Key Insights

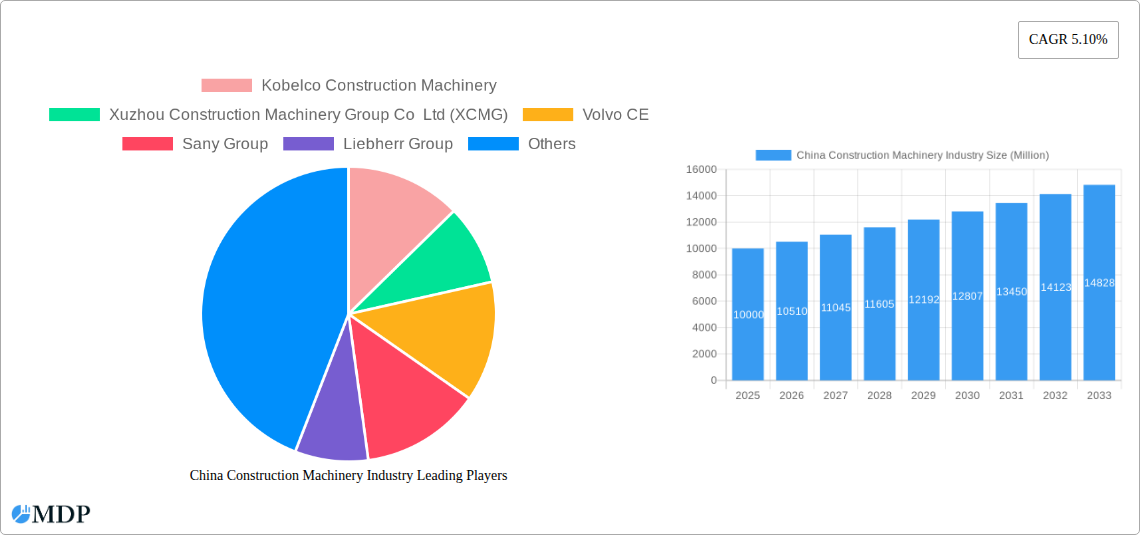

The China construction machinery market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by substantial government investments in infrastructure development, particularly within the Belt and Road Initiative. This initiative, coupled with ongoing urbanization and modernization efforts across China, fuels demand for excavators, loaders, cranes, and other heavy machinery. The market's segmentation reveals a dynamic landscape: the hybrid and electric drive type segments are experiencing accelerated growth due to increasing environmental concerns and government regulations promoting sustainable construction practices. While the OEM sales channel currently dominates, the aftermarket segment shows promising potential, fueled by the expanding operational lifespan of existing machinery and the increasing need for maintenance and repair services. Key players such as Sany Group, XCMG, and Zoomlion are leveraging technological advancements and strategic partnerships to consolidate their market positions and compete effectively against global giants like Caterpillar and Volvo CE. Challenges remain, including fluctuating raw material prices, potential labor shortages, and the ongoing impact of global economic uncertainties, but the overall outlook remains positive.

China Construction Machinery Industry Market Size (In Billion)

The forecast period (2025-2033) anticipates a Compound Annual Growth Rate (CAGR) of 5.10%, indicating a continuously expanding market. The construction of new buildings, energy infrastructure projects, and transportation networks significantly contributes to this growth. The market is witnessing a shift towards technologically advanced machinery, integrating automation, digitalization, and remote operation capabilities. This technological shift necessitates investment in research and development, requiring manufacturers to adapt quickly to maintain their competitiveness. The market's regional concentration in China offers substantial opportunities for domestic manufacturers, but also presents challenges in terms of navigating government regulations and ensuring consistent supply chain management. Competition is intense, with both domestic and international players vying for market share.

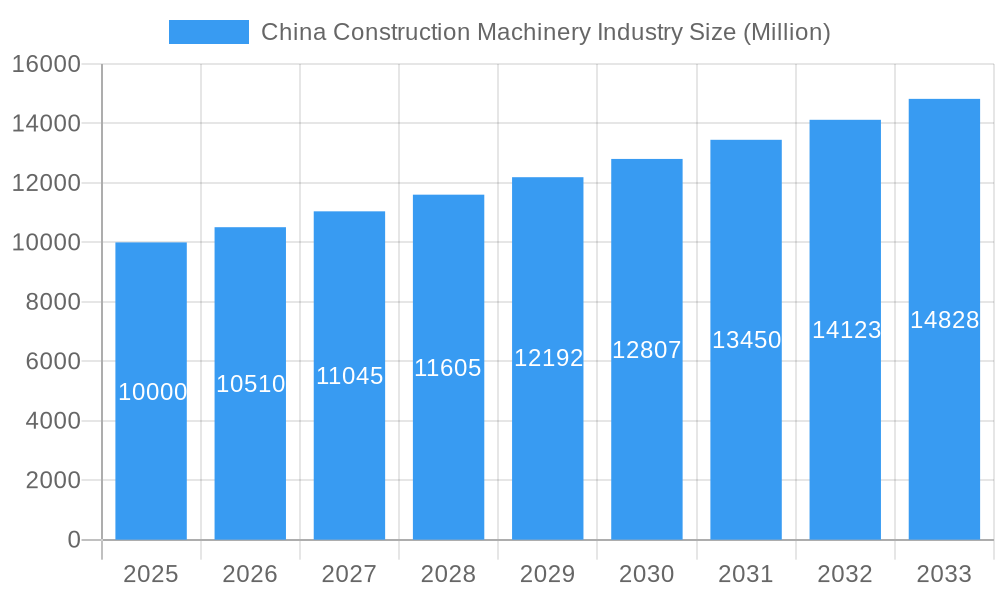

China Construction Machinery Industry Company Market Share

China Construction Machinery Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China construction machinery industry, offering invaluable insights for stakeholders across the value chain. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, leading players, and future opportunities. The report leverages extensive data analysis to provide actionable intelligence for strategic decision-making. Key segments analyzed include drive type (conventional, hybrid, electric), sales channel (OEM, aftermarket), application type (building, infrastructure, energy), and machinery type (cranes, telescopic handlers, excavators, loaders and backhoes, motor graders). Leading companies like XCMG, Sany Group, and Caterpillar Inc. are profiled, alongside an assessment of market concentration and competitive dynamics.

China Construction Machinery Industry Market Dynamics & Concentration

The China construction machinery market, valued at xx Million USD in 2024, is characterized by intense competition amongst both domestic and international players. Market concentration is relatively high, with the top five players—XCMG, Sany Group, Zoomlion, Caterpillar, and Liugong—holding a combined market share of approximately xx%. Innovation is a key driver, fueled by government initiatives promoting technological advancement and sustainability in the construction sector. Stringent regulatory frameworks focusing on emission standards and safety regulations also shape industry dynamics. Product substitution, particularly the increasing adoption of electric and hybrid machinery, is impacting market segmentation. End-user trends favor technologically advanced, efficient, and environmentally friendly equipment. M&A activity in the sector has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024, primarily focused on strengthening supply chains and expanding market reach.

- Market Concentration: Top 5 players hold approximately xx% market share.

- Innovation Drivers: Government initiatives, technological advancements, and environmental regulations.

- Regulatory Framework: Stringent emission and safety standards.

- Product Substitutes: Growing adoption of electric and hybrid machinery.

- End-User Trends: Demand for advanced, efficient, and eco-friendly equipment.

- M&A Activity: Approximately xx deals between 2019 and 2024.

China Construction Machinery Industry Industry Trends & Analysis

The China construction machinery market exhibits a robust growth trajectory, driven primarily by large-scale infrastructure development projects fueled by government investment. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated at xx%, with market penetration expected to reach xx% by 2033. Technological disruptions are reshaping the industry, with increased adoption of automation, digitalization, and advanced materials leading to improved efficiency, safety, and reduced environmental impact. Consumer preferences are increasingly focused on energy efficiency, reduced emissions, and advanced technological features. Competitive dynamics are intense, with both domestic and international players vying for market share through product innovation, strategic partnerships, and aggressive pricing strategies. The market is witnessing a shift towards higher-value, technologically advanced equipment, particularly in segments like electric excavators and intelligent construction solutions. This trend is expected to drive premiumization and further market growth.

Leading Markets & Segments in China Construction Machinery Industry

The infrastructure sector remains the dominant application segment, contributing approximately xx% of total market revenue. The Eastern region of China consistently showcases the highest demand. Key drivers for this dominance include:

- Infrastructure Development: Massive government investments in infrastructure projects like high-speed railways and urban development.

- Economic Growth: Continued expansion of the Chinese economy driving demand for construction activities.

- Urbanization: Rapid urbanization leading to increased demand for residential and commercial construction.

Dominant Segments:

- Drive Type: Conventional drive types still maintain a majority of the market share but the hybrid and electric segments show strong growth potential, driven by environmental concerns and government incentives.

- Sales Channel: OEM sales account for the larger portion of the revenue, while the aftermarket is expected to experience significant growth in the coming years.

- Application Type: Infrastructure and building segments contribute the most to the total revenue, with significant growth potential in the energy sector.

- Machinery Type: Excavators, loaders and backhoes, and cranes remain the largest product segments by revenue, but telescopic handlers are also gaining popularity.

China Construction Machinery Industry Product Developments

Recent product innovations are focused on enhancing efficiency, safety, and environmental performance. This involves the integration of advanced technologies such as automation, telematics, and alternative power systems (electric and hybrid). Companies are emphasizing the development of specialized machinery tailored to specific application needs, improving overall market fit and competitive advantages. The focus on enhancing product features like precision control, fuel efficiency, and reduced noise levels is shaping market trends.

Key Drivers of China Construction Machinery Industry Growth

Several factors are driving the growth of the China construction machinery industry. These include:

- Government Infrastructure Spending: Massive investments in infrastructure projects.

- Urbanization: Rapid urbanization increasing the demand for construction.

- Technological Advancements: Increased adoption of automation and advanced technologies.

- Economic Growth: Continued expansion of the Chinese economy.

Challenges in the China Construction Machinery Industry Market

The industry faces several challenges, including:

- Supply Chain Disruptions: Global supply chain volatility affecting the availability of components.

- Intense Competition: High competition from both domestic and international players.

- Environmental Regulations: Meeting stringent emission standards.

- Economic Slowdown: Potential impact of economic slowdowns on construction activity. The impact is estimated at xx Million USD of lost revenue annually.

Emerging Opportunities in China Construction Machinery Industry

Several emerging opportunities are expected to drive long-term growth, including:

- Technological Advancements: Development and adoption of autonomous construction equipment and smart construction solutions.

- Strategic Partnerships: Collaboration between manufacturers and technology providers.

- Market Expansion: Expansion into new markets both domestically and internationally.

Leading Players in the China Construction Machinery Industry Sector

Key Milestones in China Construction Machinery Industry Industry

- August 2022: XCMG announced the building of its second XE7000 hydraulic excavator, enhancing its mining equipment offerings.

- October 2022: Shantui delivered its first DL300G bulldozer to a customer in Hong Kong, showcasing its expansion into new markets.

- November 2022: XCMG signed USD 60 Million worth of contracts with global suppliers, strengthening its supply chain resilience.

- November 2022: XCMG selected Allison transmissions as the exclusive supplier for its all-terrain cranes, highlighting strategic partnerships.

Strategic Outlook for China Construction Machinery Industry Market

The China construction machinery market presents significant long-term growth potential, driven by sustained infrastructure investment, technological innovation, and increasing urbanization. Strategic opportunities lie in leveraging technological advancements to enhance product offerings, fostering strategic partnerships to expand market reach, and capitalizing on the growing demand for sustainable and efficient construction solutions. The market's future trajectory is bright, with consistent growth anticipated throughout the forecast period.

China Construction Machinery Industry Segmentation

-

1. Machinery Type

- 1.1. Crane

- 1.2. Telescopic Handlers

- 1.3. Excavators

- 1.4. Loaders and Backhoe

- 1.5. Motor Graders

-

2. Drive Type

- 2.1. Conventional

- 2.2. Hybrid and Electric

-

3. Sales Channel

- 3.1. OEM

- 3.2. Aftermarket

-

4. Application Type

- 4.1. Building

- 4.2. Infrastructure

- 4.3. Energy

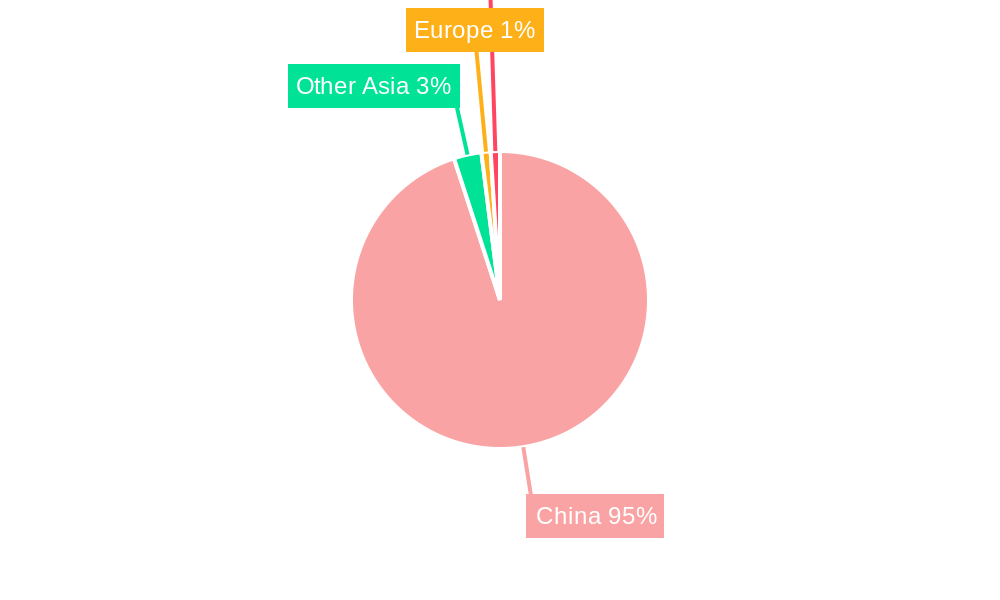

China Construction Machinery Industry Segmentation By Geography

- 1. China

China Construction Machinery Industry Regional Market Share

Geographic Coverage of China Construction Machinery Industry

China Construction Machinery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Electrification of Construction Equipment May Propel the Market Growth

- 3.3. Market Restrains

- 3.3.1. Construction Rental Business May Hamper Market Growth

- 3.4. Market Trends

- 3.4.1. Growing Demand for Excavators to Drive the Market.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Construction Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 5.1.1. Crane

- 5.1.2. Telescopic Handlers

- 5.1.3. Excavators

- 5.1.4. Loaders and Backhoe

- 5.1.5. Motor Graders

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. Conventional

- 5.2.2. Hybrid and Electric

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. OEM

- 5.3.2. Aftermarket

- 5.4. Market Analysis, Insights and Forecast - by Application Type

- 5.4.1. Building

- 5.4.2. Infrastructure

- 5.4.3. Energy

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kobelco Construction Machinery

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Xuzhou Construction Machinery Group Co Ltd (XCMG)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Volvo CE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sany Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Liebherr Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 China Communications Construction Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Caterpillar Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Zoomlion Heavy Industry Science and Technology Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tadano Ltd*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Kobelco Construction Machinery

List of Figures

- Figure 1: China Construction Machinery Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: China Construction Machinery Industry Share (%) by Company 2025

List of Tables

- Table 1: China Construction Machinery Industry Revenue undefined Forecast, by Machinery Type 2020 & 2033

- Table 2: China Construction Machinery Industry Revenue undefined Forecast, by Drive Type 2020 & 2033

- Table 3: China Construction Machinery Industry Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 4: China Construction Machinery Industry Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 5: China Construction Machinery Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: China Construction Machinery Industry Revenue undefined Forecast, by Machinery Type 2020 & 2033

- Table 7: China Construction Machinery Industry Revenue undefined Forecast, by Drive Type 2020 & 2033

- Table 8: China Construction Machinery Industry Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 9: China Construction Machinery Industry Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 10: China Construction Machinery Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Construction Machinery Industry?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the China Construction Machinery Industry?

Key companies in the market include Kobelco Construction Machinery, Xuzhou Construction Machinery Group Co Ltd (XCMG), Volvo CE, Sany Group, Liebherr Group, China Communications Construction Company, Caterpillar Inc, Zoomlion Heavy Industry Science and Technology Co Ltd, Tadano Ltd*List Not Exhaustive.

3. What are the main segments of the China Construction Machinery Industry?

The market segments include Machinery Type, Drive Type, Sales Channel, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Electrification of Construction Equipment May Propel the Market Growth.

6. What are the notable trends driving market growth?

Growing Demand for Excavators to Drive the Market..

7. Are there any restraints impacting market growth?

Construction Rental Business May Hamper Market Growth.

8. Can you provide examples of recent developments in the market?

November 2022: XCMG confirmed signed purchasing contracts worth USD 60 million with four major global suppliers, Kawasaki Heavy Industries, Linde Hydraulics AG, Danfoss A/S, and Daimler SE, to build a high-end global supply chain network and maintain resilience in the global construction equipment manufacturing industry. The contracts were signed at the ongoing China International Import Expo (CIIE) in Shanghai.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Construction Machinery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Construction Machinery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Construction Machinery Industry?

To stay informed about further developments, trends, and reports in the China Construction Machinery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence