Key Insights

The Austrian e-bike market is poised for significant expansion, projecting a Compound Annual Growth Rate (CAGR) of 12.4%. With a current market size of €66.78 billion in the base year 2024, the market is driven by escalating environmental consciousness, supportive government policies, and technological advancements. Growing consumer preference for sustainable transportation, coupled with expanded cycling infrastructure and e-bike purchase incentives, fuels this upward trend. Innovations in e-bike technology, resulting in lighter, more efficient models with extended battery life and range, are also enhancing consumer adoption. The market is segmented by propulsion type (pedal-assisted, speed pedelec, throttle-assisted), application (cargo/utility, city/urban, trekking), and battery type (lead-acid, lithium-ion), offering a diverse range of products to meet varied consumer requirements. Intense competition among established brands such as KTM Bike Industries, Giant Manufacturing, and Haibike, alongside new entrants, is fostering innovation and improving product accessibility.

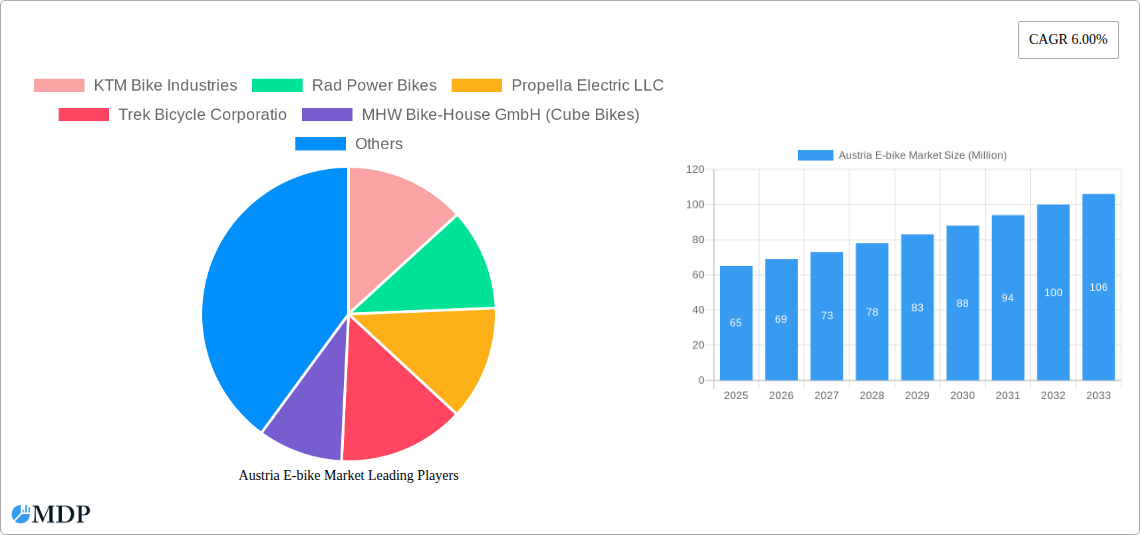

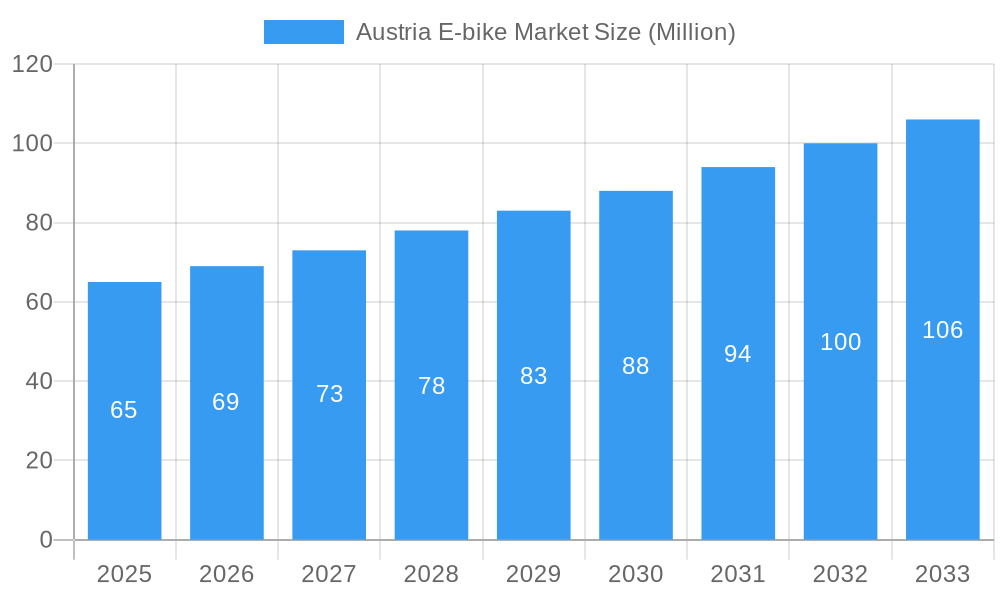

Austria E-bike Market Market Size (In Billion)

Despite favorable growth, challenges persist. The initial purchase price of e-bikes can be a deterrent for some consumers. Addressing concerns related to battery longevity and environmentally sound disposal will be crucial for sustained market development. Nevertheless, the long-term forecast for the Austrian e-bike market remains optimistic. Continued growth is anticipated, with an increasing focus on smart city integration and the development of specialized e-bike models for both urban and rural environments. The burgeoning cargo e-bike segment, particularly for urban logistics, represents a significant opportunity for future market expansion.

Austria E-bike Market Company Market Share

Austria E-bike Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Austria e-bike market, offering invaluable insights for industry stakeholders, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, trends, leading players, and future opportunities within the rapidly evolving Austrian e-bike landscape. The market is projected to reach xx Million by 2033, exhibiting significant growth potential.

Austria E-bike Market Market Dynamics & Concentration

The Austrian e-bike market is characterized by a dynamic interplay of factors influencing its growth and concentration. Market concentration is moderate, with a few key players holding significant market share, while numerous smaller players contribute to a competitive landscape. Innovation, driven by technological advancements in battery technology, motor systems, and smart connectivity features, fuels market expansion. Favorable government policies promoting sustainable transportation and cycling infrastructure further bolster market growth. However, the market also faces challenges from the rising cost of raw materials and the availability of substitute modes of transportation.

- Market Share: KTM Bike Industries holds approximately xx% of the market share, followed by Giant Manufacturing Co Ltd with xx%. Other major players such as Trek Bicycle Corporation and Haibike collectively hold xx%.

- M&A Activity: The number of M&A deals in the Austrian e-bike market during the historical period (2019-2024) averaged approximately xx per year. This suggests a moderate level of consolidation within the sector.

- Regulatory Framework: The Austrian government's supportive policies towards e-bike adoption, including subsidies and cycling infrastructure development, have significantly impacted market growth.

- End-User Trends: Growing awareness of environmental concerns and the increasing preference for healthy and sustainable commuting options are key drivers of e-bike adoption among consumers.

Austria E-bike Market Industry Trends & Analysis

The Austrian e-bike market exhibits robust growth, driven by a confluence of factors. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated to be xx%. Technological advancements, especially in battery technology (increased range and reduced weight), have significantly enhanced e-bike performance and appeal. Consumer preferences are shifting towards lightweight, high-performance e-bikes with integrated smart features. The competitive landscape is characterized by both established global brands and emerging local players vying for market share through product innovation, aggressive marketing, and strategic partnerships. Market penetration of e-bikes as a percentage of total bicycle sales currently stands at xx% and is projected to increase to xx% by 2033.

Leading Markets & Segments in Austria E-bike Market

The Austrian e-bike market shows significant regional variations in adoption rates, influenced by factors such as population density, infrastructure development, and consumer preferences. Urban areas, like Vienna, exhibit higher e-bike penetration than rural regions.

- Dominant Segment: The Pedal Assisted propulsion type dominates the market, accounting for approximately xx% of total sales. The City/Urban application type is the largest segment, reflecting the high demand for e-bikes in urban environments. Lithium-ion batteries are the prevalent battery type, offering superior performance and longer lifespans.

- Key Drivers:

- Government Incentives: Subsidies and tax benefits for e-bike purchases significantly enhance market accessibility.

- Infrastructure Development: Investment in cycling infrastructure, including dedicated bike lanes and charging stations, improves e-bike usability.

- Economic Factors: Rising fuel prices and concerns about parking availability contribute to the growing popularity of e-bikes as a cost-effective and convenient transportation solution.

Austria E-bike Market Product Developments

Recent years have witnessed significant advancements in e-bike technology. Manufacturers are focusing on integrating innovative features like improved battery technology, lighter frames, more powerful motors, and advanced connectivity options. The introduction of lightweight e-MTBs and electric road bikes signifies a growing diversification of product offerings to cater to varied consumer needs and preferences, ensuring a broader market appeal.

Key Drivers of Austria E-bike Market Growth

The growth of the Austrian e-bike market is fueled by several factors:

- Technological Advancements: Improvements in battery technology, motor efficiency, and lightweight materials are increasing the range, performance, and appeal of e-bikes.

- Government Policies: Subsidies and initiatives promoting sustainable transportation are stimulating e-bike adoption.

- Environmental Awareness: Growing concern about environmental impact is driving the shift towards sustainable transportation options, including e-bikes.

Challenges in the Austria E-bike Market Market

Despite the positive growth trajectory, the Austrian e-bike market faces several challenges:

- High Initial Cost: The relatively high purchase price of e-bikes can be a barrier for some consumers.

- Limited Charging Infrastructure: Although improving, the availability of public charging stations still needs further development.

- Competition: The increasing number of players in the market leads to intense competition and price pressures.

Emerging Opportunities in Austria E-bike Market

The Austrian e-bike market presents several promising opportunities for long-term growth. The increasing popularity of e-cargo bikes for last-mile delivery services and the integration of e-bikes into shared mobility programs represent significant avenues for expansion. Further advancements in battery technology promising increased range and faster charging times will further fuel the market's expansion. Strategic partnerships between e-bike manufacturers and public transportation providers can enhance the overall appeal of e-bikes.

Leading Players in the Austria E-bike Market Sector

- KTM Bike Industries

- Rad Power Bikes

- Propella Electric LLC

- Trek Bicycle Corporation

- MHW Bike-House GmbH (Cube Bikes)

- Peugeot Cycles

- myStromer AG (Stromer)

- Scott Corporation SA (Scott Sports)

- Giant Manufacturing Co Ltd

- GROUPE SPORTIF PTY LTD (Haibike)

Key Milestones in Austria E-bike Market Industry

- September 2022: Haibike launched the Lyke, a lightweight e-MTB with a removable Watt Hour battery, catering to a growing segment of the market.

- November 2022: Giant unveiled the Stormguard E+, a full-suspension e-bike available in Europe in 2023, priced at 7,999 Euros (E+1) and 6,499 Euros (E+2).

- December 2022: Scott Sports launched the Solace, a new electric road bike featuring TQ’s HPR550 motor system, expanding its drop-bar electric bike range.

Strategic Outlook for Austria E-bike Market Market

The Austrian e-bike market is poised for continued growth, driven by technological advancements, supportive government policies, and increasing consumer demand for sustainable transportation solutions. Strategic partnerships, focusing on integrating e-bikes into wider mobility ecosystems, along with continuous product innovation, will be crucial for success in this dynamic market. Expansion into new segments, like e-cargo bikes and specialized e-bike applications, will unlock further growth potential.

Austria E-bike Market Segmentation

-

1. Propulsion Type

- 1.1. Pedal Assisted

- 1.2. Speed Pedelec

- 1.3. Throttle Assisted

-

2. Application Type

- 2.1. Cargo/Utility

- 2.2. City/Urban

- 2.3. Trekking

-

3. Battery Type

- 3.1. Lead Acid Battery

- 3.2. Lithium-ion Battery

- 3.3. Others

Austria E-bike Market Segmentation By Geography

- 1. Austria

Austria E-bike Market Regional Market Share

Geographic Coverage of Austria E-bike Market

Austria E-bike Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in Trend of Yacht Tourism

- 3.3. Market Restrains

- 3.3.1. Higher Rentals During Peak Season

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Austria E-bike Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Pedal Assisted

- 5.1.2. Speed Pedelec

- 5.1.3. Throttle Assisted

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Cargo/Utility

- 5.2.2. City/Urban

- 5.2.3. Trekking

- 5.3. Market Analysis, Insights and Forecast - by Battery Type

- 5.3.1. Lead Acid Battery

- 5.3.2. Lithium-ion Battery

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Austria

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 KTM Bike Industries

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rad Power Bikes

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Propella Electric LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Trek Bicycle Corporatio

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MHW Bike-House GmbH (Cube Bikes)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Peugeot Cycles

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 myStromer AG (Stromer)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Scott Corporation SA (Scott Sports)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Giant Manufacturing Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GROUPE SPORTIF PTY LTD (Haibike)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 KTM Bike Industries

List of Figures

- Figure 1: Austria E-bike Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Austria E-bike Market Share (%) by Company 2025

List of Tables

- Table 1: Austria E-bike Market Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 2: Austria E-bike Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: Austria E-bike Market Revenue billion Forecast, by Battery Type 2020 & 2033

- Table 4: Austria E-bike Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Austria E-bike Market Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 6: Austria E-bike Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 7: Austria E-bike Market Revenue billion Forecast, by Battery Type 2020 & 2033

- Table 8: Austria E-bike Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Austria E-bike Market?

The projected CAGR is approximately 12.4%.

2. Which companies are prominent players in the Austria E-bike Market?

Key companies in the market include KTM Bike Industries, Rad Power Bikes, Propella Electric LLC, Trek Bicycle Corporatio, MHW Bike-House GmbH (Cube Bikes), Peugeot Cycles, myStromer AG (Stromer), Scott Corporation SA (Scott Sports), Giant Manufacturing Co Ltd, GROUPE SPORTIF PTY LTD (Haibike).

3. What are the main segments of the Austria E-bike Market?

The market segments include Propulsion Type, Application Type, Battery Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 66.78 billion as of 2022.

5. What are some drivers contributing to market growth?

Surge in Trend of Yacht Tourism.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Higher Rentals During Peak Season.

8. Can you provide examples of recent developments in the market?

December 2022: Scott sports has launched the Solace, a new electric road bike aimed new drop-bar electric bike range that is based on TQ’s HPR550 motor system.November 2022: The Stormguard E+, a full-suspension e-bike, is unveiled by Giant. The bicycles will be available for purchase in Europe in 2023 and will cost 7,999 Euros for the E+1 and 6,499 Euros for the E+2.September 2022: Haibike has launched the Lyke, a new e-MTB aimed at the emerging lightweight e-MTB category. The Lyke eMTB is offered with a removable Watt Hour Battery.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Austria E-bike Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Austria E-bike Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Austria E-bike Market?

To stay informed about further developments, trends, and reports in the Austria E-bike Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence