Key Insights

The Brazil automotive composites market is experiencing robust growth, driven by the increasing demand for lightweight vehicles to improve fuel efficiency and reduce emissions. A Compound Annual Growth Rate (CAGR) exceeding 13% from 2019 to 2033 indicates a significant expansion, with the market size projected to reach a substantial value in the coming years. This growth is fueled by several key factors. Firstly, the burgeoning automotive industry in Brazil, coupled with government initiatives promoting sustainable transportation, is creating a favorable environment for composite material adoption. Secondly, the superior strength-to-weight ratio and design flexibility offered by composites are increasingly attractive to manufacturers seeking to enhance vehicle performance and reduce production costs. The market is segmented by production process (hand layup, compression molding, continuous process, injection molding), application (structural assembly, powertrain components, interior, exterior), and material type (thermoset polymer, thermoplastic polymer, carbon fiber, glass fiber). While the hand layup process currently holds a significant market share due to its cost-effectiveness for smaller production runs, the adoption of more advanced techniques like injection molding is expected to accelerate, driven by the need for high-volume, high-precision components. The use of lightweight materials like carbon fiber and glass fiber is also on the rise, further contributing to market expansion. However, challenges such as high initial investment costs associated with advanced manufacturing processes and the potential for material degradation in harsh environmental conditions act as restraints on market growth.

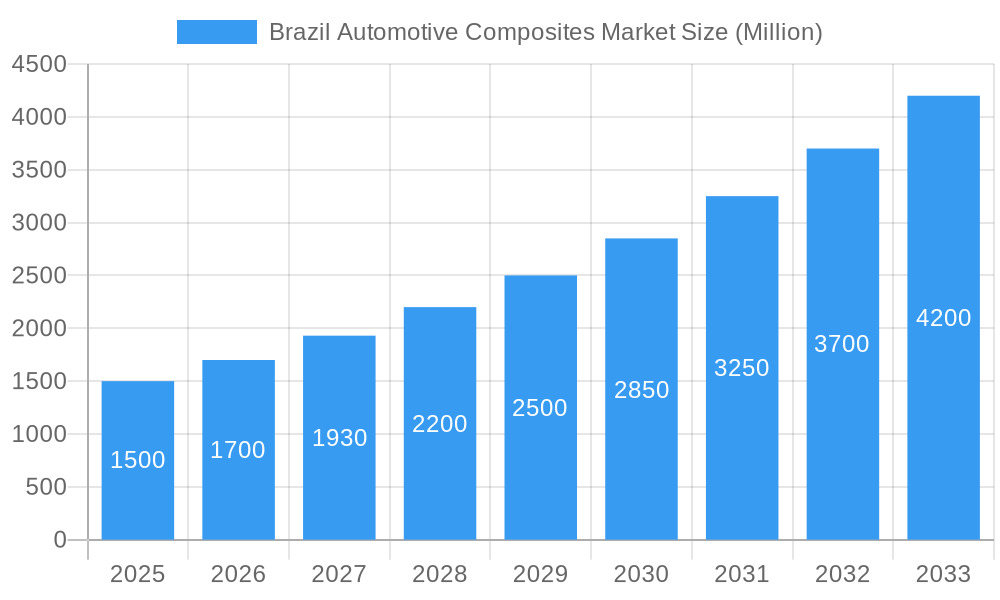

Brazil Automotive Composites Market Market Size (In Billion)

Despite these challenges, the long-term outlook for the Brazil automotive composites market remains positive. The increasing focus on electric and hybrid vehicles will further stimulate demand for lightweight composites, as these materials are crucial for extending the range and performance of such vehicles. The ongoing development of new composite materials with improved properties, along with advancements in manufacturing technologies, will also drive market expansion. Key players like SGL Carbon, Sigmatex, and Toray Industries are actively investing in research and development to capitalize on these opportunities. The continued growth of the Brazilian automotive sector, combined with technological advancements and supportive government policies, ensures a promising future for the automotive composites market in Brazil. The market is expected to see a significant shift towards higher-value applications and advanced manufacturing techniques in the coming years.

Brazil Automotive Composites Market Company Market Share

Brazil Automotive Composites Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Brazil Automotive Composites Market, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. Covering the period from 2019 to 2033, with a focus on 2025, this study unveils market trends, competitive landscapes, and future growth projections. The report meticulously examines various segments, including production processes, applications, and material types, providing a granular understanding of market dynamics and opportunities. Key players like SGL Carbon, Sigmatex, and Toray Industries are profiled, alongside analysis of market size, CAGR, and market share. Download now to gain a competitive edge!

Brazil Automotive Composites Market Market Dynamics & Concentration

The Brazilian automotive composites market exhibits a moderately concentrated landscape, with a few dominant players commanding significant market share. The market is characterized by continuous innovation driven by the need for lightweight, high-performance materials in automobiles. Stringent government regulations regarding fuel efficiency and emissions are further propelling the adoption of composites. The market also faces competition from traditional materials like steel and aluminum. However, the inherent advantages of composites, such as superior strength-to-weight ratios and design flexibility, are driving their increasing penetration. Several mergers and acquisitions (M&A) have been observed in the recent past, suggesting a trend towards consolidation. The overall market concentration is estimated at xx%, with the top 5 players holding approximately xx% of the market share in 2025. Notable M&A activities included xx deals in the historical period (2019-2024), indicating a dynamic and evolving market.

- Market Concentration (2025): xx%

- Top 5 Players Market Share (2025): xx%

- M&A Deals (2019-2024): xx

Brazil Automotive Composites Market Industry Trends & Analysis

The Brazil Automotive Composites Market is undergoing a dynamic transformation, characterized by sustained and robust growth. This expansion is primarily fueled by the escalating global and domestic demand for fuel-efficient and sustainable vehicles. Composites, with their inherent advantage of significant weight reduction compared to traditional metals like steel and aluminum, are instrumental in meeting stringent emission standards and improving fuel economy. Continuous advancements in composite material science are leading to the development of novel and high-performance materials, including advanced polymer matrices and innovative reinforcement fibers. Concurrently, cutting-edge manufacturing technologies, such as automated fiber placement, resin transfer molding (RTM), and advanced injection molding techniques, are optimizing production processes, enhancing precision, and reducing manufacturing cycle times, thereby lowering costs and boosting efficiency.

Beyond functional benefits, there's a growing consumer inclination towards vehicles that offer enhanced aesthetics, superior performance, and improved safety features, all of which can be achieved through the strategic use of composites. The market is witnessing a pronounced shift towards thermoplastic composites. This trend is propelled by their inherent recyclability, ease of processing (enabling faster production cycles), and the potential for integration with existing plastic manufacturing infrastructure, making them more attractive for mass production. The competitive landscape is vibrant, featuring a mix of well-established global composite manufacturers and agile local players, all striving to capture market share through relentless product innovation, strategic alliances, and mergers & acquisitions. The market is projected to exhibit a CAGR of **XX%** during the forecast period (2025-2033), with an anticipated market penetration of **XX%** by 2033. This impressive growth trajectory is underpinned by the expanding automotive production capacity in Brazil and the concerted efforts of government initiatives aimed at fostering a more sustainable and technologically advanced transportation ecosystem.

Leading Markets & Segments in Brazil Automotive Composites Market

The adoption and application of composite materials within Brazil's automotive sector exhibit distinct geographical and segment-specific patterns. The Southeast region of Brazil, a powerhouse of automotive manufacturing and assembly, consistently leads the market in composite material utilization due to the concentration of major automotive plants and their associated supply chains. A detailed analysis of market segmentation reveals several key trends:

By Production Process Type:

- Injection molding is experiencing significant traction, especially for complex and high-volume components, owing to its unparalleled speed, accuracy, and ability to produce intricate shapes cost-effectively.

- Continuous process methods, such as pultrusion and filament winding, are demonstrating strong growth potential, particularly for applications requiring long, consistent profiles and high-volume output.

- Hand layup, while traditionally dominant and still prevalent in niche applications demanding high customization and smaller production runs, is gradually seeing its market share evolve with the advent of more automated solutions.

By Application Type:

- Structural assembly commands the largest market share. This is primarily driven by the critical need to reduce overall vehicle weight for enhanced fuel efficiency and improved dynamic performance, with composites being ideal for body-in-white components, chassis parts, and reinforcements.

- Powertrain components are witnessing increasing integration of composites. Applications like intake manifolds, fan shrouds, and battery enclosures for electric vehicles (EVs) are benefiting from the lightweight and thermal management properties of composites, contributing to better overall powertrain efficiency.

- Interior and exterior applications are experiencing consistent and steady growth. Composites are used for applications like instrument panels, door panels, bumpers, spoilers, and body panels, offering a compelling blend of aesthetic appeal, design flexibility, and functional benefits such as impact resistance and scratch resistance.

By Material Type:

- Thermoset polymers, particularly epoxy and polyester resins, currently hold a dominant position in the market due to their well-established performance characteristics, proven reliability in automotive applications, and cost-effectiveness for many applications.

- Thermoplastic polymers are rapidly gaining momentum. Their growing popularity is attributed to their recyclability, ease of processing through methods like injection molding, faster cycle times, and the ability to be welded, making them increasingly viable for high-volume automotive production.

- Carbon fiber composites are seeing increasing adoption, especially in high-performance vehicles and luxury segments, where their exceptional strength-to-weight ratio and stiffness are highly valued. However, their relatively higher cost continues to be a limiting factor for widespread adoption across the entire automotive spectrum.

- Glass fiber composites remain the most widely utilized material type. They offer an excellent balance of cost-effectiveness, good mechanical properties, and versatility, making them a go-to choice for a broad range of automotive components.

The sustained growth and dominance of these segments are further propelled by supportive government policies that encourage local manufacturing, investments in improving logistics and infrastructure, and the overall expansion of Brazil's automotive production capabilities, including the growing production of electric and hybrid vehicles.

Brazil Automotive Composites Market Product Developments

Recent product innovations focus on developing lighter, stronger, and more cost-effective composite materials. The industry is witnessing advancements in resin systems, fiber architectures, and manufacturing processes, resulting in improved performance and reduced production costs. These innovations are tailored to meet the specific needs of different vehicle applications, ranging from lightweight body panels to high-performance engine components. The focus on recyclability and sustainable manufacturing is also evident in the development of eco-friendly composite materials.

Key Drivers of Brazil Automotive Composites Market Growth

The upward trajectory of the Brazilian automotive composites market is propelled by a confluence of powerful drivers. Foremost among these are the continuous technological advancements in both composite materials and manufacturing processes. Innovations in resin systems, fiber reinforcements (including natural fibers and recycled carbon fibers), and advanced processing techniques such as additive manufacturing for composites are enabling the creation of components that are not only lighter and stronger but also more cost-effective and environmentally friendly. Government regulations mandating stricter fuel efficiency standards and reduced vehicular emissions are a significant impetus, compelling automakers to increasingly adopt lightweight composite materials to meet these targets. The burgeoning Brazilian automotive industry itself, with a mix of established global automotive giants and emerging domestic players, is a crucial demand generator, fueling the need for advanced materials that can enhance vehicle performance, safety, and sustainability. Furthermore, the growing emphasis on lightweighting strategies across the entire vehicle architecture, from structural components to interior trim, is directly contributing to the increased demand for composite solutions.

Challenges in the Brazil Automotive Composites Market

Despite its promising growth, the Brazilian automotive composites market encounters several significant challenges that warrant careful consideration. The high initial capital investment required for advanced composite manufacturing equipment, such as automated lay-up machines and specialized molding equipment, can present a substantial barrier to entry, particularly for smaller and medium-sized enterprises (SMEs). Furthermore, the market is susceptible to supply chain volatilities and fluctuations in raw material prices, especially for key precursors like carbon fiber and specialized resins, which can impact production costs and predictability. A persistent challenge is the shortage of skilled labor specifically trained in advanced composite design, manufacturing, and repair processes, which can impede the scaling up of operations and the adoption of new technologies. The complexity and cost associated with specialized tooling for composite part production, alongside the need for highly skilled technicians, further contribute to the overall cost of implementation. These factors, coupled with the established presence and cost-competitiveness of traditional materials in certain applications, create an environment of intense competition and can slow down the widespread market penetration of composites.

Emerging Opportunities in Brazil Automotive Composites Market

Significant opportunities exist in the Brazil Automotive Composites Market. Technological breakthroughs in materials science and manufacturing processes present possibilities for developing next-generation composite materials with enhanced properties. Strategic partnerships between automotive manufacturers and composite material suppliers can create synergistic opportunities for innovation and market penetration. Expanding into new automotive applications, such as electric vehicles and autonomous driving systems, will present further growth catalysts. The focus on sustainable materials and circular economy initiatives will offer considerable opportunities for environmentally conscious companies.

Leading Players in the Brazil Automotive Composites Market Sector

- SGL Carbon

- Sigmatex

- MouldCam Pty Ltd

- Mitsubishi Chemical Carbon Fiber and Composites Inc

- Toho Tenex

- Nippon Sheet Glass Company Limited

- Toray Industries

- Hexcel Corporation

- Solva

Key Milestones in Brazil Automotive Composites Market Industry

- 2020: Launch of a new lightweight composite body panel by a major automotive manufacturer, showcasing advancements in material integration for mass production.

- 2021: Strategic partnership formed between a leading composite material supplier and an automotive OEM to co-develop a new generation of high-performance carbon fiber components for enhanced vehicle dynamics.

- 2022: Significant investment by a key industry player in a state-of-the-art composite manufacturing facility, aimed at increasing production capacity and technological capabilities within Brazil.

- 2023: Introduction of new government incentives and tax breaks specifically targeting the adoption and manufacturing of lightweight composite materials in the Brazilian automotive sector to promote sustainability and innovation.

- 2024: Acquisition of a smaller, specialized composite manufacturer by a larger global player, signaling market consolidation and a strategic move to expand market reach and technological portfolio.

Strategic Outlook for Brazil Automotive Composites Market Market

The Brazil Automotive Composites Market holds immense potential for future growth. The ongoing development of advanced composite materials and manufacturing technologies, coupled with increasing demand for fuel-efficient and sustainable vehicles, will drive market expansion. Strategic partnerships, investments in research and development, and expansion into new market segments will be critical for success in this dynamic sector. The market is poised for strong growth driven by technological innovation and supportive government policies, representing significant opportunities for both established players and new entrants.

Brazil Automotive Composites Market Segmentation

-

1. Production Process Type

- 1.1. Hand Layup

- 1.2. Compression Molding

- 1.3. Continous Process

- 1.4. Injection Molding

-

2. Application Type

- 2.1. Structural Assembly

- 2.2. Powertrain Component

- 2.3. Interior

- 2.4. Exterior

- 2.5. Others

-

3. Material Type

- 3.1. Thermoset Polymer

- 3.2. Thermoplastic Polymer

- 3.3. Carbon Fiber

- 3.4. Glass Fiber

Brazil Automotive Composites Market Segmentation By Geography

- 1. Brazil

Brazil Automotive Composites Market Regional Market Share

Geographic Coverage of Brazil Automotive Composites Market

Brazil Automotive Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Lightweight and Energy-efficient Automotive Components to Foster the Growth of the Target Market

- 3.3. Market Restrains

- 3.3.1. High Manufacturing and Processing Cost of Composites

- 3.4. Market Trends

- 3.4.1. Growing Demand for Lightweight Materials

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Automotive Composites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Hand Layup

- 5.1.2. Compression Molding

- 5.1.3. Continous Process

- 5.1.4. Injection Molding

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Structural Assembly

- 5.2.2. Powertrain Component

- 5.2.3. Interior

- 5.2.4. Exterior

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Material Type

- 5.3.1. Thermoset Polymer

- 5.3.2. Thermoplastic Polymer

- 5.3.3. Carbon Fiber

- 5.3.4. Glass Fiber

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SGL Carbon

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sigmatex

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MouldCam Pty Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 itsubishi Chemical Carbon Fiber and Composites Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Toho Tenex

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nippon Sheet Glass Company Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Toray Industries

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hexcel Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Solva

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 SGL Carbon

List of Figures

- Figure 1: Brazil Automotive Composites Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Brazil Automotive Composites Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Automotive Composites Market Revenue undefined Forecast, by Production Process Type 2020 & 2033

- Table 2: Brazil Automotive Composites Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 3: Brazil Automotive Composites Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 4: Brazil Automotive Composites Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Brazil Automotive Composites Market Revenue undefined Forecast, by Production Process Type 2020 & 2033

- Table 6: Brazil Automotive Composites Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 7: Brazil Automotive Composites Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 8: Brazil Automotive Composites Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Automotive Composites Market?

The projected CAGR is approximately 14.5%.

2. Which companies are prominent players in the Brazil Automotive Composites Market?

Key companies in the market include SGL Carbon, Sigmatex, MouldCam Pty Ltd, itsubishi Chemical Carbon Fiber and Composites Inc, Toho Tenex, Nippon Sheet Glass Company Limited, Toray Industries, Hexcel Corporation, Solva.

3. What are the main segments of the Brazil Automotive Composites Market?

The market segments include Production Process Type, Application Type, Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Lightweight and Energy-efficient Automotive Components to Foster the Growth of the Target Market.

6. What are the notable trends driving market growth?

Growing Demand for Lightweight Materials.

7. Are there any restraints impacting market growth?

High Manufacturing and Processing Cost of Composites.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Automotive Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Automotive Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Automotive Composites Market?

To stay informed about further developments, trends, and reports in the Brazil Automotive Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence