Surge in demand from the automotive sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Metal Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Operation

- 5.1.1. Manual Operation

- 5.1.2. CNC Operation

- 5.2. Market Analysis, Insights and Forecast - by Machine Types

- 5.2.1. Automatic Screw Machines

- 5.2.2. Rotary Transfer Machines

- 5.2.3. Computer Numerically Controlled(CNC)

- 5.2.4. Lathes or Turning Center

- 5.2.5. Other Machine Types

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Industries

- 5.3.2. Automobile

- 5.3.3. Electronics

- 5.3.4. Defense and Healthcare

- 5.3.5. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Operation

- 6. North America Europe Metal Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Operation

- 6.1.1. Manual Operation

- 6.1.2. CNC Operation

- 6.2. Market Analysis, Insights and Forecast - by Machine Types

- 6.2.1. Automatic Screw Machines

- 6.2.2. Rotary Transfer Machines

- 6.2.3. Computer Numerically Controlled(CNC)

- 6.2.4. Lathes or Turning Center

- 6.2.5. Other Machine Types

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Industries

- 6.3.2. Automobile

- 6.3.3. Electronics

- 6.3.4. Defense and Healthcare

- 6.3.5. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Operation

- 7. Europe Europe Metal Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Operation

- 7.1.1. Manual Operation

- 7.1.2. CNC Operation

- 7.2. Market Analysis, Insights and Forecast - by Machine Types

- 7.2.1. Automatic Screw Machines

- 7.2.2. Rotary Transfer Machines

- 7.2.3. Computer Numerically Controlled(CNC)

- 7.2.4. Lathes or Turning Center

- 7.2.5. Other Machine Types

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Industries

- 7.3.2. Automobile

- 7.3.3. Electronics

- 7.3.4. Defense and Healthcare

- 7.3.5. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Operation

- 8. Asia Pacific Europe Metal Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Operation

- 8.1.1. Manual Operation

- 8.1.2. CNC Operation

- 8.2. Market Analysis, Insights and Forecast - by Machine Types

- 8.2.1. Automatic Screw Machines

- 8.2.2. Rotary Transfer Machines

- 8.2.3. Computer Numerically Controlled(CNC)

- 8.2.4. Lathes or Turning Center

- 8.2.5. Other Machine Types

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Industries

- 8.3.2. Automobile

- 8.3.3. Electronics

- 8.3.4. Defense and Healthcare

- 8.3.5. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Operation

- 9. Middle East and Africa Europe Metal Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Operation

- 9.1.1. Manual Operation

- 9.1.2. CNC Operation

- 9.2. Market Analysis, Insights and Forecast - by Machine Types

- 9.2.1. Automatic Screw Machines

- 9.2.2. Rotary Transfer Machines

- 9.2.3. Computer Numerically Controlled(CNC)

- 9.2.4. Lathes or Turning Center

- 9.2.5. Other Machine Types

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Industries

- 9.3.2. Automobile

- 9.3.3. Electronics

- 9.3.4. Defense and Healthcare

- 9.3.5. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Operation

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Bulmac Engineering Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Sargasas UA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 DANI 151 LTD

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 INDUSTRUM GROU

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 ELIRI SA

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 R K ENTERPRISES

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 VASCHUK LTD

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Arçimed Mold & Injection

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Hardy's Precision Engineering

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Aspired LLC

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Qingdao Guanglai Jiayue International Trade Co Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 UAB Kiruna

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Bulmac Engineering Ltd

List of Figures

- Figure 1: Europe Metal Precision Turned Product Manufacturing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Metal Precision Turned Product Manufacturing Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Operation 2020 & 2033

- Table 2: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Machine Types 2020 & 2033

- Table 3: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Operation 2020 & 2033

- Table 6: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Machine Types 2020 & 2033

- Table 7: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Operation 2020 & 2033

- Table 10: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Machine Types 2020 & 2033

- Table 11: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 12: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Operation 2020 & 2033

- Table 14: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Machine Types 2020 & 2033

- Table 15: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 16: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Operation 2020 & 2033

- Table 18: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Machine Types 2020 & 2033

- Table 19: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 20: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Metal Precision Turned Product Manufacturing Market?

The projected CAGR is approximately 5.11%.

2. Which companies are prominent players in the Europe Metal Precision Turned Product Manufacturing Market?

Key companies in the market include Bulmac Engineering Ltd, Sargasas UA, DANI 151 LTD, INDUSTRUM GROU, ELIRI SA, R K ENTERPRISES, VASCHUK LTD, Arçimed Mold & Injection, Hardy's Precision Engineering, Aspired LLC, Qingdao Guanglai Jiayue International Trade Co Ltd, UAB Kiruna.

3. What are the main segments of the Europe Metal Precision Turned Product Manufacturing Market?

The market segments include Operation, Machine Types, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.05 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand from automobile industry4.; Increased focus on precision products.

6. What are the notable trends driving market growth?

Surge in demand from the automotive sector.

7. Are there any restraints impacting market growth?

4.; The cost of production and transportation4.; Regulations and quality standards.

8. Can you provide examples of recent developments in the market?

July 2023: Indri-MIM, one of the world’s leading suppliers of advanced components, announced the acquisition of the UK’s leading MIM producer, CMG Technologies. CMG Technologies is a leading manufacturer of metal injection molding and metal additive manufacturing products based in Woodbridge in Suffolk, United Kingdom.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Metal Precision Turned Product Manufacturing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Metal Precision Turned Product Manufacturing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Metal Precision Turned Product Manufacturing Market?

To stay informed about further developments, trends, and reports in the Europe Metal Precision Turned Product Manufacturing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence