Key Insights

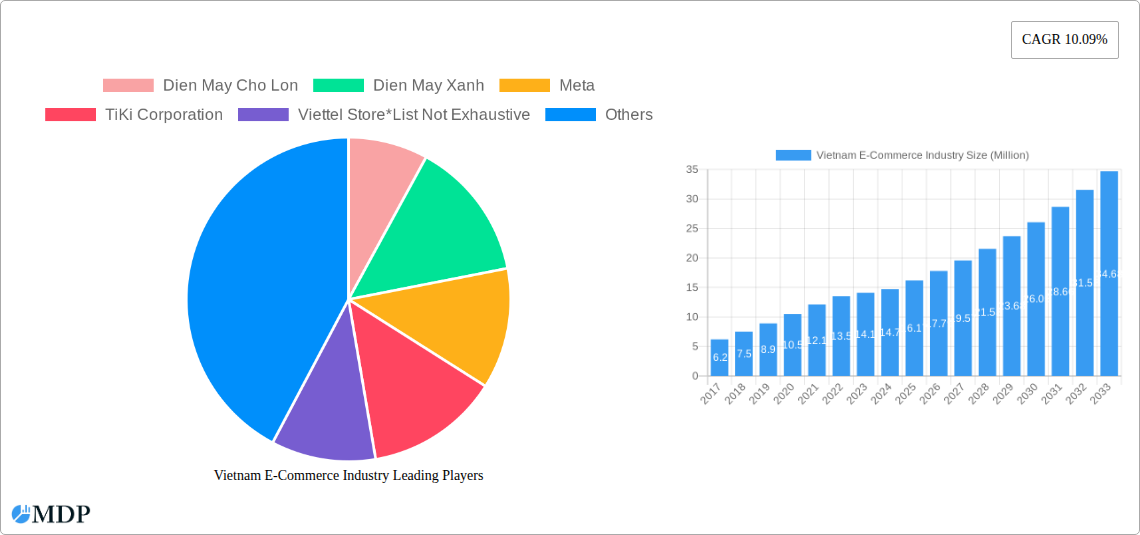

The Vietnam E-Commerce Industry is poised for remarkable expansion, with a current market size of approximately USD 14.70 billion. This dynamic sector is projected to grow at an impressive Compound Annual Growth Rate (CAGR) of 10.09% between 2025 and 2033, indicating a sustained upward trajectory. This robust growth is fueled by several key drivers, including the increasing penetration of internet and smartphone usage across the nation, a burgeoning middle class with rising disposable incomes, and a growing consumer preference for the convenience and variety offered by online shopping. The digital transformation initiatives by the Vietnamese government, coupled with enhanced logistics and payment infrastructure, further bolster the industry's potential. The B2C segment, particularly driven by the "Fashion & Apparel" and "Consumer Electronics" categories, is expected to dominate, benefiting from a young, tech-savvy population and a widespread adoption of social commerce.

Vietnam E-Commerce Industry Market Size (In Million)

Emerging trends like the rise of cross-border e-commerce, the increasing adoption of mobile commerce, and the growing demand for personalized shopping experiences are shaping the competitive landscape. Players like Shopee Pte Ltd, Lazada Vietnam, and TiKi Corporation are intensely competing, supported by domestic giants such as The Gioi Di Dong and FPT Shop, who are strategically expanding their online footprints. While the market is experiencing significant growth, certain restraints such as the need for further development in rural logistics, trust issues concerning online payments and product quality for some consumer segments, and the ongoing challenge of counterfeit products need to be addressed. Nevertheless, the overall outlook for the Vietnam E-Commerce Industry remains exceptionally positive, presenting substantial opportunities for both established players and new entrants.

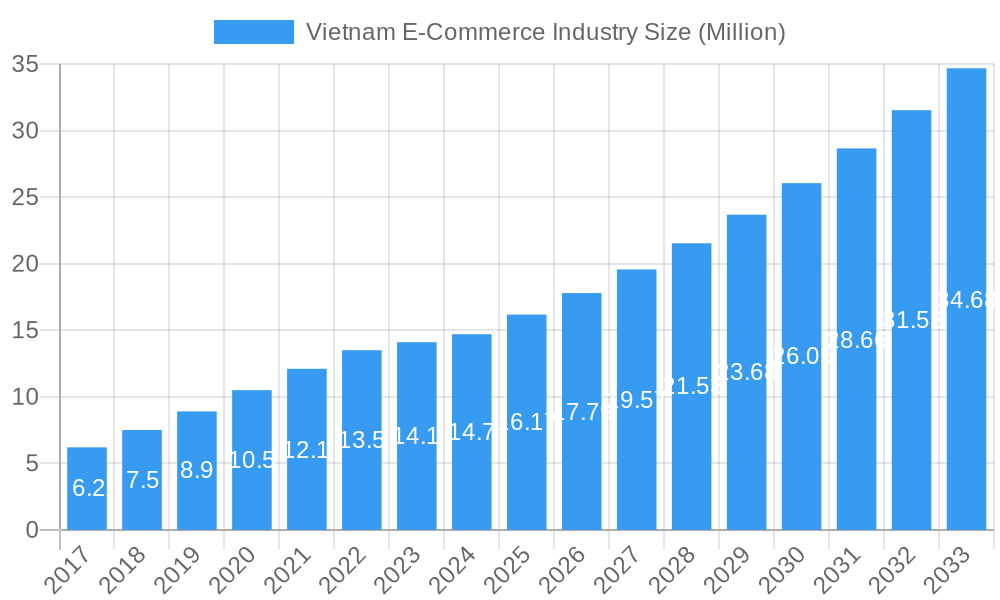

Vietnam E-Commerce Industry Company Market Share

Unveiling the Future: Vietnam E-Commerce Industry Report 2024-2033 - Market Dynamics, Trends, and Strategic Growth

Dive deep into the booming Vietnam e-commerce market with this comprehensive report. Discover critical insights into market dynamics, industry trends, leading segments, and strategic opportunities shaping the future of online retail in Vietnam. This report is an indispensable resource for e-commerce businesses, investors, technology providers, and industry stakeholders seeking to capitalize on Vietnam's rapidly evolving digital economy.

Explore the explosive growth of Vietnam online shopping, digital payments in Vietnam, and mobile commerce trends driven by a young, digitally-savvy population. We meticulously analyze the B2C e-commerce market, projecting a Gross Merchandise Volume (GMV) of over $100 billion by 2027, with significant contributions from consumer electronics, fashion & apparel, and beauty & personal care. Understand the nuances of B2B e-commerce in Vietnam, estimating its market size to surpass $50 billion by 2027.

This report provides an in-depth analysis of Vietnam's digital economy, covering key players like Shopee Pte Ltd, Lazada Vietnam, Tiki Corporation, Sendo Vietnam, Thegioi Di Dong, Dien May Xanh, Bach Hoa Xanh, and many more. Gain actionable insights into market concentration, innovation drivers, regulatory frameworks, and the competitive landscape.

Key Report Highlights:

- Extensive Market Analysis: From 2019–2033, with a deep dive into the base year 2025 and forecast period 2025–2033.

- Data-Driven Insights: Leveraging historical data (2019–2024) and future projections.

- Actionable Strategies: Identify growth accelerators, emerging opportunities, and challenges for market success.

- Industry Leader Profiles: Understand the strategies of top companies dominating the Vietnam online retail space.

- Exclusive Data: Including the latest figures on Vietnam e-commerce market size 2023 – a remarkable 25% year-on-year growth to USD 20.5 billion.

Vietnam E-Commerce Industry Market Dynamics & Concentration

The Vietnam e-commerce industry is characterized by dynamic market concentration, fueled by rapid innovation and evolving consumer preferences. While a few dominant players like Shopee Pte Ltd and Lazada Vietnam command significant market share, the landscape remains ripe for disruption. Innovation drivers are primarily centered around enhancing user experience through intuitive mobile apps, personalized recommendations, and seamless payment gateways. The integration of digital payment solutions in Vietnam is a critical factor, with increasing adoption of e-wallets and buy-now-pay-later (BNPL) services. Regulatory frameworks, while maturing, are focused on consumer protection, data privacy, and fair competition, influencing operational strategies of companies like Tiki Corporation and Sendo Vietnam. Product substitutes are abundant, particularly within the fashion & apparel and consumer electronics segments, intensifying the competitive battle. End-user trends highlight a growing demand for convenience, authenticity, and value-driven purchases. Mergers and acquisitions (M&A) activities, though not always publicly disclosed, are an undercurrent, signaling consolidation and strategic expansion by key entities such as The Gioi Di Dong and its subsidiaries like Dien May Xanh and Bach Hoa Xanh. Future M&A deals will likely focus on acquiring innovative technologies or expanding into niche market segments. The concentration is evident in the substantial market share held by leading platforms, estimated to be over 70% of the total GMV for B2C e-commerce.

Vietnam E-Commerce Industry Industry Trends & Analysis

The Vietnam e-commerce industry is on an unprecedented growth trajectory, consistently outpacing regional averages. The market is currently experiencing a Compound Annual Growth Rate (CAGR) of approximately 25%, a testament to the accelerating adoption of online shopping behaviors among Vietnamese consumers. This surge is propelled by several key factors, including a burgeoning middle class with increased disposable income, a young and highly connected population that readily embraces digital technologies, and widespread smartphone penetration enabling ubiquitous access to online platforms. Technological disruptions are a constant feature, with advancements in artificial intelligence (AI) for personalized shopping experiences, blockchain for enhanced supply chain transparency, and augmented reality (AR) for virtual try-ons, particularly in the fashion & apparel and furniture & home segments. Consumer preferences are rapidly shifting towards convenience, with a strong emphasis on fast delivery, flexible payment options, and a diverse product assortment. The rise of social commerce in Vietnam is a significant trend, blurring the lines between online marketplaces and social media engagement. Competitive dynamics are intense, with established giants like Shopee Pte Ltd and Lazada Vietnam locked in a perpetual battle for market dominance, constantly innovating with promotions, loyalty programs, and exclusive product launches. Companies like Tiki Corporation are differentiating themselves through a focus on faster delivery and a curated selection of authentic goods. The increasing penetration of mobile commerce in Vietnam is undeniable, with the majority of transactions now occurring via smartphones, necessitating mobile-first strategies from all industry players. Furthermore, the growth of cross-border e-commerce in Vietnam is opening up new avenues for both local sellers and international brands to reach a wider audience, further intensifying competition and innovation.

Leading Markets & Segments in Vietnam E-Commerce Industry

The Vietnam B2C E-Commerce market is experiencing robust growth, with the Gross Merchandise Volume (GMV) projected to grow from approximately $15 billion in 2017 to over $100 billion by 2027, indicating a significant expansion of the online retail landscape. The market segmentation by application reveals distinct areas of strength and potential.

Dominant Segments & Key Drivers:

- Consumer Electronics: This segment consistently leads, driven by increasing disposable incomes, a strong demand for the latest gadgets, and aggressive marketing by electronics retailers like Dien May Xanh and Nguyen Kim. The availability of a wide range of brands and competitive pricing on platforms like Shopee Pte Ltd and Lazada Vietnam further bolsters its position. Economic policies that encourage consumer spending and the availability of consumer credit options are key drivers.

- Fashion & Apparel: A high-growth segment, fueled by the country's young demographic, a growing interest in international trends, and the accessibility of online fashion retailers and marketplaces. Key drivers include influencer marketing, the rise of independent fashion brands, and the adoption of fast fashion models.

- Beauty & Personal Care: This segment is experiencing rapid expansion, driven by an increasing focus on wellness and self-care, as well as the growing popularity of Korean and Japanese beauty products. Social media trends and the ability of brands to engage directly with consumers online are crucial growth accelerators.

- Food & Beverage: While historically less dominant, this segment is showing significant potential, especially with the widespread adoption of food delivery apps and the increasing demand for convenience. Infrastructure development supporting last-mile delivery and partnerships with local restaurants are key factors.

- Furniture & Home: Growing in tandem with the expanding middle class and increasing homeownership, this segment benefits from visual merchandising online and the convenience of purchasing larger items without physical store visits.

- Others (Toys, DIY, Media, etc.): This broad category encompasses niche markets that are gradually gaining traction as e-commerce penetration deepens.

B2B E-Commerce Market Size: The Vietnam B2B E-Commerce market is also poised for substantial growth, with an estimated market size projected to exceed $50 billion by 2027, reflecting the increasing digitization of business procurement processes. Key drivers include the need for streamlined supply chains, improved efficiency in business transactions, and the growing number of SMEs embracing online business operations.

Vietnam E-Commerce Industry Product Developments

Product developments within the Vietnam e-commerce industry are increasingly focused on enhancing customer convenience and personalization. Innovations in mobile payment solutions are driving faster and more secure transactions, while the integration of AI-powered recommendation engines is personalizing the shopping experience, leading to higher conversion rates. Companies are also leveraging augmented reality (AR) features to allow customers to visualize products in their own space, particularly in the furniture & home and fashion & apparel segments. The development of same-day and next-day delivery services by logistics providers and platforms like Tiki Corporation is a significant competitive advantage, meeting the demand for instant gratification. Furthermore, the emergence of live commerce and social commerce features on platforms like Shopee Pte Ltd and Lazada Vietnam allows for interactive product discovery and direct engagement, fostering a sense of community and trust.

Key Drivers of Vietnam E-Commerce Industry Growth

Several interconnected factors are fueling the rapid expansion of the Vietnam e-commerce industry. Technologically, the widespread adoption of smartphones and improving internet infrastructure have made online shopping accessible to a vast majority of the population. Economically, a growing middle class with increasing disposable income is driving consumer spending. Government initiatives promoting digital transformation and the development of a conducive regulatory environment for online businesses are also pivotal. Specifically, policies that encourage foreign investment and support the growth of startups in Vietnam contribute to a dynamic market. The burgeoning young population, highly adept at using digital platforms, acts as a significant consumer base, driving demand for everything from consumer electronics to fashion & apparel. The increasing trust in online payment systems and the convenience offered by established e-commerce players like Shopee Pte Ltd and Lazada Vietnam further solidify these growth drivers.

Challenges in the Vietnam E-Commerce Industry Market

Despite its robust growth, the Vietnam e-commerce industry faces several hurdles. Regulatory complexities and evolving compliance requirements can pose challenges for businesses, particularly smaller players. Logistical infrastructure limitations, especially in rural areas, can impact delivery times and costs, affecting customer satisfaction. Intense competition among numerous players, including both domestic and international giants, leads to price wars and high marketing expenditure, squeezing profit margins. Furthermore, building consumer trust and security remains an ongoing effort, with concerns around product authenticity, data privacy, and secure payment gateways. Talent acquisition and retention in specialized areas like digital marketing, data analytics, and supply chain management also present a challenge as the industry scales rapidly.

Emerging Opportunities in Vietnam E-Commerce Industry

The Vietnam e-commerce industry is brimming with emerging opportunities for long-term growth. The increasing penetration of cross-border e-commerce presents avenues for both Vietnamese sellers to expand globally and for international brands to tap into the Vietnamese market. Technological breakthroughs, such as the adoption of AI for hyper-personalization and blockchain for supply chain transparency, offer pathways to enhance customer experience and operational efficiency. Strategic partnerships between e-commerce platforms, logistics providers, and financial institutions are creating more integrated and seamless shopping ecosystems. The growing demand for sustainable and ethically sourced products opens up niche markets for environmentally conscious brands. Expansion into Tier 2 and Tier 3 cities represents a significant untapped market potential, as digital literacy and internet access continue to improve outside major urban centers.

Leading Players in the Vietnam E-Commerce Industry Sector

- Shopee Pte Ltd

- Lazada Vietnam

- Tiki Corporation

- Sendo Vietnam

- The Gioi Di Dong

- Dien May Xanh

- Bach Hoa Xanh

- Meta

- Viettel Store

- Cellphone S

- FPT Shop

- Cho Tot

- Hoang Ha Mobile

- Nguyen Kim

- Mediamart

- Dien May Cho Lon

Key Milestones in Vietnam E-Commerce Industry Industry

- June 2023: Vietnam's retail e-commerce market scale continued its upward trajectory, increasing by 25% year-on-year, estimated to reach USD 20.5 billion. This represents 7.5% of the total revenue from consumer goods and services nationwide.

- 2022: Significant growth in mobile commerce, with smartphones accounting for over 70% of e-commerce transactions, further solidifying the importance of mobile-first strategies.

- 2021: Increased adoption of digital payment methods, including e-wallets and QR code payments, surpassing 50% of online transactions.

- 2020: The COVID-19 pandemic acted as a major catalyst, accelerating e-commerce adoption across all demographics and product categories, leading to unprecedented GMV growth.

- 2019: Introduction of enhanced logistics and fulfillment networks by major platforms, enabling faster delivery times and improving customer satisfaction.

Strategic Outlook for Vietnam E-Commerce Industry Market

The strategic outlook for the Vietnam e-commerce industry remains exceptionally bright, driven by continued digital adoption and a favorable economic environment. Future growth will be accelerated by advancements in AI-driven personalization, further enhancing customer engagement and conversion rates. Strategic partnerships between e-commerce giants, logistics providers, and financial technology companies will streamline the entire transaction process, from discovery to delivery and payment. The expansion of online grocery delivery and pharmaceuticals will tap into new consumer needs. Embracing social commerce and live streaming will be crucial for brands to connect authentically with consumers. Continued investment in logistics infrastructure and the exploration of rural e-commerce markets represent significant untapped potential. The government's ongoing commitment to digital transformation and fostering a competitive business landscape will undoubtedly support this sustained growth trajectory, positioning Vietnam as a leading e-commerce hub in Southeast Asia.

Vietnam E-Commerce Industry Segmentation

-

1. B2C E-Commerce

- 1.1. Market size (GMV) for the period of 2017-2027

-

1.2. Market Segmentation - By Application

- 1.2.1. Beauty & Personal Care

- 1.2.2. Consumer Electronics

- 1.2.3. Fashion & Apparel

- 1.2.4. Food & Beverage

- 1.2.5. Furniture & Home

- 1.2.6. Others (Toys, DIY, Media, etc.)

- 2. Market size (GMV) for the period of 2017-2027

-

3. Application

- 3.1. Beauty & Personal Care

- 3.2. Consumer Electronics

- 3.3. Fashion & Apparel

- 3.4. Food & Beverage

- 3.5. Furniture & Home

- 3.6. Others (Toys, DIY, Media, etc.)

- 4. Beauty & Personal Care

- 5. Consumer Electronics

- 6. Fashion & Apparel

- 7. Food & Beverage

- 8. Furniture & Home

- 9. Others (Toys, DIY, Media, etc.)

-

10. B2B E-Commerce

- 10.1. Market size for the period of 2017-2027

Vietnam E-Commerce Industry Segmentation By Geography

- 1. Vietnam

Vietnam E-Commerce Industry Regional Market Share

Geographic Coverage of Vietnam E-Commerce Industry

Vietnam E-Commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.09% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Formal E-Commerce Platforms Grow alongside Social Commerce; Consumers are Driven to Online Platforms for Grocery needs by Wider Assortment and Fast Delivery

- 3.3. Market Restrains

- 3.3.1. Increasing Network Complexity

- 3.4. Market Trends

- 3.4.1. Rise of Digital Payments Across the Vietnam

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam E-Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 5.1.1. Market size (GMV) for the period of 2017-2027

- 5.1.2. Market Segmentation - By Application

- 5.1.2.1. Beauty & Personal Care

- 5.1.2.2. Consumer Electronics

- 5.1.2.3. Fashion & Apparel

- 5.1.2.4. Food & Beverage

- 5.1.2.5. Furniture & Home

- 5.1.2.6. Others (Toys, DIY, Media, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Market size (GMV) for the period of 2017-2027

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Beauty & Personal Care

- 5.3.2. Consumer Electronics

- 5.3.3. Fashion & Apparel

- 5.3.4. Food & Beverage

- 5.3.5. Furniture & Home

- 5.3.6. Others (Toys, DIY, Media, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Beauty & Personal Care

- 5.5. Market Analysis, Insights and Forecast - by Consumer Electronics

- 5.6. Market Analysis, Insights and Forecast - by Fashion & Apparel

- 5.7. Market Analysis, Insights and Forecast - by Food & Beverage

- 5.8. Market Analysis, Insights and Forecast - by Furniture & Home

- 5.9. Market Analysis, Insights and Forecast - by Others (Toys, DIY, Media, etc.)

- 5.10. Market Analysis, Insights and Forecast - by B2B E-Commerce

- 5.10.1. Market size for the period of 2017-2027

- 5.11. Market Analysis, Insights and Forecast - by Region

- 5.11.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dien May Cho Lon

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dien May Xanh

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Meta

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TiKi Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Viettel Store*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nguyen Kim

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sendo Vietnam

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cellphone S

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 FPT Shop

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Lazada Vietnam

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Shopee Pte Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Cho Tot

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Hoang Ha Mobile

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Bach Hoa Xanh

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 The Gioi Di Dong

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Mediamart

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 Dien May Cho Lon

List of Figures

- Figure 1: Vietnam E-Commerce Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Vietnam E-Commerce Industry Share (%) by Company 2025

List of Tables

- Table 1: Vietnam E-Commerce Industry Revenue Million Forecast, by B2C E-Commerce 2020 & 2033

- Table 2: Vietnam E-Commerce Industry Revenue Million Forecast, by Market size (GMV) for the period of 2017-2027 2020 & 2033

- Table 3: Vietnam E-Commerce Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Vietnam E-Commerce Industry Revenue Million Forecast, by Beauty & Personal Care 2020 & 2033

- Table 5: Vietnam E-Commerce Industry Revenue Million Forecast, by Consumer Electronics 2020 & 2033

- Table 6: Vietnam E-Commerce Industry Revenue Million Forecast, by Fashion & Apparel 2020 & 2033

- Table 7: Vietnam E-Commerce Industry Revenue Million Forecast, by Food & Beverage 2020 & 2033

- Table 8: Vietnam E-Commerce Industry Revenue Million Forecast, by Furniture & Home 2020 & 2033

- Table 9: Vietnam E-Commerce Industry Revenue Million Forecast, by Others (Toys, DIY, Media, etc.) 2020 & 2033

- Table 10: Vietnam E-Commerce Industry Revenue Million Forecast, by B2B E-Commerce 2020 & 2033

- Table 11: Vietnam E-Commerce Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 12: Vietnam E-Commerce Industry Revenue Million Forecast, by B2C E-Commerce 2020 & 2033

- Table 13: Vietnam E-Commerce Industry Revenue Million Forecast, by Market size (GMV) for the period of 2017-2027 2020 & 2033

- Table 14: Vietnam E-Commerce Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Vietnam E-Commerce Industry Revenue Million Forecast, by Beauty & Personal Care 2020 & 2033

- Table 16: Vietnam E-Commerce Industry Revenue Million Forecast, by Consumer Electronics 2020 & 2033

- Table 17: Vietnam E-Commerce Industry Revenue Million Forecast, by Fashion & Apparel 2020 & 2033

- Table 18: Vietnam E-Commerce Industry Revenue Million Forecast, by Food & Beverage 2020 & 2033

- Table 19: Vietnam E-Commerce Industry Revenue Million Forecast, by Furniture & Home 2020 & 2033

- Table 20: Vietnam E-Commerce Industry Revenue Million Forecast, by Others (Toys, DIY, Media, etc.) 2020 & 2033

- Table 21: Vietnam E-Commerce Industry Revenue Million Forecast, by B2B E-Commerce 2020 & 2033

- Table 22: Vietnam E-Commerce Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam E-Commerce Industry?

The projected CAGR is approximately 10.09%.

2. Which companies are prominent players in the Vietnam E-Commerce Industry?

Key companies in the market include Dien May Cho Lon, Dien May Xanh, Meta, TiKi Corporation, Viettel Store*List Not Exhaustive, Nguyen Kim, Sendo Vietnam, Cellphone S, FPT Shop, Lazada Vietnam, Shopee Pte Ltd, Cho Tot, Hoang Ha Mobile, Bach Hoa Xanh, The Gioi Di Dong, Mediamart.

3. What are the main segments of the Vietnam E-Commerce Industry?

The market segments include B2C E-Commerce, Market size (GMV) for the period of 2017-2027, Application, Beauty & Personal Care, Consumer Electronics, Fashion & Apparel, Food & Beverage, Furniture & Home, Others (Toys, DIY, Media, etc.), B2B E-Commerce.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Formal E-Commerce Platforms Grow alongside Social Commerce; Consumers are Driven to Online Platforms for Grocery needs by Wider Assortment and Fast Delivery.

6. What are the notable trends driving market growth?

Rise of Digital Payments Across the Vietnam.

7. Are there any restraints impacting market growth?

Increasing Network Complexity.

8. Can you provide examples of recent developments in the market?

June 2023 - According to data recently published by the Vietnam E-commerce and Digital Economy Agency (Ministry of Industry and Trade), the scale of Vietnam's retail e-commerce market in 2023 continued to increase by 25% compared to the previous year, estimated to reach USD 20,5 billion, equivalent to 7.5% of the total revenue from consumer goods and services nationwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam E-Commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam E-Commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam E-Commerce Industry?

To stay informed about further developments, trends, and reports in the Vietnam E-Commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence