Key Insights

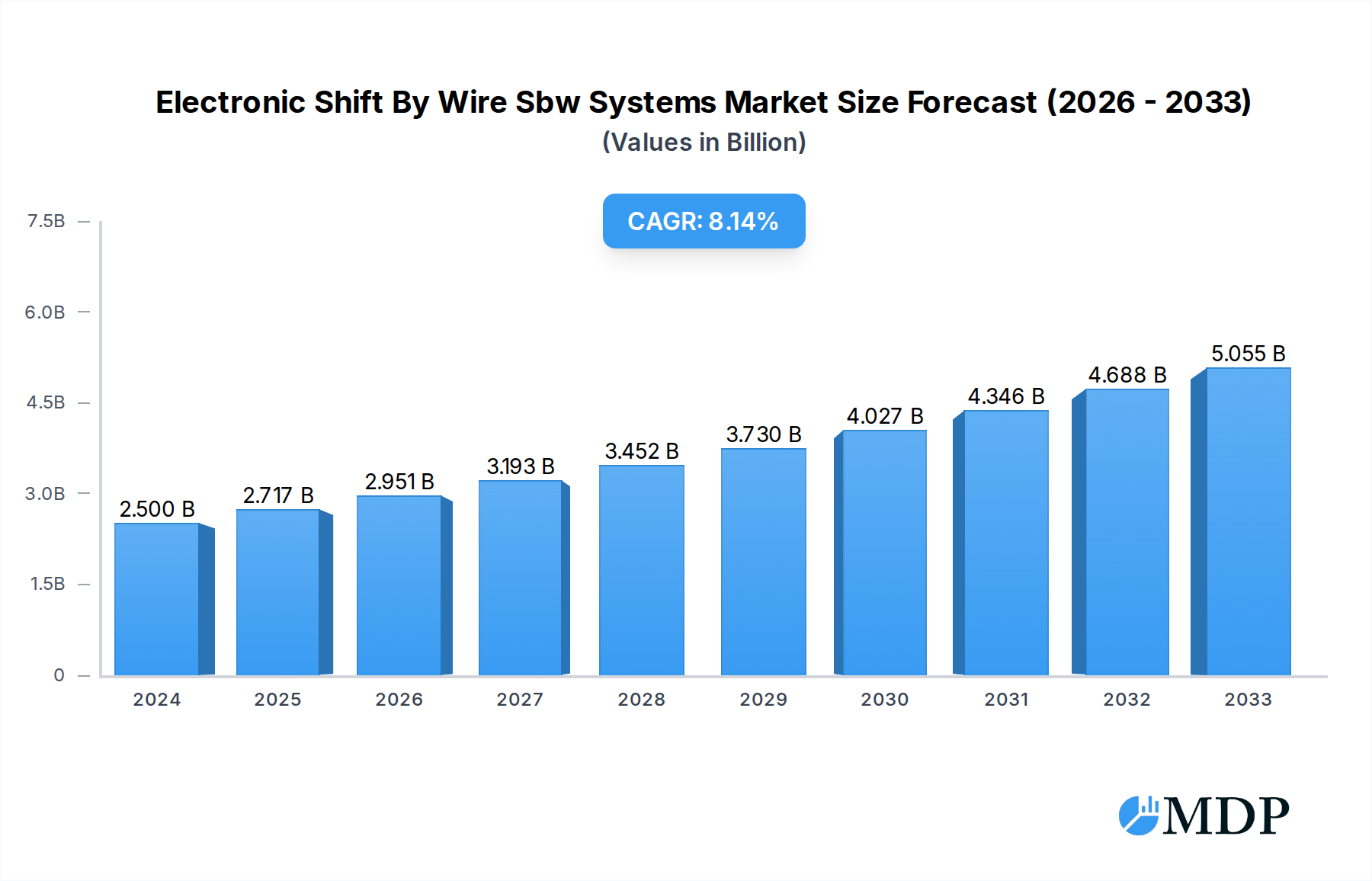

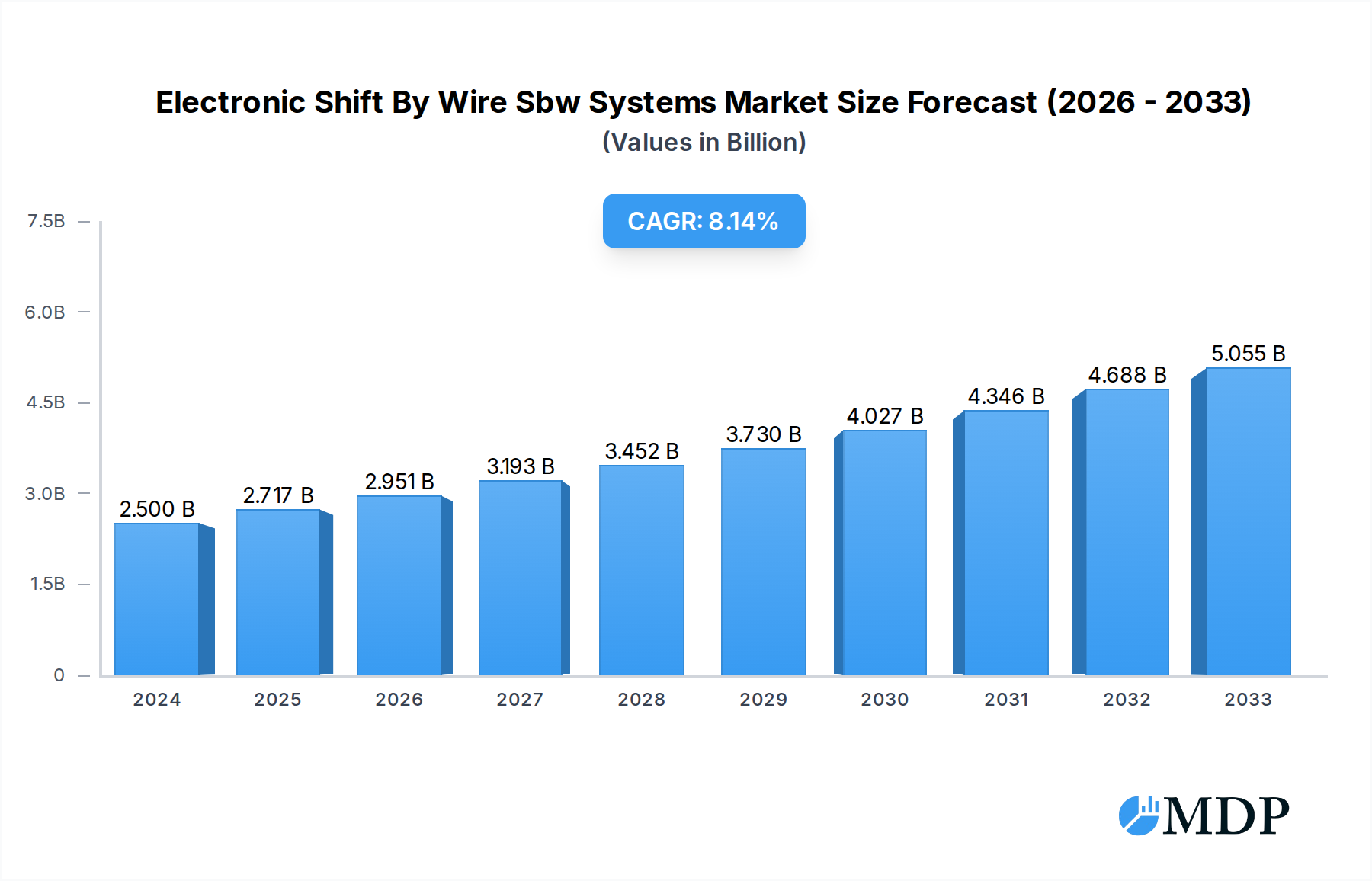

The global Electronic Shift By Wire (SBW) Systems market is poised for substantial growth, driven by the increasing adoption of advanced automotive technologies and the relentless pursuit of enhanced vehicle safety and efficiency. With a current market valuation estimated at $2.5 billion in 2024, the sector is projected to expand at a robust Compound Annual Growth Rate (CAGR) of 8.7% during the forecast period of 2025-2033. This upward trajectory is primarily fueled by the escalating demand for Electric Vehicles (EVs), where SBW systems offer significant advantages in terms of space optimization and a more intuitive driver experience. Furthermore, stringent governmental regulations promoting fuel efficiency and reduced emissions are compelling automakers to integrate sophisticated electronic control systems, thereby bolstering the SBW market. The growing complexity of vehicle architectures and the integration of autonomous driving features also necessitate advanced shifting mechanisms like SBW.

Electronic Shift By Wire Sbw Systems Market Size (In Billion)

The market's expansion is characterized by several key trends and drivers. The increasing integration of SBW systems in high-end and mid-range passenger cars, along with their growing penetration into commercial vehicles, represents a significant growth avenue. The evolution from traditional mechanical linkages to electronic controls allows for finer precision, enhanced safety features like interlock mechanisms to prevent unintended gear selection, and opportunities for innovative interior designs. Key players are investing heavily in research and development to enhance the reliability, cost-effectiveness, and user experience of SBW systems. While the initial high cost of implementation and the need for robust cybersecurity measures can be considered restraints, the long-term benefits in terms of improved vehicle performance, safety, and the potential for advanced driver-assistance systems (ADAS) integration are expected to outweigh these challenges, solidifying the market's positive outlook.

Electronic Shift By Wire Sbw Systems Company Market Share

Unlock the Future of Automotive Transmission with Electronic Shift By Wire (SBW) Systems: A Comprehensive Market Report

This in-depth report provides a strategic analysis of the global Electronic Shift By Wire (SBW) Systems market, a critical technology revolutionizing vehicle transmission control. With projected market value exceeding billions, this study offers unparalleled insights for automotive manufacturers, Tier 1 suppliers, technology developers, and investors. Spanning the Study Period 2019–2033, with Base Year 2025, Estimated Year 2025, and Forecast Period 2025–2033, the report leverages historical data from 2019–2024 to deliver actionable intelligence. Explore the intricate dynamics, emerging trends, leading markets, and key players shaping the multi-billion dollar SBW landscape.

Electronic Shift By Wire Sbw Systems Market Dynamics & Concentration

The Electronic Shift By Wire (SBW) Systems market is characterized by a moderate concentration of key players, with industry giants like ZF, Curtiss-Wright, Dura Automotive, and Ficosa holding significant market share. The market's trajectory is propelled by relentless innovation drivers, particularly the increasing demand for advanced driver-assistance systems (ADAS), autonomous driving capabilities, and enhanced vehicle safety features. Regulatory frameworks are increasingly favoring safer and more efficient transmission technologies, further bolstering SBW adoption. Product substitutes, such as traditional mechanical linkages, are steadily losing ground due to SBW's superior design flexibility, weight reduction, and improved ergonomics. End-user trends overwhelmingly point towards electrification and the integration of sophisticated electronic architectures, directly benefiting SBW systems. Mergers and acquisitions (M&A) activities, estimated to involve billions in deal values, are expected to continue as companies seek to consolidate expertise, expand product portfolios, and secure market dominance. The number of significant M&A deals is projected to be around 20-30 by the end of the forecast period.

Electronic Shift By Wire Sbw Systems Industry Trends & Analysis

The global Electronic Shift By Wire (SBW) Systems market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 15% over the forecast period. This surge is primarily driven by the automotive industry's paradigm shift towards electrification and autonomous driving. SBW systems are integral to the design and functionality of Electric Vehicles (EVs), offering space-saving advantages and enabling novel interior configurations. Technological disruptions, including advancements in sensor technology, actuator precision, and integrated control units, are continuously enhancing SBW performance, safety, and user experience. Consumer preferences are increasingly leaning towards intuitive and sophisticated in-car interfaces, with joystick and rotary-type shifters gaining traction for their ergonomic appeal and modern aesthetic. The competitive dynamics are intensifying, with established automotive suppliers vying for market leadership alongside specialized technology firms. Market penetration of SBW systems is rapidly increasing, moving from niche applications to mainstream integration across various vehicle segments. The total market value is estimated to reach over $25 billion by 2033, from a base of approximately $12 billion in 2025. Key market penetration for new vehicle production incorporating SBW is expected to exceed 70% by 2033.

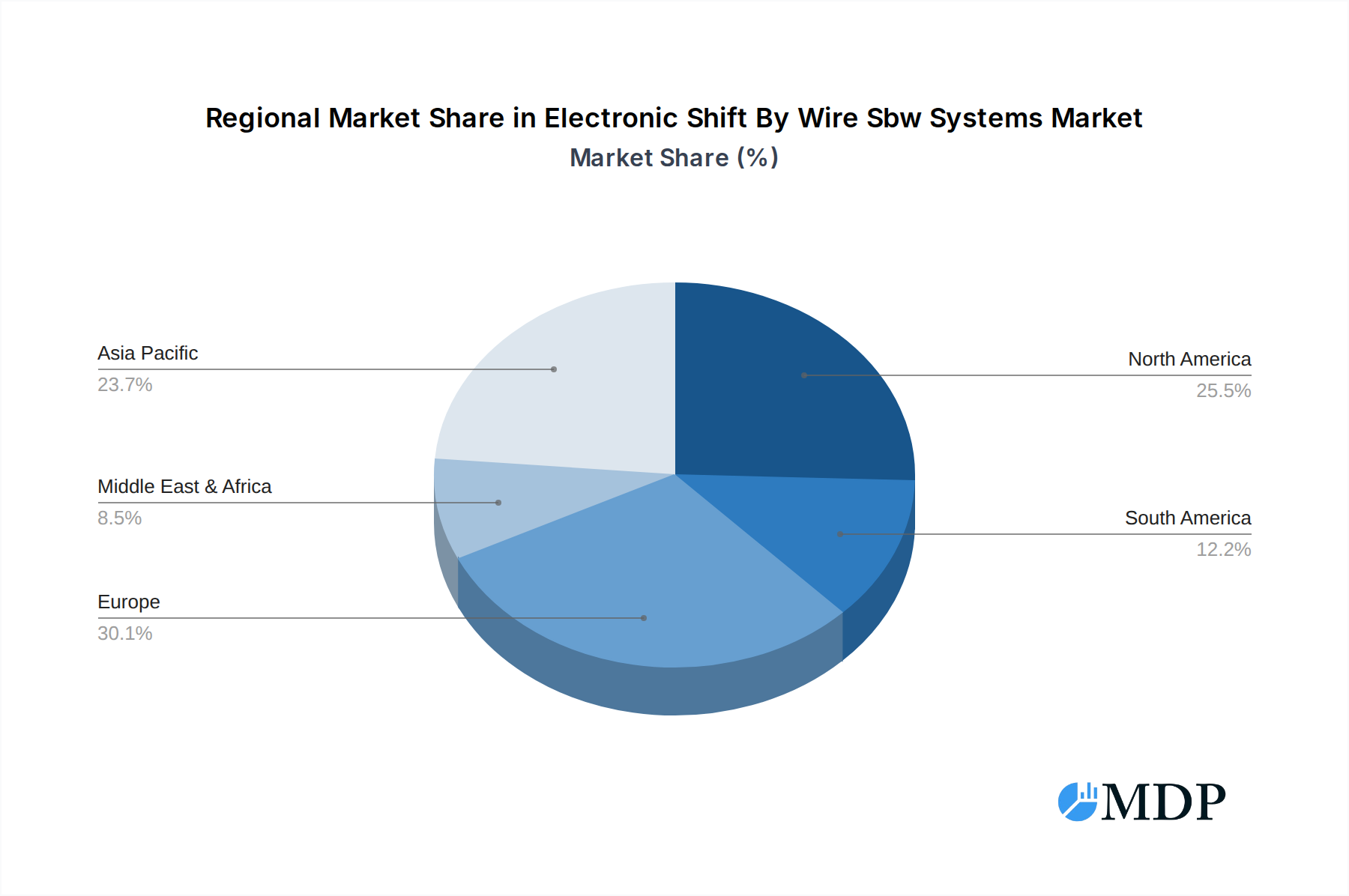

Leading Markets & Segments in Electronic Shift By Wire Sbw Systems

The Electric Vehicles segment is emerging as the dominant force within the Electronic Shift By Wire (SBW) Systems market, driven by the global acceleration of EV adoption and the inherent design advantages SBW offers in zero-emission powertrains. Within this segment, the Joystick Type shifter is experiencing significant traction due to its intuitive operation and ability to optimize cabin space, a crucial factor for EV manufacturers. Geographically, Asia Pacific stands as the leading region, propelled by the robust automotive manufacturing base in China and Japan, coupled with strong government initiatives supporting EV development and adoption.

Dominance Drivers in Electric Vehicles:

- Regulatory Mandates & Incentives: Government policies worldwide are increasingly pushing for electrification, creating a fertile ground for SBW integration.

- Design Flexibility & Space Optimization: SBW eliminates the need for bulky mechanical linkages, allowing for more versatile interior layouts and enhanced passenger comfort, a key selling point for EVs.

- Technological Advancement: Continuous improvements in battery technology and charging infrastructure are fueling consumer confidence in EVs, indirectly boosting demand for SBW systems.

- Performance & Efficiency: SBW systems contribute to the overall efficiency and responsive driving dynamics of EVs.

Dominance Drivers in Joystick Type:

- User Experience & Ergonomics: The intuitive nature of joystick shifters offers a modern and easy-to-use interface for drivers, particularly appealing in the context of advanced vehicle technology.

- Brand Differentiation: Automakers are leveraging unique shifter designs, like joysticks, to differentiate their EV offerings in a competitive market.

- Integration with Infotainment: Joystick shifters are often seamlessly integrated with advanced infotainment systems, creating a cohesive user experience.

The Combustion Vehicles segment, while still significant, is showing a slower growth rate compared to EVs, with a notable shift towards rotary and lever-type SBW systems to meet evolving emission standards and improve fuel efficiency. The Rotatory Type and Lever Type segments are experiencing steady growth as they offer a familiar yet technologically advanced alternative for traditional powertrains. The market value for SBW systems in EVs is projected to outpace that in combustion vehicles by a factor of 3:1 by 2030.

Electronic Shift By Wire Sbw Systems Product Developments

Recent product developments in Electronic Shift By Wire (SBW) Systems are focused on enhanced safety, miniaturization, and seamless integration with advanced vehicle architectures. Innovations include fail-safe mechanisms, redundant sensor systems, and improved haptic feedback for a more intuitive user experience. Companies are also developing compact and modular SBW units that can be easily adapted to various vehicle platforms, reducing development costs and time-to-market. The competitive advantage lies in offering robust, reliable, and cost-effective solutions that meet stringent automotive safety standards while enabling sophisticated functionalities like parking assist and remote operation. Market fit is achieved by tailoring SBW designs to specific vehicle types, from compact EVs to luxury SUVs.

Key Drivers of Electronic Shift By Wire Sbw Systems Growth

The exponential growth of the Electronic Shift By Wire (SBW) Systems market is propelled by several potent factors. Technologically, the relentless pursuit of vehicle autonomy and advanced driver-assistance systems (ADAS) necessitates sophisticated electronic control, making SBW an indispensable component. Economically, the decreasing cost of electronic components and the increasing scale of EV production contribute to the affordability and wider adoption of SBW. Regulatory advancements, such as mandates for enhanced vehicle safety and emissions reductions, further incentivize the transition from traditional mechanical shifters. The growing consumer demand for intuitive interfaces and premium interior designs also plays a crucial role.

Challenges in the Electronic Shift By Wire Sbw Systems Market

Despite its promising trajectory, the Electronic Shift By Wire (SBW) Systems market faces several challenges. Regulatory hurdles, particularly concerning the certification and validation of fail-safe functionalities for safety-critical systems, can slow down product deployment. Supply chain complexities, especially for specialized electronic components, can lead to production delays and cost fluctuations. Intense competitive pressures from established players and emerging disruptors also necessitate continuous innovation and cost optimization. The initial high cost of integration for certain legacy vehicle platforms can also be a barrier to widespread adoption in some segments. The estimated impact of these challenges on market growth is a reduction of 5-8% in projected market expansion.

Emerging Opportunities in Electronic Shift By Wire Sbw Systems

The Electronic Shift By Wire (SBW) Systems market is ripe with emerging opportunities. Technological breakthroughs in artificial intelligence (AI) and machine learning are enabling smarter, more predictive shifting algorithms, enhancing driving efficiency and safety. Strategic partnerships between automotive OEMs and SBW suppliers are crucial for co-developing integrated solutions tailored to future mobility needs. Market expansion into emerging economies with rapidly growing automotive sectors presents significant growth potential. Furthermore, the increasing demand for customized and personalized vehicle experiences opens avenues for innovative SBW interface designs. The predicted growth from these opportunities is estimated to add an additional $5 billion to the market by 2033.

Leading Players in the Electronic Shift By Wire Sbw Systems Sector

- Ficosa

- Kuster Holding GmbH

- Curtiss-Wright

- ZF

- Dura Automotive

- Eissmann

- Atsumitec

- Tokai Rika

- JOPP Group

- Orscheln Products

Key Milestones in Electronic Shift By Wire Sbw Systems Industry

- 2019: Increased adoption of electronic rotary shifters in mainstream combustion vehicles.

- 2020: Significant investment in SBW technology development by major EV manufacturers.

- 2021: Introduction of advanced joystick-type shifters in premium EV models, setting new design benchmarks.

- 2022: Growing emphasis on integrated SBW modules with advanced safety features and fail-safe mechanisms.

- 2023: Expansion of SBW applications beyond passenger vehicles to commercial EVs and specialized automotive equipment.

- 2024: Anticipated breakthroughs in next-generation SBW systems with enhanced connectivity and predictive functionalities.

Strategic Outlook for Electronic Shift By Wire Sbw Systems Market

The strategic outlook for the Electronic Shift By Wire (SBW) Systems market is exceptionally bright, driven by the accelerating global transition towards electric and autonomous vehicles. Future growth will be catalyzed by the integration of advanced connectivity features, including over-the-air updates and remote control capabilities. Manufacturers will focus on developing modular and scalable SBW solutions to cater to a diverse range of vehicle platforms, from compact city cars to heavy-duty trucks. Strategic collaborations and acquisitions will continue to play a vital role in consolidating expertise and expanding market reach. The market is poised for sustained expansion, with an estimated total market value projected to reach over $30 billion by 2033, driven by innovation, electrification, and evolving consumer demands for sophisticated automotive control systems.

Electronic Shift By Wire Sbw Systems Segmentation

-

1. Application

- 1.1. Combustion Vehicles

- 1.2. Electric Vehicles

-

2. Type

- 2.1. Joystick Type

- 2.2. Rotatory Type

- 2.3. Lever Type

- 2.4. Buttons Type

Electronic Shift By Wire Sbw Systems Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Electronic Shift By Wire Sbw Systems Regional Market Share

Geographic Coverage of Electronic Shift By Wire Sbw Systems

Electronic Shift By Wire Sbw Systems REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electronic Shift By Wire Sbw Systems Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Combustion Vehicles

- 5.1.2. Electric Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Joystick Type

- 5.2.2. Rotatory Type

- 5.2.3. Lever Type

- 5.2.4. Buttons Type

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Electronic Shift By Wire Sbw Systems Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Combustion Vehicles

- 6.1.2. Electric Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Joystick Type

- 6.2.2. Rotatory Type

- 6.2.3. Lever Type

- 6.2.4. Buttons Type

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Electronic Shift By Wire Sbw Systems Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Combustion Vehicles

- 7.1.2. Electric Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Joystick Type

- 7.2.2. Rotatory Type

- 7.2.3. Lever Type

- 7.2.4. Buttons Type

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Electronic Shift By Wire Sbw Systems Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Combustion Vehicles

- 8.1.2. Electric Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Joystick Type

- 8.2.2. Rotatory Type

- 8.2.3. Lever Type

- 8.2.4. Buttons Type

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Electronic Shift By Wire Sbw Systems Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Combustion Vehicles

- 9.1.2. Electric Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Joystick Type

- 9.2.2. Rotatory Type

- 9.2.3. Lever Type

- 9.2.4. Buttons Type

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Electronic Shift By Wire Sbw Systems Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Combustion Vehicles

- 10.1.2. Electric Vehicles

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Joystick Type

- 10.2.2. Rotatory Type

- 10.2.3. Lever Type

- 10.2.4. Buttons Type

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ficosa

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kuster Holding GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Curtiss-Wright

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ZF

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dura Automotive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Eissmann

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Atsumitec

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tokai Rika

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 JOPP Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Orscheln Products

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Ficosa

List of Figures

- Figure 1: Global Electronic Shift By Wire Sbw Systems Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Electronic Shift By Wire Sbw Systems Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Electronic Shift By Wire Sbw Systems Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Electronic Shift By Wire Sbw Systems Revenue (undefined), by Type 2025 & 2033

- Figure 5: North America Electronic Shift By Wire Sbw Systems Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Electronic Shift By Wire Sbw Systems Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Electronic Shift By Wire Sbw Systems Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Electronic Shift By Wire Sbw Systems Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Electronic Shift By Wire Sbw Systems Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Electronic Shift By Wire Sbw Systems Revenue (undefined), by Type 2025 & 2033

- Figure 11: South America Electronic Shift By Wire Sbw Systems Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Electronic Shift By Wire Sbw Systems Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Electronic Shift By Wire Sbw Systems Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Electronic Shift By Wire Sbw Systems Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Electronic Shift By Wire Sbw Systems Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Electronic Shift By Wire Sbw Systems Revenue (undefined), by Type 2025 & 2033

- Figure 17: Europe Electronic Shift By Wire Sbw Systems Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Electronic Shift By Wire Sbw Systems Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Electronic Shift By Wire Sbw Systems Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Electronic Shift By Wire Sbw Systems Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Electronic Shift By Wire Sbw Systems Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Electronic Shift By Wire Sbw Systems Revenue (undefined), by Type 2025 & 2033

- Figure 23: Middle East & Africa Electronic Shift By Wire Sbw Systems Revenue Share (%), by Type 2025 & 2033

- Figure 24: Middle East & Africa Electronic Shift By Wire Sbw Systems Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Electronic Shift By Wire Sbw Systems Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Electronic Shift By Wire Sbw Systems Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Electronic Shift By Wire Sbw Systems Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Electronic Shift By Wire Sbw Systems Revenue (undefined), by Type 2025 & 2033

- Figure 29: Asia Pacific Electronic Shift By Wire Sbw Systems Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Electronic Shift By Wire Sbw Systems Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Electronic Shift By Wire Sbw Systems Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electronic Shift By Wire Sbw Systems Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Electronic Shift By Wire Sbw Systems Revenue undefined Forecast, by Type 2020 & 2033

- Table 3: Global Electronic Shift By Wire Sbw Systems Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Electronic Shift By Wire Sbw Systems Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Electronic Shift By Wire Sbw Systems Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Electronic Shift By Wire Sbw Systems Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Electronic Shift By Wire Sbw Systems Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Electronic Shift By Wire Sbw Systems Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Electronic Shift By Wire Sbw Systems Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Electronic Shift By Wire Sbw Systems Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Electronic Shift By Wire Sbw Systems Revenue undefined Forecast, by Type 2020 & 2033

- Table 12: Global Electronic Shift By Wire Sbw Systems Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Electronic Shift By Wire Sbw Systems Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Electronic Shift By Wire Sbw Systems Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Electronic Shift By Wire Sbw Systems Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Electronic Shift By Wire Sbw Systems Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Electronic Shift By Wire Sbw Systems Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global Electronic Shift By Wire Sbw Systems Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Electronic Shift By Wire Sbw Systems Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Electronic Shift By Wire Sbw Systems Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Electronic Shift By Wire Sbw Systems Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Electronic Shift By Wire Sbw Systems Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Electronic Shift By Wire Sbw Systems Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Electronic Shift By Wire Sbw Systems Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Electronic Shift By Wire Sbw Systems Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Electronic Shift By Wire Sbw Systems Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Electronic Shift By Wire Sbw Systems Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Electronic Shift By Wire Sbw Systems Revenue undefined Forecast, by Application 2020 & 2033

- Table 29: Global Electronic Shift By Wire Sbw Systems Revenue undefined Forecast, by Type 2020 & 2033

- Table 30: Global Electronic Shift By Wire Sbw Systems Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Electronic Shift By Wire Sbw Systems Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Electronic Shift By Wire Sbw Systems Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Electronic Shift By Wire Sbw Systems Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Electronic Shift By Wire Sbw Systems Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Electronic Shift By Wire Sbw Systems Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Electronic Shift By Wire Sbw Systems Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Electronic Shift By Wire Sbw Systems Revenue undefined Forecast, by Application 2020 & 2033

- Table 38: Global Electronic Shift By Wire Sbw Systems Revenue undefined Forecast, by Type 2020 & 2033

- Table 39: Global Electronic Shift By Wire Sbw Systems Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Electronic Shift By Wire Sbw Systems Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Electronic Shift By Wire Sbw Systems Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Electronic Shift By Wire Sbw Systems Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Electronic Shift By Wire Sbw Systems Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Electronic Shift By Wire Sbw Systems Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Electronic Shift By Wire Sbw Systems Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Electronic Shift By Wire Sbw Systems Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electronic Shift By Wire Sbw Systems?

The projected CAGR is approximately 8.7%.

2. Which companies are prominent players in the Electronic Shift By Wire Sbw Systems?

Key companies in the market include Ficosa, Kuster Holding GmbH, Curtiss-Wright, ZF, Dura Automotive, Eissmann, Atsumitec, Tokai Rika, JOPP Group, Orscheln Products.

3. What are the main segments of the Electronic Shift By Wire Sbw Systems?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electronic Shift By Wire Sbw Systems," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electronic Shift By Wire Sbw Systems report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electronic Shift By Wire Sbw Systems?

To stay informed about further developments, trends, and reports in the Electronic Shift By Wire Sbw Systems, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence