Key Insights

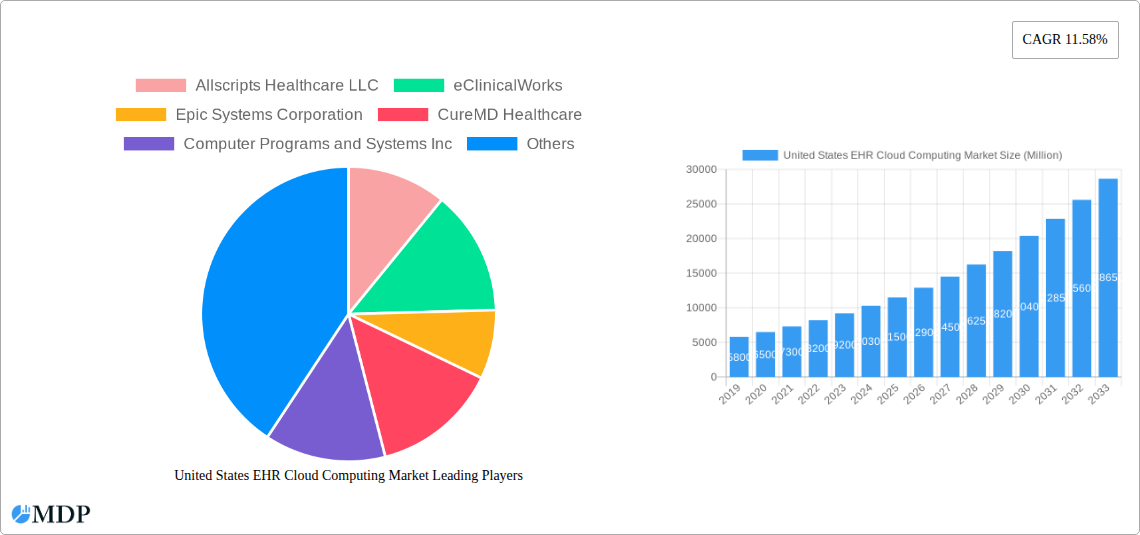

The United States EHR Cloud Computing Market is poised for substantial growth, projected to reach a market size of 19.4 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 11.58% from 2025 to 2033. This expansion is driven by increasing healthcare provider adoption of cloud-based Electronic Health Record (EHR) systems. Key growth factors include enhanced data accessibility, scalability, and cost-efficiency inherent in cloud solutions, alongside the broader shift towards digital health records, regulatory mandates for interoperability and data security, and the demand for efficient workflow management in healthcare facilities. The market serves diverse needs across Acute, Ambulatory, and Post-acute EHR segments.

United States EHR Cloud Computing Market Market Size (In Billion)

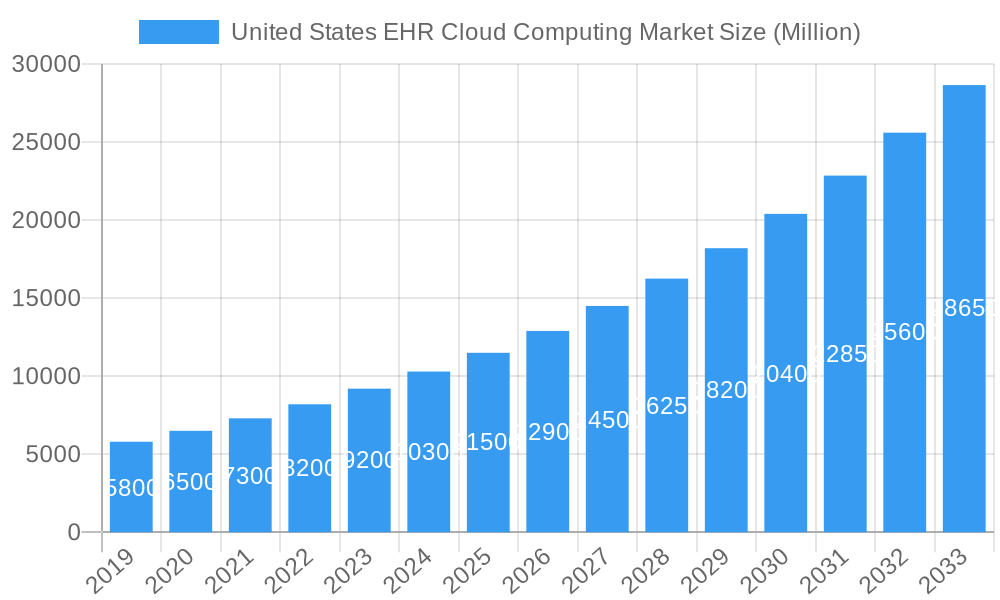

Within EHR cloud computing, Cloud-Based Software dominates deployment, though Server-Based/On-Premise Software retains a share. Software-as-a-Service (SaaS) is a leading service model, offering providers flexibility and reduced initial investment, with Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS) also gaining traction. Hospitals, clinics, and specialty centers are primary end-users investing in cloud EHR to improve patient care, streamline operations, and ensure regulatory compliance. The competitive landscape includes established players such as Epic Systems Corporation, Cerner Corporation (Oracle), and McKesson Corporation, with ongoing technological innovation and evolving healthcare needs presenting significant opportunities.

United States EHR Cloud Computing Market Company Market Share

United States EHR Cloud Computing Market Analysis: Drivers, Opportunities, and Forecast (2025-2033)

Gain critical insights into the United States EHR Cloud Computing Market. This report provides an in-depth analysis of market dynamics, industry trends, segment performance, and future growth prospects, vital for stakeholders in this evolving sector. Optimized for keywords such as "EHR cloud computing," "healthcare IT market," "digital health adoption," and "cloud healthcare solutions," this analysis delves into market concentration, innovation drivers, regulatory influences, and strategic imperatives shaping the future of cloud EHR services.

United States EHR Cloud Computing Market Market Dynamics & Concentration

The United States EHR Cloud Computing Market exhibits a dynamic and evolving concentration, driven by significant innovation and strategic mergers and acquisitions. While a few dominant players hold substantial market share, the landscape is continuously being reshaped by technological advancements and the increasing adoption of cloud-based solutions across healthcare institutions. Key innovation drivers include the demand for enhanced interoperability, improved data security, and cost-efficiency in healthcare IT infrastructure. Regulatory frameworks, such as HIPAA and HITECH, continue to influence product development and deployment strategies, emphasizing the importance of compliant and secure cloud environments. Product substitutes, while present in traditional on-premise solutions, are rapidly losing ground to the agility and scalability offered by cloud computing. End-user trends overwhelmingly favor cloud adoption due to its accessibility, reduced IT burden, and potential for real-time data analytics. Mergers and acquisitions are a significant activity, consolidating market power and expanding service offerings.

- Market Concentration: Moderate to high, with key players like Epic Systems Corporation, Cerner Corporation (Oracle), and McKesson Corporation holding significant market share.

- Innovation Drivers: Interoperability, data analytics, AI integration, patient engagement tools, cybersecurity enhancements.

- Regulatory Frameworks: HIPAA, HITECH, ONC Cures Act Final Rule.

- Product Substitutes: On-premise EHR systems, legacy data management solutions.

- End-User Trends: Growing preference for cloud-native solutions, demand for integrated care platforms, focus on remote patient monitoring.

- M&A Activities: Active, with acquisitions aimed at expanding cloud capabilities and market reach.

United States EHR Cloud Computing Market Industry Trends & Analysis

The United States EHR Cloud Computing Market is experiencing robust growth, projected to reach substantial valuations by 2033. This expansion is fueled by a confluence of factors, including escalating demand for digitized patient records, the imperative for data security and privacy, and the inherent scalability and cost-effectiveness of cloud infrastructure. The market penetration of cloud-based EHR solutions is steadily increasing as healthcare providers recognize the benefits of reduced capital expenditure, enhanced accessibility for remote workforces, and superior data management capabilities. Technological disruptions are a constant, with the integration of Artificial Intelligence (AI) and Machine Learning (ML) revolutionizing diagnostic processes, predictive analytics, and personalized treatment plans. Consumer preferences are also playing a pivotal role, with patients increasingly expecting seamless digital interactions, accessible health portals, and personalized care experiences, all facilitated by sophisticated EHR cloud platforms.

The shift towards cloud-based EHR systems is a strategic imperative for healthcare organizations aiming to optimize operational efficiency and improve patient outcomes. The Software-as-a-Service (SaaS) model, in particular, has gained immense traction, offering subscription-based access to advanced EHR functionalities without the burden of significant upfront investment in hardware and maintenance. This trend is further amplified by the increasing need for robust data analytics to inform clinical decision-making, manage population health, and streamline administrative workflows. Cybersecurity remains a paramount concern, driving investments in highly secure cloud environments capable of protecting sensitive patient data from cyber threats. The ongoing digital transformation within the healthcare sector, accelerated by events such as the COVID-19 pandemic, has underscored the critical role of cloud computing in ensuring business continuity and facilitating telehealth services.

Competitive dynamics within the market are intense, with established players continuously innovating and new entrants vying for market share. Companies are focusing on developing integrated platforms that offer a comprehensive suite of services, from patient intake and scheduling to billing and analytics. The drive towards interoperability, enabling seamless data exchange between different healthcare systems and providers, is a major focus area, supported by regulatory mandates and industry-wide initiatives. The growth trajectory is further supported by government initiatives promoting digital health adoption and incentivizing the use of certified EHR technologies. The increasing adoption of cloud-based solutions across diverse healthcare settings, including hospitals, clinics, and specialty centers, underscores the broad applicability and growing acceptance of these technologies. This sustained growth is expected to continue as the healthcare industry embraces digital innovation to enhance efficiency, improve patient care, and drive down costs.

Leading Markets & Segments in United States EHR Cloud Computing Market

The United States EHR Cloud Computing Market is characterized by its expansive reach and segmented demand, with distinct areas demonstrating significant growth and adoption. The Acute EHR segment, serving hospitals and larger healthcare facilities, consistently leads in terms of market value due to the complex needs and substantial IT budgets of these institutions. The sheer volume of patient data, critical care requirements, and the necessity for real-time access to patient histories make cloud-based Acute EHR solutions indispensable for operational efficiency and patient safety.

Within the deployment models, Cloud-Based Software commands the largest market share, eclipsing traditional server-based or on-premise software. This dominance is driven by the inherent advantages of cloud computing: scalability, flexibility, cost-effectiveness, and reduced IT maintenance overhead. Healthcare organizations are increasingly migrating their EHR systems to the cloud to leverage these benefits, enabling them to adapt quickly to changing demands and technological advancements.

The Software-as-a-Service (SaaS) model, a key component of cloud deployment, is the most prevalent service offering. SaaS provides end-users with access to EHR functionalities via a subscription, eliminating the need for significant upfront hardware investments and ongoing maintenance costs. This model offers a predictable expense structure and allows for continuous updates and feature enhancements, making it highly attractive to providers of all sizes.

In terms of end-user applications, Hospitals represent the largest segment, followed closely by Clinics. Hospitals, with their extensive patient populations and intricate workflows, require robust and comprehensive EHR systems. Clinics, especially ambulatory care centers, are rapidly adopting cloud-based EHRs to streamline patient management, improve scheduling, and enhance billing processes, contributing significantly to market growth. Specialty Centers also form a crucial segment, utilizing tailored EHR solutions to manage specific patient populations and treatment protocols.

- Type Dominance:

- Acute EHR: Driven by the critical need for comprehensive patient data management in hospital settings, advanced clinical decision support, and stringent regulatory compliance. Economic policies favoring healthcare infrastructure upgrades and federal mandates for digital health adoption further bolster this segment.

- Deployment Dominance:

- Cloud-Based Software: Propelled by its inherent scalability, accessibility, and cost-effectiveness compared to on-premise solutions. Rapid advancements in cloud security protocols and infrastructure, coupled with government incentives for cloud migration, are key drivers.

- Service Dominance:

- Software-as-a-Service (SaaS): Favored for its predictable subscription models, reduced IT burden, and continuous updates. The increasing focus on patient engagement and remote care delivery further amplifies the demand for SaaS-based EHR solutions.

- End-User Application Dominance:

- Hospitals: Driven by the complexity of patient care, large data volumes, and the need for integrated systems for multiple departments. Investments in digital transformation and the pursuit of operational efficiencies are significant factors.

- Clinics: Experiencing rapid growth due to the demand for streamlined practice management, improved patient scheduling, and efficient billing. The accessibility and affordability of cloud-based EHRs make them an ideal choice for smaller to medium-sized practices.

United States EHR Cloud Computing Market Product Developments

Product developments in the United States EHR Cloud Computing Market are centered on enhancing interoperability, leveraging artificial intelligence, and improving user experience. Innovations focus on creating seamless data exchange between disparate systems, enabling a more holistic view of patient health. AI-powered features are being integrated for predictive analytics, clinical decision support, and automating administrative tasks, leading to increased efficiency and improved patient outcomes. Furthermore, the development of intuitive user interfaces and mobile-friendly applications is crucial for adoption by healthcare professionals. These advancements aim to provide a competitive edge by offering more comprehensive, efficient, and user-centric EHR cloud solutions.

Key Drivers of United States EHR Cloud Computing Market Growth

The growth of the United States EHR Cloud Computing Market is propelled by several key factors. Technological advancements, including AI and big data analytics, are driving the demand for cloud-based solutions capable of handling complex data processing and providing actionable insights. Government initiatives and regulatory mandates, such as the push for interoperability and patient data access, strongly favor cloud adoption. The increasing focus on value-based care models necessitates efficient data management and analytics, which cloud EHRs readily provide. Furthermore, the drive for cost reduction in healthcare, coupled with the scalability and flexibility offered by cloud infrastructure, makes it an attractive option for providers of all sizes.

Challenges in the United States EHR Cloud Computing Market Market

Despite its robust growth, the United States EHR Cloud Computing Market faces several challenges. Data security and privacy concerns remain paramount, with healthcare organizations demanding stringent compliance with regulations like HIPAA. The high cost of initial migration and integration of cloud EHR systems can be a barrier for smaller practices. Interoperability issues, though improving, still persist, hindering seamless data exchange between different EHR vendors and healthcare systems. Furthermore, the need for specialized IT expertise to manage and maintain cloud-based systems can pose a challenge for some organizations.

Emerging Opportunities in United States EHR Cloud Computing Market

Emerging opportunities in the United States EHR Cloud Computing Market are ripe for exploration. The growing adoption of telehealth and remote patient monitoring presents a significant catalyst for cloud-based EHRs, enabling real-time data capture and analysis from remote devices. Advancements in AI and machine learning are opening doors for predictive diagnostics, personalized medicine, and automated clinical workflows, creating new revenue streams and value propositions. Strategic partnerships between EHR vendors and other healthcare technology providers, such as IoT device manufacturers and data analytics firms, are poised to drive innovation and market expansion.

Leading Players in the United States EHR Cloud Computing Market Sector

- Allscripts Healthcare LLC

- eClinicalWorks

- Epic Systems Corporation

- CureMD Healthcare

- Computer Programs and Systems Inc

- GE Healthcare

- Medical Information Technology Inc

- Greenway Health LLC

- McKesson Corporation

- Cerner Corporation (Oracle)

- NextGen Healthcare Inc

Key Milestones in United States EHR Cloud Computing Market Industry

- May 2022: Geisinger has chosen Amazon Web Services as its cloud vendor for EHR deployment. The health system based in Danville, Pennsylvania, will migrate its entire digital portfolio of over 400 applications and numerous workflows to AWS.

- November 2021: EverCommerce Inc. announced the acquisition of DrChrono Inc., a California based company. DrChrono provides a cloud-based EHR, practice management, and billing solution to improve the knowledge, interaction, and personalization of healthcare. The business will modernize patient engagement while enhancing administrative and provider workflows.

Strategic Outlook for United States EHR Cloud Computing Market Market

The strategic outlook for the United States EHR Cloud Computing Market is exceptionally promising, driven by an ongoing digital transformation in healthcare. Future growth will be fueled by the increasing adoption of advanced cloud technologies, including AI, IoT, and edge computing, to enhance patient care and operational efficiency. Strategic imperatives will focus on expanding interoperability capabilities, enabling seamless data sharing across the healthcare ecosystem. Investments in cybersecurity will remain critical to maintain trust and compliance. Furthermore, strategic partnerships and collaborations will play a vital role in developing integrated solutions that address the evolving needs of healthcare providers and patients, ultimately driving market expansion and innovation.

United States EHR Cloud Computing Market Segmentation

-

1. Type

- 1.1. Acute EHR

- 1.2. Ambulatory EHR

- 1.3. Post-acute EHR

-

2. Deployment

- 2.1. Cloud-Based Software

- 2.2. Server-Based/ On-Premise Software

-

3. Service

- 3.1. Software-as-a-Service (SaaS)

- 3.2. Infrastructure-as-a-Service (IaaS)

- 3.3. Platform-as-a-Service (PaaS)

-

4. End-User Applications

- 4.1. Hospital

- 4.2. Clinics

- 4.3. Specialty Centers

- 4.4. Other End Users

United States EHR Cloud Computing Market Segmentation By Geography

- 1. United States

United States EHR Cloud Computing Market Regional Market Share

Geographic Coverage of United States EHR Cloud Computing Market

United States EHR Cloud Computing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Cloud computing improves data storage

- 3.2.2 flexibility

- 3.2.3 scalability

- 3.2.4 and collaboration for the EHR cloud computing; COVID-19 has led to an increase in the use of EHR

- 3.2.5 e-prescribing

- 3.2.6 telemedicine

- 3.2.7 mobile health

- 3.2.8 and other healthcare IT systems; Rising demand for centralization of healthcare administration on cloud system

- 3.3. Market Restrains

- 3.3.1. ; Growing Use and Reliability of Bio-metric Authentication

- 3.4. Market Trends

- 3.4.1. Government initiatives to boost healthcare IT usage

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States EHR Cloud Computing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Acute EHR

- 5.1.2. Ambulatory EHR

- 5.1.3. Post-acute EHR

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud-Based Software

- 5.2.2. Server-Based/ On-Premise Software

- 5.3. Market Analysis, Insights and Forecast - by Service

- 5.3.1. Software-as-a-Service (SaaS)

- 5.3.2. Infrastructure-as-a-Service (IaaS)

- 5.3.3. Platform-as-a-Service (PaaS)

- 5.4. Market Analysis, Insights and Forecast - by End-User Applications

- 5.4.1. Hospital

- 5.4.2. Clinics

- 5.4.3. Specialty Centers

- 5.4.4. Other End Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Allscripts Healthcare LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 eClinicalWorks

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Epic Systems Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CureMD Healthcare

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Computer Programs and Systems Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GE Healthcare

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Medical Information Technology Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Greenway Health LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 McKesson Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cerner Corporation (Oracle)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 NextGen Healthcare Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Allscripts Healthcare LLC

List of Figures

- Figure 1: United States EHR Cloud Computing Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States EHR Cloud Computing Market Share (%) by Company 2025

List of Tables

- Table 1: United States EHR Cloud Computing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: United States EHR Cloud Computing Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 3: United States EHR Cloud Computing Market Revenue billion Forecast, by Service 2020 & 2033

- Table 4: United States EHR Cloud Computing Market Revenue billion Forecast, by End-User Applications 2020 & 2033

- Table 5: United States EHR Cloud Computing Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: United States EHR Cloud Computing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 7: United States EHR Cloud Computing Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 8: United States EHR Cloud Computing Market Revenue billion Forecast, by Service 2020 & 2033

- Table 9: United States EHR Cloud Computing Market Revenue billion Forecast, by End-User Applications 2020 & 2033

- Table 10: United States EHR Cloud Computing Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States EHR Cloud Computing Market?

The projected CAGR is approximately 0.3%.

2. Which companies are prominent players in the United States EHR Cloud Computing Market?

Key companies in the market include Allscripts Healthcare LLC, eClinicalWorks, Epic Systems Corporation, CureMD Healthcare, Computer Programs and Systems Inc, GE Healthcare, Medical Information Technology Inc, Greenway Health LLC, McKesson Corporation, Cerner Corporation (Oracle), NextGen Healthcare Inc.

3. What are the main segments of the United States EHR Cloud Computing Market?

The market segments include Type, Deployment, Service, End-User Applications.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.4 billion as of 2022.

5. What are some drivers contributing to market growth?

Cloud computing improves data storage. flexibility. scalability. and collaboration for the EHR cloud computing; COVID-19 has led to an increase in the use of EHR. e-prescribing. telemedicine. mobile health. and other healthcare IT systems; Rising demand for centralization of healthcare administration on cloud system.

6. What are the notable trends driving market growth?

Government initiatives to boost healthcare IT usage.

7. Are there any restraints impacting market growth?

; Growing Use and Reliability of Bio-metric Authentication.

8. Can you provide examples of recent developments in the market?

May 2022 - Geisinger has chosen Amazon Web Services as its cloud vendor for EHR deployment. The health system based in Danville, Pennsylvania, will migrate its entire digital portfolio of over 400 applications and numerous workflows to AWS.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States EHR Cloud Computing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States EHR Cloud Computing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States EHR Cloud Computing Market?

To stay informed about further developments, trends, and reports in the United States EHR Cloud Computing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence