Key Insights

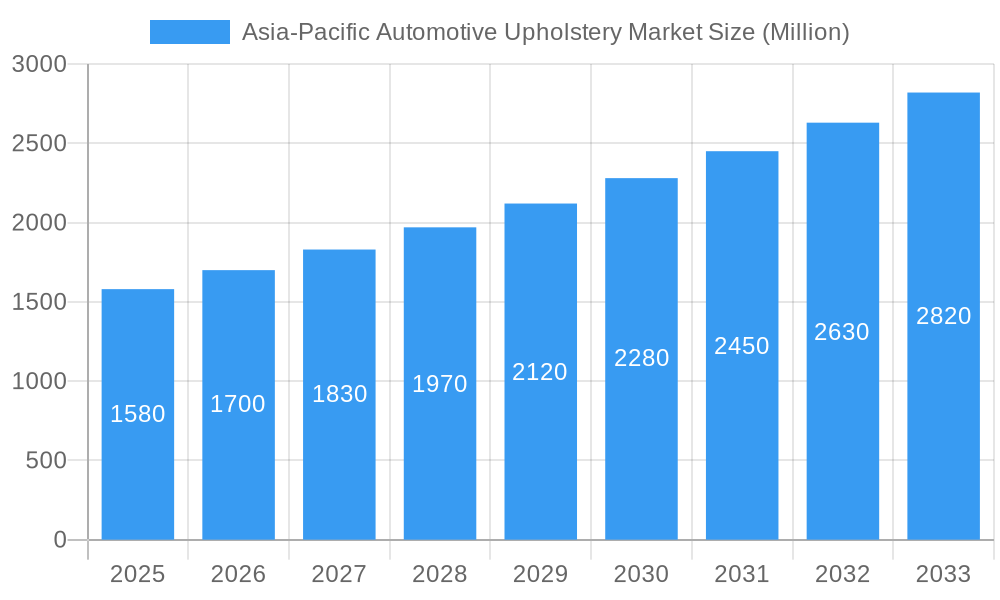

The Asia-Pacific automotive upholstery market, valued at $1.58 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 7% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the burgeoning automotive industry within the Asia-Pacific region, particularly in countries like China and India, fuels significant demand for new vehicles and consequently, upholstery components. Rising disposable incomes and a preference for enhanced vehicle aesthetics and comfort contribute to this demand. Secondly, technological advancements in upholstery materials, focusing on durability, sustainability, and innovative designs, are driving market growth. The increasing adoption of leather and specialized vinyl alternatives that offer superior comfort and longevity is a prominent trend. Finally, the growing popularity of SUVs and luxury vehicles, characterized by higher upholstery specifications, is further propelling market expansion. The market segmentation reveals a significant share for leather upholstery due to its perceived luxury and durability. OEM channels dominate sales, reflecting the high demand from automakers. Dashboard and seat upholstery represent major product segments, while China, Japan, and India are leading regional markets. However, challenges remain, including fluctuating raw material prices and increasing competition among numerous established and emerging players.

Asia-Pacific Automotive Upholstery Market Market Size (In Billion)

The competitive landscape is characterized by a mix of global giants like Toyota Boshoku Corporation, Lear Corporation, and Adient PLC, along with several regional players. These companies are focusing on strategic partnerships, technological innovations, and cost-optimization strategies to maintain their market positions. The forecast period (2025-2033) promises further growth driven by continued automotive production increases and evolving consumer preferences for sophisticated interiors. While specific restraints such as supply chain disruptions and economic uncertainties could impact growth, the overall positive outlook for the Asia-Pacific automotive sector suggests continued expansion for the automotive upholstery market. The continued focus on innovation in material science, coupled with increasing vehicle sales, positions this market for substantial future growth.

Asia-Pacific Automotive Upholstery Market Company Market Share

Asia-Pacific Automotive Upholstery Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific automotive upholstery market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033. The report meticulously examines market dynamics, trends, leading segments, key players, and future opportunities, leveraging extensive data analysis and industry expertise. The total market size is predicted to reach xx Million by 2033.

Asia-Pacific Automotive Upholstery Market Market Dynamics & Concentration

The Asia-Pacific automotive upholstery market is characterized by a moderately consolidated yet highly dynamic landscape. Prominent players like Toyota Boshoku Corporation, Seiren Co Ltd, Suminoe Textile Co Ltd, Lear Corporation, Marvel Group, Adient PLC, and Faurecia SE collectively hold a significant market share, estimated to be around xx% for the top five players. This concentration is balanced by a fiercely competitive environment driven by continuous innovation and strategic mergers & acquisitions (M&A) activities. The average M&A deal count in the sector during the historical period (2019-2024) stood at xx per year, underscoring the ongoing consolidation and strategic realignments. Key innovation drivers include the development of advanced, sustainable, and eco-friendly materials, with a particular emphasis on vegan leather alternatives, directly responding to heightened environmental awareness and consumer demand. Stringent regulatory frameworks governing material safety, emissions standards, and sustainability compliances further shape market dynamics, pushing manufacturers towards responsible production. The emergence and increasing traction of product substitutes, such as cutting-edge textiles and high-quality recycled materials, are actively impacting the demand for conventional upholstery materials. Simultaneously, evolving end-user trends that prioritize personalized and luxury interior experiences are creating lucrative niche opportunities for specialized upholstery solutions and bespoke customization services.

Asia-Pacific Automotive Upholstery Market Industry Trends & Analysis

The Asia-Pacific automotive upholstery market is experiencing robust and sustained growth, propelled by a confluence of factors. The region's burgeoning automotive industry, coupled with rising disposable incomes across many nations and an escalating demand for more sophisticated and comfortable vehicle interiors, are key accelerators. The market is estimated to have registered a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to continue its upward trajectory, maintaining a strong CAGR of xx% during the forecast period (2025-2033). Technological disruptions are playing a pivotal role, with the increasing adoption of lightweight yet durable materials and advanced manufacturing techniques significantly impacting production efficiency, overall product quality, and cost-effectiveness. A pronounced shift in consumer preferences towards sustainable and eco-friendly upholstery options is creating substantial opportunities for manufacturers who proactively offer innovative solutions such as premium vegan leather and high-performance recycled materials. The intense competitive dynamics, often characterized by strategic pricing strategies and a strong focus on product differentiation, are continuously reshaping the market landscape. The market penetration of sustainable materials is anticipated to reach a significant xx% by 2033, highlighting the growing importance of environmental consciousness in purchasing decisions.

Leading Markets & Segments in Asia-Pacific Automotive Upholstery Market

-

By Country: China currently leads the Asia-Pacific automotive upholstery market, a position driven by its expansive automotive manufacturing base and robust domestic consumer demand. Japan follows as a prominent market, distinguished by its commitment to technological advancements and a strong consumer preference for high-quality, premium interiors. India and South Korea are rapidly emerging as significant growth markets with substantial untapped potential. Key growth drivers for China include its sustained economic growth, supportive government industrial policies, and continuously expanding automotive production capacity. In Japan, technological innovation, an unwavering emphasis on superior quality, and a sophisticated consumer base are the primary market catalysts. India's growth is largely fueled by its expanding middle class and the increasing rate of car ownership. South Korea benefits from a strong domestic automotive manufacturing sector and its advanced technological capabilities in material science and production.

-

By Material Type: While leather continues to hold its position as the dominant material type, vinyl and a growing array of other material types, including innovative sustainable alternatives, are progressively gaining market share. This shift is primarily attributed to their cost-effectiveness, evolving performance characteristics, and the escalating demand for environmentally responsible options.

-

By Sales Channel Type: The OEM (Original Equipment Manufacturer) channel commands the largest market share, a clear reflection of the pivotal role automotive manufacturers play within the broader supply chain. However, the aftermarket segment presents significant growth potential, driven by the increasing popularity of vehicle customization, personalization, and aftermarket upgrades among consumers.

-

By Product Type: Seats represent the largest product segment due to their fundamental importance in vehicle comfort, functionality, and interior aesthetics. Other key product types that constitute significant market segments include dashboards, roof liners, and door trims.

Asia-Pacific Automotive Upholstery Market Product Developments

Recent product developments in the Asia-Pacific automotive upholstery market are predominantly focused on enhancing comfort, durability, and sustainability. The integration of lightweight materials is a key trend aimed at improving vehicle fuel efficiency without compromising on the luxurious feel of the interior. Advanced manufacturing processes are being leveraged to elevate product quality, achieve greater precision, and optimize production costs. The increasing consumer and regulatory pressure for environmentally conscious options has spurred the development of innovative vegan and eco-friendly materials that closely mimic the aesthetic and tactile qualities of traditional leather, thereby catering effectively to evolving consumer preferences. Furthermore, the market is witnessing a pronounced trend towards personalized upholstery solutions, offering extensive customization options to meet the diverse and often unique needs of individual customers and specific vehicle models.

Key Drivers of Asia-Pacific Automotive Upholstery Market Growth

The Asia-Pacific automotive upholstery market growth is propelled by several key factors. Firstly, the rapid expansion of the automotive industry in the region significantly boosts demand for upholstery materials. Secondly, rising disposable incomes and increased consumer spending power drive the demand for enhanced vehicle interiors and luxury features. Thirdly, government regulations promoting safety and environmental sustainability influence the demand for specific materials. The adoption of advanced technologies, such as lightweight and sustainable materials, further supports market growth.

Challenges in the Asia-Pacific Automotive Upholstery Market Market

The Asia-Pacific automotive upholstery market faces challenges, including fluctuations in raw material prices, stringent environmental regulations impacting material sourcing and production costs, and intense competition from both established and emerging players. Supply chain disruptions and geopolitical uncertainties may impact material availability and pricing.

Emerging Opportunities in Asia-Pacific Automotive Upholstery Market

The market presents significant long-term growth opportunities. The increasing demand for sustainable and eco-friendly materials creates avenues for manufacturers of vegan leather and recycled options. Technological advancements, such as the development of advanced materials with improved performance characteristics, offer opportunities for product differentiation and premium pricing. Strategic partnerships and collaborations among manufacturers, material suppliers, and automotive OEMs can unlock new market segments and accelerate growth.

Leading Players in the Asia-Pacific Automotive Upholstery Market Sector

- Toyota Boshoku Corporation

- Seiren Co Ltd

- Suminoe Textile Co Ltd

- Lear Corporation

- Marvel Group

- Adient PLC

- Faurecia SE

Key Milestones in Asia-Pacific Automotive Upholstery Market Industry

- September 2022: The BMW Group's announcement to debut vehicles with fully vegan interiors signaled a growing trend toward sustainable materials.

- February 2023: Tata Motors' introduction of red upholstery variants in its Safari and Harrier SUVs highlighted the increasing demand for customizable interiors.

- March 2023: Lexus' launch of the LC 500h with its emphasis on high-end interior design and harmonized upholstery showcased the importance of aesthetics and luxury in the market.

Strategic Outlook for Asia-Pacific Automotive Upholstery Market Market

The Asia-Pacific automotive upholstery market is poised for sustained growth, driven by several factors including the continuous expansion of the automotive industry, increasing demand for premium and sustainable interiors, and technological innovation. Strategic opportunities exist in developing and commercializing eco-friendly and customizable solutions, leveraging strategic partnerships to expand market reach and optimize supply chains, and focusing on research and development to create advanced materials with enhanced performance capabilities. The market's long-term potential is considerable, promising significant returns for businesses that successfully navigate the dynamic landscape and capitalize on emerging trends.

Asia-Pacific Automotive Upholstery Market Segmentation

-

1. Material Type

- 1.1. Leather

- 1.2. Vinyl

- 1.3. Other Material Types

-

2. Sales Channel Type

- 2.1. OEM

- 2.2. Aftermarket

-

3. Product Type

- 3.1. Dashboard

- 3.2. Seats

- 3.3. Roof Liners

- 3.4. Door Trim

Asia-Pacific Automotive Upholstery Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Automotive Upholstery Market Regional Market Share

Geographic Coverage of Asia-Pacific Automotive Upholstery Market

Asia-Pacific Automotive Upholstery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Passenger Car Sales Propelling Market Growth

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Increase in Passenger Car Sales Propelling OEM Sales Channel Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Automotive Upholstery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Leather

- 5.1.2. Vinyl

- 5.1.3. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Sales Channel Type

- 5.2.1. OEM

- 5.2.2. Aftermarket

- 5.3. Market Analysis, Insights and Forecast - by Product Type

- 5.3.1. Dashboard

- 5.3.2. Seats

- 5.3.3. Roof Liners

- 5.3.4. Door Trim

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Toyota Boshoku Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Seiren Co Ltd *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Suminoe Textile Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lear Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Marvel group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Adient PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Faurecia SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Toyota Boshoku Corporation

List of Figures

- Figure 1: Asia-Pacific Automotive Upholstery Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Automotive Upholstery Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Automotive Upholstery Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Asia-Pacific Automotive Upholstery Market Revenue Million Forecast, by Sales Channel Type 2020 & 2033

- Table 3: Asia-Pacific Automotive Upholstery Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 4: Asia-Pacific Automotive Upholstery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Automotive Upholstery Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 6: Asia-Pacific Automotive Upholstery Market Revenue Million Forecast, by Sales Channel Type 2020 & 2033

- Table 7: Asia-Pacific Automotive Upholstery Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Asia-Pacific Automotive Upholstery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Asia-Pacific Automotive Upholstery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia-Pacific Automotive Upholstery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia-Pacific Automotive Upholstery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: India Asia-Pacific Automotive Upholstery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia-Pacific Automotive Upholstery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia-Pacific Automotive Upholstery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia-Pacific Automotive Upholstery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia-Pacific Automotive Upholstery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia-Pacific Automotive Upholstery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia-Pacific Automotive Upholstery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia-Pacific Automotive Upholstery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia-Pacific Automotive Upholstery Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Automotive Upholstery Market?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the Asia-Pacific Automotive Upholstery Market?

Key companies in the market include Toyota Boshoku Corporation, Seiren Co Ltd *List Not Exhaustive, Suminoe Textile Co Ltd, Lear Corporation, Marvel group, Adient PLC, Faurecia SE.

3. What are the main segments of the Asia-Pacific Automotive Upholstery Market?

The market segments include Material Type, Sales Channel Type, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.58 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Passenger Car Sales Propelling Market Growth.

6. What are the notable trends driving market growth?

Increase in Passenger Car Sales Propelling OEM Sales Channel Growth.

7. Are there any restraints impacting market growth?

Fluctuation in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

March 2023: Lexus introduced the LC 500h, a four-seat luxury coupe with high-end features. The controls in the center console are now oriented longitudinally, and the passenger side decoration panel has been harmonized with the instrument panel upholstery to emphasize the horizontal design idea.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Automotive Upholstery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Automotive Upholstery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Automotive Upholstery Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Automotive Upholstery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence