Key Insights

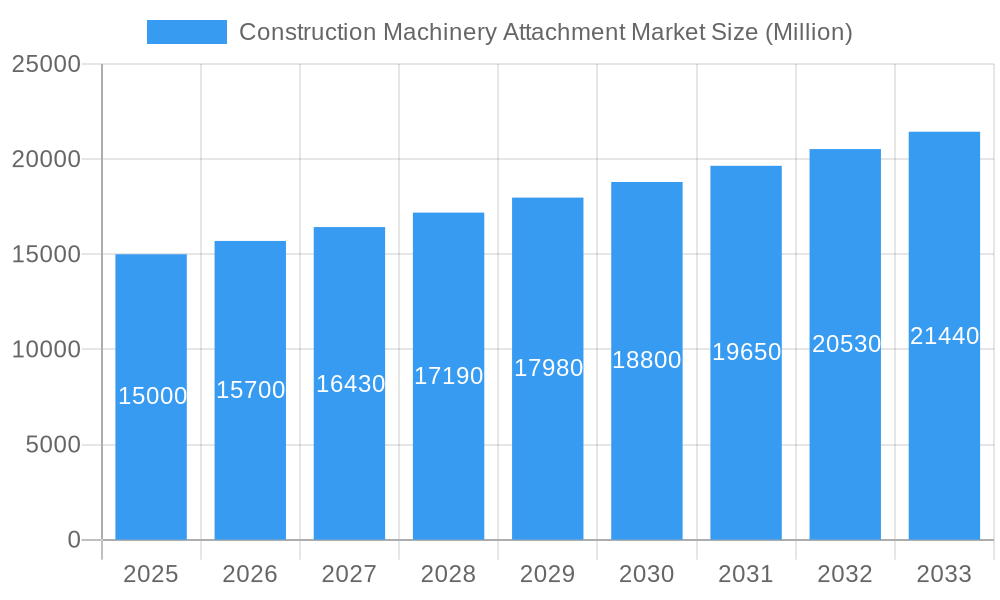

The global Construction Machinery Attachment market is projected to reach $6.41 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 5.1% from 2025 to 2033. This growth is propelled by escalating global infrastructure development, especially in rapidly urbanizing developing economies, which drives demand for construction equipment and attachments. Technological advancements, including automation and enhanced durability, are boosting site efficiency and stimulating market expansion. The increasing adoption of sustainable construction practices also fuels demand for specialized eco-friendly attachments. Key segments include buckets, grapplers, and hammers. Original Equipment Manufacturer (OEM) sales channels dominate, though the aftermarket is growing due to repair and replacement needs. Major players like Caterpillar, Komatsu, and Liebherr hold significant market positions due to their brand strength and distribution networks.

Construction Machinery Attachment Market Market Size (In Billion)

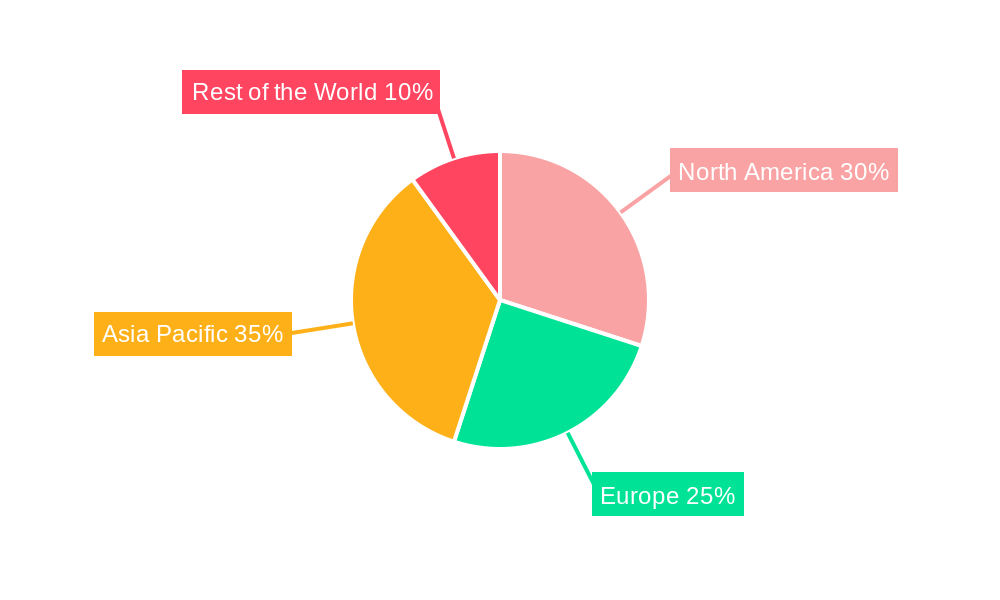

Regionally, North America and Europe exhibit steady growth from infrastructure renewal and ongoing construction. The Asia-Pacific region is anticipated to experience the most substantial expansion, driven by large-scale infrastructure projects in India and China, supported by robust economic growth. While raw material price volatility and economic downturns present potential challenges, the overall market outlook is positive, indicating significant growth potential. Segmentation by equipment type and sales channel offers critical insights for strategic planning within this dynamic industry.

Construction Machinery Attachment Market Company Market Share

Construction Machinery Attachment Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Construction Machinery Attachment Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report utilizes data from the historical period (2019-2024) to project future market trends and opportunities. The market is segmented by equipment type (Buckets, Grapplers, Hammers, Others) and sales channel (OEM, Aftermarket). Key players analyzed include JCB, Sany Group, Dheere & Company, Kubota Corporation, Caterpillar Inc., Liebherr Group, Hyundai Construction Equipment, Komatsu Ltd., Volvo Construction Equipment, and Case Construction Equipments. This is not an exhaustive list. The report projects a market value of xx Million by 2033.

Construction Machinery Attachment Market Market Dynamics & Concentration

This section delves into the dynamics shaping the Construction Machinery Attachment Market, examining market concentration, innovation drivers, regulatory influences, and competitive activities. The market is moderately concentrated, with the top 10 players holding an estimated xx% market share in 2025. Innovation is driven by advancements in materials science, automation, and digital technologies, leading to enhanced efficiency, durability, and safety features in attachments. Regulatory frameworks, varying across regions, impact material sourcing, safety standards, and emission regulations. Product substitutes, such as specialized tools and manual labor, exist but are generally less efficient and cost-effective for large-scale construction projects.

End-user trends towards increased productivity and reduced operational costs fuel demand for advanced attachments. The market has witnessed a moderate level of M&A activity in recent years, with approximately xx deals recorded between 2019 and 2024, primarily focused on expanding product portfolios and geographic reach.

- Market Concentration: Moderately concentrated, top 10 players hold approximately xx% market share (2025).

- Innovation Drivers: Advancements in materials, automation, and digital technologies.

- Regulatory Frameworks: Varying regional regulations impact material sourcing, safety, and emissions.

- Product Substitutes: Limited, with manual labor and specialized tools as alternatives.

- End-User Trends: Focus on productivity and cost reduction drives demand.

- M&A Activity: Approximately xx deals between 2019 and 2024, driven by portfolio expansion and geographic reach.

Construction Machinery Attachment Market Industry Trends & Analysis

The Construction Machinery Attachment Market is experiencing a period of dynamic growth, propelled by a confluence of powerful global and technological forces. The relentless expansion of the global construction industry, fueled by massive infrastructure development initiatives and rapid urbanization across continents, stands as a primary growth catalyst. Concurrently, significant advancements in hydraulics, sophisticated electronics, and cutting-edge materials are continuously yielding attachments that are not only more efficient and versatile but also remarkably more durable. End-users are increasingly prioritizing attachments that boast enhanced safety features, demonstrably improved operational efficiency, and a demonstrably reduced environmental footprint. The competitive arena is characterized by intense activity, with established market leaders strategically investing heavily in research and development (R&D) and unveiling innovative new product lines. Simultaneously, agile new entrants are actively exploring and carving out specialized niches. The market is projected to witness a robust Compound Annual Growth Rate (CAGR) of approximately XX% between 2025 and 2033. This projected expansion is anticipated to be driven by a combination of factors including escalating infrastructure spending in burgeoning developing economies, the accelerating adoption of advanced and streamlined construction methodologies, and a growing, persistent demand for amplified productivity and uncompromising safety standards. The market penetration of advanced attachments, particularly those equipped with integrated sensor suites and sophisticated automation capabilities, is on a steady and upward trajectory.

Leading Markets & Segments in Construction Machinery Attachment Market

The North American and European markets currently dominate the Construction Machinery Attachment Market, driven by robust construction activity and high adoption rates of advanced technologies. Within equipment types, buckets hold the largest market share, followed by grapplers and hammers. The OEM sales channel dominates, accounting for the majority of sales, but the aftermarket segment is experiencing significant growth.

Key Drivers:

- North America: Strong infrastructure spending, high construction activity.

- Europe: Significant investments in infrastructure modernization and renewable energy projects.

- Asia-Pacific: Rapid urbanization and industrialization are boosting demand.

- Buckets (Equipment Type): High demand across various construction applications.

- OEM (Sales Channel): Dominates sales volume due to new equipment purchases.

Construction Machinery Attachment Market Product Developments

Recent product innovations within the Construction Machinery Attachment Market are sharply focused on elevating attachment efficiency, bolstering safety protocols, and expanding overall versatility. Key technological advancements are being integrated, including the incorporation of advanced sensors for real-time operational monitoring, refined hydraulic systems engineered for superior power delivery and precise control, and the strategic utilization of advanced composite materials to significantly enhance durability and lifespan. These forward-thinking advancements translate into substantial competitive advantages for end-users, leading directly to increased project productivity, minimized costly downtime, and a marked improvement in overall operational efficiency. Furthermore, the market is observing a pronounced trend towards the development of modular and highly customizable attachment solutions, specifically designed to adeptly cater to an ever-wider spectrum of diverse construction applications and specific project requirements.

Key Drivers of Construction Machinery Attachment Market Growth

The Construction Machinery Attachment Market's growth is propelled by several key factors:

- Technological Advancements: Improvements in hydraulics, materials, and sensor technology enhance efficiency and performance.

- Infrastructure Development: Global investment in infrastructure projects fuels demand for construction equipment and attachments.

- Urbanization: Rapid urbanization in developing countries creates high demand for construction activities.

- Government Regulations: Regulations promoting sustainable construction practices drive demand for eco-friendly attachments.

Challenges in the Construction Machinery Attachment Market Market

The Construction Machinery Attachment Market faces challenges such as:

- Supply Chain Disruptions: Global supply chain vulnerabilities can impact material availability and lead times, increasing production costs.

- Fluctuating Raw Material Prices: Changes in commodity prices affect attachment manufacturing costs.

- Intense Competition: The presence of numerous established and emerging players creates a competitive landscape.

- Regulatory Compliance: Meeting diverse regional safety and environmental regulations adds complexity.

Emerging Opportunities in Construction Machinery Attachment Market

Significant untapped growth opportunities are emerging prominently in the sphere of developing and widely adopting advanced attachments that harness the power of Artificial Intelligence (AI), automation technologies, and the Internet of Things (IoT). These integrated technologies promise to deliver unprecedented levels of efficiency, enhance safety measures, and unlock sophisticated data analytics capabilities. Strategic collaborations and partnerships between leading attachment manufacturers and Original Equipment Manufacturers (OEMs) of construction machinery are poised to create powerful synergies, thereby expanding market reach and fostering innovation. Moreover, strategically expanding into rapidly developing emerging markets, which are characterized by substantial ongoing infrastructure development projects, presents highly promising avenues for sustained growth and market penetration.

Leading Players in the Construction Machinery Attachment Market Sector

Key Milestones in Construction Machinery Attachment Market Industry

- September 2022: CASE Construction Equipment launched an innovative new range of OEM-fitted 2D and 3D fitments for its loaders and excavators. These new attachments are engineered to offer a significantly improved profile and enhanced storage capacity, optimizing operational workflow.

- September 2022: Bobcat Company unveiled its cutting-edge T86 compact track loader and S86 skid-steer loader. These new models are designed to work seamlessly with a versatile suite of attachments, specifically engineered to substantially increase operational efficiency for a wide array of tasks.

Strategic Outlook for Construction Machinery Attachment Market Market

The Construction Machinery Attachment Market is firmly positioned for a trajectory of sustained and robust growth. This expansion is being propelled by a dynamic interplay of continuous technological innovation, substantial and ongoing global infrastructure investments, and an ever-increasing demand from the construction sector for enhanced productivity and superior safety standards. Strategic opportunities abound for companies that can successfully develop and market innovative, sustainable attachment solutions. Furthermore, expanding market presence into high-growth emerging economies and forging strategic alliances across the industry value chain are crucial strategies for capturing significant market share. A dedicated focus on offering highly customizable and modular attachment options will further bolster market competitiveness and ensure that manufacturers can adeptly cater to the evolving and diverse needs of modern construction projects worldwide.

Construction Machinery Attachment Market Segmentation

-

1. Equipment Type

- 1.1. Buckets

- 1.2. Grapplers

- 1.3. Hammers

- 1.4. Other Equipment Types

-

2. Sales Channel

- 2.1. OEM

- 2.2. Aftermarket

Construction Machinery Attachment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. Mexico

- 4.3. United Arab Emirates

- 4.4. Other Countries

Construction Machinery Attachment Market Regional Market Share

Geographic Coverage of Construction Machinery Attachment Market

Construction Machinery Attachment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing infrastructural development Across the Region

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruption of Raw Materials Could be a Challenge; High Initial Cost Related to the Purchase of Raw Materials is a Challenge

- 3.4. Market Trends

- 3.4.1. OEM to Gain Traction During Forecast Period.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Construction Machinery Attachment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 5.1.1. Buckets

- 5.1.2. Grapplers

- 5.1.3. Hammers

- 5.1.4. Other Equipment Types

- 5.2. Market Analysis, Insights and Forecast - by Sales Channel

- 5.2.1. OEM

- 5.2.2. Aftermarket

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6. North America Construction Machinery Attachment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6.1.1. Buckets

- 6.1.2. Grapplers

- 6.1.3. Hammers

- 6.1.4. Other Equipment Types

- 6.2. Market Analysis, Insights and Forecast - by Sales Channel

- 6.2.1. OEM

- 6.2.2. Aftermarket

- 6.1. Market Analysis, Insights and Forecast - by Equipment Type

- 7. Europe Construction Machinery Attachment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Equipment Type

- 7.1.1. Buckets

- 7.1.2. Grapplers

- 7.1.3. Hammers

- 7.1.4. Other Equipment Types

- 7.2. Market Analysis, Insights and Forecast - by Sales Channel

- 7.2.1. OEM

- 7.2.2. Aftermarket

- 7.1. Market Analysis, Insights and Forecast - by Equipment Type

- 8. Asia Pacific Construction Machinery Attachment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Equipment Type

- 8.1.1. Buckets

- 8.1.2. Grapplers

- 8.1.3. Hammers

- 8.1.4. Other Equipment Types

- 8.2. Market Analysis, Insights and Forecast - by Sales Channel

- 8.2.1. OEM

- 8.2.2. Aftermarket

- 8.1. Market Analysis, Insights and Forecast - by Equipment Type

- 9. Rest of the World Construction Machinery Attachment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Equipment Type

- 9.1.1. Buckets

- 9.1.2. Grapplers

- 9.1.3. Hammers

- 9.1.4. Other Equipment Types

- 9.2. Market Analysis, Insights and Forecast - by Sales Channel

- 9.2.1. OEM

- 9.2.2. Aftermarket

- 9.1. Market Analysis, Insights and Forecast - by Equipment Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Joseph Cyril Bamford

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Sany Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Dheere & Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Kubota Corporation*List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Caterpillar Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Liebherr group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Hyundai Construction Equipment

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Komatsu Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Volvo construction equipment

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Case Construction Equipments

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Joseph Cyril Bamford

List of Figures

- Figure 1: Global Construction Machinery Attachment Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Construction Machinery Attachment Market Revenue (billion), by Equipment Type 2025 & 2033

- Figure 3: North America Construction Machinery Attachment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 4: North America Construction Machinery Attachment Market Revenue (billion), by Sales Channel 2025 & 2033

- Figure 5: North America Construction Machinery Attachment Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 6: North America Construction Machinery Attachment Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Construction Machinery Attachment Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Construction Machinery Attachment Market Revenue (billion), by Equipment Type 2025 & 2033

- Figure 9: Europe Construction Machinery Attachment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 10: Europe Construction Machinery Attachment Market Revenue (billion), by Sales Channel 2025 & 2033

- Figure 11: Europe Construction Machinery Attachment Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 12: Europe Construction Machinery Attachment Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Construction Machinery Attachment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Construction Machinery Attachment Market Revenue (billion), by Equipment Type 2025 & 2033

- Figure 15: Asia Pacific Construction Machinery Attachment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 16: Asia Pacific Construction Machinery Attachment Market Revenue (billion), by Sales Channel 2025 & 2033

- Figure 17: Asia Pacific Construction Machinery Attachment Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 18: Asia Pacific Construction Machinery Attachment Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Construction Machinery Attachment Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Construction Machinery Attachment Market Revenue (billion), by Equipment Type 2025 & 2033

- Figure 21: Rest of the World Construction Machinery Attachment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 22: Rest of the World Construction Machinery Attachment Market Revenue (billion), by Sales Channel 2025 & 2033

- Figure 23: Rest of the World Construction Machinery Attachment Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 24: Rest of the World Construction Machinery Attachment Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Construction Machinery Attachment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Construction Machinery Attachment Market Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 2: Global Construction Machinery Attachment Market Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 3: Global Construction Machinery Attachment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Construction Machinery Attachment Market Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 5: Global Construction Machinery Attachment Market Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 6: Global Construction Machinery Attachment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Construction Machinery Attachment Market Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 11: Global Construction Machinery Attachment Market Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 12: Global Construction Machinery Attachment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Global Construction Machinery Attachment Market Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 18: Global Construction Machinery Attachment Market Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 19: Global Construction Machinery Attachment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: India Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: China Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Japan Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: South Korea Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Global Construction Machinery Attachment Market Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 26: Global Construction Machinery Attachment Market Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 27: Global Construction Machinery Attachment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Brazil Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Mexico Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: United Arab Emirates Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Other Countries Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction Machinery Attachment Market?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the Construction Machinery Attachment Market?

Key companies in the market include Joseph Cyril Bamford, Sany Group, Dheere & Company, Kubota Corporation*List Not Exhaustive, Caterpillar Inc, Liebherr group, Hyundai Construction Equipment, Komatsu Ltd, Volvo construction equipment, Case Construction Equipments.

3. What are the main segments of the Construction Machinery Attachment Market?

The market segments include Equipment Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.41 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing infrastructural development Across the Region.

6. What are the notable trends driving market growth?

OEM to Gain Traction During Forecast Period..

7. Are there any restraints impacting market growth?

Supply Chain Disruption of Raw Materials Could be a Challenge; High Initial Cost Related to the Purchase of Raw Materials is a Challenge.

8. Can you provide examples of recent developments in the market?

In September 2022, CASE rolls out its new range of OEM fitted 2D and 3D fitments for construction machinery including loaders and excavators. The new attachment offers better profile and allows better storage capacities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Construction Machinery Attachment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Construction Machinery Attachment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Construction Machinery Attachment Market?

To stay informed about further developments, trends, and reports in the Construction Machinery Attachment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence