Key Insights

The automotive 3D printing market is poised for significant expansion, projected to reach $5.93 billion by 2025, driven by a robust CAGR of 14.8%. This growth is propelled by the increasing demand for lightweight, high-strength components and the advantages additive manufacturing offers in producing complex, customized parts. Advancements in materials, particularly polymers and metals, further broaden the application scope. The market encompasses diverse materials (metal, polymer, ceramic), applications (production, prototyping), technologies (SLS, SLA, FDM, SLM), and components (hardware, software, services). Leading innovators like 3D Systems, Stratasys, and EOS are shaping this dynamic landscape.

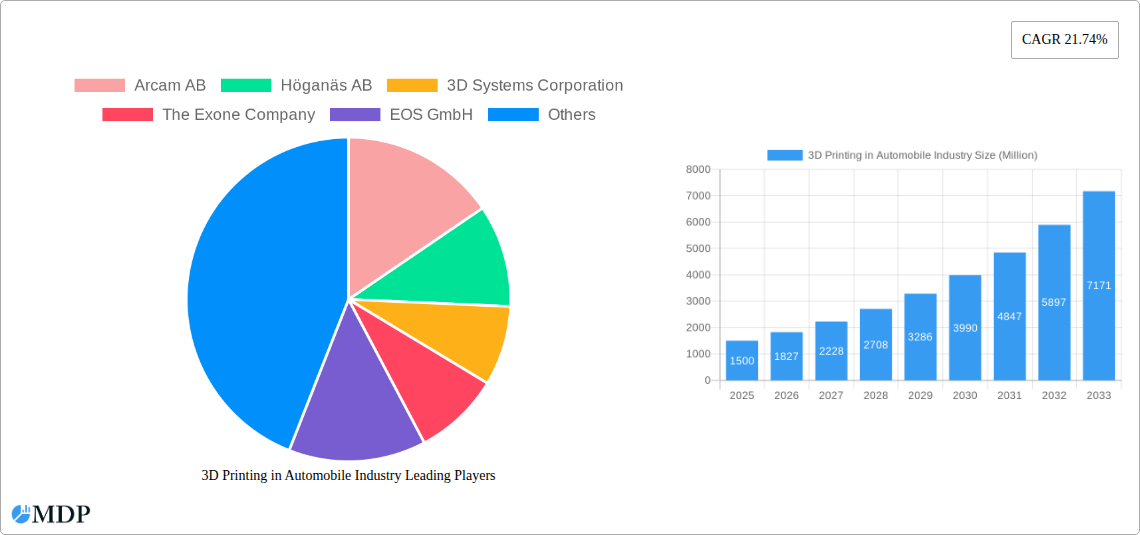

3D Printing in Automobile Industry Market Size (In Billion)

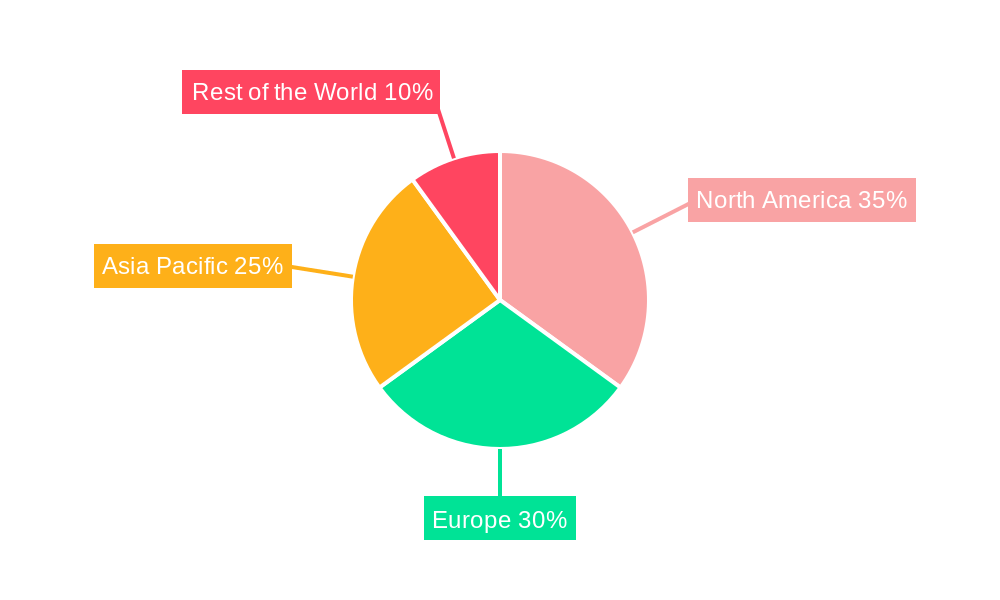

Geographically, North America retains a strong presence due to its mature automotive sector and advanced manufacturing. However, the Asia-Pacific region, led by China and India, is experiencing accelerated growth driven by rising automotive production and supportive government policies. Europe also commands a substantial share, influenced by major automotive manufacturers and a commitment to sustainable practices. The forecast period (2025-2033) anticipates sustained expansion fueled by manufacturing automation, the rise of electric vehicles, and the growing demand for personalized automotive components. This burgeoning market presents substantial opportunities for innovation and growth.

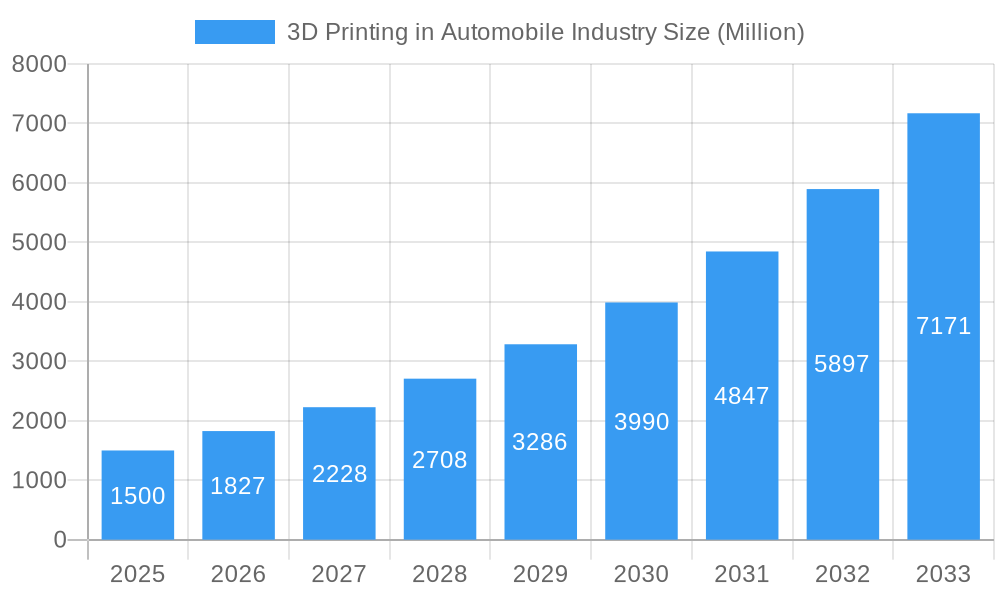

3D Printing in Automobile Industry Company Market Share

3D Printing in the Automobile Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the 3D printing market within the automotive industry, covering market dynamics, leading players, technological advancements, and future growth prospects. The report uses a study period of 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. Key industry players such as Arcam AB, Höganäs AB, 3D Systems Corporation, The ExOne Company, EOS GmbH, Voxeljet AG, Materialise NV, Moog Inc., Ultimaker BV, Stratasys Ltd., and Envisiontec GmbH are analyzed in detail. The report segments the market by material type (metal, polymer, ceramic), application type (production, prototyping/R&D), technology type (SLS, SLA, DLP, EBM, SLM, FDM), and component type (hardware, software, services). The report projects a xx Million USD market value by 2033.

3D Printing in Automobile Industry Market Dynamics & Concentration

The automotive 3D printing market is experiencing significant growth, driven by increasing demand for lightweight vehicles, customized parts, and faster prototyping cycles. Market concentration is moderate, with several key players holding substantial market share, but also a significant number of smaller companies contributing to innovation. The market share of the top 5 players is estimated to be xx% in 2025.

- Innovation Drivers: Advancements in additive manufacturing technologies, such as improved material properties and faster printing speeds, are driving market expansion. The development of new materials specifically tailored for automotive applications (e.g., high-strength polymers and lightweight metals) is another key driver.

- Regulatory Frameworks: Government regulations promoting sustainable manufacturing and reducing vehicle emissions are indirectly supporting the adoption of 3D printing for lighter and more efficient car parts.

- Product Substitutes: Traditional manufacturing processes remain competitive, but 3D printing offers advantages in terms of customization, speed, and reduced material waste. The cost-effectiveness of 3D printing is steadily improving, making it a more viable alternative.

- End-User Trends: Automakers are increasingly adopting 3D printing for both prototyping and production, driven by the need for faster product development cycles and customized vehicle components.

- M&A Activities: The automotive 3D printing sector has seen considerable merger and acquisition activity in recent years, as evidenced by xx major deals in the last five years (e.g., Stratasys' acquisition of Covestro's additive materials business). This consolidation reflects the increasing strategic importance of additive manufacturing.

3D Printing in Automobile Industry Industry Trends & Analysis

The 3D printing market in the automotive industry is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This growth is fueled by several factors: the rising demand for lightweight vehicles to improve fuel efficiency, the increasing need for customized components to enhance vehicle performance and personalization, and the accelerated adoption of additive manufacturing for rapid prototyping and tooling. Market penetration is also on the rise, as more automotive manufacturers integrate 3D printing into their production processes. Technological disruptions are accelerating this growth, with the emergence of new technologies and materials constantly pushing the boundaries of what's possible in automotive 3D printing. This trend is further augmented by changing consumer preferences towards more personalized and sustainable vehicles, creating a strong impetus for manufacturers to adopt flexible and efficient manufacturing solutions such as 3D printing. The competitive landscape is also dynamic, with both established players and new entrants vying for market share, leading to innovation and price competition that further fuels market growth.

Leading Markets & Segments in 3D Printing in Automobile Industry

Dominant Region: The North American market is currently the leading region, driven by strong automotive manufacturing activity and early adoption of 3D printing technologies. Europe follows closely, showing a rapid growth trajectory. Asia Pacific is also expected to experience considerable growth in the coming years.

Dominant Segment:

- By Material Type: Metal is currently the dominant material type, due to its suitability for high-strength components. However, polymer usage is expected to grow significantly due to its versatility and cost-effectiveness. Ceramic's niche applications are steadily increasing as well.

- By Application Type: Prototyping and R&D are currently the major application segments, but the production segment is growing rapidly as the technology matures and becomes more cost-effective.

- By Technology Type: Selective Laser Melting (SLM) and Selective Laser Sintering (SLS) are currently the most widely adopted technologies, offering high precision and quality. However, Fused Deposition Modeling (FDM) is gaining traction due to its relative affordability.

- By Component Type: Hardware currently holds the largest market share, followed by software and services. The software segment is showing significant growth potential as manufacturers seek advanced design and simulation tools.

Key Drivers:

- Economic Policies: Government incentives and subsidies for the adoption of advanced manufacturing technologies are driving growth, particularly in regions like Europe and Asia.

- Infrastructure: Improvements in infrastructure, including access to high-speed internet and reliable power grids, are essential for the widespread adoption of 3D printing.

3D Printing in Automobile Industry Product Developments

Recent product developments include the introduction of new materials with enhanced mechanical properties, higher-speed printing technologies, and advanced software solutions for design optimization and production management. These innovations are improving the efficiency, precision, and cost-effectiveness of 3D printing in automotive applications, leading to greater market acceptance. The convergence of AI and 3D printing is also poised to revolutionize the sector, enabling automated design optimization and improved production workflows. This will enable customized part production at scale, opening up new opportunities for automotive manufacturers.

Key Drivers of 3D Printing in Automobile Industry Growth

The growth of 3D printing in the automotive sector is driven by several key factors:

- Technological Advancements: Improvements in printing speed, material properties, and software solutions are making 3D printing a more viable option for mass production.

- Economic Factors: The cost-effectiveness of 3D printing is improving, making it increasingly competitive with traditional manufacturing methods.

- Regulatory Pressures: Government regulations promoting sustainable manufacturing are encouraging the adoption of 3D printing for its reduced material waste and energy consumption.

Challenges in the 3D Printing in Automobile Industry Market

Several challenges hinder market growth:

- High initial investment costs: The initial investment in 3D printing equipment can be substantial, particularly for high-volume production.

- Limited material choices: The range of materials suitable for automotive applications is still relatively limited.

- Supply chain disruptions: The global supply chain for 3D printing materials and equipment can be prone to disruptions.

Emerging Opportunities in 3D Printing in Automobile Industry

The long-term growth of 3D printing in the automotive industry is promising. Technological breakthroughs, such as the development of new, high-performance materials and the integration of AI, will significantly improve efficiency and reduce costs. Strategic partnerships between automotive manufacturers and 3D printing technology providers will further enhance the adoption of this technology. Market expansion into new geographic regions, especially in developing countries, will create additional opportunities for growth.

Leading Players in the 3D Printing in Automobile Industry Sector

- Arcam AB

- Höganäs AB

- 3D Systems Corporation

- The ExOne Company

- EOS GmbH

- Voxeljet AG

- Materialise NV

- Moog Inc

- Ultimaker BV

- Stratasys Ltd

- Envisiontec GmbH

Key Milestones in 3D Printing in Automobile Industry Industry

- November 2022: Desktop Metal secures a USD 9 million order for binder jet additive manufacturing systems from a major German automaker for mass production of powertrain components. This highlights the increasing adoption of 3D printing for high-volume production.

- November 2022: 3D Systems and ALM partner to expand access to industry-leading 3D printing materials, expanding material options for SLS technologies.

- September 2022: Stratasys completes the merger of MakerBot and Ultimaker, creating a stronger player in the desktop 3D printing market.

- September 2022: Materialise acquires Identify3D, enhancing the security of its additive manufacturing platform.

- August 2022: Stratasys acquires Covestro AG's additive materials business, strengthening its materials portfolio.

- August 2022: Voxeljet AG completes a sale-leaseback agreement, generating USD 26.78 million in gross proceeds.

Strategic Outlook for 3D Printing in Automobile Industry Market

The future of 3D printing in the automotive industry is bright. Continued technological innovation, strategic partnerships, and increasing demand for lightweight, customized vehicles will drive significant growth in the coming years. The market offers substantial opportunities for companies that can effectively leverage the advantages of 3D printing to improve efficiency, reduce costs, and enhance product development cycles. The integration of AI and automation within the 3D printing workflow will further fuel market growth, enabling mass customization and efficient production processes on a scale previously unimaginable.

3D Printing in Automobile Industry Segmentation

-

1. Technology Type

- 1.1. Selective Laser Sintering (SLS)

- 1.2. Stereo Lithography (SLA)

- 1.3. Digital Light Processing (DLP)

- 1.4. Electronic Beam Melting (EBM)

- 1.5. Selective Laser Melting (SLM)

- 1.6. Fused Deposition Modeling (FDM)

-

2. Component Type

- 2.1. Hardware

- 2.2. Software

- 2.3. Service

-

3. Material Type

- 3.1. Metal

- 3.2. Polymer

- 3.3. Ceramic

-

4. Application Type

- 4.1. Production

- 4.2. Prototyping/R&D

3D Printing in Automobile Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Other Countries

3D Printing in Automobile Industry Regional Market Share

Geographic Coverage of 3D Printing in Automobile Industry

3D Printing in Automobile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasingly Focused On Lightweighting Vehicles

- 3.3. Market Restrains

- 3.3.1. High Production Cost

- 3.4. Market Trends

- 3.4.1. Growing Adoption of Fused Deposition Modeling Technology

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global 3D Printing in Automobile Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology Type

- 5.1.1. Selective Laser Sintering (SLS)

- 5.1.2. Stereo Lithography (SLA)

- 5.1.3. Digital Light Processing (DLP)

- 5.1.4. Electronic Beam Melting (EBM)

- 5.1.5. Selective Laser Melting (SLM)

- 5.1.6. Fused Deposition Modeling (FDM)

- 5.2. Market Analysis, Insights and Forecast - by Component Type

- 5.2.1. Hardware

- 5.2.2. Software

- 5.2.3. Service

- 5.3. Market Analysis, Insights and Forecast - by Material Type

- 5.3.1. Metal

- 5.3.2. Polymer

- 5.3.3. Ceramic

- 5.4. Market Analysis, Insights and Forecast - by Application Type

- 5.4.1. Production

- 5.4.2. Prototyping/R&D

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Technology Type

- 6. North America 3D Printing in Automobile Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology Type

- 6.1.1. Selective Laser Sintering (SLS)

- 6.1.2. Stereo Lithography (SLA)

- 6.1.3. Digital Light Processing (DLP)

- 6.1.4. Electronic Beam Melting (EBM)

- 6.1.5. Selective Laser Melting (SLM)

- 6.1.6. Fused Deposition Modeling (FDM)

- 6.2. Market Analysis, Insights and Forecast - by Component Type

- 6.2.1. Hardware

- 6.2.2. Software

- 6.2.3. Service

- 6.3. Market Analysis, Insights and Forecast - by Material Type

- 6.3.1. Metal

- 6.3.2. Polymer

- 6.3.3. Ceramic

- 6.4. Market Analysis, Insights and Forecast - by Application Type

- 6.4.1. Production

- 6.4.2. Prototyping/R&D

- 6.1. Market Analysis, Insights and Forecast - by Technology Type

- 7. Europe 3D Printing in Automobile Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology Type

- 7.1.1. Selective Laser Sintering (SLS)

- 7.1.2. Stereo Lithography (SLA)

- 7.1.3. Digital Light Processing (DLP)

- 7.1.4. Electronic Beam Melting (EBM)

- 7.1.5. Selective Laser Melting (SLM)

- 7.1.6. Fused Deposition Modeling (FDM)

- 7.2. Market Analysis, Insights and Forecast - by Component Type

- 7.2.1. Hardware

- 7.2.2. Software

- 7.2.3. Service

- 7.3. Market Analysis, Insights and Forecast - by Material Type

- 7.3.1. Metal

- 7.3.2. Polymer

- 7.3.3. Ceramic

- 7.4. Market Analysis, Insights and Forecast - by Application Type

- 7.4.1. Production

- 7.4.2. Prototyping/R&D

- 7.1. Market Analysis, Insights and Forecast - by Technology Type

- 8. Asia Pacific 3D Printing in Automobile Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology Type

- 8.1.1. Selective Laser Sintering (SLS)

- 8.1.2. Stereo Lithography (SLA)

- 8.1.3. Digital Light Processing (DLP)

- 8.1.4. Electronic Beam Melting (EBM)

- 8.1.5. Selective Laser Melting (SLM)

- 8.1.6. Fused Deposition Modeling (FDM)

- 8.2. Market Analysis, Insights and Forecast - by Component Type

- 8.2.1. Hardware

- 8.2.2. Software

- 8.2.3. Service

- 8.3. Market Analysis, Insights and Forecast - by Material Type

- 8.3.1. Metal

- 8.3.2. Polymer

- 8.3.3. Ceramic

- 8.4. Market Analysis, Insights and Forecast - by Application Type

- 8.4.1. Production

- 8.4.2. Prototyping/R&D

- 8.1. Market Analysis, Insights and Forecast - by Technology Type

- 9. Rest of the World 3D Printing in Automobile Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology Type

- 9.1.1. Selective Laser Sintering (SLS)

- 9.1.2. Stereo Lithography (SLA)

- 9.1.3. Digital Light Processing (DLP)

- 9.1.4. Electronic Beam Melting (EBM)

- 9.1.5. Selective Laser Melting (SLM)

- 9.1.6. Fused Deposition Modeling (FDM)

- 9.2. Market Analysis, Insights and Forecast - by Component Type

- 9.2.1. Hardware

- 9.2.2. Software

- 9.2.3. Service

- 9.3. Market Analysis, Insights and Forecast - by Material Type

- 9.3.1. Metal

- 9.3.2. Polymer

- 9.3.3. Ceramic

- 9.4. Market Analysis, Insights and Forecast - by Application Type

- 9.4.1. Production

- 9.4.2. Prototyping/R&D

- 9.1. Market Analysis, Insights and Forecast - by Technology Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Arcam AB

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Höganäs AB

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 3D Systems Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 The Exone Company

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 EOS GmbH

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Voxeljet AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Materialise NV

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Moog Inc *List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Ultimaker BV

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Stratasys Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Envisiontec GmbH

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Arcam AB

List of Figures

- Figure 1: Global 3D Printing in Automobile Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America 3D Printing in Automobile Industry Revenue (billion), by Technology Type 2025 & 2033

- Figure 3: North America 3D Printing in Automobile Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 4: North America 3D Printing in Automobile Industry Revenue (billion), by Component Type 2025 & 2033

- Figure 5: North America 3D Printing in Automobile Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 6: North America 3D Printing in Automobile Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 7: North America 3D Printing in Automobile Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 8: North America 3D Printing in Automobile Industry Revenue (billion), by Application Type 2025 & 2033

- Figure 9: North America 3D Printing in Automobile Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 10: North America 3D Printing in Automobile Industry Revenue (billion), by Country 2025 & 2033

- Figure 11: North America 3D Printing in Automobile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe 3D Printing in Automobile Industry Revenue (billion), by Technology Type 2025 & 2033

- Figure 13: Europe 3D Printing in Automobile Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 14: Europe 3D Printing in Automobile Industry Revenue (billion), by Component Type 2025 & 2033

- Figure 15: Europe 3D Printing in Automobile Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 16: Europe 3D Printing in Automobile Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 17: Europe 3D Printing in Automobile Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 18: Europe 3D Printing in Automobile Industry Revenue (billion), by Application Type 2025 & 2033

- Figure 19: Europe 3D Printing in Automobile Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 20: Europe 3D Printing in Automobile Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Europe 3D Printing in Automobile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific 3D Printing in Automobile Industry Revenue (billion), by Technology Type 2025 & 2033

- Figure 23: Asia Pacific 3D Printing in Automobile Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 24: Asia Pacific 3D Printing in Automobile Industry Revenue (billion), by Component Type 2025 & 2033

- Figure 25: Asia Pacific 3D Printing in Automobile Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 26: Asia Pacific 3D Printing in Automobile Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 27: Asia Pacific 3D Printing in Automobile Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 28: Asia Pacific 3D Printing in Automobile Industry Revenue (billion), by Application Type 2025 & 2033

- Figure 29: Asia Pacific 3D Printing in Automobile Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 30: Asia Pacific 3D Printing in Automobile Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific 3D Printing in Automobile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of the World 3D Printing in Automobile Industry Revenue (billion), by Technology Type 2025 & 2033

- Figure 33: Rest of the World 3D Printing in Automobile Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 34: Rest of the World 3D Printing in Automobile Industry Revenue (billion), by Component Type 2025 & 2033

- Figure 35: Rest of the World 3D Printing in Automobile Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 36: Rest of the World 3D Printing in Automobile Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 37: Rest of the World 3D Printing in Automobile Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 38: Rest of the World 3D Printing in Automobile Industry Revenue (billion), by Application Type 2025 & 2033

- Figure 39: Rest of the World 3D Printing in Automobile Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 40: Rest of the World 3D Printing in Automobile Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Rest of the World 3D Printing in Automobile Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Technology Type 2020 & 2033

- Table 2: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Component Type 2020 & 2033

- Table 3: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 4: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 5: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Technology Type 2020 & 2033

- Table 7: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Component Type 2020 & 2033

- Table 8: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 9: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 10: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States 3D Printing in Automobile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada 3D Printing in Automobile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of North America 3D Printing in Automobile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Technology Type 2020 & 2033

- Table 15: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Component Type 2020 & 2033

- Table 16: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 17: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 18: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Germany 3D Printing in Automobile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: United Kingdom 3D Printing in Automobile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France 3D Printing in Automobile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of Europe 3D Printing in Automobile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Technology Type 2020 & 2033

- Table 24: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Component Type 2020 & 2033

- Table 25: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 26: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 27: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 28: China 3D Printing in Automobile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Japan 3D Printing in Automobile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: India 3D Printing in Automobile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific 3D Printing in Automobile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Technology Type 2020 & 2033

- Table 33: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Component Type 2020 & 2033

- Table 34: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 35: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 36: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Brazil 3D Printing in Automobile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Argentina 3D Printing in Automobile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Other Countries 3D Printing in Automobile Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the 3D Printing in Automobile Industry?

The projected CAGR is approximately 14.8%.

2. Which companies are prominent players in the 3D Printing in Automobile Industry?

Key companies in the market include Arcam AB, Höganäs AB, 3D Systems Corporation, The Exone Company, EOS GmbH, Voxeljet AG, Materialise NV, Moog Inc *List Not Exhaustive, Ultimaker BV, Stratasys Ltd, Envisiontec GmbH.

3. What are the main segments of the 3D Printing in Automobile Industry?

The market segments include Technology Type, Component Type, Material Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.93 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasingly Focused On Lightweighting Vehicles.

6. What are the notable trends driving market growth?

Growing Adoption of Fused Deposition Modeling Technology.

7. Are there any restraints impacting market growth?

High Production Cost.

8. Can you provide examples of recent developments in the market?

November 2022- Desktop Metal, the parent company of ExOne, announced that it had won a USD 9 million order from one of the major German car manufacturers for binder jet additive manufacturing systems used for the mass production of powertrain components.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "3D Printing in Automobile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the 3D Printing in Automobile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the 3D Printing in Automobile Industry?

To stay informed about further developments, trends, and reports in the 3D Printing in Automobile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence