Key Insights

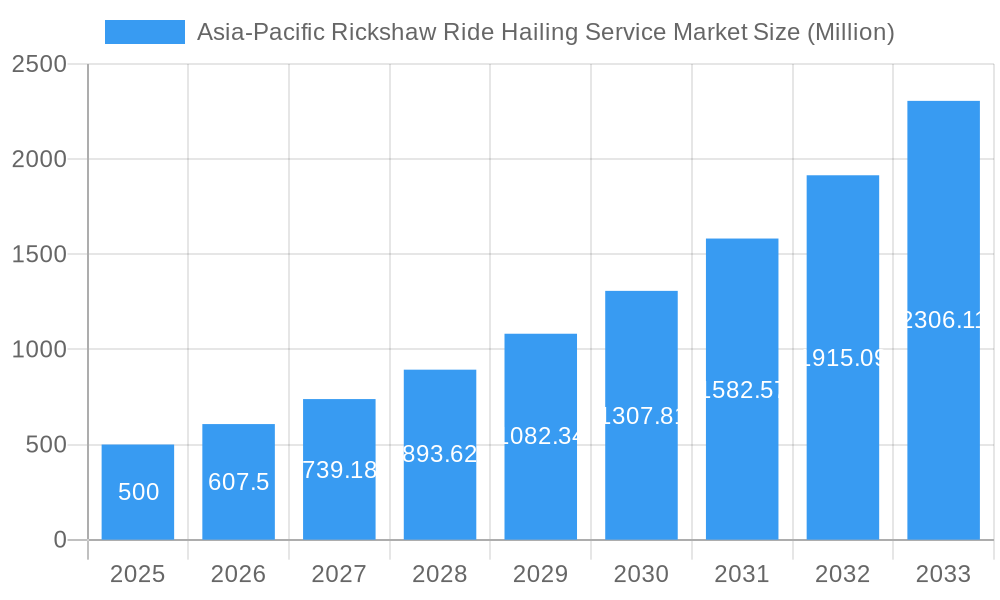

The Asia-Pacific rickshaw ride-hailing service market is experiencing robust growth, driven by increasing urbanization, rising disposable incomes, and the expanding adoption of smartphones and mobile payment systems. The market's convenience, affordability relative to other transportation options, and its role in addressing last-mile connectivity contribute significantly to its appeal. A Compound Annual Growth Rate (CAGR) of 21.50% from 2019 to 2024 suggests a substantial market expansion. While precise market sizing data is unavailable, considering the CAGR and the significant presence of players like Ola Cabs, Gojek, and Grab in the region, a conservative estimate places the 2025 market value at approximately $500 million USD. This figure takes into account market penetration across major Asian countries and the potential for continued growth in less-penetrated regions. The market is segmented by application (freight and logistics, passenger commuting), booking type (online, offline), payment method (cashless, cash, e-wallet), propulsion type (electric, internal combustion engine), and country (with China, India, and Japan leading). The increasing adoption of electric rickshaws is another key factor influencing market dynamics, presenting both opportunities and challenges related to infrastructure development and government regulations. This trend is particularly noteworthy in India and China, where significant investments are being made in sustainable transportation solutions.

Asia-Pacific Rickshaw Ride Hailing Service Market Market Size (In Million)

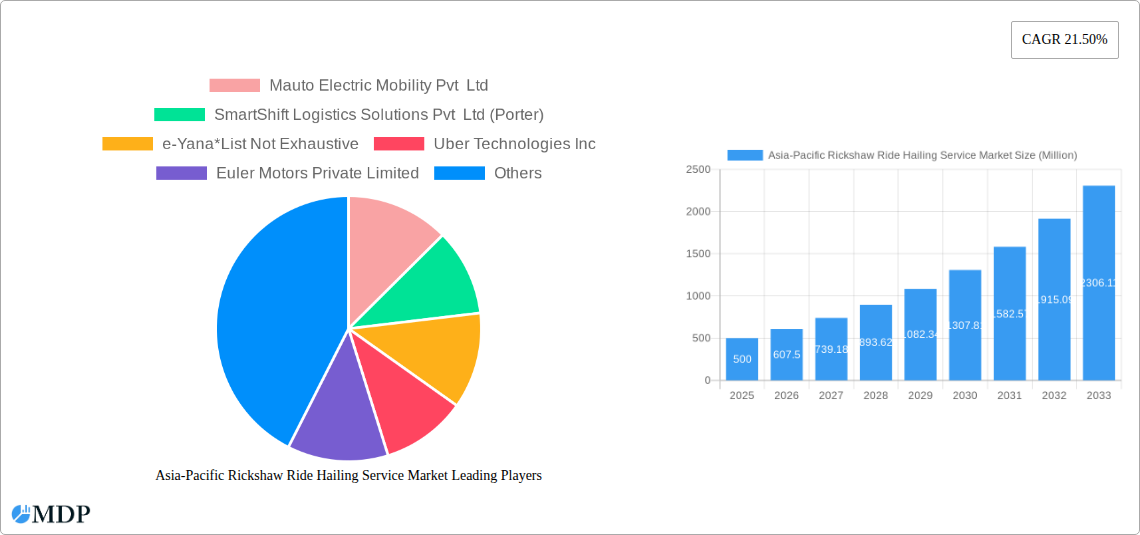

The competitive landscape is intensely dynamic, characterized by both established multinational players and numerous local startups. The presence of companies like Uber and Didi Chuxing highlights the global interest in this sector. However, local players possess valuable insights into regional market specifics, including cultural nuances and regulatory frameworks. Future growth will likely depend on several factors, including the continued expansion of smartphone penetration, improvements in ride-hailing app features and functionality, and the successful integration of electric vehicles into the market. Regulatory considerations, including licensing and safety standards, will also play a crucial role in shaping the market’s trajectory. The market's future success hinges on navigating these factors effectively while continuing to meet the evolving needs and expectations of consumers in the region.

Asia-Pacific Rickshaw Ride Hailing Service Market Company Market Share

Asia-Pacific Rickshaw Ride Hailing Service Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific rickshaw ride-hailing service market, offering invaluable insights for stakeholders seeking to understand and capitalize on its growth potential. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. The market is segmented by application (freight and logistics, passenger commuting), booking type (online, offline), payment method (cashless, cash, e-money/e-wallet), propulsion type (electric, internal combustion engine), and country (China, Japan, India, South Korea, Rest of Asia-Pacific). Key players include Mauto Electric Mobility Pvt Ltd, SmartShift Logistics Solutions Pvt Ltd (Porter), e-Yana, Uber Technologies Inc, Euler Motors Private Limited, Jugnoo (Socomo Technologies Pvt Ltd), Gojek tech, Grab, DiDi Chuxing (Beijing Xiaoju Technology Co Ltd), and Ola Cabs (ANI Technologies Pvt Ltd). The report offers actionable insights into market dynamics, trends, leading segments, and future opportunities, presenting a xx Million USD market valuation in 2025, projected to reach xx Million USD by 2033, exhibiting a CAGR of xx%.

Asia-Pacific Rickshaw Ride Hailing Service Market Market Dynamics & Concentration

The Asia-Pacific rickshaw ride-hailing service market is characterized by a dynamic interplay of factors influencing its growth and concentration. Innovation, particularly in electric vehicle technology and mobile payment systems, is a key driver. Regulatory frameworks, varying significantly across countries, play a crucial role in shaping market access and operations. The emergence of alternative transportation options, such as improved public transit, presents a competitive challenge. Consumer preferences, shaped by factors like affordability, convenience, and safety, are also influential. Mergers and acquisitions (M&A) activity is contributing to market consolidation, with xx M&A deals recorded in the past five years. Market share is currently dominated by established players like Gojek and Grab, holding approximately xx% and xx% respectively, while smaller players like Mauto Electric Mobility Pvt Ltd and Euler Motors Private Limited are striving for significant market penetration.

Asia-Pacific Rickshaw Ride Hailing Service Market Industry Trends & Analysis

The Asia-Pacific rickshaw ride-hailing market is experiencing significant growth, driven by increasing urbanization, rising disposable incomes, and the expanding adoption of smartphones. Technological advancements, particularly in electric vehicle technology and mobile payment systems, are transforming the industry. Consumer preferences are shifting towards cashless payments and convenient online booking options. Competitive dynamics are intense, with both established players and new entrants vying for market share. The market exhibits a xx% penetration rate in major urban centers, with a projected xx% increase by 2033. The market is witnessing a shift towards electric vehicles driven by government regulations and growing environmental concerns. This transition presents both opportunities and challenges for companies in the market. The CAGR for the forecast period (2025-2033) is estimated at xx%.

Leading Markets & Segments in Asia-Pacific Rickshaw Ride Hailing Service Market

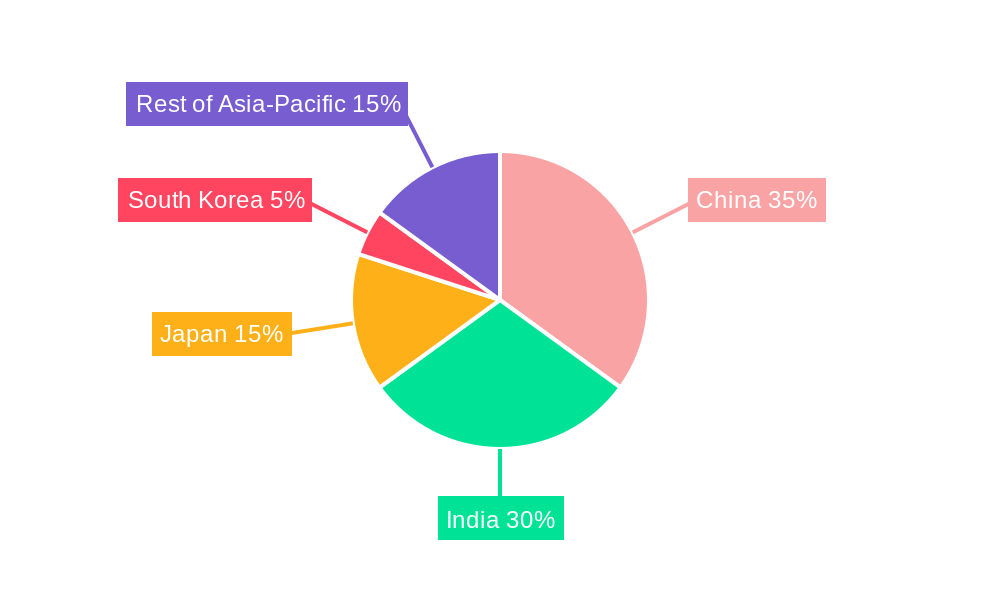

Dominant Region/Country: India currently holds the largest market share due to its vast population, high density of rickshaws, and growing adoption of ride-hailing apps. China follows closely with significant growth potential in its urban areas.

Dominant Segment (Application): Passenger commuting accounts for the largest segment, driven by the increasing demand for convenient and affordable personal transportation. Freight and logistics are also growing, particularly in smaller cities and towns with limited access to traditional transportation.

Dominant Segment (Booking Type): Online bookings are rapidly increasing, as consumers increasingly utilize smartphone apps for convenience and transparency.

Dominant Segment (Payment): Cashless payments are gaining traction due to increasing smartphone penetration and government initiatives promoting digital transactions. E-money/e-wallet adoption is particularly high in countries like China and India.

Dominant Segment (Propulsion Type): Internal Combustion Engine (ICE) rickshaws currently dominate the market, but there is a strong and increasing trend towards electric rickshaws due to environmental concerns and government incentives.

Key Drivers:

- India: Government initiatives promoting electric vehicles, improving infrastructure, and expanding digital payments.

- China: High urbanization rates, technological advancements, and a robust mobile payment ecosystem.

Asia-Pacific Rickshaw Ride Hailing Service Market Product Developments

Recent product innovations focus on enhancing safety, comfort, and efficiency. Electric rickshaws with improved battery technology, GPS tracking, and mobile payment integration are gaining popularity. Companies are also exploring features such as real-time tracking, route optimization, and integrated payment systems to provide a seamless user experience. This focus on technological advancements and tailored functionalities aims to increase market share and improve customer satisfaction.

Key Drivers of Asia-Pacific Rickshaw Ride Hailing Service Market Growth

Technological advancements, including the development of electric rickshaws and improved mobile applications, are a primary driver. Government initiatives promoting electric mobility and digital payments are also boosting market growth. The increasing urbanization and rising disposable incomes in the region are creating a larger pool of potential customers. Furthermore, the convenience and affordability of rickshaw ride-hailing services compared to other transportation options contribute to their growing popularity.

Challenges in the Asia-Pacific Rickshaw Ride Hailing Service Market Market

Regulatory inconsistencies across different countries create challenges for market expansion and standardization. The reliability and safety of some rickshaw services remain concerns for consumers. Supply chain disruptions and fluctuations in the price of electric vehicle components can impact the cost and availability of electric rickshaws. Intense competition among various ride-hailing platforms necessitates continuous innovation and investment to maintain a competitive edge. A lack of standardized charging infrastructure for electric vehicles is a significant constraint impacting the wide-spread adoption of electric vehicles.

Emerging Opportunities in Asia-Pacific Rickshaw Ride Hailing Service Market

The expansion of electric vehicle infrastructure and the continuous improvement of battery technology present significant opportunities. Strategic partnerships between ride-hailing companies and electric vehicle manufacturers can accelerate the adoption of electric rickshaws. Exploring new market segments, such as last-mile delivery services and tourism, can further drive growth. Innovations focused on improving the safety and comfort of rickshaws will be crucial for expanding customer base and market share.

Leading Players in the Asia-Pacific Rickshaw Ride Hailing Service Market Sector

- Mauto Electric Mobility Pvt Ltd

- SmartShift Logistics Solutions Pvt Ltd (Porter)

- e-Yana

- Uber Technologies Inc

- Euler Motors Private Limited

- Jugnoo (Socomo Technologies Pvt Ltd)

- Gojek tech

- Grab

- DiDi Chuxing (Beijing Xiaoju Technology Co Ltd)

- Ola Cabs (ANI Technologies Pvt Ltd)

Key Milestones in Asia-Pacific Rickshaw Ride Hailing Service Market Industry

- 2021: Uber India announced increasing its electric vehicle fleet to 3,000 e-vehicles, emphasizing its commitment to e-mobility.

Strategic Outlook for Asia-Pacific Rickshaw Ride Hailing Service Market Market

The Asia-Pacific rickshaw ride-hailing service market holds significant future potential, driven by increasing urbanization, technological advancements, and supportive government policies. Strategic partnerships, technological innovations, and expansion into new markets will be critical for companies to capitalize on these opportunities. Focus on sustainability, enhanced safety features, and improved customer experience will be key to achieving long-term success in this rapidly evolving sector.

Asia-Pacific Rickshaw Ride Hailing Service Market Segmentation

-

1. Application

- 1.1. Freight and Logistics

- 1.2. Passenger Commuting

-

2. Booking Type

- 2.1. Online

- 2.2. Offline

-

3. Payment

- 3.1. Cashless

- 3.2. E-Money / E-Wallet

-

4. Propulsion Type

- 4.1. Electric

- 4.2. Internal Combustion Engine

Asia-Pacific Rickshaw Ride Hailing Service Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Rickshaw Ride Hailing Service Market Regional Market Share

Geographic Coverage of Asia-Pacific Rickshaw Ride Hailing Service Market

Asia-Pacific Rickshaw Ride Hailing Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Inclusion of E-bikes in the Sharing Fleet

- 3.3. Market Restrains

- 3.3.1. Limited Infrastructure May Hinder Market Growth

- 3.4. Market Trends

- 3.4.1 Rising Tourism

- 3.4.2 Leisure Traveling and Logistics Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Rickshaw Ride Hailing Service Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Freight and Logistics

- 5.1.2. Passenger Commuting

- 5.2. Market Analysis, Insights and Forecast - by Booking Type

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Payment

- 5.3.1. Cashless

- 5.3.2. E-Money / E-Wallet

- 5.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.4.1. Electric

- 5.4.2. Internal Combustion Engine

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mauto Electric Mobility Pvt Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SmartShift Logistics Solutions Pvt Ltd (Porter)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 e-Yana*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Uber Technologies Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Euler Motors Private Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jugnoo (Socomo Technologies Pvt Ltd )

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gojek tech

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Grab

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DiDi Chuxing (Beijing Xiaoju Technology Co Ltd )

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ola Cabs (ANI Technologies Pvt Ltd)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Mauto Electric Mobility Pvt Ltd

List of Figures

- Figure 1: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Rickshaw Ride Hailing Service Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 3: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Million Forecast, by Payment 2020 & 2033

- Table 4: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 5: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 8: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Million Forecast, by Payment 2020 & 2033

- Table 9: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 10: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: China Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Japan Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: South Korea Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: India Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Australia Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: New Zealand Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Indonesia Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Malaysia Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Singapore Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Thailand Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Vietnam Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Philippines Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Rickshaw Ride Hailing Service Market?

The projected CAGR is approximately 21.50%.

2. Which companies are prominent players in the Asia-Pacific Rickshaw Ride Hailing Service Market?

Key companies in the market include Mauto Electric Mobility Pvt Ltd, SmartShift Logistics Solutions Pvt Ltd (Porter), e-Yana*List Not Exhaustive, Uber Technologies Inc, Euler Motors Private Limited, Jugnoo (Socomo Technologies Pvt Ltd ), Gojek tech, Grab, DiDi Chuxing (Beijing Xiaoju Technology Co Ltd ), Ola Cabs (ANI Technologies Pvt Ltd).

3. What are the main segments of the Asia-Pacific Rickshaw Ride Hailing Service Market?

The market segments include Application, Booking Type, Payment, Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Inclusion of E-bikes in the Sharing Fleet.

6. What are the notable trends driving market growth?

Rising Tourism. Leisure Traveling and Logistics Sector.

7. Are there any restraints impacting market growth?

Limited Infrastructure May Hinder Market Growth.

8. Can you provide examples of recent developments in the market?

In 2021, Uber India announced increasing its electric vehicle fleet to 3,000 e-vehicles due to trending e-mobility and green technology trends in the country. The company also has plans to establish charging infrastructures and partnered with OEM to smoothen its operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Rickshaw Ride Hailing Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Rickshaw Ride Hailing Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Rickshaw Ride Hailing Service Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Rickshaw Ride Hailing Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence