Key Insights

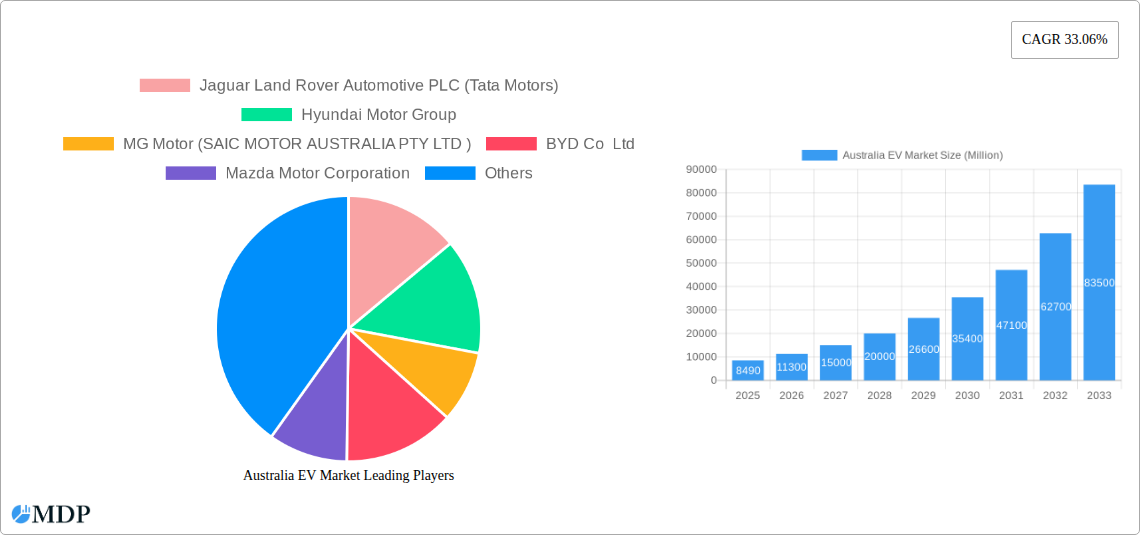

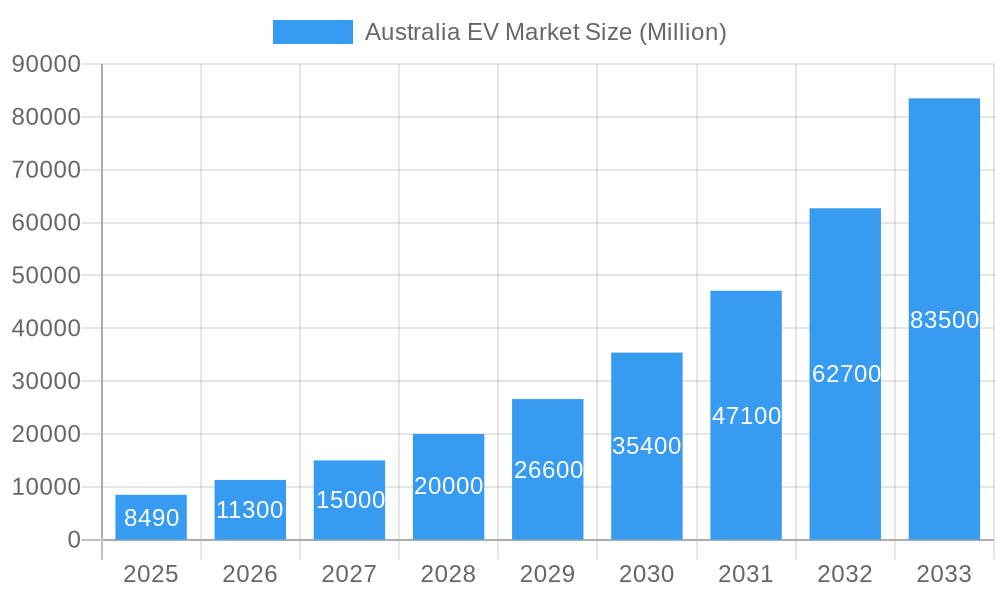

The Australian electric vehicle (EV) market is experiencing robust growth, projected to reach a market size of $8.49 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 33.06% from 2019 to 2033. This surge is driven by several factors. Increasing consumer awareness of environmental concerns and government incentives promoting EV adoption are key drivers. Furthermore, technological advancements leading to longer driving ranges, improved battery performance, and reduced charging times are making EVs a more practical and appealing option for Australian consumers. The expanding charging infrastructure, coupled with a growing range of EV models available from major manufacturers like Tesla, BYD, Hyundai, and others, further fuels market expansion. While the initial cost of EVs remains a restraint, leasing options and decreasing battery costs are gradually mitigating this barrier. Segmentation within the market reveals strong growth across passenger cars and light commercial vehicles, with medium- and heavy-duty commercial vehicle segments poised for significant future growth as technology and infrastructure improve.

Australia EV Market Market Size (In Billion)

The forecast for the Australian EV market from 2025 to 2033 indicates continued strong expansion, fueled by ongoing government support, technological innovation, and increasing consumer demand. The market's growth trajectory will likely be influenced by factors such as the availability and affordability of charging stations, the introduction of new EV models, fluctuations in global supply chains impacting vehicle production, and potential changes in government policies related to emissions and fuel efficiency. The competitive landscape is dynamic, with both established automotive giants and new EV-focused companies vying for market share. Successfully navigating this landscape requires a strategic focus on innovation, cost-effectiveness, and customer experience to capitalize on the significant opportunities presented by the rapidly evolving Australian EV market.

Australia EV Market Company Market Share

Australia EV Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning Australian Electric Vehicle (EV) market, offering invaluable insights for industry stakeholders, investors, and policymakers. Spanning the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, trends, leading players, and future growth potential. The Australian EV market is poised for significant expansion, driven by government incentives, technological advancements, and growing environmental awareness. This report will equip you with the knowledge to navigate this rapidly evolving landscape and capitalize on emerging opportunities. The total market value is projected to reach xx Million by 2033.

Australia EV Market Market Dynamics & Concentration

The Australian EV market is characterized by increasing concentration, with a few major players holding significant market share. However, the market remains dynamic with considerable room for new entrants and technological innovation. Government regulations, including emission standards and incentives, significantly influence market growth. The presence of established automotive manufacturers alongside emerging EV-focused companies creates a complex competitive landscape. Product substitutes, such as hybrid vehicles and fuel-efficient gasoline cars, still pose a challenge. Consumer preferences are shifting towards EVs, driven by environmental concerns and the decreasing cost of battery technology. M&A activity within the sector is expected to increase as companies strive for scale and technological advantage. The total number of M&A deals in the sector between 2019 and 2024 was xx, with a market concentration ratio (CR4) of xx%.

- Market Concentration: Increasing, driven by consolidation among major players.

- Innovation Drivers: Technological advancements in battery technology, charging infrastructure, and vehicle design.

- Regulatory Framework: Government incentives and emission regulations are key drivers.

- Product Substitutes: Hybrid and petrol vehicles continue to compete.

- End-User Trends: Growing consumer preference for eco-friendly transportation options.

- M&A Activity: Expect increased mergers and acquisitions to shape the competitive landscape.

Australia EV Market Industry Trends & Analysis

The Australian EV market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% between 2025 and 2033. This growth is fueled by several factors: government incentives to boost EV adoption, decreasing battery costs, improving EV technology (range and performance), and a growing awareness of climate change among consumers. Technological disruptions, particularly advancements in battery technology and charging infrastructure, are accelerating the transition to electric mobility. Consumer preferences are shifting towards EVs, particularly amongst younger demographics and environmentally conscious buyers. Competitive dynamics are intensifying with both established and new players vying for market share. Market penetration is expected to reach xx% by 2033, up from xx% in 2024.

Leading Markets & Segments in Australia EV Market

The Australian EV market is witnessing growth across various segments, though passenger cars currently dominate.

By Propulsion Type:

- Battery Electric Vehicles (BEVs): The fastest-growing segment, driven by decreasing battery costs and improved range. Key drivers include government incentives focusing on BEVs and consumer preference for zero-emission vehicles.

- Hybrid Electric Vehicles (HEVs): A significant segment, primarily acting as a transitional technology.

- Plug-In Hybrid Electric Vehicles (PHEVs): Moderate growth, offering a balance between electric and petrol capabilities.

- Fuel Cell Electric Vehicles (FCEVs): Limited market presence currently, due to high cost and limited infrastructure.

By Vehicle Type:

- Passenger Cars: The largest segment, driven by strong consumer demand and a wide range of models available.

- Light Commercial Vehicles (LCVs): Growing rapidly, with several manufacturers offering electric vans and utes.

- Medium-Duty and Heavy-Duty Commercial Vehicles: Early stages of adoption, hampered by higher costs and longer charging times, but growing interest driven by fleet sustainability goals.

The largest market by volume remains New South Wales, driven by high population density and supportive government policies.

Australia EV Market Product Developments

The Australian EV market is witnessing significant product innovation, focused on enhancing battery technology, extending range, improving charging times, and offering diverse vehicle types to meet various consumer needs. Advancements include solid-state batteries, fast-charging capabilities, and improved energy efficiency. Manufacturers are concentrating on developing vehicles suitable for the Australian climate and driving conditions, encompassing diverse terrains and long distances. The focus is on creating competitive advantages through superior technology, attractive pricing, and comprehensive after-sales services.

Key Drivers of Australia EV Market Growth

Several factors propel the growth of the Australian EV market:

- Government Incentives: Substantial tax breaks, subsidies, and infrastructure investment.

- Technological Advancements: Improved battery technology, longer ranges, and faster charging.

- Environmental Concerns: Growing consumer awareness of climate change and its effects.

- Decreasing Battery Costs: Making EVs more affordable and accessible.

Challenges in the Australia EV Market Market

Despite the positive outlook, the Australian EV market faces challenges:

- High Initial Purchase Price: EVs remain more expensive than comparable petrol cars.

- Range Anxiety: Concerns about limited driving range and charging infrastructure availability.

- Charging Infrastructure Limitations: Insufficient public charging stations, especially in regional areas.

- Supply Chain Disruptions: Global semiconductor shortages impact EV production.

Emerging Opportunities in Australia EV Market

The Australian EV market presents numerous opportunities for long-term growth:

- Technological Breakthroughs: Advancements in battery technology and charging infrastructure will drive adoption.

- Strategic Partnerships: Collaboration between automotive manufacturers, energy companies, and government agencies.

- Market Expansion: Growing demand in regional areas and for commercial vehicles.

Leading Players in the Australia EV Market Sector

Key Milestones in Australia EV Market Industry

- February 2022: Polestar commences sales in Australia, launching the Polestar 2.

- February 2022: Hyzon Motors establishes Australian headquarters in Melbourne, focusing on hydrogen-powered commercial vehicles.

- March 2022: BYD launches three electric crossovers, including the Atto 3, through EV Direct.

- April 2022: SEAT announces Australian production and delivery of the CUPRA Born electric vehicle, opening a Sydney showroom.

Strategic Outlook for Australia EV Market Market

The Australian EV market is poised for substantial growth over the next decade. Continued government support, technological innovation, and increasing consumer demand will drive market expansion. Strategic partnerships and investment in charging infrastructure will be crucial for overcoming existing challenges and unlocking the full potential of this dynamic sector. The focus on sustainable transportation and the reduction of carbon emissions presents a significant opportunity for growth and innovation in the Australian EV market.

Australia EV Market Segmentation

-

1. Propulsion Type

- 1.1. Battery Electric Vehicles

- 1.2. Hybrid Electric Vehicles

- 1.3. Fuel Cell Electric Vehicles

- 1.4. Plug-In Hybrid Electric Vehicles

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Light Commercial Vehicles

- 2.3. Medium-Duty Commercial Vehicles

- 2.4. Heavy-Duty Commercial Vehicles

Australia EV Market Segmentation By Geography

- 1. Australia

Australia EV Market Regional Market Share

Geographic Coverage of Australia EV Market

Australia EV Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 33.06% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Investments into Developing Charging Infrastructure in the Country

- 3.3. Market Restrains

- 3.3.1. Lack of Public Charging Station

- 3.4. Market Trends

- 3.4.1. Hybrid Electric Vehicle Segment of Market Likely to Hold Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia EV Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Battery Electric Vehicles

- 5.1.2. Hybrid Electric Vehicles

- 5.1.3. Fuel Cell Electric Vehicles

- 5.1.4. Plug-In Hybrid Electric Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Light Commercial Vehicles

- 5.2.3. Medium-Duty Commercial Vehicles

- 5.2.4. Heavy-Duty Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Jaguar Land Rover Automotive PLC (Tata Motors)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hyundai Motor Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MG Motor (SAIC MOTOR AUSTRALIA PTY LTD )

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BYD Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mazda Motor Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lexus Motor Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mercedes-benz Group AG *List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Honda Motor Company Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Volkswagen AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Renault Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Tesla Motors Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 BMW Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Toyota Motor Corporation

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Jaguar Land Rover Automotive PLC (Tata Motors)

List of Figures

- Figure 1: Australia EV Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia EV Market Share (%) by Company 2025

List of Tables

- Table 1: Australia EV Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 2: Australia EV Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: Australia EV Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Australia EV Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 5: Australia EV Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Australia EV Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia EV Market?

The projected CAGR is approximately 33.06%.

2. Which companies are prominent players in the Australia EV Market?

Key companies in the market include Jaguar Land Rover Automotive PLC (Tata Motors), Hyundai Motor Group, MG Motor (SAIC MOTOR AUSTRALIA PTY LTD ), BYD Co Ltd, Mazda Motor Corporation, Lexus Motor Corporation, Mercedes-benz Group AG *List Not Exhaustive, Honda Motor Company Ltd, Volkswagen AG, Renault Group, Tesla Motors Inc, BMW Group, Toyota Motor Corporation.

3. What are the main segments of the Australia EV Market?

The market segments include Propulsion Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.49 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Investments into Developing Charging Infrastructure in the Country.

6. What are the notable trends driving market growth?

Hybrid Electric Vehicle Segment of Market Likely to Hold Significant Share in the Market.

7. Are there any restraints impacting market growth?

Lack of Public Charging Station.

8. Can you provide examples of recent developments in the market?

April 2022: SEAT announced that CUPRA's first fully electric model CUPRA Born will go into production for Australia by the end of 2022 and will start deliveries early in 2023. 2022 will also see the automotive brand open a CUPRA City Garage in Sydney's CBD. The unique destination, close to the world's most famous harbor, will offer an unconventional and unique customer experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia EV Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia EV Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia EV Market?

To stay informed about further developments, trends, and reports in the Australia EV Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence