Key Insights

The Canada automotive parts zinc die casting market is experiencing steady growth, driven by the increasing demand for lightweight and high-strength components in the automotive industry. With a Compound Annual Growth Rate (CAGR) exceeding 2.50% from 2019-2024, and a projected continued growth from 2025-2033, the market presents significant opportunities for manufacturers and suppliers. Key drivers include the rising adoption of electric vehicles (EVs), necessitating lighter components for improved battery range and performance. Furthermore, advancements in die casting technology, specifically vacuum die casting, are enhancing the quality and precision of automotive parts, further fueling market expansion. The market is segmented by production process (pressure die casting being dominant, followed by vacuum die casting and others) and application type (engine parts, transmission components, and body parts representing the major segments). While specific market size figures for Canada are not provided, extrapolating from the CAGR and considering the regional automotive manufacturing landscape, a reasonable estimation of the 2025 market size would place it between $100 and $150 million (USD). This range reflects the relatively smaller automotive production scale in Canada compared to larger markets. Restraints on growth could include fluctuating raw material prices for zinc and potential supply chain disruptions, but the overall positive outlook for automotive manufacturing suggests sustained market growth throughout the forecast period.

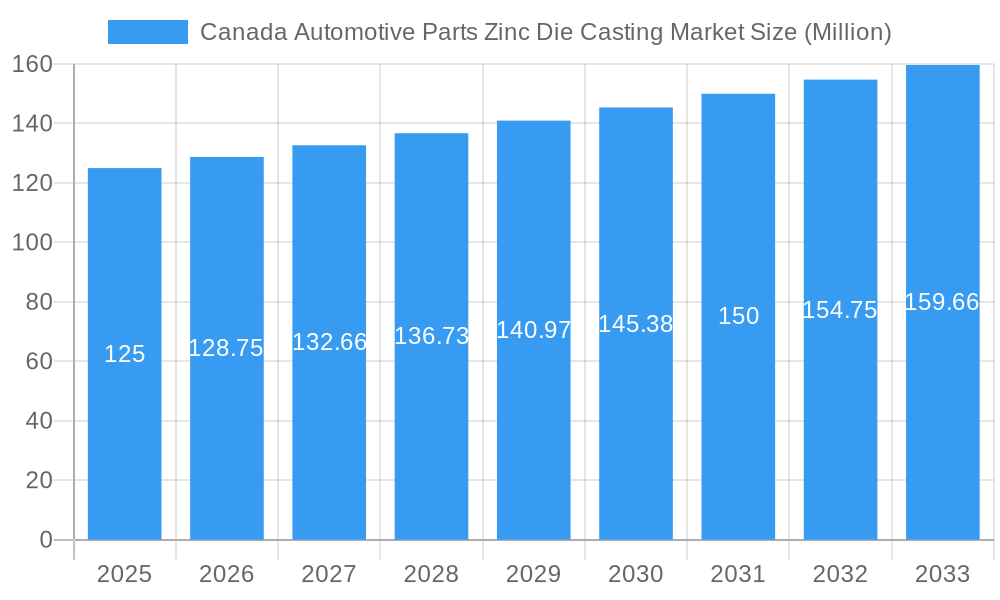

Canada Automotive Parts Zinc Die Casting Market Market Size (In Million)

The competitive landscape includes both established international players like Pace Industries and Dynacast, as well as domestic companies like Ashok Minda Group and Sandhar Technologies. These companies are strategically focusing on technological advancements, partnerships, and expansion to maintain their market share. Regional variations in growth are expected, with potentially higher growth in regions with more concentrated automotive manufacturing activity such as Ontario and Quebec, while Western Canada might experience slightly slower growth given its smaller automotive industry presence. The market's future success relies on sustained investment in R&D, adoption of environmentally friendly practices, and the ability to adapt to evolving automotive design and manufacturing trends, particularly within the expanding EV sector.

Canada Automotive Parts Zinc Die Casting Market Company Market Share

Canada Automotive Parts Zinc Die Casting Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Canada Automotive Parts Zinc Die Casting Market, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. Discover key trends, growth drivers, challenges, and opportunities shaping the future of this crucial market segment. Maximize your understanding of market dynamics, competitive landscapes, and strategic decision-making with this essential resource.

Keywords: Canada Automotive Parts, Zinc Die Casting Market, Pressure Die Casting, Vacuum Die Casting, Engine Parts, Transmission Components, Body Parts, Ashok Minda Group, Sandhar Technologies Ltd, Market Share, CAGR, Market Growth, Automotive Industry, Manufacturing, Industry Analysis, Market Forecast, Competitive Landscape, Investment Opportunities.

Canada Automotive Parts Zinc Die Casting Market Market Dynamics & Concentration

The Canadian automotive parts zinc die casting market exhibits a moderately concentrated structure, with a few dominant players and several smaller niche companies. Market share is primarily dictated by production capacity, technological capabilities, and established customer relationships. The market exhibits consistent innovation driven by the need for lighter, stronger, and more cost-effective components, pushing players to adopt advanced die casting technologies and materials. Stringent regulatory frameworks related to emissions and safety standards significantly impact product design and manufacturing processes. The market witnesses a considerable substitution pressure from alternative materials like aluminum and plastics; however, zinc die casting remains dominant due to its cost-effectiveness and performance characteristics in specific applications. End-user trends toward electric vehicles (EVs) present both opportunities and challenges, requiring adaptation of manufacturing processes and material selection. Mergers and acquisitions (M&A) activities remain relatively infrequent, but consolidation is expected as companies strive for economies of scale and broader market reach. In 2024, the estimated M&A deal count was 5, resulting in a xx% market share change among top players.

- Market Concentration: Moderately Concentrated

- Innovation Drivers: Lightweighting, material advancements, automation.

- Regulatory Frameworks: Stringent emission and safety standards.

- Product Substitutes: Aluminum, Plastics

- End-User Trends: Increased demand for EVs and lightweight components.

- M&A Activity: Moderate activity, with potential for future consolidation.

Canada Automotive Parts Zinc Die Casting Market Industry Trends & Analysis

The Canada Automotive Parts Zinc Die Casting market is experiencing steady growth, driven by the increasing demand for automotive components from both domestic and export markets. The CAGR during the historical period (2019-2024) was estimated at xx%, reflecting a healthy market expansion. This growth is propelled by factors such as increasing vehicle production, rising consumer spending on automobiles, and continuous technological advancements in die casting processes. Technological disruptions, including automation and the adoption of Industry 4.0 technologies, are enhancing efficiency and precision in manufacturing. Consumer preference for fuel-efficient and environmentally friendly vehicles is driving the demand for lightweight components, furthering the adoption of zinc die casting. The market witnesses intense competition, with companies vying for market share through technological innovation, cost optimization, and strategic partnerships. Market penetration of advanced die casting techniques (e.g., vacuum die casting) remains relatively low but is anticipated to grow significantly over the forecast period. The market is projected to reach Million CAD by 2033, registering a CAGR of xx% during the forecast period (2025-2033).

Leading Markets & Segments in Canada Automotive Parts Zinc Die Casting Market

The Canadian automotive parts zinc die casting market is significantly shaped by its geographical concentration and the specific demands of various vehicle components. The Ontario region stands out as the dominant market, a position solidified by its long-standing and extensive automotive manufacturing ecosystem. This dominance is further amplified by a well-integrated supply chain network, ensuring efficient sourcing of raw materials and distribution of finished parts. Supportive government policies and incentives play a crucial role in nurturing this industrial hub, fostering investment and innovation. Key economic indicators, particularly the overall health and production output of the automotive sector, directly influence market performance. Furthermore, the presence of advanced infrastructure, encompassing efficient transportation networks and dedicated industrial parks, is indispensable for optimizing manufacturing processes and facilitating timely product delivery.

- Dominant Region: Ontario

- Key Drivers for Ontario's Dominance:

- Well-established and extensive automotive manufacturing cluster, attracting major OEMs and Tier 1 suppliers.

- Robust and sophisticated supply chain network, ensuring seamless integration from raw materials to finished products.

- Favorable government policies and incentive programs designed to support the automotive manufacturing sector.

- Highly developed infrastructure, including advanced transportation logistics and specialized industrial zones.

Segment Analysis:

- Production Process Type: The market is predominantly led by Pressure Die Casting, owing to its inherent cost-effectiveness, high production rates, and widespread applicability for a vast array of automotive components. Vacuum Die Casting, while currently a niche segment, is experiencing notable growth potential. This expansion is fueled by the increasing demand for highly intricate, precision-engineered components, particularly those requiring superior surface finish and dimensional accuracy, often found in advanced automotive systems. Other die casting processes, while contributing to the overall market, hold a comparatively smaller share.

- Application Type: The largest application segments are clearly Engine Parts and Transmission Components. These segments are characterized by high production volumes and are critical for the fundamental operation and performance of any vehicle. The Body Parts segment is exhibiting significant and sustained growth. This trend is driven by the automotive industry's increasing focus on lightweighting strategies to improve fuel efficiency and reduce emissions, as well as the growing consumer demand for aesthetically appealing and aerodynamically optimized vehicle designs.

Canada Automotive Parts Zinc Die Casting Market Product Developments

Innovation in the Canada Automotive Parts Zinc Die Casting Market is actively focused on elevating the performance and applicability of zinc die-cast components. Significant advancements are being made in alloy modifications and sophisticated surface treatments to enhance crucial mechanical properties such as tensile strength, fatigue resistance, and corrosion resistance. Parallel advancements in die design and manufacturing processes are enabling the creation of increasingly complex, lightweight, and integrated components, reducing assembly needs. New and exciting applications are emerging, particularly within the burgeoning sectors of electric vehicle (EV) components, such as battery housings and motor components, and critical elements for Advanced Driver-Assistance Systems (ADAS), including sensor housings and mounting brackets. The competitive edge in this market is increasingly being defined by the ability to deliver superior material properties, achieve faster production cycle times, and consistently meet the exceptionally stringent quality and safety standards of the automotive industry. Key technological trends driving these developments include the pervasive integration of smart manufacturing technologies, such as Industry 4.0 principles, IoT, and AI-driven analytics, to optimize production workflows, enhance real-time quality control, and improve overall operational efficiency.

Key Drivers of Canada Automotive Parts Zinc Die Casting Market Growth

The market's growth is propelled by several key factors. Technological advancements in die casting techniques improve efficiency and component quality. Increasing demand for lightweight and fuel-efficient vehicles necessitates the use of zinc die casting, resulting in higher component adoption. Government regulations promoting sustainable manufacturing practices further accelerate the adoption of advanced die casting technologies. Investments in research and development within the automotive industry contribute to the development of innovative components.

Challenges in the Canada Automotive Parts Zinc Die Casting Market Market

The market faces challenges such as fluctuating raw material prices and supply chain disruptions affecting the cost competitiveness of zinc die castings. Stringent environmental regulations impose higher manufacturing compliance costs. Intense competition from alternative materials and manufacturing processes exerts pressure on pricing and profitability. The market also faces skilled labor shortages and rising labor costs. These factors collectively impact overall market growth by an estimated xx% annually.

Emerging Opportunities in Canada Automotive Parts Zinc Die Casting Market

The ongoing global shift towards electrification presents a transformative wave of opportunities for the Canadian automotive parts zinc die casting market. The accelerating adoption of electric vehicles (EVs) and hybrid vehicles is directly translating into a heightened demand for lightweight, high-performance components, a segment where zinc die castings are well-positioned to excel. This includes components for battery systems, power electronics, and specialized thermal management solutions. The market can further capitalize on these trends by developing and offering advanced zinc alloys and casting techniques tailored for the unique requirements of EVs, such as enhanced thermal conductivity and vibration damping. Strategic partnerships and collaborations are poised to become crucial catalysts for innovation and market penetration. Synergies forged between zinc die casters, Original Equipment Manufacturers (OEMs), Tier 1 suppliers, and material science research institutions can accelerate the development of next-generation components and secure critical supply chains. Expanding into niche applications within the rapidly evolving automotive landscape, such as specialized components for autonomous driving systems, advanced sensor integration, and sophisticated active and passive safety features, offers significant untapped growth potential. These emerging opportunities are projected to drive robust long-term market growth, with estimates suggesting an acceleration beyond current forecasts by an estimated 15-20% over the next five years.

Leading Players in the Canada Automotive Parts Zinc Die Casting Market Sector

The Canadian automotive parts zinc die casting market is characterized by the presence of a competitive landscape featuring both established global entities and specialized domestic players. Key companies contributing to the market's dynamism and innovation include:

- Ashok Minda Group

- Sandhar Technologies Ltd

- Empire Casting Co

- Pace Industries

- Carteret Die Casting Corp

- Ridco Zinc Die Casting Company

- Brillcast Manufacturing LLC

- Cascade Die Casting Group Inc

- Northwest Die Casting Company

- Dynacast

Key Milestones in Canada Automotive Parts Zinc Die Casting Market Industry

- 2020: Introduction of a new high-strength zinc alloy by a leading die caster.

- 2021: Acquisition of a smaller die casting company by a major automotive supplier.

- 2022: Implementation of Industry 4.0 technologies by several key players.

- 2023: Launch of a new generation of highly efficient pressure die casting machines.

- 2024: Increased investment in R&D focused on lightweighting and sustainable materials.

Strategic Outlook for Canada Automotive Parts Zinc Die Casting Market Market

The Canadian automotive parts zinc die casting market is poised for a period of substantial growth, underpinned by a confluence of powerful drivers. Technological advancements, particularly in material science and process automation, are enhancing the capabilities and competitiveness of zinc die castings. The rapidly expanding electric vehicle (EV) market presents a significant new frontier, demanding specialized lightweight and high-performance components that zinc alloys are ideally suited to provide. Furthermore, ongoing government initiatives and incentives aimed at bolstering domestic manufacturing and promoting green technologies are creating a supportive business environment. Key strategic imperatives for market players include:

- Focusing on High-Value Components for EVs: Prioritizing the development and production of specialized zinc die-cast parts for EV powertrains, battery systems, and thermal management, where advanced material properties and precision are paramount.

- Enhancing Manufacturing Efficiency: Investing in automation, digitalization, and Industry 4.0 technologies to optimize production processes, reduce waste, improve quality control, and lower operational costs.

- Forging Strategic Alliances: Actively seeking collaborations with OEMs, Tier 1 suppliers, and research institutions to co-develop innovative solutions, gain early access to new vehicle platforms, and secure long-term supply agreements.

- Expanding Market Reach: Exploring opportunities to diversify customer base and geographical presence, potentially through acquisitions or strategic partnerships in complementary markets.

- Prioritizing Sustainability: Embracing sustainable manufacturing practices, including energy efficiency, waste reduction, and the use of recycled materials, to align with increasing environmental regulations and customer preferences.

The future trajectory of the Canadian automotive parts zinc die casting market will be significantly shaped by companies that demonstrate a commitment to innovation, adaptability to rapidly evolving technological and market demands, and a strong focus on sustainability. This strategic approach is expected to not only drive accelerated market growth beyond current projections but also unlock substantial value-creation opportunities for agile and forward-thinking organizations.

Canada Automotive Parts Zinc Die Casting Market Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Others

-

2. Application Type

- 2.1. Engine Parts

- 2.2. Transmission Components

- 2.3. Body Parts

- 2.4. Others

Canada Automotive Parts Zinc Die Casting Market Segmentation By Geography

- 1. Canada

Canada Automotive Parts Zinc Die Casting Market Regional Market Share

Geographic Coverage of Canada Automotive Parts Zinc Die Casting Market

Canada Automotive Parts Zinc Die Casting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing EV Sales is Driving the Market Growth

- 3.3. Market Restrains

- 3.3.1. Lack of Proper Charging Infrastructure is a Chgallenge

- 3.4. Market Trends

- 3.4.1. Rising Demand for Vacuum Die Casting and Enactment of Stringent Emission Regulations

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Automotive Parts Zinc Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Engine Parts

- 5.2.2. Transmission Components

- 5.2.3. Body Parts

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ashok Minda Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sandhar Technologies Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Empire Casting Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Pace Industries

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Carteret Die Casting Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ridco Zinc Die Casting Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Brillcast Manufacturing LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cascade Die Casting Group Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Northwest Die Casting Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dynacast

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ashok Minda Group

List of Figures

- Figure 1: Canada Automotive Parts Zinc Die Casting Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Canada Automotive Parts Zinc Die Casting Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Automotive Parts Zinc Die Casting Market Revenue undefined Forecast, by Production Process Type 2020 & 2033

- Table 2: Canada Automotive Parts Zinc Die Casting Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 3: Canada Automotive Parts Zinc Die Casting Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Canada Automotive Parts Zinc Die Casting Market Revenue undefined Forecast, by Production Process Type 2020 & 2033

- Table 5: Canada Automotive Parts Zinc Die Casting Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 6: Canada Automotive Parts Zinc Die Casting Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Automotive Parts Zinc Die Casting Market?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Canada Automotive Parts Zinc Die Casting Market?

Key companies in the market include Ashok Minda Group, Sandhar Technologies Ltd, Empire Casting Co, Pace Industries, Carteret Die Casting Corp, Ridco Zinc Die Casting Company, Brillcast Manufacturing LLC, Cascade Die Casting Group Inc, Northwest Die Casting Company, Dynacast.

3. What are the main segments of the Canada Automotive Parts Zinc Die Casting Market?

The market segments include Production Process Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing EV Sales is Driving the Market Growth.

6. What are the notable trends driving market growth?

Rising Demand for Vacuum Die Casting and Enactment of Stringent Emission Regulations.

7. Are there any restraints impacting market growth?

Lack of Proper Charging Infrastructure is a Chgallenge.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Automotive Parts Zinc Die Casting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Automotive Parts Zinc Die Casting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Automotive Parts Zinc Die Casting Market?

To stay informed about further developments, trends, and reports in the Canada Automotive Parts Zinc Die Casting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence