Key Insights

The automotive glass fiber composites market is poised for significant expansion, driven by the imperative for lightweight and high-strength materials in modern vehicle construction. This sector projects a robust Compound Annual Growth Rate (CAGR) of 14.5%, with an estimated market size of 11.1 billion by 2025. The primary catalysts for this growth include the automotive industry's intensified focus on enhancing fuel efficiency and reducing emissions, directly correlating with the adoption of lighter composite materials. Furthermore, evolving governmental mandates for fuel economy and safety standards are compelling automakers to integrate these advanced solutions. The market is segmented by fiber type, including short, long, and continuous fiber thermoplastics, serving diverse applications from interior and exterior components to structural and powertrain elements. Key industry leaders, such as Solvay Group, Asahi Fiber Glass, and Owens Corning, are pivotal in driving innovation and production dynamics. Geographically, North America, Europe, and Asia Pacific are key regions, with China and the United States leading due to their extensive automotive manufacturing capacities and mature supply chains. Growth is anticipated across all regions, reflecting the global nature of the automotive sector.

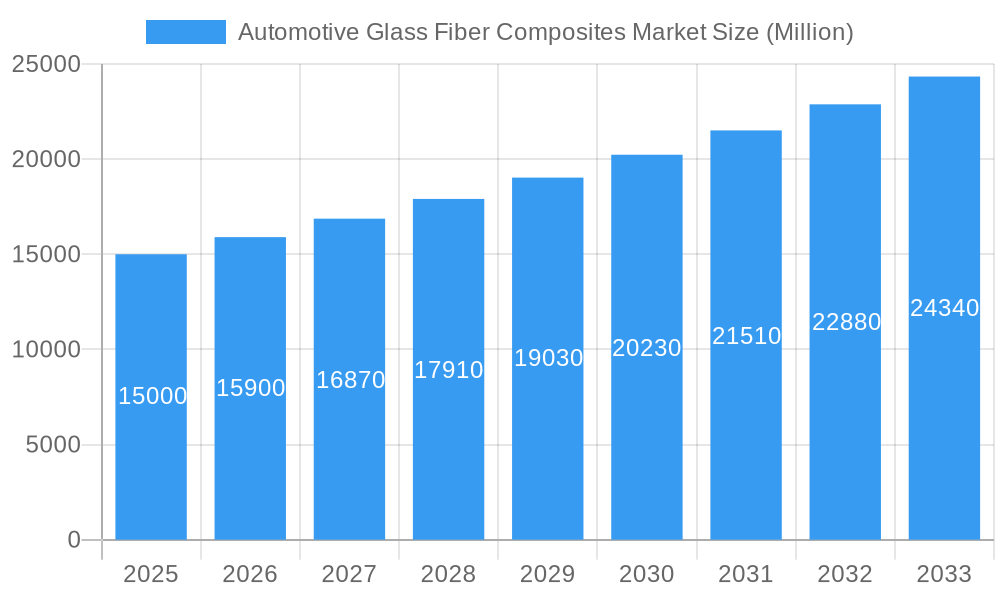

Automotive Glass Fiber Composites Market Market Size (In Billion)

Advancements in manufacturing technologies and material science are further accelerating market growth by improving the performance and cost-effectiveness of glass fiber composites. While initial investment costs for composite manufacturing and the requirement for specialized expertise and equipment may present some challenges, ongoing research and development efforts are actively addressing these barriers, promising sustained expansion. The forecast period (2025-2033) indicates continued upward momentum, propelled by evolving vehicle architectures, the increasing prevalence of electric vehicles necessitating lighter materials, and a heightened emphasis on sustainable manufacturing practices within the automotive industry. This market offers substantial opportunities for manufacturers, material suppliers, and technology providers.

Automotive Glass Fiber Composites Market Company Market Share

Automotive Glass Fiber Composites Market: A Comprehensive Analysis (2019-2033)

This comprehensive report provides an in-depth analysis of the Automotive Glass Fiber Composites Market, offering invaluable insights for industry stakeholders. With a focus on market dynamics, leading players, and future trends, this report is an essential resource for strategic decision-making. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024. The report covers key segments including Short Fiber Thermoplastic (SFT), Long Fiber Thermoplastic (LFT), Continuous Fiber Thermoplastic (CFT), and Other Intermediate Types, along with applications such as Interiors, Exteriors, Structural Assembly, Power-train Components, and Others. Key players analyzed include Solvay Group, Jiangsu Changhai Composite Materials, ASAHI FIBER GLASS Co Ltd, Nippon Sheet Glass Company Limited, Owens Corning, 3B (Braj Binani Group), Veplas Group, and SAERTEX GmbH & Co KG.

Automotive Glass Fiber Composites Market Market Dynamics & Concentration

The automotive glass fiber composites market is experiencing significant growth driven by the increasing demand for lightweight and fuel-efficient vehicles. Market concentration is moderate, with a few major players holding significant market share, but a number of smaller, specialized companies also compete. Innovation in materials science is a primary driver, with ongoing research into stronger, lighter, and more cost-effective composites. Stringent regulatory frameworks, particularly concerning emissions and fuel economy, are pushing adoption. Product substitutes, such as aluminum and steel, still pose a challenge, although the advantages of composites in specific applications are becoming increasingly clear. End-user trends show a strong preference for enhanced vehicle performance and safety features, further fueling the demand for advanced materials. M&A activity within the industry has been moderate, with approximately xx deals recorded in the past five years, indicating a focus on strategic partnerships and acquisitions to enhance technology and market reach. Market share distribution among the top players is roughly: Solvay Group (xx%), Owens Corning (xx%), Nippon Sheet Glass (xx%), and others (xx%).

- Market Concentration: Moderate, with several key players and niche players.

- Innovation Drivers: Advancements in materials science, improved processing techniques.

- Regulatory Frameworks: Stringent emission and fuel efficiency standards drive adoption.

- Product Substitutes: Aluminum, steel, and other materials offer competition.

- End-User Trends: Demand for lighter, stronger, and safer vehicles.

- M&A Activity: Approximately xx deals in the past 5 years.

Automotive Glass Fiber Composites Market Industry Trends & Analysis

The automotive glass fiber composites market exhibits a robust CAGR of xx% during the forecast period (2025-2033). This growth is propelled by several key factors. The automotive industry's increasing focus on lightweighting to improve fuel efficiency and reduce emissions is a major driver. Technological disruptions, such as the development of high-performance composites and innovative manufacturing processes, are also significantly impacting market growth. The rising demand for electric vehicles (EVs) is boosting the adoption of glass fiber composites due to their ability to enhance battery life and range. Changing consumer preferences towards advanced vehicle features and safety enhance market penetration. Competitive dynamics are characterized by intense competition among established players and emerging companies, leading to continuous product innovations and improvements. Market penetration is expected to reach xx% by 2033, with substantial growth in the Asian and European markets.

Leading Markets & Segments in Automotive Glass Fiber Composites Market

The Asia-Pacific region currently dominates the automotive glass fiber composites market, driven by rapid industrialization, increasing vehicle production, and favorable government policies supporting the adoption of lightweight materials. China, in particular, is a major growth engine due to its massive automotive market and supportive government initiatives.

- Dominant Region: Asia-Pacific (particularly China)

- Key Drivers in Asia-Pacific:

- Rapid industrialization and economic growth

- Increasing vehicle production and sales

- Government initiatives promoting lightweighting in vehicles

- Growing demand for electric vehicles.

Dominant Segments:

Intermediate Type: Short Fiber Thermoplastic (SFT) currently holds the largest market share due to its cost-effectiveness and ease of processing. However, Long Fiber Thermoplastic (LFT) and Continuous Fiber Thermoplastic (CFT) are witnessing significant growth, driven by their superior mechanical properties. Other intermediate types represent a smaller, but still growing, segment.

Application: The exterior segment is currently the largest, followed by structural assembly. However, the powertrain components segment is rapidly growing due to the increasing use of composites in electric vehicle batteries and motors. Interior applications are also gaining traction due to the demand for lightweight and aesthetically pleasing components.

Automotive Glass Fiber Composites Market Product Developments

Recent product developments focus on enhancing the mechanical properties, durability, and cost-effectiveness of glass fiber composites. Solvay's introduction of SolvaLite SF200 surfacing film for paintable Class A body panels demonstrates this trend. Innovations are geared towards expanding the applications of these composites to encompass diverse vehicle components, catering to the automotive industry's needs for lightweighting, enhanced performance, and cost reduction.

Key Drivers of Automotive Glass Fiber Composites Market Growth

Several factors drive the growth of the automotive glass fiber composites market. The foremost is the automotive industry's push for lightweighting to improve fuel efficiency and meet increasingly stringent emission regulations. Furthermore, the rising adoption of electric vehicles significantly boosts demand for high-performance composites for batteries and other critical components. Government incentives and subsidies promoting the use of sustainable and lightweight materials are also fueling market expansion.

Challenges in the Automotive Glass Fiber Composites Market Market

The automotive glass fiber composites market faces challenges like the high initial cost of materials and manufacturing compared to traditional materials. Fluctuations in raw material prices pose a significant challenge, impacting profitability. Furthermore, the complexity of processing and integrating these composites into automotive manufacturing processes necessitates significant investment in advanced equipment and skilled labor. Competitive pressures from established materials also pose a threat.

Emerging Opportunities in Automotive Glass Fiber Composites Market

Emerging opportunities in this market arise from technological advancements such as the development of next-generation high-strength composites. Strategic collaborations among material suppliers, automotive manufacturers, and technology developers are expected to create new market opportunities. Expansion into emerging economies with growing automotive sectors presents significant potential.

Leading Players in the Automotive Glass Fiber Composites Market Sector

- Solvay Group

- Jiangsu Changhai Composite Materials

- ASAHI FIBER GLASS Co Ltd

- Nippon Sheet Glass Company Limited

- Owens Corning

- 3B (Braj Binani Group)

- Veplas Group

- SAERTEX GmbH & Co KG

Key Milestones in Automotive Glass Fiber Composites Market Industry

November 2022: Solvay and Orbia announced a USD 850 Million joint venture for battery materials production, partially funded by a USD 178 Million DOE grant. This significantly strengthens Solvay's position in the market and expands capacity for battery materials.

October 2022: Solvay launched SolvaLite SF200 surfacing film, a key innovation for high-end vehicle body panels, showcasing technological advancement and market expansion in premium segments.

February 2022: Teijin Automotive Technologies opened a new manufacturing facility in China, highlighting the growth of the market in Asia and the increasing demand for EV components.

Strategic Outlook for Automotive Glass Fiber Composites Market Market

The automotive glass fiber composites market holds significant future potential, driven by the ongoing trend toward vehicle lightweighting and the growth of the electric vehicle sector. Strategic opportunities lie in developing advanced composite materials with enhanced properties, expanding into new applications, and fostering collaborations across the value chain. The market is poised for sustained growth, fueled by technological innovation and the increasing demand for sustainable and fuel-efficient vehicles.

Automotive Glass Fiber Composites Market Segmentation

-

1. Intermediate Type

- 1.1. Short Fiber Thermoplastic (SFT)

- 1.2. Long Fiber Thermoplastic (LFT)

- 1.3. Continuous Fiber Thermoplastic (CFT)

- 1.4. Other Intermediate Types

-

2. Application

- 2.1. Interiors

- 2.2. Exteriors

- 2.3. Structural Assembly

- 2.4. Power-train Components

- 2.5. Others

Automotive Glass Fiber Composites Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Automotive Glass Fiber Composites Market Regional Market Share

Geographic Coverage of Automotive Glass Fiber Composites Market

Automotive Glass Fiber Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Tourism Across Activities the Country

- 3.3. Market Restrains

- 3.3.1. Hike In Fuel Prices To Restrict The Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Glass Fiber Composites in Automobiles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Glass Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Intermediate Type

- 5.1.1. Short Fiber Thermoplastic (SFT)

- 5.1.2. Long Fiber Thermoplastic (LFT)

- 5.1.3. Continuous Fiber Thermoplastic (CFT)

- 5.1.4. Other Intermediate Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Interiors

- 5.2.2. Exteriors

- 5.2.3. Structural Assembly

- 5.2.4. Power-train Components

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Intermediate Type

- 6. North America Automotive Glass Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Intermediate Type

- 6.1.1. Short Fiber Thermoplastic (SFT)

- 6.1.2. Long Fiber Thermoplastic (LFT)

- 6.1.3. Continuous Fiber Thermoplastic (CFT)

- 6.1.4. Other Intermediate Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Interiors

- 6.2.2. Exteriors

- 6.2.3. Structural Assembly

- 6.2.4. Power-train Components

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Intermediate Type

- 7. Europe Automotive Glass Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Intermediate Type

- 7.1.1. Short Fiber Thermoplastic (SFT)

- 7.1.2. Long Fiber Thermoplastic (LFT)

- 7.1.3. Continuous Fiber Thermoplastic (CFT)

- 7.1.4. Other Intermediate Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Interiors

- 7.2.2. Exteriors

- 7.2.3. Structural Assembly

- 7.2.4. Power-train Components

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Intermediate Type

- 8. Asia Pacific Automotive Glass Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Intermediate Type

- 8.1.1. Short Fiber Thermoplastic (SFT)

- 8.1.2. Long Fiber Thermoplastic (LFT)

- 8.1.3. Continuous Fiber Thermoplastic (CFT)

- 8.1.4. Other Intermediate Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Interiors

- 8.2.2. Exteriors

- 8.2.3. Structural Assembly

- 8.2.4. Power-train Components

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Intermediate Type

- 9. South America Automotive Glass Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Intermediate Type

- 9.1.1. Short Fiber Thermoplastic (SFT)

- 9.1.2. Long Fiber Thermoplastic (LFT)

- 9.1.3. Continuous Fiber Thermoplastic (CFT)

- 9.1.4. Other Intermediate Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Interiors

- 9.2.2. Exteriors

- 9.2.3. Structural Assembly

- 9.2.4. Power-train Components

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Intermediate Type

- 10. Middle East and Africa Automotive Glass Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Intermediate Type

- 10.1.1. Short Fiber Thermoplastic (SFT)

- 10.1.2. Long Fiber Thermoplastic (LFT)

- 10.1.3. Continuous Fiber Thermoplastic (CFT)

- 10.1.4. Other Intermediate Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Interiors

- 10.2.2. Exteriors

- 10.2.3. Structural Assembly

- 10.2.4. Power-train Components

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Intermediate Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Solvay Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Jiangsu Changhai Composite Materials

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ASAHI FIBER GLASS Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nippon Sheet Glass Company Limite

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Owens Corning

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 3B (Braj Binani Group)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Veplas Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SAERTEX GmbH & Co KG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Solvay Group

List of Figures

- Figure 1: Global Automotive Glass Fiber Composites Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Automotive Glass Fiber Composites Market Revenue (billion), by Intermediate Type 2025 & 2033

- Figure 3: North America Automotive Glass Fiber Composites Market Revenue Share (%), by Intermediate Type 2025 & 2033

- Figure 4: North America Automotive Glass Fiber Composites Market Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Automotive Glass Fiber Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Automotive Glass Fiber Composites Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Automotive Glass Fiber Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Automotive Glass Fiber Composites Market Revenue (billion), by Intermediate Type 2025 & 2033

- Figure 9: Europe Automotive Glass Fiber Composites Market Revenue Share (%), by Intermediate Type 2025 & 2033

- Figure 10: Europe Automotive Glass Fiber Composites Market Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Automotive Glass Fiber Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Automotive Glass Fiber Composites Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Automotive Glass Fiber Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Automotive Glass Fiber Composites Market Revenue (billion), by Intermediate Type 2025 & 2033

- Figure 15: Asia Pacific Automotive Glass Fiber Composites Market Revenue Share (%), by Intermediate Type 2025 & 2033

- Figure 16: Asia Pacific Automotive Glass Fiber Composites Market Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Automotive Glass Fiber Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Automotive Glass Fiber Composites Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Automotive Glass Fiber Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Automotive Glass Fiber Composites Market Revenue (billion), by Intermediate Type 2025 & 2033

- Figure 21: South America Automotive Glass Fiber Composites Market Revenue Share (%), by Intermediate Type 2025 & 2033

- Figure 22: South America Automotive Glass Fiber Composites Market Revenue (billion), by Application 2025 & 2033

- Figure 23: South America Automotive Glass Fiber Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Automotive Glass Fiber Composites Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Automotive Glass Fiber Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Automotive Glass Fiber Composites Market Revenue (billion), by Intermediate Type 2025 & 2033

- Figure 27: Middle East and Africa Automotive Glass Fiber Composites Market Revenue Share (%), by Intermediate Type 2025 & 2033

- Figure 28: Middle East and Africa Automotive Glass Fiber Composites Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa Automotive Glass Fiber Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Automotive Glass Fiber Composites Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Automotive Glass Fiber Composites Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Intermediate Type 2020 & 2033

- Table 2: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Intermediate Type 2020 & 2033

- Table 5: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Intermediate Type 2020 & 2033

- Table 11: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Intermediate Type 2020 & 2033

- Table 18: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: China Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Japan Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: India Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Intermediate Type 2020 & 2033

- Table 25: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 26: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: Brazil Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of South America Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Intermediate Type 2020 & 2033

- Table 30: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 31: Global Automotive Glass Fiber Composites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: United Arab Emirates Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: South Africa Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of Middle East and Africa Automotive Glass Fiber Composites Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Glass Fiber Composites Market?

The projected CAGR is approximately 14.5%.

2. Which companies are prominent players in the Automotive Glass Fiber Composites Market?

Key companies in the market include Solvay Group, Jiangsu Changhai Composite Materials, ASAHI FIBER GLASS Co Ltd, Nippon Sheet Glass Company Limite, Owens Corning, 3B (Braj Binani Group), Veplas Group, SAERTEX GmbH & Co KG.

3. What are the main segments of the Automotive Glass Fiber Composites Market?

The market segments include Intermediate Type, Application .

4. Can you provide details about the market size?

The market size is estimated to be USD 11.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in Tourism Across Activities the Country.

6. What are the notable trends driving market growth?

Increasing Adoption of Glass Fiber Composites in Automobiles.

7. Are there any restraints impacting market growth?

Hike In Fuel Prices To Restrict The Market Growth.

8. Can you provide examples of recent developments in the market?

November 2022: Solvay and Orbia announced a framework agreement for a joint venture to produce battery materials creating the largest capacity in North America. The total investment is estimated to be around USD 850 million, partially funded by a USD 178 million grant from the US Department of Energy to Solvay to build a facility in Augusta, Georgia. Solvay and Orbia intend to use two production sites in the southeastern United States, one for raw materials and the other for finished goods. Both plants will be fully operational by 2026.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Glass Fiber Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Glass Fiber Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Glass Fiber Composites Market?

To stay informed about further developments, trends, and reports in the Automotive Glass Fiber Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence