Key Insights

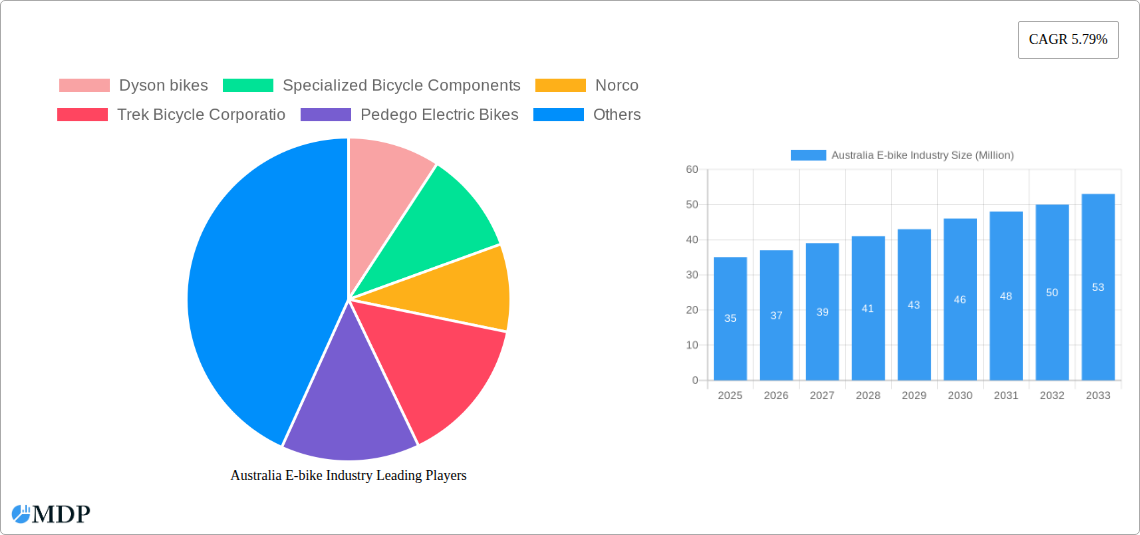

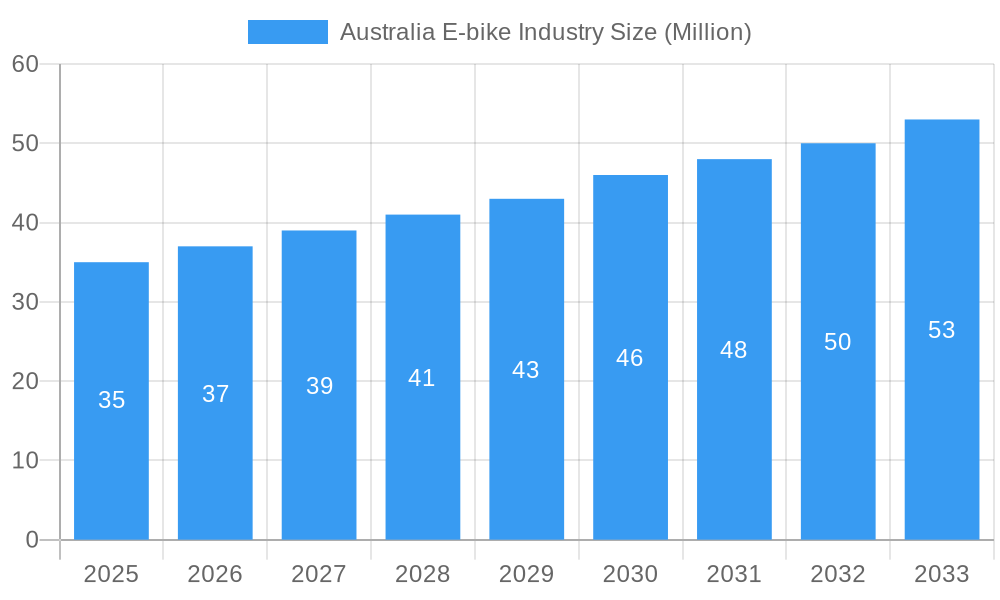

The Australian e-bike market, currently experiencing robust growth, is projected to expand significantly over the next decade. With a Compound Annual Growth Rate (CAGR) of 5.79% from 2019 to 2024, the market demonstrates strong consumer interest fueled by factors like increasing environmental awareness, rising fuel costs, and government initiatives promoting sustainable transportation. The segment is driven by diverse applications, with city/urban e-bikes leading the way due to their practicality in navigating congested urban areas. The increasing adoption of lithium-ion batteries, offering superior performance and longer range compared to lead-acid alternatives, further fuels this expansion. While specific market size figures for 2025 are unavailable, extrapolating from the provided CAGR and assuming a reasonable base year value, we can estimate a market size in the tens of millions of Australian dollars for 2025. Leading players like Specialized Bicycle Components, Trek Bicycle Corporation, and Pedego Electric Bikes are actively shaping the market with diverse product offerings catering to various needs and budgets. Growth is likely to be sustained by ongoing technological advancements, such as improved battery technology and more integrated smart features.

Australia E-bike Industry Market Size (In Million)

However, potential restraints include the relatively high initial cost of e-bikes compared to traditional bicycles, and the limited charging infrastructure in some areas. The market is segmented by propulsion type (pedal-assisted, speed pedelec, throttle-assisted), application type (cargo/utility, city/urban, trekking), and battery type (lead-acid, lithium-ion, others). Future growth will likely depend on addressing affordability concerns, expanding charging infrastructure, and enhancing consumer awareness about the benefits of e-bike ownership. Government incentives and policies supporting sustainable transportation could further accelerate market expansion. Competition among established and emerging players will continue to intensify, fostering innovation and driving down prices, thereby boosting market accessibility.

Australia E-bike Industry Company Market Share

Australia E-bike Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Australian e-bike industry, covering market dynamics, leading players, and future growth opportunities. The report analyzes the market from 2019 to 2024 (historical period), with a base year of 2025, and forecasts until 2033. The total market size is expected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. This report is essential for industry stakeholders, investors, and anyone seeking to understand the evolving landscape of the Australian e-bike market.

Australia E-bike Industry Market Dynamics & Concentration

This section analyzes the competitive landscape of the Australian e-bike market, including market concentration, innovation drivers, regulatory frameworks, and key industry trends. The market is characterized by a mix of both global and domestic players, with market share currently dominated by a few key players. The market concentration ratio (CR4) is estimated to be xx% in 2025.

- Innovation Drivers: Technological advancements in battery technology (Lithium-ion battery adoption is a major driver) and motor systems are crucial for market growth. Lightweight designs and improved range are key features driving consumer demand.

- Regulatory Frameworks: Government incentives and regulations around e-bike usage and infrastructure development significantly impact market penetration.

- Product Substitutes: Traditional bicycles and other forms of personal transportation (cars, public transport) compete with e-bikes.

- End-User Trends: Growing environmental awareness, increasing urban congestion, and the rising popularity of fitness activities contribute to the rising demand for e-bikes.

- M&A Activities: The number of M&A deals in the Australian e-bike sector between 2019 and 2024 was xx, indicating a moderate level of consolidation. Future M&A activity is expected to increase as larger companies seek to expand their market share.

Australia E-bike Industry Industry Trends & Analysis

The Australian e-bike market is experiencing robust growth driven by several factors. The market is witnessing a shift towards higher-performance models with improved battery technology and a wider range of applications. The CAGR for the period 2025-2033 is estimated to be xx%. Market penetration, currently at xx%, is projected to reach xx% by 2033. Technological advancements, such as improved battery technology (leading to longer ranges and faster charging times) and the introduction of smart features, are enhancing the appeal of e-bikes. Consumer preferences are shifting towards more stylish and versatile models suited for various applications, reflecting a growing adoption rate across different demographics. Competitive dynamics are characterized by both established brands and emerging players, leading to a diversified product range and innovative business models.

Leading Markets & Segments in Australia E-bike Industry

The Australian e-bike market is geographically diverse, with substantial growth seen across major cities and regional areas. The City/Urban segment currently holds the largest market share, driven by factors like rising urban congestion and government initiatives promoting sustainable transportation.

Dominant Segments:

- Propulsion Type: Lithium-ion Battery powered Pedal Assisted e-bikes dominate the market due to their efficiency and range.

- Application Type: City/Urban e-bikes hold the largest market share, followed by Trekking and Cargo/Utility.

- Battery Type: Lithium-ion Batteries are the most prevalent battery type, surpassing Lead Acid Batteries due to their superior performance.

Key Drivers:

- Government Incentives: Subsidies and tax breaks for e-bike purchases stimulate demand.

- Infrastructure Development: Dedicated e-bike lanes and charging stations enhance convenience and usability.

- Urban Congestion: Increasing traffic congestion drives the adoption of e-bikes as an efficient alternative.

Australia E-bike Industry Product Developments

Recent product innovations highlight a trend toward lighter, more powerful, and technologically advanced e-bikes. Manufacturers are focusing on enhancing battery life, integrating smart features (connectivity and tracking), and designing bikes that are adaptable for various terrains and applications. This reflects the evolving needs of consumers who seek better performance, increased convenience, and seamless integration with their digital lifestyles. The market is seeing a surge in e-MTBs (electric mountain bikes) and cargo e-bikes, catering to diverse user requirements.

Key Drivers of Australia E-bike Industry Growth

Several factors contribute to the sustained growth of the Australian e-bike market. Technological advancements, particularly in battery technology and motor efficiency, extend range and reduce charging times, increasing consumer appeal. Government incentives, such as tax rebates and subsidies, make e-bikes more affordable and accessible. Growing environmental awareness and efforts to reduce carbon emissions drive consumer preference toward sustainable transportation solutions. Furthermore, improved infrastructure, including dedicated bike lanes and charging stations, significantly enhances e-bike usability.

Challenges in the Australia E-bike Industry Market

The Australian e-bike market faces challenges, including the relatively high initial cost compared to traditional bicycles, limiting accessibility for some consumers. Supply chain disruptions and the availability of essential components (particularly batteries) can hinder production and market supply. The competitive landscape, with both domestic and international players, creates intense price pressure. Furthermore, the lack of standardized safety regulations across different states presents a regulatory hurdle.

Emerging Opportunities in Australia E-bike Industry

The long-term growth potential of the Australian e-bike industry is significant. Continued advancements in battery technology, leading to increased range and longer lifespans, will drive further adoption. Strategic partnerships between e-bike manufacturers, component suppliers, and government agencies can lead to infrastructure development and market expansion. Exploring new market segments, such as cargo e-bikes for last-mile delivery services and e-bikes for tourism, presents further growth opportunities.

Leading Players in the Australia E-bike Industry Sector

- Dyson bikes

- Specialized Bicycle Components

- Norco

- Trek Bicycle Corporation

- Pedego Electric Bikes

- Riese & Müller

- Robert Bosch GmbH

- NCM Bike

- Merida Industry Co Ltd

- Giant Manufacturing Co

Key Milestones in Australia E-bike Industry Industry

- November 2022: NCM Bike introduced the NCM ET Cycle T720 Step through Electric Bike. This launch expanded the company's product portfolio and targeted a specific consumer segment.

- November 2022: Focus Bikes launched the JAM² SL Electric Mountain Bike. This high-end model caters to the growing demand for premium e-MTBs in the Australian market.

- September 2022: Specialized Bicycle Components announced a recall of certain electric mountain bike battery packs due to fire risks. This highlights the importance of battery safety standards and product recalls in maintaining consumer confidence.

Strategic Outlook for Australia E-bike Industry Market

The Australian e-bike market is poised for significant growth over the next decade. Continued technological innovation, supportive government policies, and increasing consumer awareness of environmental benefits will drive demand. Strategic partnerships and investments in infrastructure will further accelerate market expansion. Focus on developing specialized e-bike models for various applications (e.g., cargo, tourism) will tap into niche markets and generate additional revenue streams. The market is expected to experience a steady rise in both unit sales and overall market value.

Australia E-bike Industry Segmentation

-

1. Propulsion Type

- 1.1. Pedal Assisted

- 1.2. Speed Pedelec

- 1.3. Throttle Assisted

-

2. Application Type

- 2.1. Cargo/Utility

- 2.2. City/Urban

- 2.3. Trekking

-

3. Battery Type

- 3.1. Lead Acid Battery

- 3.2. Lithium-ion Battery

- 3.3. Others

Australia E-bike Industry Segmentation By Geography

- 1. Australia

Australia E-bike Industry Regional Market Share

Geographic Coverage of Australia E-bike Industry

Australia E-bike Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Traffic Congestion and Increasing Urban Population to Foster Market Growth

- 3.3. Market Restrains

- 3.3.1. Strict Government Regulations and Policies Toward Ride-hailing Services Impact the Market Growth

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia E-bike Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Pedal Assisted

- 5.1.2. Speed Pedelec

- 5.1.3. Throttle Assisted

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Cargo/Utility

- 5.2.2. City/Urban

- 5.2.3. Trekking

- 5.3. Market Analysis, Insights and Forecast - by Battery Type

- 5.3.1. Lead Acid Battery

- 5.3.2. Lithium-ion Battery

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dyson bikes

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Specialized Bicycle Components

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Norco

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Trek Bicycle Corporatio

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pedego Electric Bikes

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Riese & Müller

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Robert Bosch GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NCM Bike

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Merida Industry Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Giant Manufacturing Co

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Dyson bikes

List of Figures

- Figure 1: Australia E-bike Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Australia E-bike Industry Share (%) by Company 2025

List of Tables

- Table 1: Australia E-bike Industry Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 2: Australia E-bike Industry Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 3: Australia E-bike Industry Revenue undefined Forecast, by Battery Type 2020 & 2033

- Table 4: Australia E-bike Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Australia E-bike Industry Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 6: Australia E-bike Industry Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 7: Australia E-bike Industry Revenue undefined Forecast, by Battery Type 2020 & 2033

- Table 8: Australia E-bike Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia E-bike Industry?

The projected CAGR is approximately 3.67%.

2. Which companies are prominent players in the Australia E-bike Industry?

Key companies in the market include Dyson bikes, Specialized Bicycle Components, Norco, Trek Bicycle Corporatio, Pedego Electric Bikes, Riese & Müller, Robert Bosch GmbH, NCM Bike, Merida Industry Co Ltd, Giant Manufacturing Co.

3. What are the main segments of the Australia E-bike Industry?

The market segments include Propulsion Type, Application Type, Battery Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Traffic Congestion and Increasing Urban Population to Foster Market Growth.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Strict Government Regulations and Policies Toward Ride-hailing Services Impact the Market Growth.

8. Can you provide examples of recent developments in the market?

November 2022: Company has introduced NCM ET Cycle T720 Step through Electric Bike in the market.November 2022: Focus Bikes Drops The Fancy JAM² SL Electric Mountain Bike, This sleek and athletic 29er has a carbon frame and a Fazua Drive 60 system.September 2022: Specialized, announced a recall of some battery packs on specific electric mountain bike models in May 2021 owing to fire dangers caused by these batteries' flaws.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia E-bike Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia E-bike Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia E-bike Industry?

To stay informed about further developments, trends, and reports in the Australia E-bike Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence