Key Insights

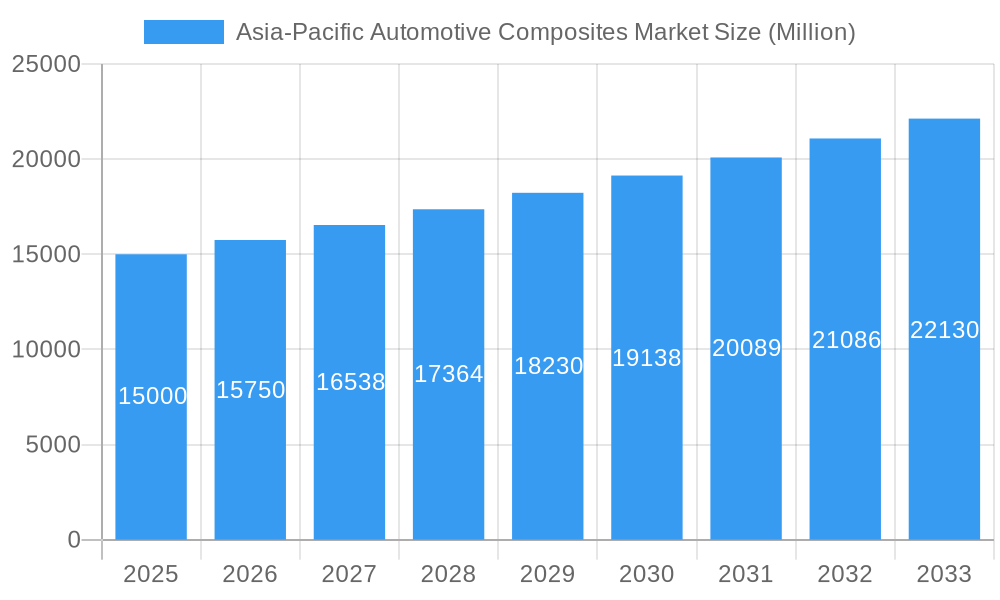

The Asia-Pacific automotive composites market is projected for substantial expansion, driven by the escalating demand for lightweight vehicles to improve fuel efficiency and decrease emissions. The region's significant automotive manufacturing base, particularly in China, Japan, and India, is a primary growth driver. The market is anticipated to exhibit a compound annual growth rate (CAGR) of 11.6% from 2025 to 2033. Key factors fueling this growth include the increasing adoption of advanced materials such as carbon fiber-reinforced polymers (CFRP) and thermoplastic polymers, which offer superior strength-to-weight ratios over conventional materials. Innovations in manufacturing processes like resin transfer molding (RTM) and vacuum infusion processing (VIP) are enhancing production efficiency and reducing costs, making composites more viable for a broader range of automotive applications. Segmentation highlights robust demand in structural assembly and powertrain components. Leading market participants include Nippon Sheet Glass Co Ltd, Teijin Limited, and BASF. Despite challenges like material costs and manufacturing complexity, ongoing technological advancements and supportive governmental policies are expected to foster sustained market growth.

The Asia-Pacific region leads the global market due to high automotive production volumes in China and Japan. Substantial investments in automotive R&D, coupled with growing consumer preference for fuel-efficient and eco-friendly vehicles, are further propelling market expansion. Segments demonstrating significant growth are those leveraging advanced materials and innovative manufacturing techniques. Evolving safety regulations, the rising adoption of electric vehicles (EVs), and a focus on vehicle durability and longevity will also influence market dynamics. The competitive landscape is dynamic, featuring established corporations and emerging enterprises, characterized by continuous innovation and strategic partnerships. The current market size is estimated at NaN million, with strong indicators of continued expansion.

Asia-Pacific Automotive Composites Market Company Market Share

Asia-Pacific Automotive Composites Market: A Comprehensive Analysis (2019-2033)

Unlock the potential of the booming Asia-Pacific automotive composites market with this in-depth report. Discover key trends, leading players, and lucrative opportunities shaping the future of lightweight automotive design. This comprehensive study covers the period 2019-2033, providing historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033).

Asia-Pacific Automotive Composites Market Market Dynamics & Concentration

The Asia-Pacific automotive composites market is experiencing dynamic growth, driven by increasing demand for lightweight vehicles and stringent fuel efficiency regulations. Market concentration is moderate, with several key players holding significant shares. Innovation in material science, particularly in carbon fiber and thermoplastic polymers, is a primary growth driver. Stringent emission norms and safety standards are compelling automakers to adopt composite materials. The presence of strong product substitutes, such as traditional steel and aluminum, presents a challenge, but ongoing advancements in composite technology are mitigating this. End-user preferences are shifting toward improved fuel efficiency, safety, and aesthetics, all of which favor the adoption of composite components. The market has witnessed a significant number of M&A activities in recent years, with approximately xx deals recorded between 2019 and 2024, primarily focused on consolidating market share and accessing new technologies. Market share distribution among the top five players is estimated at approximately xx% in 2025.

- Key Innovation Drivers: Advanced materials, automated manufacturing processes, improved design capabilities.

- Regulatory Framework: Stringent emission standards, safety regulations, and government incentives for lightweight vehicles.

- Product Substitutes: Steel, aluminum, and other traditional automotive materials.

- End-User Trends: Demand for fuel-efficient, safer, and aesthetically appealing vehicles.

- M&A Activities: xx deals recorded between 2019 and 2024, focusing on market consolidation and technological advancements.

Asia-Pacific Automotive Composites Market Industry Trends & Analysis

The Asia-Pacific automotive composites market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033). This robust growth is fueled by several factors, including the rapid expansion of the automotive industry in the region, particularly in China and India. Technological advancements in composite materials manufacturing, such as the increased adoption of automated fiber placement and resin transfer molding, are significantly reducing production costs and improving quality. Consumer preference for lighter, more fuel-efficient vehicles is a significant driver. The competitive landscape is characterized by both established players and emerging entrants, fostering innovation and driving down prices. Market penetration of composite materials in various automotive applications is steadily increasing, with a significant share expected in structural assembly and powertrain components by 2033. The rising adoption of electric vehicles (EVs) further fuels market growth, as composites are crucial for reducing vehicle weight and improving battery range. Specific advancements like the development of recyclable composite materials are positively impacting market acceptance.

Leading Markets & Segments in Asia-Pacific Automotive Composites Market

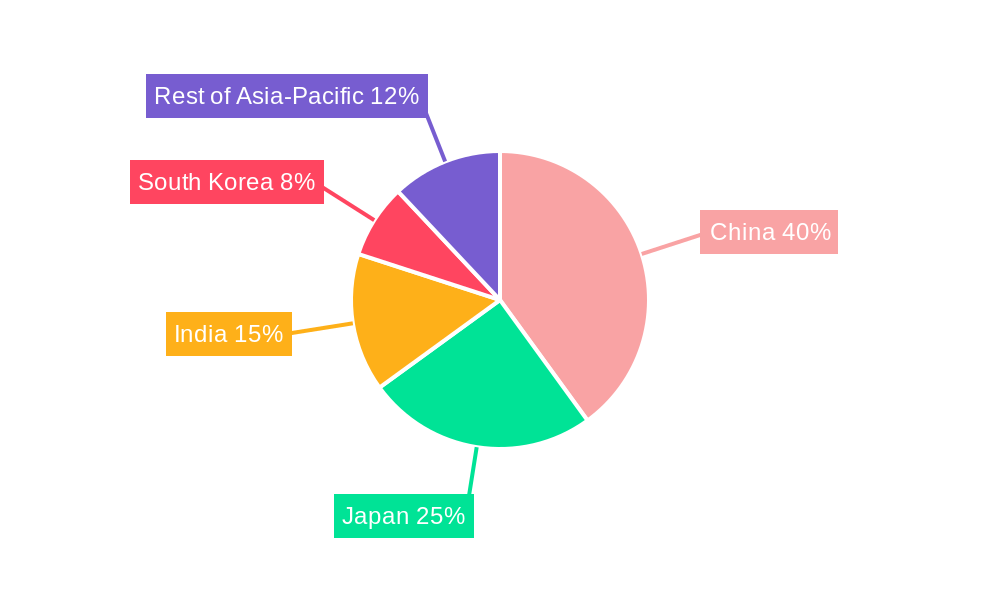

China remains the dominant market within the Asia-Pacific region, accounting for approximately xx% of the total market value in 2025. This dominance is driven by strong automotive production, supportive government policies, and a growing middle class. India is also experiencing rapid growth, although its market share is comparatively smaller.

Dominant Segments:

- Production Type: Resin Transfer Molding (RTM) holds a significant market share due to its cost-effectiveness and suitability for high-volume production.

- Material Type: Thermoset polymers dominate due to their high strength-to-weight ratio and relatively lower cost. However, Thermoplastic polymers are gaining traction due to their recyclability and ease of processing. Carbon fiber composites are experiencing growth driven by high-performance requirements in specific applications.

- Application Type: Structural assembly is the largest application segment, followed by powertrain components. Interior and exterior applications are also significant but with comparatively smaller market shares.

Key Drivers by Segment:

- China: Strong automotive manufacturing base, government support for the automotive industry, and expanding infrastructure.

- India: Rapid economic growth, increasing vehicle ownership, and government initiatives to promote domestic manufacturing.

- RTM: Cost-effectiveness, high-volume production capability, and good mechanical properties.

- Thermoset Polymers: High strength-to-weight ratio and relatively lower cost compared to other materials.

Asia-Pacific Automotive Composites Market Product Developments

Recent product innovations focus on enhancing the performance and cost-effectiveness of composite materials. This includes the development of lighter and stronger fibers, improved resin systems, and advanced manufacturing processes like automated fiber placement (AFP) and tape laying. These advancements enable the creation of complex parts with improved mechanical properties, leading to wider adoption across various automotive applications. The focus is on developing recyclable and sustainable composite materials to address environmental concerns. These developments are enhancing the competitive advantage of composite materials compared to traditional materials, leading to increased market penetration.

Key Drivers of Asia-Pacific Automotive Composites Market Growth

The Asia-Pacific automotive composites market's growth is driven by several interconnected factors: The increasing demand for lightweight vehicles to improve fuel efficiency is a major driver, complemented by stringent government regulations on emissions. Technological advancements in composite materials and manufacturing processes are reducing costs and improving performance. The rising adoption of electric vehicles (EVs) further fuels growth, as composites are crucial for optimizing battery range and vehicle weight. Furthermore, supportive government policies and investments in infrastructure in major markets like China and India are accelerating market expansion.

Challenges in the Asia-Pacific Automotive Composites Market Market

Despite the growth potential, challenges remain. High initial investment costs associated with composite material manufacturing can hinder adoption, especially among smaller players. Supply chain complexities and material sourcing issues can impact production timelines and costs. The competitive landscape, with both established players and emerging entrants, presents intense price pressure. Furthermore, overcoming consumer perceptions regarding the durability and repairability of composite materials remains a crucial task. These challenges are estimated to collectively impact the market growth by approximately xx% by 2033.

Emerging Opportunities in the Asia-Pacific Automotive Composites Market

Significant opportunities lie in developing sustainable and recyclable composite materials, addressing environmental concerns. Strategic partnerships between material suppliers, automotive manufacturers, and technology providers can accelerate innovation and market penetration. Expanding into new applications, such as battery casings and other EV-specific components, offers substantial growth potential. Investment in advanced manufacturing technologies and skilled workforce development will be critical for long-term success.

Leading Players in the Asia-Pacific Automotive Composites Market Sector

- Nippon Sheet Glass Co Ltd

- Teijin Limited

- Delphi

- Kineco

- BASF

- Caytec Industries Inc

- Gurit

- 3B-Fiberglass

- Johns Manville

- Base Group

Key Milestones in Asia-Pacific Automotive Composites Market Industry

- 2020: Introduction of a new recyclable thermoplastic composite material by [Company Name].

- 2021: Strategic partnership between [Company A] and [Company B] to develop advanced composite components for EVs.

- 2022: Acquisition of [Company X] by [Company Y] to expand market share in the region.

- 2023: Launch of a new automated fiber placement (AFP) facility in China by [Company Z].

- 2024: Introduction of stringent new emission regulations impacting composite material adoption.

Strategic Outlook for Asia-Pacific Automotive Composites Market Market

The Asia-Pacific automotive composites market presents significant long-term growth potential. Strategic investments in R&D, sustainable materials, and advanced manufacturing capabilities are crucial for success. Focusing on specific application segments, such as EVs and lightweight commercial vehicles, can drive profitability. Strategic partnerships and collaborations are key to leveraging technological advancements and navigating the complex regulatory landscape. The market is poised for considerable expansion, driven by technological progress, economic growth, and environmentally conscious initiatives.

Asia-Pacific Automotive Composites Market Segmentation

-

1. Production Type

- 1.1. Hand Layup

- 1.2. Resin Transfer Molding

- 1.3. Vaccum Infusion Processing

- 1.4. Compression Molding

-

2. Material Type

- 2.1. Thermoset Polymer

- 2.2. Thermoplastic Polymer

- 2.3. Carbon Fiber

- 2.4. Others

-

3. Application Type

- 3.1. Structural Assembly

- 3.2. Power Train Components

- 3.3. Interior

- 3.4. Exterior

- 3.5. Others

Asia-Pacific Automotive Composites Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asia-Pacific Automotive Composites Market Regional Market Share

Geographic Coverage of Asia-Pacific Automotive Composites Market

Asia-Pacific Automotive Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Commercial Vehicle Sales to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Interest Rates to Hamper the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Trend to Decrease weight Driving Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Automotive Composites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Type

- 5.1.1. Hand Layup

- 5.1.2. Resin Transfer Molding

- 5.1.3. Vaccum Infusion Processing

- 5.1.4. Compression Molding

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Thermoset Polymer

- 5.2.2. Thermoplastic Polymer

- 5.2.3. Carbon Fiber

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Structural Assembly

- 5.3.2. Power Train Components

- 5.3.3. Interior

- 5.3.4. Exterior

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Type

- 6. China Asia-Pacific Automotive Composites Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Type

- 6.1.1. Hand Layup

- 6.1.2. Resin Transfer Molding

- 6.1.3. Vaccum Infusion Processing

- 6.1.4. Compression Molding

- 6.2. Market Analysis, Insights and Forecast - by Material Type

- 6.2.1. Thermoset Polymer

- 6.2.2. Thermoplastic Polymer

- 6.2.3. Carbon Fiber

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Application Type

- 6.3.1. Structural Assembly

- 6.3.2. Power Train Components

- 6.3.3. Interior

- 6.3.4. Exterior

- 6.3.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Production Type

- 7. India Asia-Pacific Automotive Composites Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Type

- 7.1.1. Hand Layup

- 7.1.2. Resin Transfer Molding

- 7.1.3. Vaccum Infusion Processing

- 7.1.4. Compression Molding

- 7.2. Market Analysis, Insights and Forecast - by Material Type

- 7.2.1. Thermoset Polymer

- 7.2.2. Thermoplastic Polymer

- 7.2.3. Carbon Fiber

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Application Type

- 7.3.1. Structural Assembly

- 7.3.2. Power Train Components

- 7.3.3. Interior

- 7.3.4. Exterior

- 7.3.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Production Type

- 8. Japan Asia-Pacific Automotive Composites Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Type

- 8.1.1. Hand Layup

- 8.1.2. Resin Transfer Molding

- 8.1.3. Vaccum Infusion Processing

- 8.1.4. Compression Molding

- 8.2. Market Analysis, Insights and Forecast - by Material Type

- 8.2.1. Thermoset Polymer

- 8.2.2. Thermoplastic Polymer

- 8.2.3. Carbon Fiber

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Application Type

- 8.3.1. Structural Assembly

- 8.3.2. Power Train Components

- 8.3.3. Interior

- 8.3.4. Exterior

- 8.3.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Production Type

- 9. South Korea Asia-Pacific Automotive Composites Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Type

- 9.1.1. Hand Layup

- 9.1.2. Resin Transfer Molding

- 9.1.3. Vaccum Infusion Processing

- 9.1.4. Compression Molding

- 9.2. Market Analysis, Insights and Forecast - by Material Type

- 9.2.1. Thermoset Polymer

- 9.2.2. Thermoplastic Polymer

- 9.2.3. Carbon Fiber

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Application Type

- 9.3.1. Structural Assembly

- 9.3.2. Power Train Components

- 9.3.3. Interior

- 9.3.4. Exterior

- 9.3.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Production Type

- 10. Rest of Asia Pacific Asia-Pacific Automotive Composites Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Type

- 10.1.1. Hand Layup

- 10.1.2. Resin Transfer Molding

- 10.1.3. Vaccum Infusion Processing

- 10.1.4. Compression Molding

- 10.2. Market Analysis, Insights and Forecast - by Material Type

- 10.2.1. Thermoset Polymer

- 10.2.2. Thermoplastic Polymer

- 10.2.3. Carbon Fiber

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by Application Type

- 10.3.1. Structural Assembly

- 10.3.2. Power Train Components

- 10.3.3. Interior

- 10.3.4. Exterior

- 10.3.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Production Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nippon Sheet Glass Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Teijin Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Delphi

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kineco

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BASF

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Caytec Industries Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Gurit

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 3B-Fiberglass

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Johns Manville

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Base Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Nippon Sheet Glass Co Ltd

List of Figures

- Figure 1: Asia-Pacific Automotive Composites Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Automotive Composites Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Automotive Composites Market Revenue million Forecast, by Production Type 2020 & 2033

- Table 2: Asia-Pacific Automotive Composites Market Revenue million Forecast, by Material Type 2020 & 2033

- Table 3: Asia-Pacific Automotive Composites Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 4: Asia-Pacific Automotive Composites Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Automotive Composites Market Revenue million Forecast, by Production Type 2020 & 2033

- Table 6: Asia-Pacific Automotive Composites Market Revenue million Forecast, by Material Type 2020 & 2033

- Table 7: Asia-Pacific Automotive Composites Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 8: Asia-Pacific Automotive Composites Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: Asia-Pacific Automotive Composites Market Revenue million Forecast, by Production Type 2020 & 2033

- Table 10: Asia-Pacific Automotive Composites Market Revenue million Forecast, by Material Type 2020 & 2033

- Table 11: Asia-Pacific Automotive Composites Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 12: Asia-Pacific Automotive Composites Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Automotive Composites Market Revenue million Forecast, by Production Type 2020 & 2033

- Table 14: Asia-Pacific Automotive Composites Market Revenue million Forecast, by Material Type 2020 & 2033

- Table 15: Asia-Pacific Automotive Composites Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 16: Asia-Pacific Automotive Composites Market Revenue million Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Automotive Composites Market Revenue million Forecast, by Production Type 2020 & 2033

- Table 18: Asia-Pacific Automotive Composites Market Revenue million Forecast, by Material Type 2020 & 2033

- Table 19: Asia-Pacific Automotive Composites Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 20: Asia-Pacific Automotive Composites Market Revenue million Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Automotive Composites Market Revenue million Forecast, by Production Type 2020 & 2033

- Table 22: Asia-Pacific Automotive Composites Market Revenue million Forecast, by Material Type 2020 & 2033

- Table 23: Asia-Pacific Automotive Composites Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 24: Asia-Pacific Automotive Composites Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Automotive Composites Market?

The projected CAGR is approximately 11.6%.

2. Which companies are prominent players in the Asia-Pacific Automotive Composites Market?

Key companies in the market include Nippon Sheet Glass Co Ltd, Teijin Limited, Delphi, Kineco, BASF, Caytec Industries Inc, Gurit, 3B-Fiberglass, Johns Manville, Base Group.

3. What are the main segments of the Asia-Pacific Automotive Composites Market?

The market segments include Production Type, Material Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Commercial Vehicle Sales to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

Trend to Decrease weight Driving Growth.

7. Are there any restraints impacting market growth?

Fluctuations in Interest Rates to Hamper the Growth of the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Automotive Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Automotive Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Automotive Composites Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Automotive Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence