Key Insights

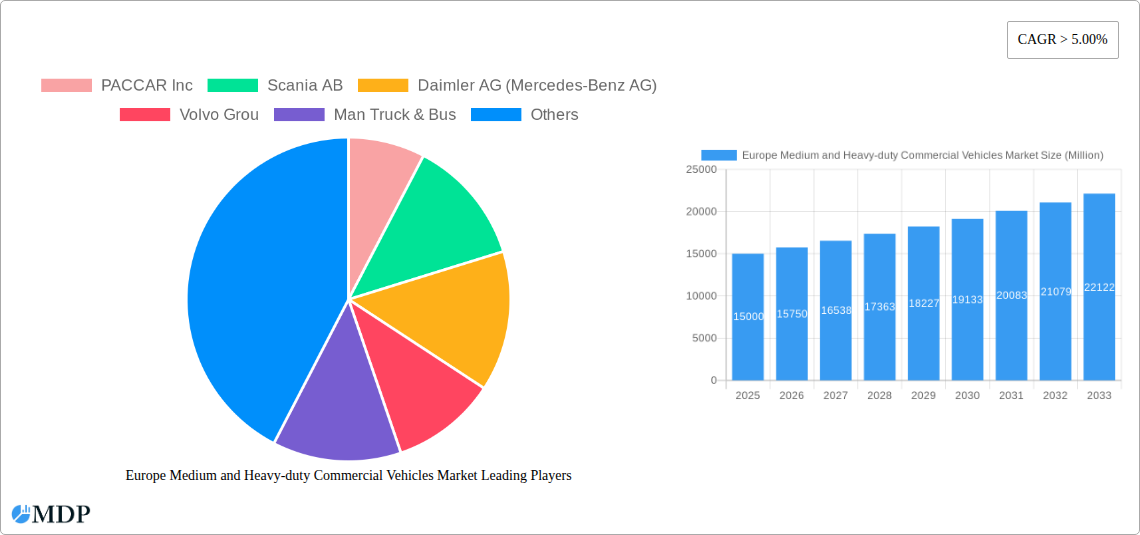

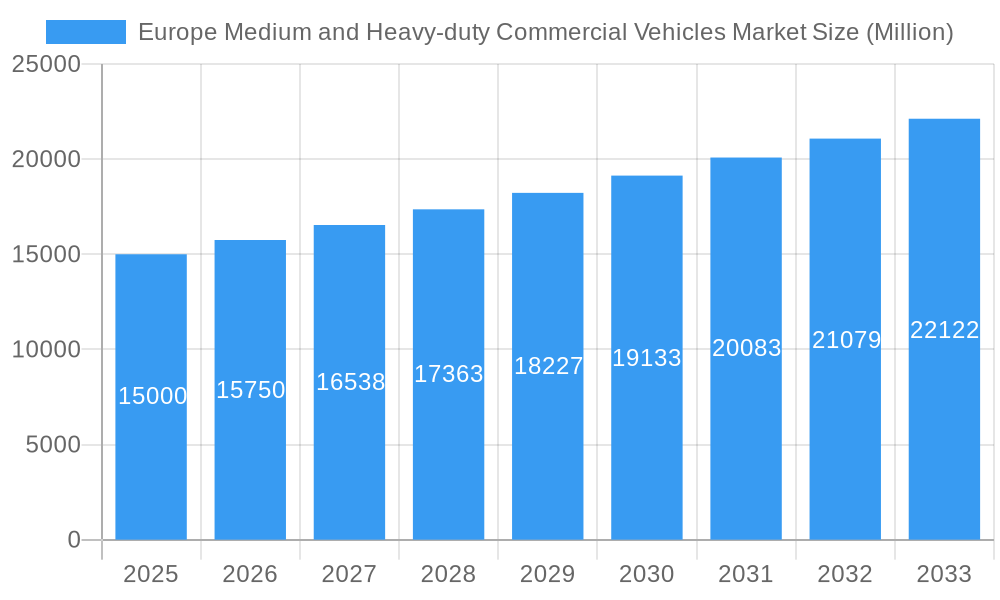

The European medium and heavy-duty commercial vehicle market is poised for significant expansion, driven by a Compound Annual Growth Rate (CAGR) of approximately 5.3%. This robust growth is projected from 2025 to 2033, with the market size expected to reach 40.99 billion by the end of the forecast period.

Europe Medium and Heavy-duty Commercial Vehicles Market Market Size (In Billion)

Key growth catalysts include escalating demand for efficient logistics, fueled by e-commerce penetration and industrial expansion. Simultaneously, stringent environmental regulations are accelerating the transition towards hybrid and electric vehicles (HEV, PHEV, BEV, FCEV). While internal combustion engine (ICE) vehicles remain prevalent, alternative fuel sources such as compressed natural gas (CNG), liquefied petroleum gas (LPG), and particularly electric powertrains are gaining market share.

Europe Medium and Heavy-duty Commercial Vehicles Market Company Market Share

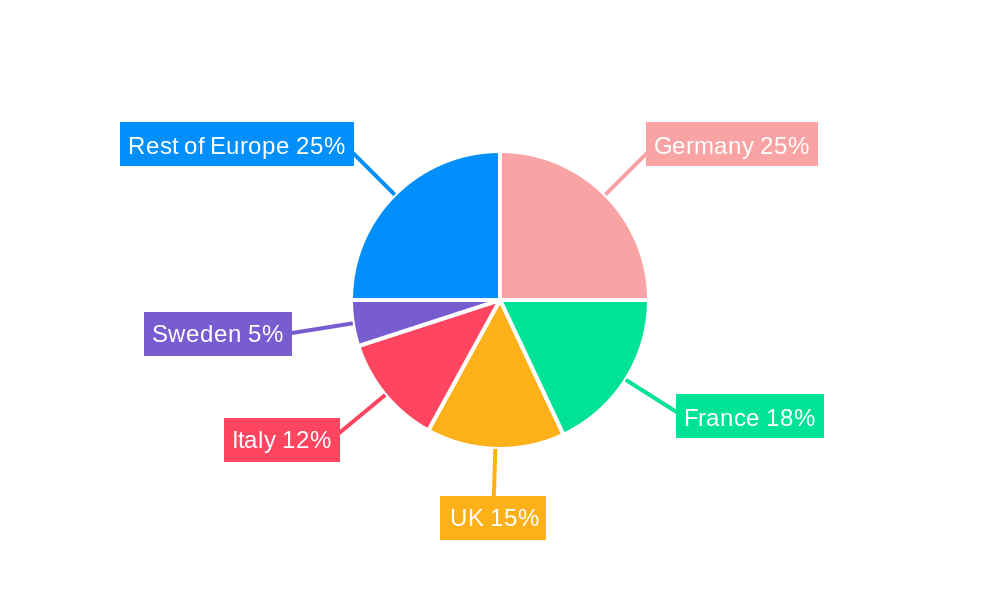

Leading markets include Germany, France, and the UK, with notable growth also observed in Sweden and the Netherlands, signifying a continent-wide trend. Significant investments in electric commercial vehicle infrastructure, coupled with advancements in battery and hydrogen fuel cell technology, are further propelling market development.

Challenges include the higher upfront investment for electric and hybrid vehicles compared to ICE alternatives. Uneven charging and refueling infrastructure availability across Europe may also impede widespread adoption of alternative fuel vehicles. Supply chain volatilities and broader economic conditions could influence purchasing decisions.

Despite these hurdles, supportive government incentives, favorable policies, and the long-term operational cost advantages of cleaner vehicles are expected to counterbalance these restraints, ensuring sustained positive market momentum. The competitive landscape, featuring prominent manufacturers such as PACCAR, Scania, Daimler, Volvo, and MAN, continues to foster innovation and enhance industry efficiency.

Europe Medium and Heavy-duty Commercial Vehicles Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Medium and Heavy-duty Commercial Vehicles market, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, industry trends, leading players, and future growth opportunities, making it an essential resource for industry stakeholders, investors, and strategic decision-makers. The report features detailed segmentation by vehicle type, propulsion type, fuel category, and country, providing a granular understanding of the market landscape. Key players analyzed include PACCAR Inc, Scania AB, Daimler AG (Mercedes-Benz AG), Volvo Group, and MAN Truck & Bus. Expect detailed forecasts and data-driven analysis to help navigate the complexities of this evolving market.

Europe Medium and Heavy-duty Commercial Vehicles Market Market Dynamics & Concentration

The European medium and heavy-duty commercial vehicle market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. The market share of the top five players in 2024 was approximately xx%, indicating some degree of consolidation. However, the market is dynamic, with ongoing mergers and acquisitions (M&A) activities shaping the competitive landscape. Over the historical period (2019-2024), approximately xx M&A deals were recorded, reflecting the industry's efforts to achieve scale and expand product portfolios.

Key innovation drivers include advancements in electrification, automation, and connectivity technologies. Stringent emission regulations, such as Euro VI and the upcoming Euro VII standards, are pushing manufacturers to develop cleaner and more fuel-efficient vehicles. The increasing adoption of alternative fuels (e.g., CNG, LNG, hydrogen) is further reshaping the market. Product substitutes, such as rail and maritime transport, pose a competitive threat, especially for long-haul transportation. However, the growing demand for efficient last-mile delivery solutions and e-commerce continues to support the market's growth. End-user trends, particularly the focus on sustainability and operational efficiency, are influencing vehicle purchasing decisions.

Europe Medium and Heavy-duty Commercial Vehicles Market Industry Trends & Analysis

The European medium and heavy-duty commercial vehicle market witnessed significant changes during the historical period (2019-2024). The market experienced a xx% CAGR during this period, primarily driven by economic growth, expanding e-commerce activities, and investments in infrastructure development. However, the COVID-19 pandemic temporarily impacted growth in 2020 and 2021, leading to supply chain disruptions and reduced demand. The market is currently experiencing a transition towards sustainable transportation solutions, with increasing adoption of hybrid and electric vehicles. The penetration rate of electric commercial vehicles in 2024 was approximately xx%, expected to grow significantly by 2033. Technological disruptions, such as the introduction of autonomous driving features and advanced driver-assistance systems (ADAS), are transforming the industry. Consumer preferences are shifting towards fuel-efficient, environmentally friendly, and technologically advanced vehicles. Competitive dynamics are intense, with manufacturers constantly vying for market share through product innovation, strategic partnerships, and cost optimization.

Leading Markets & Segments in Europe Medium and Heavy-duty Commercial Vehicles Market

Germany, France, and the UK remain the leading markets for medium and heavy-duty commercial vehicles in Europe, accounting for xx% of the total market in 2024.

- Key Drivers for Germany: Strong industrial base, well-developed infrastructure, and government support for sustainable transportation.

- Key Drivers for France: Significant logistics sector, supportive regulatory framework, and growing e-commerce activities.

- Key Drivers for UK: Large transportation network, robust economy, and increasing demand for last-mile delivery services.

Among vehicle types, heavy-duty trucks dominate the market, representing approximately xx% of total sales in 2024. This is followed by medium-duty trucks and buses. In terms of propulsion type, diesel-powered vehicles continue to hold a significant share, but the market is witnessing a rapid shift towards hybrid and electric vehicles. The BEV segment is experiencing the fastest growth, driven by government incentives and environmental concerns. By fuel category, diesel remains the dominant fuel type, but CNG, LPG, and electricity are gaining traction.

Europe Medium and Heavy-duty Commercial Vehicles Market Product Developments

Recent product innovations focus on improving fuel efficiency, reducing emissions, enhancing safety features, and integrating advanced technologies like telematics and autonomous driving capabilities. Manufacturers are introducing hybrid and electric commercial vehicles with extended range and faster charging times to overcome range anxiety. The integration of ADAS features is becoming increasingly common, improving driver safety and operational efficiency. These advancements are enhancing the competitive advantage of manufacturers by meeting evolving customer demands and complying with stricter environmental regulations.

Key Drivers of Europe Medium and Heavy-duty Commercial Vehicles Market Growth

The growth of the European medium and heavy-duty commercial vehicle market is propelled by several factors: Firstly, the ongoing expansion of e-commerce is fueling demand for efficient last-mile delivery solutions. Secondly, infrastructure development projects across Europe are boosting the need for heavy-duty construction vehicles. Finally, supportive government policies and incentives promoting the adoption of cleaner vehicles are accelerating the market's transition towards sustainable transportation.

Challenges in the Europe Medium and Heavy-duty Commercial Vehicles Market Market

The market faces challenges, including the high initial cost of electric and hybrid vehicles, the limited availability of charging infrastructure, and the complexities of integrating new technologies. Supply chain disruptions and the fluctuating prices of raw materials also pose significant challenges. Furthermore, intense competition among manufacturers and the need to comply with stringent emission regulations put pressure on profit margins. These factors could restrain market growth if not effectively addressed.

Emerging Opportunities in Europe Medium and Heavy-duty Commercial Vehicles Market

The market presents substantial opportunities for growth. The increasing adoption of alternative fuels, such as hydrogen and biogas, offers new avenues for expansion. Strategic partnerships between manufacturers and technology providers are accelerating innovation in areas like autonomous driving and connected vehicles. Expanding into emerging markets within Europe and focusing on niche applications, such as specialized transport solutions, could unlock further growth potential.

Leading Players in the Europe Medium and Heavy-duty Commercial Vehicles Market Sector

- PACCAR Inc

- Scania AB

- Daimler AG (Mercedes-Benz AG)

- Volvo Group

- MAN Truck & Bus

Key Milestones in Europe Medium and Heavy-duty Commercial Vehicles Market Industry

- 2020: Significant slowdown in sales due to the COVID-19 pandemic.

- 2021: Introduction of stricter emission regulations in several European countries.

- 2022: Increased investments in electric vehicle infrastructure.

- 2023: Several major manufacturers announced ambitious plans for electric vehicle production.

- 2024: Continued growth in the adoption of hybrid and electric commercial vehicles.

Strategic Outlook for Europe Medium and Heavy-duty Commercial Vehicles Market Market

The future of the European medium and heavy-duty commercial vehicle market is bright. The ongoing transition to sustainable transportation, coupled with technological advancements and supportive government policies, will drive market growth. Companies that effectively adapt to these changes by investing in innovation, optimizing their supply chains, and developing sustainable solutions will be well-positioned to capitalize on the long-term growth potential of the market. The focus will be on providing efficient, environmentally friendly, and technologically advanced vehicles to meet the evolving needs of customers. The market is expected to reach a value of xx Million by 2033, with a CAGR of xx% during the forecast period (2025-2033).

Europe Medium and Heavy-duty Commercial Vehicles Market Segmentation

-

1. Vehicle Type

- 1.1. Commercial Vehicles

-

2. Propulsion Type

-

2.1. Hybrid and Electric Vehicles

-

2.1.1. By Fuel Category

- 2.1.1.1. BEV

- 2.1.1.2. FCEV

- 2.1.1.3. HEV

- 2.1.1.4. PHEV

-

2.1.1. By Fuel Category

-

2.2. ICE

- 2.2.1. CNG

- 2.2.2. Diesel

- 2.2.3. Gasoline

- 2.2.4. LPG

-

2.1. Hybrid and Electric Vehicles

Europe Medium and Heavy-duty Commercial Vehicles Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Medium and Heavy-duty Commercial Vehicles Market Regional Market Share

Geographic Coverage of Europe Medium and Heavy-duty Commercial Vehicles Market

Europe Medium and Heavy-duty Commercial Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Travel and Tourism to Fuel Market Demand

- 3.3. Market Restrains

- 3.3.1. High Maintenance cost of RV Rental Fleets

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Medium and Heavy-duty Commercial Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. Hybrid and Electric Vehicles

- 5.2.1.1. By Fuel Category

- 5.2.1.1.1. BEV

- 5.2.1.1.2. FCEV

- 5.2.1.1.3. HEV

- 5.2.1.1.4. PHEV

- 5.2.1.1. By Fuel Category

- 5.2.2. ICE

- 5.2.2.1. CNG

- 5.2.2.2. Diesel

- 5.2.2.3. Gasoline

- 5.2.2.4. LPG

- 5.2.1. Hybrid and Electric Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PACCAR Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Scania AB

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Daimler AG (Mercedes-Benz AG)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Volvo Grou

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Man Truck & Bus

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 PACCAR Inc

List of Figures

- Figure 1: Europe Medium and Heavy-duty Commercial Vehicles Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Medium and Heavy-duty Commercial Vehicles Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Medium and Heavy-duty Commercial Vehicles Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Europe Medium and Heavy-duty Commercial Vehicles Market Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 3: Europe Medium and Heavy-duty Commercial Vehicles Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Medium and Heavy-duty Commercial Vehicles Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 5: Europe Medium and Heavy-duty Commercial Vehicles Market Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 6: Europe Medium and Heavy-duty Commercial Vehicles Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Medium and Heavy-duty Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Medium and Heavy-duty Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Medium and Heavy-duty Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Medium and Heavy-duty Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Medium and Heavy-duty Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Medium and Heavy-duty Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Medium and Heavy-duty Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Medium and Heavy-duty Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Medium and Heavy-duty Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Medium and Heavy-duty Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Medium and Heavy-duty Commercial Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Medium and Heavy-duty Commercial Vehicles Market?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the Europe Medium and Heavy-duty Commercial Vehicles Market?

Key companies in the market include PACCAR Inc, Scania AB, Daimler AG (Mercedes-Benz AG), Volvo Grou, Man Truck & Bus.

3. What are the main segments of the Europe Medium and Heavy-duty Commercial Vehicles Market?

The market segments include Vehicle Type, Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 40.99 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Travel and Tourism to Fuel Market Demand.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Maintenance cost of RV Rental Fleets.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Medium and Heavy-duty Commercial Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Medium and Heavy-duty Commercial Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Medium and Heavy-duty Commercial Vehicles Market?

To stay informed about further developments, trends, and reports in the Europe Medium and Heavy-duty Commercial Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence