Key Insights

The ASEAN two-wheeler rental market, valued at $2.27 billion in 2024, is poised for significant expansion with a projected Compound Annual Growth Rate (CAGR) of 8% from 2024 to 2033. This growth is propelled by a confluence of factors including a flourishing tourism sector, particularly in Indonesia, Thailand, and Vietnam, driving demand for short-term scooter and moped rentals. Simultaneously, escalating urbanization and traffic congestion in key ASEAN cities are bolstering the adoption of convenient and cost-effective two-wheeler rental solutions for daily commuting, thereby increasing long-term rental demand. The rising popularity of motorcycle tourism and adventure travel further contributes to market expansion across diverse vehicle segments. The market is segmented by vehicle type (motorcycles, scooters/mopeds), rental duration (short-term, long-term), and application (tourism, daily commuting). Key industry players, including Kawasaki, Piaggio, Suzuki, Yamaha, Honda, Triumph, and BMW, are strategically investing in fleet expansion, technological advancements, and superior customer service to secure a competitive advantage.

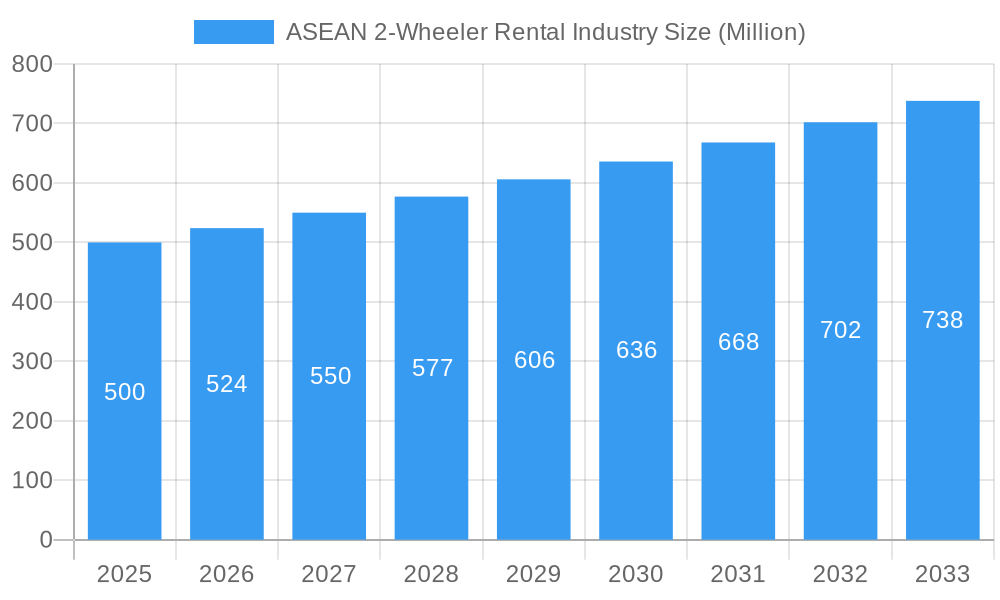

ASEAN 2-Wheeler Rental Industry Market Size (In Billion)

Despite the promising outlook, certain challenges persist. Volatile fuel prices can influence rental costs and overall demand. The highly competitive landscape, populated by both local and international operators, necessitates robust marketing initiatives and competitive pricing for sustained profitability. Additionally, varying regulatory frameworks and safety standards across ASEAN nations present operational complexities for rental providers. Nevertheless, the long-term market trajectory remains optimistic, underpinned by consistent economic development, rising disposable incomes, and an enduring preference for efficient and economical personal mobility solutions within the region. Indonesia is anticipated to retain its position as a leading market within ASEAN, owing to its substantial population and developing tourism infrastructure.

ASEAN 2-Wheeler Rental Industry Company Market Share

ASEAN 2-Wheeler Rental Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the ASEAN 2-wheeler rental market, offering invaluable insights for industry stakeholders, investors, and strategic planners. From market dynamics and competitive landscapes to emerging trends and future growth projections, this report unveils the key factors shaping this dynamic sector. The study covers the period from 2019 to 2033, with a focus on 2025 as the base and estimated year. The report utilizes robust data and forecasts to provide actionable intelligence, empowering informed decision-making. Key players like Kawasaki, Piaggio, Suzuki, Yamaha, Honda, Triumph, and BMW are analyzed, though the list is not exhaustive. The report segments the market by vehicle type (motorcycle, scooter/moped), rental duration (short-term, long-term), and application (tourism, daily commuting).

ASEAN 2-Wheeler Rental Industry Market Dynamics & Concentration

This section analyzes the ASEAN 2-wheeler rental market's concentration, identifying key players and their market share. We examine innovation drivers, regulatory frameworks, and the impact of substitute products. End-user trends, including shifting preferences and evolving demographics, are also explored, along with a detailed review of mergers and acquisitions (M&A) activities within the industry.

- Market Concentration: The ASEAN 2-wheeler rental market exhibits a [Level of Concentration: e.g., moderately concentrated] structure, with the top 5 players holding an estimated xx% market share in 2025. Smaller, regional players account for the remaining share.

- Innovation Drivers: Technological advancements in electric vehicles and connected mobility solutions are driving innovation, while evolving consumer preferences for convenience and sustainability are influencing product development.

- Regulatory Framework: Varying regulatory landscapes across ASEAN nations significantly impact market growth. Streamlined licensing and permitting processes can stimulate growth, while stringent regulations can create hurdles.

- Product Substitutes: Ride-hailing services and public transportation systems represent key substitutes, influencing consumer choices.

- End-User Trends: Growing urbanization, rising disposable incomes, and increasing tourism are key factors fueling demand for 2-wheeler rental services.

- M&A Activity: The past five years have witnessed [Number] M&A deals in the ASEAN 2-wheeler rental market, primarily driven by consolidation efforts and expansion strategies. These deals have led to [Impact of M&A on market concentration: e.g., increased market share for larger players].

ASEAN 2-Wheeler Rental Industry Industry Trends & Analysis

This section delves into the key trends shaping the ASEAN 2-wheeler rental industry. We examine market growth drivers, technological disruptions, evolving consumer preferences, and the competitive dynamics influencing market evolution. The analysis includes projected Compound Annual Growth Rate (CAGR) and market penetration rates.

The ASEAN 2-wheeler rental market is projected to experience significant growth, with a CAGR of xx% during the forecast period (2025-2033). Key growth drivers include [List Drivers e.g., rising tourism, increasing urbanization, growing popularity of short-term rentals, and government initiatives promoting sustainable transportation]. Technological disruptions, such as the integration of mobile apps for booking and GPS navigation, are enhancing customer experience and driving market penetration. Evolving consumer preferences toward convenience, affordability, and eco-friendly options further influence market dynamics. Intense competition among existing players and the entry of new market players are shaping the competitive landscape. Market penetration is expected to reach xx% by 2033.

Leading Markets & Segments in ASEAN 2-Wheeler Rental Industry

This section identifies the dominant regions, countries, and segments within the ASEAN 2-wheeler rental market. We analyze key drivers for dominance, such as economic policies, infrastructure development, and tourism patterns.

- Dominant Region/Country: [Dominant Region/Country: e.g., Thailand] is currently the leading market due to [Reasons: e.g., strong tourism sector, well-developed infrastructure, and favorable government policies].

- Dominant Vehicle Type: [Dominant Vehicle Type: e.g., Scooters/ Mopeds] represent the largest segment due to [Reasons: e.g., affordability, ease of use, and suitability for urban environments].

- Dominant Rental Duration: [Dominant Rental Duration: e.g., Short-term rentals] are currently the most popular, driven by [Reasons: e.g., tourist traffic and daily commuting needs].

- Dominant Application: [Dominant Application: e.g., Tourism] is a key driver of market demand, contributing significantly to revenue generation.

Key Drivers:

- Economic Policies: Government initiatives promoting tourism and sustainable transportation directly influence market growth.

- Infrastructure Development: Improved road networks and transportation infrastructure enhance the accessibility and convenience of 2-wheeler rentals.

- Tourism Growth: A thriving tourism sector significantly boosts demand for short-term rentals.

ASEAN 2-Wheeler Rental Industry Product Developments

Recent product innovations have focused on enhancing convenience and safety. Smart features like GPS tracking, mobile app integration for booking and payment, and improved security systems are becoming increasingly common. Electric scooters and motorcycles are gaining popularity, aligning with growing environmental concerns and government incentives. These new offerings are tailored to meet diverse customer needs, providing competitive advantages in a dynamic market.

Key Drivers of ASEAN 2-Wheeler Rental Industry Growth

Several factors contribute to the growth of the ASEAN 2-wheeler rental market. Technological advancements, such as the development of electric vehicles and improved booking systems, are enhancing convenience and sustainability. Favorable economic conditions, including rising disposable incomes and increased tourism, are stimulating demand. Supportive government policies promoting sustainable transportation further contribute to market expansion.

Challenges in the ASEAN 2-Wheeler Rental Industry Market

The ASEAN 2-wheeler rental market faces several challenges. Regulatory hurdles, such as varying licensing requirements across different countries, create operational complexities. Supply chain disruptions can impact the availability of vehicles and parts. Intense competition, including the emergence of new players and the expansion of existing ones, puts pressure on pricing and profitability. These factors collectively impact market expansion and growth rates.

Emerging Opportunities in ASEAN 2-Wheeler Rental Industry

The ASEAN 2-wheeler rental market presents significant long-term growth opportunities. Technological advancements, such as the development of autonomous vehicles and advanced safety features, will further enhance the appeal of rental services. Strategic partnerships with hotels, tour operators, and transportation companies can expand market reach and diversify revenue streams. Market expansion into less-penetrated regions within ASEAN will offer substantial growth potential.

Key Milestones in ASEAN 2-Wheeler Rental Industry Industry

- 2020: [Milestone: e.g., Launch of a major ride-sharing platform integrating 2-wheeler rentals].

- 2022: [Milestone: e.g., Introduction of government subsidies for electric 2-wheeler rentals in [Country]].

- 2023: [Milestone: e.g., Acquisition of a major rental company by a larger multinational].

- 2024: [Milestone: e.g., Significant expansion of a major player into a new ASEAN country].

Strategic Outlook for ASEAN 2-Wheeler Rental Industry Market

The ASEAN 2-wheeler rental market holds significant future potential, driven by sustained economic growth, urbanization, and technological advancements. Strategic opportunities include expanding into underserved markets, developing innovative rental models, leveraging technology for improved operational efficiency, and focusing on sustainable and eco-friendly options. Companies that adapt to evolving consumer preferences and effectively navigate regulatory landscapes are poised for significant growth in the years to come.

ASEAN 2-Wheeler Rental Industry Segmentation

-

1. Vehicle Type

- 1.1. Motorcycle

- 1.2. Scooter/Moped

-

2. Rental Duration Type

- 2.1. Short term

- 2.2. Long Term

-

3. Application Type

- 3.1. Tourism

- 3.2. Daily Commuting

-

4. Geography

-

4.1. ASEAN

- 4.1.1. Indonesia

- 4.1.2. Malaysia

- 4.1.3. Singapore

- 4.1.4. Philippines

- 4.1.5. Rest of ASEAN

-

4.1. ASEAN

ASEAN 2-Wheeler Rental Industry Segmentation By Geography

-

1. ASEAN

- 1.1. Indonesia

- 1.2. Malaysia

- 1.3. Singapore

- 1.4. Philippines

- 1.5. Rest of ASEAN

ASEAN 2-Wheeler Rental Industry Regional Market Share

Geographic Coverage of ASEAN 2-Wheeler Rental Industry

ASEAN 2-Wheeler Rental Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Lightweight and Energy-efficient Automotive Components to Foster the Growth of the Target Market

- 3.3. Market Restrains

- 3.3.1. High Manufacturing and Processing Cost of Composites

- 3.4. Market Trends

- 3.4.1. Technological Advancements and Traffic Congestion Are Driving the Growth For 2-Wheeler Rental Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN 2-Wheeler Rental Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Motorcycle

- 5.1.2. Scooter/Moped

- 5.2. Market Analysis, Insights and Forecast - by Rental Duration Type

- 5.2.1. Short term

- 5.2.2. Long Term

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Tourism

- 5.3.2. Daily Commuting

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. ASEAN

- 5.4.1.1. Indonesia

- 5.4.1.2. Malaysia

- 5.4.1.3. Singapore

- 5.4.1.4. Philippines

- 5.4.1.5. Rest of ASEAN

- 5.4.1. ASEAN

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. ASEAN

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kawasaki

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Piaggio

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Suzuki

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Yamaha

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Honda

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Triumph

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BMW*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Kawasaki

List of Figures

- Figure 1: Global ASEAN 2-Wheeler Rental Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: ASEAN ASEAN 2-Wheeler Rental Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 3: ASEAN ASEAN 2-Wheeler Rental Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: ASEAN ASEAN 2-Wheeler Rental Industry Revenue (billion), by Rental Duration Type 2025 & 2033

- Figure 5: ASEAN ASEAN 2-Wheeler Rental Industry Revenue Share (%), by Rental Duration Type 2025 & 2033

- Figure 6: ASEAN ASEAN 2-Wheeler Rental Industry Revenue (billion), by Application Type 2025 & 2033

- Figure 7: ASEAN ASEAN 2-Wheeler Rental Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 8: ASEAN ASEAN 2-Wheeler Rental Industry Revenue (billion), by Geography 2025 & 2033

- Figure 9: ASEAN ASEAN 2-Wheeler Rental Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 10: ASEAN ASEAN 2-Wheeler Rental Industry Revenue (billion), by Country 2025 & 2033

- Figure 11: ASEAN ASEAN 2-Wheeler Rental Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Rental Duration Type 2020 & 2033

- Table 3: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 4: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 7: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Rental Duration Type 2020 & 2033

- Table 8: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 9: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Global ASEAN 2-Wheeler Rental Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Indonesia ASEAN 2-Wheeler Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Malaysia ASEAN 2-Wheeler Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Singapore ASEAN 2-Wheeler Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Philippines ASEAN 2-Wheeler Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of ASEAN ASEAN 2-Wheeler Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN 2-Wheeler Rental Industry?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the ASEAN 2-Wheeler Rental Industry?

Key companies in the market include Kawasaki, Piaggio, Suzuki, Yamaha, Honda, Triumph, BMW*List Not Exhaustive.

3. What are the main segments of the ASEAN 2-Wheeler Rental Industry?

The market segments include Vehicle Type, Rental Duration Type, Application Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.27 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Lightweight and Energy-efficient Automotive Components to Foster the Growth of the Target Market.

6. What are the notable trends driving market growth?

Technological Advancements and Traffic Congestion Are Driving the Growth For 2-Wheeler Rental Market.

7. Are there any restraints impacting market growth?

High Manufacturing and Processing Cost of Composites.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN 2-Wheeler Rental Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN 2-Wheeler Rental Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN 2-Wheeler Rental Industry?

To stay informed about further developments, trends, and reports in the ASEAN 2-Wheeler Rental Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence