Key Insights

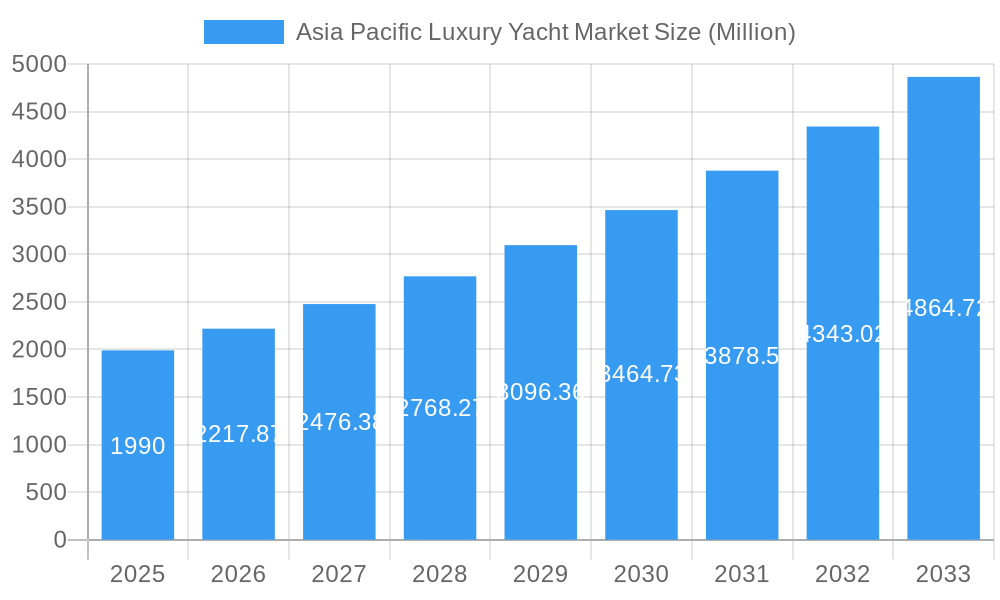

The Asia Pacific luxury yacht market, valued at $1.99 billion in 2025, is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of 11.30% from 2025 to 2033. This expansion is driven by several key factors. Rising disposable incomes among high-net-worth individuals (HNWIs) in countries like China, India, and South Korea are fueling demand for luxury goods, including yachts. A burgeoning tourism sector in the region, coupled with a growing appreciation for leisure activities and experiential travel, further contributes to market growth. The increasing popularity of luxury yacht charters and the development of advanced, eco-friendly yacht technologies are also positive influences. Furthermore, investments in marina infrastructure and improved regulatory environments in several Asia-Pacific countries are facilitating market expansion. Segmentation reveals strong performance across yacht types (motorized and sailing), sizes (particularly the 20-50 meter range, catering to a wider clientele), and applications (both private and commercial uses).

Asia Pacific Luxury Yacht Market Market Size (In Billion)

However, the market faces certain restraints. Economic volatility in some parts of the region and fluctuations in currency exchange rates can impact purchasing decisions. Environmental concerns and regulations related to emissions from luxury yachts pose challenges to manufacturers and operators. Competition among established players and emerging domestic brands also influences pricing and market share. Despite these challenges, the long-term outlook for the Asia Pacific luxury yacht market remains positive, primarily due to the region's growing economic strength and the increasing demand for sophisticated leisure experiences. This presents significant opportunities for yacht manufacturers, charter companies, and related service providers to capitalize on this expanding market. China, India, and Australia are expected to be key growth drivers within this market segment.

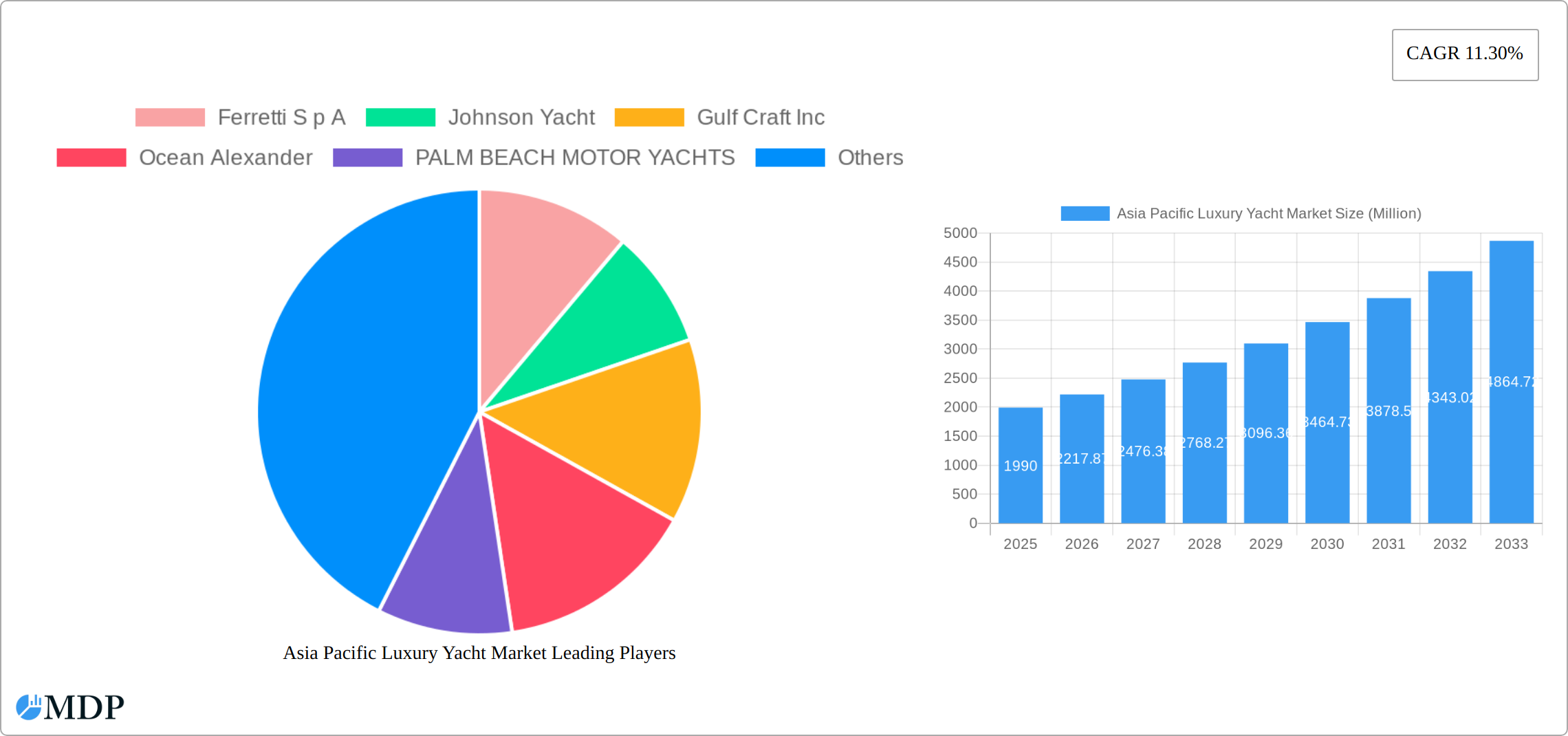

Asia Pacific Luxury Yacht Market Company Market Share

Asia Pacific Luxury Yacht Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia Pacific luxury yacht market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. Covering the period from 2019 to 2033, with a focus on 2025, this report delivers a meticulous forecast, grounded in historical data and current market trends. The study encompasses key market segments, leading players, and emerging opportunities, empowering informed decision-making and strategic planning.

Study Period: 2019-2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025-2033 Historical Period: 2019-2024

Asia Pacific Luxury Yacht Market Market Dynamics & Concentration

The Asia Pacific luxury yacht market is characterized by a complex interplay of factors influencing its growth and concentration. Market concentration is relatively moderate, with several key players holding significant shares but no single entity dominating the landscape. The market share of the top five players in 2025 is estimated at xx%, indicating a fragmented but competitive environment. Innovation is a key driver, with continuous advancements in yacht design, materials, and technology shaping consumer preferences and driving market expansion. Stringent regulatory frameworks related to safety, environmental impact, and import/export regulations influence market operations. The availability of substitute leisure activities such as private jet travel and high-end villa rentals creates competitive pressure. End-user trends towards personalized experiences and sustainable luxury are reshaping the market. Mergers and acquisitions (M&A) activity has been moderate in recent years, with approximately xx M&A deals recorded between 2019 and 2024. This activity is expected to increase slightly in the coming years driven by consolidation among manufacturers.

- Market Concentration: Moderately fragmented, top 5 players hold xx% market share (2025).

- Innovation Drivers: Technological advancements in yacht design, materials, and onboard amenities.

- Regulatory Frameworks: Stringent safety, environmental, and import/export regulations.

- Product Substitutes: Private jet travel, high-end villa rentals.

- End-User Trends: Growing demand for personalized luxury experiences and sustainable practices.

- M&A Activity: Approximately xx M&A deals between 2019 and 2024.

Asia Pacific Luxury Yacht Market Industry Trends & Analysis

The Asia Pacific luxury yacht market is experiencing a dynamic and upward trajectory, projected to witness significant growth with a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025-2033. This robust expansion is underpinned by a confluence of powerful economic and societal shifts. A primary catalyst is the remarkable increase in disposable incomes across key Asian economies, with nations like China, India, and Southeast Asian countries leading the charge. This economic prosperity is directly contributing to a burgeoning population of High-Net-Worth Individuals (HNWIs) who are increasingly seeking opulent lifestyle experiences and tangible assets that signify status and exclusivity.

Furthermore, technological innovation is playing a pivotal role in reshaping the luxury yacht landscape. The integration of cutting-edge smart technology, advanced automation, and sustainable propulsion systems is not merely enhancing the operational efficiency and user experience but also elevating the overall luxury quotient. Consumers are demonstrating a clear preference for larger, more sophisticated vessels that offer unparalleled comfort, advanced entertainment systems, and personalized amenities. The demand for bespoke customization, allowing owners to imprint their unique style and functional requirements onto their yachts, is also a significant trend. The competitive arena is characterized by a vibrant mix of established international yacht manufacturers and agile regional players, all vying for a substantial share of this burgeoning market. Despite the rapid growth, the market penetration of luxury yachts in the Asia Pacific region remains relatively nascent, indicating immense untapped potential and promising opportunities for future market development.

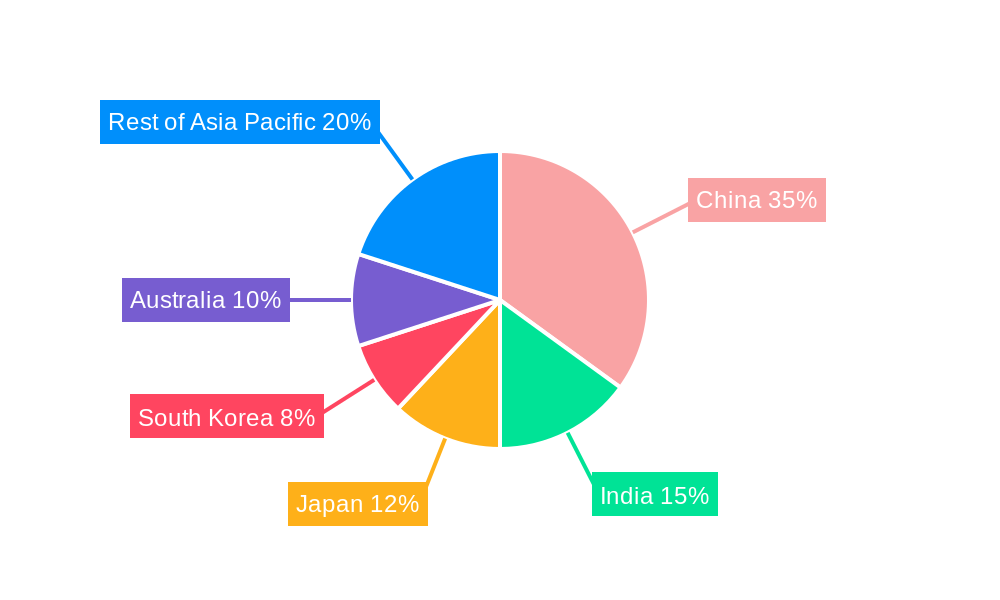

Leading Markets & Segments in Asia Pacific Luxury Yacht Market

China and Australia are currently leading the Asia Pacific luxury yacht market in terms of both sales volume and value, accounting for xx% and xx% of the total market revenue, respectively, in 2025. This dominance is driven by factors such as robust economic growth, expanding HNWI populations, and well-developed infrastructure for yacht ownership and maintenance. The Motorized Luxury Yacht segment is the largest, holding xx% of market share in 2025, followed by Sailing Luxury Yachts at xx%. The demand for yachts above 50 meters is steadily growing within the private sector.

Key Drivers:

- China: Strong economic growth, expanding HNWI population, government initiatives promoting tourism and leisure.

- Australia: Established yachting culture, favorable maritime regulations, well-developed yachting infrastructure.

- India: Rapid economic growth, rising HNWI population, increasing interest in luxury leisure activities.

- Singapore: Strong maritime infrastructure, favorable tax policies, strategic location as a regional hub.

- Japan: High disposable incomes, established luxury market, increasing interest in luxury yachting.

Dominant Segments:

- By Yacht Type: Motorized Luxury Yachts hold the largest market share.

- By Size: The 20-50 meter segment shows significant growth.

- By Application: Private application dominates the market with xx% market share.

Asia Pacific Luxury Yacht Market Product Developments

Recent product innovations focus on incorporating sustainable materials, advanced propulsion systems, and smart home technologies to enhance the luxury and eco-friendliness of yachts. Hybrid and electric propulsion systems are gaining traction, driven by environmental concerns and technological advancements. The integration of smart technologies improves onboard comfort and safety. Companies are focusing on creating bespoke designs and features to meet the increasing demand for personalization. This trend is attracting a new generation of affluent consumers looking for unique and personalized experiences.

Key Drivers of Asia Pacific Luxury Yacht Market Growth

The ascent of the Asia Pacific luxury yacht market is propelled by several interconnected drivers. The phenomenal surge in the number of High-Net-Worth Individuals across the region, coupled with steadily rising disposable incomes, is creating a fertile ground for increased demand for high-end luxury goods and exclusive experiences, with yachts at the forefront. Strategic government initiatives aimed at bolstering tourism infrastructure, promoting recreational boating, and developing world-class marina facilities are creating a highly conducive ecosystem for market expansion. Moreover, relentless technological advancements are revolutionizing yacht design and functionality. Innovations leading to improved fuel efficiency, enhanced onboard comfort through advanced climate control and entertainment systems, and the incorporation of sophisticated navigation and safety features are attracting a discerning clientele who demand the very best in maritime luxury.

Challenges in the Asia Pacific Luxury Yacht Market Market

Despite promising growth prospects, the Asia Pacific luxury yacht market faces several challenges. Stricter environmental regulations concerning emissions and waste disposal could impact operating costs and profitability. Supply chain disruptions and fluctuating raw material prices pose significant challenges to yacht manufacturers. Intense competition from established international brands and emerging regional players requires ongoing innovation and adaptation. The high cost of ownership and maintenance is a barrier to entry for potential buyers.

Emerging Opportunities in Asia Pacific Luxury Yacht Market

The Asia Pacific luxury yacht market is brimming with lucrative avenues for businesses that are adept at recognizing and adapting to the evolving desires of consumers. The burgeoning popularity of luxury yacht charter services and bespoke rental experiences presents a significant and accessible revenue stream, catering to a wider demographic seeking ephemeral luxury. Strategic collaborations and innovative partnerships between discerning yacht manufacturers, luxury service providers, and experienced charter management companies can unlock new market segments and offer comprehensive, end-to-end luxury experiences. A notable trend is the growing consumer consciousness towards environmental sustainability. Therefore, exploring and incorporating eco-friendly materials, hybrid and electric propulsion systems, and sustainable operational practices presents a powerful opportunity to capture the attention of an increasingly environmentally aware clientele. Furthermore, strategic expansion into secondary and emerging luxury markets across the Asia-Pacific region, supported by targeted marketing campaigns and robust distribution networks, can significantly broaden market reach and drive sustained growth.

Leading Players in the Asia Pacific Luxury Yacht Market Sector

- Ferretti S p A

- Johnson Yacht

- Gulf Craft Inc

- Ocean Alexander

- PALM BEACH MOTOR YACHTS

- Fincantieri Yachts

- Superyacht Australia

- Horizon Yacht

- Heysea Yachts Company Limited

- Riviera Australia Pty Ltd

- Azimut Benetti

- Oceanco Yacht

- Sanlorenzo Asia

- Sunseeker

- Grand Banks Yachts

Key Milestones in Asia Pacific Luxury Yacht Market Industry

- 2020: Implementation of increasingly stringent emission standards across several key Asia-Pacific nations, driving innovation in cleaner yacht technologies.

- 2021: A surge in the launch of innovative hybrid and electric luxury yacht models by prominent global manufacturers, signaling a shift towards sustainability.

- 2022: Witnessed a notable increase in Mergers & Acquisitions (M&A) activity within the luxury yacht sector, indicating consolidation and strategic growth plays.

- 2023: Significant investments in the expansion and upgrading of luxury yacht marinas and berthing facilities in prime tourist and coastal hubs across the region.

- 2024: Introduction and widespread adoption of pioneering smart yacht technologies, enhancing connectivity, automation, and personalized guest experiences.

Strategic Outlook for Asia Pacific Luxury Yacht Market Market

The Asia Pacific luxury yacht market is strategically positioned for continued and robust growth, buoyed by a favorable economic climate, relentless technological progress, and a discernible shift in consumer aspirations. Key strategic imperatives for manufacturers and service providers revolve around a steadfast commitment to sustainable practices, the meticulous delivery of personalized and bespoke experiences, and the seamless integration of advanced technological features. Expanding the market presence into secondary and emerging luxury destinations within the vast Asia-Pacific region offers substantial opportunities for market penetration and brand establishment. Companies that proactively embrace these evolving trends, invest strategically in research and development, and prioritize innovation are exceptionally well-positioned to capitalize on the significant and enduring growth potential of this dynamic and expanding market.

Asia Pacific Luxury Yacht Market Segmentation

-

1. Yacht Type

- 1.1. Sailing Luxury Yacht

- 1.2. Motorized Luxury Yacht

- 1.3. Other Types

-

2. Size

- 2.1. Up to 20 Meters

- 2.2. 20 to 50 Meters

- 2.3. Above 50 Meters

-

3. Application

- 3.1. Commercial

- 3.2. Private

Asia Pacific Luxury Yacht Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Luxury Yacht Market Regional Market Share

Geographic Coverage of Asia Pacific Luxury Yacht Market

Asia Pacific Luxury Yacht Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Tourism Industry is Expected to Boost the Luxury Yacht Market

- 3.3. Market Restrains

- 3.3.1. Luxury Yacht Charter and Used Yacht to Hamper Market Growth

- 3.4. Market Trends

- 3.4.1. Motorized Luxury Yacht Type Segment to Fuel the Market Demand -

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Luxury Yacht Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Yacht Type

- 5.1.1. Sailing Luxury Yacht

- 5.1.2. Motorized Luxury Yacht

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Size

- 5.2.1. Up to 20 Meters

- 5.2.2. 20 to 50 Meters

- 5.2.3. Above 50 Meters

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Commercial

- 5.3.2. Private

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Yacht Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ferretti S p A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Johnson Yacht

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gulf Craft Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ocean Alexander

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PALM BEACH MOTOR YACHTS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fincantieri Yachts

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Superyacht Australia*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Horizon Yacht

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Heysea Yachts Company Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Riviera Australia Pty Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Azimut Benetti

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Oceanco Yacht

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Sanlorenzo Asia

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Sunseeker

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Grand Banks Yachts

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Ferretti S p A

List of Figures

- Figure 1: Asia Pacific Luxury Yacht Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Luxury Yacht Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Luxury Yacht Market Revenue Million Forecast, by Yacht Type 2020 & 2033

- Table 2: Asia Pacific Luxury Yacht Market Revenue Million Forecast, by Size 2020 & 2033

- Table 3: Asia Pacific Luxury Yacht Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Asia Pacific Luxury Yacht Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Asia Pacific Luxury Yacht Market Revenue Million Forecast, by Yacht Type 2020 & 2033

- Table 6: Asia Pacific Luxury Yacht Market Revenue Million Forecast, by Size 2020 & 2033

- Table 7: Asia Pacific Luxury Yacht Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Asia Pacific Luxury Yacht Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Asia Pacific Luxury Yacht Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia Pacific Luxury Yacht Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia Pacific Luxury Yacht Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: India Asia Pacific Luxury Yacht Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia Pacific Luxury Yacht Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia Pacific Luxury Yacht Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia Pacific Luxury Yacht Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia Pacific Luxury Yacht Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia Pacific Luxury Yacht Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia Pacific Luxury Yacht Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia Pacific Luxury Yacht Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia Pacific Luxury Yacht Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Luxury Yacht Market?

The projected CAGR is approximately 11.30%.

2. Which companies are prominent players in the Asia Pacific Luxury Yacht Market?

Key companies in the market include Ferretti S p A, Johnson Yacht, Gulf Craft Inc, Ocean Alexander, PALM BEACH MOTOR YACHTS, Fincantieri Yachts, Superyacht Australia*List Not Exhaustive, Horizon Yacht, Heysea Yachts Company Limited, Riviera Australia Pty Ltd, Azimut Benetti, Oceanco Yacht, Sanlorenzo Asia, Sunseeker, Grand Banks Yachts.

3. What are the main segments of the Asia Pacific Luxury Yacht Market?

The market segments include Yacht Type, Size, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.99 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Tourism Industry is Expected to Boost the Luxury Yacht Market.

6. What are the notable trends driving market growth?

Motorized Luxury Yacht Type Segment to Fuel the Market Demand -.

7. Are there any restraints impacting market growth?

Luxury Yacht Charter and Used Yacht to Hamper Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Luxury Yacht Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Luxury Yacht Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Luxury Yacht Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Luxury Yacht Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence