Key Insights

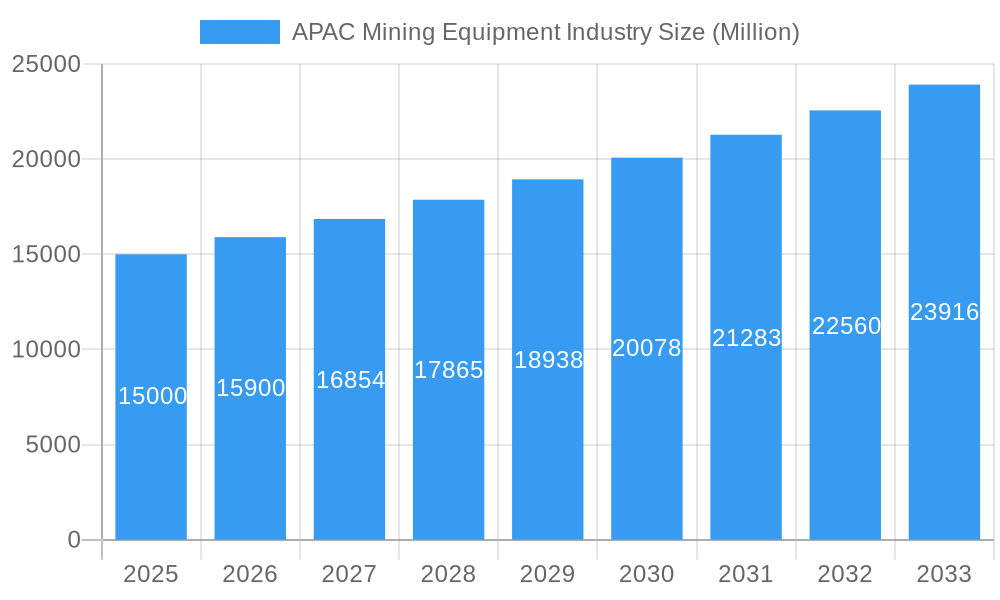

The Asia-Pacific (APAC) mining equipment market is experiencing substantial growth, propelled by escalating mining operations across key nations including China, India, and Australia. The market, valued at $88.2 billion in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 6.8% from 2025 to 2033. This expansion is driven by several critical factors. Firstly, the escalating demand for essential raw materials like minerals and metals, crucial for infrastructure development and industrialization throughout APAC, significantly fuels market growth. Secondly, advancements in mining equipment technology, particularly the integration of autonomous vehicles and enhanced automation, are boosting productivity and operational efficiency, further stimulating market expansion. Lastly, government-backed initiatives focused on modernizing mining practices and promoting sustainability are fostering a conducive environment for growth. Market segmentation highlights a clear preference for Li-ion batteries over lead-acid batteries in passenger vehicles, aligning with the global trend towards electrification and sustainability in the mining sector. Leading companies such as Northern Heavy Industries Group, Liebherr, JCB, Hitachi, Metso, Caterpillar, Sany, Tata Motors, and AB Volvo are actively engaged in this competitive landscape, driving innovation and diversifying product offerings to meet evolving industry demands.

APAC Mining Equipment Industry Market Size (In Billion)

The prominent presence of major industry participants underscores a highly competitive environment, driving both innovation and cost-effectiveness. Despite facing challenges such as volatile commodity prices and stringent environmental regulations, the market's long-term trajectory remains optimistic. The increasing emphasis on sustainable mining practices presents significant opportunities for companies providing eco-friendly equipment and technologies. Growth within specific segments, notably passenger vehicles and Li-ion battery-powered equipment, is particularly notable, signaling a transition towards cleaner and more efficient mining operations. Regional growth disparities are anticipated, with India and China expected to lead due to their extensive mining activities and supportive government policies. Japan and South Korea are projected to contribute moderately to overall market expansion. The sustained growth of mining activities and technological innovation will continue to be the primary catalysts for market growth throughout the forecast period.

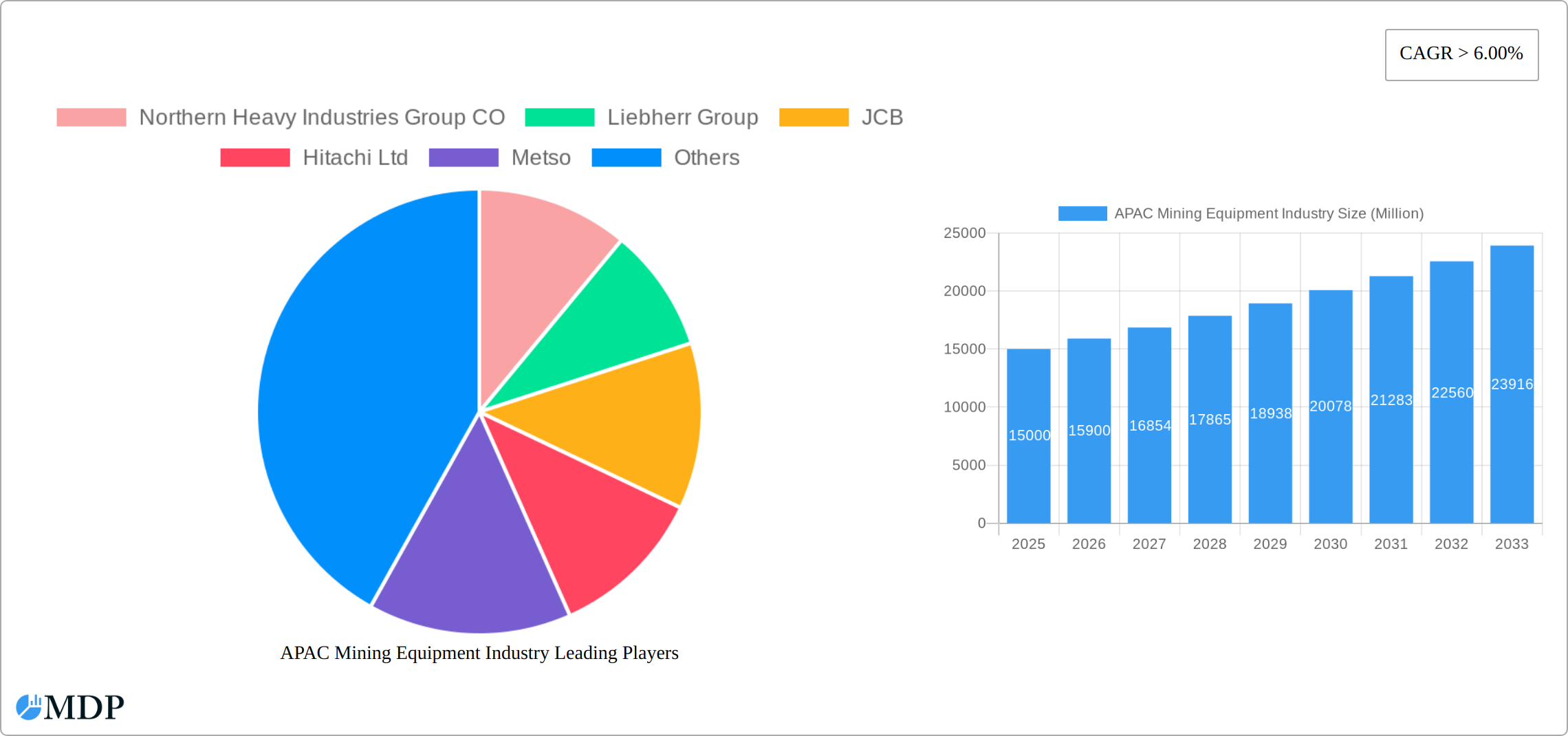

APAC Mining Equipment Industry Company Market Share

Unlock Explosive Growth: The Definitive APAC Mining Equipment Industry Report (2019-2033)

This comprehensive report delivers unparalleled insights into the dynamic APAC mining equipment market, providing a crucial roadmap for businesses navigating this high-growth sector. From market sizing and segmentation to competitive landscapes and future projections, this in-depth analysis is essential for strategic decision-making. With a detailed study period spanning 2019-2033 (Base Year: 2025, Estimated Year: 2025, Forecast Period: 2025-2033, Historical Period: 2019-2024), this report empowers you to anticipate market shifts and capitalize on emerging opportunities. The market is projected to reach xx Million by 2033.

APAC Mining Equipment Industry Market Dynamics & Concentration

This section analyzes the competitive intensity of the APAC mining equipment market, identifying key players and their strategies. We delve into innovation drivers, regulatory landscapes, substitute products, end-user trends, and mergers & acquisitions (M&A) activities.

- Market Concentration: The APAC mining equipment market exhibits a moderately concentrated landscape, with the top five players holding an estimated xx% market share in 2025. This share is projected to xx% by 2033.

- Innovation Drivers: Technological advancements in automation, electrification, and digitalization are driving significant innovation. The increasing demand for sustainable mining practices further fuels this trend.

- Regulatory Frameworks: Stringent environmental regulations and safety standards are shaping industry practices and influencing product development. Governments across APAC are investing heavily in infrastructure development, creating opportunities for mining equipment manufacturers.

- Product Substitutes: The emergence of alternative technologies and materials presents both opportunities and challenges for traditional mining equipment manufacturers. The report details the competitive pressures from emerging substitutes and their market penetration.

- End-User Trends: The increasing adoption of large-scale mining operations and the growing demand for efficient and productive equipment are driving market growth. The report provides a detailed analysis of end-user preferences.

- M&A Activities: The report documents xx M&A deals in the APAC mining equipment sector between 2019 and 2024. Consolidation is expected to continue, driven by the need for scale and technological capabilities.

APAC Mining Equipment Industry Industry Trends & Analysis

This section provides a comprehensive overview of the key trends shaping the APAC mining equipment industry. We analyze market growth drivers, technological disruptions, consumer preferences, and competitive dynamics, providing insights into future market potential.

The APAC mining equipment market is experiencing robust growth, driven by factors including rising infrastructure development, increasing urbanization, and growing industrialization across the region. Technological advancements, such as the adoption of autonomous vehicles and improved safety features, are transforming the industry. The market's Compound Annual Growth Rate (CAGR) is estimated at xx% during the forecast period (2025-2033). Market penetration of advanced technologies like AI-powered equipment is projected to reach xx% by 2033. The evolving consumer preferences toward environmentally friendly and energy-efficient equipment are also shaping market dynamics. Intense competition amongst established players and new entrants adds to the dynamism of the market, compelling continuous innovation and improvements in efficiency.

Leading Markets & Segments in APAC Mining Equipment Industry

This section identifies the dominant regions, countries, and segments within the APAC mining equipment market, focusing on vehicle types (Passenger Vehicles, Commercial Vehicles) and battery types (Li-ion, Lead Acid).

Dominant Region/Country: China is projected to be the leading market throughout the forecast period, driven by its extensive mining operations and robust infrastructure development. Australia and India also represent significant growth opportunities.

Dominant Vehicle Type: Commercial vehicles dominate the market due to the high demand for heavy-duty equipment in mining operations. Passenger vehicle adoption in mining sectors remains relatively niche.

Dominant Battery Type: Li-ion batteries are gaining traction, driven by their higher energy density and longer lifespan. However, lead-acid batteries still hold a significant market share due to their lower cost.

Key Drivers:

- Economic Policies: Government initiatives promoting infrastructure development and industrial growth significantly impact market demand.

- Infrastructure Development: The expansion of mining operations and related infrastructure projects drives the demand for mining equipment.

- Technological Advancements: The adoption of advanced technologies, such as automation and electric vehicles, is transforming the market.

APAC Mining Equipment Industry Product Developments

The APAC mining equipment market is witnessing significant product innovations, focusing on enhanced efficiency, safety, and sustainability. Manufacturers are integrating advanced technologies like AI, IoT, and automation to optimize operations and reduce environmental impact. These innovations aim to improve fuel efficiency, reduce emissions, and enhance operator safety, addressing key market needs and providing a competitive edge. New applications are emerging in areas such as underground mining and autonomous hauling.

Key Drivers of APAC Mining Equipment Industry Growth

The APAC mining equipment industry is experiencing robust growth propelled by a confluence of influential factors:

- Technological Advancements: The integration of cutting-edge technologies such as automation, electrification, and comprehensive digitalization is revolutionizing mining operations. These innovations are significantly boosting operational efficiency, enhancing productivity, and enabling safer working environments. Advanced AI-powered predictive maintenance systems and IoT-enabled fleet management are also becoming increasingly prevalent.

- Economic Growth and Infrastructure Development: The burgeoning economies across the APAC region, coupled with substantial investments in infrastructure development and ongoing industrialization, are creating a consistent and escalating demand for mining equipment. The need to extract raw materials for construction, manufacturing, and energy sectors underpins this growth.

- Regulatory Support and Sustainability Push: Governments in many APAC nations are actively promoting sustainable and responsible mining practices. This regulatory landscape encourages the adoption of advanced equipment that minimizes environmental impact, improves safety, and adheres to stricter operational standards, thereby creating lucrative opportunities for manufacturers of eco-friendly and technologically superior solutions.

Challenges in the APAC Mining Equipment Industry Market

Despite the promising outlook, the APAC mining equipment industry navigates a landscape marked by several significant challenges:

- Stringent Regulatory Frameworks and Compliance Costs: The implementation of increasingly rigorous environmental regulations and stringent safety standards, while crucial for responsible mining, can lead to substantial compliance costs for equipment manufacturers and operators. These regulations often necessitate investments in new technologies and processes, potentially impacting profitability. The impact of these regulations leads to an estimated [Insert Specific Figure Here, e.g., $500] Million annual loss for the industry due to adaptation and retrofitting costs.

- Global Supply Chain Volatility: The industry remains susceptible to disruptions within global supply chains, impacting the availability of raw materials, components, and finished products. Geopolitical events, trade disputes, and logistical bottlenecks can significantly affect production schedules and delivery timelines, leading to extended lead times and increased costs. This has resulted in an average [Insert Specific Figure Here, e.g., 15]% increase in production costs.

- Intensifying Competitive Landscape: The APAC market is characterized by intense competition, with both established global players and agile emerging companies vying for market share. This dynamic environment necessitates continuous innovation, aggressive pricing strategies, and a strong focus on customer service to maintain a competitive edge.

Emerging Opportunities in APAC Mining Equipment Industry

The APAC mining equipment market is ripe with emerging opportunities that promise substantial long-term growth:

The global shift towards sustainable and green mining practices is a primary catalyst, opening up significant avenues for manufacturers specializing in electric-powered vehicles, autonomous drilling systems, and advanced material handling equipment designed for minimal environmental footprint. Furthermore, strategic alliances and collaborative ventures are fostering the acceleration of technological innovation and facilitating market penetration into new and untapped regions within APAC. The exploration and development of previously inaccessible mineral reserves, coupled with the adoption of novel and more efficient extraction methodologies, further bolster the industry's growth trajectory and unlock new revenue streams.

Leading Players in the APAC Mining Equipment Industry Sector

Key Milestones in APAC Mining Equipment Industry Industry

- 2020: Introduction of the first fully autonomous mining truck in Australia.

- 2022: Major investment by several governments in developing electric mining equipment infrastructure.

- 2023: Several significant mergers and acquisitions among major industry players.

Strategic Outlook for APAC Mining Equipment Industry Market

The APAC mining equipment market is confidently charting a course towards sustained and accelerated growth. This upward trajectory is underpinned by the continued integration of advanced technologies, substantial investments in critical infrastructure projects across the region, and a pervasive demand for mining solutions that champion environmental sustainability. To thrive in this dynamic and evolving market, companies must prioritize strategic collaborations, robust investment in research and development, and a steadfast commitment to developing and deploying efficient, eco-conscious technologies. The long-term potential within this sector is immense, presenting significant and rewarding opportunities for both seasoned industry veterans and innovative new entrants alike.

APAC Mining Equipment Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Vehicles

- 1.2. Commercial Vehicles

-

2. Battery Type

- 2.1. Li-ion

- 2.2. Lead Acid

-

3. Geography

-

3.1. Asia Pacific

- 3.1.1. India

- 3.1.2. China

- 3.1.3. Japan

- 3.1.4. South Korea

- 3.1.5. Rest of Asia-Pacific

-

3.1. Asia Pacific

APAC Mining Equipment Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. India

- 1.2. China

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

APAC Mining Equipment Industry Regional Market Share

Geographic Coverage of APAC Mining Equipment Industry

APAC Mining Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing infrastructural development Across the Region

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruption of Raw Materials Could be a Challenge; High Initial Cost Related to the Purchase of Raw Materials is a Challenge

- 3.4. Market Trends

- 3.4.1. Increase in number of Mineral Exploration Sites

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. APAC Mining Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Vehicles

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Battery Type

- 5.2.1. Li-ion

- 5.2.2. Lead Acid

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Asia Pacific

- 5.3.1.1. India

- 5.3.1.2. China

- 5.3.1.3. Japan

- 5.3.1.4. South Korea

- 5.3.1.5. Rest of Asia-Pacific

- 5.3.1. Asia Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Northern Heavy Industries Group CO

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Liebherr Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 JCB

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hitachi Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Metso

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Caterpillar Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sany Heavy Equipment International Holdings

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tata Motor

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AB Volvo

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Northern Heavy Industries Group CO

List of Figures

- Figure 1: APAC Mining Equipment Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: APAC Mining Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: APAC Mining Equipment Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: APAC Mining Equipment Industry Revenue billion Forecast, by Battery Type 2020 & 2033

- Table 3: APAC Mining Equipment Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: APAC Mining Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: APAC Mining Equipment Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: APAC Mining Equipment Industry Revenue billion Forecast, by Battery Type 2020 & 2033

- Table 7: APAC Mining Equipment Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: APAC Mining Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: India APAC Mining Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: China APAC Mining Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Japan APAC Mining Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: South Korea APAC Mining Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific APAC Mining Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Mining Equipment Industry?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the APAC Mining Equipment Industry?

Key companies in the market include Northern Heavy Industries Group CO, Liebherr Group, JCB, Hitachi Ltd, Metso, Caterpillar Inc, Sany Heavy Equipment International Holdings, Tata Motor, AB Volvo.

3. What are the main segments of the APAC Mining Equipment Industry?

The market segments include Vehicle Type, Battery Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 88.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing infrastructural development Across the Region.

6. What are the notable trends driving market growth?

Increase in number of Mineral Exploration Sites.

7. Are there any restraints impacting market growth?

Supply Chain Disruption of Raw Materials Could be a Challenge; High Initial Cost Related to the Purchase of Raw Materials is a Challenge.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Mining Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Mining Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Mining Equipment Industry?

To stay informed about further developments, trends, and reports in the APAC Mining Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence