Key Insights

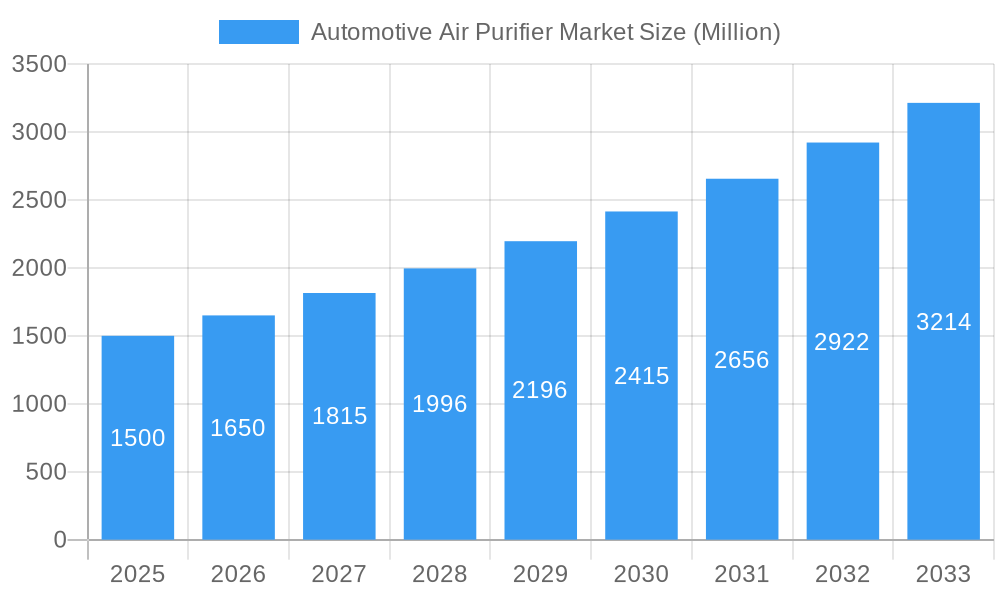

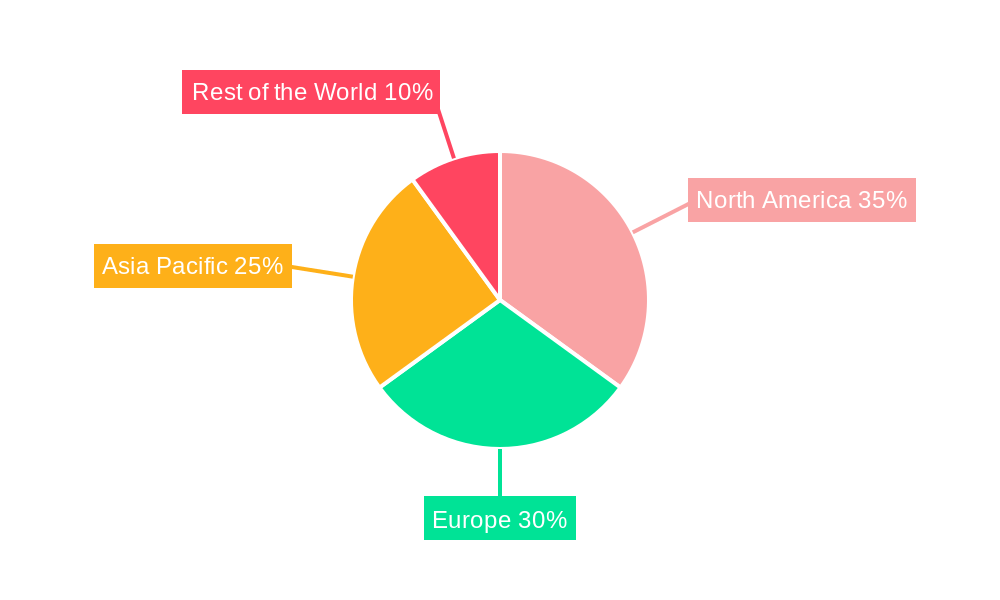

The automotive air purifier market is poised for substantial expansion, driven by escalating global concerns regarding indoor and outdoor air quality. Projections indicate a Compound Annual Growth Rate (CAGR) of 10.29% from a market size of $2.12 billion in the base year 2025, with sustained growth anticipated through 2033. Rising disposable incomes, particularly in emerging economies like India and China, are a key factor in the increasing adoption of vehicles equipped with advanced air purification systems. The market is segmented by vehicle type, including passenger cars and commercial vehicles; technology, encompassing HEPA, activated carbon, and ionic filters; and sales channel, comprising OEM and aftermarket. While passenger cars currently lead in market share due to higher individual ownership, the commercial vehicle segment is expected to experience accelerated growth, influenced by evolving regulations and heightened public health awareness. Technological advancements are a primary market driver, with HEPA filters maintaining dominance due to their superior efficiency. Ionic and activated carbon filters are gaining traction for their cost-effectiveness and targeted pollutant removal capabilities. The OEM channel commands a significant market share as manufacturers increasingly integrate air purifiers into new vehicle models. However, the aftermarket segment presents considerable growth potential for retrofitting existing vehicles. North America and Europe currently represent substantial market shares; however, rapid industrialization and urbanization in the Asia-Pacific region are projected to stimulate significant regional growth in the coming years. Key industry players, including Honeywell, Denso, and 3M, are actively engaged in developing and marketing innovative air purification technologies, intensifying competition and fueling market expansion.

Automotive Air Purifier Market Market Size (In Billion)

The automotive air purifier market outlook is exceptionally positive. Continued urbanization and rising global air pollution levels will sustain demand for cleaner vehicle interiors. Furthermore, government regulations promoting cleaner air and stricter emission standards are expected to bolster market growth. The integration of smart technologies, such as real-time air quality monitoring and automated filter replacement alerts, is anticipated to enhance consumer appeal and drive further innovation within the sector. The growing awareness of respiratory health issues, combined with increasing disposable incomes in emerging markets, establishes a foundation for sustained expansion of the automotive air purifier market throughout the forecast period. Intensified competition among existing and new market participants will likely focus on technological advancements, cost optimization, and strategic partnerships to secure market share.

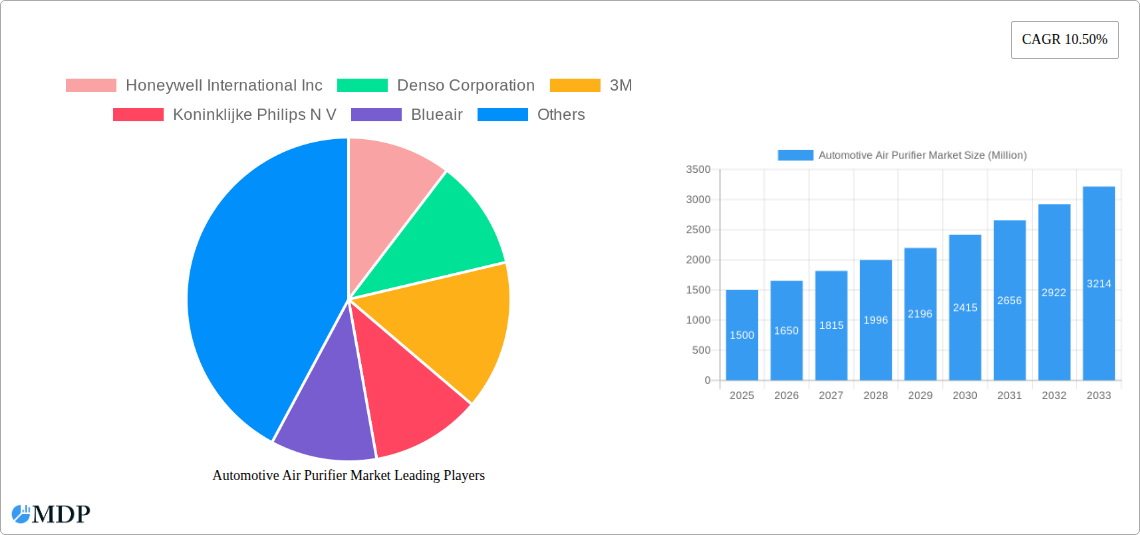

Automotive Air Purifier Market Company Market Share

Automotive Air Purifier Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Automotive Air Purifier Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the forecast period of 2025-2033 and a base year of 2025. Expect detailed breakdowns of market dynamics, leading players, technological advancements, and future growth projections, all supported by robust data and analysis. The market is segmented by vehicle type (passenger cars and commercial vehicles), technology (HEPA, activated carbon, and ionic filters), and sales channel (OEM and aftermarket). The total market value is projected to reach xx Million by 2033.

Automotive Air Purifier Market Market Dynamics & Concentration

The automotive air purifier market is experiencing significant growth, driven by increasing consumer awareness of air quality and stringent government regulations. Market concentration is moderately high, with key players like Honeywell International Inc, Denso Corporation, and 3M holding substantial market share. However, smaller players are also emerging, introducing innovative technologies and driving competition.

Innovation Drivers: The market is characterized by continuous innovation in filtration technologies, including the development of more efficient and effective HEPA filters, activated carbon filters, and ionic filters. The integration of smart features, such as air quality monitoring and control systems, is also gaining traction.

Regulatory Frameworks: Stringent emission regulations and increasing focus on improving indoor air quality are driving demand for automotive air purifiers, particularly in developed regions.

Product Substitutes: While there are limited direct substitutes for automotive air purifiers, improved vehicle ventilation systems and natural ventilation strategies can be considered indirect substitutes.

End-User Trends: Consumers are increasingly prioritizing vehicle air quality, leading to higher demand for air purifiers in both new and used vehicles. This trend is especially pronounced in regions with high levels of air pollution.

M&A Activities: The number of M&A activities in the market has been moderate in recent years (xx deals between 2019-2024), with larger players acquiring smaller companies to expand their product portfolios and technological capabilities. Market share data indicates that the top 5 players collectively hold approximately xx% of the global market.

Automotive Air Purifier Market Industry Trends & Analysis

The automotive air purifier market is expected to witness robust growth with a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several factors:

- Rising Air Pollution Concerns: Increasing awareness of the harmful effects of air pollution on human health is driving consumer demand for improved vehicle air quality.

- Technological Advancements: Continuous innovation in filtration technologies is leading to the development of more effective and efficient air purifiers. The integration of smart features and connectivity is also enhancing user experience and market appeal.

- Stringent Government Regulations: Governments across the globe are implementing stricter emission and air quality standards, further driving the adoption of automotive air purifiers.

- Expanding Electric Vehicle Market: The growth of the electric vehicle market presents significant opportunities for automotive air purifiers, as EVs are often more susceptible to air quality issues due to their sealed cabin environments.

- Shifting Consumer Preferences: Consumers are increasingly prioritizing features that enhance comfort and health, boosting the demand for air purifiers.

Market penetration of automotive air purifiers remains relatively low, with only xx% of vehicles currently equipped with these systems. However, this is expected to increase significantly during the forecast period, driven by factors mentioned above. The competitive dynamics are characterized by both established players and new entrants, leading to increased product innovation and price competition.

Leading Markets & Segments in Automotive Air Purifier Market

Dominant Region/Country: Asia Pacific is expected to be the leading market for automotive air purifiers during the forecast period, driven by high population density, increasing urbanization, and growing concerns about air pollution. China and India are expected to be the key contributors to this regional growth.

- Key Drivers in Asia Pacific:

- Rapid urbanization and industrialization leading to increased air pollution levels.

- Rising disposable incomes and increased awareness of air quality issues among consumers.

- Supportive government policies and regulations promoting cleaner air.

- Expanding automotive industry and increasing sales of passenger and commercial vehicles.

Dominant Segments:

- Vehicle Type: Passenger cars currently dominate the market, although the commercial vehicle segment is showing faster growth due to the increasing awareness of driver health and safety within professional fleets.

- Technology: HEPA filters are the most widely adopted technology, but activated carbon filters are gaining traction due to their ability to remove various harmful gases. Ionic filters are also gaining popularity, albeit from a smaller market share.

- Sales Channel: The OEM channel currently holds a larger share of the market, but the aftermarket channel is expected to grow at a faster rate in the coming years, as consumers increasingly seek aftermarket upgrades to improve vehicle air quality.

Automotive Air Purifier Market Product Developments

Recent product innovations have focused on improving filter efficiency, reducing energy consumption, and integrating smart features. Companies are developing smaller, lighter, and more energy-efficient air purifiers that can be easily integrated into vehicle designs. The integration of smart sensors for real-time air quality monitoring and control systems is also gaining traction. These advancements enhance the product's usability and market appeal, driving the adoption rate of automotive air purifiers. The focus on compact design meets the demands of modern vehicle interiors while leveraging advancements in filtration to tackle air quality challenges.

Key Drivers of Automotive Air Purifier Market Growth

The growth of the automotive air purifier market is primarily driven by technological advancements, economic factors, and regulatory changes. The development of high-efficiency filtration technologies like improved HEPA and activated carbon filters directly improves air quality within vehicles. Growing consumer disposable incomes support the purchasing of premium vehicle features like air purifiers. Lastly, stricter emission standards and air quality regulations are pushing manufacturers to incorporate better air filtration systems into their vehicles.

Challenges in the Automotive Air Purifier Market Market

The automotive air purifier market faces several challenges, including high initial costs, which may act as a barrier to entry for some consumers. Supply chain disruptions impacting the availability of raw materials could affect production and profitability. Intense competition among established and emerging players creates pricing pressures. Finally, regulatory hurdles and compliance requirements can add complexity to product development and market entry.

Emerging Opportunities in Automotive Air Purifier Market

The automotive air purifier market presents several lucrative opportunities. Technological breakthroughs, such as the development of more efficient and cost-effective filtration technologies, are driving market growth. Strategic partnerships between automotive manufacturers and air purifier companies will further enhance the market penetration of these systems. Finally, expanding into new markets, particularly in developing economies, offers significant growth potential.

Leading Players in the Automotive Air Purifier Market Sector

- Honeywell International Inc

- Denso Corporation

- 3M

- Koninklijke Philips N V

- Blueair

- MANN+HUMMEL

- Sharp Business Systems (India) Pvt Ltd

- Xiamen Airbus Electronic Technology Co Ltd

- MAHLE Gmb

- Marelli Corporation

- Panasonic Corporation

Key Milestones in Automotive Air Purifier Market Industry

- September 2022: MANN+HUMMEL GmbH launched the PureAir roof box, a retrofit solution for reducing fine dust in ambient air.

- July 2022: MANN+HUMMEL received €840,412 in funding to develop a sensor array for cathode air cleaner systems in commercial vehicles.

- November 2021: Marelli Corporation announced an "Indoor Air Quality (IAQ) Purification System" for vehicles and indoor environments.

Strategic Outlook for Automotive Air Purifier Market Market

The automotive air purifier market is poised for significant growth, driven by the increasing demand for cleaner and healthier vehicle environments. Companies can capitalize on this opportunity by focusing on developing innovative and cost-effective products, expanding into new markets, and forging strategic partnerships. The long-term market outlook is positive, with continued growth projected across various segments and regions.

Automotive Air Purifier Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Technology

- 2.1. HEPA

- 2.2. Activated Carbon

- 2.3. Ionic Filter

-

3. Sales Channel

- 3.1. OEM

- 3.2. Aftermarket

Automotive Air Purifier Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. Mexico

- 4.3. United Arab Emirates

- 4.4. Other Countries

Automotive Air Purifier Market Regional Market Share

Geographic Coverage of Automotive Air Purifier Market

Automotive Air Purifier Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For Connected Cars; Advancements In Data Analytics And Machine Learning

- 3.3. Market Restrains

- 3.3.1. High Implementation And Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Rise in Air Pollution Level Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Air Purifier Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. HEPA

- 5.2.2. Activated Carbon

- 5.2.3. Ionic Filter

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. OEM

- 5.3.2. Aftermarket

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Automotive Air Purifier Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Cars

- 6.1.2. Commercial Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. HEPA

- 6.2.2. Activated Carbon

- 6.2.3. Ionic Filter

- 6.3. Market Analysis, Insights and Forecast - by Sales Channel

- 6.3.1. OEM

- 6.3.2. Aftermarket

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Automotive Air Purifier Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Cars

- 7.1.2. Commercial Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. HEPA

- 7.2.2. Activated Carbon

- 7.2.3. Ionic Filter

- 7.3. Market Analysis, Insights and Forecast - by Sales Channel

- 7.3.1. OEM

- 7.3.2. Aftermarket

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Automotive Air Purifier Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Cars

- 8.1.2. Commercial Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. HEPA

- 8.2.2. Activated Carbon

- 8.2.3. Ionic Filter

- 8.3. Market Analysis, Insights and Forecast - by Sales Channel

- 8.3.1. OEM

- 8.3.2. Aftermarket

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Automotive Air Purifier Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Cars

- 9.1.2. Commercial Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. HEPA

- 9.2.2. Activated Carbon

- 9.2.3. Ionic Filter

- 9.3. Market Analysis, Insights and Forecast - by Sales Channel

- 9.3.1. OEM

- 9.3.2. Aftermarket

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Honeywell International Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Denso Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 3M

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Koninklijke Philips N V

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Blueair

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 MANN+HUMMEL

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Sharp Business Systems (India) Pvt Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Xiamen Airbus Electronic Technology Co Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 MAHLE Gmb

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Marelli Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Panasonic Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Automotive Air Purifier Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Automotive Air Purifier Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 3: North America Automotive Air Purifier Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Automotive Air Purifier Market Revenue (billion), by Technology 2025 & 2033

- Figure 5: North America Automotive Air Purifier Market Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Automotive Air Purifier Market Revenue (billion), by Sales Channel 2025 & 2033

- Figure 7: North America Automotive Air Purifier Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 8: North America Automotive Air Purifier Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Automotive Air Purifier Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive Air Purifier Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 11: Europe Automotive Air Purifier Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Europe Automotive Air Purifier Market Revenue (billion), by Technology 2025 & 2033

- Figure 13: Europe Automotive Air Purifier Market Revenue Share (%), by Technology 2025 & 2033

- Figure 14: Europe Automotive Air Purifier Market Revenue (billion), by Sales Channel 2025 & 2033

- Figure 15: Europe Automotive Air Purifier Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 16: Europe Automotive Air Purifier Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Automotive Air Purifier Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive Air Purifier Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 19: Asia Pacific Automotive Air Purifier Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: Asia Pacific Automotive Air Purifier Market Revenue (billion), by Technology 2025 & 2033

- Figure 21: Asia Pacific Automotive Air Purifier Market Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Asia Pacific Automotive Air Purifier Market Revenue (billion), by Sales Channel 2025 & 2033

- Figure 23: Asia Pacific Automotive Air Purifier Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 24: Asia Pacific Automotive Air Purifier Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive Air Purifier Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Automotive Air Purifier Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 27: Rest of the World Automotive Air Purifier Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Rest of the World Automotive Air Purifier Market Revenue (billion), by Technology 2025 & 2033

- Figure 29: Rest of the World Automotive Air Purifier Market Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Rest of the World Automotive Air Purifier Market Revenue (billion), by Sales Channel 2025 & 2033

- Figure 31: Rest of the World Automotive Air Purifier Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 32: Rest of the World Automotive Air Purifier Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Rest of the World Automotive Air Purifier Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Air Purifier Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Automotive Air Purifier Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 3: Global Automotive Air Purifier Market Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 4: Global Automotive Air Purifier Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Air Purifier Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Automotive Air Purifier Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 7: Global Automotive Air Purifier Market Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 8: Global Automotive Air Purifier Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Automotive Air Purifier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive Air Purifier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive Air Purifier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Air Purifier Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 13: Global Automotive Air Purifier Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 14: Global Automotive Air Purifier Market Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 15: Global Automotive Air Purifier Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive Air Purifier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive Air Purifier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Automotive Air Purifier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Automotive Air Purifier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Global Automotive Air Purifier Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 21: Global Automotive Air Purifier Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 22: Global Automotive Air Purifier Market Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 23: Global Automotive Air Purifier Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: India Automotive Air Purifier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: China Automotive Air Purifier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Japan Automotive Air Purifier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: South Korea Automotive Air Purifier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Automotive Air Purifier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Automotive Air Purifier Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 30: Global Automotive Air Purifier Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 31: Global Automotive Air Purifier Market Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 32: Global Automotive Air Purifier Market Revenue billion Forecast, by Country 2020 & 2033

- Table 33: Brazil Automotive Air Purifier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Mexico Automotive Air Purifier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: United Arab Emirates Automotive Air Purifier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Other Countries Automotive Air Purifier Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Air Purifier Market?

The projected CAGR is approximately 10.29%.

2. Which companies are prominent players in the Automotive Air Purifier Market?

Key companies in the market include Honeywell International Inc, Denso Corporation, 3M, Koninklijke Philips N V, Blueair, MANN+HUMMEL, Sharp Business Systems (India) Pvt Ltd, Xiamen Airbus Electronic Technology Co Ltd, MAHLE Gmb, Marelli Corporation, Panasonic Corporation.

3. What are the main segments of the Automotive Air Purifier Market?

The market segments include Vehicle Type, Technology, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.12 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For Connected Cars; Advancements In Data Analytics And Machine Learning.

6. What are the notable trends driving market growth?

Rise in Air Pollution Level Drives the Market.

7. Are there any restraints impacting market growth?

High Implementation And Maintenance Costs.

8. Can you provide examples of recent developments in the market?

In September 2022, MANN+HUMMEL GmbH introduced the PureAir roof box, an innovative solution for reducing fine dust in the ambient air. It can be mounted on the roof as a retrofit solution for existing vehicle fleets and is intended for use on last-mile delivery vehicles, in local public transport, or on waste disposal vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Air Purifier Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Air Purifier Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Air Purifier Market?

To stay informed about further developments, trends, and reports in the Automotive Air Purifier Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence