Key Insights

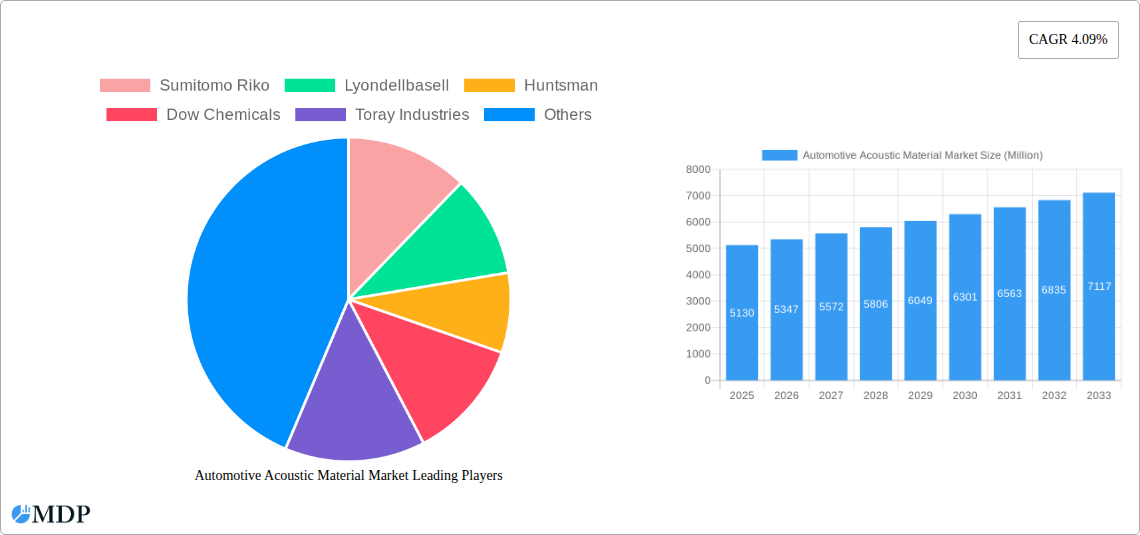

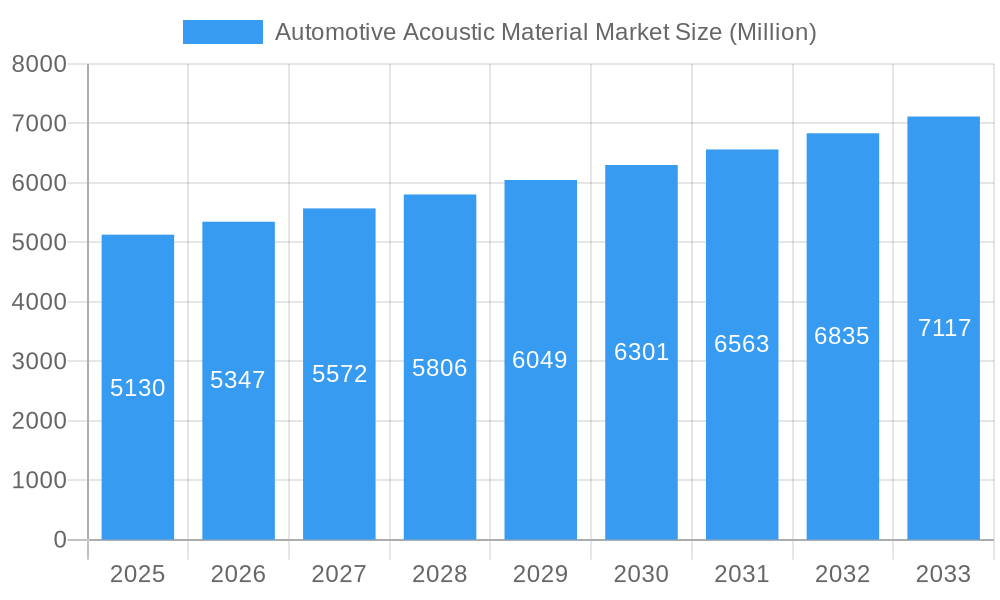

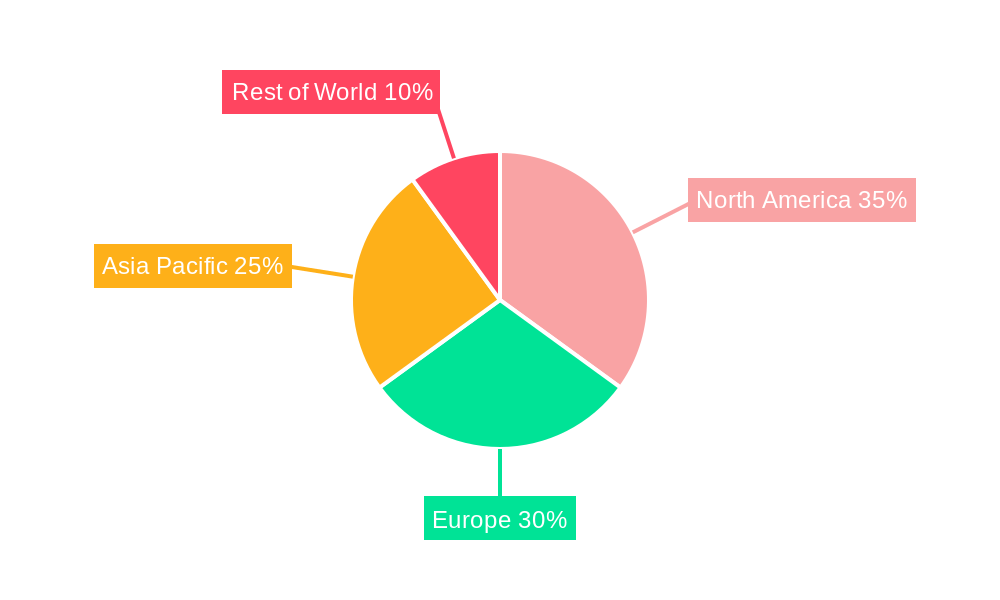

The automotive acoustic material market, valued at $5.13 billion in 2025, is projected to experience steady growth, driven by increasing consumer demand for enhanced vehicle noise, vibration, and harshness (NVH) performance. The market's Compound Annual Growth Rate (CAGR) of 4.09% from 2025 to 2033 reflects a consistent upward trajectory fueled by several factors. The rising popularity of electric and hybrid vehicles contributes significantly, as these vehicles lack the masking engine noise of internal combustion engines, making acoustic materials crucial for passenger comfort. Furthermore, stricter global regulations on vehicle noise emissions are pushing manufacturers to incorporate advanced acoustic solutions. Segment-wise, passenger cars currently dominate the market, followed by commercial vehicles, with polyurethane and textile materials being the leading choices due to their cost-effectiveness and performance characteristics. Geographically, North America and Europe are currently leading markets, driven by high vehicle production and stringent environmental regulations. However, the Asia-Pacific region is expected to witness significant growth in the coming years, fueled by rapid industrialization and rising vehicle sales, particularly in India and China. The market faces some restraints, including fluctuating raw material prices and the potential for substitute materials. However, continuous innovation in material science and the development of lighter, more efficient acoustic solutions are expected to offset these challenges.

Automotive Acoustic Material Market Market Size (In Billion)

The competitive landscape is characterized by the presence of major players such as Sumitomo Riko, LyondellBasell, Huntsman, Dow Chemicals, and others, each vying for market share through product innovation and strategic partnerships. The ongoing research and development efforts focused on creating sustainable and high-performance acoustic materials will shape the market's future. The market's growth will also be influenced by technological advancements in noise cancellation technologies and the integration of smart materials that adapt to varying noise levels. The market is expected to witness increased consolidation and strategic alliances as companies seek to expand their product portfolios and geographical reach. The demand for personalized comfort and luxury features in vehicles is also driving the development of customized acoustic solutions, creating further opportunities for growth.

Automotive Acoustic Material Market Company Market Share

Automotive Acoustic Material Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Automotive Acoustic Material Market, offering valuable insights for stakeholders across the automotive industry supply chain. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period (2025-2033). This report covers the historical period (2019-2024), with 2025 serving as the base and estimated year. The report delves into market dynamics, industry trends, leading segments, and key players, providing actionable intelligence for strategic decision-making.

Automotive Acoustic Material Market Market Dynamics & Concentration

The Automotive Acoustic Material Market is characterized by a moderately concentrated landscape, with key players such as Sumitomo Riko, LyondellBasell, Huntsman, Dow Chemicals, and Toray Industries holding significant market share. The market's dynamics are shaped by several factors, including:

- Innovation Drivers: Continuous advancements in material science, leading to lighter, more effective noise-dampening materials, are driving market growth. The increasing demand for enhanced NVH (Noise, Vibration, and Harshness) performance in vehicles is fueling innovation.

- Regulatory Frameworks: Stringent emission and safety regulations globally are influencing the adoption of advanced acoustic materials. This is particularly prominent in regions with stricter environmental standards.

- Product Substitutes: Competition from alternative noise reduction technologies, such as active noise cancellation systems, presents a challenge, yet also fosters innovation within the acoustic material sector.

- End-User Trends: The rising preference for electric vehicles (EVs) is creating new opportunities, as EVs require different acoustic solutions compared to internal combustion engine (ICE) vehicles. The growing focus on passenger comfort and improved driving experience is a key market driver.

- M&A Activities: The market has witnessed several mergers and acquisitions in recent years, including Freudenberg Group's acquisition of Low & Bonar in 2020. These activities reshape the competitive landscape and facilitate technological integration. The number of M&A deals in the past five years is estimated at xx. Market share consolidation is expected to continue.

Automotive Acoustic Material Market Industry Trends & Analysis

The Automotive Acoustic Material Market is experiencing significant growth, driven by several key factors:

The market demonstrates a strong growth trajectory, largely fueled by the increasing demand for enhanced NVH (Noise, Vibration, and Harshness) characteristics in vehicles. This trend is particularly pronounced in the luxury and premium vehicle segments where the demand for superior comfort levels translates into higher acoustic material adoption. The rise of electric vehicles (EVs) is also a significant factor, as the absence of engine noise necessitates the use of advanced acoustic materials to reduce road noise and other external disturbances. Furthermore, technological advancements, such as the development of lighter and more efficient sound-absorbing materials, play a crucial role in driving growth. This is also propelled by innovations in material science which lead to improved performance and reduced weight, thus enhancing fuel efficiency. The market penetration of advanced acoustic materials is estimated at xx% in 2025, and is expected to reach xx% by 2033. The CAGR for the market is projected to be xx% during the forecast period. Competitive dynamics remain intense, with companies constantly striving to enhance their product offerings and expand their market reach.

Leading Markets & Segments in Automotive Acoustic Material Market

The passenger car segment dominates the Automotive Acoustic Material Market, driven by the high volume of passenger car production globally. However, the commercial vehicle segment is showing promising growth, particularly in regions with expanding logistics and transportation sectors.

- Dominant Region: [Insert Dominant Region, e.g., Asia-Pacific]

- Dominant Country: [Insert Dominant Country, e.g., China]

- Dominant Segment (Vehicle Type): Passenger Cars

- Key Drivers: High volume of passenger car production, rising consumer demand for improved NVH performance.

- Dominant Segment (Application): Bonnet Liner

- Key Drivers: Critical role in reducing engine noise transmission.

- Dominant Segment (Material): Polyurethane

- Key Drivers: Excellent sound absorption properties, cost-effectiveness, and ease of processing.

Within the dominant regions, factors such as robust economic growth, expanding automotive manufacturing base, and favorable government policies contribute to market expansion. The Asia-Pacific region stands out due to its rapid industrialization and surging demand for vehicles. In contrast, mature markets in North America and Europe demonstrate a more steady, albeit consistent growth rate.

Automotive Acoustic Material Market Product Developments

Recent product developments focus on lightweight, high-performance materials with improved sound absorption and vibration damping capabilities. Innovations in polyurethane formulations, advanced textile structures, and fiberglass composites are enhancing the effectiveness and versatility of acoustic materials. These developments cater to the automotive industry's demand for lighter vehicles with improved fuel efficiency and enhanced occupant comfort.

Key Drivers of Automotive Acoustic Material Market Growth

Several factors are driving growth in the automotive acoustic material market:

- Technological Advancements: Development of lighter, more effective sound-absorbing materials.

- Stringent Regulations: Government mandates for reduced vehicle noise emissions.

- Rising Consumer Demand: Increased preference for quieter and more comfortable vehicles, especially in premium segments.

- Growth of the Electric Vehicle Market: The need for noise reduction in EVs due to the absence of engine noise.

Challenges in the Automotive Acoustic Material Market Market

The market faces challenges including:

- Fluctuating Raw Material Prices: Price volatility for key raw materials, impacting production costs.

- Supply Chain Disruptions: Global supply chain uncertainties can hinder timely delivery of materials.

- Intense Competition: Pressure from established players and new entrants.

- Meeting stringent environmental regulations: The need to develop eco-friendly, sustainable acoustic materials.

Emerging Opportunities in Automotive Acoustic Material Market

Emerging opportunities include:

- Development of bio-based and recycled acoustic materials: Growing demand for sustainable and environmentally friendly materials.

- Expansion into new vehicle segments: Increasing focus on electric and autonomous vehicles presents new opportunities.

- Strategic partnerships and collaborations: Joint ventures to leverage technological expertise and market access.

- Technological advancements in active noise cancellation: Integrating active and passive noise control technologies to optimize NVH performance.

Leading Players in the Automotive Acoustic Material Market Sector

Key Milestones in Automotive Acoustic Material Market Industry

- October 2021: Sumitomo Riko establishes a new vehicle testing course with special road surfaces to evaluate NVH performance. This signifies a focus on enhancing testing capabilities to meet the rising demand for advanced acoustic materials.

- September 2021: BASF introduces a new flame-retardant Ultramid grade for electric vehicles, improving acoustic properties and production efficiency. This highlights advancements in material science to meet specific needs in the EV sector.

- May 2020: Freudenberg Group acquires Low & Bonar PLC, expanding its market presence and product portfolio. This merger signifies a consolidation trend in the industry and signifies an increased focus on market share and technological integration.

Strategic Outlook for Automotive Acoustic Material Market Market

The Automotive Acoustic Material Market is poised for continued growth, driven by technological advancements, increasing demand for improved NVH performance, and the expansion of the electric vehicle market. Strategic opportunities lie in developing sustainable, lightweight materials, forging strategic partnerships, and expanding into emerging markets. The market’s future success hinges on companies’ ability to innovate, adapt to evolving regulatory landscapes, and meet the demands of a rapidly changing automotive industry.

Automotive Acoustic Material Market Segmentation

-

1. Material

- 1.1. Polyurethane

- 1.2. Textile

- 1.3. Fiberglass

- 1.4. Other Materials

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

-

3. Application

- 3.1. Bonnet Liner

- 3.2. Door Trim

- 3.3. Other Applications

Automotive Acoustic Material Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. United Arab Emirates

- 4.3. Other Countries

Automotive Acoustic Material Market Regional Market Share

Geographic Coverage of Automotive Acoustic Material Market

Automotive Acoustic Material Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.09% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Traffic Congestion and Increasing Urban Population to Foster Market Growth

- 3.3. Market Restrains

- 3.3.1. Strict Government Regulations and Policies Toward Ride-hailing Services Impact the Market Growth

- 3.4. Market Trends

- 3.4.1. Growing Demand for Premium Cars

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Acoustic Material Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Polyurethane

- 5.1.2. Textile

- 5.1.3. Fiberglass

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Bonnet Liner

- 5.3.2. Door Trim

- 5.3.3. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Automotive Acoustic Material Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Polyurethane

- 6.1.2. Textile

- 6.1.3. Fiberglass

- 6.1.4. Other Materials

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicles

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Bonnet Liner

- 6.3.2. Door Trim

- 6.3.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Europe Automotive Acoustic Material Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Polyurethane

- 7.1.2. Textile

- 7.1.3. Fiberglass

- 7.1.4. Other Materials

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicles

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Bonnet Liner

- 7.3.2. Door Trim

- 7.3.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Asia Pacific Automotive Acoustic Material Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Polyurethane

- 8.1.2. Textile

- 8.1.3. Fiberglass

- 8.1.4. Other Materials

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicles

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Bonnet Liner

- 8.3.2. Door Trim

- 8.3.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Rest of the World Automotive Acoustic Material Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Polyurethane

- 9.1.2. Textile

- 9.1.3. Fiberglass

- 9.1.4. Other Materials

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Cars

- 9.2.2. Commercial Vehicles

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Bonnet Liner

- 9.3.2. Door Trim

- 9.3.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Sumitomo Riko

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Lyondellbasell

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Huntsman

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Dow Chemicals

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Toray Industries

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Henkel Adhesive Technologies

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 BASF SE

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Covestro

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Sika

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Freudenberg Grou

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 3M Acoustics

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Sumitomo Riko

List of Figures

- Figure 1: Global Automotive Acoustic Material Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Acoustic Material Market Revenue (Million), by Material 2025 & 2033

- Figure 3: North America Automotive Acoustic Material Market Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America Automotive Acoustic Material Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 5: North America Automotive Acoustic Material Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America Automotive Acoustic Material Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Automotive Acoustic Material Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Automotive Acoustic Material Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Automotive Acoustic Material Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive Acoustic Material Market Revenue (Million), by Material 2025 & 2033

- Figure 11: Europe Automotive Acoustic Material Market Revenue Share (%), by Material 2025 & 2033

- Figure 12: Europe Automotive Acoustic Material Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 13: Europe Automotive Acoustic Material Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 14: Europe Automotive Acoustic Material Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Automotive Acoustic Material Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Automotive Acoustic Material Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Automotive Acoustic Material Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive Acoustic Material Market Revenue (Million), by Material 2025 & 2033

- Figure 19: Asia Pacific Automotive Acoustic Material Market Revenue Share (%), by Material 2025 & 2033

- Figure 20: Asia Pacific Automotive Acoustic Material Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 21: Asia Pacific Automotive Acoustic Material Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Asia Pacific Automotive Acoustic Material Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Pacific Automotive Acoustic Material Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Automotive Acoustic Material Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive Acoustic Material Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Automotive Acoustic Material Market Revenue (Million), by Material 2025 & 2033

- Figure 27: Rest of the World Automotive Acoustic Material Market Revenue Share (%), by Material 2025 & 2033

- Figure 28: Rest of the World Automotive Acoustic Material Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 29: Rest of the World Automotive Acoustic Material Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 30: Rest of the World Automotive Acoustic Material Market Revenue (Million), by Application 2025 & 2033

- Figure 31: Rest of the World Automotive Acoustic Material Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Rest of the World Automotive Acoustic Material Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Automotive Acoustic Material Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Acoustic Material Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Global Automotive Acoustic Material Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Automotive Acoustic Material Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Automotive Acoustic Material Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Acoustic Material Market Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Global Automotive Acoustic Material Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 7: Global Automotive Acoustic Material Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Automotive Acoustic Material Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Acoustic Material Market Revenue Million Forecast, by Material 2020 & 2033

- Table 13: Global Automotive Acoustic Material Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 14: Global Automotive Acoustic Material Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Automotive Acoustic Material Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Automotive Acoustic Material Market Revenue Million Forecast, by Material 2020 & 2033

- Table 21: Global Automotive Acoustic Material Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 22: Global Automotive Acoustic Material Market Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Automotive Acoustic Material Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: India Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: China Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: South Korea Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Automotive Acoustic Material Market Revenue Million Forecast, by Material 2020 & 2033

- Table 30: Global Automotive Acoustic Material Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 31: Global Automotive Acoustic Material Market Revenue Million Forecast, by Application 2020 & 2033

- Table 32: Global Automotive Acoustic Material Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: Brazil Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: United Arab Emirates Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Other Countries Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Acoustic Material Market?

The projected CAGR is approximately 4.09%.

2. Which companies are prominent players in the Automotive Acoustic Material Market?

Key companies in the market include Sumitomo Riko, Lyondellbasell, Huntsman, Dow Chemicals, Toray Industries, Henkel Adhesive Technologies, BASF SE, Covestro, Sika, Freudenberg Grou, 3M Acoustics.

3. What are the main segments of the Automotive Acoustic Material Market?

The market segments include Material , Vehicle Type, Application .

4. Can you provide details about the market size?

The market size is estimated to be USD 5.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Traffic Congestion and Increasing Urban Population to Foster Market Growth.

6. What are the notable trends driving market growth?

Growing Demand for Premium Cars.

7. Are there any restraints impacting market growth?

Strict Government Regulations and Policies Toward Ride-hailing Services Impact the Market Growth.

8. Can you provide examples of recent developments in the market?

In October 2021, Sumitomo Riko announced that as part of a joint research project with the National Institute of Advanced Industrial Science and Technology (AIST) in Japan, it had recovered a part of the proving ground for vehicle testing installed at the Tsukuba North Site of AIST and installed a new course with special road surfaces. Six types of special road surfaces were installed: road noise road, ride comfort road, Belgian-block road, undulating road, gravel and sand exposed road, and harshness road, to measure and evaluate the NVH of vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Acoustic Material Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Acoustic Material Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Acoustic Material Market?

To stay informed about further developments, trends, and reports in the Automotive Acoustic Material Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence